Red Biotechnology Market Size and Trends 2026 to 2035

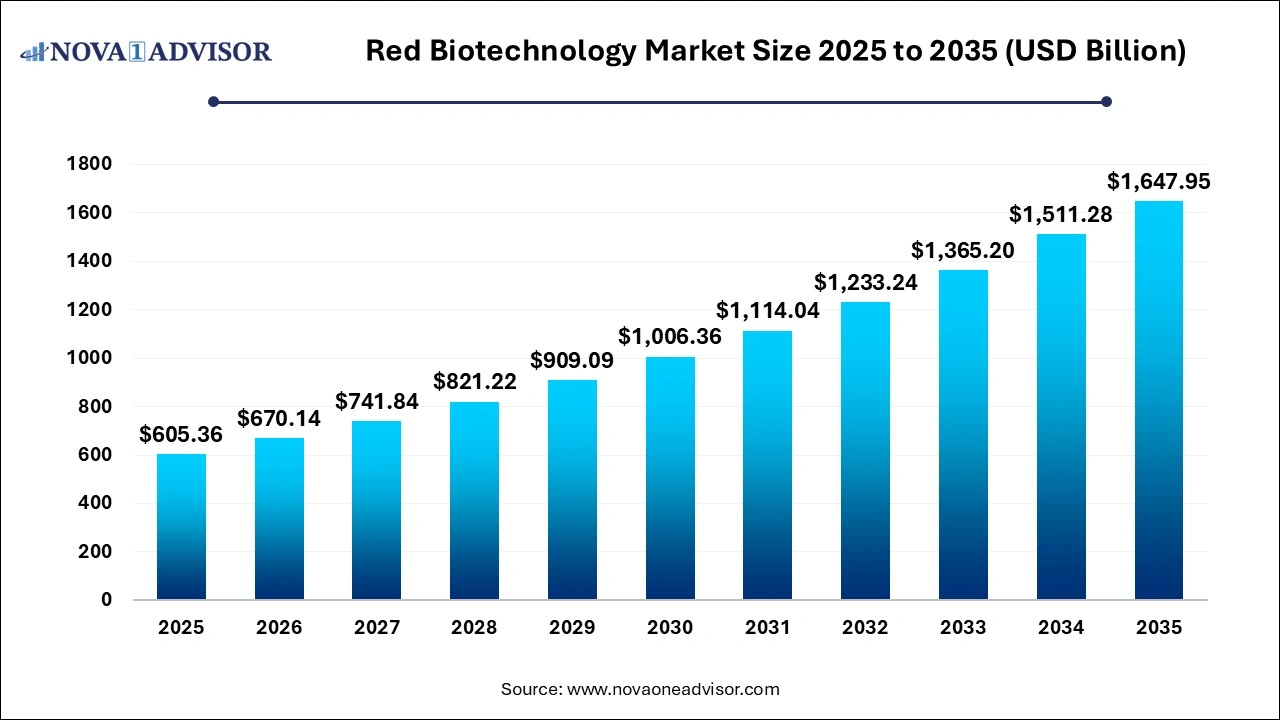

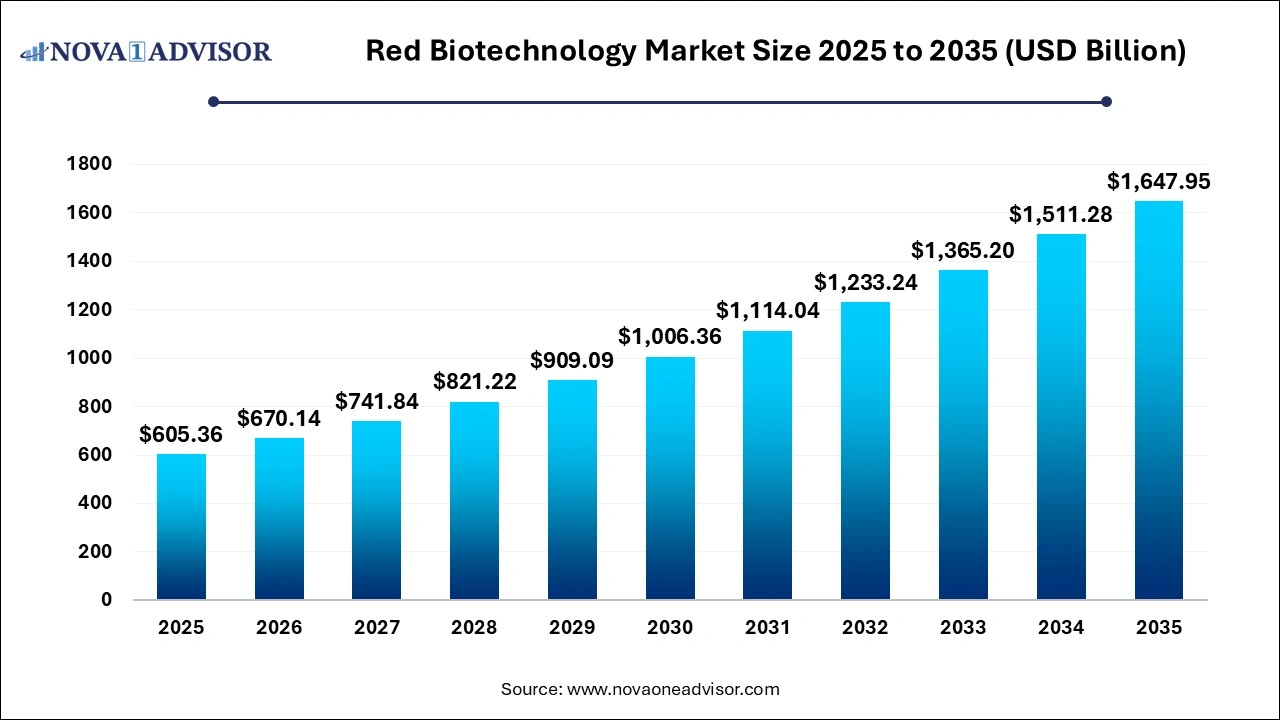

The global red biotechnology market size is calculated at USD 605.36 billion in 2025, grows to USD 670.14 billion in 2026, and is projected to reach around USD 1,647.95 billion by 2035, growing at a CAGR of 10.7% from 2026 to 2035. The red biotechnology market growth can be linked to the rising healthcare expenditure, increased emphasis on development of personalized treatment strategies, robust clinical trial pipelines and stringent regulatory frameworks.

Red Biotechnology Market Key Takeaways

- North America dominated the global red biotechnology market with the largest share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the monoclonal antibodies segment dominated the market with the largest share in 2025.

- By product, the gene therapy products segment is expected to show the fastest growth over the forecast period.

- By end use, the pharmaceutical and biotechnology companies segment accounted for the biggest market share in 2025.

- By end use, the CMOs & CROs segment is expected to register the fastest growth during the forecast period.

How is the Red Biotechnology Market Evolving?

