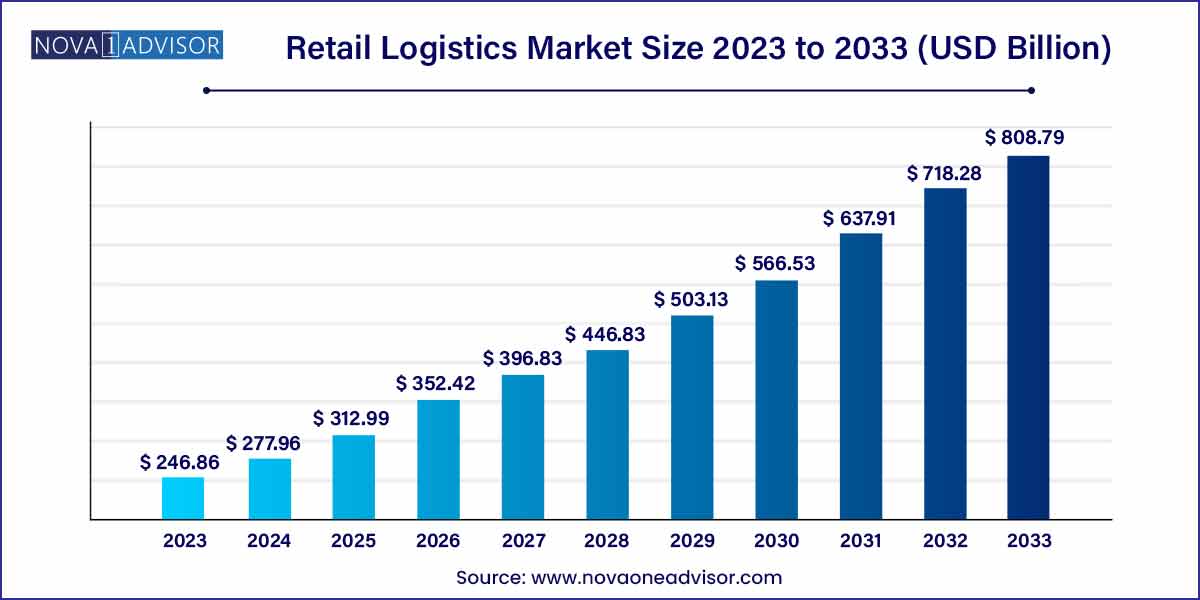

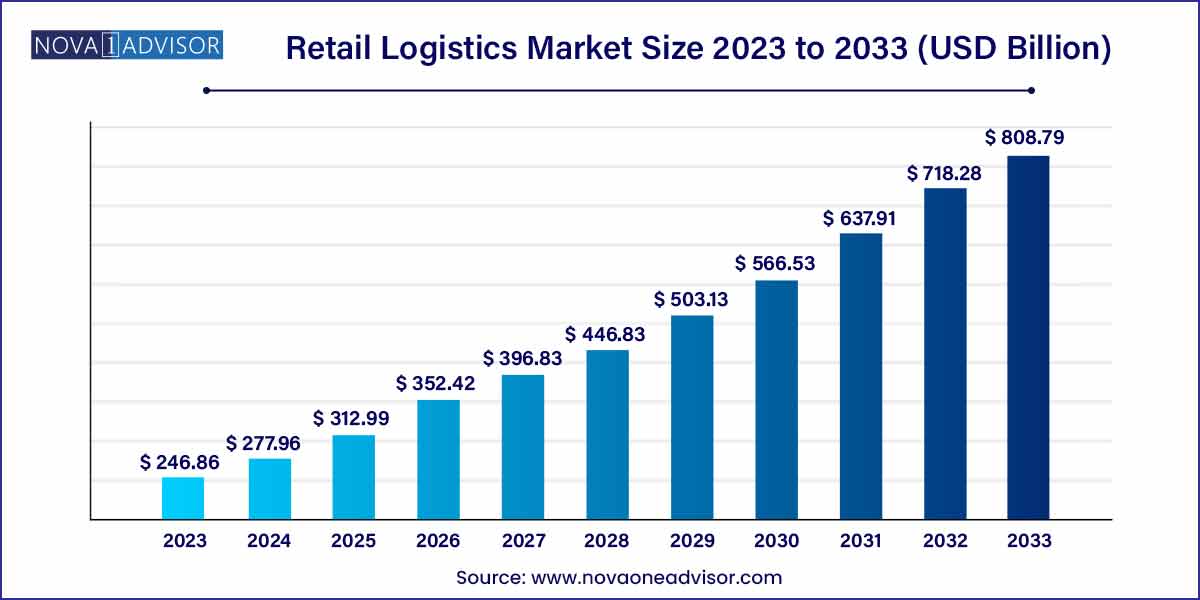

The global retail logistics market size was exhibited at USD 246.86 billion in 2023 and is projected to hit around USD 808.79 billion by 2033, growing at a CAGR of 12.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- The conventional retail logistics segment dominated the market, accounting for a revenue share of 56.1% in 2023.

- The'supply chain solutions segment was valued at USD 87.80 billion in 2023 and held the largest revenue share of 35.5% in 2023.

