Protein Therapeutics Market Size and Trends

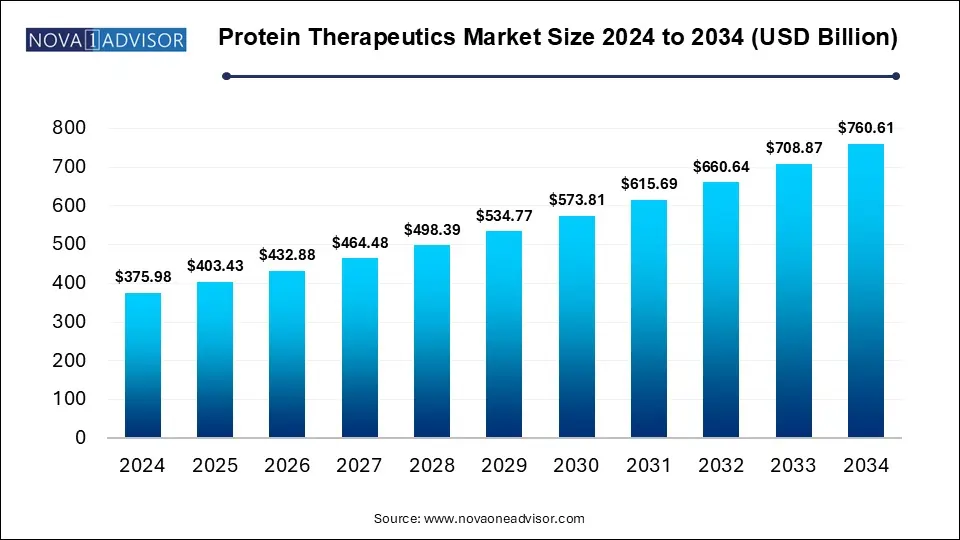

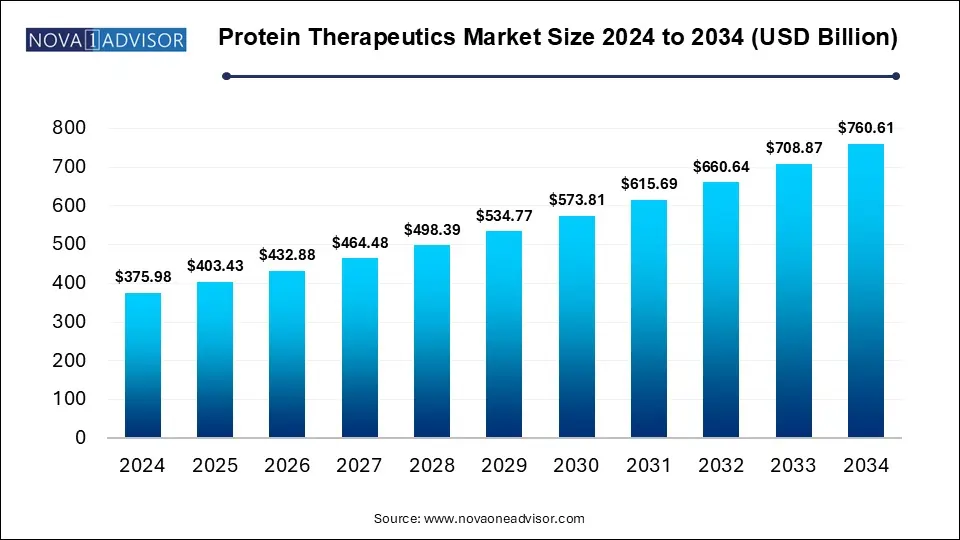

The global protein therapeutics market size is calculated at USD 375.98 billion in 2024, grows to USD 403.43 billion in 2025, and is projected to reach around USD 760.61 billion by 2034 at a CAGR of 7.3% from 2025 to 2034 The market is expanding due to growing awareness of biological treatment and its effectiveness. Improved delivery methods and reduced side effects are attracting more patients. Supporting regulatory policies are also accelerating product approvals and market growth.

Protein Therapeutics Market Key Takeaways

- North America dominated the protein therapeutics market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By product, the monoclonal antibodies segment held the major market share in 2024.

- By product, the Erythropoietin segment is projected to grow at a CAGR in between 2025 and 2034.

- By application, the metabolic disorders segment contributed the biggest market share in 2024.

- By application, the immunological disorders segment is anticipated to grow at the fastest CAGR in the market during the studied years.

How is the Protein Therapeutics Market Evolving?

