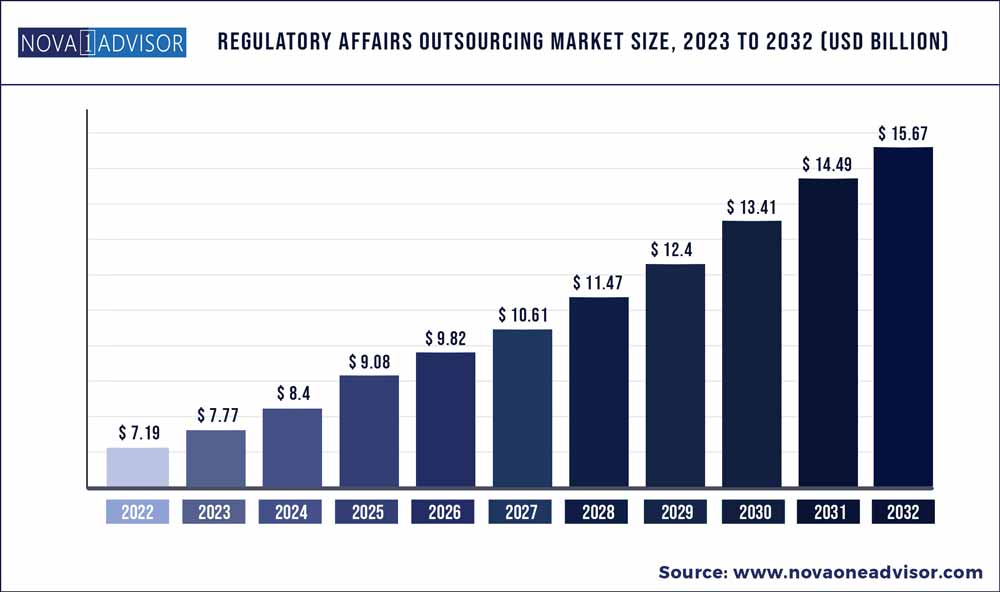

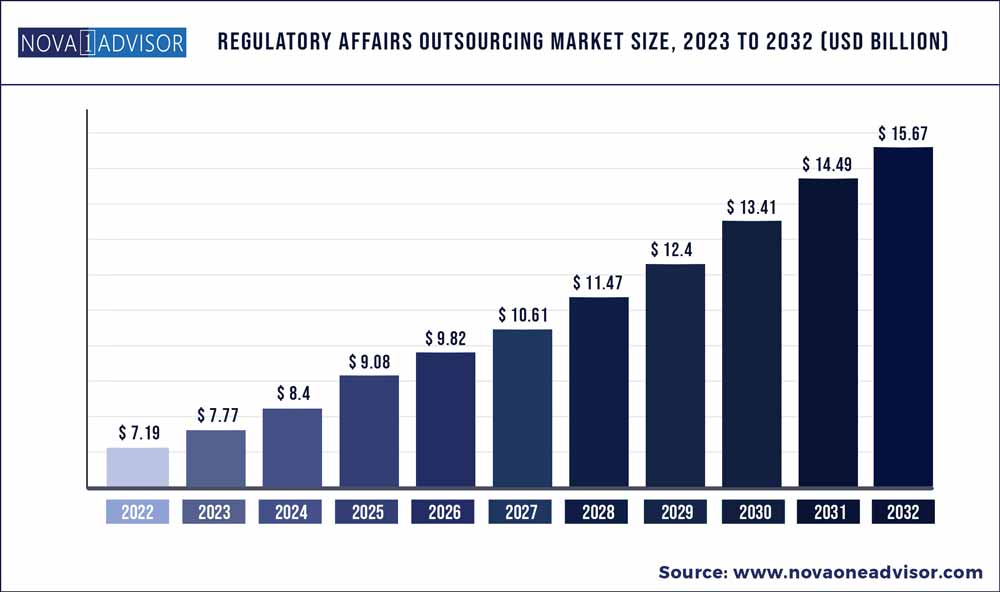

The global regulatory affairs outsourcing market size was exhibited at USD 7.19 billion in 2022 and is projected to hit around USD 15.67 billion by 2032, growing at a CAGR of xx% during the forecast period 2023 to 2032.