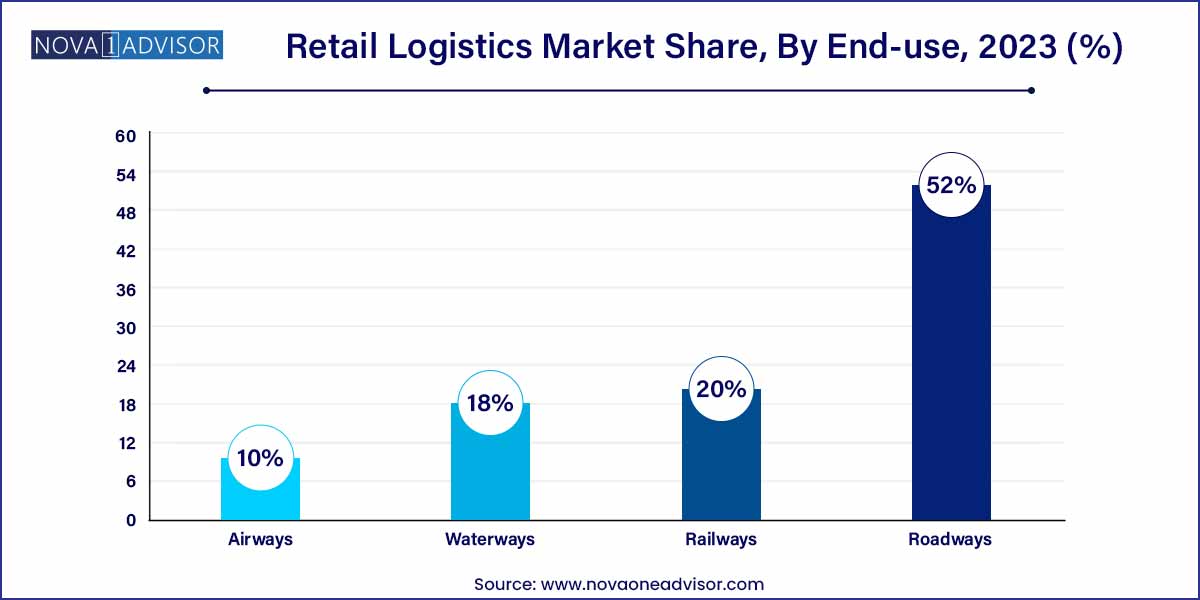

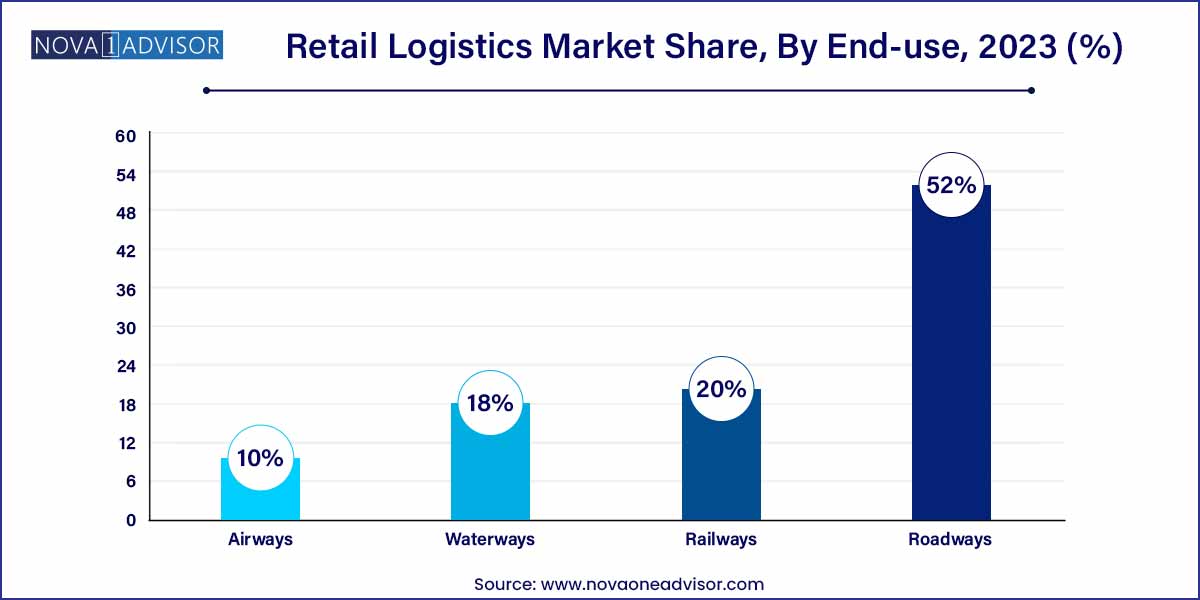

- The roadway mode of transport segment held the largest market share of 52% in 2023.

