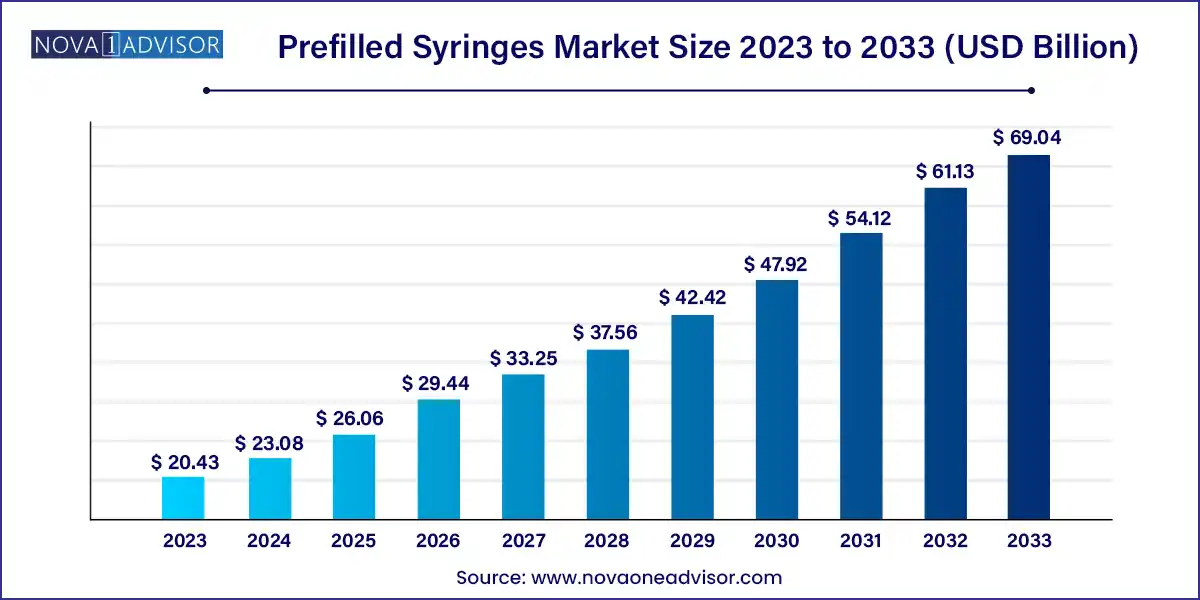

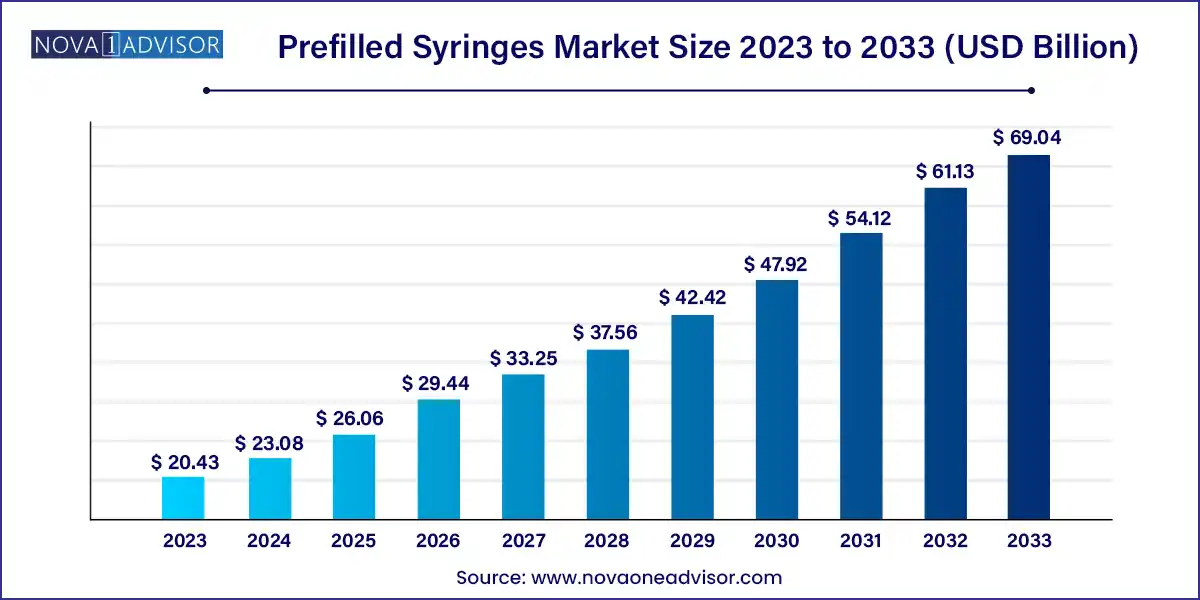

The global prefilled syringes market size was exhibited at USD 20.43 billion in 2023 and is projected to hit around USD 69.04 billion by 2033, growing at a CAGR of 12.95% during the forecast period 2024 to 2033.

Key Takeaways:

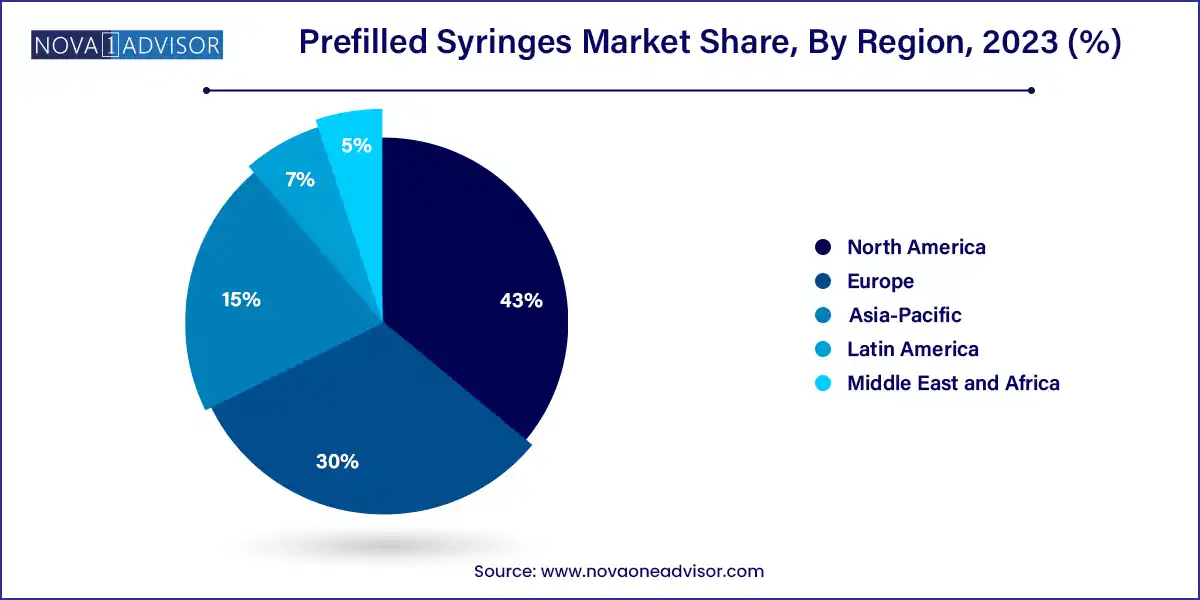

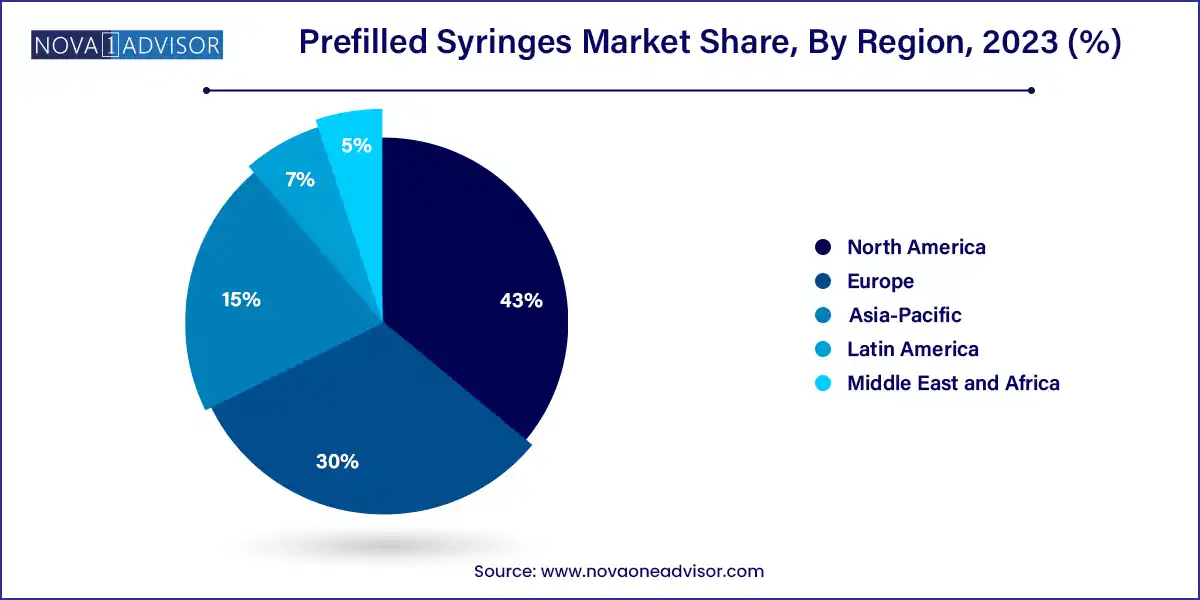

- Geographically speaking, Europe dominated the prefilled syringes market with the highest share of 43.0% in 2023.

- Based on type, the disposable prefilled syringes segment captured the largest market share with around 78.98% in 2023 owing to its wide applications.

- Based on the material, the glass syringes segment dominated the market with around 53.27% of the revenue share.

- Considering the scope of application, the diabetes segment dominated the industry with around 53.75% of the revenue share.