Red biotechnology is field of medical or health biotechnology which focuses on utilizing biological systems and organisms for developing medical treatments, diagnostic tools and protective measures. Wide range of applications such as in pharmaceutical development, gene therapy, regenerative medicine and in innovation of new diagnostic tools are contributing to the red biotechnology market growth.

Increasing prevalence of chronic and rare diseases, rising investments in developing innovative therapeutic solutions, advancements in diagnostic technologies such point-of-care diagnostics, supportive government initiatives, expanding biopharmaceutical sector and favourable regulatory environments are driving the growth of the red biotechnology market. Expiring patents of blockbuster biologics are paving the way for biosimilars market expansion.

What Are the Key Trends in the Red Biotechnology Market in 2025?

- In July 2025, Merck, a leading company in science and technology sector, completed the acquisition of SpringWorks Therapeutics, Inc., at an enterprise value of $3.4 billion, following the fulfilment of customary closing conditions and regulatory clearances.

- In May 2025, Bio-Thera Solutions, Ltd. And Hikma Pharmaceuticals PLC declared the approval of STARJEMZA® (ustekinumab-hmny) Injection, a biosimilar referencing Stelara (ustekinumab) Injection by the U.S. Food and Drug Administration (FDA).

How is AI Benefitting the Red Biotechnology Market?