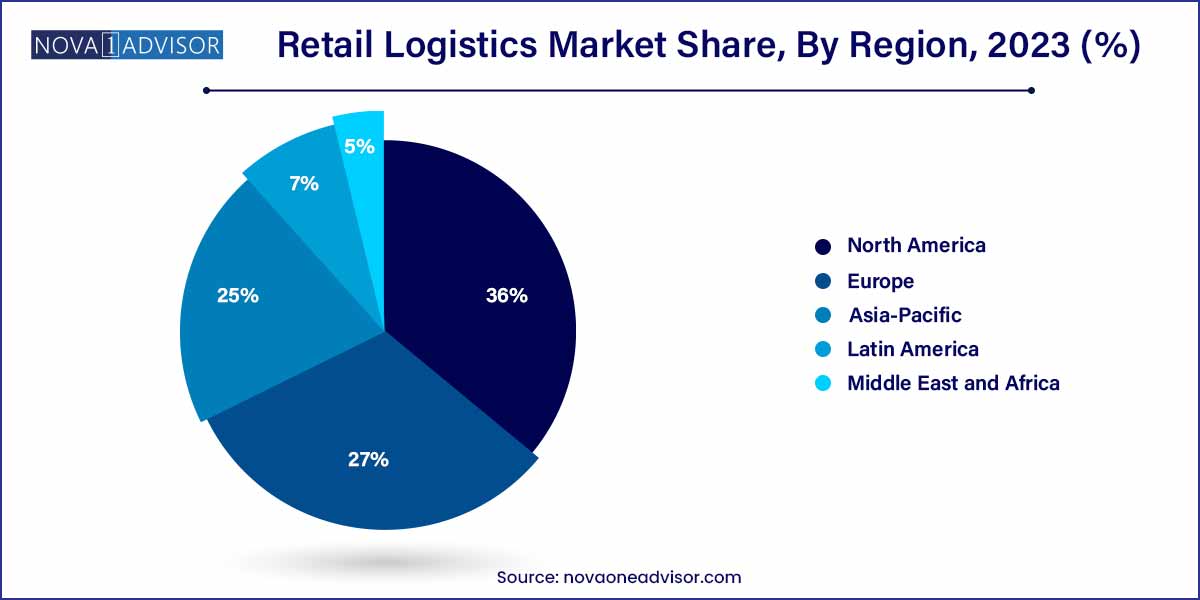

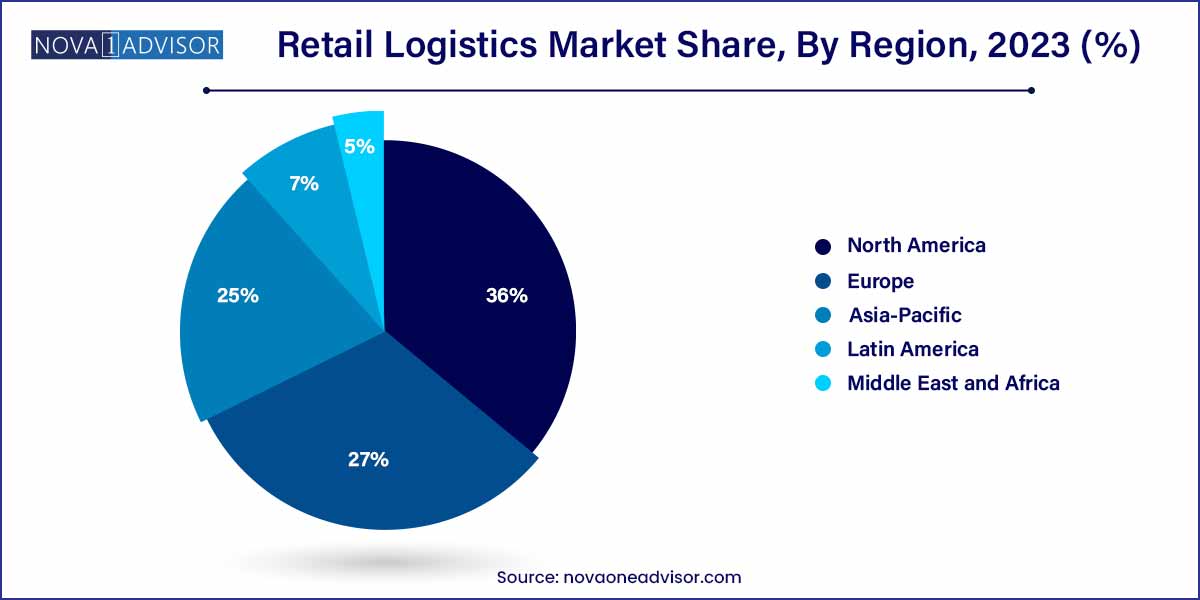

- Asia Pacific accounted for the largest revenue share of 27% in 2023.

Retail Logistics Market: Overview

The retail logistics market has undergone a significant transformation in the last decade, evolving from a back-end operational necessity into a strategic differentiator for brands. The rise of e-commerce, omnichannel retailing, digital inventory visibility, and customer experience-centric business models has repositioned logistics as a value-driving function within the global retail ecosystem.

Retail logistics refers to the processes involved in managing the movement of goods from suppliers and manufacturers to retail outlets or end consumers. It includes transportation, warehousing, inventory management, packaging, reverse logistics, order fulfillment, and other supply chain-related services. With the retail industry becoming increasingly digitized and customer expectations rising around speed, convenience, and flexibility, the logistics function has grown increasingly sophisticated and central to competitive differentiation.

Globalization and the interconnection of supply chains have further magnified the importance of efficient logistics networks. Retailers today source goods from multiple countries, operate multi-node warehouses, and deliver to customers across borders—making logistics a core component of business success. The COVID-19 pandemic exposed vulnerabilities in traditional logistics setups, and in its aftermath, companies doubled down on agile, resilient, and tech-enabled logistics systems.

