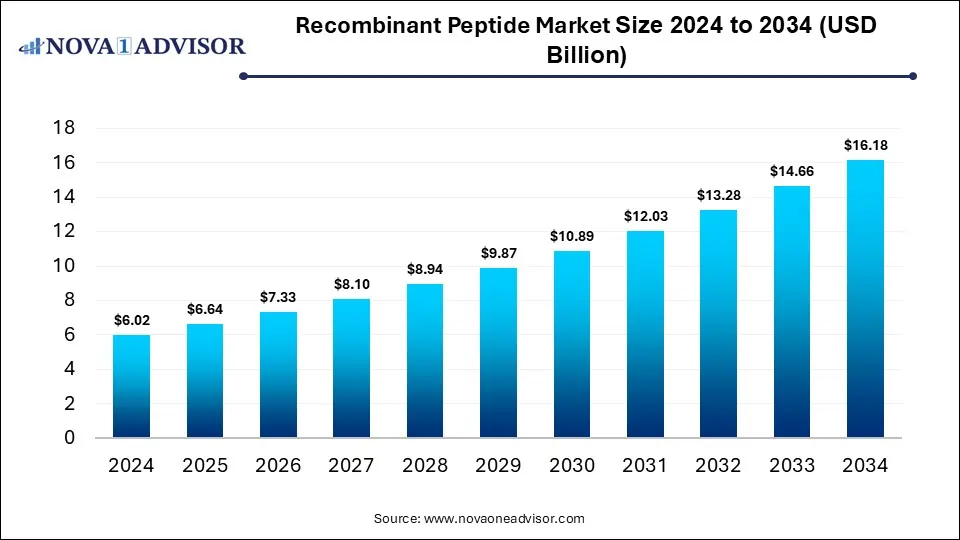

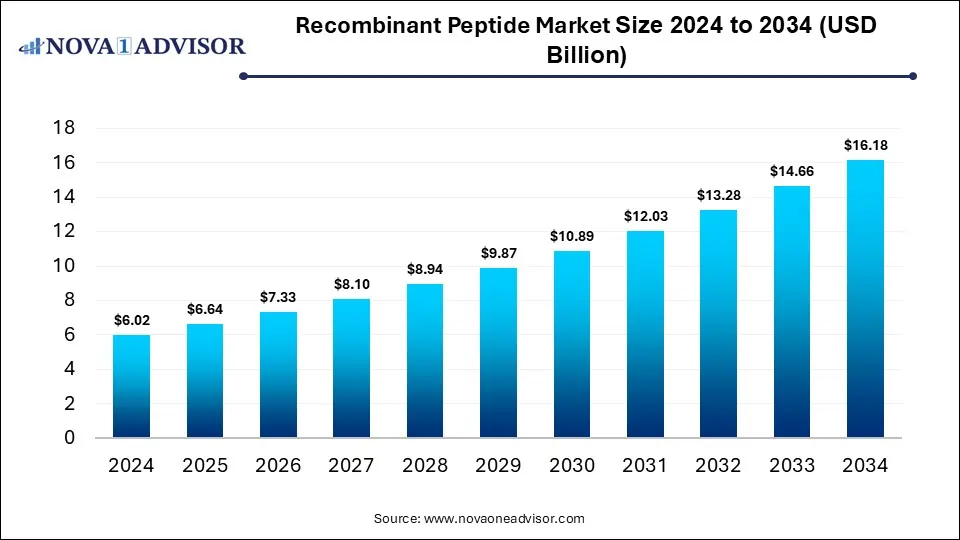

Recombinant Peptide Market Size and Growth 2025 to 2034

The global recombinant peptide market size was estimated at USD 6.02 billion in 2024 and is expected to reach USD 16.18 billion in 2034, expanding at a CAGR of 10.4% during the forecast period of 2025 and 2034. The market growth is driven by rising demand for targeted therapeutics, advancements in peptide synthesis technologies, increasing prevalence of chronic diseases, and growing adoption in drug delivery and cosmetic applications.

