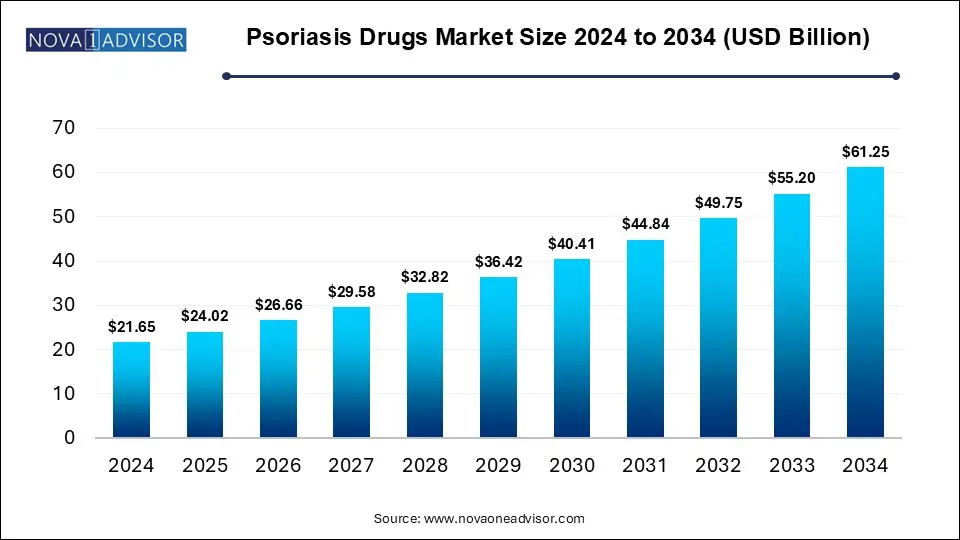

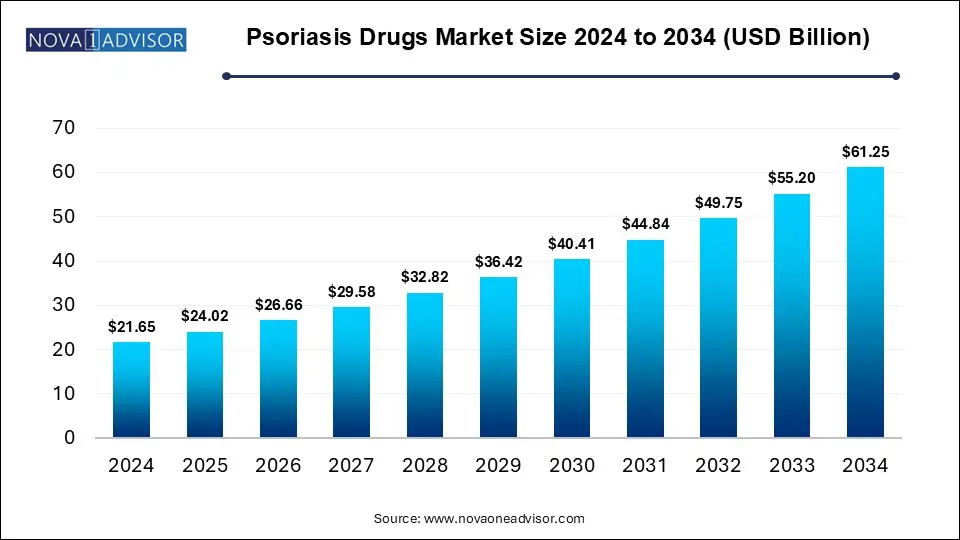

Psoriasis Drugs Market Size and Growth

The psoriasis drugs market size was exhibited at USD 21.65 billion in 2024 and is projected to hit around USD 61.25 billion by 2034, growing at a CAGR of 10.96% during the forecast period 2025 to 2034.

Psoriasis Drugs Market Key Takeaways:

-

Tumor necrosis factor (TNF) inhibitors led the market in 2024, representing 42.0% of the total share.

-

In 2024, the biologics category held the largest portion of the market, accounting for 49.0%.

-

The topicals category is anticipated to grow at a compound annual growth rate (CAGR) of 11.4% during the forecast timeframe.

-

Growth in the topical segment is expected to proceed at a CAGR of 10.4% throughout the forecast period.

-

Hospital pharmacies represented the largest distribution channel in 2024, holding a 45% market share.

-

Retail pharmacies are forecasted to expand at the fastest pace, with a projected CAGR of 11.3% over the analysis period.

-

In 2024, North America emerged as the dominant region in the global psoriasis drugs market, securing a 39% revenue share.

Market Overview

Psoriasis is a chronic, immune-mediated skin condition characterized by the rapid buildup of skin cells, leading to scaling, inflammation, and redness. Affecting approximately 2–3% of the global population, psoriasis is a significant dermatological concern, often associated with comorbidities such as psoriatic arthritis, cardiovascular disease, and depression. The burden of this condition has driven the consistent evolution of treatment options, ranging from traditional topicals to advanced biologics.

