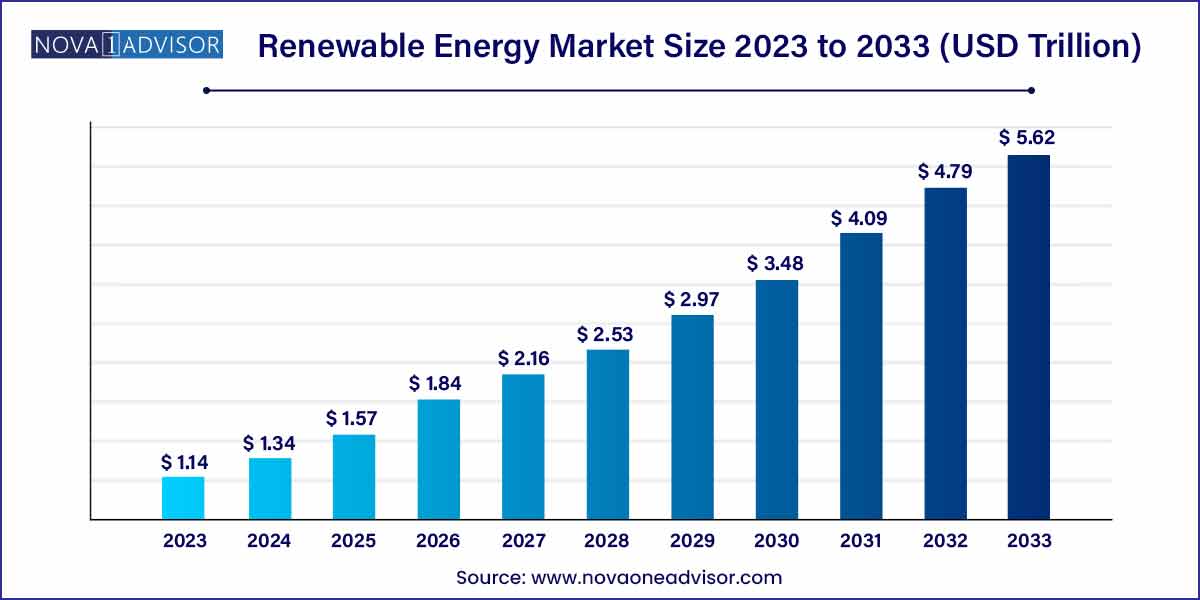

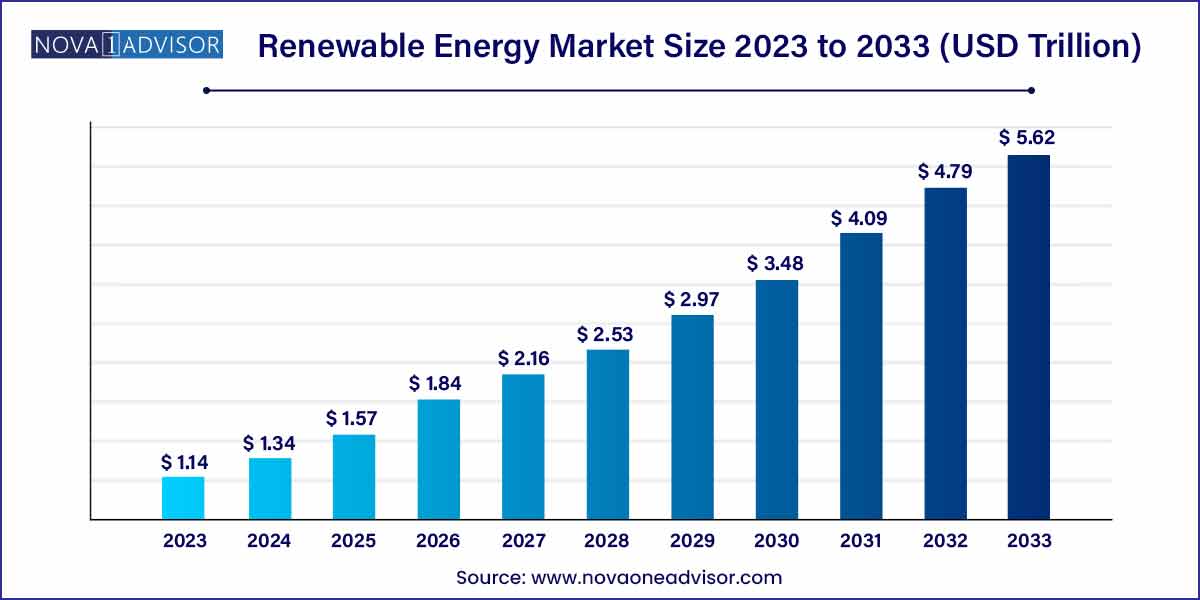

The global renewable energy market size was estimated at USD 1.14 trillion in 2023 and is projected to hit around USD 5.62 Trillion by 2033, growing at a CAGR of 17.3% during the forecast period from 2024 to 2033.

Key Takeaways:

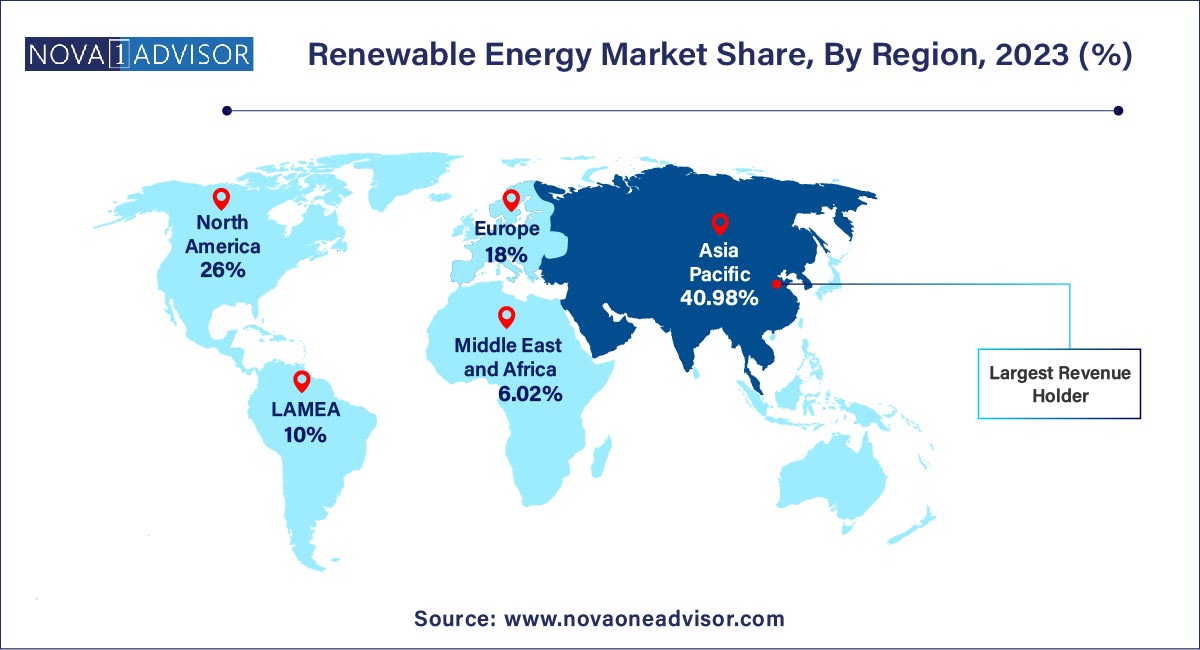

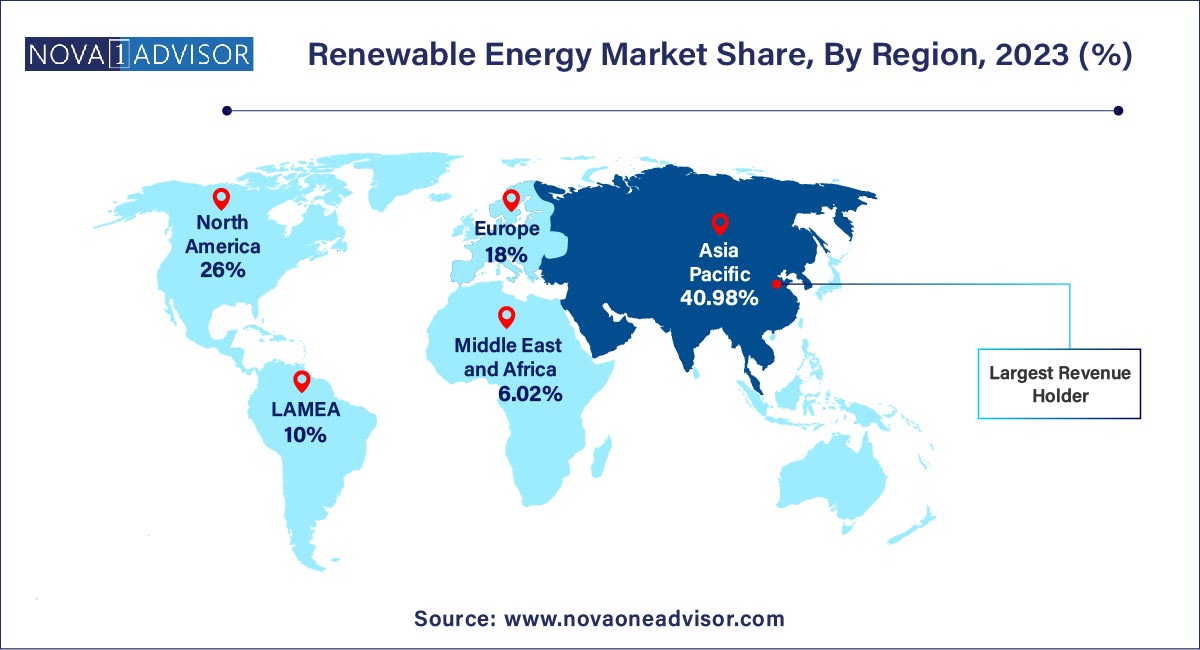

- Asia Pacific accounted for a significant revenue share of 40.98% in 2023.

- The market in North America is expected to grow at a significant pace over the forecast period.

