Preclinical CRO Market Size, Share, Growth, Report 2026 to 2035

The global preclinical CRO market size was valued at USD 5.95 billion in 2025 and is projected to surpass around USD 13.83 billion by 2035, registering a CAGR of 8.8% over the forecast period of 2026 to 2035.

Key Takeaways:

- North America accounted for the largest share of 47.11% in 2025.

- Asia Pacific is also anticipated to grow at the fastest rate of 11.6% during the forecast period.

- The toxicology testing segment accounted for the largest revenue share of 25.9% of the global preclinical CRO market in 2025.

- The bioanalysis and DMPK studies segment is expected to register the fastest CAGR of 9.3% during the forecast period.

- The Patient Derived Organoid (PDO) Model segment held the largest share of 80.16% in 2025.

- The Patient derived xenograft (PDX) model market has been analyzed to grow at a CAGR of 8.4% during the forecast period.

- The biopharmaceutical companies segment is expected to hold the largest market share of 81% in 2025.

- The government and academic institutes segment are estimated to register the fastest growth of 9.1% during the forecast period.

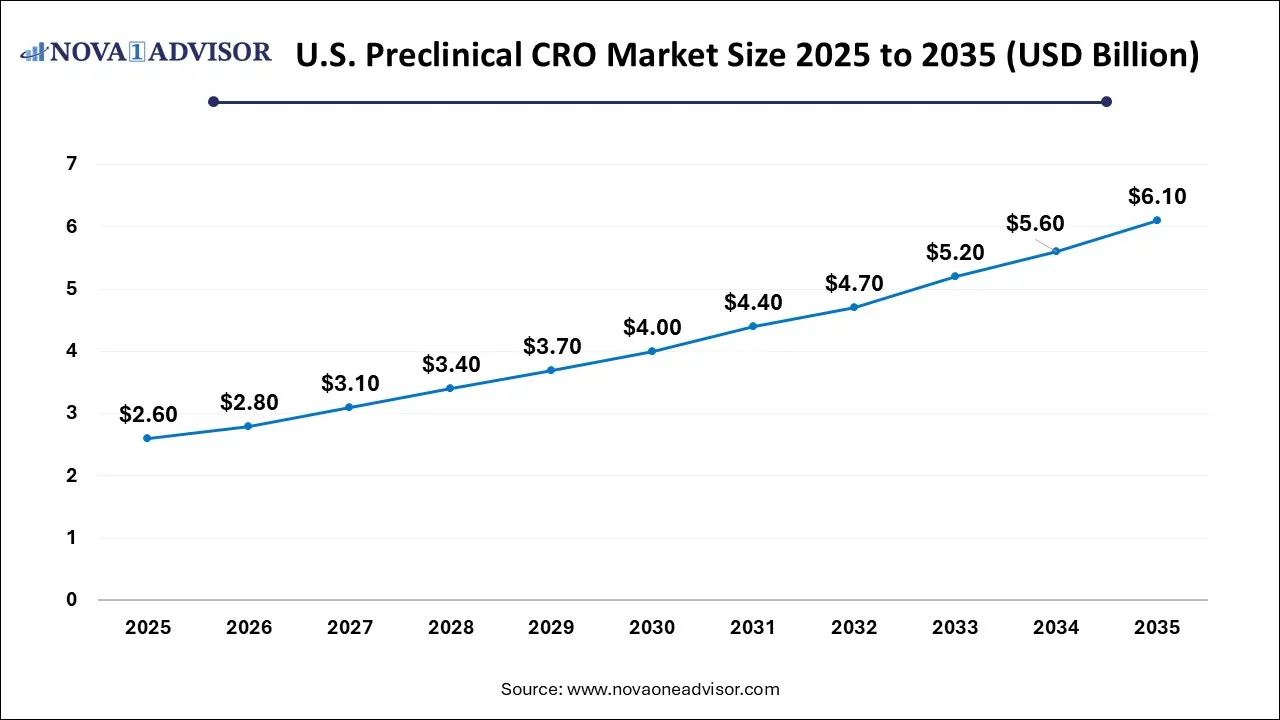

U.S. Preclinical CRO Market Size and Growth 2026 to 2035

The U.S. Preclinical CRO Market size is calculated at USD 2.6 billion in 2025 and is expected to reach nearly USD 6.1 billion in 2035, accelerating at a strong CAGR of 8.06% between 2026 and 2035.

