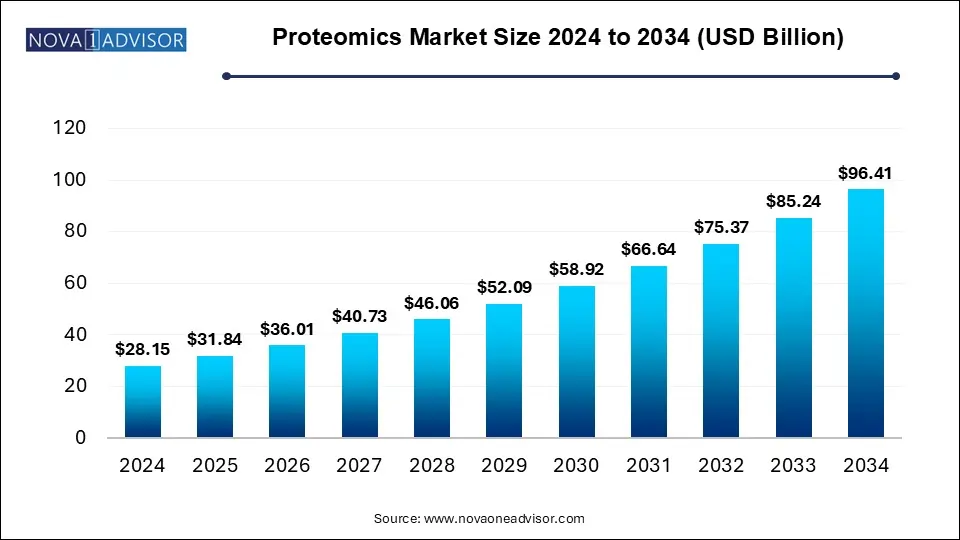

Proteomics Market Size and Growth

The proteomics market accounted for USD 28.15 billion in 2024 and is expected to hit around USD 96.41 billion by 2034, growing with a CAGR of 13.1% from 2025 to 2034. This market is growing due to advancements in technology, increasing demand for personalized medicine, rising R7D investments, and expanding applications in drug discovery and diagnostics.

Proteomics Market Key Takeaways

- North America dominated the proteomics market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product & service, the reagents & consumables segment held the largest market share in 2024.

- By product & service, the services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By technology, the spectrometry segment dominated the market with a major revenue share in 2024.

- By technology, the next-generation sequencing (NGS) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug discovery segment led the market in 2024.

- By application, the clinical diagnostics segment is expected to grow at the fastest CAGR in the market during the forecast period.

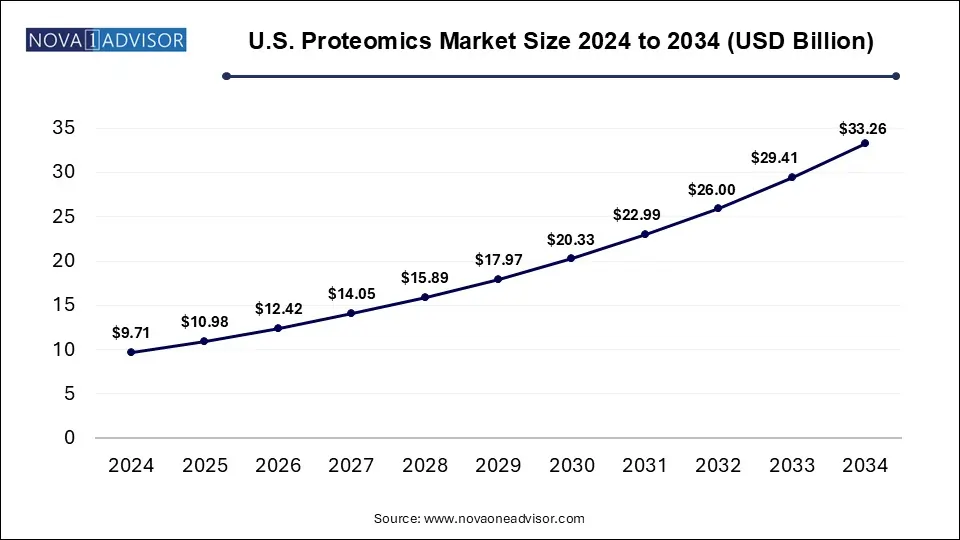

U.S. Proteomics Market Size and Growth 2025 to 2034

The U.S. Proteomics Market size was valued at USD 9.71 billion in 2024 and is expected to hit around USD 33.26 billion by 2034, growing at a CAGR of 11.84% from 2025 to 2034.

