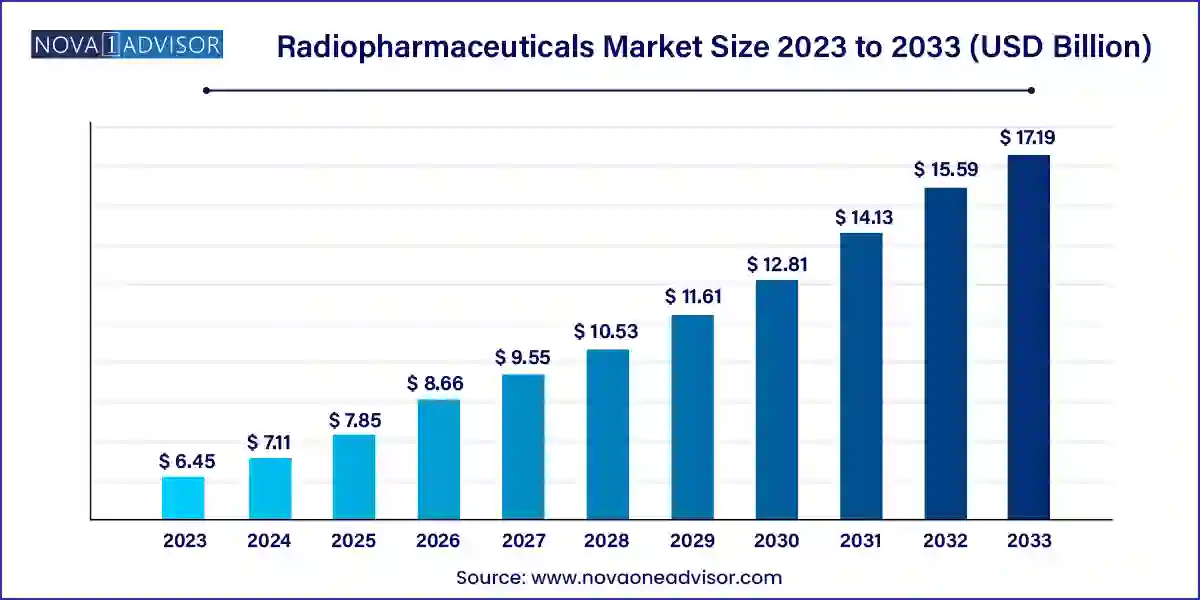

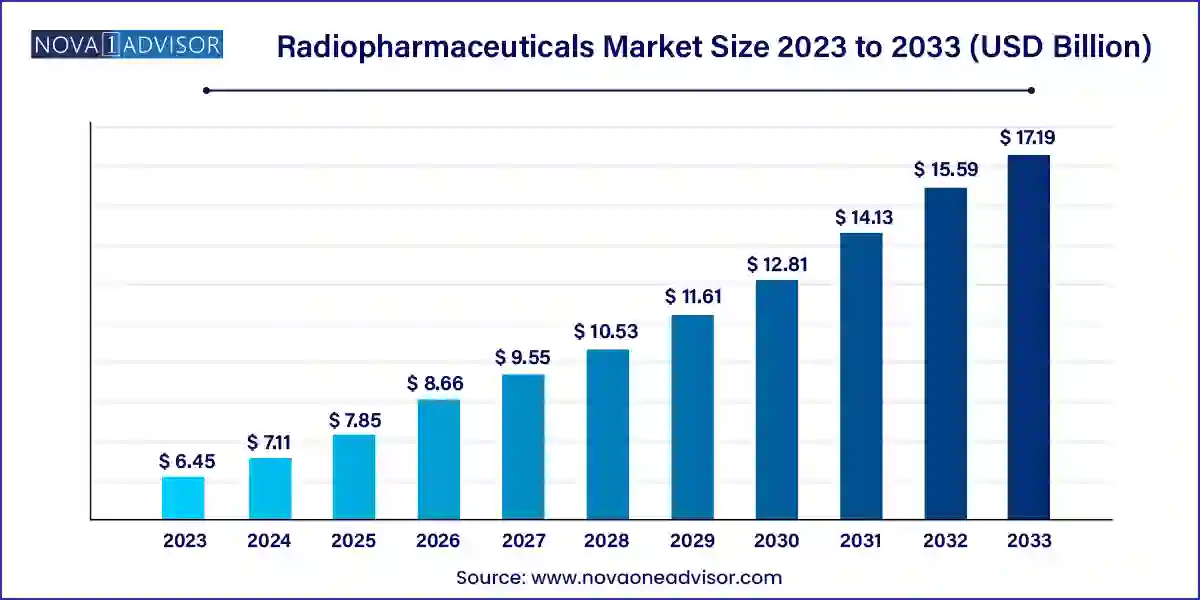

Radiopharmaceuticals Market Size and Growth

The radiopharmaceuticals market size was exhibited at USD 6.45 billion in 2023 and is projected to hit around USD 17.19 billion by 2033, growing at a CAGR of 10.3% during the forecast period 2024 to 2033.

Key Takeaways:

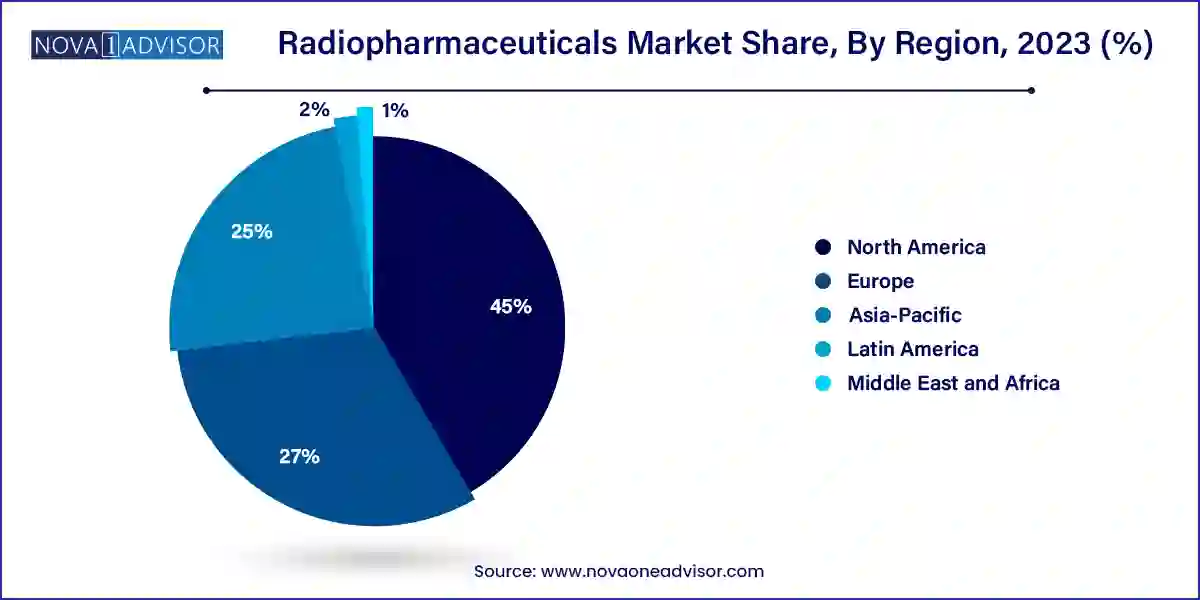

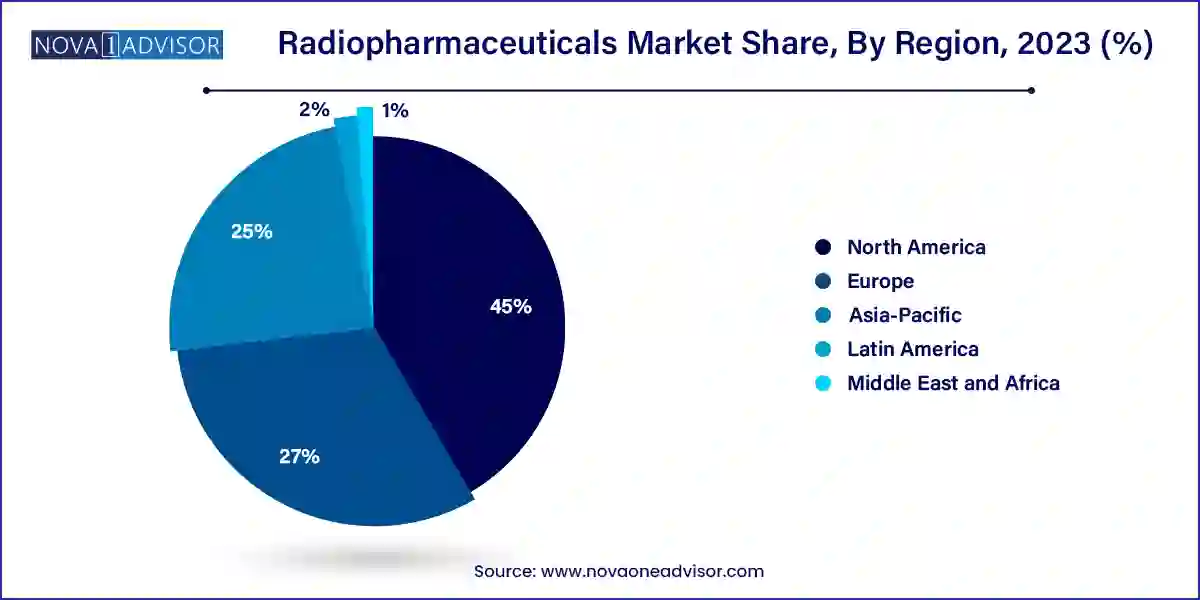

- North America led the market with the highest market share of 45% in 2023.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Radioisotopes, the technetium-99m segment has held the largest revenue share of 45% in 2023.

- By Radioisotopes, the Gallium-68 segment is anticipated to grow at a noteworthy CAGR of 13.1% during the projected period.

- By Application, the cancer segment generated more than 53% of revenue share in 2023.

- By Application, the cardiology segment is projected to expand at the fastest CAGR over the projected period.