North America dominated the global preclinical CRO market in 2025. Factors include a strong biopharma presence, robust regulatory frameworks, technological leadership, and high R&D investments. The U.S. remains the single-largest market, with top CROs headquartered or operating extensive facilities nationwide. In March 2024, North America accounted for over 50% of global preclinical outsourcing revenue.

Asia-Pacific is the fastest-growing region. Countries like China, India, and South Korea are emerging as attractive destinations for preclinical outsourcing, offering cost advantages, skilled talent, and improving regulatory harmonization. In April 2024, WuXi AppTec opened a new state-of-the-art preclinical facility in Suzhou, signaling Asia-Pacific's growing importance.

U.S. preclinical CRO market trends

The growing prevalence of cardiovascular diseases coupled with rapid expansion of the biotechnology sector has boosted the market expansion. Additionally, rapid investment by pharmaceutical companies for opening up new research and development centers is playing a vital role in shaping the industrial landscape.

China preclinical CRO market analysis

The growing demand for advanced therapies to treat infectious diseases coupled with technological advancements in the genetic engineering sector has driven the market expansion. Additionally, the presence of numerous biotechnology companies along with rapid investment by government for strengthening the medical device testing is contributing to the industry in a positive manner.

Why Europe is a significant contributor of the preclinical CRO market?

Europe is a significant contributor of the preclinical CRO industry. The increasing demand for high-quality antiviral vaccines in numerous countries including Germany, Italy, France, Netherlands, UK and some others has boosted the market expansion. Additionally, rapid investment by government for strengthening the healthcare sector coupled with rise in number of biotech startups is contributing to the industry in a positive manner. Moreover, the presence of numerous preclinical CRO providers such as ICON plc, Charles River Laboratories, Eurofins Scientific and some others is expected to accelerate the growth of the preclinical CRO market in this region.

Germany preclinical CRO market analysis

The growing focus of biotech companies to conduct research of several types of medicines coupled with rapid investment by government for developing the genetic engineering sector has boosted the market expansion. Additionally, the increasing demand for advanced mRNA therapeutics to treat cancer is playing a prominent role in shaping the industry in a positive manner.

What is the role of Latin America in the preclinical CRO market?

Latin America is playing a vital role in shaping the preclinical CRO market. The growing adoption of CRO services by biotech companies in numerous countries including Argentina, Brazil, Peru, Venezuela and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the biopharma industry is playing a vital role in shaping the industry in a positive manner. Moreover, the presence of several market players coupled with rapid expansion of the pharmacology sector is expected to propel the growth of the preclinical CRO market in this region.

Argentina preclinical CRO market trends

The growing emphasis of pharma companies for outsourcing their research and trial activities to third-party companies has boosted the market growth. Also, the surging cases of lungs cancer and skin cancer has increased the demand for advanced therapeutics, thereby driving the industrial expansion.

Why Middle East and Africa held a notable share of the preclinical CRO market?

Middle East and Africa held a notable share of the industry. The rise in the number of biopharma companies in several nations including UAE, Qatar, Saudi Arabia, South Africa and some others has driven the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare sector coupled with rapid expansion of the toxicology sector is playing a prominent role in shaping the industrial landscape. Moreover, partnerships among genetic engineering companies and pharma brands to develop high-quality medicines is expected to accelerate the growth of the preclinical CRO market in this region.

