The global portable generator market size was exhibited at USD 4.50 billion in 2023 and is projected to hit around USD 7.69 billion by 2033, growing at a CAGR of 5.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- The Asia-Pacific region dominated the market and accounted for more than 35.0% of the share in 2023

- The gasoline generator segment dominated the market in 2023 and accounted for more than 42.0% of the global revenue.

- The low power generator segment dominated the market in 2023 and accounted for more than 40.0% of the global revenue.

- The emergency segment dominated the market in 2023 and accounted for more than 65.0% of the global revenue.

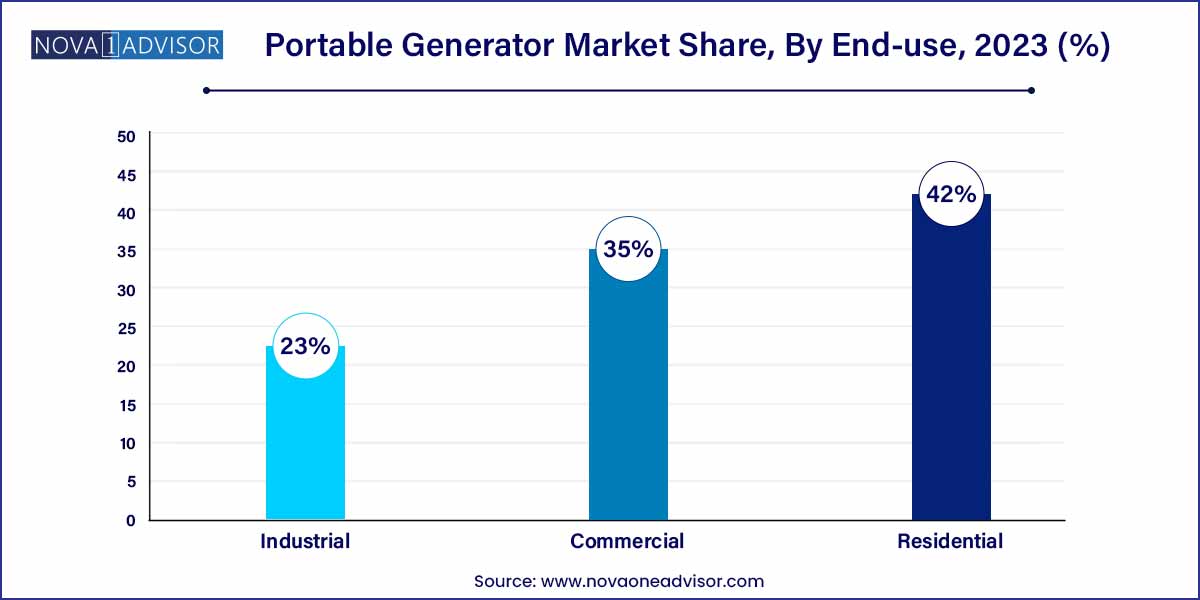

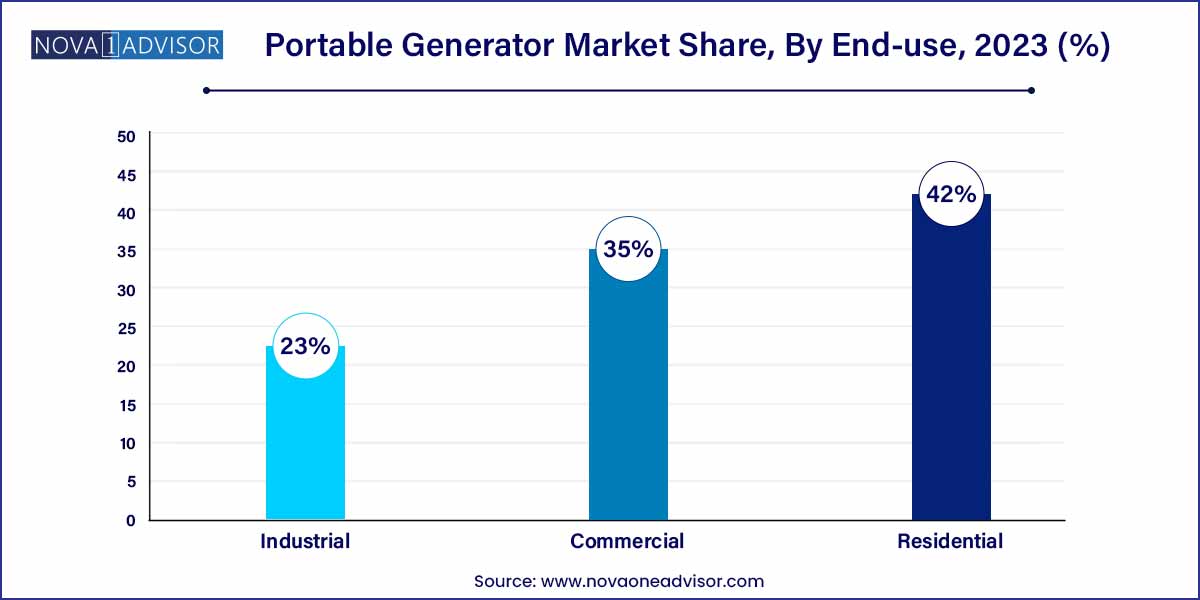

- The residential segment dominated the market in 2023 and accounted for more than 42.0% of the global revenue.

Market Overview

The portable generator market plays a vital role in providing temporary, flexible, and reliable power solutions for residential, commercial, and industrial applications. Portable generators serve as critical backup during power outages, facilitate operations at remote sites, and enable outdoor activities requiring electricity. Their mobility, versatility, and growing technological enhancements make them an indispensable solution in various sectors worldwide.

The market is expanding significantly due to increasing incidences of power grid failures, rising construction and mining activities in remote locations, and a growing preference for emergency preparedness among households. Technological advancements, such as inverter technology, eco-friendly fuel alternatives, and hybrid systems, are reshaping the dynamics of the portable generator industry. Additionally, the increasing frequency of extreme weather events—hurricanes, wildfires, and floods—has emphasized the need for reliable off-grid power sources. As sustainability gains momentum, manufacturers are focusing on introducing cleaner, more efficient models to meet stringent environmental regulations and evolving consumer preferences.