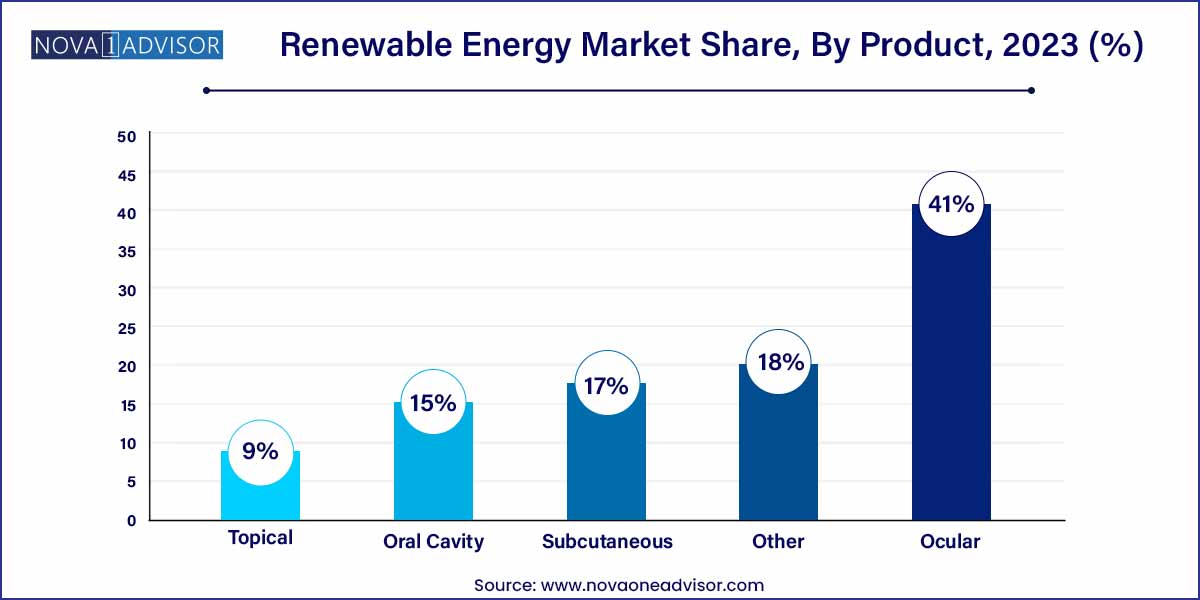

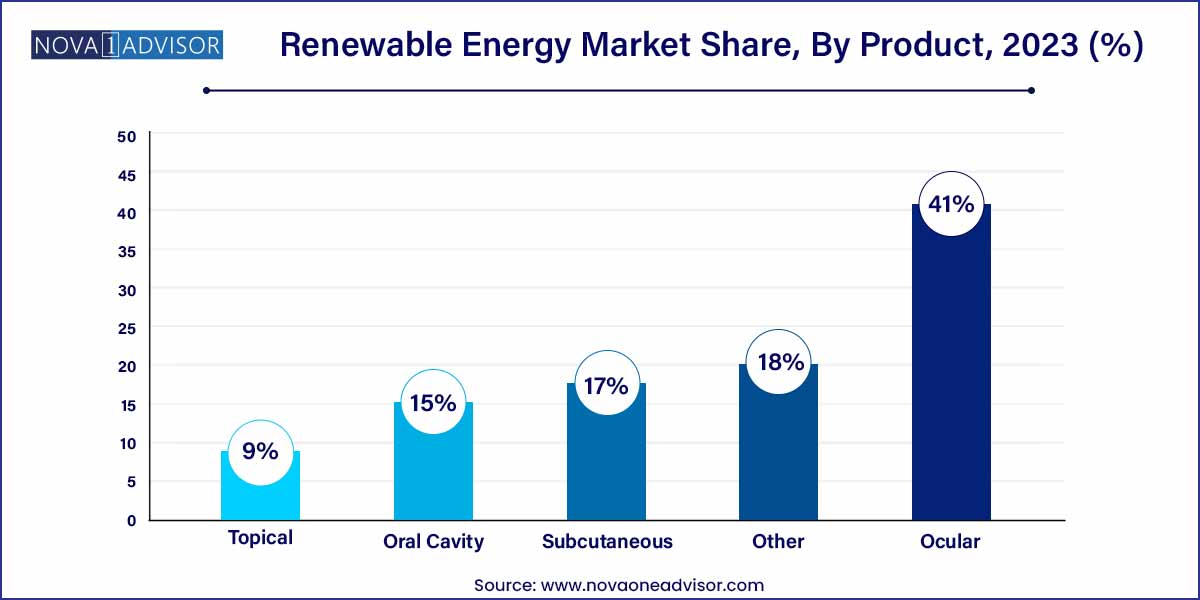

- The solar power segment accounted for the largest market share of 41% in 2023

- Hydropower segment accounted for a significant revenue share of 18% in 2023.

- Wind power and bioenergy segments are also expected to increase steadily over the forecast period

