Protein Expression Market Size and Trends

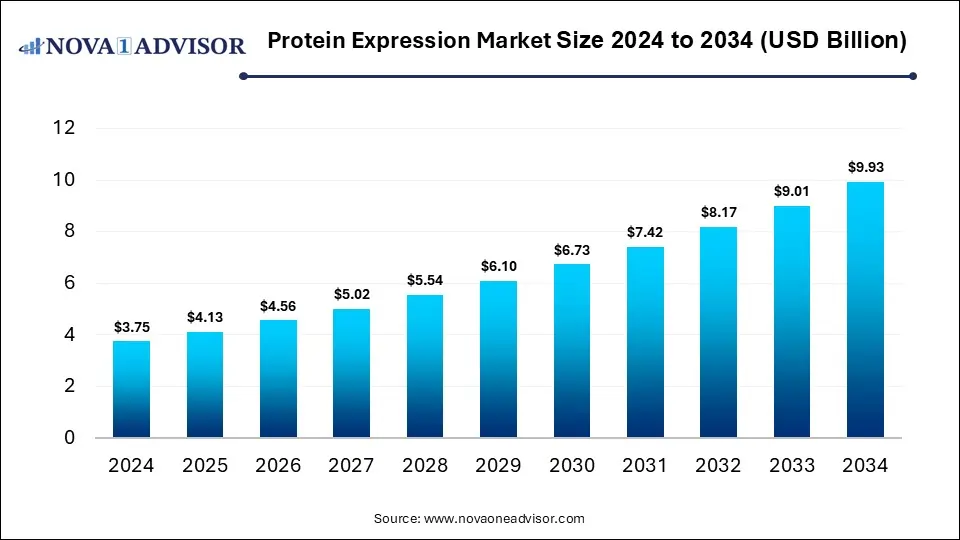

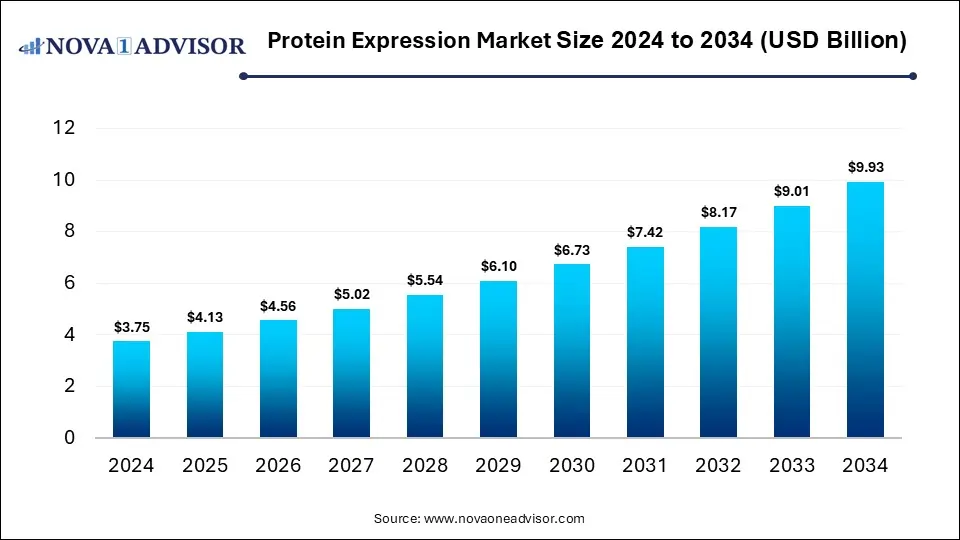

The protein expression market size was exhibited at USD 3.75 billion in 2024 and is projected to hit around USD 9.93 billion by 2034, growing at a CAGR of 10.23% during the forecast period 2025 to 2034.The market is growing due to rising demand for recombinant proteins in biopharmaceuticals and increasing research in drug discovery, diagnostics, and therapeutic development. Advances in expression systems and technologies are also accelerating market expansion.

Protein Expression Market Key Takeaways:

- North America dominated the protein expression market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By expression systems, the mammalian cell segment held the largest market share in 2024.