Key Pointers:

- The product registration and clinical trial applications segment dominated the market and accounted for the largest revenue share of more than 25.19% of the global revenue.

- The legal representation services segment is anticipated to witness the fastest growth rate of 8.6% over the forecast period of 2023-2032.

- The large companies segment is projected to register the fastest growth rate of 9.4% over the forecast period.

- The medium-sized companies segment accounted for the 47.9% revenue share in 2022

- The pharmaceutical segment dominated the market and accounted for the largest share of 62.14% in 2022.

- The medical device segment is projected to register a considerable CAGR of 8.1% over

- The oncology segment dominated the market and accounted for the largest share of more than 33.11% in 2022.

- The immunology segment is expected to expand at the fastest CAGR of 9.6% over the forecast period

- The clinical studies segment dominated the market and accounted for the largest revenue share of 47.10% in 2022.

- The preclinical segment is anticipated to expand at the fastest CAGR of 8.8% over

- The pharmaceutical companies segment dominated the market and accounted for the largest share of more than 39.9% in 2022.

- Asia Pacific region dominated the regulatory affairs outsourcing market and accounted for the largest revenue share of more than 38.22% in 2022.

- The North America regional market also reported a significant share in the global industry.

Regulatory Affairs Outsourcing Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 7.77 Billion

|

|

Market Size by 2032

|

USD 15.67 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 8.1%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

Service, company size, category, indication, stage, end-use, region

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Accell Clinical Research; LLC; Genpact; CRITERIUM, INC; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; ICON plc; Covance, Inc. (Labcorp Drug Development); Parexel International Corporation; Freyr; PHARMALEX GMBH; NDA Group AB; Pharmexon; Qvigilance; BlueReg; Cambridge Regulatory Services; APCER Life Sciences, Inc.; Real Regulatory Ltd; VCLS; PrimeVigilance; ProPharma Group MIS Limited; Regulatory Pharma Net srl; ZEINCRO; BioMapas; Regenold Gmbh

|

The outsourcing of regulatory affairs has become an increasingly important practice in the healthcare industry. An increase in geographical expansion activities by companies that aim for speedy approvals in local markets is expected to contribute to the adoption of outsourcing models for regulatory services. The outsourcing market for regulatory affairs is expanding rapidly due to the increase in R&D activities, augmenting the volume of clinical trial applications and product registration.

increase in the fixed costs of in-house resources for regulatory affairs & operation activities like training, technology, specialized knowledge, and facilities are driving outsourcing of regulatory affair functions. Addressing local regulatory challenges and constant changes in the regulations of the major markets, such as the U.S., Europe, and Asia, is creating demand for these services. Compliance with the current regulations has become an immense chore, leave alone trying to stay up to date with developments around the world. Amendments to current regulations are likely to simplify the regulatory pathway for the industry but in turn, complicate the operation for healthcare product manufacturing companies. Thus, leading to the regulatory affairs outsourcing to service providers.

The market witnessed a significant decline in 2020 due to the outbreak of the COVID-19 pandemic, as there was a halt in clinical trial activities including regulatory updates. Disruption in the supply chain and closure of R&D sites resulted in a significant loss of revenues in 2020 across the industry. However, due to the pandemic, various healthcare companies are opting for more regulatory advice, as companies push to speed up the product development & approvals in therapies, vaccines, & devices for COVID-19. Owing to the urgent need for medical devices and therapies for COVID-19, regulatory authorities are providing emergency use authorization for the majority of products. Such actions have further promoted the demand for these services post 2022 and the positive rebound of sales across the industry can be witnessed from 2023.

Services Insights

The product registration and clinical trial applications segment dominated the market and accounted for the largest revenue share of more than 25.19% of the global revenue. The increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific is driving the outsourcing trend for clinical trial applications.

