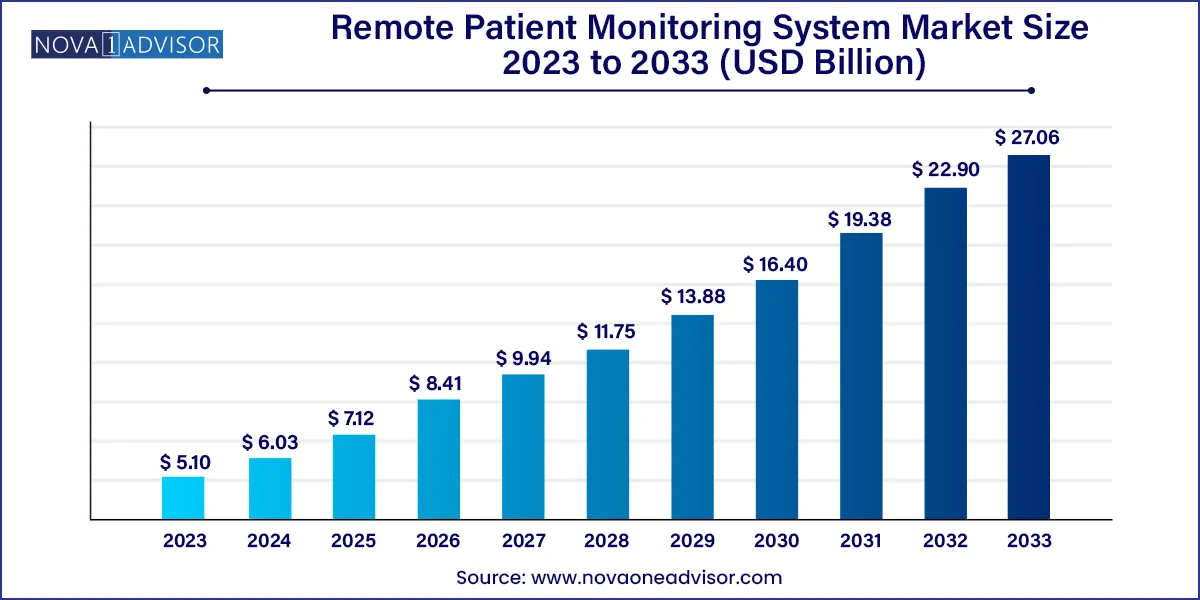

The global remote patient monitoring system market size was exhibited at USD 5.10 billion in 2023 and is projected to hit around USD 27.06 billion by 2033, growing at a CAGR of 18.16% during the forecast period 2024 to 2033.

Key Takeaways:

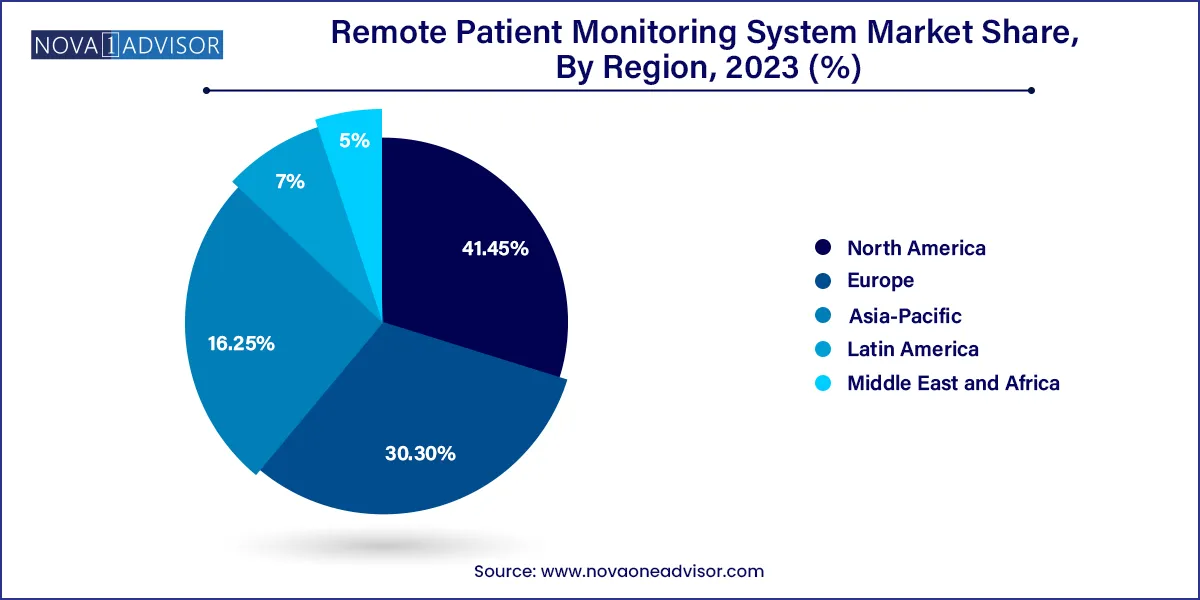

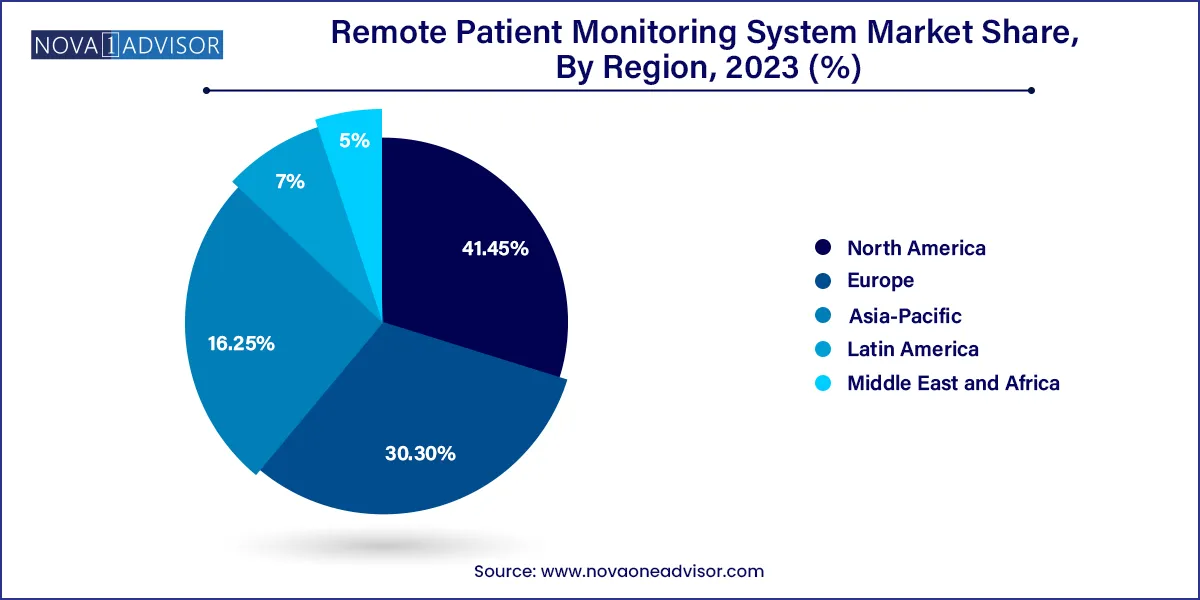

- North America dominated the remote patient monitoring system industry in 2023, accounting for more than 41.45% of the total market share.

- The special monitors segment led the market with a share of over 82.54% in 2023.

- Diabetes emerged as the leading application segment in 2023 and accounted for 13.2% of the market share.