Meanwhile, the shift toward direct-to-consumer (D2C) models, especially among fashion, electronics, and personal care retailers, has increased the reliance on third-party logistics (3PL), real-time tracking systems, automated fulfillment centers, and last-mile delivery solutions. Logistics providers are adapting through innovation—deploying drones, autonomous delivery vehicles, AI-based route optimization, and predictive inventory analytics. As the retail landscape continues to evolve, the global retail logistics market is positioned at the intersection of innovation, service excellence, and scalable operational efficiency.

Retail Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 246.86 Billion |

| Market Size by 2033 |

USD 808.79 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Solution, Mode Of Transport, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

XPO Logistics, Inc.; DSV; Kuehne + Nagel International; C.H. Robinson Worldwide, Inc.; Nippon Express; FedEx; Schneider; United Parcel Service; APL Logistics Ltd; DHL International GmbH; A.P. Moller - Maersk. |

Retail Logistics Market Dynamics

The retail logistics market is dynamically influenced by the ongoing e-commerce revolution. The surge in online retail activities has reshaped the logistics landscape, necessitating innovative solutions to accommodate the increasing demand for swift and reliable deliveries. As consumers increasingly favor the convenience of online shopping, retailers are compelled to optimize their supply chains, emphasizing last-mile delivery solutions to meet evolving customer expectations. This paradigm shift in consumer behavior has become a pivotal force driving the growth and transformation of the retail logistics sector.