Protein therapeutics are medically engineered proteins used to treat various diseases by targeting specific biological functions. They offer high precision, making them effective for conditions like cancer, autoimmune disorders, and hormonal deficiencies. The protein therapeutics market is rapidly evolving, driven by rising chronic disease prevalence and advancements in biotechnology. Monoclonal antibodies remain a dominant product segment, while biosimilars and biobetters are gaining attention due to cost-effectiveness and scalability. Personalized medicine approaches are enhancing treatment efficacy, and increased R&D investment is expanding therapeutic applications.

What are the Key Trends in the Protein Therapeutics Market in 2025?

- In April 2025, OpenFold expanded its collaboration network by partnering with eight new companies, including Novo Nordisk and Bristol-Myers Squibb, to boost AI-driven drug discovery. The initiative aims to advance open-source molecular science through shared industry and academic expertise.

- In April 2025, Gilead Sciences partnered with San Diego-based Tentarix Biotherapeutics to develop new treatments for cancer and inflammatory diseases. The deal includes an equity investment and grants Gilead access to three programs and subsidiaries, each valued at around $80 million, bringing the total agreement to approximately $306 million.

How AI is Powering the Protein Therapeutics Market?

AI is transforming the market by accelerating drug discovery, optimizing protein design, and predicting protein interactions with high precision. It helps researchers identify promising therapeutic candidates faster and more cost-effectively than traditional methods. AI-driven tools enhance the accuracy of structure prediction, reduce development time, and support personalized medicine approaches. By integrating vast biological data, AI enables smarter decision-making, ultimately improving the success rate of novel protein-based therapies.

Report Scope of Protein Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 403.43 Billion |

| Market Size by 2034 |

USD 760.61 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 7.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Amgen Inc., Abbott Laboratories, Abbvie Inc., Baxter International Inc., Biogen Inc., Csl Behring L.L.C. (CSL Limited), Eli Lilly and Company, F. Hoffmann-La Roche AG (Roche Holding AG), Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S (Novo Holdings A/S), Pfizer Inc. |

Market Dynamics

Driver

Why Growing Prevalence of Chronic Diseases a Major Driver for the Protein Therapeutic Market?

The growing prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders is a major driver for the market. These conditions often require targeted long-term treatments that protein-based therapies can effectively provide. Protein therapeutics, such as monoclonal antibodies and insulin, offer high specificity and fewer side effects, making them ideal for managing chronic illness. As the global health burden rises, demand for these advanced biological products continues to grow, fueling protein therapeutics market expansion.

- For Instance, In September 2024, Chronic diseases like cancer, diabetes, and heart conditions—often not contagious—are increasingly widespread, causing nearly 41 million deaths, or 75% of global deaths. This surge is largely driven by aging populations, rising obesity, and sedentary lifestyles. While high-income countries have established healthcare systems to manage these issues, low- and middle-income nations face growing rates of chronic illnesses without adequate medical infrastructure. As a result, they bear nearly 80% of deaths from these noncommunicable diseases.

Restraint

High Development and Manufacturing Costs

High development and manufacturing costs, while a challenge, act as a driver for the protein therapeutic market by encouraging innovation, investment, and strategic partnerships. These costs reflect the complexity and precision required in producing biologics, which also contributes to their high value and effectiveness. As companies aim to recover these investments, they focus on the high-demand therapeutics area, leading to a strong pipeline of advanced treatments and sustained market expansion.

Opportunity

Rising Rare Disease Therapeutics

The growing focus on rare disease therapeutics creates a key opportunity for the protein therapeutic market because many rare diseases lack effective treatments. Protein-based therapies can target specific disease mechanisms with high precision, offering hope for conditions that are difficult to treat with traditional drugs. Increased research, regulatory support, and funding for rare diseases encourage the development of these specialized proteins, expanding the market and meeting critical unmet medical needs.

- For Instance, In April 2025, Glycomine’s GLM101, targeting a rare genetic disorder, advanced to phase 2 trials involving over 20 patients in the US and Europe. Over 24 weeks, nine adolescent and adult patients with ataxia a symptom of PMM2-CDG—showed an 11.9-point improvement in muscle control, highlighting the therapy’s promising potential.

Segmental Insights

The Monoclonal Antibodies Segment Major Share

By product, the monoclonal antibodies segment held the major market share in 2024, because of its proven effectiveness in treating a wide range of chronic diseases, including cancer, autoimmune, and inflammatory disorders. Advances in biotechnology have enhanced the specificity, efficacy, and safety of these antibodies, making them highly preferred in clinical settings. Additionally, increased investment in research, faster regulatory approvals, and growing adoption by healthcare providers have expanded their availability. This combination of scientific progress and market demand has firmly positioned monoclonal antibodies as the leading product segment in the protein therapeutics market.