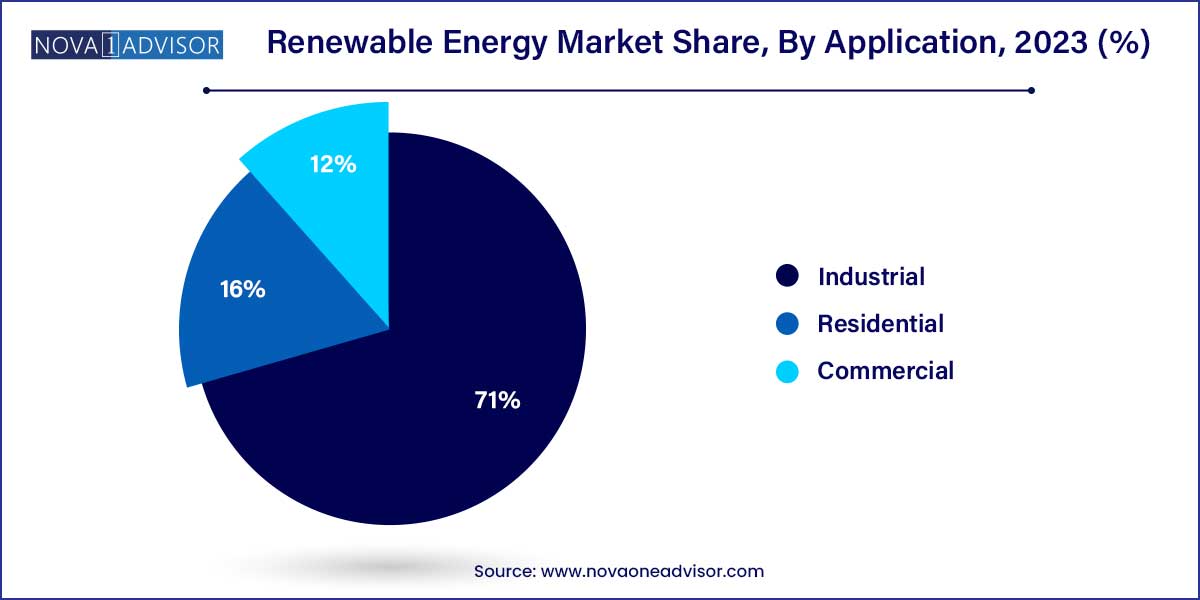

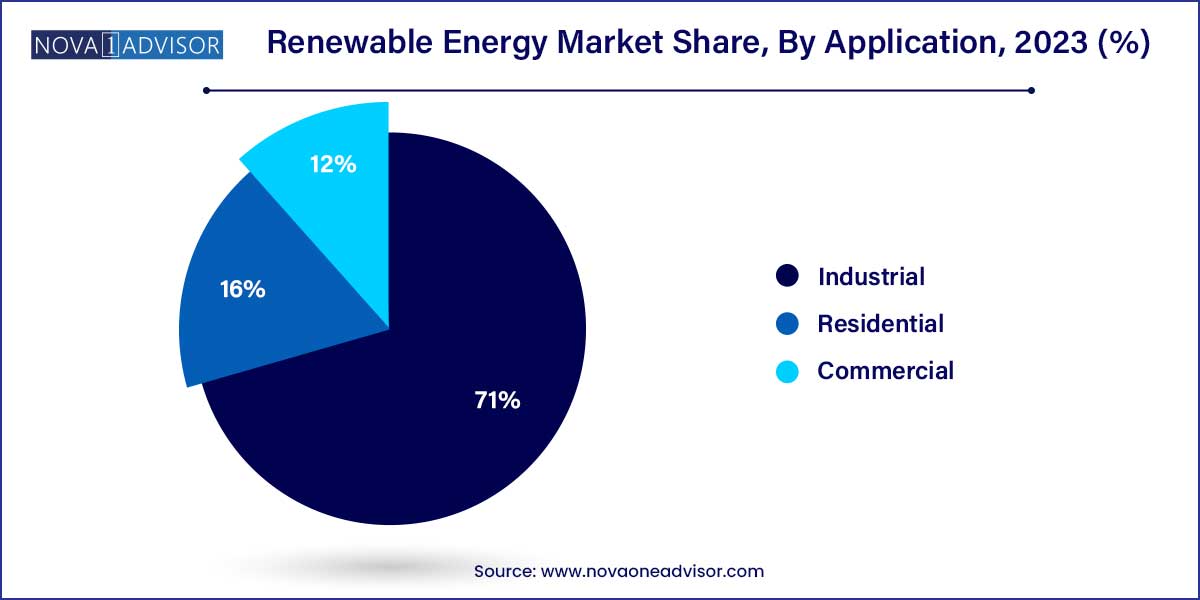

- The industrial segment led the market in 2023 and accounted for a revenue share of 71%.

- The expansion of solar PV panels facility in residential applications is expected to increase product demand over forecast period.