- By expression systems, the prokaryotic segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the reagents segment dominated the market with a major revenue share in 2024.

- By product, the services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the therapeutic segment held the highest market share in 2024.

- By application, the industrial segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the pharmaceutical and biotechnological companies segment held the highest revenue shares in 2024.

- By end user, the contract research organization segment is expected to grow at the fastest CAGR in the market during the forecast period.

Which Factors are Driving the Growth of the Protein Expression Market?

Protein expression is the process by which cells synthesize specific proteins from a gene, enabling their study, production, or use in research, diagnostics, and therapeutics. The growth of the potential expression market is also propelled by the rising adoption of high-throughput protein production platforms, increasing focus on synthetic biology, and the expression of contract research organizations (CROs) offering protein services. Moreover, the surge in academic and industrial research targeting novel enzymes, antibodies, and therapeutic proteins, along with government funding for biotechnology initiatives, is boosting demand. Emerging applications in industrial biocayalysts, biofuels, and agricultural biotechnology are further supporting market expansion.

- For Instance, In February 2025, India’s Department of Biotechnology (DBT), along with BIRAC, introduced a joint initiative inviting proposals on "Smart Proteins," aiming to promote research and innovation in this emerging field. (Source: https://dbtindia.gov.in/)

What are the Key trends in the Protein Expression Market in 2024?

- In April 2025, Thermo Fisher Scientific announced a USD 2 billion investment to strengthen U.S. innovation and manufacturing, with USD 500 million specifically dedicated to advancing next-generation protein expression research and development. (Source: https://ir.thermofisher.com/)

- In June 2024, LenioBio partnered with Labscoop to expand the availability of its cell-free protein synthesis technology in North America. Through this collaboration, Labscoop will showcase LenioBio’s offerings, including the ALiCE platform, on its marketplace, providing wider access for academic and commercial laboratories. (Source: https://www.leniobio.com/)

How Can AI Affect the Protein Expression Market?

AI is transforming the market by accelerating gene design, optimizing expression systems, and predicting protein structures with high accuracy. It enables faster identification of expression bottlenecks, reduces experimental costs, and improves yield efficiency. AI-driven analytics also support personalized therapeutic protein development and streamline large-scale biomanufacturing processes. Overall, AI integration enhances innovation, productivity, and precision, significantly driving growth in the protein expression market.

Report Scope of Protein Expression Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.13 Billion |

| Market Size by 2034 |

USD 9.93 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.23% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Expression System, Product, Application, End use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Agilent Technologies, Inc.; Bio-Rad Laboratories; Thermo Fisher Scientific, Inc.; Merck Millipore; New England BioLabs, Inc.; Promega Corporation; QIAGEN; Takara Bio, Inc.; Oxford Expression Technologies; Lucigen Corporation |

Market Dynamics

Driver

Rising Demand for Recombinant Protein in Therapeutics and Vaccines

The demand for recombinant proteins in therapeutic and vaccines fuels the protein expression market as they enable rapid development of novel biologics and next-generation vaccine platforms. These proteins support innovation in gene therapies, immunotherapies, and biosimilars, addressing unmet medical needs. Additionally, their ability to be engineered for enhanced stability and functionality makes them valuable for large-scale production, encouraging pharmaceutical companies and researchers to adopt advanced protein expression methods for faster, cost-effective solutions.

- For Instance, In May 2024, Takeda’s recombinant ADAMTS13 (rADAMTS13)—an enzyme replacement therapy using recombinant protein technology—received a positive recommendation from the European Medicines Agency’s CHMP under exceptional circumstances for treating congenital thrombotic thrombocytopenic purpura (cTTP). This marked a breakthrough as the first recombinant enzyme replacement therapy targeting this rare blood-clotting disorder in the EU. (Source: https://www.takeda.com/)

Restraint

Renewed Focus on Small Molecules in Drug Development

The shift back to small molecules in drug development restrains the protein expression market because it diverts research pipelines and clinical trials away from biologics. Small molecules are increasingly explored for novel targets, including areas once dominated by protein therapies, reducing the urgency to develop complex recombinant proteins. As funding and partnerships tilt towards small molecule innovation, the demand for advanced protein expression platforms declines, limiting growth opportunities in the biopharmaceutical industry.

