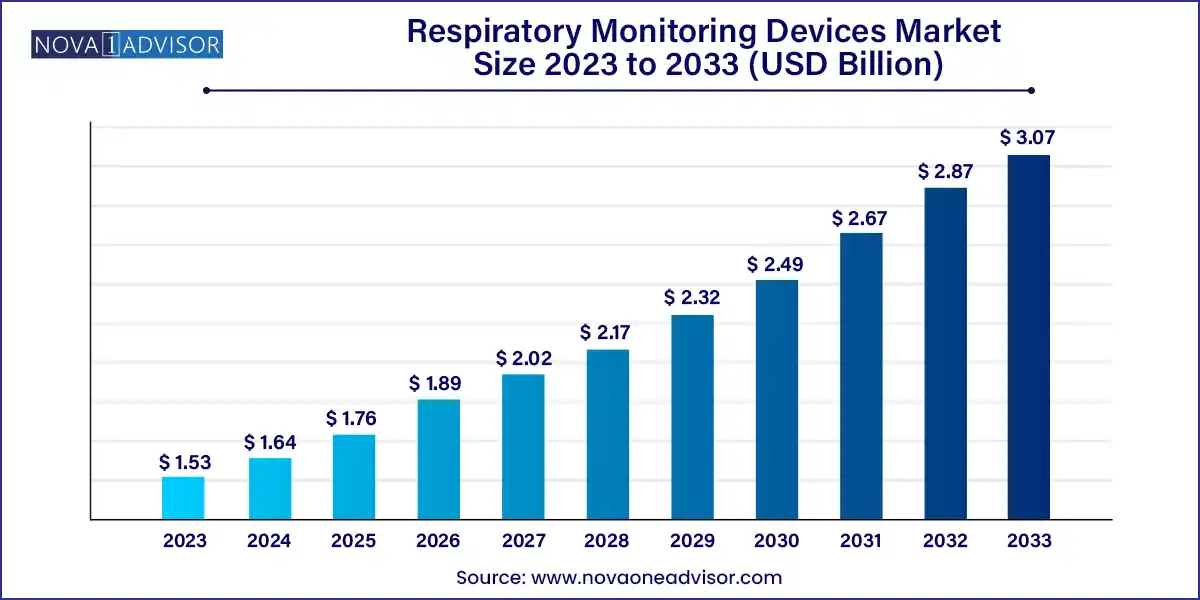

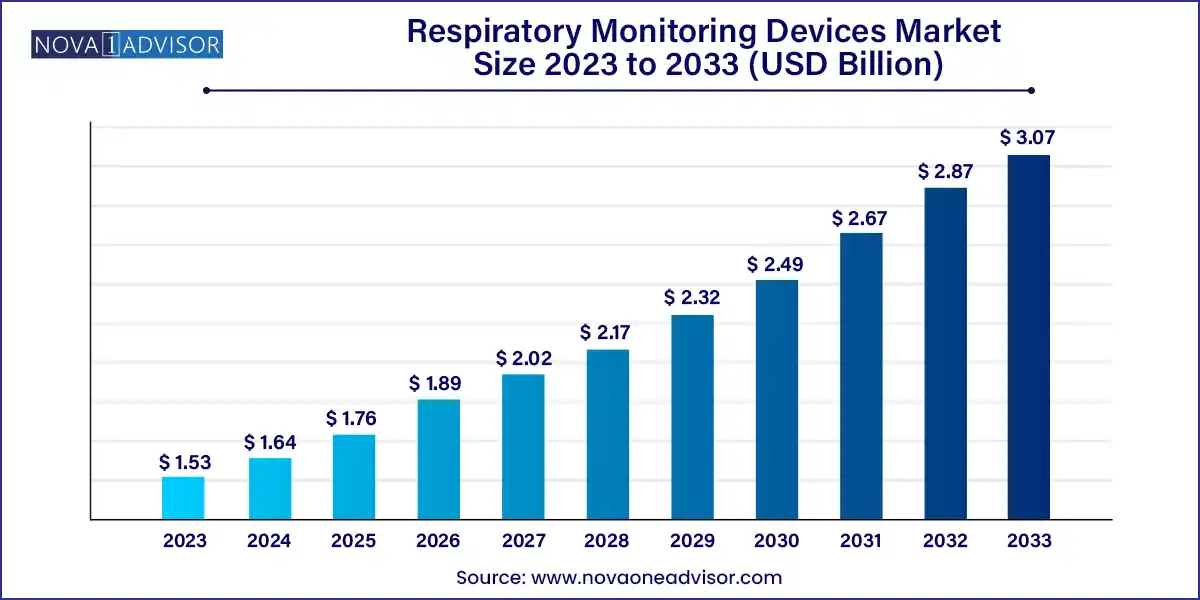

The global respiratory monitoring devices market size was exhibited at USD 1.53 billion in 2023 and is projected to hit around USD 3.07 billion by 2033, growing at a CAGR of 7.22% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America led the global market with the largest market share in 2023.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Device Type, the pulse oximeters segment has held the largest revenue share in 2023.