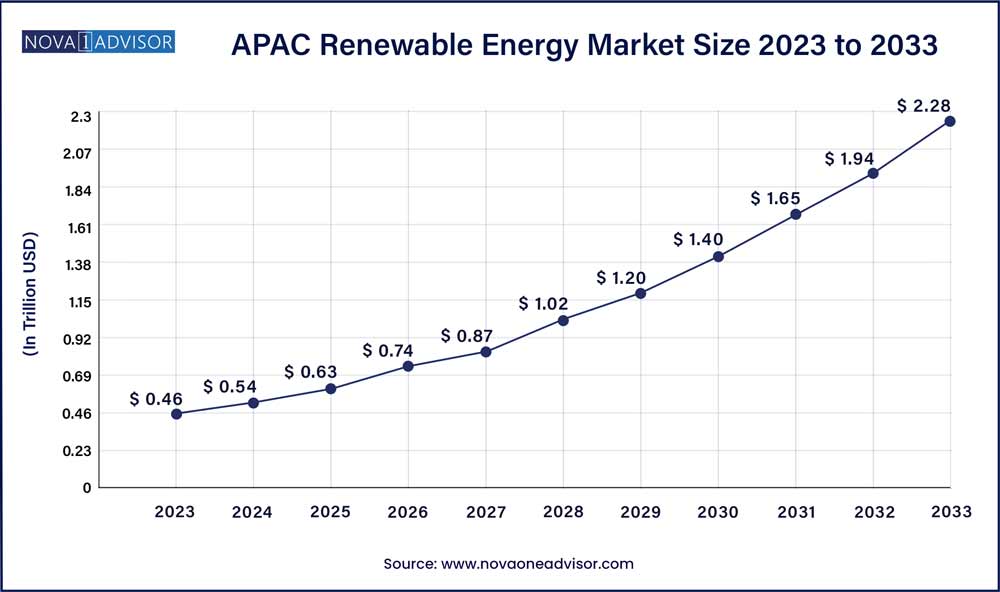

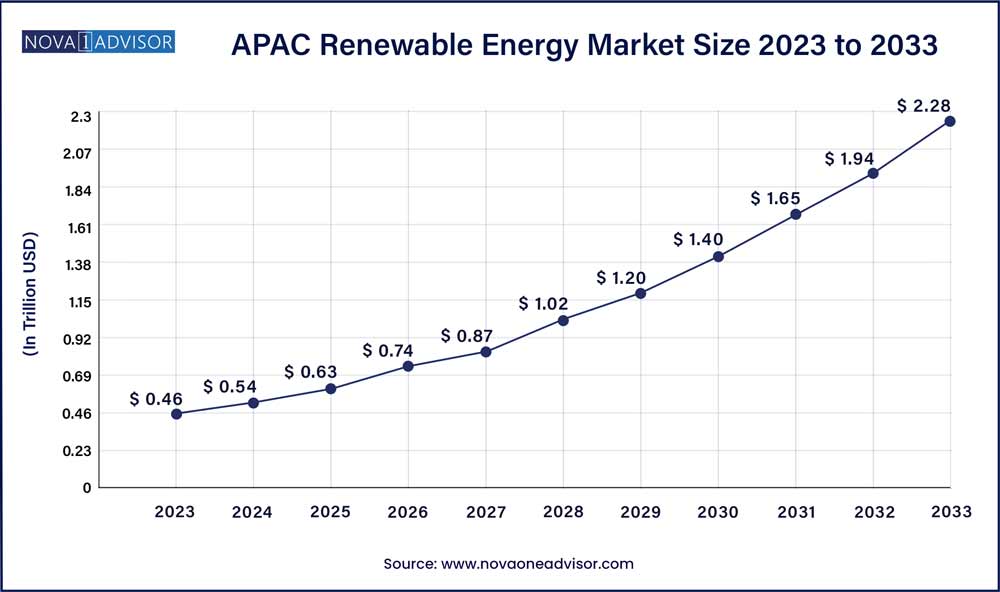

Renewable Energy Market Size in Asia Pacific 2024 To 2033

The Asia Pacific renewable energy market size was estimated at USD 0.46 Trillion in 2023 and is expected to surpass around USD 2.28 Trillion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 17.42% during the forecast period 2024 to 2033.

Asia-Pacific dominates the global renewable energy market, led by massive installations in China, India, Japan, and Australia. China alone accounted for over 50% of new global renewable capacity additions in 2024. With a vast coastline, favorable irradiance, and extensive government support, the region is home to the world’s largest solar farms (e.g., Tengger Desert Solar Park) and offshore wind facilities. India's ambitious 500 GW renewable target by 2030 is driving unprecedented investment, while Japan is ramping up solar and offshore wind to compensate for nuclear phase-outs.

Middle East & Africa (MEA) is the fastest-growing region, albeit from a smaller base. The region is pivoting from hydrocarbon dependence to diversify energy portfolios. Countries like Saudi Arabia (NEOM project), UAE (Mohammed bin Rashid Al Maktoum Solar Park), and Egypt (Benban Solar Park) are investing billions in solar and wind infrastructure. Simultaneously, Sub-Saharan Africa is using decentralized solar mini-grids and home systems to electrify rural populations, catalyzed by organizations like Power Africa and the African Development Bank.