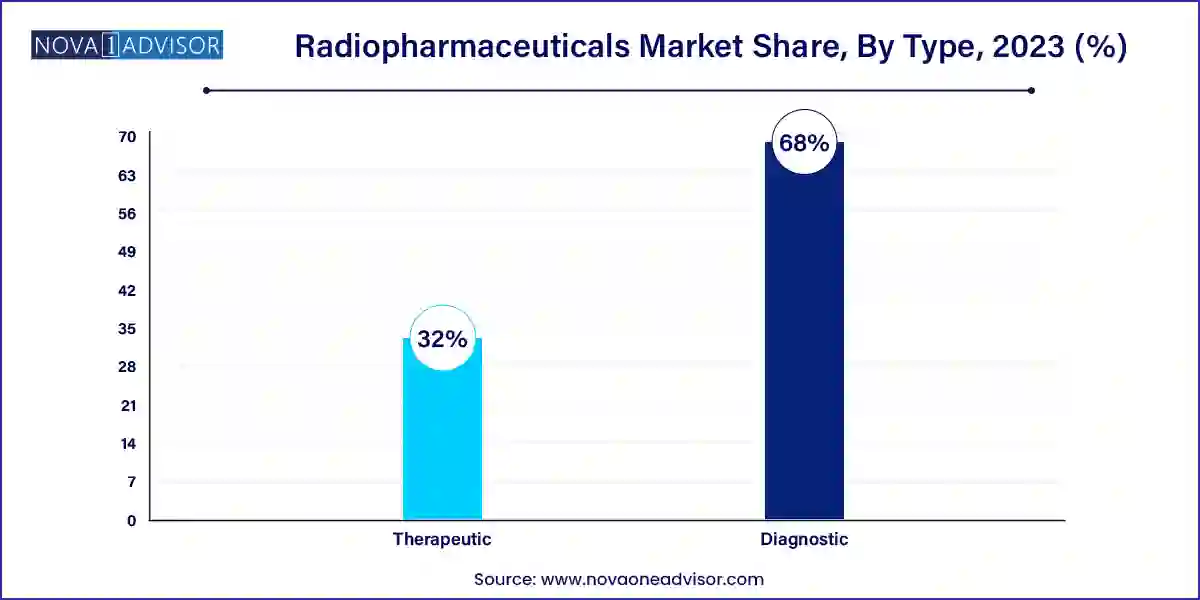

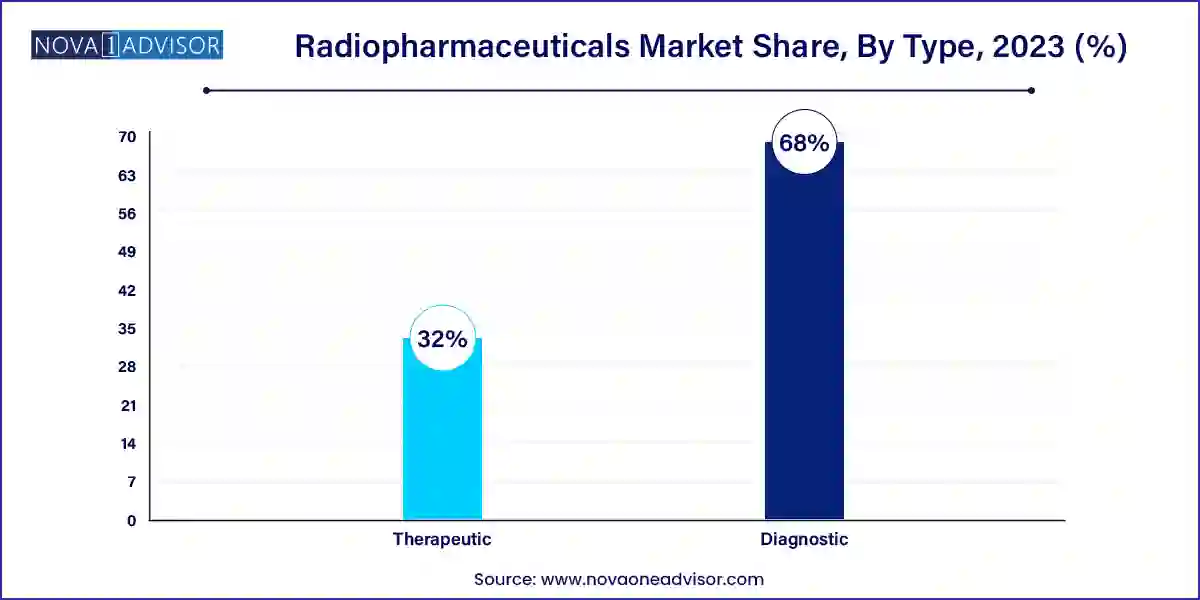

- By Type, the diagnostic segment contributed more than 68% of revenue share in 2023.

- By Type, the therapeutics segment is estimated to grow at the fastest CAGR over the projected period.

- By End User, the hospitals and clinics segment registered over 52% of revenue share in 2023.

- By End User, the medical imaging centers segment is estimated to grow at a remarkable CAGR of 14.8% over the predicted period.

Radiopharmaceuticals Market Overview

The radiopharmaceuticals sector encompasses the realm of nuclear medicine pharmaceuticals. These substances contain radioactive elements, facilitating the diagnosis and treatment of a wide array of medical conditions. Radiopharmaceuticals emit radiation that can be detected through cutting-edge imaging devices like PET and SPECT scanners. This facilitates the visualization of internal physiological processes and the detection of diseases such as cancer, cardiac conditions, and neurological disorders.

