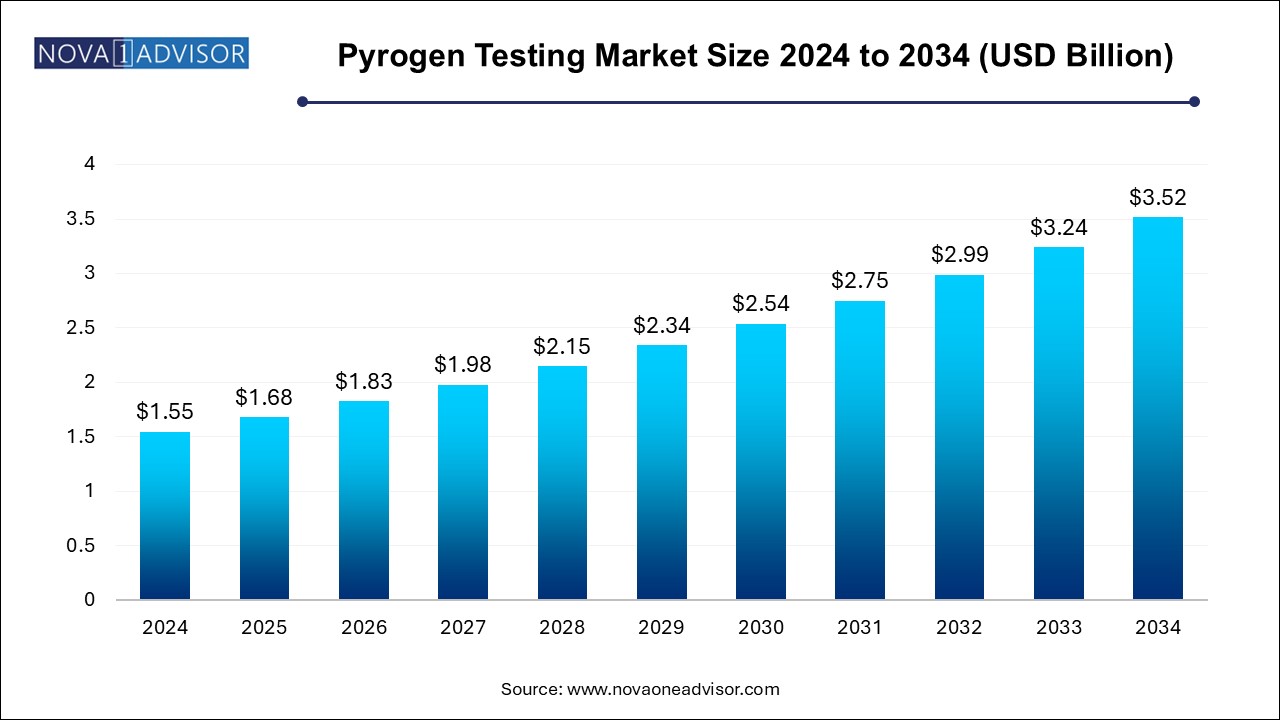

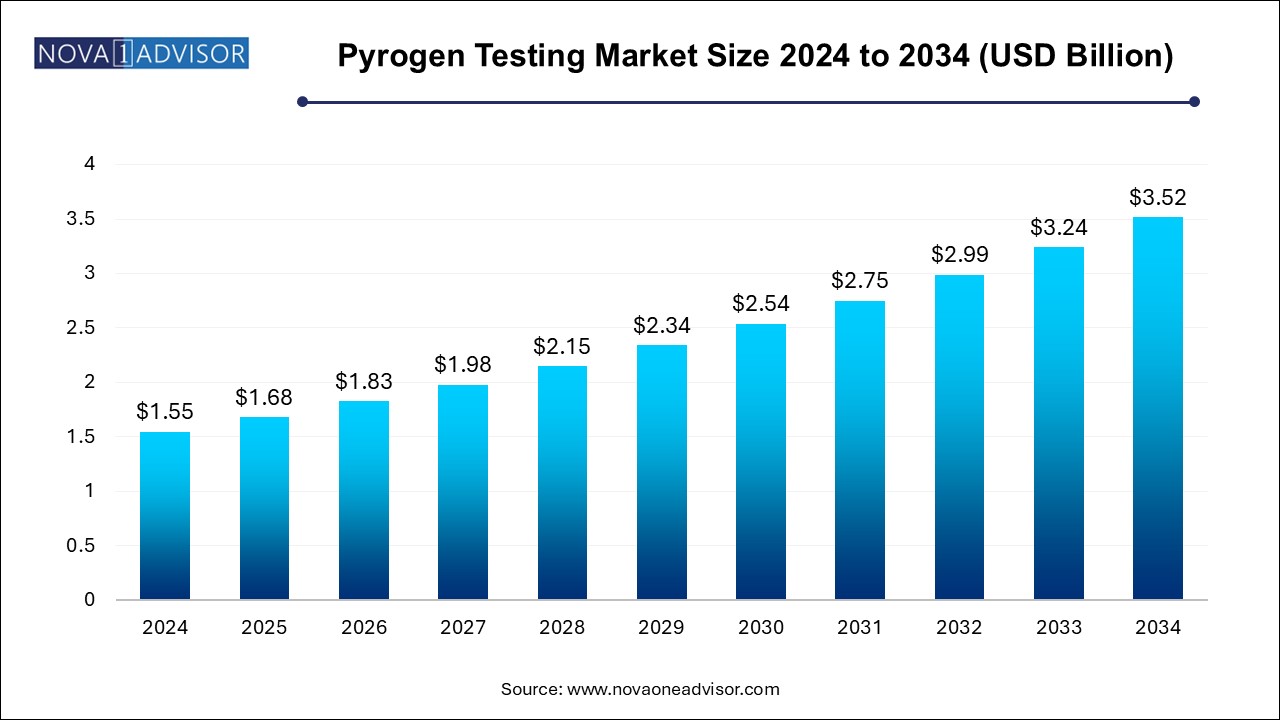

Pyrogen Testing Market Size and Growth

The pyrogen testing market size was exhibited at USD 1.55 billion in 2024 and is projected to hit around USD 3.52 billion by 2034, growing at a CAGR of 8.55% during the forecast period 2024 to 2034.

Pyrogen Testing Market Key Takeaways:

- In 2024, the consumables segment was the largest segment with a share of 55.1%, and is estimated to maintain its dominance during the forecast period.