- By Device Type, the peak flow meters segment is anticipated to grow at the fastest CAGR during the projected period.

- By Indication, the COPD dominated the global market in 2023.

- By Indication, the infectious disease segment is projected to expand at the fastest CAGR over the projected period.

- By End User, the hospitals segment had the biggest market share in 2023.

- By End User, the homecare segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

The Respiratory Monitoring Devices Market plays a pivotal role in modern healthcare by facilitating early diagnosis, real-time monitoring, and effective management of respiratory conditions. With the growing prevalence of chronic respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and sleep apnea, these devices have become indispensable in clinical, outpatient, and home settings. These tools range from spirometers and pulse oximeters to advanced polysomnography systems and capnographs, providing essential data on respiratory rate, oxygen saturation, lung function, and airway flow.

The COVID-19 pandemic has further underscored the importance of respiratory monitoring, driving exponential demand for oximeters and ventilator-compatible monitoring tools. Post-pandemic, the market has continued to thrive, powered by heightened health awareness, the need for proactive respiratory care, and the shift toward telehealth-enabled homecare models. Furthermore, increasing pollution levels, tobacco consumption, and aging populations in developed and developing economies alike contribute to the market’s enduring relevance.

In addition, the integration of digital health technologies, including wireless connectivity, AI-driven analytics, and cloud-based data sharing, has revolutionized how patients and physicians interact with respiratory data. This technological evolution is encouraging innovation across the value chain from manufacturers and software developers to hospitals and insurance providers making respiratory monitoring more accessible, accurate, and personalized.

Major Trends in the Market

-

Miniaturization and Wearable Devices: There is a growing shift toward compact, wearable respiratory monitors that allow continuous tracking of patient metrics, especially for chronic disease patients in home settings.

-

Integration with Telehealth Platforms: Devices increasingly feature Bluetooth and IoT connectivity, enabling real-time data transmission to remote healthcare providers and reducing the need for frequent hospital visits.

-

AI and Predictive Analytics in Monitoring: Advanced algorithms are being deployed to detect anomalies in respiratory patterns and predict exacerbations of chronic diseases, allowing for early intervention.

-

Homecare and Portable Solutions on the Rise: Consumer-centric trends favor portable spirometers, wireless pulse oximeters, and capnographs that provide diagnostic insights outside hospital environments.

-

Increased Use in Pediatric and Geriatric Care: Specially designed respiratory monitors for children and elderly patients are gaining traction, particularly as this demographic sees higher susceptibility to respiratory infections and disorders.

-

Adoption of Cloud-Based Data Platforms: Cloud integration facilitates centralized data storage, cross-platform access, and longitudinal analysis, enhancing patient care coordination and outcome tracking.

Respiratory Monitoring Devices Market Report Scope

Market Driver: Rising Global Burden of Respiratory Diseases

A key market driver is the escalating prevalence of respiratory disorders, most notably asthma, COPD, and sleep apnea. According to the World Health Organization, COPD alone causes more than 3 million deaths annually, making it the third leading cause of death globally. The burden of respiratory illnesses is not confined to the elderly but also affects children and adults, particularly in urban environments with poor air quality. Monitoring devices enable early detection, therapeutic effectiveness tracking, and hospitalization prevention all of which are essential in chronic care pathways. The growing focus on reducing healthcare costs and improving quality of life has cemented the role of respiratory monitors in disease management strategies across the globe.

Market Restraint: High Costs and Access Inequality

While the respiratory monitoring market shows strong growth potential, the high cost of advanced monitoring systems poses a significant restraint. Devices such as polysomnography systems and capnographs can be prohibitively expensive, especially in low-resource settings where reimbursement mechanisms are limited or absent. Even in developed nations, insurance coverage gaps can hinder widespread adoption of newer, high-end monitoring technologies. Additionally, the need for trained professionals to operate sophisticated equipment remains a bottleneck in many rural and semi-urban healthcare settings. These challenges are compounded by issues such as import dependency and distribution hurdles in emerging markets.

Market Opportunity: Expanding Homecare and Remote Patient Monitoring

The post-pandemic healthcare paradigm has shifted toward decentralized, home-based care, opening up vast opportunities for personal respiratory monitoring devices. The rise in chronic respiratory conditions demands continuous, long-term management, making homecare a more sustainable and preferred model. Devices such as portable spirometers, wearable pulse oximeters, and app-connected peak flow meters are increasingly tailored for at-home use, empowering patients to self-monitor and share data with clinicians in real time. As remote monitoring platforms gain traction, manufacturers can capitalize by bundling devices with cloud services, mobile apps, and teleconsultation features. This shift also addresses the aging population's needs, enabling elderly patients to manage chronic conditions in a familiar environment.

Segmental Analysis

By Device Type

Pulse oximeters currently dominate the respiratory monitoring devices market, owing to their non-invasive nature, cost-effectiveness, and widespread application across various healthcare settings. They are particularly crucial in emergency care, post-operative monitoring, and for patients with oxygen therapy needs. Their usage surged during the COVID-19 pandemic, and this adoption trend has carried forward due to increased public and professional awareness. Portable and fingertip oximeters are also extensively used in homecare, further bolstering the segment’s dominance.

