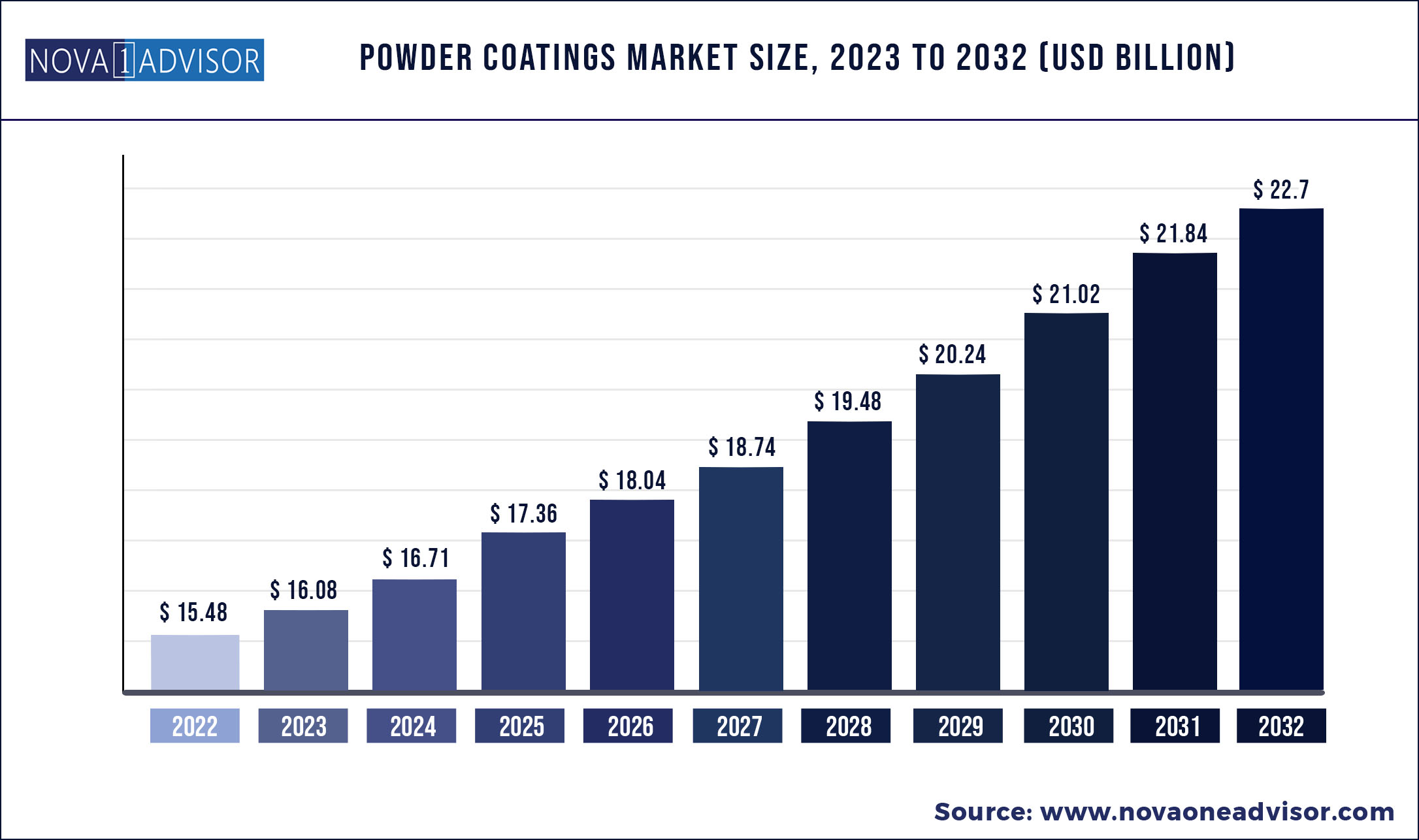

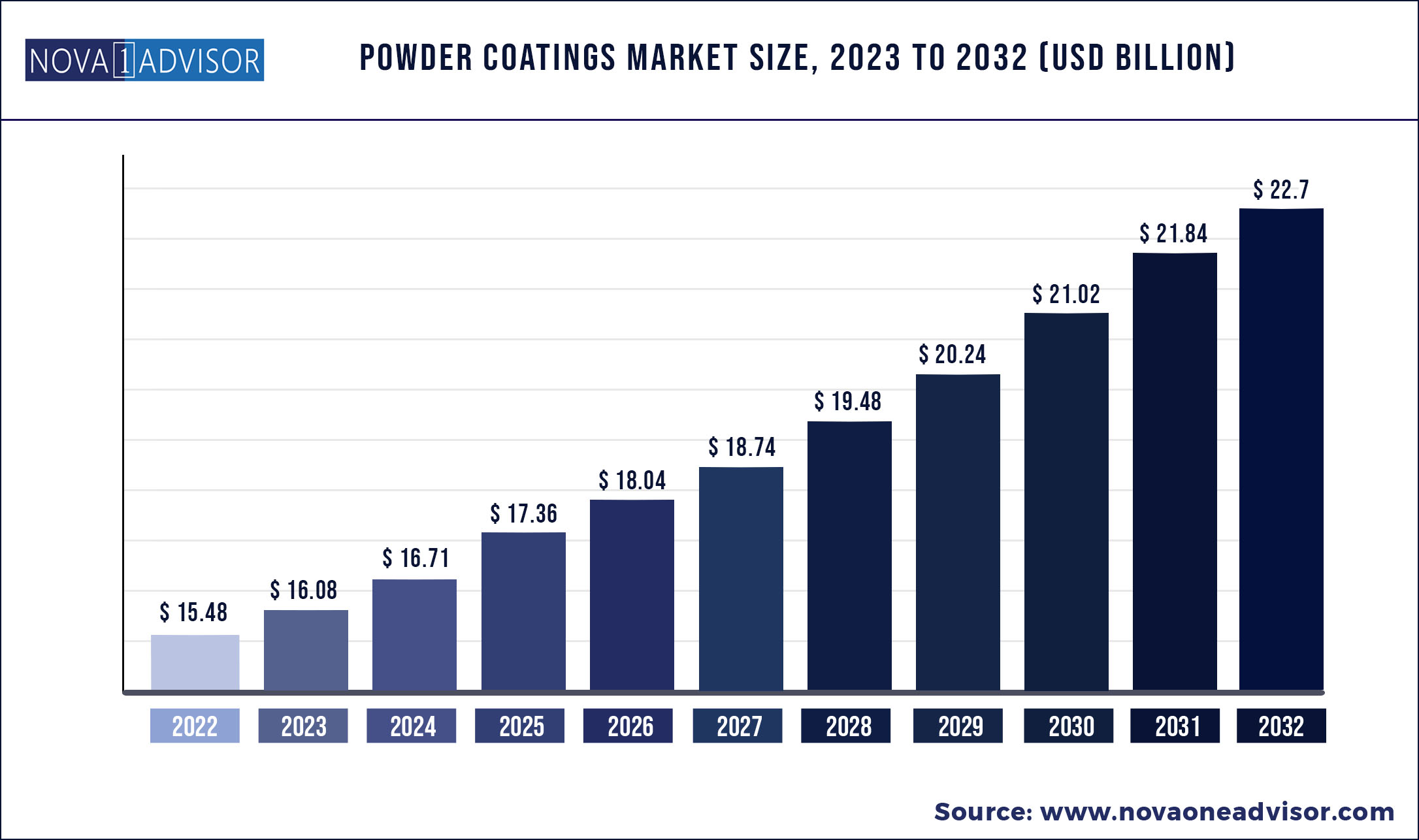

The global Powder Coatings market size was exhibited at USD 15.48 billion in 2022 and is projected to hit around USD 22.7 billion by 2032, growing at a CAGR of 3.9% during the forecast period 2023 to 2032.

Powder coatings are 100% solid coatings, which comprise a homogeneous blend of polymers, pigments, and additives produced in the form of fine powder. These are solvent-free coatings and provide durable as well as attractive finishes. The powder is applied with the help of a spray gun, which imparts an electrical charge on powder particles and directs them toward the object to be coated. The object is then subjected to heat, which causes the powder to melt, flow out, and form a tough, coherent film.

Powder coatings are used to provide protective and decorative finishes. They are available in a wide range of colors and textures. Technological advancements have resulted in excellent performance properties.

Powder Coatings Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 16.08 Billion

|

|

Market Size by 2032

|

USD 22.7 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 3.9 %

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

By Type, Coating Method, Application

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

Akzo Nobel N.V.|Axalta Coating Systems |PPG Industries, Inc.| KAPCI Coatings|Kansai Paint Co., Ltd|Nippon Paint Holdings Co., Ltd. |The Valspar Corporation | Asian Paints Limited |Kansai Nerolac Paints Limited |BASF SE| RPM International Inc. |DuluxGroup Limited

|

Powder Coating Market Dynamics

Driver: Growth in various end-use industries

Powder coatings have a wide range of applications in automotive, appliances, furniture, architectural, general industrial, and other industries. There is growth in the demand for powder coatings with new applications being developed. The furniture and appliances industries will continue to grow steadily in the future. IT and telecom are also new markets, where applications of powder coatings are extensively explored. Door handles, bumpers, window handles, and other parts of automobiles, including radiator coil spring, shock absorbers, and breaking parts, are also powder coated. Steady economic growth is bringing more investments to the Asia Pacific region. Since the last decade, investments by steel companies have pushed the development of appliances, construction, automotive, and electronics sectors in the developing countries of Asia Pacific and the Middle East. The growth of these industries is driving the demand for powder coatings.