UAE preclinical CRO market analysis

The growing emphasis of medical device companies for opening up new production centers along with technological advancements in the biotechnology sector has boosted the market expansion. Additionally, the rising prevalence of chronic diseases such as cardiovascular diseases and cancers is playing a vital role in shaping the industry in a positive manner.

Market Overview

The Preclinical Contract Research Organization (CRO) Market has become a cornerstone of modern drug development, providing essential services that enable pharmaceutical, biotechnology, and medical device companies to streamline their preclinical research processes. Preclinical CROs offer specialized services ranging from pharmacokinetics, toxicology, and safety pharmacology to bioanalysis, compound management, and medicinal chemistry, facilitating the progression of drug candidates from discovery through to clinical trials.

The market's growth is propelled by the increasing complexity and costs associated with drug discovery, rising outsourcing trends among pharmaceutical and biotech companies, and the urgent need to accelerate time-to-market for novel therapies. Additionally, advancements in patient-derived models and computational biology are revolutionizing preclinical research, enhancing the predictive value of early-stage studies.

Leading CROs such as Charles River Laboratories, WuXi AppTec, and Labcorp Drug Development are expanding their global footprint, investing in high-end technologies like CRISPR gene editing, AI-driven data analytics, and personalized preclinical models to cater to evolving sponsor demands.

Preclinical CRO market outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the growing demand for GLP-compliant services coupled with technological advancements in the medical devices.

- Major Investors: Numerous market players are actively entering this market, drawn by joint ventures, R&D and business expansions. Several CRO companies such as Medpace, Inc, PRA Health Sciences, Inc.; Wuxi AppTec and some others have started investing rapidly for advancing drug manufacturing methodology.

- Startup Ecosystem: Various startup brands are engaged in providing CRO solutions across the globe. The prominent startup companies dealing in preclinical CRO comprises of Jubilant Biosys, Bioneeds, Vipragen Biosciences and some others.

Major Trends in the Market

-

Adoption of AI and Big Data Analytics: Leveraging artificial intelligence to optimize trial design, predict drug behavior, and improve data interpretation.

-

Rise of Patient-Derived Models: Increasing use of patient-derived organoids and xenografts to enhance translational relevance.

-

Shift Toward Integrated Preclinical Services: Single-source providers offering end-to-end capabilities from discovery through IND-enabling studies.

-

Growth in Biologics and Cell & Gene Therapy Research: Expanding demand for specialized preclinical testing of biologics and advanced therapies.

-

Expansion of Toxicology and Safety Pharmacology Services: Responding to regulatory emphasis on comprehensive safety assessments.

-

Strategic Mergers and Acquisitions: CROs consolidating capabilities and geographical reach.

-

Rising Demand for GLP-Compliant Services: Ensuring regulatory compliance and data integrity for IND submissions.