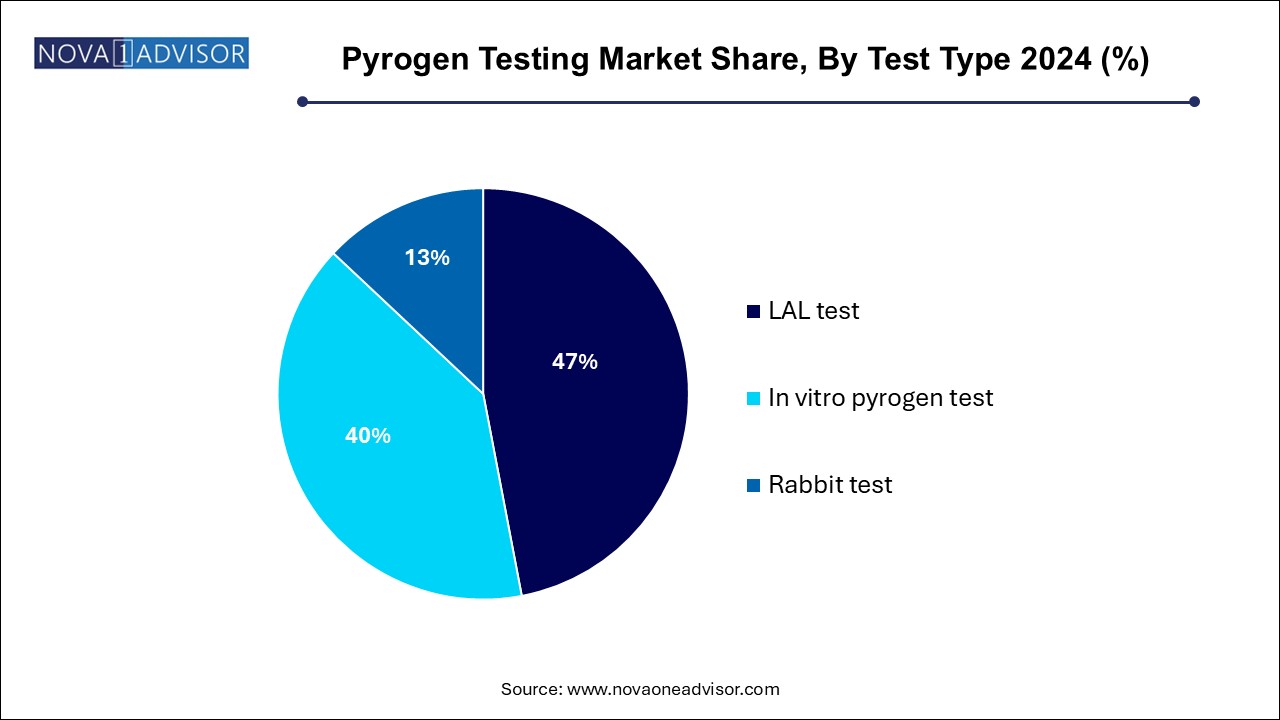

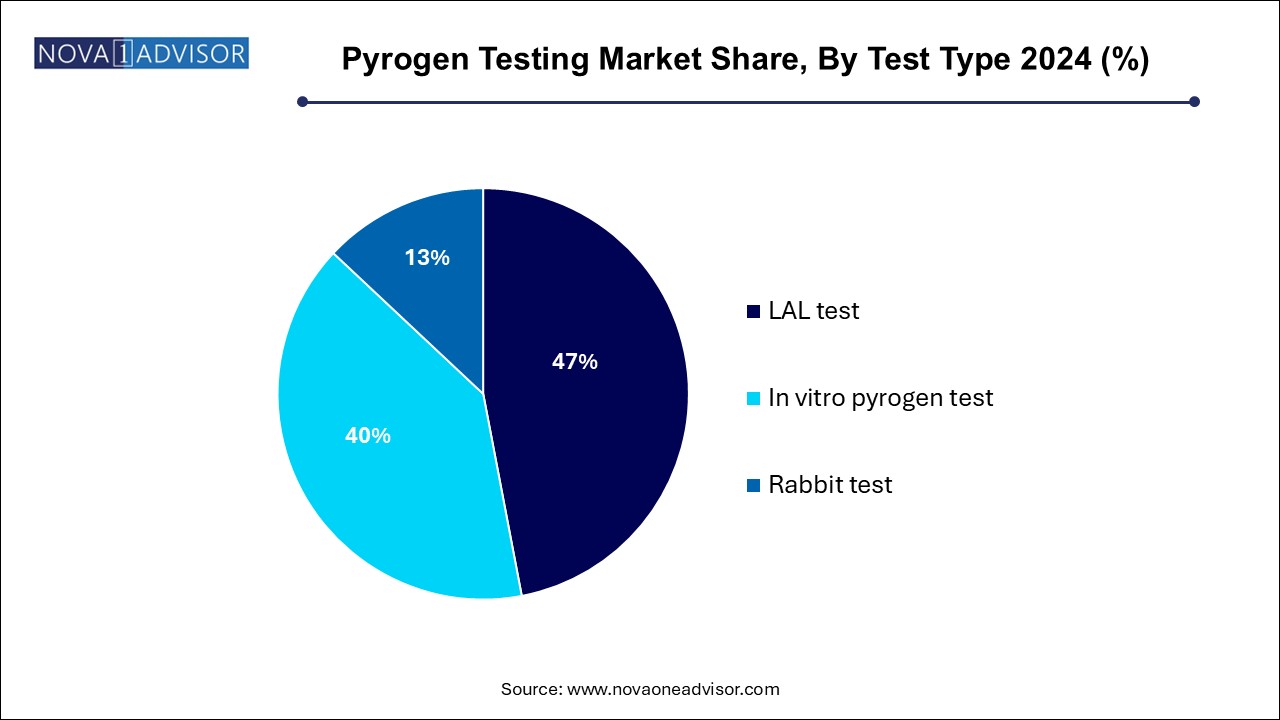

- The LAL test segment dominated the market with a share of 47% in 2024.

- The pharmaceutical and biotechnology companies dominated the overall market with a share of 59.96% in 2024.

- The medical devices companies' segment is expected to grow significantly over the forecast period.

- North America dominated the pyrogen testing market with the largest revenue share of 40.9% in 2024.

Market Overview

The pyrogen testing market is an essential component of the pharmaceutical, biotechnology, and medical devices industries, ensuring the safety of products that come into direct contact with human blood or tissues. Pyrogens, primarily endotoxins released from bacterial cell walls, can cause severe febrile reactions and even fatal shock if introduced into the human body. Therefore, rigorous testing to detect these contaminants is a mandatory regulatory requirement for injectable drugs, implantable devices, and biologics.

The global push toward better regulatory compliance, increased demand for parenteral therapeutics, and rising R&D activities have created a robust foundation for pyrogen testing technologies. Traditional methods such as the Rabbit Pyrogen Test (RPT) are being complemented, and in some cases replaced, by newer, more sensitive in vitro assays and Limulus Amebocyte Lysate (LAL) based tests.

