Primary Care POC Diagnostics Market Size and Forecast 2025 to 2034

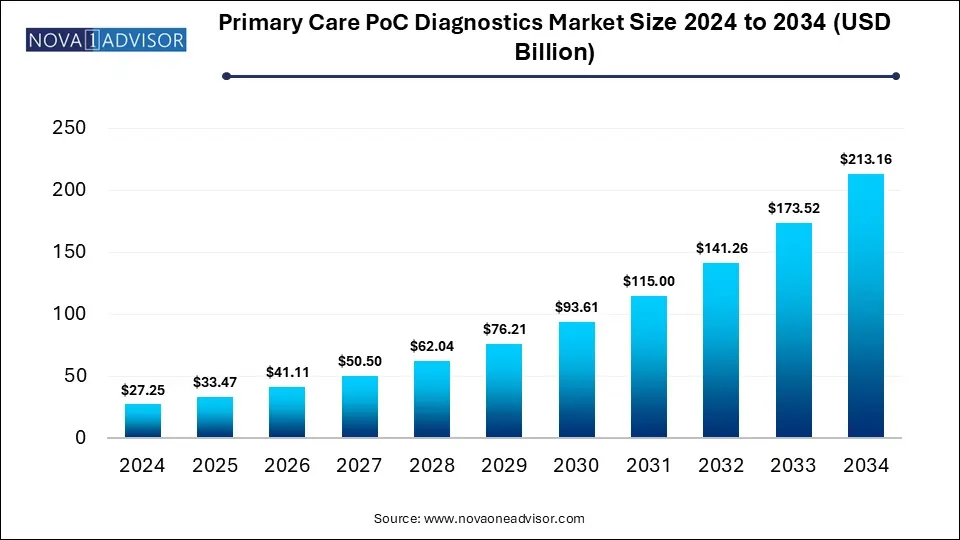

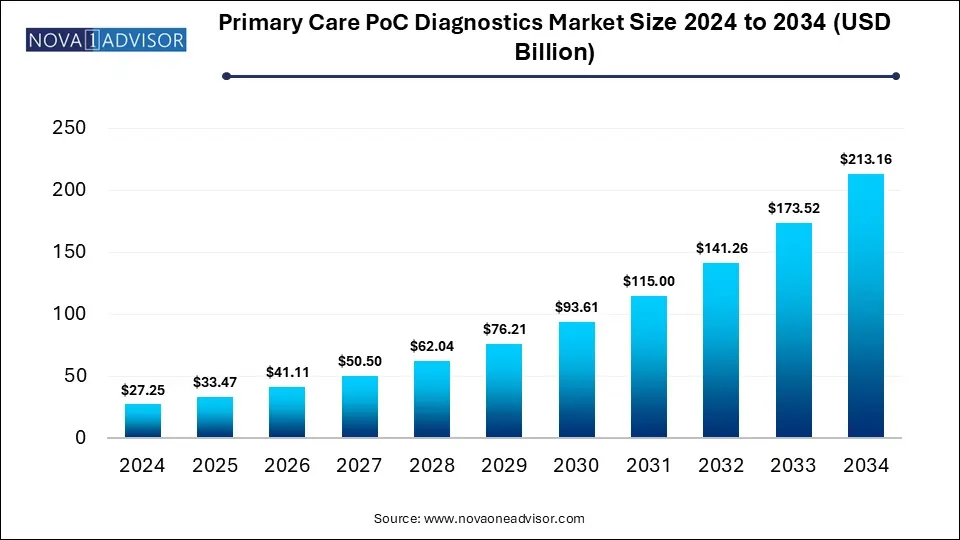

The global primary care POC diagnostics market size was valued at USD 27.25 billion in 2024 and is anticipated to reach around USD 213.16 billion by 2034, growing at a CAGR of 22.84% from 2025 to 2034. The growth of the primary care POC diagnostics market can be linked to the increased demand for rapid and easily accessible testing, strategic collaborations, innovative product launches, and focus on early detection and prevention of diseases.

Primary Care POC Diagnostics Market Key Takeaways

- North America primary care POC diagnostics market dominated in 2024 and accounted for the market share of 45%.

- Asia Pacific primary care POC diagnostics market is estimated to register the fastest CAGR over the forecast period.

- Glucose testing dominated the market and accounted for a share of 14.71% in 2025.

- The cancer markers segment is expected to register the fastest CAGR during the forecast period.

- The pharmacy & retail clinics segment accounted for the largest market revenue share of 48% in 2024.

- Physician office is expected to grow significantly over the forecast period.

