Precision Psychiatry Market Size Trends Analysis and Forecast till 2034

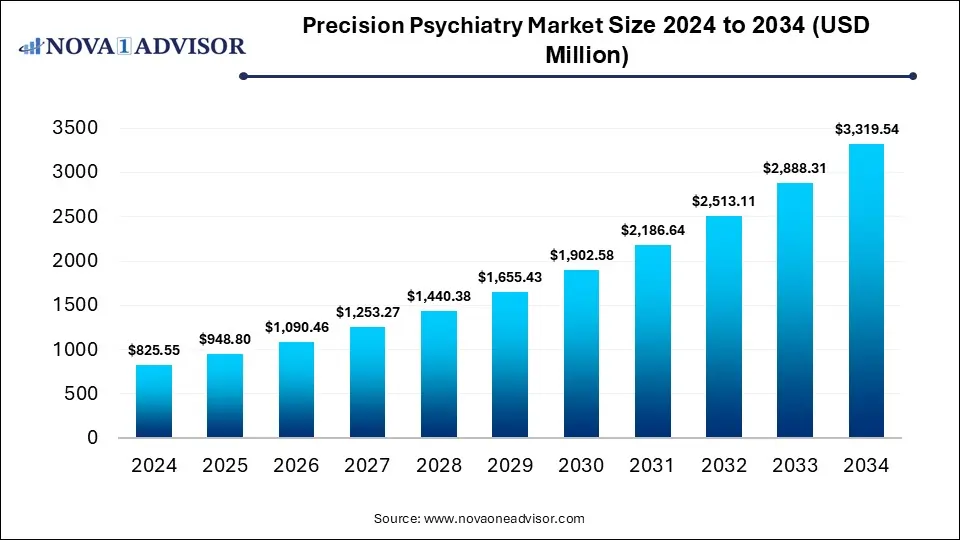

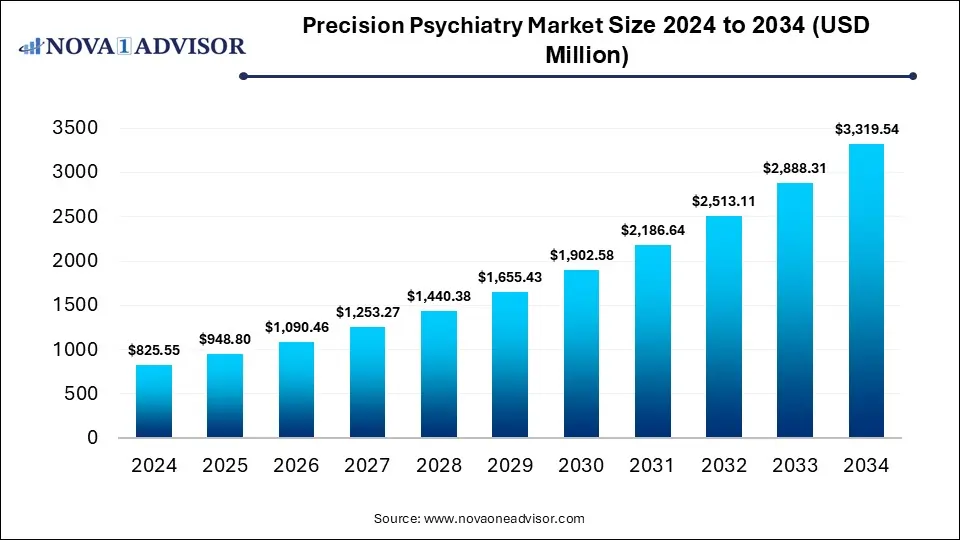

The global precision psychiatry market size was estimated at USD 825.55 million in 2024 and is expected to reach USD 3,319.54 million in 2034, expanding at a CAGR of 14.93% during the forecast period of 2025 and 2034. The market growth is driven by advancements in genomics, neuroimaging, biomarker research, and AI-based diagnostic tools that enable personalized mental health treatment.