Market Overview

The Renewable Energy Market is undergoing a profound transformation, emerging as the cornerstone of the global energy transition amid escalating environmental concerns, depleting fossil fuel reserves, and pressing climate change commitments. Renewable energy refers to energy derived from naturally replenishing resources such as sunlight, wind, rain, tides, waves, and geothermal heat. Unlike conventional fossil fuels, renewables offer the potential for an inexhaustible, clean, and increasingly cost-competitive energy supply.

Driven by international frameworks such as the Paris Agreement and Sustainable Development Goals (SDGs), the market is being catalyzed by aggressive decarbonization targets, advancements in technology, policy support, and changing consumer preferences. The renewable sector is no longer a niche it is now a critical component of national energy portfolios and industrial strategies, with cumulative investment surpassing $500 billion globally in 2023, according to BloombergNEF.

The expansion of renewables is not just driven by environmental mandates, but also by economic imperatives. The Levelized Cost of Electricity (LCOE) for solar and onshore wind has dropped dramatically in the last decade, making them more affordable than coal and gas in many regions. Grid parity has already been achieved in over 60 countries. Additionally, energy security concerns, especially after geopolitical events like the Russia-Ukraine war, have compelled countries to reduce dependency on imported fuels by accelerating domestic renewable capacity.

From massive offshore wind farms in the North Sea to decentralized rooftop solar systems in Indian villages, renewable energy is being deployed at every scale and across every geography. With its deepening integration into grid systems, hybrid energy models, and smart energy technologies, renewable energy is poised to lead the global energy future.

Major Trends in the Market

-

Hybrid Power Solutions: Combining solar, wind, and storage systems to create more stable and efficient power generation.

-

Green Hydrogen Production: Renewable electricity is increasingly being used to produce green hydrogen for use in industry, transport, and storage.

-

Energy-as-a-Service (EaaS): Companies and utilities are offering subscription-based clean energy models with solar panels, batteries, and smart meters bundled together.

-

Decentralization and Microgrids: Rural and remote regions are embracing off-grid and microgrid renewable solutions to improve energy access.

-

Corporate Power Purchase Agreements (PPAs): Tech giants and manufacturers are entering into long-term renewable PPAs to meet their sustainability goals.

-

Floating Solar and Offshore Wind Expansion: To overcome land constraints, countries are investing in floating PV and large-scale offshore wind platforms.

-

Digital Integration and AI in Energy Management: AI-powered forecasting, predictive maintenance, and blockchain-based energy trading are improving efficiency in renewable operations.

Renewable Energy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 1.34 Trillion |

| Market Size by 2033 |

USD 5.62 Trillion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.3% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, application, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Acconia S.A.; General Electric; Enel Spa; Tata Power; Innergex; Suzlon Energy Ltd.; Invenergy; ABB; Siemens Gamesa Renewable Energy, S.A.; Xcel Energy, Inc.; Schneider Electric |

Market Driver: Climate Policy Commitments and Decarbonization Strategies

The most powerful growth driver for the renewable energy market is the global commitment to reduce greenhouse gas emissions under international climate frameworks. As of 2025, more than 140 countries have set net-zero emission goals, with target dates ranging from 2030 to 2070. Achieving these objectives is impossible without a massive shift toward renewable energy sources.

Governments are enacting robust policy measures, including carbon pricing, tax credits, auctions, mandates for renewable portfolio standards (RPS), and direct subsidies. For instance, the European Union’s REPowerEU plan aims to deploy over 600 GW of solar and 510 GW of wind by 2030. Similarly, China’s 14th Five-Year Plan targets 33% of national electricity to come from non-fossil sources by 2025. In the U.S., the Inflation Reduction Act (IRA) allocates over $370 billion in incentives for clean energy. These frameworks give certainty to investors and developers, creating a fertile ecosystem for innovation and scaling.

Market Restraint: Grid Infrastructure and Storage Limitations

Despite its strong growth momentum, the renewable energy market faces significant challenges with grid integration and storage infrastructure. Unlike fossil fuels, which provide constant power, most renewables are intermittent solar and wind are weather-dependent, making them less predictable and harder to dispatch.