The global psoriasis drugs market is poised for robust growth, driven by technological advancements, increased disease awareness, and rising demand for personalized medicine. In 2024, the market saw considerable domination by biologics and tumor necrosis factor (TNF) inhibitors, reflecting the growing preference for targeted therapies over conventional treatments. With innovation at the forefront, pharmaceutical giants and biotech firms are investing heavily in the development of next-generation therapies, including interleukin inhibitors and biosimilars.

The global market is also benefiting from supportive regulatory pathways, improving reimbursement frameworks, and increasing collaborations between healthcare providers and drug developers. Furthermore, the COVID-19 pandemic underscored the importance of self-administered treatments, propelling the market for topical agents and home-based care options.

Major Trends in the Market

-

Increasing adoption of biologics and biosimilars for moderate to severe psoriasis.

-

Rising prevalence of psoriatic comorbidities, prompting early and aggressive intervention.

-

Growth of teledermatology and virtual care, enabling remote consultations and prescriptions.

-

Development of IL-17 and IL-23 inhibitors, offering superior efficacy and safety profiles.

-

Patient-centric innovations, such as auto-injectors and subcutaneous delivery systems.

-

Expansion of over-the-counter (OTC) and cosmetic-grade topical solutions for mild cases.

-

Emergence of personalized and precision medicine based on genetic profiling.

-

Collaborations between academic institutes and pharma companies to boost R&D.

-

Shift towards sustainable packaging and eco-friendly formulations in dermatological care.

Report Scope of Psoriasis Drugs Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 24.02 Billion |

| Market Size by 2034 |

USD 61.25 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.96% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Class, Treatment, Route, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AbbVie Inc.; Amgen Inc.; Johnson & Johnson Services Inc.; Novartis AG; Eli Lilly and Company; AstraZeneca; Celgene Corporation; UCB S.A.; Merck; Boehringer Ingelheim International GmbH |

Market Driver: Advancements in Biologic Therapies

One of the primary drivers fueling the growth of the psoriasis drugs market is the continuous advancement in biologic therapies. Unlike traditional treatments, biologics are engineered to target specific components of the immune system, such as cytokines, that play a central role in the pathogenesis of psoriasis. The success of TNF inhibitors like adalimumab (Humira) and etanercept (Enbrel) paved the way for newer biologics, including IL-17 and IL-23 inhibitors.

These drugs offer improved efficacy, reduced flare-ups, and better long-term skin clearance compared to earlier treatments. For example, secukinumab (Cosentyx) and guselkumab (Tremfya) have demonstrated remarkable results in clinical trials. This has not only enhanced the treatment landscape but also improved patient quality of life. The expanding indications of biologics beyond skin symptoms to include psoriatic arthritis further contribute to their demand.

Market Restraint: High Cost of Biologic Drugs

Despite their benefits, biologics remain prohibitively expensive, posing a significant barrier to market penetration, especially in low- and middle-income countries. High production costs, complex storage requirements, and limited access to insurance coverage restrict the widespread adoption of these therapies. Even in developed nations, high out-of-pocket costs deter patients from continuing long-term biologic treatment.

For instance, a single dose of a biologic like ustekinumab (Stelara) can cost several thousand dollars, making affordability a critical concern. Additionally, the limited availability of biosimilars—generic versions of biologics—continues to impact price competitiveness. The economic burden on healthcare systems and patients remains a challenge that needs strategic policy intervention.

Market Opportunity: Expanding Access in Emerging Markets

An exciting opportunity lies in the untapped potential of emerging economies in Asia Pacific, Latin America, and parts of the Middle East and Africa. As healthcare infrastructure improves and government initiatives increase healthcare spending, these regions are becoming attractive markets for pharmaceutical companies. Increasing awareness about dermatological health and expanding dermatology clinics in urban and semi-urban areas are further facilitating early diagnosis and treatment of psoriasis.

Moreover, the rise in generic drug manufacturing and the entry of biosimilars are helping reduce costs, improving affordability for a broader patient base. Companies that prioritize regional partnerships, local manufacturing, and awareness campaigns are well-positioned to capture significant market share in these fast-growing regions.

Psoriasis Drugs Market By Class Insights

Tumor necrosis factor (TNF) inhibitors dominated the psoriasis drug class segment in 2024, accounting for 41.0% of the total market share. Drugs like adalimumab, infliximab, and etanercept have long been the cornerstone of moderate to severe psoriasis treatment. Their well-established safety profiles, widespread physician acceptance, and strong clinical evidence make them the preferred choice for patients unresponsive to topical or systemic treatments. Furthermore, their efficacy in treating psoriatic arthritis makes them a dual-benefit therapy, solidifying their dominant position.