The global radiopharmaceuticals market has expanded owing to breakthroughs in healthcare technology, an increasing prevalence of chronic illnesses, and a burgeoning elderly demographic. It plays a pivotal role in personalized medicine and the advancement of innovative medical therapeutics.

Growth Factors

The radiopharmaceuticals sector, an integral component of nuclear medicine, has witnessed substantial expansion owing to its pivotal role in the diagnosis and treatment of diverse medical conditions. Radiopharmaceuticals consist of specialized drugs containing radioactive components that emit detectable radiation via sophisticated imaging instruments like PET and SPECT scanners. This technological advancement enables the visualization of internal bodily functions, aiding in the detection of ailments such as cancer, cardiovascular maladies, and neurological disorders.

Report Scope of Radiopharmaceuticals Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.11 Billion |

| Market Size by 2033 |

USD 17.19 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 10.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Radioisotope, By Application, By Type, and By End User |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

| Key Companies Profiled |

Bayer AG, Iso-Tex Diagnostics, Inc, Jubilant Pharmova Limited, Novartis AG, General Electric Company, Lantheus Holdings, Inc., Eli Lilly and Company, Siemens AG, Curium Pharma, Cardinal Health Inc., and Others. |

Radiopharmaceuticals Market Dynamics

Driver

Personalized medicine

Personalized medicine stands as a distinctive driving force propelling the dynamic expansion of the radiopharmaceuticals market. This groundbreaking paradigm tailors medical interventions to individual patients, leveraging their distinct genetic, molecular, and clinical profiles, thus ushering in a transformative era in healthcare. Within the realm of radiopharmaceuticals, this approach empowers the creation of exceptionally precise diagnostic and therapeutic solutions. Through the application of cutting-edge imaging techniques and the development of radiopharmaceuticals engineered to selectively bind to disease-specific biomarkers, healthcare professionals can deliver pinpoint diagnoses and meticulously monitor ailments such as cancer, cardiovascular disorders, and neurodegenerative conditions.

Furthermore, personalized medicine fuels the innovation of radiopharmaceutical-based treatments meticulously crafted to effectively combat diseases while minimizing adverse effects. The art of matching patients with radiopharmaceuticals uniquely suited to their genetic constitution and disease attributes not only elevates treatment outcomes and safety but also stimulates market growth by igniting a surge in research and development endeavors aimed at engineering novel, highly specialized radiopharmaceuticals.

Moreover, it fosters increased acceptance and utilization of radiopharmaceuticals as healthcare providers increasingly grasp their pivotal role in achieving precise diagnoses and delivering laser-focused therapeutic interventions. With the continued ascent of personalized medicine, the radiopharmaceuticals market is poised to ascend to unprecedented heights, revolutionizing the landscape of disease management and patient-centric care.

Restraints

Short half-lives

The relatively short half-lives of many radiopharmaceuticals pose a significant restraint on the radiopharmaceuticals market's growth. These short half-lives, often measured in minutes to hours, limit the window of opportunity for both production and administration of these compounds. Firstly, from a production standpoint, it necessitates a highly efficient and streamlined manufacturing process, as delays can lead to significant radioactive decay, rendering the radiopharmaceutical ineffective or less potent. This requirement for precision and speed in production can increase operational costs and complexity.

Secondly, in terms of administration, the short half-lives demand well-established and well-coordinated distribution networks to ensure timely delivery to healthcare facilities. This can be particularly challenging in regions with limited infrastructure or remote areas. Additionally, the short half-lives restrict the use of radiopharmaceuticals to specific diagnostic and therapeutic applications, limiting their versatility and potentially reducing their market potential. Overcoming these challenges requires ongoing investment in research and development to create radiopharmaceuticals with longer half-lives and innovative solutions for efficient production and distribution, thus expanding their utility in healthcare.