Market Overview

The global Primary Care Point-of-Care (POC) Diagnostics market is at the forefront of a healthcare transformation, addressing the critical need for rapid, accurate, and decentralized diagnostic capabilities. As healthcare shifts toward value-based models emphasizing early diagnosis, disease prevention, and accessibility, point-of-care testing has emerged as a vital enabler. In primary care settings—ranging from physician offices and urgent care clinics to pharmacy-based and non-traditional sites—POC diagnostics facilitate on-the-spot testing, enabling clinicians to make timely decisions and initiate treatment during the same patient visit.

The market encompasses a broad range of tests that deliver fast, actionable insights at the site of care without requiring centralized lab infrastructure. These include glucose monitoring for diabetes, HbA1c for long-term glycemic control, rapid infectious disease detection (such as influenza, COVID-19, and strep throat), lipid panels for cardiovascular screening, coagulation assays, pregnancy and fertility tests, and cancer biomarkers. POC tests also extend into drug of abuse screening, nephrology, hematology, autoimmune disease evaluation, and decentralized chemistry—supporting holistic health management.

Driven by the need for operational efficiency, patient satisfaction, and improved clinical outcomes, adoption of POC technologies is rapidly increasing across both developed and developing markets. In the U.S., retail clinics and pharmacy-based testing services are redefining primary care access. In Europe, physician offices are integrating POC systems to support aging populations and chronic disease management. Meanwhile, emerging markets in Asia and Latin America are embracing POC solutions to extend diagnostic reach into rural and underserved areas.

Technological advances such as microfluidics, biosensors, mobile health platforms, and cloud connectivity are further catalyzing the market. These innovations enable miniaturization of diagnostic equipment, enhance sensitivity and specificity, and allow seamless data integration with electronic health records (EHRs). As a result, the primary care POC diagnostics market is not only expanding in volume but also in clinical scope, making it a cornerstone of modern, patient-centric healthcare delivery.

Major Trends in the Market

-

Integration with Digital Health Platforms: POC devices are increasingly equipped with Bluetooth and cloud-based connectivity for real-time result sharing and EHR integration.

-

Expansion of POC Diagnostics into Retail Clinics: Pharmacies and wellness centers are offering on-site diagnostic services, particularly for chronic and infectious diseases.

-

Miniaturization and Portability of Devices: Advances in microfluidics and biosensor technologies are enabling compact, user-friendly, handheld diagnostic tools.

-

Rise of Multiplex Testing Platforms: New-generation systems support simultaneous detection of multiple biomarkers, reducing the need for multiple visits.

-

Regulatory Push for Decentralized Testing: In response to public health crises, agencies are promoting rapid approval pathways for POC diagnostics.

-

Shift Toward Home-Based Primary Care: Telehealth and remote diagnostics are supporting the delivery of POC testing kits for use at home under clinical supervision.

-

Focus on Antimicrobial Stewardship: Rapid infectious disease testing is helping reduce antibiotic overuse by facilitating evidence-based prescription decisions.

-

Increased Demand for Chronic Disease Monitoring: Growing prevalence of diabetes, cardiovascular disorders, and kidney diseases is driving uptake of primary care-based monitoring tools.

How is AI Influencing the Primary Care POC Diagnostics Market?

Artificial intelligence (AI) in transforming the primary care POC diagnostics market by enhancing the accuracy, speed and accessibility of testing. AI algorithms can be applied for analyzing medical images such as X-rays and ultrasounds obtained from POC devices for detecting and diagnosing various disease conditions such as retinopathy, pneumonia. Machine learning models can be deployed for surveying historical and real-time patient data to predict disease progression and possible outcomes, further allowing clinicians to proactively manage patient care. Detection of traditional biomarkers easily found in accessible bodily fluids such as saliva and sweat with AI-assisted biosensors can enable personalized and adaptive patient care. Integration of telemedicine with AI is facilitating real-time analysis of patient data and images, leading to accurate and timely assessments during remote consultations, especially in underserved areas.

Primary Care POC Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 33.47 Billion |

| Market Size by 2034 |

USD 213.16 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 22.84% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F Hoffmann-La Roche Ltd.., Danaher, Abbott, Siemens Healthineers, BIOMÉRIEUX, QIAGEN, Nova Biomedical, Johnson & Johnson Services, Inc., OraSure Technologies, Inc., BD |

Key Market Driver

Rising Burden of Chronic and Infectious Diseases

The increasing global burden of chronic diseases, including diabetes, cardiovascular diseases, and kidney disorders, is a major driver of the primary care POC diagnostics market. In the United States alone, over 37 million people live with diabetes, and timely monitoring of blood glucose and HbA1c levels is critical for effective management. Similarly, cardiovascular conditions demand regular lipid profiling and coagulation assessment. POC tests empower physicians to conduct these assessments during a patient’s visit, eliminating delays associated with central lab processing.