Opportunity

Growing Emphasis on Plant-based and Cell-free Expression Systems

The emphasis on plant-based and cell-free expression systems creates future opportunities as they open pathways for producing proteins that are difficult to express in conventional hosts. These systems allow greater flexibility in modifying proteins with unique structures or functions, expanding their therapeutic and industrial applications. Moreover, their compatibility with emerging synthetic biology tools supports innovative product development, while decentralized, on-demand production makes them ideal for rapid on-demand production models makes them ideal for rapid response to health emergencies and specialized market needs.

- For Instance, In March 2024, Thermo Fisher Scientific improved various cell-free expression systems covering bacterial, rabbit reticulocyte, and human-derived lysates to enable the rapid synthesis of recombinant proteins. (Source: https://www.thermofisher.com/)

Segmental Insights

How did Mammalian Cell Segment dominate the Protein Expression Market in 2024?

In 2024, the mammalian expression system held the largest share of the market due to its ability to produce complex proteins with proper folding, post-translational modifications, and high bioactivity, which are essential for therapeutic use. It remains the gold standard for manufacturing monoclonal antibodies, recombinant proteins, and advanced biologics. Strong adoption in biopharmaceutical R&D, combined with regulatory preference for mammalian-derived therapeutics, further strengthened its dominance over other expression systems in the global market.

The prokaryotic expression system is anticipated to witness the fastest CAGR as it increasingly supports high-throughput screening, synthetic biology applications, and production of novel biomaterials. Its compatibility with advanced genome editing tools allows efficient engineering of microbial hosts for specialized protein synthesis. Moreover, expanding use in bio-manufacturing sectors such as biofuels, biodegradable plastics, and agricultural biotechnology is driving adoption, positioning prokaryotic systems as a versatile and scalable platform beyond traditional therapeutic protein production.

What made the Reagents Segment Dominant in the Protein Expression Market in 2024?

In 2024, the reagents segment dominated the market as reagents such as enzymes, vectors, and transfection kits are essential at every stage of protein production, from gene cloning to expression and purification. Their repeated and large-scale use in both research and commercial applications ensures consistent demand. Additionally, ongoing innovations in high-efficiency reagents that improve yield and reduce experimental errors further strengthened their adoption, making this segment the primary revenue contributor in the market.

The services segment is projected to expand rapidly as it enables access to advanced expression platforms that many academic labs and smaller biotech firms cannot afford in-house. Growing collaborations between industry and academia for specialized protein projects, along with the rising need for tailored proteins in emerging areas like synthetic biology, diagnostics, and industrial enzymes, are fueling demand. Moreover, service providers are increasingly integrating AI-driven analytics and automation, offering faster, more precise, and flexible solutions that boost market growth.

Why Did the Therapeutic Segment Dominate the Market in 2024?

The therapeutic segment led the protein expression market in 2024 as it increasingly supported next-generation treatments like gene therapies, immunotherapies, and cell-based therapies that rely on complex proteins. Advances in protein engineering enabled the creation of more stable, potent, and patient-specific therapeutics, boosting adoption. Additionally, strong industry focus on biosimilars and biobetters to address patent expirations, along with rising collaborations for innovative biologic pipelines, positioned the therapeutic segment at the forefront of market share.

- For Instance, A November 2023 review in Biologics highlighted a cost-saving approach of using Escherichia coli to produce larger biomolecules, including full-length antibodies, which are conventionally manufactured in Chinese Hamster Ovary (CHO) cells. (Source:https://www.researchgate.net/)

The industrial segment is expected to grow at the fastest CAGR as protein expression is increasingly used in producing enzymes for food processing, detergents, textiles, paper, and biofuels. Rising demand for sustainable and eco-friendly industrial processes is driving reliance on recombinant proteins that enhance efficiency and reduce chemical usage. Moreover, advances in synthetic biology and metabolic engineering are enabling cost-effective large-scale enzyme production, positioning the industrial segment as a key growth driver in the coming years.