Precision Psychiatry Market Key Takeaways

- By region, North America held the largest share of the precision psychiatry market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By component, the diagnostics segment led the market in 2024.

- By component, the therapeutic segment is expected to expand at the highest CAGR over the projected timeframe.

- By technology, the genomics & pharmacogenomics segment led the market in 2024.

- By technology, the artificial intelligence & machine learning segment is expected to expand at the highest CAGR over the projection period.

- By disorder type, the depression segment led the market in 2024.

- By end user, the hospital & clinic segment held the dominant share in 2024.

Impact of AI on the Precision Psychiatry Market

AI is significantly enabling more accurate diagnosis, risk prediction, and treatment personalization based on individual patient data. Machine learning algorithms can analyze complex datasets, such as genetic profiles, neuroimaging, electronic health records, and behavioral data, to identify patterns that may not be visible to clinicians. This allows for early detection of psychiatric disorders like depression, schizophrenia, and bipolar disorder, improving patient outcomes and reducing trial-and-error prescribing. AI also supports the development of predictive models that can tailor therapies to specific biological and psychological profiles. As data availability and computational power grow, AI is poised to become a foundational tool in advancing precision psychiatry.

Market Overview

The market growth is attributed to the advancements in genomics, increased adoption of digital health tools, growing mental health awareness, and the integration of AI and big data analytics in clinical practice. As healthcare systems shift toward individualized care, precision psychiatry is positioned to revolutionize mental health diagnostics and therapy. Precision psychiatry is an emerging field that applies personalized medicine principles to mental health by integrating genetic, neurobiological, and psychosocial data to tailor diagnosis and treatment to individual patients.

Unlike traditional psychiatry, which often relies on generalized treatment protocols, precision psychiatry enables targeted interventions based on biomarkers, brain imaging, and AI-driven analytics. This approach improves treatment efficacy, reduces side effects, and helps in early identification of conditions like depression, anxiety, schizophrenia, and bipolar disorder. Rising investments in psychiatry research is expected to boost the growth of the market.

- For instance, the National Institute of Mental Health (NIMH) aims to advance the understanding and treatment of mental illnesses through cutting-edge basic and clinical research. To support this mission, NIMH promotes innovative, interdisciplinary science that translates into improved prevention, recovery, and care. The 2020 NIMH Strategic Plan for Research provides a framework to guide impactful research, address emerging challenges, and accelerate the translation of discoveries into practice and policy.

What are the Major Trends in the Precision Psychiatry Market?

- AI-Powered Predictive Modeling

Artificial Intelligence and machine learning are increasingly used to predict psychiatric disorders and treatment responses by analyzing complex datasets including genetics, neuroimaging, and patient history. These models help clinicians move away from trial-and-error approaches and enable more targeted interventions.

- Integration of Multi-Omics Data

Precision psychiatry is incorporating genomics, proteomics, metabolomics, and epigenetics to better understand the biological basis of mental illness. This multi-layered data helps in identifying biomarkers that can guide diagnosis, prognosis, and treatment decisions.

- Expansion of Digital Phenotyping

Digital tools, such as smartphone apps and wearable devices, are being used to track real-time behavioral and physiological data (e.g., sleep patterns, voice tone, activity levels). This continuous monitoring helps detect early signs of psychiatric conditions and tailor interventions accordingly.

- Personalized Pharmacotherapy

Genetic testing and pharmacogenomics are enabling psychiatrists to choose medications based on how individual patients metabolize drugs. This reduces adverse effects and improves treatment efficacy, especially in conditions like depression, ADHD, and anxiety disorders.

- Collaborations Between Tech Firms and Healthcare Providers

There is a growing trend of partnerships between biotechnology companies, AI startups, and healthcare institutions to co-develop precision psychiatry tools. These collaborations accelerate innovation, clinical validation, and deployment of personalized mental health solutions at scale.