How is North America Contributing to the Expansion of the Proteomics Market?

North America led the market in 2024 largely because of the rapid uptake of precision medicine initiatives and high demand for advanced diagnostic solutions. The region has witnessed a surge in clinical applications of proteomics, particularly in oncology and rare diseases, driving revenue growth. Furthermore, strong venture capital investments into proteomics start-ups and the expansion of contract research services have accelerated the commercialization of new technologies, reinforcing North America’s dominant position in the global market.

- For Instance, In January 2024, Biognosys broadened its U.S. footprint by establishing a new contract research facility dedicated to proteomics services, highlighting the rising need for specialized solutions to advance drug development.

How is Asia-Pacific Accelerating the Market?

Asia Pacific is expected to witness the fastest CAGR in the proteomics market as the region is experiencing rapid growth in academic research output and start-up ecosystems focused on omics sciences. The availability of a large and genetically diverse patient population provides unique opportunities for biomarker discovery and clinical validation. Moreover, increasing cross-border collaborations with Western research institutions and pharmaceutical firms are driving knowledge transfer and accelerating the adoption of cutting-edge proteomics technologies across the region.

How is Innovation Impacting the Proteomics Market?

Proteomics is the large-scale study of the entire set of proteins (the proteome) produced or modified by an organism, tissue, or cell at a specific time. It involves analyzing protein structures, functions, interactions, and dynamics to understand biological processes, disease mechanisms, and potential therapeutic targets. Innovation is significantly driving the growth of the proteomics market by introducing advanced technologies like high-resolution mass spectrometry, next-generation sequencing-based proteomics, and AI-powered data analysis. These innovations enhance the accuracy, speed, and depth of protein identification and quantification. They are also enabling breakthroughs in biomarker discovery, precision medicine, and drug development. As a result, research and healthcare providers can better understand complex diseases, develop targeted therapies, and improve diagnostic tools, boosting the market expansion globally.

- For Instance, In July 2024, a study published in Nature Communications reported that researchers applied a proteomics-based method to identify effectors released by Rickettsia species, providing valuable insights into the host-pathogen interaction.

What are the Key trends in the Proteomics Market in 2024?

- In January 2025, Quantum-Si introduced Platinum® Pro, an upgraded benchtop protein sequencer designed to simplify and advance proteomics studies. Building on the earlier Platinum system, it features improved usability, customizable data analysis, and a Pro Mode for tailored applications. The platform is intended to make high-resolution protein sequencing more accessible, supporting diverse uses such as proteoform profiling, drug discovery, and diagnostic research.

- In January 2025, Sapient partnered with Alamar Biosciences to strengthen its targeted proteomics services through the use of Alamar’s ultra-sensitive NULISA™ assays. This collaboration improves the detection of low-level cytokines, chemokines, and neuroinflammatory markers, aiding drug discovery and development. As a certified NULISAseq™ provider, Sapient combines this platform with its mass spectrometry expertise to offer comprehensive, compliant multi-omics solutions across all stages of clinical research.

How Can AI Affect the Proteomics Market?

AI is transforming the market by enabling faster, more accurate analysis of large and complex protein datasets. Machine learning algorithms help identify protein structures, functions, and interactions with greater precision, accelerating biomarker discovery and drug target validation. AI-driven tools also streamline data interpretation, reduce errors, and improve predictive modeling in disease research. By integrating AI with proteomics technologies, researchers can advance personalized medicine, enhance diagnostics, and optimize therapeutic development, significantly driving market growth and innovation

Report Scope of Proteomics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 31.84 Billion |

| Market Size by 2034 |

USD 96.41 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product & service, Application, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Illumina, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Bruker Corporation; F. Hoffmann-La Roche Ltd.; Waters Corporation; Merck KGaA; Danaher; Standard BioTools Inc. |

Market Opportunity

Expansion into Multi Omics Research and Systems Biology

A more thorough knowledge of biological systems is being made possible by the combination of proteomics transcriptomics metabolomics and genomics. Research on multi omics is propelling advancements in immune system disorders, regenerative medicine and cancer biology. Businesses creating integrated multi omics platforms and software solutions will have enormous growth potential as researchers tackle disease from a holistic perspective.

Market Challenge

High Cost of Proteomics Technologies

Advanced equipment like mass spectrometers chromatography systems and bioinformatics tools are necessary for proteomics research but they are costly to buy and maintain. Many small research labs and biotech startups cannot afford proteomics due to the high costs of reagents sample preparation and data analysis software. Adoption is hampered by this financial barrier especially in developing nations with little funding for scientific research.