Driven by advances in biotechnology, the market is also seeing a growing interest in recombinant factor C (rFC) assays as ethical alternatives to horseshoe crab-derived LAL tests. Additionally, the increasing complexity of biologic drugs, including monoclonal antibodies, cell and gene therapies, and vaccines, is expanding the need for highly reliable pyrogen detection methods. Emerging markets are also catching up quickly due to strengthening regulatory frameworks, contributing to a dynamic global growth scenario.

Major Trends in the Market

-

Shift Toward In Vitro Pyrogen Testing: Animal-free alternatives gaining favor due to ethical concerns and regulatory encouragement.

-

Growing Popularity of Recombinant Factor C Assays: rFC-based tests are emerging as sustainable and ethical alternatives to traditional LAL testing.

-

Automation and High-throughput Testing: Automated endotoxin detection systems increasing efficiency and reducing human error.

-

Increasing Pharmaceutical Outsourcing: Rise in contract research and manufacturing services fueling demand for outsourced pyrogen testing.

-

Expanded Focus on Medical Device Testing: Implantable and invasive device manufacturers increasing their testing budgets.

-

Regulatory Push for Standardization: Global agencies such as the FDA, EMA, and USP emphasizing consistent endotoxin testing protocols.

-

Sustainability Concerns Influencing LAL Test Adoption: Environmental protection movements encouraging reduced use of horseshoe crabs.

-

Emergence of Portable Testing Devices: Development of compact, field-deployable endotoxin testing systems.

Report Scope of Pyrogen Testing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.68 Billion |

| Market Size by 2034 |

USD 3.52 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 8.55% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Test Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Charles River Laboratories; Ellab A/S; Merck KGaA; GenScript; bioMérieux SA; Lonza; Thermo Fisher Scientific, Inc.; Associates of Cape Cod, Inc.; FUJIFILM Wako Chemicals U.S.A. Corporation (Pyrostar) |

Key Market Driver: Rising Demand for Biologics and Injectable Pharmaceuticals

One of the major drivers of the pyrogen testing market is the exponential growth in biologic drugs and injectable pharmaceutical products. Biologics, including monoclonal antibodies, vaccines, gene therapies, and recombinant proteins, require rigorous endotoxin control due to their complex molecular structures and the nature of their administration routes (typically intravenous).

Given that any trace of pyrogen contamination can have devastating clinical consequences, regulatory bodies worldwide impose strict testing requirements on these products. Consequently, companies are investing heavily in sensitive and reliable pyrogen detection technologies to ensure compliance, improve safety profiles, and maintain market credibility, thereby boosting demand across consumables, instruments, and testing services.

Key Market Restraint: High Costs and Technical Challenges of Advanced Testing Methods

Despite market growth, the high costs and technical complexities associated with advanced pyrogen testing methods pose a considerable restraint. Cutting-edge techniques such as in vitro monocyte activation tests (MAT) and recombinant factor C-based assays require expensive instruments, consumables, skilled technicians, and stringent laboratory conditions.

Additionally, some in vitro alternatives have limitations when it comes to detecting non-endotoxin pyrogens, potentially requiring complementary testing, which adds to operational expenses. For small and mid-sized pharmaceutical or biotech firms, these costs can be prohibitive, leading to reliance on older, animal-based methods or outsourced testing, limiting direct adoption of newer technologies.

Key Market Opportunity: Expansion into Emerging Economies

A significant opportunity for the pyrogen testing market lies in the expansion into emerging economies such as China, India, Brazil, and Southeast Asian countries. These regions are witnessing a surge in pharmaceutical manufacturing, driven by growing domestic healthcare demand, favorable government policies, and increased global outsourcing.

As regulatory authorities in these countries harmonize their standards with global agencies like the U.S. FDA and EMA, manufacturers are compelled to adopt internationally accepted pyrogen testing protocols. Companies that offer affordable, high-throughput, and flexible testing solutions will be well-positioned to capitalize on these rapidly growing markets.

Pyrogen Testing Market By Product Insights

Consumables dominate the product segment, owing to their recurrent use across a variety of pyrogen testing workflows. Reagents, LAL cartridges, media, and assay kits are indispensable for routine testing in quality assurance and R&D laboratories. Given the need for repeated testing at various manufacturing stages, consumables ensure a continuous revenue stream for suppliers. Particularly, chromogenic LAL reagents and endotoxin-specific kits have become staples in pharmaceutical and biotech manufacturing facilities.

Services are growing at the fastest rate, driven by the trend toward outsourcing non-core activities. Pharmaceutical and biotechnology companies increasingly partner with contract research organizations (CROs) and specialized endotoxin testing service providers to reduce operational costs, access expertise, and expedite regulatory submissions. These service providers offer turnkey solutions, including method development, validation, and routine batch release testing, fueling their rapid growth.

Pyrogen Testing Market By Test Type Insights

LAL tests dominate the pyrogen testing market, remaining the gold standard for endotoxin detection for over four decades. Comprising chromogenic, turbidimetric, and gel-clot assays, LAL testing is renowned for its sensitivity, reliability, and regulatory acceptance. Among these, chromogenic LAL assays are especially popular due to their quantitative output and compatibility with high-throughput workflows.

In vitro pyrogen testing is the fastest-growing segment, particularly the monocyte activation test (MAT). In vitro methods eliminate the need for animal testing, align with the global shift toward ethical laboratory practices, and offer broader pyrogen detection beyond endotoxins. As regulatory bodies encourage animal-free alternatives, the adoption of MAT and recombinant factor C-based assays is surging, particularly among large pharmaceutical manufacturers.

Pyrogen Testing Market By End-use Insights

Pharmaceutical and biotechnology companies dominate the end-use segment, being the primary drivers of demand for pyrogen testing. Stringent regulations require drug manufacturers to ensure the absence of pyrogens in parenteral and biologic products at multiple points along the production chain. Consequently, in-house testing labs, as well as outsourced service providers, are heavily engaged in supporting pharma QA/QC needs.

Medical device companies are expanding rapidly, reflecting the growing complexity and usage of implantable and invasive medical devices. Devices such as catheters, orthopedic implants, and heart valves must be stringently tested for endotoxins to prevent post-surgical infections. With regulatory emphasis on sterility and safety, this segment is witnessing robust growth in pyrogen testing adoption.

Pyrogen Testing Market By Regional Insights

North America leads the global pyrogen testing market, primarily due to a strong pharmaceutical and biotech industry presence, supportive regulatory frameworks, and high healthcare standards. The U.S., in particular, accounts for a substantial market share, driven by the FDA’s rigorous sterility testing requirements and the presence of global drug manufacturing giants.

Moreover, major technology providers like Lonza, Charles River Laboratories, and Thermo Fisher Scientific have headquarters or significant operations in North America, ensuring ready access to advanced pyrogen detection technologies and services. Investments in drug discovery, biosimilars, and personalized medicine further cement North America’s dominance.

Asia-Pacific is the fastest-growing region, fueled by rapid pharmaceutical industrialization, favorable government initiatives, and expanding healthcare infrastructure. China and India, as major hubs for generic drug production and clinical trials, are significant contributors to regional growth.

Additionally, increasing foreign investments, local innovation, and the harmonization of regulatory standards with international norms are compelling manufacturers to adopt robust pyrogen testing practices. As regional economies modernize, demand for high-quality, efficient, and regulatory-compliant testing solutions is escalating at an unprecedented pace.

Some of the prominent players in the pyrogen testing market include:

- Charles River Laboratories

- Ellab A/S

- Merck KGaA

- GenScript Biotech

- bioMérieux SA

- Lonza Group

- Thermo Fisher Scientific, Inc.

- Associates of Cape Cod, Inc.

- FUJIFILM Wako Chemicals U.S.A. Corporation (Pyrostar )

Pyrogen Testing Market Recent Developments

-

March 2025: Lonza Group announced the expansion of its recombinant Factor C (rFC)-based pyrogen testing portfolio, offering an animal-free, sustainable alternative to traditional LAL tests.

-

February 2025: Charles River Laboratories launched an upgraded in vitro pyrogen test kit with improved detection of non-endotoxin pyrogens to support regulatory-compliant batch release testing.

-

January 2025: Thermo Fisher Scientific introduced a fully automated, high-throughput endotoxin detection system integrated with AI-based anomaly detection.

-

December 2024: Merck KGaA announced the launch of new chromogenic LAL assay kits designed for greater sensitivity and faster processing times.

-

November 2024: Wako Chemicals expanded its Endosafe endotoxin testing platform by launching a compact, portable reader for field-based applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the pyrogen testing market

By Product

- Consumables

- Instruments

- Services

By Test Type

-

- Chromogenic test

- Turbidimetric test

- Gel clot test

- In vitro pyrogen test

- Rabbit test

By End-use

- Pharmaceutical and biotechnology companies

- Medical devices companies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)