Preclinical CRO Market Report Scope

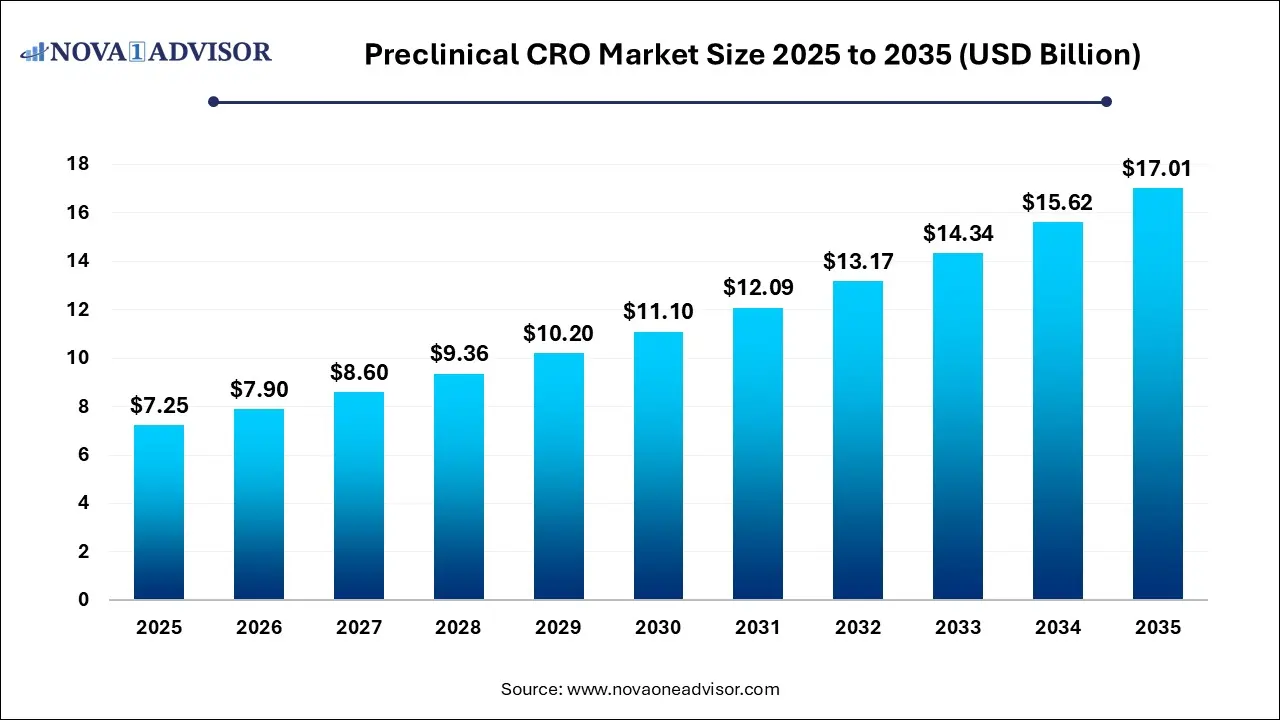

| Report Attribute |

Details |

| Market Size in 2026 |

USD 7.90 Billion |

| Market Size by 2035 |

USD 17.01 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.9% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Service, Model Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

WuXi AppTec, Inc. (WAI); LABCORP; Eurofins scientific se; Medpace holdings inc; Charles River Laboratories International, Inc.; Intertek group plc (igp); SGA SA; PPD (Thermo Fisher Scientific, Inc.); PRA Health Sciences, INC. (ICON plc); CROWN bioscience |

Key Market Driver

Increasing Outsourcing of Preclinical Research to Specialized CROs

One of the primary drivers for the Preclinical CRO market is the growing trend among pharmaceutical and biotechnology companies to outsource early-stage research activities. Cost containment pressures, the need for operational efficiency, and access to cutting-edge technologies and expertise make outsourcing a strategic imperative. In March 2024, a survey by BioPharma Dive indicated that 68% of biopharmaceutical companies plan to increase their outsourcing budgets for preclinical services in the next three years, highlighting robust market growth prospects.

Key Market Restraint

High Cost and Time-Intensive Nature of Preclinical Studies

Despite technological advancements, preclinical studies remain costly and time-consuming. Developing animal models, conducting GLP toxicology studies, and performing complex bioanalytical assays require significant financial investments and extended timelines. For smaller biotech firms and startups, these barriers can delay development programs or necessitate seeking external funding, impacting overall market growth. Moreover, failure rates in preclinical studies remain high, adding to the financial risk.

Key Market Opportunity

Emergence of Patient-Derived Organoid (PDO) and Patient-Derived Xenograft (PDX) Models

The rising adoption of patient-derived models presents a significant opportunity to enhance the translational relevance of preclinical research. PDOs and PDX models better mimic human disease biology compared to traditional cell lines, improving the predictability of therapeutic responses. CROs investing in PDO/PDX platforms and associated technologies stand to gain a competitive advantage. In February 2024, Crown Bioscience announced the expansion of its PDX model library to cover rare oncology indications, underscoring the market potential.