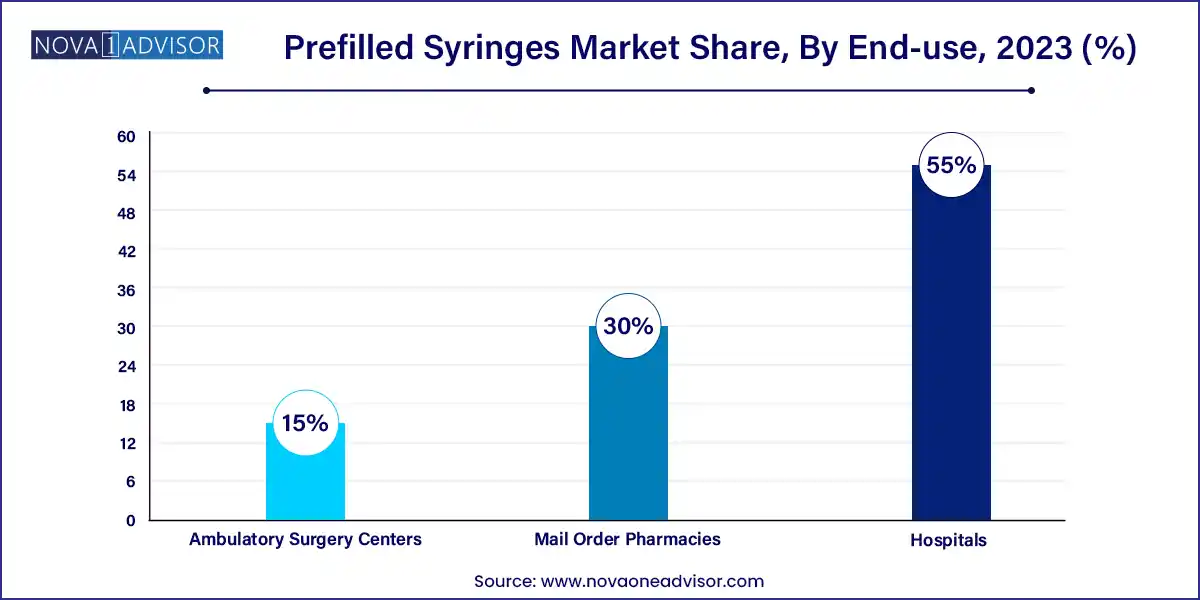

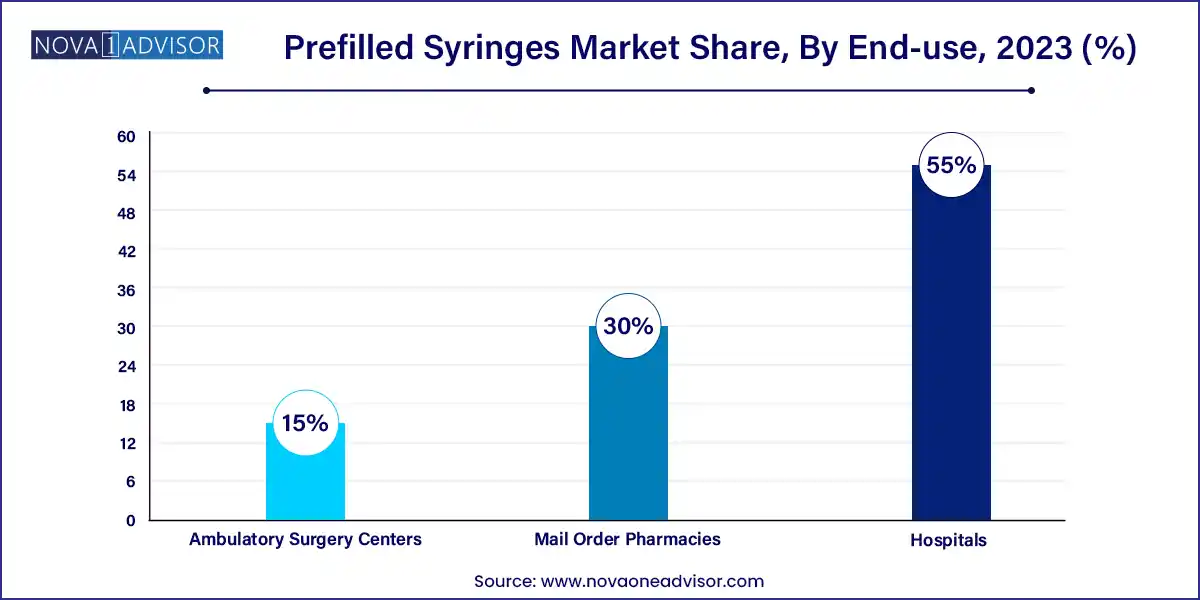

- The hospital segment dominated the market holding a share of 55.0% in 2023

Market Overview

The prefilled syringes market has experienced transformative growth in recent years, fueled by a confluence of medical, technological, and consumer-driven forces. Prefilled syringes are single-use injectable drug delivery systems that are preloaded with a precise dose of medication. These devices are increasingly preferred over traditional vial-and-syringe systems due to their convenience, safety, and accuracy. As healthcare continues to prioritize patient-centric models and self-administration of medication, the demand for prefilled syringes is accelerating across therapeutic areas such as diabetes, autoimmune diseases, and emergency medicine.

The surge in chronic diseases, aging populations, and the evolution of biologics has greatly influenced the market. Moreover, pharmaceutical companies are increasingly integrating prefilled syringes into their product delivery pipelines due to their role in enhancing patient compliance, reducing dosage errors, and improving shelf-life stability. The COVID-19 pandemic provided an additional stimulus, as mass vaccination campaigns and emergency drug administration highlighted the need for efficient, ready-to-use delivery systems.

Technological advancements in material sciences, especially the shift from traditional glass to advanced polymers, have enabled innovation in design, usability, and safety. These developments are aligned with regulatory support and growing healthcare infrastructure in emerging markets, ensuring that the prefilled syringes market remains a critical component of global drug delivery solutions.

Major Trends in the Market

-

Shift Toward Self-Administration: Prefilled syringes are a cornerstone of homecare and self-injection trends, especially in chronic disease management (e.g., insulin delivery, biologics for arthritis).

-

Rise of Biologics and Biosimilars: The growth in complex biologic therapies that require parenteral delivery is spurring demand for specialized prefilled delivery systems.

-

Plastic Over Glass: Plastic syringes, particularly those made from cyclic olefin polymers (COP), are gaining popularity due to break resistance and improved drug compatibility.

-

Safety-Engineered Devices: Integrated safety features like retractable needles and tamper-evidence seals are becoming standard to prevent needlestick injuries and enhance compliance.

-

Customization and Companion Devices: Pharma companies are investing in customized prefilled systems with auto-injectors and pen injectors for improved patient experience.

-

Sustainability and Eco-Friendly Materials: Green initiatives are pushing manufacturers toward recyclable components and lower environmental impact packaging.