- Technological Advancements:

The relentless march of technological advancements continues to redefine the retail logistics industry. Automation, artificial intelligence, and data analytics are at the forefront, enhancing the efficiency and precision of logistics operations. Predictive analytics aid in demand forecasting, optimizing inventory management and reducing costs. Furthermore, the integration of technologies such as RFID (Radio-Frequency Identification) and IoT (Internet of Things) contributes to real-time tracking and visibility across the supply chain.

Retail Logistics Market Restraint

- Last-Mile Delivery Challenges:

A significant restraint in the retail logistics market is the intricate challenges associated with last-mile delivery. The final leg of the supply chain, involving the delivery of goods to the end consumer, is fraught with complexities. Urban congestion, traffic bottlenecks, and the demand for rapid deliveries pose considerable obstacles. Retailers are grappling with the need for innovative solutions to optimize last-mile logistics, balancing speed and cost-effectiveness while meeting the increasing expectations for same-day or next-day deliveries. Overcoming these challenges is crucial for the sustained growth of the retail logistics sector.

- Supply Chain Disruptions:

Another key restraint impacting the retail logistics market is the vulnerability of supply chains to disruptions. Global supply chains are susceptible to various external factors, including natural disasters, geopolitical tensions, and pandemics. These disruptions can lead to delays, increased costs, and logistical bottlenecks. In an era where resilience is paramount, retail logistics providers face the ongoing challenge of developing strategies to mitigate these risks and build more robust and adaptable supply chain systems. The ability to navigate and recover from unforeseen disruptions is critical for maintaining the efficiency and reliability of retail logistics operations.

Retail Logistics Market Opportunity

- E-commerce Expansion in Emerging Markets:

A significant opportunity within the retail logistics market lies in the expansion of e-commerce into emerging markets. As internet accessibility grows in regions with burgeoning consumer populations, there is a substantial untapped market for online retail. Logistics providers have the chance to capitalize on this opportunity by establishing efficient and scalable supply chain networks tailored to the unique challenges of these markets. Developing robust last-mile delivery solutions and adapting logistics strategies to meet the specific needs of diverse consumer bases present avenues for substantial growth and market penetration.

- Integration of Sustainable Practices:

The increasing emphasis on sustainability presents a noteworthy opportunity for the retail logistics sector. Consumers are becoming more environmentally conscious, and retailers are actively seeking eco-friendly logistics solutions to align with this shift in consumer preferences. Opportunities abound for logistics providers to integrate sustainable practices, such as optimizing transportation routes, adopting greener packaging options, and exploring alternative energy sources for their fleets.

Retail Logistics Market Challenges

- Last-Mile Delivery Complexities:

A primary challenge in the retail logistics market is the intricate nature of last-mile delivery. The final leg of the supply chain, involving the direct delivery of goods to consumers, poses considerable complexities. Urban congestion, traffic hurdles, and the demand for swift and reliable deliveries create substantial obstacles for logistics providers. The quest for cost-effective and timely last-mile solutions requires innovative approaches, including the exploration of alternative delivery methods, to address the evolving expectations of consumers and the logistical challenges presented by densely populated urban areas.

- Supply Chain Disruptions:

The retail logistics sector faces persistent challenges related to supply chain disruptions. Global supply chains are susceptible to various external factors, including natural disasters, geopolitical events, and pandemics. These disruptions can lead to delays, increased costs, and logistical bottlenecks. Navigating the complexities of a globalized supply chain requires resilient strategies, contingency planning, and the implementation of technologies to enhance visibility and agility. Balancing the need for efficiency with the imperative of building robust, adaptable supply chain systems is an ongoing challenge for retail logistics providers.

Segments Insights:

Type Insights

The e-commerce retail logistics segment dominates the overall market due to the structural shift in consumer shopping behaviors toward online channels. The convenience of shopping from home, coupled with evolving digital payment ecosystems and mobile penetration, has contributed to the meteoric rise of this segment. Logistics players have had to reconfigure networks to serve smaller, frequent shipments to residential locations, in contrast to the bulk deliveries characteristic of conventional retail.

In contrast, conventional retail logistics, while still significant, is growing at a slower pace. However, it is evolving by integrating with digital technologies. Brick-and-mortar chains are increasingly leveraging their physical stores as local fulfillment centers for online orders, a trend referred to as BOPIS (Buy Online, Pickup In Store). Retailers like Target and Best Buy in the U.S. have transformed their inventory strategies to enable real-time fulfillment visibility, allowing them to remain competitive in the e-commerce era.