Conversely, interleukin inhibitors are projected to be the fastest-growing drug class. These include IL-17 inhibitors (like secukinumab) and IL-23 inhibitors (like guselkumab). Their higher selectivity and reduced side effects offer significant improvements over TNF inhibitors. Clinical trials have shown superior PASI (Psoriasis Area and Severity Index) scores and long-term remission with IL inhibitors. As newer molecules receive regulatory approvals and post-marketing data supports their benefits, the uptake of these drugs is expected to rise sharply.

Psoriasis Drugs Market By Treatment Insights

The biologics segment captured the largest share of 47.0% in 2024, driven by their growing acceptance as the standard of care for chronic and severe cases. Biologics not only offer improved efficacy but also reduce the frequency of dosing, enhancing patient adherence. Pharmaceutical giants continue to expand their biologic portfolios with novel agents targeting specific interleukins and cytokines, setting a benchmark for therapeutic innovation.

Topical treatments are forecasted to grow at the fastest CAGR of 11.4% during the forecast period. These therapies, including corticosteroids and vitamin D analogues, are the first line of defense for mild to moderate psoriasis. Their convenience, affordability, and availability as OTC medications make them highly accessible. Innovations in drug formulation, such as foams, sprays, and non-greasy gels, are further enhancing patient preference, especially for pediatric and geriatric populations.

Psoriasis Drugs Market By Route Of Administration Insights

Parenteral administration dominated the market in 2024, owing to the injectable nature of most biologics and TNF inhibitors. This route ensures faster systemic absorption and is essential for patients with moderate to severe symptoms. The use of subcutaneous self-injectors, such as auto-injector pens, has also contributed to patient compliance and adoption.

Topical administration is expected to exhibit rapid growth, supported by advancements in dermal drug delivery technologies. With the increasing availability of novel drug formulations that enhance skin penetration and minimize irritation, topical therapies are gaining ground. Additionally, rising demand for non-invasive options, especially among patients with mild symptoms, is driving the segment’s expansion.

Psoriasis Drugs Market By Distribution Channel Insights

Hospital pharmacies accounted for a leading share of 45% in 2024, mainly due to the administration of high-cost biologics and complex treatments requiring professional supervision. Inpatient and outpatient dermatology departments within hospitals are major centers for psoriasis management, further reinforcing this segment’s dominance.

Retail pharmacies are poised to witness the fastest growth at a CAGR of 11.3%, supported by the increasing availability of topical agents and self-injectable biologics for home use. The growing trend of self-medication and telehealth prescriptions is also propelling sales through retail chains and online pharmacies.

Psoriasis Drugs Market By Regional Insights

North America led the global psoriasis drugs market in 2024, with a market share of 39%. The region’s dominance can be attributed to high disease prevalence, advanced healthcare infrastructure, and the widespread adoption of biologic therapies. The U.S. remains a pharmaceutical hub with robust R&D investments and an extensive pipeline of psoriasis therapies. The presence of leading market players, favorable reimbursement policies, and patient advocacy groups further bolster market growth.

The growing focus on personalized healthcare and increasing approvals for innovative biologics and biosimilars contribute to the region’s leadership. Additionally, government support for chronic disease management and digital health integration facilitates early diagnosis and effective treatment.

Asia Pacific: The Fastest Growing Market

Asia Pacific is projected to grow at the fastest rate over the forecast period, driven by a large patient pool, rising awareness, and improving access to healthcare services. Countries like India, China, and South Korea are witnessing a surge in dermatological consultations and psoriasis diagnoses due to better healthcare access and digital health platforms.

Furthermore, the region’s pharmaceutical manufacturing capabilities are improving, making treatments more affordable. Government initiatives to support dermatological health and increasing partnerships between local and global pharma players are likely to fuel sustained market expansion.

Some of the prominent players in the psoriasis drugs market include:

- AbbVie Inc.

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Eli Lilly and Company

- AstraZeneca

- Celgene Corporation

- UCB S.A.

- Merck

- Boehringer Ingelheim International GmbH

Psoriasis Drugs Market Recent Developments

-

May 2024 – Novartis announced a positive update for Cosentyx (secukinumab), demonstrating long-term efficacy in both psoriasis and psoriatic arthritis across multiple global studies.

-

March 2024 – Amgen launched its biosimilar of adalimumab (Amjevita) in Europe, expanding access to TNF inhibitor therapies at a lower cost.

-

January 2024 – AbbVie’s Skyrizi (risankizumab) received FDA approval for expanded use in patients with moderate to severe plaque psoriasis.

-

December 2023 – UCB’s bimekizumab, an IL-17A and IL-17F inhibitor, received EMA approval and is anticipated to enter multiple global markets through 2025.

-

November 2023 – Lilly’s mirikizumab (Omvoh), targeting IL-23, achieved successful Phase III results, making it a strong pipeline candidate.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the psoriasis drugs market

By Class

- Tumor Necrosis Factor Inhibitors

- Interleukin Inhibitors

- Vitamin D Analogues

- Corticosteriods

- Others

By Treatment

- Topicals

- Systemic

- Biologics

By Route of Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)