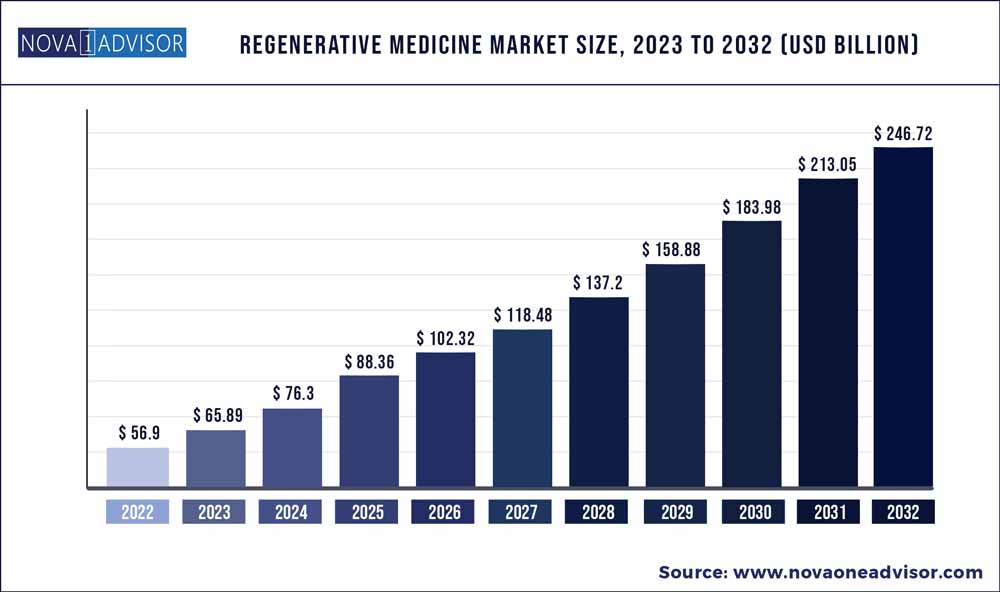

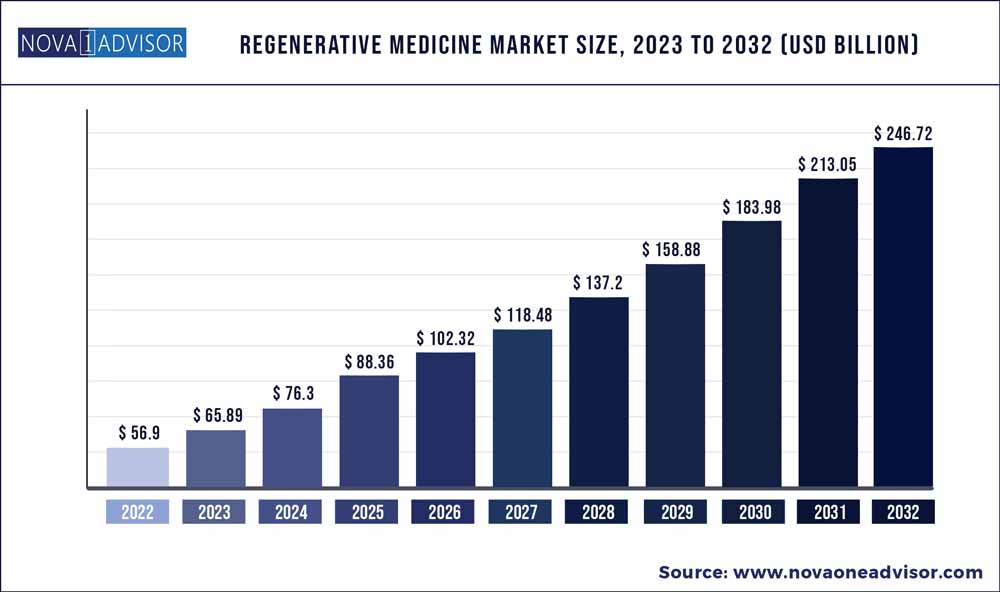

The global regenerative medicine market size was exhibited at USD 56.9 billion in 2022 and is projected to hit around USD 246.72 billion by 2032, growing at a CAGR of 15.8% during the forecast period 2023 to 2032.

Key Pointers:

- The North America region dominated the regenerative medicine market, capturing a market share of 51.39% in 2022.

- Asia Pacific is anticipated to witness the fastest growth in the coming years owing to the rapid adoption of cell-based methods in the healthcare industry.

- The therapeutics segment held a 69.19% revenue share of the regenerative medicine market in 2022

- The oncology segment dominated the regenerative medicine market in 2022, capturing a revenue share of 32.11%

- Stem cell and progenitor cell-based therapies are projected to witness significant growth owing to huge investments in the R&D space and a growing number of stem cell banks

- The therapeutics segment held the largest share in the regenerative medicine market, owing to the growing aging population coupled with an increasing rate of age-related disorders.

- The rise in a number of clinical trials for stem cell and tissue-based regenerative therapies along with an increase in demand for regenerative therapies is expected to positively influence the growth of the market.

Regenerative Medicine Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 65.89 Billion

|

|

Market Size by 2032

|

USD 246.72 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 15.8%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Product, Therapeutic category

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

AstraZeneca plc; F. Hoffmann-La Roche Ltd.; Integra Lifesciences Corp.; Astellas Pharma, Inc.; Cook Biotech, Inc.; Bayer AG; Pfizer, Inc.; Merck KGaA; Abbott; Vericel Corp.; Novartis AG; GlaxoSmithKline (GSK); Baxter International, Inc.; Boehringer Ingelheim; Amgen, Inc.; Cesca Therapeutics, Inc.; U.S. Stem Cell, Inc.; Bristol-Myers Squibb; Eli Lilly and Company; NuVasive, Inc.; Organogenesis, Inc.; MiMedx Group, Inc.; Takara Bio, Inc.; Osiris Therapeutics, Inc.; Corline Biomedical AB

|

The presence of a strong pipeline is one of the major drivers in the regenerative medicine market. Companies invest heavily in R&D to upgrade their products with the latest technology and fulfil the unmet needs of their customers.

Furthermore, with the increasing demand for disease treatment therapies, companies have focused their efforts to accelerate R&D for gene therapies that target the cause of disease at a genomic level. The cell and gene therapies in the U.S. pipeline programs (Phase I-III trials) grew from 289 in 2018 to 362 by 2019 according to the data published by PhRMA,. This represents an increase of 25% in a single year. Continuous advancements in this field would further boost the demand for regenerative medicines.

Technological advancements such as stem cells, tissue engineering, and nanotechnology has made regenerative medicines a highly interdisciplinary in field. Stem cells are undifferentiated cells, which have the capability to repair and/or regenerate into other cells such as cartilage, tendons, ligaments, muscle, and bones. In July 2021, BlueRock Therapeutics received FDA approval for its pluripotent stem cell-derived dopaminergic neuron therapy, DA01, for advanced Parkinson’s disease treatment. This approval was expected to expand the company’s offerings.

Several key players are taking strategic initiatives such as new product development, strategic alliances, and others have contributed to the regenerative medicine market growth. For instance, in November 2021, Astellas Pharma, Inc. entered into an agreement with Pantherna Therapeutics GmbH to study mRNA-based regenerative medicine. Under this initiative, Astellas' high drug discovery capabilities and Pantherna's state-of-the-art mRNA platform will be used to promote research on developing a new program. In addition, in May 2021, Bayer AG entered into a collaboration with Senti Bio for gene circuit-engineered cell therapies development for regenerative medicine.

Product Insights

The therapeutics segment held a 69.19% revenue share of the regenerative medicine market in 2022, owing to the rising geriatric population, coupled with higher incidence rates of age-related as well as degenerative disorders. The increased prevalence of diseases with unmet medical solutions, such as cancer, diabetes, and neurodegenerative diseases, including AMD, has encouraged researchers to develop alternative options. For instance, in April 2022, Kite, a Gilead Company, announced that it had received the U.S. FDA's authorization for its CAR T-cell therapy product, Yescarta, which could be used for the treatment of refractory or relapsed large B-cell lymphoma.

The banks segment is projected to witness considerable growth in the coming years. Considerable investment has been made to establish bio-banks, including tissue and cord blood banks, to provide the perceived research benefits. These banks comprise systematically organized and maintained cell lines for single or multi-use by researchers, healthcare providers, and other stakeholders. Stem cells and biologically engineered tissues are the most significant tools used in regenerative medicine. Thus, these banks are an important part of the regenerative medicine market.

Therapeutic category Insights

The oncology segment dominated the regenerative medicine market in 2022, capturing a revenue share of 32.11%, owing to the growing burden of cancer globally. Various government organizations along with private companies have made high investments in cancer research and the development of regenerative & advanced cell therapies. In January 2023, Calidi Biotherapeutics (CBT) and First Light Acquisition Group (FLAG) entered into a partnership agreement that aims to revolutionize oncolytic virotherapies with the help of stem cell-based platforms.

The cardiovascular segment is anticipated to witness significant growth during the forecast period. Advancements in cell-based therapies and regenerative medicines have accelerated the growth of the segment. Many key players are involved in the development of regenerative therapies to repair, restore, and revascularize damaged heart tissues. There is a growing adoption of single and mixed cells from autologous as well as allogeneic sources to study the effect on CVDs. In addition, advanced biologics, small molecules, and gene therapy are being investigated to stimulate the regeneration of damaged heart cells. These factors would further fuel the regenerative medicine market growth.

Regional Insights

The North America region dominated the regenerative medicine market, capturing a market share of 51.39% in 2022. The high market growth is attributed to the availability of government and private funding for development, the presence of advanced tech frameworks to support the rapid detection of chronic diseases, and high healthcare spending in the region. Moreover, several ongoing clinical trials for regenerative medicine by significant market players have contributed to the region’s growth. In December 2021, Bristol Myers Squibb received U.S. FDA approval for Orencia for the prevention of acute graft versus host disease in adults and pediatric patients 2 years of age and older, undertaking hematopoietic stem cell transplantation (HSCT).

Asia Pacific is anticipated to witness the fastest growth rate in the coming years. This growth is attributed to the rapid adoption of cell-based approaches in healthcare, the rising geriatric population in the region, and the emergence of key players. In recent years, China has emerged with rapid expansion in infrastructure and facilities to accelerate stem cell research. This, in turn, is anticipated to fuel the growth of regenerative medicine in the region.

Some of the prominent players in the Regenerative Medicine Market include:

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp.

- Novartis AG

- GlaxoSmithKline (GSK)

- Baxter International, Inc.

- Boehringer Ingelheim

- Amgen Inc.

- Cesca Therapeutics, Inc.

- U.S. Stem Cell, Inc.

- Bristol-Myers Squibb

- Eli Lilly and Company

- NuVasive, Inc.

- Organogenesis, Inc.

- MiMedx Group, Inc.

- Takara Bio, Inc.

- Osiris Therapeutics, Inc.

- Corline Biomedical AB

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Regenerative Medicine market.

By Product

- Therapeutics

- Primary cell-based therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Tools

- Banks

- Services

By Therapeutic Category

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)