Recombinant Peptide Market Key Takeaways

- By region, North America held the largest share of the recombinant peptide market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By type, the cyclic peptides segment led the market in 2024.

- By type, the fusion peptides segment is expected to expand at the highest CAGR over the projected timeframe.

- By application, the therapeutics segment led the market in 2024.

- By application, the diagnostics segment is expected to expand at the highest CAGR over the projection period.

- By therapeutic area, the cancer / oncology segment led the market in 2024.

- By route of administration, the injectable segment held the dominant share in 2024.

- By end use, the pharmaceutical & biotechnology companies segment led the market in 2024.

Impact of AI on the Recombinant Peptide Market

AI is significantly transforming the recombinant peptide market by streamlining drug discovery, optimizing peptide design, and reducing development timelines. Machine learning algorithms can predict peptide structures, stability, and binding affinity with high accuracy, helping researchers create more effective and targeted peptide-based therapeutics. AI also enables faster screening of peptide libraries, identifying promising candidates for diseases like cancer, metabolic disorders, and infections. In manufacturing, AI-driven automation improves process efficiency, quality control, and cost-effectiveness. Overall, AI is accelerating innovation and enhancing competitiveness across the recombinant peptide value chain.

- On July 30, 2025, BioDuro and Atombeat Inc. announced a strategic collaboration to develop an AI-powered platform for accelerated peptide drug discovery. Combining Atombeat’s AI-driven design with BioDuro’s expertise in chemistry, biology, and DMPK, the platform aims to streamline the workflow from molecular design to preclinical candidates, delivering high-quality cyclic peptides faster and more cost-effectively across various therapeutic areas.

Market Overview

The market is experiencing rapid growth, driven by the rising demand for targeted biologics, advancements in genetic engineering, and the increasing prevalence of chronic diseases like cancer and metabolic disorders. As innovation accelerates in biologics and personalized medicine, the recombinant peptide market is positioned for strong expansion globally. The industry focused on the development, production, and commercialization of synthetic peptides engineered through recombinant DNA technology. These peptides offer high purity, better stability, and reduced immunogenicity, making them ideal for therapeutic applications, vaccine development, cosmetics, and biotechnology research. A major advantage in using recombinant methods, including viral vectors and plasmid DNA, is their ability to produce complex peptides efficiently at scale, ensuring consistency and precision.

What are the Major Trends in the Recombinant Peptide Market?

- Rising Demand for Targeted Therapeutics

Pharmaceutical companies are increasingly turning to recombinant peptides for their high specificity and low toxicity in treating chronic diseases like cancer, diabetes, and autoimmune disorders. This is driving R&D investments and clinical pipeline expansion.

- Integration of AI in Peptide Design

Artificial Intelligence and machine learning tools are revolutionizing peptide development by predicting molecular behavior, optimizing sequences, and accelerating drug discovery. This leads to more efficient and cost-effective development cycles.

Advancements in Manufacturing Technologies

New expression systems and bioreactor technologies are enabling high-yield and scalable production of recombinant peptides. Innovations in purification and formulation are also enhancing product quality and reducing time to market.

Growing Use in Cosmeceuticals and Dermatology

Recombinant peptides are increasingly used in skincare products for anti-ageing, wound healing, and skin regeneration due to their bioactivity and biocompatibility. This is opening new revenue streams beyond traditional pharma.

Expansion in Vaccine and Drug Delivery Applications

Recombinant peptides are being incorporated into vaccine platforms and as carriers for targeted drug delivery. Their precision and ability to elicit controlled immune responses make them valuable in next-gen therapeutics.