Restraint: Difficulty in obtaining thin films

Powder coatings produce a thick finish on metal products. It is difficult to produce thin finishes using these coatings. The thickening of the polymer can lead to the formation of an uneven texture. Uniform flow and leveling are prerequisites for thin films. Although any powder coating can be formulated for thin film applications, not all these chemistries are suitable for it. The thin film of powder coating becomes more and more orange peeled in texture due to the particle size and glass transition temperature of the powder. For optimum material handling and ease of application, powder coating should have a particle size in the range of 30 to 50 micrometers. A successful thin film application involves the correlation between color and opacity of pigmentation of powder coatings.

Opportunity: Increasing use of powder coating in automotive industry

2018 has been a year of many innovations and technological advancements in the automotive industry. Sustainability plays an important role in the future of self-driving cars, with the global autonomous market expected to be worth USD 60 billion in 2030. In 2022, market predictions remain cautiously optimistic along with light vehicle sales set to increase, though modestly. Investments in the automotive industry in China provide high growth opportunities to powder coating manufacturers, as it is one of the main applications of this coating.

Powder coating is used for coating automotive engines, chassis, wheels, filters, joysticks, mirrors, wipers, horns, and other parts of vehicles. Transparent powder coating is being developed as a varnish for car bodies. Powder coatings have been traditionally used in these areas and have gained confidence. They have proven to be exceptionally durable and corrosion-free, along with the capability to impart high-quality esthetics.

Powder Coating Market Challenge Environmental Challenges

The powder coating industry faces many environmental challenges with the increasing focus on meeting state and local regulations regarding wastewater discharge. Powder coating operations have metals, oil & grease, and suspended solids in their waste streams generated during cleaning and pre-treatment phases of their operations. It is difficult for powder coating manufacturers to meet many state and local environmental regulations. Metal finishing companies that use various electroplating processes have been facing the challenges of heavy metal contamination in wastewater.

High Demand for Powder Coatings Due to Environment-friendly Characteristics

Rapid industrialization and urbanization has led to an increase in air pollution. Air pollutants such as volatile organic compounds (VOCs), particulate matter (PM), carbon monoxide (CO), and others, cause serious health hazards to agriculture and climate. Domestic and international regulatory organizations are pressurizing several developing and developed countries to enact legislations to restrict VOC emissions in order to reduce pollution.

Rules and regulations govern the evaluation, storage, handling, and transportation of specific chemicals, as well as their emissions, effluents, and other pollutants. The violation of such regulations is likely to result in legal obligations as well as severe penalties and losses. Thus, the demand for less harmful alternatives has increased. This is driving the powder coatings market.

Permits, testing, and record keeping have significantly reduced due to the low level of VOC released by powder coatings. Furthermore, powder coatings do not necessitate any specific transportation, storage, or handling methods. This is augmenting the powder coatings market.

Rise in Demand for Powder Coatings in Dynamic Automotive Industry

Powder coatings are transforming the automotive industry through faster production times and lower operating costs. They also provide irresistible value proposition for consumers. Conversion from conventional liquid coatings to powder coatings for auto body exteriors is taking place at a rapid pace. Powder coatings are used in automotive applications due to their abrasion and corrosion resistance. Powder coatings resist acid rain, ultraviolet rays of the sun, and road and weather damage. This helps cars retain their “showroom look” much longer, thus improving their resale value. There exists immense potential for high-heat resistant powder coatings on aftermarket mufflers, which protect against nicks, and prolong the life of the muffler.

Powder coatings are also applied to wheels, bumpers, door handles, roof racks, and exterior and interior trims. Primer powder coatings are now being used in some luxury cars to promote adhesion and resist corrosion. They are also used on the leading edge of sheet metals and rocker panels to protect against chipping. Thus, automotive is expected to be a highly attractive segment of the powder coatings market in terms of volume and growth rate during the forecast period.