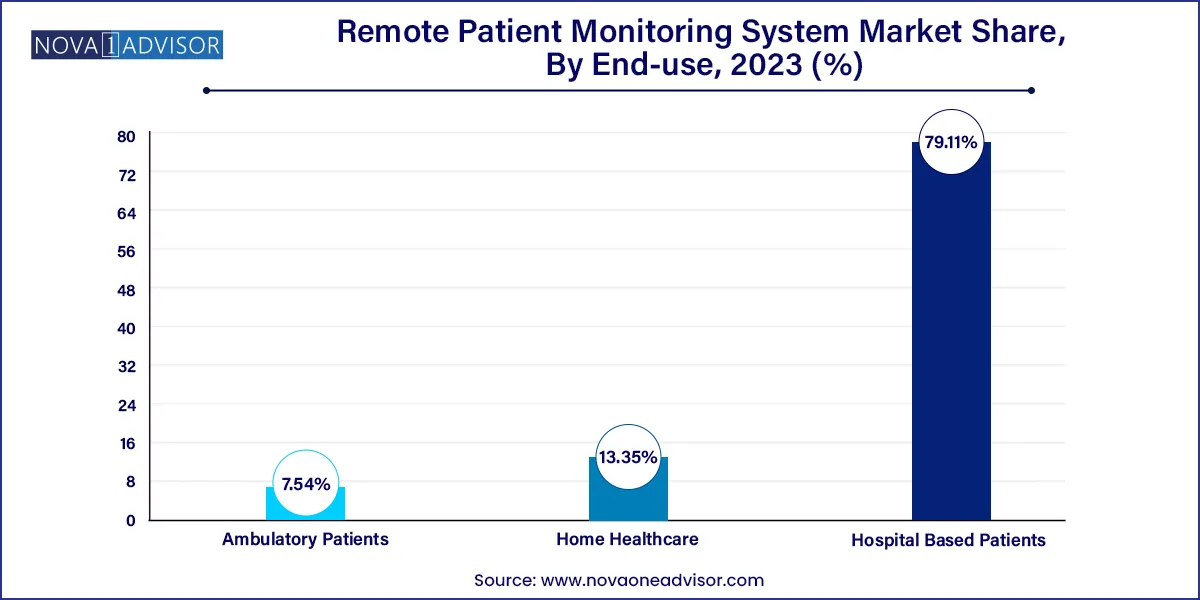

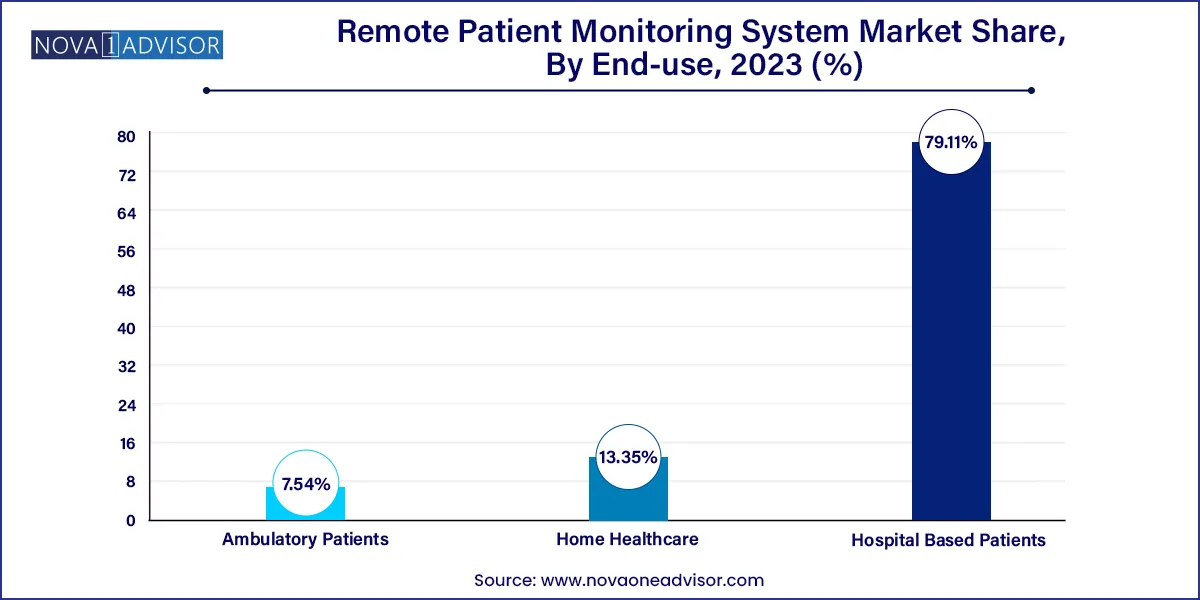

- The hospital-based patient segment was the leading end-use segment in 2023 and accounted for 79.11% of the market share.

- However, alternate site monitoring, especially home healthcare, is anticipated to exhibit a sturdy CAGR over the forecast period.

Market Overview

The global Remote Patient Monitoring (RPM) System Market has emerged as a pivotal component of the modern healthcare ecosystem. Leveraging advanced digital technologies, RPM enables healthcare providers to remotely track and manage patient health outside traditional clinical settings. This paradigm shift from episodic care to continuous and proactive healthcare is being driven by the dual forces of technological advancement and evolving patient expectations. Whether for chronic disease management, post-operative care, or wellness monitoring, RPM systems are redefining the scope of medical service delivery.

Remote patient monitoring systems typically include medical devices such as blood pressure monitors, pulse oximeters, and glucose meters that connect to platforms collecting and transmitting real-time data to healthcare providers. This data-driven approach facilitates early intervention, reduces hospital admissions, improves patient compliance, and lowers overall healthcare costs. The COVID-19 pandemic significantly accelerated RPM adoption globally, showcasing its utility in reducing healthcare facility burden while maintaining patient care continuity. As healthcare systems globally pivot toward value-based models, RPM systems are positioned to become indispensable tools in chronic disease management, elder care, and personalized medicine.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI) in RPM solutions for predictive analytics and personalized care recommendations.