Report Scope of Precision Psychiatry Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 948.80 Million |

| Market Size by 2034 |

USD 3,319.54 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 14.93% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Component, By Technology, By Disorder Type, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Advancements in Genomics and Biomarker Discovery

Advancements in genomics and biomarker discovery are driving the growth of the market, as they enable a deeper understanding of the biological underpinnings of mental health disorders. Through genetic testing and identification of biomarkers, such as specific gene variants, proteins, or neuroimaging patterns, clinicians can now classify psychiatric conditions more accurately and tailor treatments to individual patients. This reduces the reliance on trial-and-error approaches, which are common in traditional psychiatry, and leads to faster, more effective interventions with fewer side effects.

Moreover, ongoing research in genome-wide association studies (GWAS) and multi-omics is expanding the catalog of actionable biomarkers, fueling the development of personalized therapeutics. As these tools become more accessible and clinically validated, they are expected to significantly accelerate the adoption of precision psychiatry globally.

- In September 2025, Precision Psychiatry in West Des Moines, Iowa, now offers EXOMIND TMS, an FDA-cleared, noninvasive, medication-free treatment for treatment-resistant depression. The clinic provides accessible, evidence-based, and patient-centered care for conditions such as depression, anxiety, and mental fog.

Rising Prevalence of Mental Health Disorders

The market growth is attributed to the rising prevalence of mental health disorders such as depression, anxiety, schizophrenia, and bipolar disorder is a major driver of growth in the Precision Psychiatry market. As traditional treatment methods often fail to deliver consistent results across diverse patient populations, there is increasing demand for more personalized and effective solutions. Precision psychiatry addresses this need by using genetic, biological, and behavioral data to guide diagnosis and treatment, improving patient outcomes and reducing the trial-and-error approach common in mental health care. With mental illness affecting nearly 1 in 8 people globally, according to WHO, healthcare systems are under pressure to adopt innovative, data-driven models like precision psychiatry.

Restraint

High Cost of Genetic and Neuroimaging Tests

The market growth is hindered by the tests such as whole-genome sequencing, pharmacogenomic panels, and functional MRI (fMRI) scans can be prohibitively expensive, especially in low- and middle-income countries where mental health budgets are already limited. These costs limit accessibility for many patients and make it challenging for healthcare providers to integrate precision tools into routine psychiatric care. Additionally, insurance coverage for such tests is often inconsistent, further discouraging their clinical use. As a result, despite the clinical promise of precision psychiatry, its growth is restrained by financial and systemic hurdles.

Opportunities

Integration with Digital Health Platforms

The market is creating emerging opportunities for expanding access, improving monitoring, and enabling real-time data collection. Tools like mobile apps, telepsychiatry platforms, and wearable devices allow for continuous tracking of behavioral and physiological indicators, such as mood, sleep, speech, and activity, which can be fed into AI models to personalize care. This not only enhances early diagnosis and treatment adjustment but also supports remote delivery of precision-based interventions, especially in underserved areas. Furthermore, digital platforms make it easier to scale clinical trials and collect population-level data for biomarker discovery. As mental health care increasingly shifts toward hybrid and tech-enabled models, digital integration becomes a key driver of innovation and adoption in precision psychiatry.

Development of Companion Diagnostics

The market is creating immersive opportunities, enabling more targeted and effective treatment strategies. These diagnostics, often based on genetic, proteomic, or neurobiological markers, help identify which patients are most likely to benefit from a specific psychiatric medication or therapy. This reduces the trial-and-error approach in prescribing, which is a major challenge in traditional psychiatry, and improves patient outcomes while minimizing side effects. As pharmaceutical companies increasingly invest in personalized therapies for mental health disorders, companion diagnostics are becoming essential tools for regulatory approval and clinical success.