Many existing power grids were not designed to handle the variability of renewables or the bidirectional energy flows from decentralized sources like rooftop solar. Without modernized transmission lines, smart meters, and robust energy storage, renewable projects face curtailment and inefficiency. Battery technologies like lithium-ion are still expensive at grid scale, and while pumped hydro remains viable, it has geographical limitations. In markets such as India and parts of Africa, transmission losses, bottlenecks, and technical losses continue to delay or diminish the potential of large-scale renewable projects.

Market Opportunity: Electrification of Hard-to-Abate Sectors

A transformative opportunity for the renewable energy market lies in the electrification of sectors that are traditionally hard to decarbonize, such as heavy industry, transport, and heating. Using renewable electricity to power these sectors either directly or indirectly via green hydrogen, e-fuels, and heat pumps opens up multi-billion-dollar revenue streams.

For example, the steel industry, which currently relies on coal-based blast furnaces, is beginning to shift to green hydrogen-based Direct Reduced Iron (DRI) processes. Automotive giants are electrifying fleets, while public transportation systems are transitioning to battery-powered buses. Even aviation and maritime sectors are exploring renewable-powered synthetic fuels and hydrogen propulsion. The convergence of renewables with emerging technologies like electrified ammonia production, hydrogen fuel cells, and carbon capture utilization and storage (CCUS) is expanding the role of renewables far beyond conventional electricity generation.

Segments Insights:

By Product Insights

Hydropower currently dominates the renewable energy market, historically accounting for the largest share of renewable electricity production. Large-scale hydroelectric dams, especially in China, Brazil, Canada, and the U.S., have long provided stable, dispatchable power with low operational costs. Hydropower is particularly valuable for its grid-balancing capabilities and ability to serve as base-load power. However, environmental concerns, displacement issues, and finite river resources have slowed down new large-scale hydro developments in many countries.

In contrast, solar power is the fastest-growing segment, with global installed capacity surpassing 1.3 TW by early 2025. Solar is being rapidly deployed across residential rooftops, commercial facilities, and large utility-scale farms. Its modularity, short lead times, and scalability make it an ideal choice for distributed generation. Countries such as India, the U.S., China, and Germany are leading this charge, supported by falling PV module prices and robust incentive schemes. Innovations like perovskite solar cells, bifacial panels, and floating solar farms are further accelerating this growth.

By Application Insights

Industrial application dominates the renewable energy market, driven by large energy-intensive sectors such as manufacturing, chemicals, data centers, and mining. These industries are adopting renewables to reduce energy costs, improve ESG scores, and comply with climate disclosure regulations. Corporate renewable energy procurement, particularly through PPAs, is a major trend. Companies like Apple, Amazon, and Microsoft have committed to running entirely on renewable energy, spurring massive private investment in wind and solar projects.

Meanwhile, residential application is the fastest-growing, fueled by energy independence concerns, high utility bills, and government incentives. Rooftop solar installations are booming in countries like Australia, the U.S., and Germany. In developing economies, solar home systems are bringing electricity to off-grid rural areas. The bundling of solar panels with battery storage and smart home energy management systems is also gaining traction, creating resilient, self-sufficient households in both urban and rural contexts.

Recent Developments

-

March 2025 – Siemens Gamesa secured a contract to supply 100 wind turbines to a 1.2 GW offshore wind project in Taiwan, one of the largest offshore developments in Asia-Pacific.

-

February 2025 – Tesla Energy launched its V5 solar roof system in Europe, combining PV generation with integrated Powerwall storage and smart grid-ready inverters.

-

January 2025 – Adani Green Energy announced the commissioning of a 2 GW hybrid solar-wind park in Gujarat, India, touted as the largest hybrid renewable facility globally.

-

November 2024 – Ørsted began construction of a 1.5 GW floating offshore wind farm off the coast of Norway, leveraging advanced anchoring systems for deep-water deployment.

-

September 2024 – Shell and BP jointly invested $1.8 billion in green hydrogen production plants powered by onshore wind and solar in Oman, targeting export markets in Europe and Asia.

Key Renewable Energy Companies:

- ABB

- Acconia S.A.

- Enel Spa

- General Electric

- Innergex

- Invenergy

- Schneider Electric

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Ltd.

- Tata Power

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Renewable Energy market.

By Product

- Hydropower

- Wind Power

- Solar Power

- Bioenergy

- Others

By Application

- Industrial

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)