- For Instance, In June 2024, the Department of Biochemistry at the Indian Institute of Science developed an innovative method for generating recombinant proteins. (Source: https://www.thehindu.com/)

How does the Pharmaceutical and Biotechnological Companies Segment Dominate the Protein Expression Market?

In 2024, the pharmaceutical and biotechnological companies segment accounted for the highest revenue share in the protein expression market due to their extensive use of recombinant proteins in drug discovery, biologics manufacturing, and vaccine development. These companies invest heavily in advanced expression systems to accelerate therapeutic pipelines and meet rising global demand for innovative treatments. Strong funding, large-scale production capabilities, and continuous expansion of biologics portfolios further reinforced their leading position compared to other end-user segments.

- For Instance In February 2024, BioAscent opened an advanced protein production facility to strengthen its drug discovery efforts, enabling in-house protein generation and improving screening efficiency for its clients. (Source: https://www.bioascent.com/)

The contract research organization segment is projected to expand quickly as it benefits from the surge in complex biologics research that requires advanced protein expression platforms not always available in-house. Increasing regulatory scrutiny is also pushing companies to rely on CROs with strong compliance expertise to navigate approvals. Additionally, the growing trend of global partnerships and cross-border clinical projects fuels demand for CRO-driven protein expression services, making them a strategic choice for accelerating innovation and market entry.

- For Instance, In June 2024, Syngene International Ltd. launched an innovative protein production platform built on cell line and transposon technology licensed from ExcellGene. (Source: https://www.biopharminternational.com/)

Regional Insights

How is North America contributing to the Expansion of the Protein Expression Market?

North America led the market in 2024 due to its strong presence of academic research institutions and collaborations driving innovation in protein science. The region also witnessed rapid growth in personalized medicine initiatives and biosimilar development, both heavily dependent on advanced protein expression technologies. Additionally, rising government-backed healthcare programs, along with a high rate of partnerships between biotech start-ups and established firms, further fueled North America’s dominance in the global protein expression landscape.

How is Asia-Pacific Accelerating the Protein Expression Market?

Asia-Pacific is projected to witness the fastest CAGR as the region is experiencing a surge in synthetic biology startups and innovation hubs focusing on novel protein applications. Growing investment from venture capital firms and multinational companies in local biotech ecosystems is accelerating the adoption of advanced expression platforms. Furthermore, rising emphasis on academic–industry partnerships and the establishment of regional centers for biomanufacturing excellence are creating strong momentum, making Asia-Pacific a rapidly emerging leader in the protein expression market.

Some of the prominent players in the protein expression market include:

Protein Expression Market By Recent Developments

- In June 2025, Sanofi finalized its USD 9.1 billion acquisition of Blueprint Medicines, strengthening its rare immunology portfolio and expanding revenue through the addition of Ayvakit. (Source: https://www.sanofi.com/)

- In January 2023, Quantum-Si Incorporated, a leader in protein sequencing, partnered with Aviva Systems Biology to co-develop protein enrichment kits. The collaboration focuses on advancing protein sequencing methods to enable deeper analysis of proteins and their variants, known as proteoforms. (Source: https://www.marketscreener.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the protein expression market