-

Growth in wearable health tech such as smartwatches and biosensors, enhancing real-time patient monitoring.

-

Cloud-based data management platforms that ensure scalable and secure storage of patient information.

-

Expansion of RPM coverage by insurance providers under value-based care models.

-

Increased adoption of mobile health (mHealth) apps for seamless communication and data sharing between patients and providers.

-

Focus on remote monitoring for mental health and sleep disorders, driven by increased awareness and diagnosis rates.

-

Government initiatives supporting telehealth infrastructure, especially in underserved and rural areas.

Report Scope of the Remote Patient Monitoring System Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.03 Billion |

| Market Size by 2033 |

USD 27.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.16% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; Nihon Kohden Corporation; Omron Corporation; OSI Systems, Inc.; Koninklijke Philips N.V.; F. Hoffmann-La Roche Ltd; Welch Allyn; Smiths Medical; Abbott; Boston Scientific Corporation; Dräger Medical; GE Healthcare; Honeywell; Johnson & Johnson; LifeWatch; Medtronic; Masimo; Vitls, Inc.; CareValidate; Biotronik; American Telecare. |

Key Market Driver

Chronic Disease Prevalence and Aging Population

The rising incidence of chronic diseases, such as diabetes, hypertension, and cardiovascular disorders, has become a dominant driver for RPM adoption. According to the World Health Organization, chronic diseases account for 71% of all deaths globally. Managing these conditions requires continuous monitoring, timely intervention, and patient education. RPM systems provide exactly that. For instance, diabetic patients using continuous glucose monitors (CGMs) can share data with endocrinologists in real-time, enabling dosage adjustments without an in-person visit. Additionally, aging populations in regions like Japan, Italy, and the U.S. are prompting healthcare systems to adopt RPM to manage complex, multi-morbidity patients at home, preserving hospital resources while maintaining quality care.

Major Market Restraint

Data Privacy and Security Concerns

As RPM systems heavily depend on digital connectivity and cloud-based platforms, data privacy and cybersecurity are major concerns. These systems collect sensitive health information that, if compromised, can result in serious breaches of patient confidentiality. Moreover, the healthcare sector has become a prime target for cyberattacks. Lack of standardized cybersecurity protocols and inconsistent regulatory frameworks across regions add complexity. Patient trust is crucial, and data breaches can severely undermine the credibility of RPM technologies. Regulatory compliance, such as HIPAA in the U.S. and GDPR in Europe, must be enforced strictly to mitigate these risks and ensure system resilience.

Emerging Market Opportunity

RPM in Rural and Underserved Areas

Remote patient monitoring holds immense potential in bridging healthcare access gaps, especially in rural and remote regions with limited medical infrastructure. By deploying RPM solutions, healthcare providers can offer real-time monitoring and virtual consultations, reducing the need for travel and improving health outcomes. For example, in India, startups like Dozee are equipping primary health centers with RPM tools to track vital parameters for early detection of illness. Similarly, U.S. government-funded programs are supporting broadband expansion and telemonitoring devices in medically underserved areas. The scalability and adaptability of RPM systems make them ideal for expanding reach and equity in global healthcare delivery.

Segments Insights:

Remote Patient Monitoring System Market By Product Insights

Vital sign monitors currently dominate the RPM market, driven by their widespread use and essential role in monitoring key health parameters such as blood pressure, pulse, and temperature. Blood pressure monitors and pulse oximeters are especially prevalent, given the high incidence of cardiovascular and respiratory conditions. These devices are affordable, user-friendly, and commonly integrated into both hospital-based and home healthcare RPM programs. Heart rate monitors and temperature monitors also play key roles in early detection of systemic infections and cardiovascular events.

Conversely, special monitors are the fastest-growing segment. Devices like continuous glucose monitors, prothrombin monitors, and fetal heart monitors are being increasingly adopted for disease-specific monitoring. For instance, real-time blood glucose tracking allows diabetic patients to maintain optimal glucose levels with minimal clinical visits. Similarly, respiratory monitors and multi-parameter monitors are gaining traction in intensive care and neonatal care, where comprehensive and continuous monitoring is essential. Innovation in device miniaturization and wireless integration is accelerating growth in this segment

Remote Patient Monitoring System Market By Application Insights

The cardiovascular disease segment holds the largest share in the RPM market due to the global burden of heart-related conditions and the need for continuous monitoring. ECG monitors, blood pressure monitors, and pulse oximeters are integral in managing heart disease patients, especially post-surgical or during cardiac rehabilitation. Hospitals are increasingly discharging patients with home-based RPM kits to ensure recovery monitoring, reduce readmissions, and enable early detection of complications.