Infectious diseases, particularly those with high transmission potential such as COVID-19, influenza, and respiratory syncytial virus (RSV), have further emphasized the need for rapid diagnostics. The COVID-19 pandemic showcased the vital role of POC diagnostics in mass testing, early detection, and treatment triage, accelerating both innovation and regulatory support in the sector. With healthcare systems striving to minimize unnecessary hospital visits and optimize outpatient care, POC testing is becoming an essential tool for early diagnosis, treatment initiation, and disease surveillance.

Key Market Restraint

Inconsistency in Test Accuracy and Quality Control

Despite their numerous advantages, POC diagnostics face challenges related to variability in test accuracy, operator dependence, and lack of standardization. Unlike centralized labs with controlled environments and skilled technicians, POC tests are often administered in diverse settings by personnel with limited laboratory training. This can lead to errors in sample collection, result interpretation, or device handling impacting test reliability and potentially influencing treatment decisions.

Moreover, not all POC devices are subject to the same regulatory rigor as traditional diagnostic systems. While many high-end platforms undergo extensive validation, some rapid tests (especially in emerging markets) may enter the market with suboptimal sensitivity or specificity, particularly in complex applications such as cancer detection or autoimmune markers. These limitations have sparked concerns among clinicians and regulators about clinical decision-making based solely on POC results. Addressing these challenges requires robust training programs, regulatory harmonization, and continued innovation in test quality assurance.

Key Market Opportunity

Growth of Pharmacy-Based and Retail Clinic Testing Services

An emerging opportunity in the market lies in the rapid expansion of diagnostic services in non-traditional healthcare settings, particularly pharmacies and retail clinics. With over 70,000 pharmacy locations across Europe and North America, these establishments are increasingly viewed as accessible, trusted points of care especially for time-sensitive diagnostics. Major pharmacy chains like CVS Health, Walgreens Boots Alliance, and Boots UK have introduced services offering blood pressure screening, glucose monitoring, lipid profiling, and COVID-19 testing, using POC platforms.

As governments and insurers push for decentralized, low-cost primary care models, retail clinics are poised to play a central role in community health management. POC diagnostics can help pharmacists identify early signs of chronic disease, flag abnormal results for physician referral, and engage patients in proactive health behaviors. This trend not only improves care access but also opens lucrative channels for diagnostic manufacturers to partner with retail giants and expand their customer base.

Primary Care POC Diagnostics Market Report Segmentation Insights

By Product Insights

In 2024, glucose testing remained the dominant segment within the primary care POC diagnostics market. This prominence is primarily driven by the global prevalence of diabetes and the need for routine monitoring. Handheld glucometers, continuous glucose monitoring (CGM) systems, and HbA1c rapid testing kits are widely used in primary care, physician offices, and pharmacy clinics. These tools offer immediate feedback and are pivotal in both diagnosing pre-diabetes and managing glycemic control in diabetic patients. Companies like Roche Diagnostics, Abbott, and Ascensia have introduced advanced glucose monitoring devices that integrate with mobile apps, enhancing patient engagement and provider decision-making.

Meanwhile, infectious disease testing is the fastest-growing segment, spurred by the rising incidence of viral and bacterial infections and the need for rapid differentiation at the point of care. Products for COVID-19, influenza, RSV, and strep throat are increasingly deployed in physician clinics and retail settings. These tests help reduce disease transmission, guide antimicrobial use, and facilitate public health surveillance. Multiplex testing devices—capable of detecting several pathogens in one go—are gaining popularity, particularly in pediatric and geriatric care.

By End Use Insights

The pharmacy & retail clinics segment accounted for the largest market revenue share of 48% in 2024. ueled by the expansion of consumer-directed healthcare. These sites are increasingly equipped with POC platforms for infectious diseases, cholesterol monitoring, and lifestyle-related diagnostics. The convenience, affordability, and extended operating hours of pharmacies make them attractive for working adults and underserved populations. Additionally, pharmacist-led health initiatives and government-supported public health programs are boosting testing volumes in these settings.

Physician office is expected to grow significantly over the forecast period. due to the integration of POC diagnostics into routine care for chronic disease screening, urgent symptom evaluation, and health checkups. Physicians prefer POC tools that provide rapid results, enabling them to adjust medications, make referrals, or deliver immediate counseling during patient visits. Devices such as blood gas analyzers, cardiac markers, and lipid tests are common in primary care practices. This setting benefits from consistent patient-provider relationships and repeat testing.