The legal representation services segment is anticipated to witness the fastest growth rate of 8.6% over the forecast period of 2023-2032. This is due to the increasing demand for legal representatives across the globe on account of the globalization of medical devices and pharmaceutical companies. The regulations are very complex and ever-changing. Changing the regulatory landscape in regions, such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and custom clearance. These factors are promoting the demand for legal representation services globally.

Company Size Insights

The large companies segment is projected to register the fastest growth rate of 8.5% over the forecast period. Large companies generally prefer to establish long-term relations with their service providers to avoid sudden disruption in their operations and thus, prefer a service provider that can meet their regulatory needs to support their various cross-scale and ramp-up operations. Apart from this, according to an article published by GEP (2020), large-scale pharma companies generally outsource about 50% of their regulatory affairs needs. These factors are contributing to the growth of this segment.

On the basis of company sizes, the market has been divided into small, medium, and large. The medium-sized companies segment accounted for the 47.9% revenue share in 2022 and is estimated to expand further retaining the leading position over the forecast period. The presence of several mid-sized established providers, especially privately-held ones, is anticipated to contribute to this segment share. Moreover, the medium-sized pharmaceutical and medical device companies do not have enough capital to develop an in-house regulatory affairs team, which is further driving the demand for regulatory affairs outsourcing among medium-sized companies.

Category Insights

The pharmaceutical segment dominated the market and accounted for the largest share of 62.14% in 2022. The pharmaceutical segment is currently leading the regulatory affairs outsourcing market due to the increasing demand for regulatory support services in the pharmaceutical industry. With the growing number of new drug applications and the increasing complexity of regulatory requirements, pharmaceutical companies are increasingly outsourcing their regulatory affairs functions to specialized service providers. Outsourcing enables these companies to access the expertise of regulatory professionals and reduce costs associated with maintaining an in-house regulatory affairs team. Additionally, the pharmaceutical segment is also witnessing growth due to the increasing focus on drug safety, efficacy, and quality, which requires extensive regulatory support.

However, the medical device segment is projected to register a considerable CAGR of 8.1% over the forecast period of 2023-2030, this can be attributed to the fact that medical devices companies are now focusing on their core competencies and outsourcing noncore functions to increase their productivity and operational efficiency. The growing demand for advanced medical devices and new technological advancements in medical devices are further contributing to the growth of the segment.

Indication Insights

The oncology segment dominated the market and accounted for the largest share of more than 33.11% in 2022. The recent advances in the biology of cancer and the emergence of new tools for genome analysis have opened a clinical perspective in oncology, which has led to personalized medicine. Scientific progress is driving an increase in the number of personalized medicine products and services subject to regulatory review. Hence, contributing to the market growth. Other indications included in the scope of the study are neurology, cardiology, immunology, and others.

The immunology segment is expected to expand at the fastest CAGR of 9.6% over the forecast period of 2023-2030. This is due to its potential in facilitating the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases. The strategic initiatives undertaken by market players for immunology are anticipated to facilitate the segment growth. For instance, in 2020, Eli Lilly entered into an agreement to acquire Dermira’s immunology portfolio. In addition, the COVID-19 pandemic had created an urgent need for vaccines. Thus, the development of vaccines for COVID-19 is likely to have a positive impact on segment growth.

Stage Insights

The clinical studies segment dominated the market and accounted for the largest revenue share of 47.10% in 2022. This can be attributed to the increasing number of clinical trial registrations over the past few years. According to ClinicalTrials.gov, nearly 401,716 trials were registered in January 2022, as compared to around 325,834 by the end of 2019. Moreover, this rise in the number of biologics, high demand for advanced technologies, and a requirement for personalized orphan drugs & medicine are other factors likely to fuel segment growth during the forecast period.