How Macroeconomic Variables Influence the Precision Psychiatry Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth. Increasing healthcare spending, investment in medical research, and access to advanced technologies. In wealthier economies, there's a stronger focus on personalized medicine, including genomics and AI-based diagnostics, which supports the development and adoption of precision psychiatry. However, in regions with slower economic growth or limited healthcare budgets, the high costs and infrastructure demands of precision psychiatry can restrain its expansion.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the precision psychiatry market by increasing the overall cost of developing and delivering personalized treatments. As prices rise, both healthcare providers and patients may face affordability challenges, limiting access to advanced diagnostics and therapies. Additionally, tighter pricing regulations and reimbursement issues can discourage pharmaceutical companies from investing in high-cost precision psychiatry solutions.

Exchange Rates

Exchange rate fluctuations can positively and negatively affect, depending on the direction and stability of the changes. A favorable exchange rate can reduce the cost of importing advanced medical technologies and research tools, promoting market expansion in developing regions. Conversely, unfavorable or volatile exchange rates can increase costs for imported equipment, diagnostics, and pharmaceuticals, thereby restraining market growth and limiting international collaboration.

Segment Outlook

Component Insights

Why Did the Diagnostics Segment Lead the Market in 2024?

The diagnostics segment led the precision psychiatry market in 2024 due to its critical role in enabling personalized mental health treatment. Advanced diagnostic tools such as genomic testing, biomarker analysis, and neuroimaging are increasingly used to identify the underlying biological factors of psychiatric disorders, leading to more accurate diagnoses and tailored therapies. The growing accessibility of genetic sequencing and integration of AI in diagnostic platforms has further improved the speed and precision of assessments. Additionally, early diagnosis through biomarkers is becoming a key strategy in preventing the progression of complex mental illnesses, making diagnostics essential in clinical settings.

The therapeutics segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing demand for personalized and more effective treatment options for mental health disorders. Advances in pharmacogenomics are enabling the development of targeted drug therapies that align with an individual’s genetic makeup, significantly improving treatment outcomes and reducing trial-and-error prescribing. Additionally, the rise of digital therapeutics, such as AI-driven cognitive behavioral therapy (CBT) apps and neurofeedback platforms, is expanding access to innovative, non-pharmacological treatment modalities. Pharmaceutical and biotech companies are heavily investing in R&D for precision-targeted psychiatric drugs, supported by favorable regulatory pathways and companion diagnostics.

- In September 2024, the FDA approved a new schizophrenia drug (Cobenfy) and several digital therapeutics, while the EMA approved the psychiatric drug paliperidone.

Technology Insights

Why Did the Genomics & Pharmacogenomics Segment Dominate the Precision Psychiatry Market?

The genomics & pharmacogenomics segment dominated the market with the largest share in 2024. This is because these technologies enable clinicians to understand how genetic variations influence an individual’s response to psychiatric medications, leading to more accurate prescribing and reduced adverse effects. Widespread adoption of genetic testing panels for conditions like depression and schizophrenia has become common in clinical practice, driven by falling sequencing costs and improved data interpretation tools. Moreover, large-scale research initiatives and biobanks have expanded the availability of psychiatric genomic data, fueling innovation in both diagnostics and therapeutics. This central role in optimizing treatment efficacy and patient safety solidifies genomics and pharmacogenomics as the dominant technology segment in the market.

The artificial intelligence & machine learning segment is expected to grow at the fastest CAGR during the projection period, owing to its transformative potential in analyzing complex and high-dimensional mental health data. AI/ML algorithms can detect patterns across genetic, behavioral, imaging, and clinical data that are often undetectable by traditional methods, enabling earlier and more precise diagnosis. These technologies also enhance treatment personalization by predicting individual responses to medications or therapies, improving outcomes and reducing trial-and-error prescribing. With increasing integration into digital health platforms and growing investment in AI-based mental health startups, adoption is accelerating rapidly.

Disorder Type Insights.

Why Did the Depression Segment Lead the Market in 2024?