Report Scope of Recombinant Peptide Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.64 Billion |

| Market Size by 2034 |

USD 16.18 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.4% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By Therapeutic Area, By Route of Administration, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Market Dynamics

Drivers

Growing Investment in R&D

The increased funding enables the development of advanced recombinant technologies, including more efficient expression systems and improved peptide stability and bioavailability. Biotech and pharmaceutical companies are increasingly focusing on peptide-based therapeutics due to their high specificity and favorable safety profiles, particularly in oncology, metabolic disorders, and infectious diseases. Moreover, collaborations between academic institutions, startups, and established pharmaceutical firms are accelerating innovation and commercial translation.

- In August 2025, BioMed X partnered with Novo Nordisk to tackle a key challenge in drug development: efficient oral delivery of therapeutic peptides. A dedicated research team will be formed under the collaboration, supported by both organizations.

Growing Usage in Diagnostics and Vaccine Development

Recombinant peptides are used as highly specific biomarkers for detecting diseases such as cancer, infectious diseases, and autoimmune disorders, enabling more accurate and early diagnosis. In vaccine development, recombinant peptides are employed as antigenic components that can trigger targeted immune responses, offering safer and more stable alternatives to traditional vaccine materials. As global health systems prioritize preparedness and precision medicine, the demand for peptide-based diagnostics and vaccines continues to rise.

Restraints

High Manufacturing and Purification Costs

limiting scalability and increasing the final cost of products. Producing recombinant peptides requires advanced biotechnological processes, stringent quality controls, and expensive raw materials, which collectively drive up production expenses. Purification, in particular, is complex and labor-intensive, as it must ensure high purity and stability to meet regulatory and therapeutic standards. These costs can make recombinant peptides less accessible, especially in cost-sensitive or developing markets. As a result, smaller companies and healthcare systems may be discouraged from adopting or investing in peptide-based solutions.

Stability Issues

The peptides are often prone to degradation, denaturation, and loss of bioactivity during manufacturing, storage, and administration. This instability can reduce their shelf life and therapeutic efficacy, complicating formulation and delivery methods. Additionally, peptides typically have a short half-life in the body, which limits their effectiveness and may require frequent dosing or specialized delivery systems. These factors increase development costs and pose regulatory hurdles, making it harder to bring stable, effective peptide products to market.

Opportunity

Emerging & Untapped Markets

Countries in Asia-Pacific, Latin America, and Africa are witnessing increased healthcare spending, improved regulatory frameworks, and rising awareness about advanced therapies, which collectively boost demand for innovative treatments like recombinant peptides. These regions also have a high prevalence of chronic and infectious diseases, driving the need for effective and affordable peptide-based diagnostics and therapeutics. Moreover, expanding biopharma activities and collaborations in these markets opens doors for local production and distribution, reducing costs and improving access. As a result, these emerging markets represent significant growth potential for companies willing to invest and adapt to regional needs.

How Macroeconomic Variables Influence the Recombinant Peptide Market?

Economic Growth and GDP

Economic growth and rising GDP generally lead to positive growth, increasing national healthcare budgets and enabling greater investment in advanced medical technologies. Higher GDP allows governments and private sectors to fund research, improve healthcare infrastructure, and expand access to innovative therapies, including peptide-based treatments. Conversely, in low-GDP regions, limited financial resources and healthcare funding can restrain market growth due to affordability issues and a lack of infrastructure.

Inflation & Drug Pricing Pressures

It can negatively affect the growth of the recombinant peptide market, increasing production costs and reducing profit margins for manufacturers. As raw material, labor, and distribution expenses rise, companies may struggle to maintain competitive pricing, especially in cost-sensitive healthcare systems. Additionally, regulatory and public pressure to keep drug prices affordable can limit the adoption of high-cost recombinant peptide therapies, particularly in low- and middle-income regions.