By Regional Insights

North America primary care POC diagnostics market dominated in 2024 and accounted for the market share of 45%. driven by strong healthcare infrastructure, high prevalence of chronic diseases, and early adoption of decentralized diagnostics. The United States, in particular, leads in retail clinic innovation, supported by major pharmacy chains, private insurers, and value-based care models. The COVID-19 pandemic catalyzed the rollout of rapid tests at pharmacies, schools, and community centers, highlighting the importance of scalable POC infrastructure. Robust reimbursement frameworks, favorable FDA guidance, and active collaborations between diagnostic companies and healthcare providers continue to support the regional market.

U.S. Primary Care POC Diagnostics Market Trends

U.S. is leading the market in North America. The market dominance is driven by increased demand for rapid and accessible diagnostic solutions, rising chronic disease burden, and focus on preventive healthcare and pandemic preparedness. Technological advancements such as miniaturization, AI integration, development of handheld and portable tools, use of biosensors and innovations like multi-condition POC testing devices are expanding the market potential. Supportive government initiatives and favorable reimbursement policies are encouraging the adoption of primary care POC diagnostics.

- For instance, in February 2025, Aptitude Medical Systems, Inc. gained the U.S. Food and Drug Administration’s (FDA’s) Emergency Use Authorization (EUA) for its next-gen molecular Metrix COVID/Flu multiplex test which detects and differentiates SARS-CoV-2, Influenza A virus, and Influenza B virus in 20 minutes. The test can be used at home and in CLIA-waived point-of-care (POC) settings.

Asia-Pacific is emerging as the fastest-growing region, propelled by rising healthcare investments, large patient populations, and increased awareness about preventive health. Countries like China, India, and Indonesia are adopting POC technologies to bridge diagnostic gaps in rural and semi-urban areas where laboratory access is limited. Public-private partnerships, mobile health units, and community-based care models are deploying POC kits for tuberculosis, malaria, dengue, and glucose testing. Additionally, Japan and South Korea are investing in POC innovation for an aging population, with a focus on at-home and remote diagnostics. The region’s dynamic healthcare landscape and favorable demographics present immense growth potential for diagnostic manufacturers.

China Primary Care POC Diagnostics Market Trends

China is dominating the market in Asia Pacific, due to factors such as rising prevalence of chronic and infectious diseases in the large population, improvements in primary care infrastructure, increased emphasis on monitoring and management of chronic conditions and focus on decentralizing healthcare services. Integration of advanced technologies such as artificial intelligence, biosensors and nanotechnology for enhancing diagnostics speed and accuracy as well as development of small and portable POC diagnostic tools are facilitating primary care in remote and underserved areas at reduced, further expanding the market potential. Increased funding provided by the Chinese government for public hospitals and promoting decentralized care are bolstering the market growth.

Primary Care POC Diagnostics Market Top Key Companies:

The following are the leading companies in the primary care POC diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

-

Abbott Laboratories

-

Roche Diagnostics

-

Siemens Healthineers

-

Becton, Dickinson and Company (BD)

-

QuidelOrtho Corporation

-

bioMérieux

-

Chembio Diagnostics

-

Danaher Corporation (Cepheid)

-

Nova Biomedical

-

Instrumentation Laboratory (Werfen)

Recent Developments

- In July 2025, PHASE Scientific signed an exclusive U.S. distribution agreement with Lumos Diagnostic for a first-in-class, rapid point-of-care (POC) test that is used for diagnosis of bacterial acute respiratory infection and differentiation from non-bacterial etiology in about 10 minutes using a single drop of blood. The launch expands PHASE Scientific's INDICAID portfolio, further strengthening its presence in point-of-care respiratory diagnostics.

- In January 2025, Aptitude Medical Systems, Inc. secured over $10 million in funding from the Bill & Melinda Gates Foundation for accelerating the development and launch of its new Over-The-Counter (OTC) and Point of Care (POC) Chlamydia, gonorrhea, and trichomoniasis sexually transmitted infection (STI) test on the Metrix molecular diagnostics platform.

- In November 2024, NOWDiagnostics, Inc. (NOWDx), launched its First To Know Syphilis Test which is the first-of-its-kind, self-directed rapid test for syphilis prevention. The test provides in-home results with little as a drop of blood in 15 minutes and is available across the U.S.

Primary Care POC Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Primary Care POC Diagnostics market.

By Product

- Glucose Testing

- Hb1Ac Testing

- Coagulation Testing

- Fertility/Pregnancy

- Infectious Disease

- Cardiac Markers

- Thyroid Stimulating Hormone

- Hematology

- Primary Care Systems

- Decentralized Clinical Chemistry

- Feces

- Lipid Testing

- Cancer Marker

- Blood Gas/Electrolytes

- Ambulatory Chemistry

- Drug of Abuse (DOA) Testing

- Autoimmune Diseases

- Urinalysis/Nephrology

By End Use

- Pharmacy & Retail Clinics

- Physician Office

- Urgent Care Clinics

- Non-practice Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)