The depression segment led the precision psychiatry market in 2024, due to its high global prevalence and significant impact on public health. As one of the most common and debilitating mental disorders, there is a strong demand for more effective, personalized treatment approaches that precision psychiatry can offer. Advances in genetic testing, biomarker identification, and AI-driven diagnostics have improved the ability to tailor therapies specifically for depression, reducing treatment resistance and side effects. Additionally, increased awareness and reduced stigma around mental health have led to greater diagnosis rates and treatment seeking, further driving market growth.

- In June 2025, Mindstrong Health’s digital biomarker service was introduced, allowing real-time monitoring of cognitive and emotional states through smartphone usage patterns, which improves early detection and personalized management of depression.

The autism spectrum disorder (ASD) segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing awareness, earlier diagnosis, and a growing emphasis on personalized intervention strategies. Advances in genetic research have identified numerous biomarkers linked to ASD, enabling more precise diagnosis and the development of targeted therapies tailored to individual neurodevelopmental profiles. Additionally, rising global prevalence rates and improved screening programs are driving demand for innovative diagnostic tools and therapeutic approaches. The integration of AI and digital health solutions further supports customized care plans, enhancing outcomes for patients with ASD.

End-User Insights.

Why Did the Hospitals & Clinics Segment Lead the Market in 2024?

The hospital & clinics segment led the precision psychiatry market in 2024 due to the primary points of care where advanced diagnostic and therapeutic technologies are implemented. These institutions have the infrastructure, skilled professionals, and patient volume necessary to adopt complex precision psychiatry tools such as genomic testing, neuroimaging, and AI-driven decision support systems. Their central role in diagnosing and managing mental health disorders makes them key users of personalized medicine approaches. Additionally, growing integration of precision psychiatry services into hospital workflows and increased funding for mental health programs further reinforce their market dominance.

The pharmaceutical & biotech companies segment is expected to expand at the highest CAGR in the coming years. This is mainly due to their increasing investment in research and development of targeted psychiatric therapies. Advances in genomics and pharmacogenomics enable these companies to design drugs tailored to specific genetic profiles, improving treatment efficacy and reducing side effects. Additionally, collaborations with AI firms and diagnostic companies accelerate the development of companion diagnostics that support personalized medicine approaches. Growing regulatory support for precision therapies and the rising prevalence of mental health disorders further drive their focus on innovative drug development.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the precision psychiatry market while holding the largest share in 2024. The region’s growth is primarily attributed to its advanced healthcare infrastructure, strong investment in mental health research, and early adoption of precision medicine technologies. The region benefits from the presence of leading biotech and pharmaceutical companies, as well as top-tier academic institutions, driving innovation in genomics, AI, and digital therapeutics. Supportive regulatory frameworks, such as the FDA’s encouragement of companion diagnostics and personalized treatments, have accelerated the clinical integration of precision psychiatry tools. Additionally, high mental health awareness and widespread insurance coverage for psychiatric services have increased the demand for personalized care.

The U.S. is a major contributor to the North American precision psychiatry market due to its robust healthcare system, strong R&D ecosystem, and early adoption of cutting-edge medical technologies. It leads in precision medicine initiatives, with significant funding from both government programs like the NIH’s "All of Us" research initiative and private sector investments. The presence of major pharmaceutical companies, AI startups, and top academic institutions further accelerates innovation in personalized mental health care.

- In September 2024, the U.S. government passed updates to the Mental Health Parity and Addiction Equity Act, mandating better insurance coverage for personalized psychiatric testing and treatments.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for precision psychiatry. This is due to rising mental health awareness, increasing healthcare investments, and rapid adoption of advanced technologies across emerging economies. Countries like China, India, Japan, and South Korea are expanding their genomic research infrastructure and integrating AI into healthcare, which supports the development of personalized psychiatric care. Government initiatives aimed at improving mental health services and large, underserved patient populations are further driving demand for innovative diagnostic and therapeutic solutions.