However, the capnography segment is expected to be the fastest growing. Capnography devices offer real-time monitoring of end-tidal COâ‚‚, making them vital for surgical procedures, emergency medicine, and intensive care. With rising surgical volumes and expanding ICU infrastructure, demand for capnography is increasing. Additionally, capnography’s growing role in sedation monitoring, especially in dental and ambulatory care, is contributing to its growth. Companies are also introducing compact, handheld devices, enhancing accessibility beyond hospital settings.

By Indication

COPD dominates the market based on indication, reflecting the global burden of the disease and the critical role of monitoring devices in long-term care. COPD patients require regular monitoring to manage exacerbations, titrate oxygen levels, and assess lung function decline. Devices like spirometers, pulse oximeters, and capnographs are essential in this continuum of care. Moreover, clinical guidelines often recommend the use of respiratory monitors for early detection and disease progression tracking, further driving segment growth.

In contrast, sleep apnea is the fastest growing segment. Increasing awareness of sleep-related disorders, coupled with rising obesity rates, is fueling demand for diagnostic and monitoring tools like polysomnography systems and wearable sleep trackers. The growing availability of home-based sleep studies and CPAP adherence monitoring technologies is accelerating segment expansion. Innovations such as smartphone-connected oximeters and cloud-enabled sleep diagnostics have enhanced patient engagement and accessibility in this area.

By End User

Hospitals lead the end-user segment, primarily due to their access to comprehensive diagnostic tools, trained personnel, and funding for advanced respiratory systems. Hospitals use a wide array of devices for critical care, surgery, diagnostics, and emergency treatment, including capnography, gas analyzers, and polysomnography setups. They also tend to be early adopters of new technologies, supported by research and training frameworks that promote evidence-based use.

On the other hand, the homecare segment is projected to grow at the fastest pace. Home-based respiratory monitoring is becoming mainstream, particularly for asthma, sleep apnea, and COPD management. Patients now prefer remote monitoring tools that provide comfort, convenience, and real-time communication with clinicians. Homecare adoption is supported by a growing number of portable, intuitive, and affordable respiratory monitoring solutions. Moreover, government efforts to reduce hospital burden and facilitate aging-in-place are accelerating this trend.

Regional Analysis

North America remains the leading regional market, driven by high disease prevalence, well-developed healthcare infrastructure, and strong reimbursement frameworks. The U.S., in particular, is characterized by early adoption of advanced medical technologies, including smart spirometers, connected pulse oximeters, and cloud-based data platforms. High awareness among patients and physicians and favorable FDA approvals have contributed to rapid innovation and commercialization. For example, companies such as Masimo and Medtronic have strong North American operations that support technological proliferation.

In contrast, Asia-Pacific is emerging as the fastest-growing region in the respiratory monitoring devices market. Countries such as China, India, and Japan are seeing rising respiratory disease prevalence due to urban pollution, smoking rates, and aging demographics. Government initiatives like China’s Healthy China 2030 plan and India’s Ayushman Bharat are improving healthcare access and infrastructure. Additionally, increasing medical tourism in Southeast Asia is supporting hospital investments in modern monitoring technologies. Local and international players are also targeting this region with affordable, portable solutions tailored for middle-income groups.

Some of the prominent players in the Respiratory monitoring devices market include:

- Medtronic

- GE Healthcare

- Masimo

- Philips Healthcare

- Welch Allyn, Inc.

- Smiths Medical

- MGC Diagnostics Corporation

- Novelda AS

- Dragerwerk AG & Co. KGaA

- Nihon Kohden Corporation

Recent Developments

-

In January 2025, Masimo Corporation launched the Rad-G with Temperature a multimodal pulse oximeter and thermometer for homecare settings, enhancing multiparameter patient monitoring in a single handheld device.

-

In October 2024, Medtronic announced the release of the Capnostream 35, a compact capnography monitor designed for procedural sedation in ambulatory clinics, reflecting the growing use of respiratory monitors in outpatient settings.

-

In August 2024, Philips Respironics introduced its DreamWear Full Face Mask with Built-in Sensors, which integrates with mobile apps for real-time tracking of breathing patterns in sleep apnea patients.

-

In May 2024, Nihon Kohden launched a new line of smart spirometers with cloud integration for use in remote and rural clinics across Southeast Asia, aiming to support decentralized care.

-

In March 2024, Nonin Medical received CE approval for its updated line of wireless finger pulse oximeters with enhanced signal processing and pediatric application capabilities.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global respiratory monitoring devices market.

By Device Type

- Capnography

- Peak Flow Meters

- Pulse Oximeters

- Spirometers

- Gas Analyzers

- Polysomnography

- Others

By Indication

- Sleep Apnea

- COPD

- Asthma

- Infectious Disease

By End User

- Hospitals

- Clinics

- Homecare

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)