-

Mail-Order and E-Pharmacy Distribution: Direct-to-patient pharmaceutical distribution is rising, enhancing the role of mail-order pharmacies in prefilled syringe logistics.

Prefilled Syringes Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 23.08 Billion |

| Market Size by 2033 |

USD 69.04 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.95% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Material, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Gerresheimer AG; Schott Group; BD; Unilife Corporation; Nipro Medical Corporation; Owen Mumford; Haselmeier AG |

Market Driver: Rising Burden of Chronic and Autoimmune Diseases

One of the strongest forces propelling the prefilled syringes market is the global rise in chronic and autoimmune conditions, including diabetes, rheumatoid arthritis, and multiple sclerosis. These conditions require regular, long-term drug administration—often through subcutaneous or intramuscular injection. Prefilled syringes offer precise dosage, reduced risk of contamination, and improved patient adherence, especially among aging or mobility-limited populations.

Take the example of rheumatoid arthritis patients who rely on weekly injections of biologics like adalimumab or etanercept. Prefilled syringes simplify this regimen, enabling patients to administer the drug without needing clinical assistance. Similarly, diabetic patients benefit from insulin prefilled syringes that minimize prep time and dosage error, making daily management of their condition more consistent and safer.

Market Restraint: Material Compatibility and Drug Stability Issues

While the advantages of prefilled syringes are numerous, the challenge of drug stability especially for biologics within the syringe material remains a major restraint. Glass, although inert and widely used, is susceptible to breakage, delamination, and interaction with sensitive formulations. Issues such as protein aggregation, pH drift, and silicone oil interactions can compromise drug efficacy and safety.

Plastic syringes, though more durable, can raise concerns about leachables and extractables, which are problematic for biologics. Furthermore, regulatory standards for material compatibility are stringent and region-specific, leading to high R&D and compliance costs for manufacturers. This complexity makes development timelines longer and product customization more expensive, especially for emerging biotech companies with limited resources.

Market Opportunity: Expansion of Self-Injectable Biologics

The growing pipeline of self-administered biologics presents a substantial opportunity for the prefilled syringes market. As pharmaceutical firms develop complex biologic drugs for oncology, immunology, and rare diseases, there is a parallel push to package them in user-friendly, pre-measured delivery formats. The global shift toward outpatient care and decentralized clinical models means more patients are managing therapies at home, often without medical supervision.

Companies that integrate prefilled syringes with auto-injectors or electronic compliance tools (e.g., sensors to track dosing) stand to gain a significant competitive edge. This is especially true in the U.S., Europe, and Japan, where aging demographics and digital health infrastructure are creating robust ecosystems for high-value, self-administered therapeutics. The intersection of biologics, patient empowerment, and digital therapeutics is set to redefine the next decade of drug delivery systems.

Segments Insights:

By Type Insights

Disposable prefilled syringes dominate the market, accounting for the majority of usage in hospitals, homecare, and emergency settings. These syringes offer convenience, eliminate cross-contamination risk, and are well-suited for single-dose biologics and vaccines. They are especially preferred for mass immunization programs, insulin administration, and emergency drugs like epinephrine. Pharmaceutical companies and contract manufacturing organizations (CMOs) favor disposable syringes due to their lower maintenance and broad regulatory acceptance.

Conversely, reusable prefilled syringes are gaining momentum, especially when integrated with advanced auto-injection systems. These devices are increasingly used in chronic conditions requiring frequent dosing, where patients can replace cartridges without discarding the device. Reusable formats also align with sustainability goals, as they reduce medical waste. As digital health integration improves, reusable systems may be embedded with connectivity features for dose tracking and patient feedback.

By Material Insights

Glass prefilled syringes continue to dominate, given their inert nature, optical clarity, and legacy use in injectable drug delivery. Most pharmaceutical formulations are developed and validated in glass containers, making it the default material for high-purity drugs and temperature-sensitive biologics. Regulatory familiarity and existing infrastructure further cement glass's lead in both mature and emerging markets.

However, plastic prefilled syringes, particularly made of cyclic olefin copolymer (COC) and cyclic olefin polymer (COP), are the fastest growing segment. These materials are break-resistant, lightweight, and compatible with most sterilization processes. They also eliminate concerns of glass delamination and particulate generation, which are crucial in pediatric and ophthalmic formulations. As manufacturers focus on travel-friendly and tamper-proof designs, plastic syringes offer higher design flexibility and performance customization.