Major Trends in the Market

-

Increasing popularity of inverter generators: Inverter generators offer quieter operation, fuel efficiency, and clean energy, suitable for sensitive electronics.

-

Growing demand for dual-fuel generators: Flexibility to switch between gasoline and propane enhances reliability and appeals to cost-conscious users.

-

Focus on eco-friendly models: Introduction of solar-powered and hybrid portable generators aligning with global carbon reduction goals.

-

Integration of smart technologies: IoT-enabled generators offer remote monitoring, predictive maintenance alerts, and operational optimization.

-

Expansion of portable generators in outdoor recreational activities: Rising trend in camping, RV travel, and outdoor events drives demand for compact, low-noise units.

-

Emphasis on lightweight and ergonomic designs: Manufacturers are innovating for improved portability without sacrificing power output.

-

Emergence of rental services: Businesses and consumers increasingly rent generators for short-term needs, expanding rental-focused business models.

Portable Generator Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.50 Billion |

| Market Size by 2033 |

USD 7.69 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Power Range, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Briggs & Stratton Corporation; Champion Power Equipment; Caterpillar, Inc.; Cummins Inc.; Generac Power Systems, Inc.; Kohler Co.; Multiquip Inc.; WINCO; Yamaha Motor Corporation, U.S.A. ; Duromax Power Equipment. |

Segments Insights:

Product Insights

Gasoline generators dominated the product segment in 2024. Gasoline-powered generators remain popular due to their affordability, easy availability of fuel, and lightweight designs suitable for residential and light commercial use. Their ubiquity, ease of operation, and lower upfront costs make them the go-to option for emergency preparedness among homeowners, outdoor enthusiasts, and small contractors.