Exchange Rates

Exchange rate fluctuations can negatively affect the market and companies involved in the international trade of raw materials, equipment, or finished products. A weaker local currency can increase the cost of imports, making peptide production more expensive and less competitive in global markets. This can lead to pricing challenges, reduced profit margins, and limited market access, especially in developing countries that rely heavily on imported biotech inputs

Segment Outlook

Type Insights

Why Did the Cyclic Peptides Segment Lead the Market in 2024?

The cyclic peptides segment led the recombinant peptide market in 2024 due to their significantly greater metabolic stability compared to linear peptides, resisting proteolytic degradation and enabling longer half‑life in vivo, which makes them more attractive for therapeutic and diagnostic applications. Their rigid, constrained conformation also gives them higher binding affinity and selectivity for targets (including protein‑protein interactions) that are harder to address with small molecules or linear peptides. Furthermore, cyclic peptides tend to have improved membrane permeability and sometimes better oral or non‑injectable delivery potential, alleviating one of the major drawbacks of many peptide drugs.

The fusion peptides segment is expected to expand at the highest CAGR in the coming years. This is mainly due to their enhanced therapeutic properties and versatility. Technological advancements and growing regulatory acceptance are making them increasingly viable for drug development. Their ability to address key limitations of traditional peptides makes them especially attractive for complex diseases. As clinical success and investment continue to rise, fusion peptides are set to play a pivotal role in the future of recombinant peptide therapeutics.

Application Insights

Why Did the Therapeutics Segment Dominate the Recombinant Peptide Market in 2024?

The therapeutics segment dominated the market with the largest share in 2024. This is mainly due to rising cases of chronic diseases like cancer, diabetes, and cardiovascular disorders, which drive demand for targeted and effective treatments. Recombinant peptides offer high specificity and lower toxicity, making them ideal for modern drug development. Advances in peptide engineering and regulatory support have accelerated approvals and clinical adoption. Additionally, therapeutic applications generate higher revenue, reinforcing their leading market position.

The diagnostics segment is expected to grow at the fastest CAGR during the projection period, owing to increasing demand for accurate, rapid, and cost-effective disease detection methods. Recombinant peptides are widely used as biomarkers in diagnostic assays for conditions like cancer, infectious diseases, and autoimmune disorders, offering high specificity and sensitivity. The rise in point-of-care testing and personalized medicine further fuels this demand, especially in both developed and emerging markets. Additionally, technological advancements in peptide synthesis and assay development are making peptide-based diagnostics more accessible and reliable. This growing reliance on precision diagnostics is propelling the segment's rapid expansion.

Therapeutic Area Insights

Why Did the Cancer / Oncology Segment Lead the Market in 2024?

The cancer / oncology segment led the recombinant peptide market in 2024 due to the increasing global incidence of various cancers and the urgent need for more effective, targeted therapies. Recombinant peptides are highly valued in oncology for their ability to precisely target tumor cells, minimize side effects, and overcome resistance mechanisms common in traditional treatments. Advances in peptide-based immunotherapies, such as cancer vaccines and checkpoint inhibitors, are driving significant clinical and commercial interest. Additionally, ongoing research and numerous clinical trials focused on peptide therapeutics for cancer bolster this segment’s growth. The high unmet medical need and substantial funding dedicated to oncology further solidify its dominant position in the market.

The metabolic disorders segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the rising prevalence of conditions like diabetes and obesity worldwide. Recombinant peptides offer promising therapeutic options that can regulate metabolism, improve insulin sensitivity, and aid weight management with fewer side effects compared to traditional drugs. Advances in peptide engineering have led to the development of longer-acting and more effective peptide-based treatments for metabolic diseases. Additionally, increasing healthcare awareness and investments in research are accelerating the adoption of these therapies. This growing demand positions metabolic disorders as a key driver of market growth in the coming years.

Route of Administration Insights

Why Did the Injectable Lead the Market in 2024?