China is a major player in the Asia Pacific precision psychiatry market due to its significant investments in genomic research, AI-driven healthcare, and mental health infrastructure. The Chinese government has prioritized precision medicine through initiatives like the China Precision Medicine Initiative, which funds large-scale genomics projects and mental health research. Additionally, the rapid growth of digital health startups and collaborations with global biotech firms are accelerating the adoption of personalized psychiatric diagnostics and treatments.

Region-Wise Market Outlook

| Region |

Market Size in 2024* |

Projected CAGR (Next 2025 - 2034 ) |

Growth Factors |

Restraints |

Growth Overview |

| North America |

USD 343.4 Million |

5.87% |

Strong healthcare infrastructure; high R&D investment; early adoption of genomic/digital psychiatry tools |

High costs; stringent privacy & regulatory standards |

Steady growth |

| Asia Pacific |

USD 241.2 Million |

7.03% |

Increasing healthcare spending; improving access to psychiatric services |

Limited infrastructure in some poorer/remote areas |

Projected to be the fastest-growing region |

| Europe |

USD 192.8 Million |

9.93% |

Strong governmental mental health policies |

Pricing pressure and regulatory delays |

Moderate growth rate |

| Latin America |

USD 66.6 Billion |

4.7% |

Rising awareness and increasing investment |

Weak infrastructure and less R&D funding |

Steady growth |

| Middle East & Africa (MEA) |

USD 42.3 Billion |

3.38% |

Growing investments in healthcare |

lack of infrastructure |

Slower Growth |

Precision Psychiatry Market Value Chain Analysis

1. Research & Development (R&D)

The R&D stage forms the foundation of the precision psychiatry value chain, focusing on discovering psychiatric biomarkers, genetic variants, and developing algorithms for treatment personalization. Major pharmaceutical, biotech, and genomic companies invest in clinical trials, psychiatric genomics, and neuroimaging studies to develop novel diagnostics and therapies tailored to individual patients.

- Key Players Involved: Myriad Genetics, 23andMe, Illumina, Roche, Pfizer, Takeda Pharmaceutical, NIH (USA), China Precision Medicine Initiative

2. Technology Development & Platform Integration

This stage involves building the computational platforms, AI/ML models, and data analytics tools that power precision psychiatry. These technologies process and interpret complex data from genomics, imaging, and digital behavior, enabling personalized diagnosis and treatment pathways. Companies like IBM and Verily provide cloud-based AI platforms that integrate genomic data with clinical records.

- Key Players Involved: IBM Watson Health, Tempus, Deep Genomics, Verily (Alphabet), Oxford Nanopore Technologies, PathAI

3. Diagnostic Tools & Product Manufacturing

This stage includes the manufacturing of genetic tests, neuroimaging tools, and biomarker-based diagnostics specifically used in psychiatry. These tools help clinicians identify the underlying biological causes of mental health disorders and select appropriate therapies. GeneSight and Genomind are notable leaders in pharmacogenomic testing for depression and other psychiatric conditions.

- Key Players Involved: GeneSight (Myriad Genetics), Genomind, Illumina, Thermo Fisher Scientific, Qiagen, Natera

4. Clinical Implementation & Service Delivery

Clinical service providers integrate precision psychiatry tools into healthcare workflows, delivering genomic testing, AI-supported diagnostics, and tailored treatment plans directly to patients. Hospitals and clinics play a critical role in bridging the gap between innovation and patient care by interpreting test results and adjusting therapies based on individual profiles.

- Key Players Involved: Mayo Clinic, Cleveland Clinic, Johns Hopkins Medicine, Apollo Hospitals, Ramsay Health Care, Kaiser Permanente

5. Distribution, Sales & Commercialization

This stage focuses on the logistics, distribution, and commercialization of precision psychiatry products and services. Distributors, CROs (Contract Research Organizations), and sales networks ensure that tests, software platforms, and therapeutics reach clinical settings efficiently. Commercialization also includes marketing and physician education to boost adoption.

