The global portable oxygen concentrators market size was recorded at USD 1.70 billion in 2023 and is foreseen to touch around USD 3.99 billion by 2033, with a registered compound annual growth rate (CAGR) of 8.9% from 2024 to 2033.

Key Takeaways

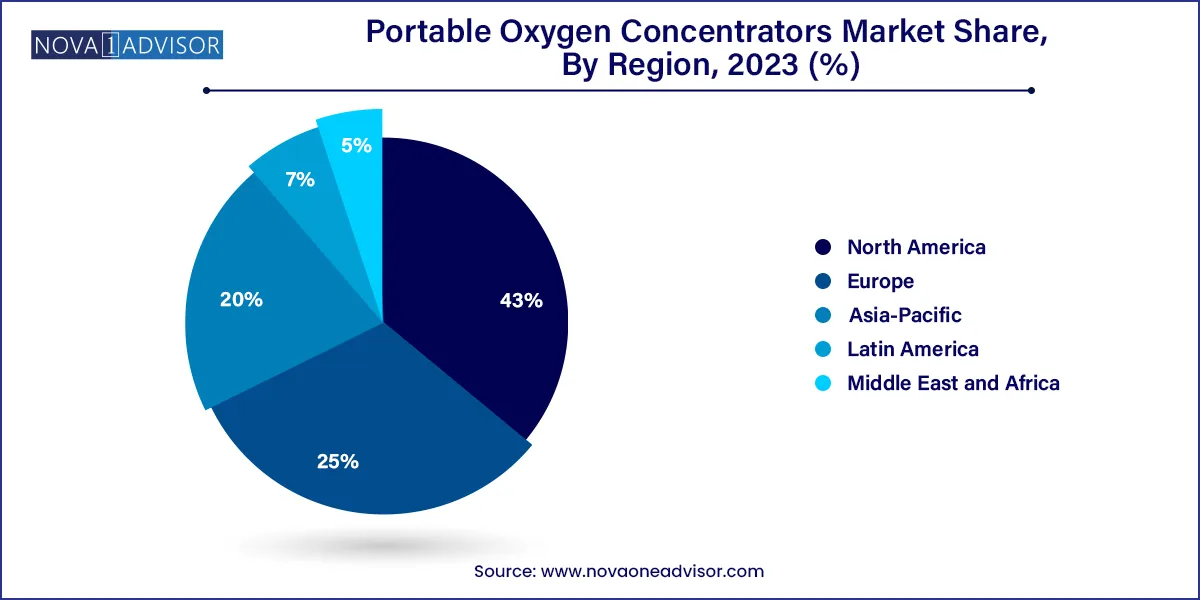

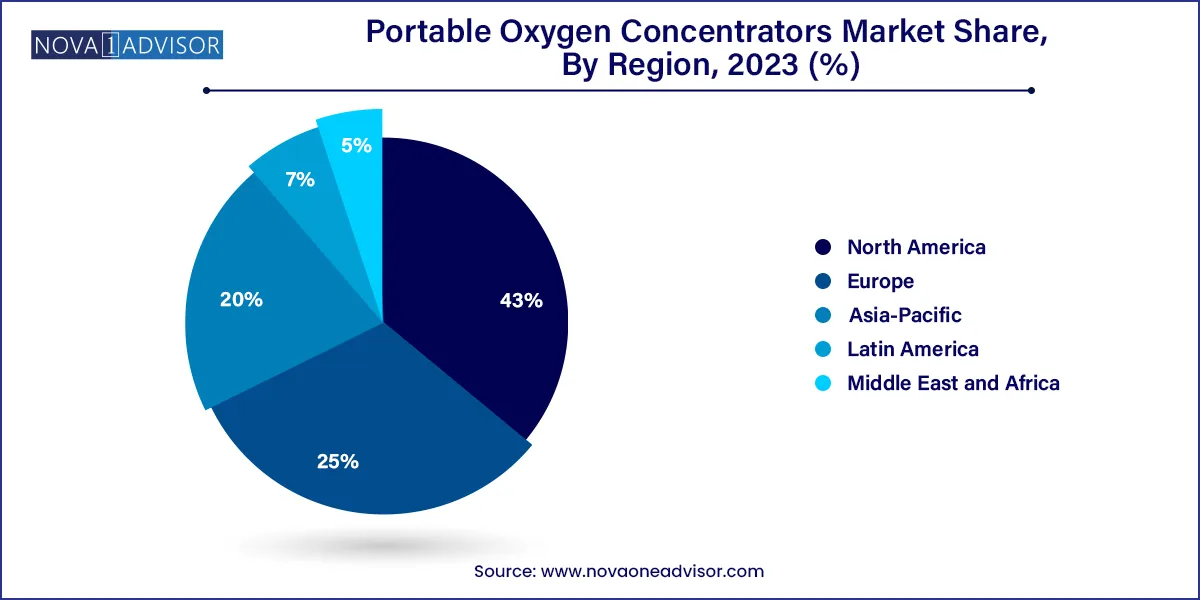

- The North America market accounted for 43.0% revenue share in 2023.