By Expression Systems

- Prokaryotic

- Mammalian cell

- Insect cell

- Yeast

- Others

By Product

- Reagents

- Competent cells

- Expression vectors

- Services

- Instruments

By Application

- Therapeutic

- Industrial

- Research

By End Use

- Pharmaceutical and biotechnological companies

- Academic research

- Contract research organizations

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

-

Table 1: U.S. Protein Expression Market, by Expression Systems

-

Table 2: U.S. Protein Expression Market, by Product

-

Table 3: U.S. Protein Expression Market, by Application

-

Table 4: U.S. Protein Expression Market, by End Use

-

Table 5: Canada Protein Expression Market, by Expression Systems

-

Table 6: Canada Protein Expression Market, by Product

-

Table 7: Canada Protein Expression Market, by Application

-

Table 8: Canada Protein Expression Market, by End Use

-

Table 9: Mexico Protein Expression Market, by Expression Systems

-

Table 10: Mexico Protein Expression Market, by Product

-

Table 11: Mexico Protein Expression Market, by Application

-

Table 12: Mexico Protein Expression Market, by End Use

-

Table 13: Germany Protein Expression Market, by Expression Systems

-

Table 14: Germany Protein Expression Market, by Product

-

Table 15: Germany Protein Expression Market, by Application

-

Table 16: Germany Protein Expression Market, by End Use

-

Table 17: France Protein Expression Market, by Expression Systems

-

Table 18: France Protein Expression Market, by Product

-

Table 19: France Protein Expression Market, by Application

-

Table 20: France Protein Expression Market, by End Use

-

Table 21: UK Protein Expression Market, by Expression Systems

-

Table 22: UK Protein Expression Market, by Product

-

Table 23: UK Protein Expression Market, by Application

-

Table 24: UK Protein Expression Market, by End Use

-

Table 25: Italy Protein Expression Market, by Expression Systems

-

Table 26: Italy Protein Expression Market, by Product

-

Table 27: Italy Protein Expression Market, by Application

-

Table 28: Italy Protein Expression Market, by End Use

-

Table 29: Rest of Europe Protein Expression Market, by Segments

-

Table 30: China Protein Expression Market, by Expression Systems

-

Table 31: China Protein Expression Market, by Product

-

Table 32: China Protein Expression Market, by Application

-

Table 33: China Protein Expression Market, by End Use

-

Table 34: Japan Protein Expression Market, by Expression Systems

-

Table 35: Japan Protein Expression Market, by Product

-

Table 36: Japan Protein Expression Market, by Application

-

Table 37: Japan Protein Expression Market, by End Use

-

Table 38: South Korea Protein Expression Market, by Expression Systems

-

Table 39: South Korea Protein Expression Market, by Product

-

Table 40: South Korea Protein Expression Market, by Application

-

Table 41: South Korea Protein Expression Market, by End Use

-

Table 42: India Protein Expression Market, by Expression Systems

-

Table 43: India Protein Expression Market, by Product

-

Table 44: India Protein Expression Market, by Application

-

Table 45: India Protein Expression Market, by End Use

-

Table 46: Southeast Asia Protein Expression Market, by Segments

-

Table 47: Rest of Asia Pacific Protein Expression Market, by Segments

-

Table 48: Brazil Protein Expression Market, by Expression Systems

-

Table 49: Brazil Protein Expression Market, by Product

-

Table 50: Brazil Protein Expression Market, by Application

-

Table 51: Brazil Protein Expression Market, by End Use

-

Table 52: Rest of Latin America Protein Expression Market, by Segments

-

Table 53: GCC Countries Protein Expression Market, by Expression Systems

-

Table 54: GCC Countries Protein Expression Market, by Product

-

Table 55: GCC Countries Protein Expression Market, by Application

-

Table 56: GCC Countries Protein Expression Market, by End Use

-

Table 57: Turkey Protein Expression Market, by Segments

-

Table 58: Africa Protein Expression Market, by Segments

-

Table 59: Rest of MEA Protein Expression Market, by Segments

-

Figure 1: U.S. Protein Expression Market Share, by Expression Systems

-

Figure 2: U.S. Protein Expression Market Share, by Product

-

Figure 3: U.S. Protein Expression Market Share, by Application

-

Figure 4: U.S. Protein Expression Market Share, by End Use

-

Figure 5: Canada Protein Expression Market Share, by Segments

-

Figure 6: Mexico Protein Expression Market Share, by Segments

-

Figure 7: Germany Protein Expression Market Share, by Expression Systems

-

Figure 8: France Protein Expression Market Share, by Segments

-

Figure 9: UK Protein Expression Market Share, by Segments

-

Figure 10: Italy Protein Expression Market Share, by Segments

-

Figure 11: China Protein Expression Market Share, by Expression Systems

-

Figure 12: Japan Protein Expression Market Share, by Segments

-

Figure 13: South Korea Protein Expression Market Share, by Segments

-

Figure 14: India Protein Expression Market Share, by Segments

-

Figure 15: Brazil Protein Expression Market Share, by Segments

-

Figure 16: GCC Countries Protein Expression Market Share, by Segments

-

Figure 17: Turkey Protein Expression Market Share, by Segments

-

Figure 18: Africa Protein Expression Market Share, by Segments