Limited Clinical Translation of Proteomics Discoveries

The discovery of biomarkers has benefited greatly from proteomics but relatively few proteomics-based biomarkers have made a leap from research to clinical use. Their use in diagnostic and personalized medicine is slowed by issues with inter individual variability biomarkers validation and regulatory barriers. Due to problems with sensitivity specificity and practicality many promising biomarkers never reach clinical relevance.

Segmental Insights

Proteomics Market By Product & Services

What made the Reagents & Consumables Segment Dominant in the Proteomics Market in 2024?

The dominance of the reagents and consumables segment in 2024 was driven by the expansion of large-scale proteomics projects and clinical applications, which require a consistent supply of standardized materials. Increasing collaborations between academic institutions and pharmaceutical companies boosted demand for readu to use consumables to ensure reproducibility and efficiency. Moreover, the rise of high-throughput technologies created a need for specialized kits and reagents tailored for automation, making this segment essential for accelerating research outcomes and maintaining workflow reliability.

The services segment is expected to expand rapidly as proteomics research increasingly requires end-to-end solutions, from sample preparation to advanced bioinformatics interpretations. Many organizations turn to service providers not only for technical support but also for regulatory compliance, validation, and large-scale project management. Additionally, the rising complexity of proteomics applications in drug discovery and diagnostics has created demand for specialized contract research services, driving faster adoption and positioning the market as a critical growth area during the forecast period.

Proteomics Market By Application

How did the Drug Discovery Segment Dominate the Proteomics Market?

The drug discovery segment dominated the proteomics market because of the rising use of proteomics in predicting drug efficacy and adverse effects before clinical trials, which reduces costly failure in later stages. Proteomics also supports the repurposing of existing drugs by uncovering new protein targets linked to diseases. With growing investment from pharmaceutical companies to shortened development timelines, and improved success rates, the application of proteomics in optimizing pipelines has become a major factor driving the market leadership.

The clinical diagnostics segment is set to expand at the fastest CAGR because of the growing focus on monitoring treatment responses and disease progression through proteomic markers. Unlike static genetic data, protein profiles change dynamically, allowing real-time tracking of patient health. This capability is attracting strong interest in chronic disease management and post-therapy evaluation. In addition, collaboration between diagnostic companies and healthcare providers between diagnostic companies and healthcare providers to develop clinically validated proteomic assays is further accelerating adoption, fueling rapid growth in the market.

Proteomics Market By Technology

How did the Spectrometry Segment Dominate the Proteomics Market in 2024?

The spectrometry segment led the proteomics market in 2024 largely, due to its broad application versatility across areas like food safety testing, forensic analysis, and environmental monitoring, in addition to healthcare research. Continuous innovation in portable and automated spectrometry systems has made the technology more accessible for diverse end-users. Moreover, integration with advanced software for faster data interpretation enhanced usability, driving widespread adoption beyond traditional labs and positioning spectrometry as the top revenue-generating technology in proteomics.

The next-generation sequencing (NGS) segment is projected to grow at the fastest CAGR as it supports the discovery of novel protein isoforms and alternative splicing events, which are often missed by traditional methods. Its ability to generate comprehensive datasets helps uncover hidden regulatory mechanisms that directly influence protein expression. Furthermore, the integration of NGS with cloud-based analytics and real-time data sharing enhances collaboration in large research networks, making it a preferred tool for advancing translation research and fueling rapid market expansion.

- For Instance, In February 2024, Pixelgen Technologies entered a non-exclusive partnership with Japan’s BioStream Co., Ltd. to distribute its advanced NGS-based spatial proteomics tools for single-cell analysis. This collaboration is expected to strengthen the availability of cutting-edge solutions and contribute to the growth of the proteomics market.

Some of The Prominent Players in The Proteomics Market Include:

Recent Developments in the Proteomics Market

- In July 2024, Thermo Fisher Scientific Inc. completed the acquisition of Olink Holding AB for USD 3.1 billion, strengthening its portfolio in next-generation proteomics and enhancing its capabilities in advanced protein analysis solutions.

- In May 2024, Bruker Corporation opened a new manufacturing facility in Bremen, Germany, aimed at boosting innovation, promoting sustainability, and fostering collaboration in the field of mass spectrometry.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Proteomics Market

By Product & Services

- Instruments

- Reagents & Consumables

- Services

By Application

- Drug Discovery

- Clinical Diagnostics

- Others

By Technology

- Next-generation Sequencing

- Microarray Instruments

- X-Ray Crystallography

- Spectrometry

- Chromatography

- Protein Fractionation Systems

- Electrophoresis

- Surface Plasma Resonance (SPR) Systems

- Other Technologies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)