Thermosets to Witness Surge in Demand Due to Excellent Temperature and Corrosion Resistance Properties

Based on type, the global powder coatings market has been segmented into thermoset and thermoplastic. The thermoset segment accounted for major share of 81.8% in 2022, owing to the preference of thermoset powder coatings in automotive, appliances, and general industrial products. Thermosets are preferred due to their excellent temperature and corrosion resistance properties. The thermoset segment has been further sub-segmented into epoxy, polyester, epoxy polyester hybrid, acrylic, and others. Low-temperature powder coatings and anti-microbial powder coatings are also prominent sub-segments of the thermoset segment.

The polyester sub-segment constitutes key share of the thermoset segment, as polyester has superior durability and high resistance to UV light, primarily in buildings, agriculture machinery, and garden and leisure equipment. Epoxy polyester hybrid is another type of powder coating. The sub-segment is projected to grow at a rapid pace during the forecast period due to the superior weatherability of epoxy polyester hybrid vis-à-vis epoxy powder coatings.

Rise in Adoption of Electrostatic Spray Coating Method to Reduce Spray Waste

The electrostatic spray segment held key share of 85% of the global market in 2022, owing to the preference of electrostatic spray for powder coatings in automotive, architecture, and furniture applications. Electrostatic spray is primarily used for thermoset powder coatings. Electrostatic spray requires the usage of a spray gun to apply an electrostatic charge to powder particles, which are attracted to the grounded part. The substrate is then subjected to heat, which causes the powder to melt, flow out, and form a tough, coherent film.

The electrostatic spray coating method is efficient due to the static electric charge created, which results in minimum spray waste. It is a cost effective method due to overspray reduction. Electrostatic sprayed finished product is of good quality due to the even distribution of paint. Thus, electrostatic spray is expected to be a highly attractive segment of the powder coatings market in terms of volume and growth rate during the forecast period.

Increase in Demand for Powder Coatings for Use in General Metals

Based on application, the powder coatings market has been segmented into appliances, automotive, architecture, metal furniture, ACE, general metals, and others. The general metals segment held key share of 31.9% in 2022 due to the rise in acceptance of powder coatings in the metal industry. Powder coating can be applied to stainless steel in domestic appliances.

The appliances segment is projected to grow at a rate of 16% during the forecast period. Powder coatings are used in appliances, as they improve esthetic appeal and resistance to abrasion, chemicals, and temperature cycling. The architecture segment constituted a small share of the market in 2021. The segment is likely to grow at a steady pace during the forecast period, owing to stringent verification processes by governments for VOC emissions. Powder coating is solvent-free; therefore, it does not emit VOCs.

Asia Pacific is the largest powder coating market in the forecast period

Asia Pacific is currently the fastest-growing and the largest market for powder coatings. With economic contraction and saturation in European and North American markets, the demand is shifting to the Asia Pacific region. Powder coating manufacturers are targeting this region, as it has the strongest construction industry, accounting for approximately 42% of global construction spending. Countries such as India, China, and Indonesia are investing heavily in various end-use industries, which is likely to influence the growth of the powder coatings market in these countries. The demand is also growing in the region, with a rise in income levels. Many foreign players are investing in the market of these countries to cater to the demand for powder coatings.

The spread of the coronavirus started in China in early January 2022. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand resulted in the pandemic situation, with rapid positive cases and death. This situation led national governments across Asia Pacific to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a manufacturing hub globally, the impact of COVID-19 is anticipated to be much higher in the country. Considering the above factors, the powder coatings market is expected to decline in Asia Pacific in 2022.

Some of the prominent players in the Powder Coatings Market include:

- Akzo Nobel N.V.

- Axalta Coating Systems

- The Sherwin-Williams Company

- PPG Industries, Inc.

- KAPCI Coatings

- Kansai Paint Co., Ltd

- Nippon Paint Holdings Co., Ltd.

- The Valspar Corporation

- Berger Paints India Limited

- Asian Paints Limited

- Kansai Nerolac Paints Limited

- SOMAR

- BASF SE

- RPM International Inc.

- DuluxGroup Limited

- Marpol Private Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Powder Coatings market.

By Type

- Thermoset

- Epoxy

- Polyester

- Epoxy Polyester Hybrid

- Acrylic

- Others (including Low Temperature Powder Coatings and Anti-microbial Powder Coatings)

- Thermoplastics

- Polyvinyl Chloride (PVC)

- Nylon

- Polyolefin

- Polyvinylidene Fluoride (PVDF)

By Coating Method

- Electrostatic Spray

- Fluidized Bed

By Application

- General Metals

- Metal Furniture

- Agriculture, Construction, and Earthmoving Equipment (ACE)

- Automotive

- Architecture

- Appliances

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)