By Application Insights

Diabetes is the leading application segment, driven by the large global diabetic population requiring frequent insulin administration. Prefilled insulin syringes simplify the dosing process and support better adherence, especially among elderly or visually impaired patients. Many diabetic patients prefer prefilled options for their portability and discrete use. Major players like Novo Nordisk, Sanofi, and Eli Lilly have prefilled insulin portfolios with variants targeting different patient needs and insulin sensitivity levels.

That said, vaccines and biotech drugs are witnessing the fastest growth, largely due to the post-COVID focus on immunization infrastructure and the expansion of the biologics market. mRNA vaccines and recombinant protein-based therapies are increasingly being formulated for prefilled syringe delivery, reducing wastage and improving cold chain logistics. As more novel biologics enter the market for oncology, rare diseases, and autoimmune disorders, prefilled syringes are becoming the preferred delivery platform due to their sterility, precision, and compatibility with controlled-dose regimens.

By Distribution Channel Insights

Hospitals account for the dominant share of distribution, as they remain the primary point of care for surgeries, emergency interventions, and in-patient biologic treatments. Hospitals favor prefilled syringes for efficiency, safety, and reduction in preparation time, especially in high-volume and high-risk environments like emergency rooms and operating theaters. Infection control protocols also support the use of disposable, sterile prefilled formats.

In contrast, mail order pharmacies represent the fastest growing channel, fueled by the rise of digital health and chronic disease management at home. With the proliferation of e-prescriptions and telemedicine, patients increasingly receive prefilled syringes delivered directly to their homes. This trend is particularly strong in the U.S. and parts of Europe, where pharmacy benefit managers (PBMs) and insurers incentivize mail-order options to reduce costs and improve therapy adherence.

By Regional Insights

Europe leads the global prefilled syringes market, owing to its early adoption of advanced biologics, strong pharmaceutical manufacturing base, and patient-centric regulatory environment. Germany, France, and Switzerland are major hubs for syringe manufacturing, supported by established players such as SCHOTT, Gerresheimer, and Vetter Pharma. The region's robust biosimilar pipeline and aging population further fuel demand for user-friendly drug delivery solutions. European healthcare systems also emphasize safety and compliance, driving adoption of syringes with advanced safety features.

Meanwhile, Asia-Pacific is the fastest growing region, propelled by healthcare modernization, rising chronic disease prevalence, and expanding middle-class access to biologics. Countries like China, India, and Japan are seeing significant investments in biosimilar manufacturing, vaccine development, and outpatient care infrastructure. Japan, in particular, has a high rate of self-injection device usage due to its rapidly aging population and focus on homecare. Additionally, government immunization programs and public-private partnerships in India and Southeast Asia are boosting demand for disposable prefilled syringes.

Some of the prominent players in the Prefilled syringes market include:

- Gerresheimer AG

- Schott Group

- Unilife Corporation

- Nipro Medical Corporation

- Owen Mumford

- Haselmeier AG

- BD & Others

Recent Developments

-

March 2025 – BD (Becton, Dickinson and Company) announced the expansion of its prefilled syringe manufacturing facility in Zaragoza, Spain, to meet increasing European demand for vaccine delivery systems.

-

January 2025 – Gerresheimer AG launched a new line of ready-to-fill COP prefilled syringes targeting biologics and ophthalmics, emphasizing break resistance and higher compatibility.

-

November 2024 – SCHOTT Pharma signed a strategic partnership with a Korean biotech firm to supply high-barrier glass prefilled syringes for mRNA vaccines and complex injectables.

-

September 2024 – Eli Lilly received FDA approval for a new disposable prefilled pen for weekly injection of tirzepatide, its dual GIP/GLP-1 drug for Type 2 diabetes and obesity.

-

June 2024 – West Pharmaceutical Services introduced a digital platform that integrates with connected prefilled syringes to track dose adherence in autoimmune therapy patients.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global prefilled syringes market.

Type

- Disposable Prefilled Syringes

- Reusable Prefilled Syringes

Material

- Glass Prefilled Syringes

- Plastic Prefilled Syringes

Application

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Others

-

- Vaccines and Other Biotech Drugs

Distribution Channel

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)