- Key Players Involved: McKesson Corporation, Cardinal Health, AmerisourceBergen, IQVIA, PRA Health Sciences

Precision Psychiatry Market Companies

Myriad Genetics is a leader in pharmacogenomic testing, particularly with its GeneSight® test, which helps personalize psychiatric medication choices based on patients’ genetic profiles. Their work significantly reduces trial-and-error in psychiatric drug prescriptions, improving treatment outcomes and patient adherence.

Illumina provides advanced genomic sequencing technologies that underpin much of the genetic research in precision psychiatry, enabling the identification of biomarkers associated with psychiatric disorders. Their high-throughput sequencing platforms support large-scale studies and clinical diagnostics, accelerating the development of personalized therapies.

IBM Watson Health develops AI and machine learning platforms that analyze complex psychiatric and genomic data to support precision diagnosis and treatment planning. Their solutions integrate clinical, genomic, and behavioural data to improve predictive accuracy and optimize individualized care.

Pear Therapeutics pioneers digital therapeutics, offering FDA-approved software-based treatments for psychiatric disorders such as depression and substance use disorder. Their products complement traditional therapies by providing evidence-based, personalized behavioral interventions through mobile platforms.

Genomind focuses on providing comprehensive genetic testing services for mental health, offering clinicians actionable insights into how a patient’s genetics influence medication response. Their solutions help tailor psychiatric treatment plans, reducing adverse drug reactions and improving clinical efficacy.

- Verily Life Sciences (Alphabet Inc.)

Verily leverages data analytics and wearable technologies to gather and interpret mental health-related data, advancing personalized psychiatry research. Their cloud-based platforms enable integration of multi-modal data, facilitating novel insights into psychiatric conditions and personalized treatment approaches.

Recent Developments

- In September 2025, NeuroKaire launched a blood-based precision psychiatry test in the U.S. It uses patient-derived neurons and genetic data to help match patients with the most effective antidepressants, aiming to reduce the period of trial-and-error prescribing.

- In July 2025, the PrecInNor initiative between NIMHANS in India and the University of Oslo in Norway was launched to advance mental health research globally.

- In September 2024, Circular Genomics launched MindLight, the first blood-based SSRI response test that uses circular RNA biomarkers from the brain to predict a patient’s likelihood of responding to selective serotonin reuptake inhibitors (SSRIs)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the precision psychiatry market.

By Component

-

- Genomic Testing

- Neuroimaging

- Biomarker Testing

-

- Targeted Drug Therapies

- Digital Therapeutics

- Psychopharmacogenetics

-

- Genetic Counseling

- Data Analysis & AI Services

- Clinical Decision Support

By Technology

- Genomics & Pharmacogenomics

- Artificial Intelligence & Machine Learning

- Neuroimaging Technologies

- Big Data & Analytics

- Wearable Devices & Digital Monitoring Tools

By Disorder Type

- Depression

- Schizophrenia

- Bipolar Disorder

- Anxiety Disorders

- ADHD

- Autism Spectrum Disorder (ASD)

- Post-Traumatic Stress Disorder (PTSD)

- Others (e.g., OCD, personality disorders)

By End User

- Hospitals & Clinics

- Research Institutes

- Diagnostic Laboratories

- Pharmaceutical & Biotech Companies

- Academic Institutions

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

- Table 1: Global Precision Psychiatry Market Size (USD Million) by Component, 2024–2034

- Table 2: Global Precision Psychiatry Market Size (USD Million) by Technology, 2024–2034

- Table 3: Global Precision Psychiatry Market Size (USD Million) by Disorder Type, 2024–2034

- Table 4: Global Precision Psychiatry Market Size (USD Million) by End User, 2024–2034