The injectable segment led the recombinant peptide market in 2024 due to the most recombinant peptides require precise dosing and rapid bioavailability, which injections provide, especially for complex or chronic conditions. Injectable delivery ensures the peptides remain stable and effective, bypassing degradation that often occurs in the digestive system with oral administration. Many approved peptide-based therapies, particularly in oncology, metabolic, and autoimmune disorders, are designed for injections, reinforcing this route’s dominance. Additionally, established healthcare practices and infrastructure support injectable formulations, making them the preferred choice for clinicians and patients. While alternative delivery methods are emerging, injectables remain the gold standard for efficacy and reliability.

The oral segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the advances in formulation technologies that improve peptide stability and absorption in the digestive tract. Oral delivery offers greater patient convenience and compliance compared to injections, making it highly attractive for chronic treatments like metabolic and cardiovascular disorders. Innovations such as peptide encapsulation, permeation enhancers, and protective coatings are overcoming traditional challenges like enzymatic degradation and poor bioavailability. Additionally, growing demand for non-invasive therapies and expanding outpatient care settings are driving interest in oral peptide products.

End User Insights

Why Did the Pharmaceutical and Biotechnology Companies Segment Lead the Market in 2024?

The pharmaceutical and biotechnology companies segment led the recombinant peptide market in 2024 due to their leading role in drug discovery, development, and commercialization of peptide-based therapies. These companies invest heavily in R&D and have the advanced infrastructure needed for complex peptide synthesis and manufacturing. Their focus on innovation, including developing novel peptide therapeutics and diagnostics, drives market growth. Additionally, strategic collaborations and partnerships with academic institutions and contract manufacturers enhance their capacity to bring new peptide products to market. Their strong financial resources and regulatory expertise further solidify their dominant position in the market.

The academic and research institute segment is expected to expand at the highest CAGR in the coming years. This is mainly due to the increasing focus on fundamental research and drug discovery using peptide technologies. These institutions drive innovation by exploring new peptide sequences, mechanisms, and applications, fueling the development of novel therapeutics and diagnostics. Growing government and private funding for life sciences research further support this expansion. Additionally, advancements in peptide synthesis and screening technologies are making recombinant peptides more accessible to researchers worldwide. This surge in academic research activity is accelerating the growth of this segment in the coming years.

Regional Analysis

What Made North America the Dominant Region in the Market?

North America sustained dominance in the recombinant peptide market while holding the largest share in 2024. The region’s dominance is primarily attributed to the well-established biotechnology and pharmaceutical industries, backed by significant investments in R&D and innovation. The region benefits from strong regulatory frameworks, advanced healthcare infrastructure, and high adoption rates of cutting-edge therapies. Additionally, the presence of leading biotech companies, research institutions, and favorable government initiatives supports the rapid development and commercialization of recombinant peptide products. High prevalence of chronic diseases and growing demand for personalized medicine further drive market growth. These factors combined make North America the largest and most influential market for recombinant peptides.

The U.S. is a major contributor to the North American recombinant peptide market due to the robust pharmaceutical and biotechnology sectors. The country leads in research and development activities, supported by substantial government funding and private investments. Additionally, the presence of numerous biotech startups, established companies, and advanced healthcare infrastructure further strengthens the U.S. market’s dominance within the region.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is emerging as the fastest-growing market for recombinant peptides. This is due to the increasing healthcare expenditure, expanding biotech infrastructure, and rising awareness about advanced therapies in the region. Rapid urbanization, a growing middle class, and improving access to healthcare services are driving demand for innovative treatments, including peptide-based therapeutics and diagnostics. Governments in countries like China, India, and Japan are investing heavily in biotechnology research and offering supportive regulatory policies, which encourage local manufacturing and innovation. Additionally, the high prevalence of chronic diseases and infectious conditions fuels market expansion. These factors collectively position Asia Pacific as the fastest-growing market for recombinant peptides.