The preclinical segment is anticipated to expand at the fastest CAGR of 8.8% over the forecast period of 2023-2030. The rising demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, and the increasing prevalence of existing diseases, such as CVDs, cancer, and neurological diseases are the key factors contributing to the preclincial segment’s growth. Moreover, stringent regulations related to preclinical studies, laid down by global regulatory bodies, such as International Conference on Harmonization (ICH), WHO, FDA, EMEA (Europe), PMDA (Japan), ANVISA (Brazil), MHRA (UK), & ROEB (Canada), are further driving the demand for regulatory affairs outsourcing agency for preclinical studies.

End-use Insights

The pharmaceutical companies segment dominated the market and accounted for the largest share of more than 39.9% in 2022. The segment is anticipated to expand further at the fastest CAGR of 8.0% retaining its leading market position over the forecast period. This is due to the growth in evolving areas, such as biosimilar, orphan drugs, and personalized medicines, which are creating more demand for regulatory services, thereby boosting the segment growth. In addition, the significant number of new drugs entering the pharmaceutical industry has further improved segment growth.

The medical device and biotechnology companies segments both have registered a substantial share in the market in 2022. This can be attributed to the increased demand for biopharmaceuticals, vaccines, advanced medical devices, and others. The growing demand for wearable technologies along with recent epidemic events is further contributing to the share of these segments. Furthermore, the increasing number of launches pertaining to medical devices is another significant factor boosting demand for regulatory affairs services, thus supporting segmental growth.

Regional Insights

Asia Pacific region dominated the regulatory affairs outsourcing market and accounted for the largest revenue share of more than 38.22% in 2022. The region is also projected to witness the fastest CAGR over the forecast period. This can be attributed to the increasing number of clinical trials and the rising number of companies trying to enter markets in developing countries, such as India and China. Furthermore, the availability of a skilled workforce in the region at lower costs compared to the U.S. is another factor expected to propel the regional market growth.

The North America regional market also reported a significant share in the global industry. The presence of key pharmaceutical and medical devices companies and the rise in the R&D spending in the region and some of the key factors driving the market in North America. North America and Europe are expected to be the key markets for regulatory affairs outsourcing owing to the presence of two major international regulatory agencies, the European Medicines Agency (EMA) and U.S. FDA, which regulate more than half of medical devices worldwide.

Some of the prominent players in the Regulatory Affairs Outsourcing Market include:

- Accell Clinical Research, LLC

- Genpact

- CRITERIUM, INC

- Promedica International

- WuXi AppTec

- Medpace

- Charles River Laboratories

- ICON plc

- Covance, Inc. (Labcorp Drug Development)

- Parexel International Corporation

- Freyr

- PHARMALEX GMBH

- NDA Group AB

- Pharmexon

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- APCER Life Sciences, Inc.

- Real Regulatory Ltd

- VCLS

- PrimeVigilance

- ProPharma Group MIS Limited

- Regulatory Pharma Net srl

- ZEINCRO

- BioMapas

- REGENOLD GMBH

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Regulatory Affairs Outsourcing market.

By Service

- Regulatory Consulting

- Strategy & Development Planning

- QA Consulting

- Others

- Legal Representation

- Regulatory Writing & Publishing

- Product Registration & Clinical Trial Applications

- Regulatory Submission

- Regulatory Operations

- Other Services

By Company Size

By Category

- Pharmaceuticals

- Regulatory Consulting

- Strategy & Development Planning

- QA consulting

- Others

- Legal Representation

- Regulatory Writing & Publishing

- Product Registration & Clinical Trial Applications

- Regulatory Submissions

- Regulatory Operations

- Other Services

- Medical Device

- Regulatory Consulting

- Strategy & Development Planning

- Qa Consulting

- Others

- Legal Representation

- Regulatory Writing & Publishing

- Product Registration & Clinical Trial Applications

- Regulatory Submissions

- Regulatory Operations

- Other Services

By Indication

- Oncology

- Neurology

- Cardiology

- Immunology

- Others

By Stage Outlook

- Preclinical

- Clinical

- PMA (Post Market Authorization)

By End-use

- Medical Device Companies

- Pharmaceutical Companies

- Biotechnology Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)