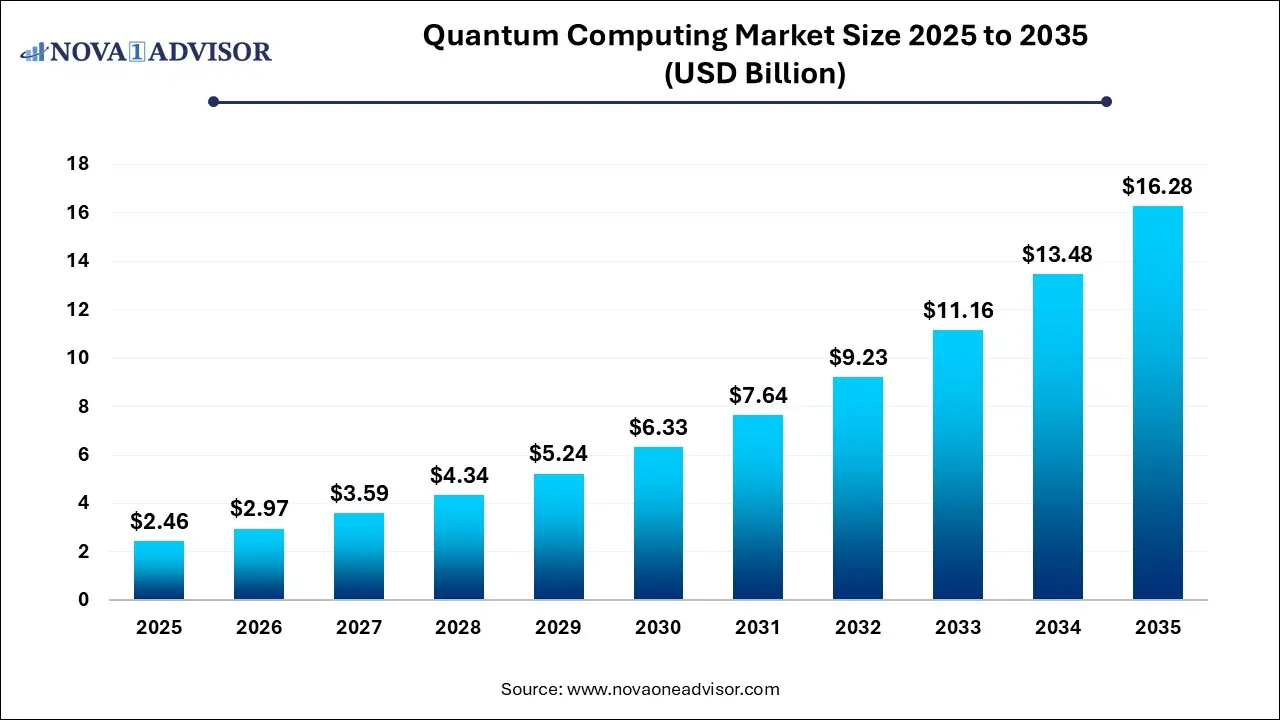

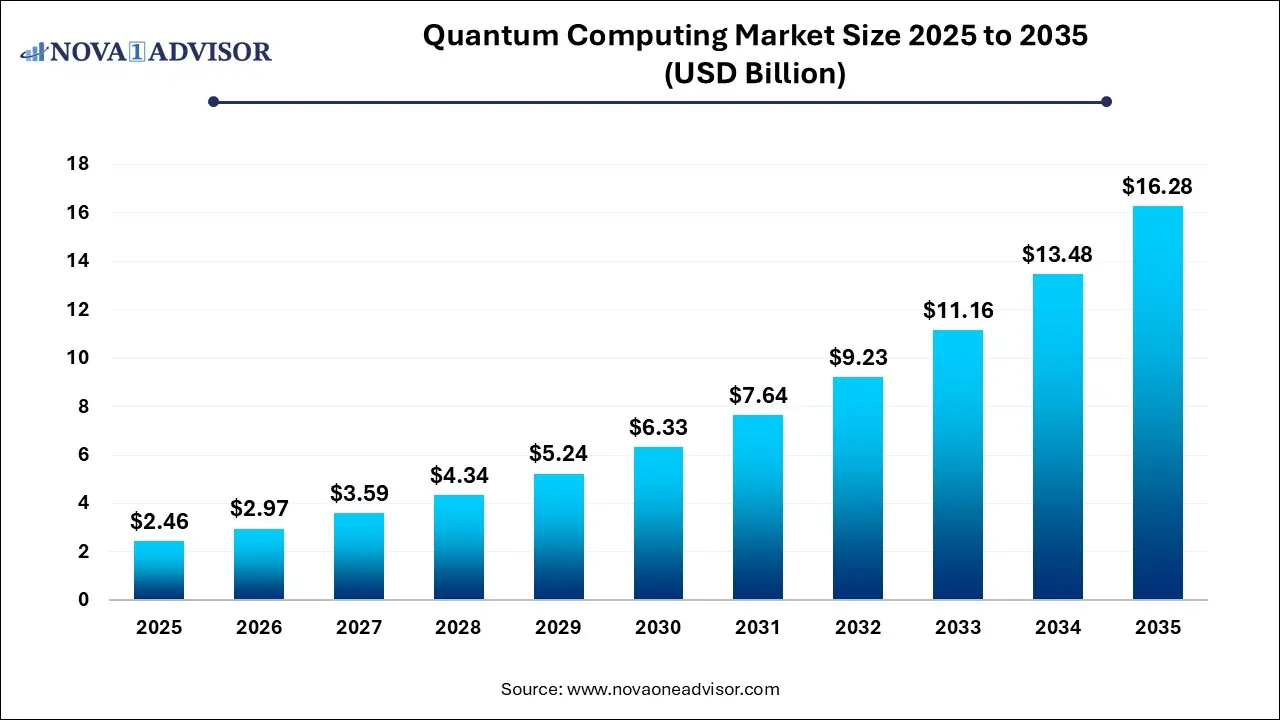

Quantum Computing Market Size and Growth

The quantum computing market size was exhibited at USD 2.46 billion in 2025 and is projected to hit around USD 16.28 billion by 2035, growing at a CAGR of 20.8% during the forecast period 2026 to 2035.

Quantum Computing Market Key Takeaways:

- The system segment dominated the market with a share of over 65.0% in 2025.

- The service segment is expected to grow at the fastest rate from 2026 to 2035.

- The on-premises segment dominated the market with the highest revenue share in 2025.

- Quantum cloud services were gaining popularity for deployment.

- The optimization segment dominated the market with the highest revenue share in 2025.

- The BFSI segment dominated the market with the highest revenue share in 2025.

- North America quantum computing market accounted for a significant market share of 32.0% in 2025.

Market Overview

The Quantum Computing Market represents a transformative leap in computational capability, harnessing the principles of quantum mechanics to process information in fundamentally new ways. Unlike classical computers, which use bits, quantum computers use quantum bits or qubits that can exist in multiple states simultaneously through superposition. This capability allows them to solve problems in minutes that would otherwise take classical systems millennia to crack.

As of 2025, the quantum computing ecosystem is evolving rapidly. Governments, tech giants, and academic institutions are investing heavily in the development of hardware, software, and hybrid quantum-classical systems. While fully fault-tolerant quantum computers remain under development, early-stage systems are already being commercialized for research and pilot applications in fields such as finance, materials science, logistics, and drug discovery.

A key shift in the market has been the transition from theoretical exploration to practical deployment. Enterprises are beginning to experiment with quantum algorithms in supply chain optimization, portfolio simulation, and cryptographic modeling. Companies like IBM, Google, Amazon, IonQ, and Rigetti are offering cloud-based access to quantum systems, while numerous startups focus on error correction, quantum software, and novel computing architectures. As commercialization gains momentum, the global quantum computing market is positioned for exponential growth over the next decade.