The Erythropoietin Segment: Fastest Growing

By product, the Erythropoietin segment is projected to grow at a CAGR in between 2025 and 2034 due to increasing cases of anemia, especially in patients with chronic kidney disease and cancer. Its role in stimulating red blood cell production makes it essential for treatment. The development of long-acting formulations and the introduction of cost-effective biosimilars have further boosted demand. Growing awareness and improved access in also contribute to the protein therapeutics market growth.

The Metabolic Disorders Segment's Biggest Share

By application, the metabolic disorders segment contributed the biggest market share in 2024, due to the rising prevalence of conditions like diabetes, obesity, and hypercholesterolemia. Protein-based treatments, such as insulin, are essential for managing these diseases, ensuring sustained demand. Advancements in therapies, including enzyme replacement and gene therapies, have improved patient outcomes. Additionally, lifestyle changes and increased awareness have led to earlier diagnoses and further driven the growth of the protein therapeutics market.

The Immunological Disorders Segment Fastest CAGR

By application, the immunological disorders segment is anticipated to grow at the fastest CAGR in the market during the studied years. The increasing prevalence of autoimmune diseases such as rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease has heightened the demand for targeted protein-based treatments. Advancements in biologics, including monoclonal antibodies and cytokine inhibitors, have enhanced treatment efficacy and patient outcomes. Furthermore, increased investment in research and development, along with supporting regulatory frameworks, is accelerating the introduction of innovative therapies, thereby propelling market expansion.

Regional Insights

How is North America Powering the Protein Therapeutic Market?

North America dominated the protein therapeutics market in 2024, through its advanced healthcare infrastructure, robust biotechnological sector, and substantial investment in research and development. The high prevalence of chronic diseases, such as cancer and diabetes, drives demand for protein-based therapies. Additionally, supportive regulatory frameworks and the presence of major pharmaceutical companies facilitate the rapid development and commercialization of innovative treatments. These factors collectively position North America as a leading force in the global market.

- For Instance, In April 2025, Chris Bahl, the Founder, CEO, and President of Boston-based biotech firm AI Proteins, is set to speak at the renowned TED conference in Vancouver, Canada. He will spotlight the company’s groundbreaking efforts in creating next-generation miniprotein therapeutics aimed at treating a wide range of diseases.

How is Asia-Pacific approaching the Protein Therapeutic market in 2024?

Asia-Pacific is anticipated to grow at the fastest rate in the protein therapeutics market during the forecast period. Countries like China and India are investing heavily in biotechnology, enhancing their capabilities in research, development, and manufacturing. The region's large patient population, coupled with a rising prevalence of chronic diseases, is increasing demand for advanced protein-based therapies. Additionally, supportive government policies and growing healthcare infrastructure are facilitating market growth, positioning Asia-Pacific as a significant contributor to the global protein therapies landscape.

Top Companies in the Protein Therapeutic Market

- Amgen Inc.

- Abbott Laboratories

- Abbvie Inc.

- Baxter International Inc.

- Biogen Inc.

- Csl Behring L.L.C. (CSL Limited)

- Eli Lilly and Company

- F. Hoffmann-La Roche AG (Roche Holding AG)

- Johnson & Johnson

- Merck & Co. Inc.

- Novo Nordisk A/S (Novo Holdings A/S)

- Pfizer Inc.

Recent Developments in the Protein Therapeutic Market

- In January 2024, Ractigen Therapeutics, a key player in small activating RNA (saRNA) therapeutics, formed a strategic alliance with the University Medical Center linked to Utrecht University. This collaboration aims to advance saRNA-based therapies targeting complex neurodevelopmental disorders, enhancing research and clinical development in this area.

- In April 2025, Rani Therapeutics reported promising preclinical results for RT-114, a dual GLP-1/GLP-2 agonist (PG-102), administered through its innovative RaniPill® capsule. The study demonstrated successful oral delivery and bioequivalence, marking a key advancement in the development of needle-free peptide therapies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Monoclonal Antibodies

- Insulin

- Fusion Protein

- Erythropoietin

- Interferon

- Human Growth Hormone

- Follicle Stimulating Hormone

By Application

- Metabolic Disorders

- Immunologic Disorders

- Hematological Disorders

- Cancer

- Hormonal Disorders

- Genetic Disorders

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)