Artificial intelligence (AI) algorithms can be applied for advancing drug discovery and development processes by accelerating identification of potential drug candidates, in predictive modelling, for creating personalized treatment plans as well as for streamlining clinical trials. Designing of gene therapies and optimization of genetic engineering techniques can be achieved with the use of AI algorithms. AI can potentially accelerate the development of stem cell-based therapies and novel vaccines. By leveraging AI, biotechnology companies can optimize bioprocesses for manufacturing of biopharmaceuticals, biofuels and other typed of biotechnological products.

Report Scope of Red Biotechnology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 605.36 Billion |

| Market Size by 2035 |

USD 1,647.95 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 10.53% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Amgen Inc., AstraZeneca, Biogen, Celgene Corporation (Bristol-Myers Squibb Company), F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., Merck KGaA, Pfizer Inc., Regeneron Pharmaceuticals, Inc.,Takeda Pharmaceutical Company Limited |

Market Dynamics

Drivers

Rising Healthcare Burden

Globally rising burden of chronic diseases such as cardiovascular disorders, cancer, diabetes and rare diseases are driving the demand for innovative and targeted treatments to effectively manage these conditions and improve patient life outcomes. Red biotechnology offers various solutions like biopharmaceutical such as recombinant proteins and monoclonal antibodies, cell and gene therapies, vaccines and personalized medicine.

Restraints

High Capital Expenditure and Stringent Regulations

The development of novel drugs and therapies is a lengthy process which involves extensive preclinical and clinical testing, regulatory checks and scaling-up manufacturing processes. High costs associated with these processes can potentially limit market entry, particularly for smaller biotech companies on a tight budget. Additionally, stringent guidelines and requirements imposed by regulatory agencies for ensuring the safety, efficacy and quality of products can be time-consuming and costly, further leading to delayed product launch.

Opportunities

New Therapeutic Modalities

Ongoing scientific advancements and evolving healthcare needs across the globe are creating the need for development of treatments tailored to an individual’s lifestyle, genetic makeup and disease pattern for enhancing the efficacy of treatments, mitigating side effects and improving patient outcomes. Adoption of pharmacogenomics and companion diagnostics, focus on addressing unmet medical needs with gene and cell therapies, progress in regenerative medicine and development of therapeutic vaccines are paving the path for growth of the red biotechnology market.

Segmental Insights

What Made Monoclonal Antibodies the Dominant Segment in 2025?

By product, the monoclonal antibodies segment accounted for the largest market share in 2025. Monoclonal antibodies (mAbs) are known for their high specificity for targeting antigens on cells with minimal side effects which drives their demand for treating conditions like autoimmune disorders and cancer. Rising cases of chronic diseases, increasing regulatory approvals, demand for targeted therapies, and expanding applications in areas such as cardiovascular disease and infectology are contributing to the segment’s market dominance.

Advancements in monoclonal antibody development such as novel antibody engineering, and improvements in production methods using transgenic animals, phage display techniques and cell-free protein synthesis methods as well as the use of innovative delivery and targeting methods such as antibody-drug conjugates (ADCs) and nanobodies are contributing to the market growth.

By product, the gene therapy products segment is expected to register the fastest growth during the predicted timeframe. Rising prevalence of genetic disorders and chronic diseases, ongoing clinical trials and growing emphasis of biotech companies on developing a strong product pipeline are contributing to the market growth. The curative potential of gene therapies for treating various conditions is attracting significant investments from governments and venture capitalists. Integration of sophisticated tools and techniques such as CRISPR-Cas 9 technology, viral and non-viral delivery systems such as liposomes and nanoparticles, in vivo gene editing approaches as well as gene therapy for blood disorders and infectious diseases are expanding this segment’s market growth potential.

- For instance, in November 2024, PTC Therapeutics, Inc. announced the accelerated approval of its Kebilidi (eladocagene exuparvovec-tneq), an adeno-associated virus vector-based gene therapy indicated for the treatment of adult and pediatric patients with aromatic L-amino acid decarboxylase (AADC) deficiency. The approval makes it first-ever gene therapy directly administered to the brain in the U.S.

How Pharmaceutical and Biotechnology Companies Segment Dominated the Market in 2025?