China is a major player in the Asia Pacific recombinant peptide market due to its massive investments in biotechnology research and development, as well as government initiatives supporting innovation and local manufacturing. The country’s rapidly growing healthcare infrastructure and large patient population create strong demand for advanced therapies. Additionally, China’s focus on improving regulatory frameworks and attracting global biotech partnerships further accelerates market growth.

Region-Wise Market Outlook

| Region |

Market Size (2024) |

Projected CAGR (2025–2034) |

Growth Factors |

Restraints |

Growth Outlook |

| North America |

USD 2.5 Billion |

5.91% |

Established biopharmaceutical infrastructure, robust R&D investments, high incidence of chronic diseases, and supportive regulatory frameworks. |

High manufacturing costs, regulatory complexities, and market competition. |

Dominant region with steady growth, driven by innovation and infrastructure. |

| Asia Pacific |

USD 1.8 Billion |

6.77% |

Increasing healthcare access, rising chronic disease prevalence, government support for biotech, and expanding manufacturing capabilities in countries like China and India. |

Regulatory challenges, quality control issues, and infrastructure disparities.

|

Rapid expansion, particularly in China, India, and Japan. |

| Europe |

USD 1.4 Billion |

10.01% |

Strong healthcare systems, centralised regulatory support, and increasing adoption of peptide-based therapies. |

Economic constraints in certain regions and reimbursement issues. |

Stable growth with a focus on diagnostics and speciality therapies. |

| Latin America |

USD 0.5 Million |

4.37% |

Emerging pharmaceutical capabilities, increasing healthcare investments, and rising disease burden. |

Limited access to advanced technologies and healthcare disparities. |

Gradual growth, primarily in Brazil and Argentina. |

| Middle East & Africa |

USD 0.3 Million |

2.65% |

Growing healthcare infrastructure, increasing disease awareness, and public-private partnerships. |

Political instability and economic challenges. |

Slow growth with potential in select countries. |

Recombinant Peptide Market Value Chain Analysis

1. Raw Material Sourcing

The value chain begins with sourcing high-quality raw materials, including amino acids, expression vectors, host cells (such as bacteria, yeast, or mammalian cells), and culture media. The purity and availability of these inputs directly impact the efficiency and yield of recombinant peptide production, making this a critical foundational step.

2. Gene Cloning and Expression

In this stage, the target gene encoding the peptide is cloned into suitable vectors and introduced into host cells. Efficient gene expression systems are essential to produce peptides at high yields and desired quality, ensuring that the recombinant peptides meet therapeutic or industrial standards.

3. Fermentation and Cultivation

The genetically engineered host cells are cultivated under optimized conditions in bioreactors. This step maximizes cell growth and peptide production, requiring precise control over parameters such as temperature, pH, and nutrient supply to ensure scalability and consistency.

4. Peptide Extraction and Purification

Once peptides are produced, they are extracted from the host cells or culture media through various purification techniques like chromatography and filtration. High purity levels are crucial at this stage to ensure the peptides are safe and effective for their intended applications, particularly in pharmaceuticals.

5. Formulation and Packaging

Purified peptides are then formulated into stable products suitable for distribution and use. This may involve adding stabilizers or converting peptides into lyophilized powders or liquid forms, followed by packaging that preserves product integrity during storage and transport.

6. Distribution and Logistics

Efficient distribution networks ensure that recombinant peptide products reach manufacturers, research institutions, and end-users in a timely manner. Cold chain logistics and compliance with regulatory standards are often necessary to maintain product efficacy, especially for pharmaceutical-grade peptides.

7. End-Use Applications

The final stage involves the utilization of recombinant peptides in pharmaceuticals, biotechnology research, diagnostics, and other industries. Feedback from end-users helps refine production processes and drive innovation, closing the loop in the value chain for continuous improvement.

Recombinant Peptide Market Companies

1. Novo Nordisk

Novo Nordisk is a global leader in peptide-based therapies, especially in diabetes care with GLP-1 receptor agonists, driving innovation in long-acting recombinant peptides. Their strong R&D focus and extensive product portfolio make them a dominant force in therapeutic peptides.