- Asia Pacific market is growing at a high CAGR over the forecast period

- By product, the portable segment has captured a 56% revenue share in 2023.

- By technology, the pulse flow segment has captured a 68.45% revenue share in 2023.

- By indication, the COPD segment has held the major share of around 42% in 2023.

- By end use, the homecare segment held a 57.3% revenue share in 2023.

Market Overview

The Portable Oxygen Concentrators (POC) market has emerged as a vital component in the global medical devices sector, propelled by a growing emphasis on respiratory healthcare and technological innovation. A portable oxygen concentrator is a medical device that provides oxygen therapy to individuals requiring higher concentrations of oxygen than that in ambient air. Unlike traditional bulky oxygen cylinders, POCs are compact, lightweight, and battery-operated, making them ideal for patients who wish to maintain mobility and independence while undergoing oxygen therapy.

The market’s expansion is closely tied to the rising prevalence of chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and sleep apnea, which collectively affect hundreds of millions of people worldwide. According to the World Health Organization (WHO), over 250 million people globally suffer from COPD alone, underscoring the urgent need for effective oxygen therapy solutions. Additionally, an aging population, increasing pollution levels, and heightened awareness regarding home healthcare have substantially amplified the demand for POCs.

COVID-19 further highlighted the critical need for oxygen delivery systems, significantly accelerating the adoption of POCs for at-home use, especially in regions where hospital infrastructure was overwhelmed. Moreover, innovations in battery life, device miniaturization, and integration with smart technologies have made POCs more user-friendly and efficient, attracting broader consumer bases, including travelers and sports enthusiasts dealing with high-altitude conditions.

Major Trends in the Market

-

Growing preference for home healthcare solutions due to cost-effectiveness and comfort, especially among geriatric and chronic disease patients.

-

Technological advancements in POCs, such as the integration of IoT, Bluetooth connectivity, and app-controlled settings.

-

Increased government support and reimbursement policies, particularly in developed markets like the U.S. and Europe.

-

Miniaturization and weight reduction of devices enhancing portability and convenience.

-

Surge in medical tourism and travel-friendly regulations, which are encouraging the adoption of travel-compliant POCs.

-

Rapid urbanization and rising pollution levels leading to increased incidence of respiratory conditions.

-

Collaborations and partnerships among manufacturers and healthcare providers to improve distribution and after-sales service.

Portable Oxygen Concentrators Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.85 Billion |

| Market Size by 2033 |

USD 3.99 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Product Type, By Technology, By Indication ,By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AirSep Corporation, Besco Medical Co., LTD (China), CAIRE Inc. (US), Chart Industries, Inc. (US), Drive DeVilbiss Healthcare (US), Foshan Keyhub Electronic Industries Co. Ltd. (Guangdong), GCE Group (Sweden), Inogen, Inc. (US), Inova Labs, Inc., Invacare Corporation (US), Koninklijke Philips N.V (Netherlands), Nidek Medical (India), O2 CONCEPTS LLC., (US), Oxus America, Inc. (Oxus), Philips Respironics (US), and Others. |

Key Market Driver: Rising Geriatric Population with Respiratory Ailments

One of the primary driving forces behind the POC market's growth is the expanding elderly population, which is more susceptible to respiratory conditions. The aging process leads to a natural decline in lung function, rendering seniors more vulnerable to diseases like COPD and pulmonary fibrosis. According to the United Nations, the global population aged 65 and above is projected to double by 2050, reaching over 1.5 billion. This demographic shift has profound implications for the demand for respiratory support technologies. POCs offer a non-invasive, user-friendly, and mobile alternative to traditional oxygen therapy, allowing elderly patients to maintain a higher quality of life and independence, which directly contributes to the market's expansion.

4. Key Market Restraint: High Device and Maintenance Costs

Despite the numerous advantages offered by portable oxygen concentrators, high acquisition and maintenance costs pose a significant barrier to widespread adoption, particularly in low and middle-income countries. A typical POC unit can cost between USD 2,000 and USD 4,000, which is often not covered entirely by insurance policies. Additionally, recurring expenses related to battery replacement, filters, and servicing can be burdensome for many users. These cost factors make POCs inaccessible to a large section of the population that could benefit from them. Furthermore, lack of awareness about reimbursement options and insufficient infrastructure to support device servicing in rural regions exacerbates this restraint.

Key Market Opportunity: Integration with Smart Healthcare Ecosystems

An emerging opportunity within the POC market lies in integrating these devices into the larger digital health and remote patient monitoring ecosystems. With the rise of smart healthcare technologies, POCs can now be equipped with Bluetooth and Wi-Fi to connect with smartphones and tablets, enabling real-time data sharing with healthcare providers. This not only improves patient compliance and therapy outcomes but also reduces hospital readmissions by enabling early intervention. Companies that invest in such integrated technologies stand to gain a competitive advantage, as this evolution aligns with broader trends in telemedicine, personalized healthcare, and value-based care models.