- Table 5: North America Market Size (USD Million) by Component, 2024–2034

- Table 6: North America Market Size (USD Million) by Technology, 2024–2034

- Table 7: North America Market Size (USD Million) by Disorder Type, 2024–2034

- Table 8: North America Market Size (USD Million) by End User, 2024–2034

- Table 9: U.S. Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 10: Canada Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 11: Mexico Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 12: Europe Market Size (USD Million) by Component, 2024–2034

- Table 13: Europe Market Size (USD Million) by Technology, 2024–2034

- Table 14: Germany Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 15: France Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 16: UK Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 17: Italy Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 18: Asia Pacific Market Size (USD Million) by Component, 2024–2034

- Table 19: Asia Pacific Market Size (USD Million) by Technology, 2024–2034

- Table 20: China Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 21: Japan Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 22: India Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 23: South Korea Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 24: Southeast Asia Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 25: Latin America Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 26: Brazil Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 27: Middle East & Africa Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 28: GCC Countries Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 29: Turkey Market Size (USD Million) by Component & Disorder Type, 2024–2034

- Table 30: Africa Market Size (USD Million) by Component & Disorder Type, 2024–2034

List of Figures

- Figure 1: Global Market Share by Component, 2024

- Figure 2: Global Market Share by Technology, 2024

- Figure 3: Global Market Share by Disorder Type, 2024

- Figure 4: Global Market Share by End User, 2024

- Figure 5: North America Market Share by Component, 2024

- Figure 6: North America Market Share by Technology, 2024

- Figure 7: North America Market Share by Disorder Type, 2024

- Figure 8: North America Market Share by End User, 2024

- Figure 9: U.S. Market Share by Component, 2024

- Figure 10: U.S. Market Share by Disorder Type, 2024

- Figure 11: Canada Market Share by Component, 2024

- Figure 12: Canada Market Share by Disorder Type, 2024

- Figure 13: Mexico Market Share by Component, 2024

- Figure 14: Mexico Market Share by Disorder Type, 2024

- Figure 15: Europe Market Share by Component, 2024

- Figure 16: Europe Market Share by Technology, 2024

- Figure 17: Germany Market Share by Component, 2024

- Figure 18: Germany Market Share by Disorder Type, 2024

- Figure 19: France Market Share by Component, 2024

- Figure 20: France Market Share by Disorder Type, 2024

- Figure 21: UK Market Share by Component, 2024

- Figure 22: UK Market Share by Disorder Type, 2024

- Figure 23: Italy Market Share by Component, 2024

- Figure 24: Italy Market Share by Disorder Type, 2024

- Figure 25: Asia Pacific Market Share by Component, 2024

- Figure 26: Asia Pacific Market Share by Technology, 2024

- Figure 27: China Market Share by Component, 2024

- Figure 28: China Market Share by Disorder Type, 2024

- Figure 29: Japan Market Share by Component, 2024

- Figure 30: Japan Market Share by Disorder Type, 2024

- Figure 31: India Market Share by Component, 2024

- Figure 32: India Market Share by Disorder Type, 2024

- Figure 33: South Korea Market Share by Component, 2024

- Figure 34: South Korea Market Share by Disorder Type, 2024

- Figure 35: Southeast Asia Market Share by Component, 2024

- Figure 36: Southeast Asia Market Share by Disorder Type, 2024

- Figure 37: Latin America Market Share by Component, 2024

- Figure 38: Latin America Market Share by Disorder Type, 2024

- Figure 39: Brazil Market Share by Component, 2024

- Figure 40: Brazil Market Share by Disorder Type, 2024

- Figure 41: Middle East & Africa Market Share by Component, 2024

- Figure 42: Middle East & Africa Market Share by Disorder Type, 2024

- Figure 43: GCC Countries Market Share by Component, 2024

- Figure 44: GCC Countries Market Share by Disorder Type, 2024

- Figure 45: Turkey Market Share by Component, 2024

- Figure 46: Turkey Market Share by Disorder Type, 2024

- Figure 47: Africa Market Share by Component, 2024

- Figure 48: Africa Market Share by Disorder Type, 2024