Opportunities

Neurological applications

Neurological applications are etching distinctive contours in the radiopharmaceuticals market, sketching a vivid canvas of promising prospects. This metamorphosis is spurred by a myriad of forces reshaping the demand dynamics for radiopharmaceuticals. First and foremost, the surging prevalence of neurodegenerative ailments, exemplified by Alzheimer's and Parkinson's, compels a shift towards precise diagnostics, continuous surveillance, and deep-seated research. Radiopharmaceuticals, endowed with the knack for unveiling the intricacies of cerebral function and molecular-level disorders, have risen to become indispensable assets for neurologists and researchers alike.

In parallel, as the annals of neurobiology unfurl, radiopharmaceuticals are emerging as keystone elements in the realm of pharmaceutical development and clinical experimentation, sparking intricate collaborations between pharmaceutical juggernauts and radiopharmaceutical maestros. This burgeoning panorama not only fans the flames of innovation but also diversifies the utility of radiopharmaceuticals, transcending the precincts of oncology and elevating their pertinence and economic feasibility. This expansive trajectory is poised to spark heightened investments, transformative research endeavors, and fervent developmental pursuits in the radiopharmaceutical domain, promising an era rife with burgeoning opportunities and metamorphic growth.

Impact of COVID-19

The COVID-19 pandemic had a mixed impact on the radiopharmaceuticals market. While disruptions in the supply chain and reduced patient access to healthcare facilities initially posed challenges, the crisis also underscored the importance of diagnostic imaging and therapeutic radiopharmaceuticals in disease management and research. Increased focus on vaccine development and tracking the virus using radiopharmaceuticals, such as PET tracers, drove innovation.

The market adapted to new safety protocols, telemedicine integration, and collaborations to ensure continued production and supply. In the long term, the pandemic's emphasis on healthcare resilience and advanced diagnostics is expected to bolster the radiopharmaceuticals market's growth.

Radiopharmaceuticals Market By Radioisotopes Insights

Technetium-99m dominates the radioisotope segment, owing to its widespread use in diagnostic nuclear medicine procedures. It is utilized in over 80% of all nuclear imaging tests globally due to its ideal half-life, gamma photon emission energy, and versatility in labeling with various ligands. Technetium-based radiopharmaceuticals are commonly used in cardiac imaging, bone scans, and renal studies, making it the backbone of SPECT imaging worldwide.

Gallium-68 is the fastest-growing isotope, driven by its critical role in PET imaging and theranostic applications. Its ability to label peptides for imaging of neuroendocrine tumors and prostate cancer has expanded its clinical use. With the increasing availability of Gallium-68 generators and compact cyclotrons, its usage is set to increase further. Gallium-68-labeled PSMA (Prostate-Specific Membrane Antigen) has revolutionized prostate cancer imaging and has become a cornerstone in both diagnostics and treatment planning.

Radiopharmaceuticals Market By Application Insights

Cancer dominates the application segment, reflecting the significant share of radiopharmaceuticals used in oncology diagnostics and therapeutics. PET and SPECT scans with isotopes like Fluorine-18 and Lutetium-177 are used for staging, evaluating treatment efficacy, and guiding radiation therapy. Radiopharmaceutical therapy is increasingly being used in treating lymphomas, neuroendocrine tumors, and bone metastases.

Cardiology is the fastest-growing application area, as cardiovascular diseases rise among aging and obese populations. Technetium-99m-labeled agents like sestamibi and tetrofosmin are integral in myocardial perfusion imaging, helping detect ischemia and infarctions. The integration of nuclear cardiology into routine cardiovascular diagnostics, coupled with advancements in hybrid imaging systems, is accelerating growth in this segment.

Radiopharmaceuticals Market By Type Insights

Diagnostic radiopharmaceuticals dominate the market, as they form the foundation of nuclear imaging. Products based on Technetium-99m, Fluorine-18, and Iodine-123 are widely used in diagnosing cancer, cardiac conditions, thyroid disorders, and neurological diseases. Diagnostic isotopes benefit from high physician acceptance, regulatory approvals, and integration into clinical protocols.