Major Trends in the Market

-

Quantum-as-a-Service (QaaS) becoming mainstream: Vendors offer cloud-based access to quantum systems, democratizing usage and accelerating adoption.

-

Hybrid quantum-classical systems: Increasing integration of quantum processors with classical high-performance computing to solve real-world problems.

-

Post-quantum cryptography development: Organizations invest in new encryption methods that remain secure in a quantum-enabled future.

-

Accelerating government investments: Countries like the U.S., China, Canada, and Germany are funding national quantum research initiatives and infrastructure.

-

Rapid evolution in hardware platforms: Ongoing research into trapped ions, superconducting qubits, photonics, and topological qubits to improve coherence and scalability.

-

Industry-specific quantum use cases: Emerging applications tailored for sectors such as BFSI (risk modeling), chemicals (molecular simulations), and logistics (route optimization).

-

Talent and ecosystem development: Universities and industry players focus on quantum education, building a pipeline of researchers and developers.

Report Scope of Quantum Computing Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.97 Billion |

| Market Size by 2035 |

USD 16.28 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 20.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Offering, Deployment, Application, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Accenture Plc.; D-WaveSystem Inc.; Google LLC; IBM Corporation; Intel Corporation; Microsoft Corporation; Quantinuum Ltd.; Rigetti & Co, Inc.; Riverlane; Zapata Computing |

Market Driver: Rising Demand for Unprecedented Computational Power

One of the primary drivers of the quantum computing market is the unmet need for exponentially greater computational power. Classical computers, even at supercomputing scale, struggle with problems involving massive variable sets—common in climate modeling, molecular structure prediction, and high-dimensional financial simulations.

Quantum computing, with its ability to perform parallel calculations across multiple states, offers a revolutionary pathway to solving these challenges. For instance, pharmaceutical companies use quantum algorithms to simulate molecular interactions, reducing R&D timelines. Similarly, financial institutions are exploring quantum techniques for portfolio optimization and fraud detection. As traditional computing approaches their physical limits, quantum computing offers a compelling alternative to unlock innovation and efficiency across industries.

Market Restraint: Hardware Instability and Scalability Challenges

Despite its promise, hardware immaturity and operational instability remain significant restraints on market growth. Qubits are extremely fragile and prone to decoherence, often requiring complex infrastructure like dilution refrigerators and electromagnetic shielding to maintain stability. Most current systems are limited in the number of qubits they can operate reliably, and quantum error correction is still in early development.

As a result, many applications are confined to simulation and proof-of-concept. The costs of building and maintaining quantum systems are also prohibitively high, limiting accessibility. Until breakthroughs in fault-tolerance, error mitigation, and qubit scalability are achieved, the full potential of quantum computing may remain unrealized.

Market Opportunity: Expansion of Quantum Machine Learning and AI

A key opportunity lies in leveraging quantum computing to accelerate artificial intelligence and machine learning. Quantum machine learning (QML) algorithms can process large and complex datasets more efficiently than classical systems. This convergence could revolutionize applications like pattern recognition, predictive analytics, and autonomous decision-making.

Industries such as retail, healthcare, and financial services are exploring QML to enhance recommendation systems, detect anomalies, and accelerate drug discovery. Companies like Xanadu, Zapata Computing, and IBM are developing hybrid frameworks to embed quantum models into AI pipelines. As quantum hardware advances, its synergy with AI presents a high-impact growth opportunity for early adopters.

Quantum Computing Market By Offering Insights

Systems dominate the market, reflecting the current R&D focus on building quantum processors and control systems. Industry leaders like IBM, Google, and Rigetti have released multiple generations of quantum hardware, focusing on increasing qubit fidelity, reducing error rates, and extending coherence times. This category also includes cryogenic infrastructure and photonic circuit platforms, making it hardware-intensive and capital-heavy.

Services are the fastest-growing segment, driven by the rapid adoption of cloud-based quantum computing platforms. Providers such as Amazon Braket, Azure Quantum, and IBM Quantum offer on-demand access to real quantum processors, developer tools, and SDKs. These services lower entry barriers, especially for enterprises and academic researchers, and enable experimentation without upfront investment in infrastructure.