By Product Type

Portable oxygen concentrators dominated the product type segment owing to their unmatched convenience, mobility, and suitability for both homecare and travel applications. Patients increasingly prefer portable units as they offer greater freedom, eliminate the need for stationary oxygen tanks, and are typically FAA-approved for air travel. Innovations such as lightweight models under 5 lbs and extended battery life (up to 13 hours) have significantly bolstered adoption rates.

Conversely, the fixed oxygen concentrator segment is anticipated to grow steadily due to its application in clinical settings and for patients with higher oxygen requirements. Fixed units, often more powerful and offering continuous flow, are still relevant in hospitals and long-term care facilities where mobility is less of a concern. However, with the miniaturization of portable units catching up to fixed units in performance, the latter faces tough competition.

By Application

Homecare emerged as the most dominant application segment, benefitting from a global shift towards home-based treatment solutions. Especially in the post-pandemic world, patients and providers alike are prioritizing treatment options that minimize hospital visits. POCs in homecare settings improve comfort, reduce healthcare costs, and foster patient autonomy, making them highly popular among chronic condition sufferers.

Travel applications are witnessing the fastest growth, as manufacturers continue to design devices that meet TSA and FAA guidelines. With global air travel resuming, patients are no longer confined due to oxygen dependence. Travel-compliant POCs have seen rising adoption among elderly tourists, adventure enthusiasts at high altitudes, and business travelers needing on-the-go oxygen support.

By Technology

Pulse flow technology currently dominates the market, especially in the portable segment, due to its energy efficiency and compact design. Pulse flow systems deliver oxygen only during inhalation, making them more battery-efficient and ideal for ambulatory patients. These units are lighter and more suited to travel, aligning with current consumer demands for portability and ease of use.

On the other hand, continuous flow technology is experiencing rapid growth, particularly in hospital and high-need homecare scenarios. Continuous flow concentrators provide a steady stream of oxygen regardless of the patient's breathing pattern, which is essential for patients with severe respiratory distress. Advances in compressor technology are gradually making continuous flow devices more portable, helping bridge the gap between stationary and mobile use cases.

By Regional Insights

North America leads the global Portable Oxygen Concentrators market, driven by high disease prevalence, favorable reimbursement policies, and widespread acceptance of homecare devices. The U.S. has one of the highest COPD patient populations globally, alongside a sophisticated healthcare infrastructure that supports home-based therapy. Moreover, insurance companies, including Medicare, often cover part of the POC cost, which encourages adoption. Several key players like Inogen, CAIRE Inc., and Philips Respironics are based in the region, facilitating innovation and supply chain robustness.

Asia-Pacific is poised to grow at the fastest rate during the forecast period, thanks to rapidly aging populations, increasing healthcare awareness, and improving disposable incomes in countries like China, India, and Japan. Air pollution, a major respiratory health hazard, is a significant driver in this region. Government initiatives aimed at expanding healthcare access, combined with the increasing penetration of medical technology in rural and semi-urban areas, are catalyzing market growth. Additionally, growing investments by global players to establish manufacturing and distribution networks in Asia-Pacific further amplify the region’s potential.

Recent Developments

-

Inogen Inc., a leading POC manufacturer, announced in January 2025 the launch of its new Inogen Rove 6 model with enhanced Bluetooth connectivity, longer battery life, and improved oxygen output. This marks a strategic shift toward smart healthcare solutions.

-

CAIRE Inc. expanded its presence in the Asia-Pacific region by opening a new facility in Vietnam in October 2024, aimed at addressing increasing regional demand and improving supply chain agility.

-

Philips Respironics introduced software updates in December 2024 to its SimplyGo Mini concentrator, enhancing user interface and mobile connectivity, and aligning with its broader digital health strategy.

-

O2 Concepts, known for its Oxlife Independence series, formed a partnership with remote monitoring service providers in November 2024, signaling a move toward integrated chronic disease management.

Portable Oxygen Concentrators Market Companies

- AirSep Corporation

- Besco Medical Co., LTD (China)

- CAIRE Inc. (US)

- Chart Industries, Inc. (US)

- Drive DeVilbiss Healthcare (US)

- Foshan Keyhub Electronic Industries Co. Ltd. (Guangdong)

- GCE Group (Sweden)

- Inogen, Inc. (US)

- Inova Labs, Inc.

- Invacare Corporation (US)

- Koninklijke Philips N.V (Netherlands)

- Nidek Medical (India)

- O2 CONCEPTS LLC., (US)

- Oxus America, Inc. (Oxus)

- Philips Respironics (US)

- Precision Medical, Inc. (US)

- ResMed (US)

- Smith’s Medical, Inc. (US)

- Zadro Health Solutions (US)

Segments Covered in the Report

By Product Type

By Technology

- Continuous Flow

- Pulse Flow

By Indication

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Sleep Apnea

- Others

By Application

- Homecare

- Travel

- Hospital

- Others

- By Geography

North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)