2. Eli Lilly and Company

Eli Lilly develops advanced peptide therapeutics such as Trulicity and Tirzepatide, addressing metabolic and cardiovascular disorders with recombinant peptides. Their investments in peptide drug discovery and clinical trials accelerate market growth and therapy adoption.

3. Amgen Inc.

Amgen leverages its biotechnology expertise to develop recombinant peptide-based biologics for oncology and cardiovascular diseases. Their robust manufacturing capabilities and global reach enhance the availability of peptide therapeutics worldwide.

4. GenScript Biotech Corporation

GenScript provides custom gene and peptide synthesis services, supporting drug development and academic research globally. Their technology platforms enable efficient production of recombinant peptides, facilitating faster development timelines.

5. Bachem Holding AG

Bachem specialises in peptide manufacturing and contract development, offering high-quality recombinant peptides for pharmaceutical and biotech clients. Their expertise in large-scale synthesis supports the growing demand in therapeutic and diagnostic applications.

6. PolyPeptide Group

PolyPeptide Group delivers custom peptide synthesis and manufacturing services, catering to the pharma and biotech sectors focused on innovative peptide therapies. Their global manufacturing network ensures consistent supply and quality for recombinant peptide products.

7. Sanofi

Sanofi, through its subsidiaries, develops recombinant peptide vaccines and therapeutics, contributing to both preventive and treatment markets. Their strong presence in emerging markets and broad pipeline support recombinant peptide adoption worldwide.

8. MBX Biosciences

MBX Biosciences focuses on peptide therapeutics targeting endocrine and metabolic disorders, advancing recombinant peptides through innovative research. Their recent IPO and funding rounds highlight growing investor confidence in their peptide-based solutions.

Recent Developments

- In July 2025, KACTUS launched its ultra-low endotoxin recombinant protein catalog, engineered for highest purity and performance. Designed to eliminate endotoxin interference, these products enhance immunotherapy, vaccine development, and preclinical research by delivering cleaner data and accelerating progress from bench to clinic.

- In April 2025, PeptiGrowth Inc. developed PG-012, a peptide with high affinity and agonist activity for FGFR2b, similar to KGF. Available from April 2025, PG-012 targets regenerative medicine and cell therapy, promoting differentiation and proliferation of epidermal and endoderm-derived cells from pluripotent stem cells.

Segments Covered in the Report

By Type

- Linear Peptides

- Cyclic Peptides

- Fusion Peptides

- Hybrid Peptides

- Modified or Stabilized Peptides

By Application

- Therapeutics

- Diagnostics

- Research & Development

- Industrial Applications

By Therapeutic Area

- Cancer / Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Metabolic Disorders (e.g., Diabetes, Obesity)

- Autoimmune & Neurological Disorders

By Route of Administration

- Injectable

- Oral

- Topical / Transdermal

- Nasal / Mucosal

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Diagnostic Laboratories

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

List of Tables

- Table 1: Global Recombinant Peptide Market Size (USD Billion) by Type, 2024–2034

- Table 2: Global Recombinant Peptide Market Size (USD Billion) by Application, 2024–2034

- Table 3: Global Recombinant Peptide Market Size (USD Billion) by Therapeutic Area, 2024–2034

- Table 4: Global Recombinant Peptide Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 5: Global Recombinant Peptide Market Size (USD Billion) by End User, 2024–2034

- Table 6: North America Market Size (USD Billion) by Type, 2024–2034

- Table 7: North America Market Size (USD Billion) by Application, 2024–2034

- Table 8: North America Market Size (USD Billion) by Therapeutic Area, 2024–2034

- Table 9: North America Market Size (USD Billion) by Route of Administration, 2024–2034

