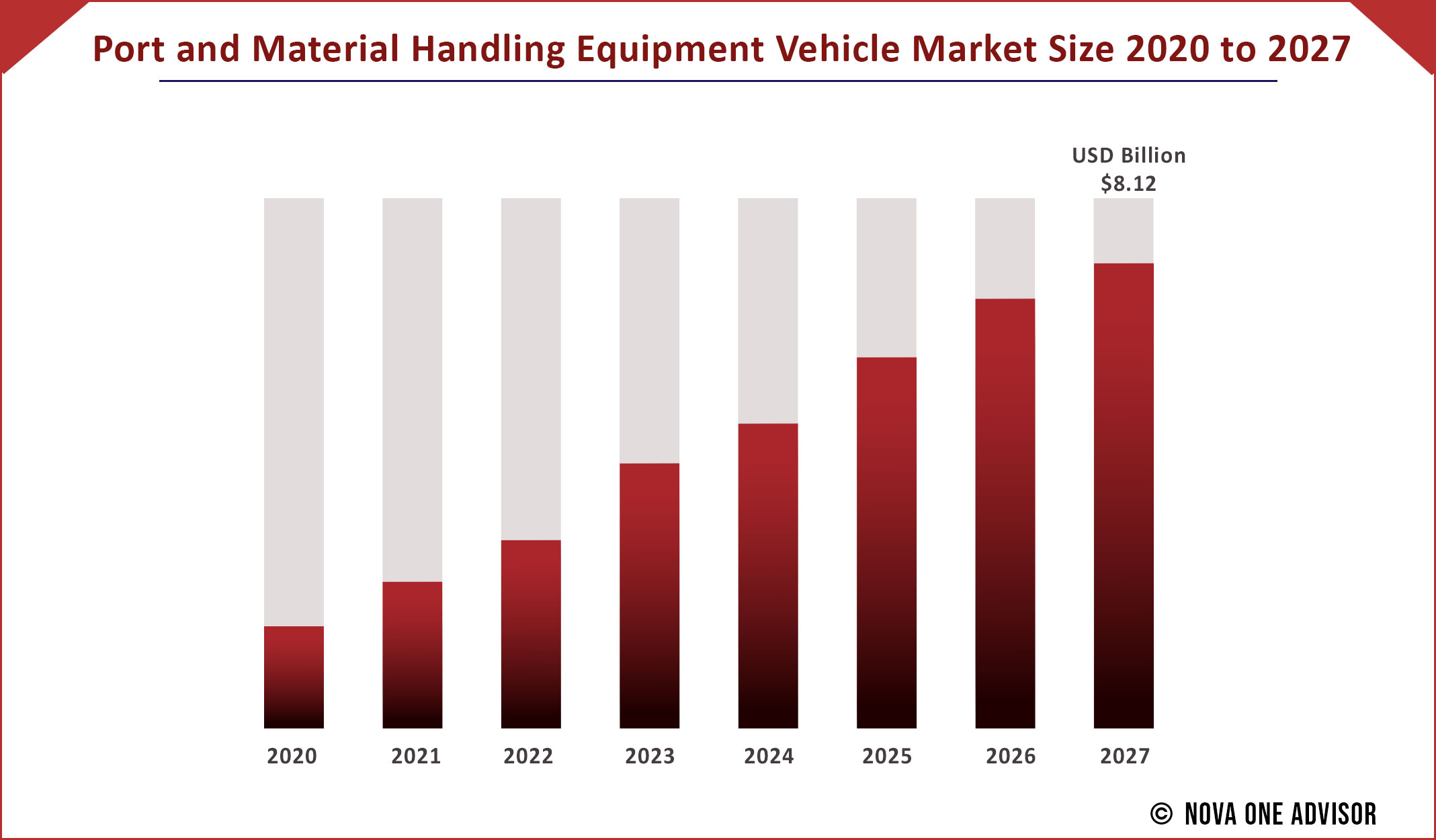

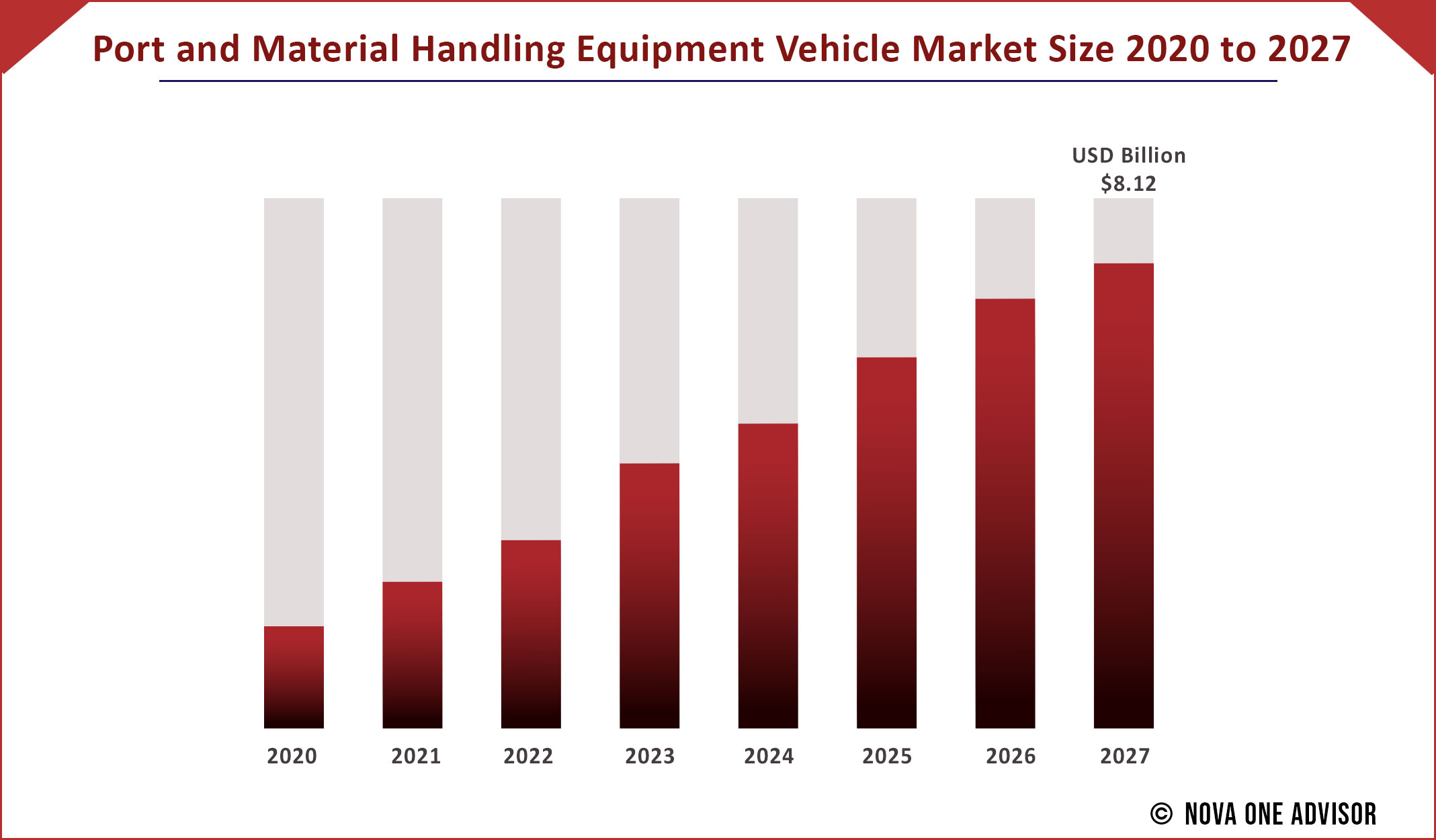

The global Port and Material Handling Equipment Vehicle market gathered revenue around USD 8.12 Billion by the end of 2027 and is estimated to expand at a modest CAGR of 4.9% during the prediction period 2021 to 2027.

Growth Factors:

The market Growing number of seaports and size of ships is affecting the port industry, in particular the container port segment. The participation of the private sector in container port operations in particular through public–private partnerships are fueling high competition among the port operators and rising performance levels. This is driving the need for new port handling infrastructure.

Furthermore, there has been an increase in links to global supply chains and sourcing of raw materials. Finished products have become increasingly globalized, and producers in various areas, often-distant areas of the world, are increasingly being forced to compete with one another for the same markets. This trend is leading to more trade of goods across countries, thus, boosting port operations. This, in turn, is propelling the demand for port and material handling equipment vehicles.