Quantum Computing Market By Deployment Insights

Cloud-based quantum deployment is the market leader, as most users access quantum hardware through cloud interfaces. It allows remote testing, algorithm prototyping, and hybrid computing without the need for physical systems. Cloud deployment is particularly appealing to enterprises and research institutions working on early-stage use cases.

On-premises deployment is growing rapidly, particularly in defense, government, and high-security research centers. The ability to maintain data sovereignty and customize hardware configurations is critical in national laboratories, intelligence agencies, and aerospace companies. With developments in modular and portable quantum units, on-premises deployment is becoming more feasible.

Quantum Computing Market By Application Insights

Optimization dominates the application landscape, finding extensive use in logistics, finance, manufacturing, and urban planning. Quantum algorithms offer immense improvements in solving complex, combinatorial optimization problems, such as shortest path, resource scheduling, and supply chain design.

Machine learning is emerging as the fastest-growing segment, owing to the convergence of AI and quantum computing. Use cases in image recognition, anomaly detection, and training of deep neural networks are under active exploration. The availability of quantum-compatible ML libraries is accelerating innovation in this space.

Quantum Computing Market By End-user Insights

BFSI is the largest end-user segment, leveraging quantum capabilities in fraud detection, high-frequency trading, and risk assessment. Financial firms like JPMorgan Chase, Goldman Sachs, and HSBC are investing in quantum labs and partnering with quantum startups to gain early mover advantage.

Healthcare is the fastest-growing end-user segment, driven by quantum-assisted drug discovery, protein folding, and genomics. Companies like Roche and Boehringer Ingelheim are exploring quantum applications in early-stage drug design and clinical trial optimization. The COVID-19 pandemic has further accelerated interest in quantum-powered biological simulations.

Quantum Computing Market By Regional Insights

North America leads the global quantum computing market, powered by the U.S.’s deep-rooted technological ecosystem. The U.S. government has committed over $1.2 billion through the National Quantum Initiative Act, while private companies dominate patent filings and commercialization efforts. IBM, Google, Microsoft, and AWS provide cloud quantum access and continually advance hardware capabilities.

Canada also plays a pivotal role, with D-Wave and Xanadu leading innovation in quantum annealing and photonics. Leading universities and startups are supported by programs such as the Canadian National Quantum Strategy, making the region a hotbed for quantum R&D, talent development, and enterprise adoption.

Asia Pacific is the fastest-growing region, fueled by state-sponsored quantum programs, academic initiatives, and industrial partnerships. China leads in terms of funding, academic output, and public demonstration of quantum supremacy. Government initiatives like the Chinese Quantum Network and satellite-based quantum encryption projects highlight strategic intent.

Japan, South Korea, and India are also investing heavily in hardware R&D, quantum cryptography, and quantum cloud services. India’s National Mission on Quantum Technologies & Applications (NM-QTA), backed by a $1 billion budget, aims to make the country a quantum innovation hub over the next decade.

Some of the prominent players in the quantum computing market include:

Quantum Computing Market Recent Developments

-

April 2025: IBM announced its 1,121-qubit “Condor” quantum processor, marking a major milestone toward fault-tolerant computing.

-

March 2025: Google Quantum AI revealed a new AI-integrated hybrid quantum-classical simulator aimed at accelerating ML model training.

-

February 2025: Amazon Web Services (AWS) extended its Braket platform by integrating photonic quantum processors from PsiQuantum.

-

January 2025: D-Wave Systems launched its new Advantage2 system with improved qubit connectivity and annealing precision, targeting optimization use cases.

-

May 2025: Quantinuum (a merger of Honeywell Quantum and Cambridge Quantum) announced its collaboration with BMW Group to explore quantum applications in battery material development.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the quantum computing market

By Offering

By Deployment

By Application

- Optimization

- Simulation

- Machine Learning

- Others

By End-user

- Aerospace & Defense

- BFSI

- Healthcare

- Automotive

- Energy & Power

- Chemical

- Government

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)