- Table 10: North America Market Size (USD Billion) by End User, 2024–2034

- Table 11: U.S. Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 12: Canada Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 13: Mexico Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 14: Europe Market Size (USD Billion) by Type, 2024–2034

- Table 15: Europe Market Size (USD Billion) by Application, 2024–2034

- Table 16: Germany Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 17: France Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 18: UK Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 19: Italy Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 20: Asia Pacific Market Size (USD Billion) by Type, 2024–2034

- Table 21: Asia Pacific Market Size (USD Billion) by Application, 2024–2034

- Table 22: China Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 23: Japan Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 24: India Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 25: South Korea Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 26: Southeast Asia Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 27: Latin America Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 28: Brazil Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 29: Middle East & Africa Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 30: GCC Countries Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 31: Turkey Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Table 32: Africa Market Size (USD Billion) by Type, Application & Therapeutic Area, 2024–2034

- Figure 1: Global Market Share by Type, 2024

- Figure 2: Global Market Share by Application, 2024

- Figure 3: Global Market Share by Therapeutic Area, 2024

- Figure 4: Global Market Share by Route of Administration, 2024

- Figure 5: Global Market Share by End User, 2024

- Figure 6: North America Market Share by Type, 2024

- Figure 7: North America Market Share by Application, 2024

- Figure 8: North America Market Share by Therapeutic Area, 2024

- Figure 9: North America Market Share by Route of Administration, 2024

- Figure 10: North America Market Share by End User, 2024

- Figure 11: U.S. Market Share by Type, 2024

- Figure 12: U.S. Market Share by Application, 2024

- Figure 13: U.S. Market Share by Therapeutic Area, 2024

- Figure 14: Canada Market Share by Type, 2024

- Figure 15: Canada Market Share by Application, 2024

- Figure 16: Canada Market Share by Therapeutic Area, 2024

- Figure 17: Mexico Market Share by Type, 2024

- Figure 18: Mexico Market Share by Application, 2024

- Figure 19: Mexico Market Share by Therapeutic Area, 2024

- Figure 20: Europe Market Share by Type, 2024

- Figure 21: Europe Market Share by Application, 2024

- Figure 22: Germany Market Share by Type, 2024

- Figure 23: Germany Market Share by Application, 2024

- Figure 24: France Market Share by Type, 2024

- Figure 25: France Market Share by Application, 2024

- Figure 26: UK Market Share by Type, 2024

- Figure 27: UK Market Share by Application, 2024

- Figure 28: Italy Market Share by Type, 2024

- Figure 29: Italy Market Share by Application, 2024

- Figure 30: Asia Pacific Market Share by Type, 2024

- Figure 31: Asia Pacific Market Share by Application, 2024

- Figure 32: China Market Share by Type, 2024

- Figure 33: China Market Share by Application, 2024

- Figure 34: Japan Market Share by Type, 2024

- Figure 35: Japan Market Share by Application, 2024

- Figure 36: India Market Share by Type, 2024

- Figure 37: India Market Share by Application, 2024

- Figure 38: South Korea Market Share by Type, 2024

- Figure 39: South Korea Market Share by Application, 2024

- Figure 40: Southeast Asia Market Share by Type, 2024

- Figure 41: Southeast Asia Market Share by Application, 2024

- Figure 42: Latin America Market Share by Type, 2024

- Figure 43: Latin America Market Share by Application, 2024

- Figure 44: Brazil Market Share by Type, 2024

- Figure 45: Brazil Market Share by Application, 2024

- Figure 46: Middle East & Africa Market Share by Type, 2024

- Figure 47: Middle East & Africa Market Share by Application, 2024

- Figure 48: GCC Countries Market Share by Type, 2024

- Figure 49: GCC Countries Market Share by Application, 2024

- Figure 50: Turkey Market Share by Type, 2024

- Figure 51: Turkey Market Share by Application, 2024

- Figure 52: Africa Market Share by Type, 2024

- Figure 53: Africa Market Share by Application, 2024