Solution Insights

Supply chain solutions constitute the largest share in the market as they encompass warehousing, inventory management, forecasting, vendor coordination, and order fulfillment. These are foundational capabilities necessary for the smooth functioning of both e-commerce and conventional retail. Retail giants such as Walmart and Amazon have invested heavily in intelligent supply chain management, integrating AI, robotics, and real-time data analytics to enhance accuracy and responsiveness. The importance of real-time inventory tracking and adaptive fulfillment strategies has turned supply chain solutions into mission-critical components.

On the other hand, reverse logistics and liquidation is the fastest-growing solution segment. As e-commerce continues to dominate, the volume of returned merchandise is also escalating. Efficient return handling, refurbishment, restocking, and liquidation have become integral to customer experience and sustainability goals. Brands like Levi's and Adidas have launched in-store and online return hubs, while logistics firms like FedEx and UPS now offer specialized reverse logistics solutions.

Mode of Transport Insights

Roadways dominate the retail logistics transportation segment, especially for last-mile and regional deliveries. The flexibility, cost-effectiveness, and extensive reach of road transport make it the preferred mode for moving goods across intra- and inter-city networks. From delivery vans and two-wheelers in urban centers to long-haul trucks in rural and cross-country logistics, roadways underpin much of retail logistics. In the U.S. and Europe, 3PL players have built sophisticated GPS-enabled fleets with real-time tracking capabilities to ensure efficiency and customer transparency.

However, airways are the fastest-growing transport mode, particularly for high-value and time-sensitive deliveries. The rise in cross-border e-commerce, especially in electronics, fashion, and luxury segments, has pushed logistics companies to invest in air freight capacity. Companies like DHL, FedEx, and Amazon Air are expanding their dedicated cargo fleets to handle increasing demand. Same-day international shipping services, albeit premium-priced, are seeing uptake among affluent customers and business buyers alike.

Regional Insights

North America dominates the retail logistics market, driven by the mature e-commerce ecosystem, advanced logistics infrastructure, and the presence of global retail giants. The U.S. accounts for the lion’s share, with Amazon, Walmart, and Target setting global benchmarks in logistics innovation. These companies have developed vast warehouse networks, automated fulfillment centers, and proprietary delivery fleets to ensure rapid, reliable service. Additionally, the region is a hotbed for technological innovation in AI, robotics, and autonomous delivery.

The strong presence of third-party logistics providers such as UPS, FedEx, and XPO Logistics further reinforces the ecosystem. Canada's integration with U.S. supply chains and Mexico’s growing role as a nearshoring hub also contribute to the region’s dominance. The availability of capital, policy support, and consumer readiness for new delivery models make North America a highly competitive and dynamic retail logistics market.

Asia-Pacific is the fastest-growing region in the global retail logistics market. With a rising middle-class population, rapid urbanization, and a mobile-first digital economy, countries like China, India, Indonesia, and Vietnam are experiencing explosive growth in online retail. E-commerce leaders such as Alibaba, JD.com, Flipkart, and Lazada are investing in localized logistics networks, including drones, EV delivery fleets, and smart lockers to manage the scale and complexity of deliveries.

The region's growth is further bolstered by government initiatives such as India's National Logistics Policy (2022), which aims to reduce logistics costs and enhance infrastructure. In China, logistics providers are pioneering smart warehouses using AI-powered robots and autonomous forklifts. Meanwhile, Southeast Asia is witnessing the rise of express logistics platforms like Ninja Van and J&T Express, catering to SMEs and cross-border sellers. These dynamics position Asia-Pacific as a future logistics powerhouse.

Some of the prominent players in the retail logistics market include:

- XPO Logistics, Inc.

- DSV

- Kuehne + Nagel International

- C.H. Robinson Worldwide, Inc.

- Nippon Express

- FedEx

- Schneider

- United Parcel Service

- APL Logistics Ltd

- DHL International GmbH

- A.P. Moller - Maersk

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global retail logistics market.

Type

- Conventional Retail Logistics

- E-commerce Retail Logistics

Solution

- Commerce Enablement

- Supply Chain Solutions

- Reverse Logistics & Liquidation

- Transportation Management

- Others

Mode of Transport

- Railways

- Airways

- Roadways

- Waterways

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)