By end use, the pharmaceutical and biotechnology companies segment dominated the market with the largest share in 2025. Pharmaceutical and biotechnology companies are heavily investing in research activities and advanced technologies such as artificial intelligence (AI), bioinformatics, genomics and molecular biology for development of cell and gene therapies, novel biologics, vaccines and personalized treatment strategies. These investments are necessary for addressing the rising burden of chronic diseases, further contributing to the market growth. Various companies have a strong pipeline of innovative therapeutic molecules such as monoclonal antibodies, recombinant proteins and mRNA vaccines undergoing clinical trials. Additionally, increased strategic collaboration and acquisition activities, advanced manufacturing facilities, well-established distribution networks and favourable regulatory environments are driving the market growth.

By end use, the CMOs & CROs segment is expected to show the fastest growth over the forecast period. Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) are companies offering outsourcing services such as manufacturing and research to pharmaceutical and biotechnology industries. High capital expenditure in development of a new biologic which involves expensive R&D, clinical trials and well-established manufacturing facilities drives companies to CROs and CMOs providing state-of-the-art equipment and facilities, specialized expertise and navigation through the complex regulatory pathways, leading accelerated time-to-market. Furthermore, increased emphasis on managing core competencies, ability to efficiently operate global supply chain networks and rising focus in conduction of international clinical trials is expected to boost the market growth of this segment in the upcoming years.

Regional Insights

Why is North America Dominating the Red Biotechnology Market?

North America dominated the global red biotechnology market in 2024. The region’s well-developed healthcare infrastructure is enabling the adoption and implementation of red biotechnology therapies. Increased investments in R&D activities, supportive regulatory frameworks such as the U.S. Food and Drug Administration’s (FDA’s) expedited approval pathways, affordable genome sequencing procedures and rising demand for targeted therapies is driving North America’s dominance in the market. Government policies such as tax incentives and research grants provided by the National Institutes of Health (NIH) for advancing cell and gene therapy projects is bolstering the market growth.

What Fuels Expansion of the Red Biotechnology Market in Asia Pacific?

Asia Pacific is expected to witness lucrative growth in the red biotechnology market over the forecast period. Increasing incidences of chronic and genetic disorders in the region’s huge population, particularly in countries like China and India. Rising healthcare expenditure, adoption of advanced technologies, digitalization of healthcare infrastructure, surging investments in innovative research, availability of skilled workforce and increasing disposable incomes are driving the market. Initiatives by various governments in the region such as the Genome India Project launched by the Department of Biotechnology, Government of India as well as the Chinese government’s Made in China 2025 initiative for boosting domestic biotechnology production are expanding the market growth.

Some of the Prominent Players in the Red Biotechnology Market

- Amgen Inc.

- AstraZeneca

- Biogen

- Celgene Corporation (Bristol-Myers Squibb Company)

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- Merck KGaA

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

Recent Developments in the Red Biotechnology Market

- In April 2025, ArtBlood and Expression Manufacturing LLC, the manufacturing subsidiary of Expression Therapeutics, Inc., signed a Memorandum of Understanding (MOU) for collaborating on the clinical development and large-scale production on in-vitro produced blood. By leveraging Expression's state-of-the-art cGMP (Current Good Manufacturing Practice) manufacturing capabilities, ArtBlood will proceed with the mass production of its proprietary blood product, BioBlood.

- In March 2025, Pierre Fabre Laboratories entered into an exclusive R&D collaboration and license agreement with RedRidge Bio for identification and development of biparatopic antibody (BPA) drug candidates against multiple targets with therapeutic focus on precision oncology, dermatology and rare diseases.

- In January 2025, Granata Bio Corporation, a biopharma company focused on women’s health and infertility, raised $15 million in its Series A+ funding round. The funding will be invested for development and expansion of reproductive health pipeline.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Red Biotechnology Market.

By Product

- Monoclonal Antibodies

- Polyclonal Antibodies

- Recombinant Proteins

- Vaccines

- Cell-Based Immunotherapy Products

- Gene Therapy Products

- Cell Therapy Products

- Tissue-Engineered Products

- Stem Cells

- Cell Culture

- Viral Vector

- Enzymes

- Kits and Reagents

- Animal models

- Molecular diagnostics

- Others

By End-User

- Academic Research Institutes

- CMOs & CROs

- Pharmaceutical & Biotechnology Companies

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)