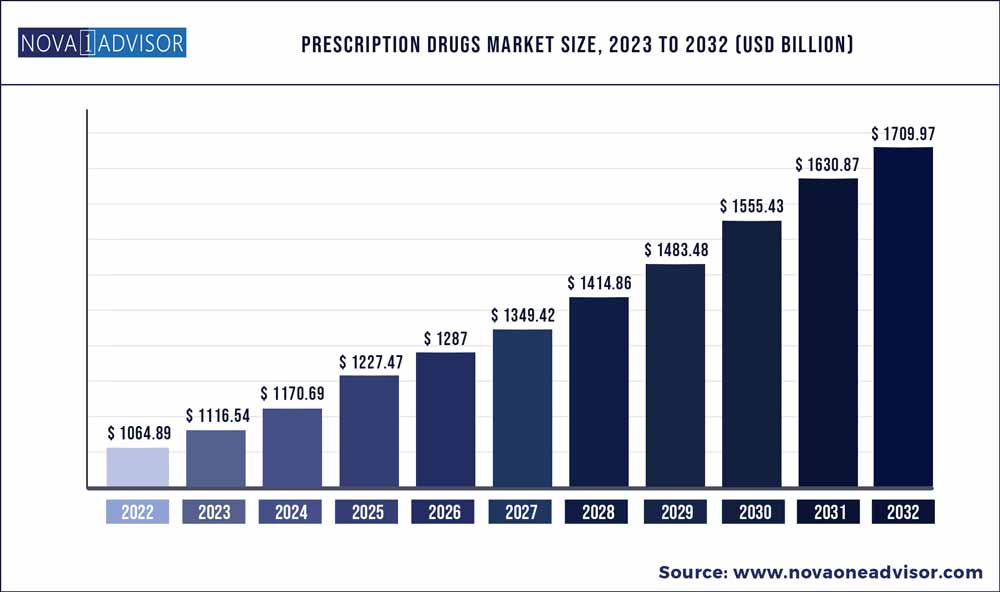

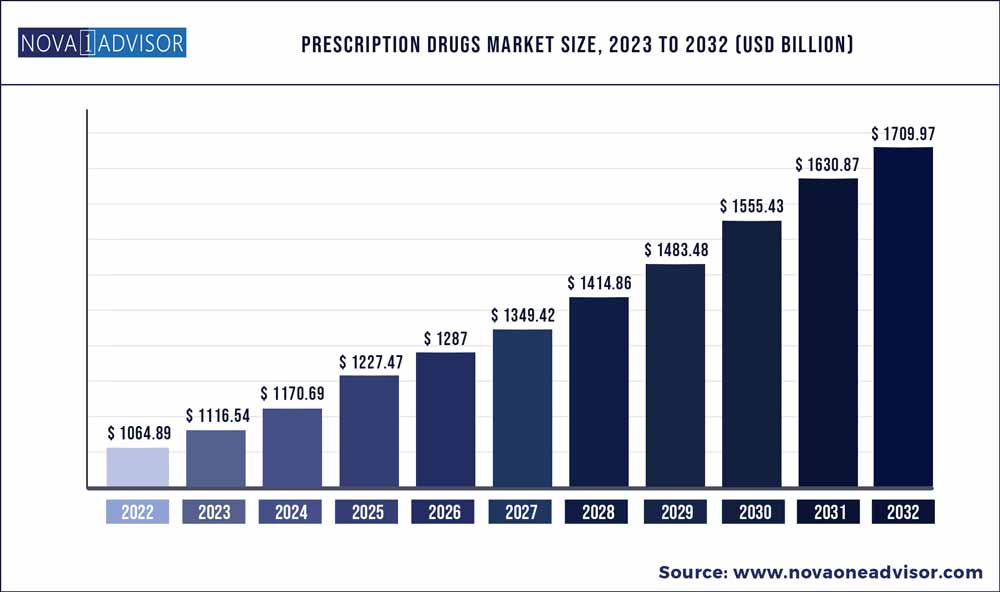

The global prescription drugs market size was valued at USD 1064.89 billion in 2022 and is predicted to be worth USD 1709.97 billion by 2032, with a CAGR of 4.85% from 2023 to 2032.

Prescription drugs comprise various types of vaccines and therapies for the treatment and management of chronic and acute diseases. These disorders include types of cancer, cardiovascular diseases, diabetes, and also orphan diseases.

In a modern clinical scenario, administration of appropriate prescription drugs is critical for better clinical outcomes of almost every patient suffering from serious disorders. Many market players are engaged in clinical trials for the development of new products for a wide range of diseases; however, the prescription drugs scenario itself has undergone profound changes with an increasing influx of generic equivalents.

Prescription drugs Market Report Scope

In the prescription drugs market, increasing R&D investments by prominent companies for the development of new drugs is a key trend. This is primarily because prevalence of several chronic disorders has been increasing in the global scenario. This has fueled the demand from patients due to their unmet clinical needs and a demand for positive clinical outcomes. Several of these chronic disorders are often refractory in nature and thus, require administration of aggressive prescribed therapies. This has prompted major pharmaceutical companies to consistently engage in clinical trials for the development, and ultimately the approval of new products. An increasing number of key manufacturers are shifting their focus toward the development of drugs to treat rare diseases. This is projected to further propel the market growth of these drugs during the forecast period.

Increase in the number of launches of generic equivalents of several key drugs in strong markets such as the U.S. is a crucial factor driving the global prescription drugs market. Rise in adoption of these generic equivalents is especially due to the fact that these generics are often as efficient as their original counterparts and can often be adopted by patients at a fraction of the costs. Patients without the access to expensive prescription products due to financial hurdles can often adopt these drugs and experience better clinical outcomes.

In October 2019, the U.S. FDA announced that it had granted approval to 1,171 generic drugs out of which 935 were full approvals and 236 were tentative approvals. The U.S. FDA particularly approved these generic equivalents to improve drug competition, and to also encourage the increasing adoption of these low-cost drug equivalents.

Some of the prominent players in the Prescription drugs Market include:

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Mylan N.V. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- GlaxoSmithKline plc (U.K.)

- Novartis AG (Switzerland)

- Merck & Co., Inc. (U.S.)

- Allergan (Ireland)

- AstraZeneca (U.K.)

- Johnson & Johnson Private Limited (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

- Bristol-Myers Squibb Company (U.S.)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH. (Germany)

- Dr. 'Reddy's Laboratories Ltd. (India)

- Gilead Sciences, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- AbbVie Inc. (U.S.)

- Lupin (India)

- Allergan (Ireland)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global prescription drugs market.

By Type

By Therapy Area

- Oncology

- Immunology

- Ophthalmology

- Respiratory

- Dermatology

- Gastroenterology

- Urology

- Gynaecology

- Endocrinology

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

- By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)