Segmental Analysis

By Service

Bioanalysis and DMPK studies dominated the service segment in 2025. Services such as in vitro ADME (Absorption, Distribution, Metabolism, Excretion) and in vivo pharmacokinetics are crucial for characterizing drug candidates' safety and efficacy profiles. Bioanalytical assays using mass spectrometry, LC-MS/MS, and ELISA techniques ensure accurate measurement of drug concentration and metabolite profiling.

In vitro ADME services are witnessing rapid growth, driven by the need to screen large compound libraries efficiently and predict human pharmacokinetics early. Companies offering integrated ADME/DMPK packages are gaining popularity among sponsors aiming for streamlined candidate selection.

Toxicology Testing services remain a cornerstone of preclinical CRO offerings. GLP-compliant safety studies are mandatory for IND submissions, and regulatory bodies emphasize rigorous toxicity assessments across multiple organ systems.

Non-GLP toxicology studies are growing steadily, serving as preliminary screens before committing to full GLP toxicology programs. In March 2024, Charles River Laboratories expanded its non-GLP toxicology capabilities in Europe, reflecting increased client demand for early toxicology insights.

Process R&D and Custom Synthesis services within Compound Management are gaining traction. With high-throughput screening campaigns generating numerous hit compounds, efficient compound storage, logistics, and re-synthesis services are essential. Biopharma clients are increasingly outsourcing these functions to CROs with robust automation and tracking systems.

Medicinal Chemistry dominated the chemistry services segment. Companies seek expertise in hit-to-lead optimization, scaffold hopping, and SAR (structure-activity relationship) studies to refine drug candidates. In March 2024, Syngene International expanded its medicinal chemistry footprint to support complex small molecule programs.

Computation Chemistry is growing rapidly, particularly with the advent of AI-driven molecular modeling, de novo drug design, and virtual screening workflows.

Safety Pharmacology services are expanding, given regulatory emphasis on evaluating potential off-target effects on the cardiovascular, respiratory, and central nervous systems. CROs are investing in telemetry studies, ex vivo assays, and computational toxicology platforms to offer comprehensive safety packages.

By Model Type

Patient-Derived Xenograft (PDX) models dominated the model type segment. PDX models offer superior tumor microenvironment preservation compared to traditional cell line xenografts, enabling more accurate prediction of clinical outcomes.

Patient-Derived Organoid (PDO) models are growing rapidly, driven by their utility in personalized medicine, drug screening, and rare disease research. In January 2024, Altis Biosystems launched a new PDO platform for gastrointestinal diseases, indicating expanding applications.

By End-use

Biopharmaceutical Companies dominated the end-use segment. Large pharmaceutical firms and emerging biotechs alike rely heavily on CROs to optimize pipeline efficiency and reduce fixed R&D costs.

Government and Academic Institutes are witnessing faster growth. Initiatives to promote translational research, academia-industry collaborations, and public-private partnerships are driving CRO demand from research institutions. In February 2024, the U.S. NIH expanded funding for preclinical service contracts under its Blueprint Neurotherapeutics Network.

Preclinical CRO Market Top Key Companies:

Recent Developments

- In November 2025, HKeyBio launched HKEY-AIDMD 3.0 platform. This is a CRO platform designed to improve prediction accuracy for clinical translation of multi-target combination therapies.

- In September 2025, CPDC launched Cadena Research. Cadena Research is a preclinical contract research organization (CRO) that offers specialized support for early-stage drug development in the radiopharmaceutical sector.

- In April 2025, Debiopharm collaborated with Oncodesign Services. This collaboration is done for launching a CRO service in the Europe region.

Preclinical CRO Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Preclinical CRO market.

By Service

- Bioanalysis and DMPK studies

- Toxicology Testing

- Compound Management

- Process R&D

- Custom Synthesis

- Others

- Chemistry

- Medicinal Chemistry

- Computation Chemistry

- Safety Pharmacology

- Others

By Model Type

- Patient Derived Organoid (PDO) Model

- Patient derived xenograft model

By End-use

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)