Gaseous generators are expected to be the fastest-growing segment. Powered by propane or natural gas, gaseous generators offer cleaner combustion, reduced emissions, and lower maintenance compared to gasoline and diesel models. With tightening emission regulations and rising fuel cost sensitivities, gaseous generators are gaining momentum across residential, commercial, and industrial applications.

Power Range Insights

Low Power (8 - 20KW) generators dominated the power range segment in 2024. Low-power generators cater primarily to residential needs, small businesses, and recreational users. They offer sufficient capacity to run essential appliances like refrigerators, sump pumps, lights, and communication devices during outages, ensuring their widespread adoption.

Medium Power (21 - 370KW) generators are projected to grow fastest. The growing demand for medium-power units in commercial spaces such as retail outlets, healthcare clinics, and construction sites is driving this segment's rapid growth. Their ability to support heavier loads without sacrificing mobility offers an attractive proposition for users requiring a balance between power and portability.

Application Insights

Emergency application segment dominated the market in 2024. Emergency power supply during unexpected outages remains the primary application for portable generators. Residential users prioritize emergency preparedness, while commercial entities like restaurants and convenience stores rely on portable backup solutions to prevent revenue losses during grid failures.

Prime/Continuous application is expected to grow at a faster pace. In industries operating in remote locations, such as oil and gas exploration and mining, portable generators are used as primary or continuous power sources. The expansion of off-grid projects and rural electrification initiatives across emerging markets is boosting demand in this segment.

End-use Insights

Residential segment dominated the end-use category in 2024. Homeowners increasingly invest in portable generators to safeguard against blackouts, protect perishable goods, maintain HVAC operations, and support medical devices. The increased frequency of climate-induced disasters has heightened residential demand across developed and developing economies alike.

Industrial segment particularly construction is expected to be the fastest-growing. Construction activities in remote areas require reliable, mobile power solutions to run machinery, tools, and site lighting. The booming construction industries in emerging economies, coupled with stringent timelines and project demands, are fostering rapid growth of portable generator use within the industrial sector.

Regional Insights

North America dominated the portable generator market in 2024. The region's leadership stems from frequent severe weather events, aging power grids, and a high level of emergency preparedness among consumers and businesses. The United States accounts for the majority of demand, supported by regulatory frameworks promoting emergency management, substantial construction activities, and a well-established culture of disaster readiness. Leading companies such as Generac Holdings and Briggs & Stratton continually innovate to meet evolving demands, solidifying the region's dominant position.

Asia-Pacific is projected to be the fastest-growing region. Rapid urbanization, industrialization, and rural electrification programs across China, India, Indonesia, and Southeast Asia are driving generator demand. Frequent natural disasters such as typhoons, floods, and earthquakes necessitate reliable backup power solutions. Additionally, expanding infrastructure development projects—ranging from highways to renewable energy farms—require portable, scalable power sources, propelling market growth in the region.

Some of the prominent players in the portable generator market include:

- Briggs & Stratton Corporation

- Champion Power Equipment

- Caterpillar, Inc.

- Cummins Inc.

- Generac Power Systems, Inc.

- Kohler Co.

- Multiquip Inc.

- WINCO

- Yamaha Motor Corporation, U.S.A.

- Duromax Power Equipment

Recent Developments

-

January 2025: Generac Holdings unveiled a new series of portable inverter generators with integrated Wi-Fi connectivity for real-time performance monitoring and maintenance alerts.

-

February 2025: Honda Power Equipment introduced its EU32i inverter generator model featuring ultra-quiet operation and compatibility with clean energy add-ons.

-

March 2025: Yamaha Motor Corporation announced the expansion of its portable generator lineup, including dual-fuel models for residential and commercial use.

-

April 2025: Briggs & Stratton Corporation partnered with a leading solar technology firm to co-develop hybrid portable generators combining propane and solar power for residential markets.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global portable generator market.

Product

- Diesel Generator

- Gaseous Generator

- Gasoline Generator

- Others

Power Range

- Low Power (8 - 20KW)

- Medium Power (21 - 370KW)

- High Power (371 - 450KW)

Application

- Prime/Continuous

- Emergency

End-use

- Commercial

- Residential

- Industrial

-

- Construction

- Mining

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)