This research report purposes at stressing the most lucrative growth prospects. The aim of the research report is to provide an inclusive valuation of the Port and Material Handling Equipment Vehicle market and it encompasses thoughtful visions, actualities, industry-validated market findings, historic data, and prognoses by means of appropriate set of assumptions and practice. Global Port and Material Handling Equipment Vehicle market report aids in comprehending market structure and dynamics by recognizing and scrutinizing the market sectors and predicted the global market outlook.

Report Coverage

| Report Scope |

Details |

| Market Size |

USD 8.12 Billion by 2027 |

| Growth Rate |

CAGR of 4.9% From 2021 to 2027 |

| Base Year |

2020 |

| Forecast Period |

2021 to 2027 |

| Historic Data |

2017 to 2020 |

| Report coverage |

Growth Factors, Revenue Status, Competitive Landscape, and Future Trends |

| Segments Covered |

Equipment Type, Application, Propulsion, Demand And Region

|

| Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned |

Konecranes, Liebherr, Shanghai Zhenhua Heavy Industries (ZPMC), Kalmar, and Hyster. Asea Brown Boveri(ABB), Anhui Heli Industrial Vehicle Imp. & Exp. Co. Ltd., Cavotec SA, CVS Ferrari s.r.l, Hyster-Yale Group, Inc |

COVID-19 Impact Assessment on Market Landscape

The report comprises the scrutiny of COVID-19 lock-down impact on the income of market leaders, disrupters and followers. Since lock down was instigated differently in diverse regions and nations, influence of same is also dissimilar across various industry verticals. The research report offers present short-term and long-term influence on the market to assist market participants across value chain makers to formulate the framework for short term and long-lasting tactics for recovery and by region.

Port and Material Handling Equipment Vehicle market Report empowers readers with all-inclusive market intelligence and offers a granular outline of the market they are operational in. Further this research study delivers exceptional combination of tangible perceptions and qualitative scrutiny to aid companies accomplishes sustainable growth. This report employs industry-leading research practices and tools to assemble all-inclusive market studies, intermingled with pertinent data. Additionally, this report also emphases on the competitive examination of crucial players by analyzing their product portfolio, pricing, gross margins, financial position, growth approaches, and regional occurrence.

Port and Material Handling Equipment Vehicle Market Segmentation analysis:

The global port and material handling equipment vehicle market has been segmented based on equipment type, application, propulsion, demand, and region

Based on equipment type, upgrade of ports in Asia Pacific, subsequent installation of new cranes, and upgrade of existing cranes are driving the demand for material handling port cranes. Electrified rubber-tired gantry and automated stacking crane types are also likely to witness higher demand over the next few years.

Based on application, container handling was the dominant segment in 2020, owing to consistent rise in global trade volumes in 2020. The total container throughput of 50 major cargo ports in the world increased by 3.2% year-over-year.

Based on propulsion, diesel is a major segment of the port and material handling equipment market; however, the introduction of the electric and fuel cell-based equipment is estimated to gain market share held by the diesel segment over the next few years, especially in developed regions such as Europe and North America

Based on demand, new demand is a major segment, in terms of revenue, of the port and material handling equipment market. Improvement in vehicle technologies is estimated to contract the MRO and services segment, in terms of revenue, in the near future.

Regional Analysis:

Based on region, the global port and material handling equipment vehicle market has been segregated into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa

Asia Pacific is projected to be a highly lucrative region of the global port and material handling equipment vehicle market during the forecast period. India, one of the rapidly expanding markets for port material handling equipment in the region, has introduced ‘Sagarmala’ project to boost sea trade. This is estimated to boost cargo traffic at Indian ports to approximately 2500 MMTPA, while the current cargo handling capacity of Indian ports is only 1500 MMTPA. A roadmap has been prepared to increase port capacity in India to 3300+ MMTPA by 2025 in order to cater to the growing traffic. This includes port operational efficiency improvement, capacity expansion of existing ports, and new port development. While Southeast Asia is projected to witness investments of more than US$ 47.1 Bn in port development, expansion projects, and planning strategies to address the rising demand and to achieve higher competitiveness through a stronger flow of investments into the transport and logistics segments.

China has also been witnessing a surge in trade activity after eased trade policy between the U.S. and China. According to the statistics released by China Ports and Harbours Association, export container volume increased 11.4%, while inland container volume increased 18.2%, Therefore, Asia Pacific is estimated to be a prominent market for port and material handling equipment vehicles.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Port and Material Handling Equipment Vehicle Market include: Konecranes, Liebherr, Shanghai Zhenhua Heavy Industries (ZPMC), Kalmar, and Hyster. Asea Brown Boveri(ABB), Anhui Heli Industrial Vehicle Imp. & Exp. Co. Ltd., Cavotec SA, CVS Ferrari s.r.l, Hyster-Yale Group, Inc

Unravelling the Critical Segments

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects including product type, application/end-user, and region. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for period 2017 to 2027 and covers subsequent region in its scope:

arket: Segmentation

- Port and Material Handling Equipment Vehicle Market, by Equipment Type

- Tug Boats

- Cranes

- Rubber-Tired Gantry (RTG) Cranes

- Electrified Rubber-Tired Gantry (E-RTGS) Cranes

- Ship-to-Shore Cranes

- Yard Cranes

- Rail-Mounted Gantry (RMG) Cranes

- Automated Stacking Cranes

- Ship Loaders

- Reach Stackers

- Mooring Systems

- Automated Guided Vehicles

- Forklift Trucks

- Container Lift Trucks

- Terminal Tractors

- Straddle Carriers

- Others

- Port and Material Handling Equipment Vehicle Market, by Application

- Container Handling

- Ship Handling

- Services

- Storage Handling

- Automated Storage Handling

- Bulk Material Handling

- Others

- Port and Material Handling Equipment Vehicle Market, by Propulsion

- Diesel

- Gasoline

- Electric/Battery

- Others

- Port and Material Handling Equipment Vehicle Market, by Demand

- New Demand

- MRO & Services

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Highlights of the Report:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

Research Methodology

In the study, a unique research methodology is utilized to conduct extensive research on the growth of the Port and Material Handling Equipment Vehicle market, and reach conclusions on the future growth parameters of the market. This research methodology is a combination of primary and secondary research, which helps analysts ensure the accuracy and reliability of the conclusions.

Secondary resources referred to by analysts during the production of the Port and Material Handling Equipment Vehicle market study are as follows - statistics from government organizations, trade journals, white papers, and internal and external proprietary databases. Analysts have also interviewed senior managers, product portfolio managers, CEOs, VPs, marketing/product managers, and market intelligence managers, all of whom have contributed to the development of this report as a primary resource.

Comprehensive information acquired from primary and secondary resources acts as a validation from companies in the market, and makes the projections on the growth prospects of the Port and Material Handling Equipment Vehicle markets more accurate and reliable.

Secondary Research

It involves company databases such as Hoover's: This assists us recognize financial information, structure of the market participants and industry competitive landscape.

The secondary research sources referred in the process are as follows:

- Governmental bodies, and organizations creating economic policies

- National and international social welfare institutions

- Company websites, financial reports and SEC filings, broker and investor reports

- Related patent and regulatory databases

- Statistical databases and market reports

- Corporate Presentations, news, press release, and specification sheet of Manufacturers

Primary Research

Primary research includes face-to face interviews, online surveys, and telephonic interviews.

- Means of primary research: Email interactions, telephonic discussions and Questionnaire based research etc.

- In order to validate our research findings and analysis we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

- CEOs, VPs, market intelligence managers

- Procuring and national sales managers technical personnel, distributors and resellers

- Research analysts and key opinion leaders from various domains

Key Points Covered in Port and Material Handling Equipment Vehicle market Study:

- Growth of Port and Material Handling Equipment Vehicle in 2021

- Market Estimates and Forecasts (2017-2027)

- Brand Share and Market Share Analysis

- Key Drivers and Restraints Shaping Market Growth

- Segment-wise, Country-wise, and Region-wise Analysis

- Competition Mapping and Benchmarking

- Recommendation on Key Winning Strategies

- COVID-19 Impact on Demand for Port and Material Handling Equipment Vehicle and How to Navigate

- Key Product Innovations and Regulatory Climate

- Port and Material Handling Equipment Vehicle Consumption Analysis

- Port and Material Handling Equipment Vehicle Production Analysis

- Port and Material Handling Equipment Vehicle and Management