Diabetes monitoring is rapidly emerging as the fastest-growing application. The global rise in Type 2 diabetes prevalence, especially in middle-income countries, has boosted demand for remote blood glucose monitoring tools. The development of advanced CGMs like Abbott’s FreeStyle Libre and Dexcom G7 has empowered patients with real-time data and alerts. Coupled with mobile apps and AI-driven analytics, RPM systems are offering diabetics enhanced control over their condition and reducing long-term complications.

Remote Patient Monitoring System Market By End-use Insights

Home healthcare is the dominant end-use segment, driven by the increasing preference for in-home care, especially among elderly and chronically ill patients. RPM systems offer a practical alternative to frequent hospital visits, enabling continuous supervision in a familiar setting. Post-acute care, post-operative recovery, and long-term disease management are increasingly being managed via home-based RPM systems. This trend is further supported by health insurance providers who offer reimbursements for RPM devices used at home.

Ambulatory patient monitoring is witnessing the fastest growth. These patients, often transitioning from inpatient to outpatient settings, benefit significantly from RPM tools during recovery or therapy phases. Wearable ECG monitors, portable pulse oximeters, and Bluetooth-enabled glucometers are enabling real-time health tracking on the move. Ambulatory RPM use is expanding in clinical trial settings as well, where real-world data collection enhances trial efficiency and patient safety.

Remote Patient Monitoring System Market By Regional Insights

North America leads the RPM market, primarily due to technological readiness, healthcare digitization, and favorable reimbursement policies. The U.S. Centers for Medicare & Medicaid Services (CMS) have significantly expanded coverage for RPM services under various care models. Companies like Philips Healthcare, Medtronic, and ResMed have strong RPM portfolios tailored for chronic disease management. Furthermore, the region's robust telehealth infrastructure and consumer acceptance of digital health tools have enabled large-scale deployment of RPM solutions. Academic research institutions are also collaborating with tech companies to develop advanced RPM algorithms for predictive health monitoring.

The Asia-Pacific region is experiencing the fastest growth in RPM adoption, fueled by increasing healthcare expenditures, a rising elderly population, and rapid urbanization. Countries like China, Japan, South Korea, and India are investing in digital health technologies to expand healthcare access. For example, the Japanese government is actively promoting remote monitoring for elderly care through subsidies and pilot programs. In India, telemedicine platforms are integrating RPM to serve rural and tier-2 cities. Startups across the region are innovating cost-effective, multilingual RPM solutions tailored for diverse populations. The combination of growing chronic disease burden and smartphone penetration makes Asia-Pacific a high-potential growth frontier.

Recent Developments

-

Philips Healthcare, in March 2024, launched its next-generation RPM platform that includes AI-enhanced decision support tools and expanded device compatibility.

-

In February 2024, Dexcom announced the FDA approval of its G7 Continuous Glucose Monitoring System for broader use in home settings.

-

ResMed, in January 2024, acquired Mementor, a digital health startup focused on sleep disorder RPM, expanding its remote care portfolio.

-

Masimo Corporation partnered with Google Cloud in December 2023 to enhance RPM data analytics and integrate machine learning insights for clinical use.

-

Dozee, an Indian health-tech startup, raised fresh funding in November 2023 to scale its RPM solutions across government hospitals in rural areas.

Some of the prominent players in the Remote patient monitoring system market include:

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd

- Nihon Kohden Corporation

- Omron Corporation

- OSI Systems, Inc.

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd

- Welch Allyn

- Smiths Medical

- Abbott

- Boston Scientific Corporation

- Dräger Medical

- GE Healthcare

- Honeywell

- Johnson & Johnson

- LifeWatch

- Medtronic

- Masimo

- Vitls, Inc

- CareValidate

- Biotronik

- American Telecare

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global remote patient monitoring system market.

Product

-

- Blood Pressure Monitors

- Pulse Oximeters

- Heart Rate Monitor (ECG)

- Temperature Monitor

- Respiratory Rate Monitor

- Brain Monitoring (EEG)

-

- Anesthesia Monitors

- Blood Glucose Monitors

- Cardiac Rhythm Monitor

- Respiratory Monitor

- Fetal Heart Monitors

- Prothrombin Monitors

- Multi Parameter Monitors (MPM)

- Others

Application

- Cancer

- Cardiovascular Diseases

- Diabetes

- Sleep Disorder

- Weight Management and Fitness Monitoring

- Bronchitis

- Infections

- Virus

- Dehydration

- Hypertension

End-use

- Hospital Based Patients

- Ambulatory Patients

- Home Healthcare

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)