Therapeutic radiopharmaceuticals are growing rapidly, driven by the success of radioisotope-based cancer therapies such as Lutetium-177-DOTATATE and Radium-223 dichloride. These isotopes deliver targeted radiation directly to cancer cells, minimizing systemic toxicity. The FDA’s approval of Pluvicto™ (Lutetium-177 PSMA therapy) in March 2022 marked a turning point, validating therapeutic radiopharmaceuticals as a mainstream cancer treatment modality.

Radiopharmaceuticals Market By End User Insights

Hospitals and clinics lead the end-user segment, due to the central role of these institutions in administering diagnostic scans and radiopharmaceutical therapies. Hospitals have the infrastructure, nuclear medicine departments, and regulatory licenses to store and administer radioactive materials. Many also partner with nuclear pharmacies for just-in-time delivery.

Medical imaging centers are the fastest-growing end-user group, especially in developed nations. These centers are increasingly equipped with PET/CT and SPECT scanners and are becoming preferred points of service for outpatient diagnostic procedures. Their growth is supported by lower operational costs, faster appointment access, and rising partnerships with insurance providers and radiopharmaceutical distributors.

Radiopharmaceuticals Market By Regional

North America is the leading region in the radiopharmaceuticals market, underpinned by robust healthcare infrastructure, high diagnostic imaging rates, and a strong presence of nuclear medicine specialists. The United States accounts for the largest market share due to its early adoption of PET imaging, favorable reimbursement policies, and ongoing clinical trials in radioligand therapy.

Additionally, North America is home to leading radiopharmaceutical developers such as Cardinal Health, Curium Pharma, and Lantheus Holdings. Academic institutions and research hospitals are deeply involved in clinical evaluations of novel tracers. Regulatory efficiency from the FDA has also enabled faster approvals and broader clinical access to new compounds.

Asia-Pacific is the fastest-growing region, driven by a rapidly expanding patient population, increased healthcare spending, and improving diagnostic infrastructure. Countries like India, China, and South Korea are witnessing exponential growth in nuclear medicine procedures. Public-private partnerships are emerging to build radiopharmacies, train specialists, and localize isotope production.

The rise of medical tourism in Southeast Asia is also increasing demand for advanced imaging and targeted therapies. Government initiatives in countries like Japan and Australia to promote cancer screening and research are further accelerating the uptake of radiopharmaceuticals in the region. Local companies are entering partnerships with global players to distribute or co-develop radiotracers, enriching the market landscape.

Recent Developments

-

February 2025: Novartis announced the commercial expansion of Pluvicto™ (Lutetium-177 PSMA therapy) in Europe, following approvals in additional countries for metastatic prostate cancer treatment.

-

December 2024: Curium Pharma signed an agreement with the University of Missouri to develop and supply Actinium-225 for targeted alpha therapy, expanding its therapeutic pipeline.

-

October 2024: Telix Pharmaceuticals launched Illuccix® (Gallium-68 PSMA PET tracer) in Asia-Pacific markets, with regulatory approvals in Japan, Singapore, and South Korea.

-

August 2024: NorthStar Medical Radioisotopes began commercial-scale production of non-uranium based Molybdenum-99 (Mo-99) in the United States, addressing historical isotope supply shortages.

-

June 2024: GE Healthcare introduced its latest PET/CT scanner, designed with AI-assisted dose optimization, enhancing the effectiveness of Fluorine-18 and Gallium-68-based diagnostics.

Some of the prominent players in the Radiopharmaceuticals market include:

- Bayer AG

- Iso-Tex Diagnostics, Inc

- Jubilant Pharmova Limited

- Novartis AG

- General Electric Company

- Lantheus Holdings, Inc.

- Eli Lilly and Company

- Siemens AG

- Curium Pharma

- Cardinal Health Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the radiopharmaceuticals market

By Radioisotope

- Iodine I

- Gallium 68

- Technetium 99m

- Fluorine 18

- Others

By Application

By Type

By End User

- Hospitals and clinics

- Medical Imaging centers

- Others

Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa