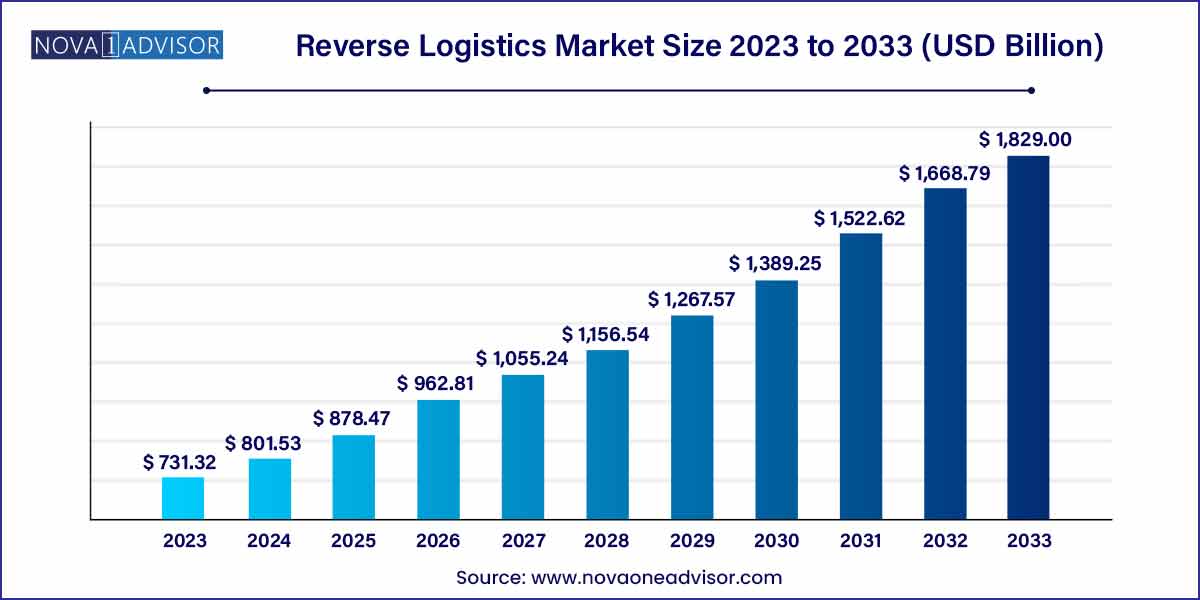

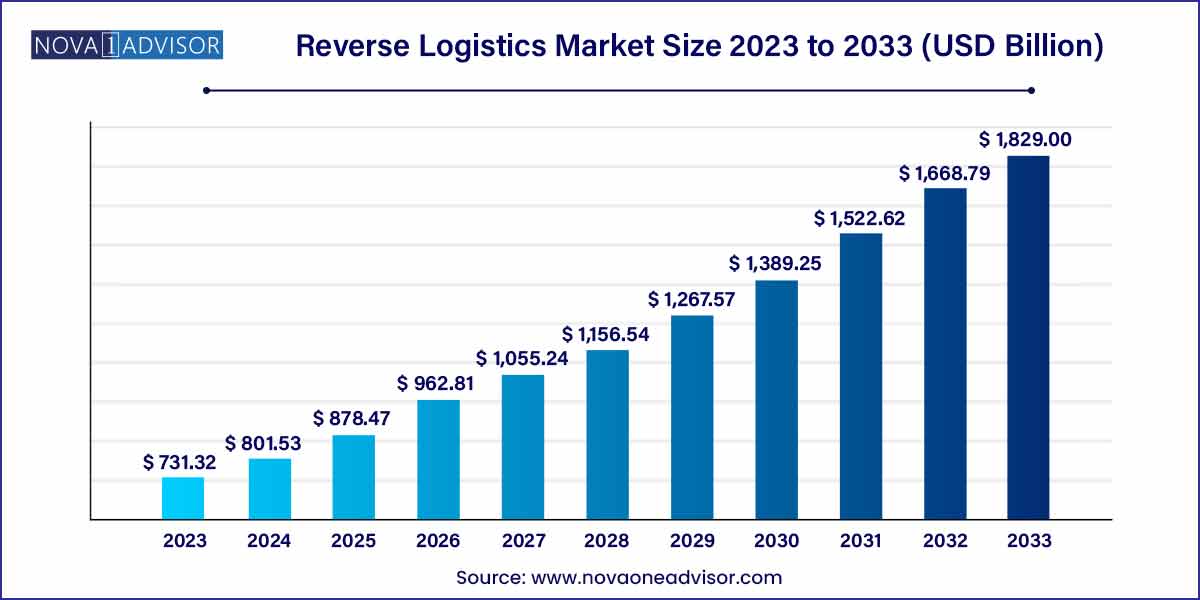

The global reverse logistics market size was exhibited at USD 731.32 billion in 2023 and is projected to hit around USD 1,829.00 billion by 2033, growing at a CAGR of 9.6% during the forecast period of 2024 to 2033.

Key Takeaways:

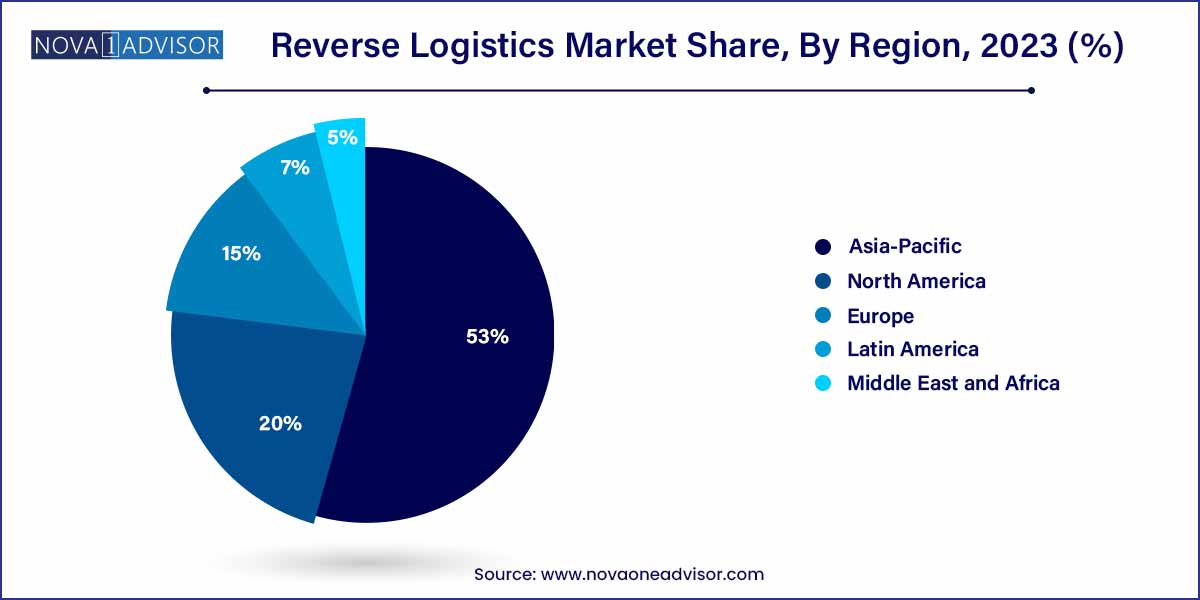

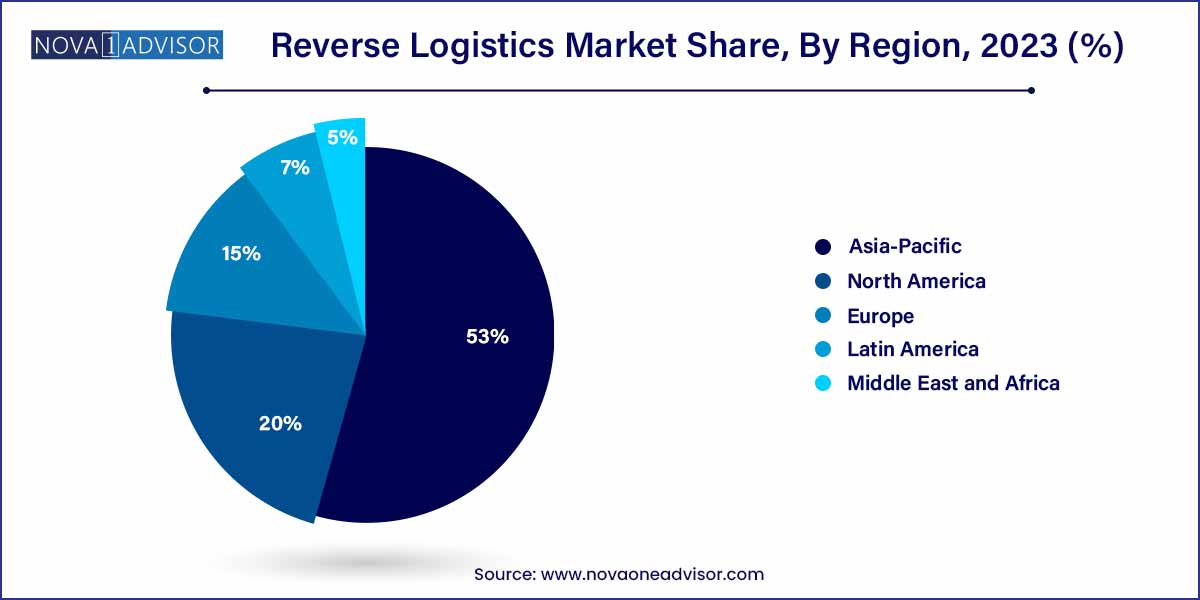

- Asia Pacific led the overall market in 2023, with a revenue share of 53.0%.

- The B2B and commercial returns segments dominated the market, with the largest revenue share of 34.59% in 2023.

- Among these, the transportation segment dominated in 2023, gaining a revenue share of 45.76%.

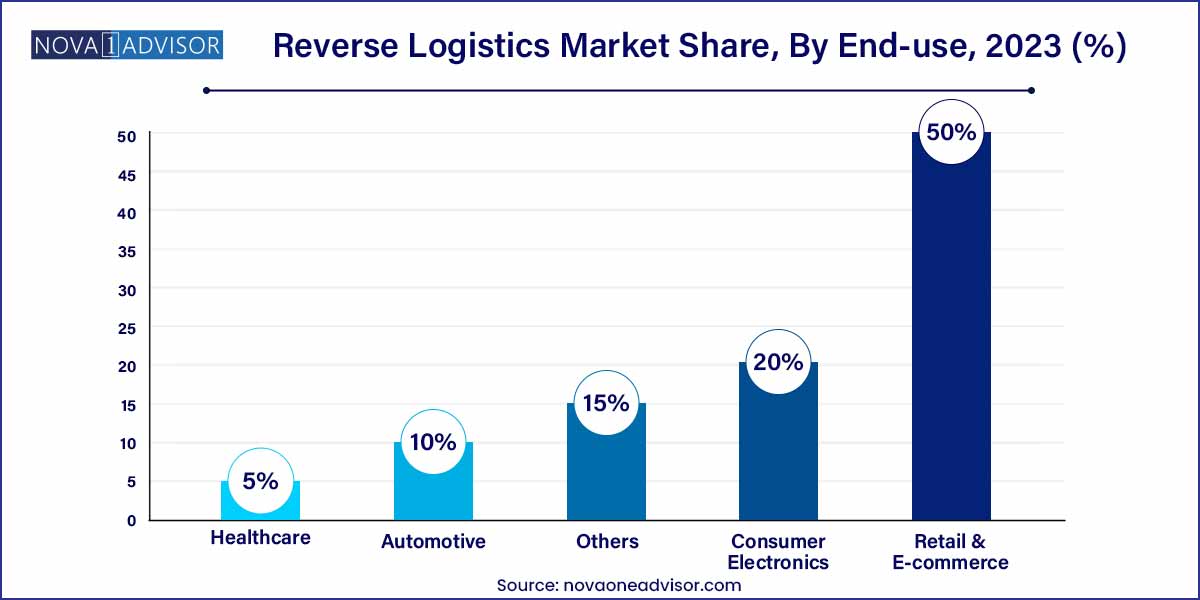

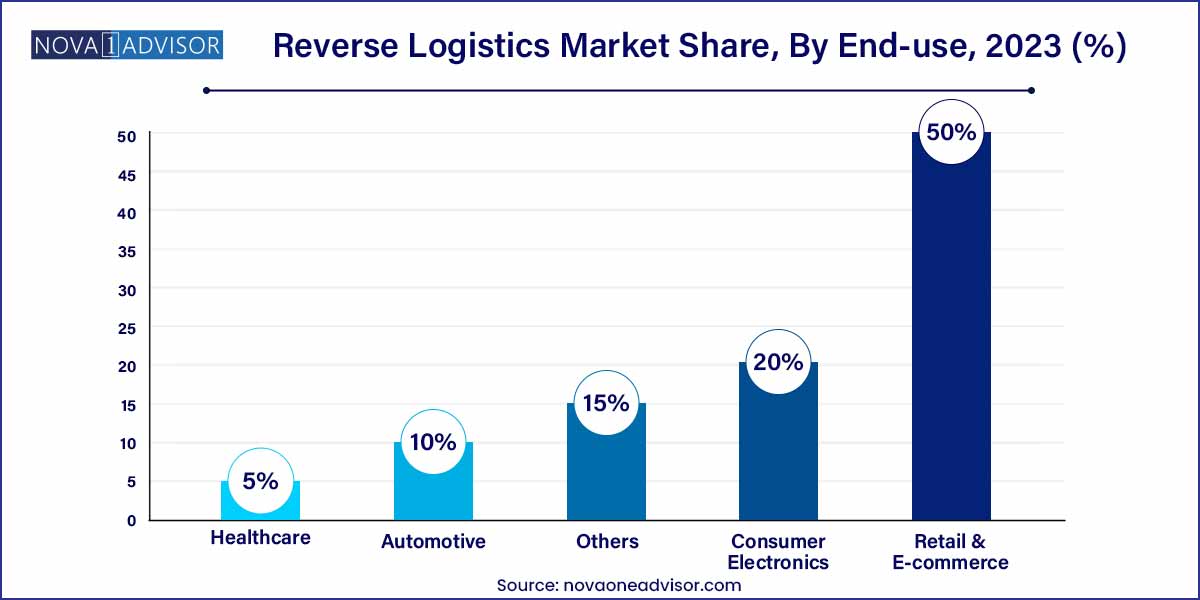

- The retail & e-commerce segment dominated the overall market in 2023, attaining a revenue share of 50.0%.

Reverse Logistics Market: Overview

In today's globalized economy, the reverse logistics sector has emerged as a critical component of supply chain management, offering businesses valuable opportunities for cost savings, environmental sustainability, and enhanced customer satisfaction. This comprehensive overview delves into the multifaceted landscape of the reverse logistics market, providing insight into its key drivers, challenges, and future prospects.

Reverse Logistics Market Growth

The reverse logistics market is experiencing robust growth, driven by several key factors. One of the primary drivers is the increasing emphasis on environmental sustainability, fueled by both consumer demand and regulatory mandates. Businesses are recognizing the importance of responsibly managing returned products and materials to minimize waste and reduce their environmental footprint. Additionally, cost reduction is a significant growth factor, as efficient reverse logistics processes can lead to substantial savings through improved inventory management, streamlined operations, and the recovery of value from returned goods. Furthermore, the focus on enhancing the customer experience is driving organizations to invest in seamless returns processes and efficient handling of product exchanges, thereby fostering greater customer satisfaction and loyalty. Finally, stringent regulatory requirements governing waste management and product disposal are compelling companies to implement robust reverse logistics frameworks to ensure compliance, further fueling market growth.

Reverse Logistics Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 731.32 Billion |

| Market Size by 2033 |

USD 1,829.00 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Return Type, Service, End-user Industry, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

DB SCHENKER (Deutsche Bahn AG); Deutsche Post AG; FedEx Corporation; Kintetsu World Express, Inc.; United Parcel Service, Inc.; Yusen Logistics Co., Ltd.; RLG Systems AG; Core Logistic Private Limited; Safexpress Pvt. Ltd. |

Reverse Logistics Market Dynamics

The reverse logistics market is propelled by various growth drivers that underscore its significance in modern supply chain management. Chief among these drivers is the increasing emphasis on environmental sustainability. Heightened environmental awareness among consumers, coupled with stringent regulatory mandates, compels businesses to adopt responsible practices in managing returned products and materials, driving demand for efficient reverse logistics solutions. Moreover, cost reduction remains a compelling factor fueling market growth. By optimizing reverse logistics processes, businesses can achieve significant savings through improved inventory management, reduced transportation costs, and the recovery of value from returned goods.

Despite its growth prospects, the reverse logistics market faces several challenges that necessitate innovative solutions and strategic approaches. One of the primary challenges is the inherent complexity of reverse logistics operations. Handling returned products involves diverse activities such as sorting, testing, refurbishment, and recycling, requiring sophisticated logistical capabilities and operational expertise. Furthermore, inventory management poses a significant challenge, as integrating returned items back into inventory systems demands meticulous tracking, valuation, and space optimization efforts. Data management is another critical challenge, as effective reverse logistics hinges on accurate data capture and analysis to identify trends, anticipate demand, and optimize processes. Additionally, assessing the condition of returned products and determining their disposition presents challenges related to inspection protocols and decision-making frameworks.

Reverse Logistics Market Restraint

- Infrastructure Limitations:

A significant restraint facing the reverse logistics market revolves around infrastructure limitations. While the concept of reverse logistics is gaining traction, many regions lack the necessary infrastructure to support efficient reverse logistics operations. Inadequate facilities for product sorting, refurbishment, and recycling, as well as limited transportation networks for reverse logistics shipments, hinder the seamless flow of returned products. Additionally, the lack of standardized processes and technology interoperability across supply chain partners further complicates reverse logistics activities, leading to inefficiencies and increased costs.

Another significant restraint impacting the reverse logistics market is the regulatory complexity surrounding product returns and disposal. As governments worldwide tighten regulations related to waste management, product recycling, and environmental protection, businesses face mounting compliance challenges in managing returned products. Navigating a complex web of regulations and ensuring adherence to diverse legal requirements across different jurisdictions adds layers of complexity to reverse logistics operations. Moreover, regulatory uncertainties and evolving compliance standards introduce additional challenges for businesses, requiring them to stay abreast of changing regulations and adapt their reverse logistics processes accordingly.

Reverse Logistics Market Opportunity

- Circular Economy Adoption:

One of the most promising opportunities in the reverse logistics market lies in the adoption of circular economy principles. As businesses increasingly recognize the importance of sustainability and resource conservation, there is growing momentum towards adopting circular economy models that prioritize product reuse, refurbishment, and recycling. Reverse logistics plays a pivotal role in enabling the transition towards a circular economy by facilitating the return, repair, and repurposing of products and materials. By implementing robust reverse logistics strategies, businesses can capture additional value from returned goods, reduce reliance on finite resources, and minimize environmental impact.

- Technological Advancements:

Another significant opportunity for the reverse logistics market lies in technological advancements and innovation. Rapid developments in automation, artificial intelligence, and data analytics are transforming the landscape of reverse logistics, offering new avenues for optimization and efficiency gains. Advanced technologies such as robotics, machine learning, and predictive analytics enable faster and more accurate sorting, testing, and refurbishment of returned products, streamlining reverse logistics processes and reducing operational costs. Furthermore, the integration of IoT (Internet of Things) devices and blockchain technology facilitates real-time tracking and traceability of returned items, enhancing transparency and visibility across the reverse supply chain.

Reverse Logistics Market Challenges

- Complexity of Operations:

One of the primary challenges confronting the reverse logistics market is the inherent complexity of operations. Unlike traditional forward logistics, which involves the linear movement of products from manufacturers to end-users, reverse logistics encompasses a myriad of processes such as product returns, refurbishment, recycling, and disposal. Managing these diverse activities within the reverse supply chain requires sophisticated logistical capabilities and operational expertise. Additionally, the handling of returned products often involves varying degrees of damage or wear, further complicating the process of sorting, testing, and determining the appropriate disposition for each item.

- Data Management and Visibility:

Another critical challenge facing the reverse logistics market is the effective management of data and visibility across the reverse supply chain. Unlike forward logistics, where the flow of goods is relatively straightforward and predictable, reverse logistics involves managing the flow of returned products, which can be highly variable and unpredictable. Tracking returned items from point-of-return to final disposition requires accurate data capture, integration, and analysis across multiple stakeholders and systems. However, many businesses struggle with fragmented data silos, disparate IT systems, and limited visibility into reverse logistics processes, leading to inefficiencies, errors, and delays. Without real-time visibility and actionable insights into the status and location of returned items, businesses face challenges in optimizing inventory management, resource allocation, and decision-making within the reverse supply chain.

Segments Insights:

COVID-19 Impact

The outbreak of the COVID-19 pandemic negatively affected supply chain operations globally. The pandemic resulted in an unprecedented strain on logistics and transportation services. Shipment companies encountered uncertainty in the movement of goods owing to the lockdowns imposed in countries such as the U.S., India, and the UK. The logistics networks were eventually disrupted due to a supply-demand imbalance and a reduced delivery capacity. The logistics activities in many nations were further hampered by a limited workforce and reduced operational hours.

However, the COVID-19 pandemic had a positive impact on the growth of e-commerce platforms. With physical stores closed, e-commerce sales increased during lockdowns. For instance, according to Digital Commerce 360, the pandemic resulted in e-commerce sales of USD 219 billion in the U.S. in 2020-2021. The increase in online sales led to an increase in product returns by consumers worldwide. Furthermore, the pandemic caused delays in returns and refunds due to the limited movement of goods and restrictions imposed by the state and international governments. In addition, return policies were increasingly being used by businesses to differentiate themselves from their competitors.

The high retail cost has paved the way for new trends such as “Buy Now, Pay Later.” Retailers have also begun advertising “Try Before You Buy” to increase sales and brand loyalty. Intelligent reverse logistics systems have become essential for businesses and their customers. The pandemic has compelled delivery companies to balance efficiency, safety, and customer satisfaction. Consumers are anticipated to prefer online purchases more than physical outlets, even after the pandemic owing to safety and security concerns. Therefore, retailers and manufacturers must prioritize reverse logistics to optimize the return process.

A high number of recalls of vaccines were recorded during the COVID-19 pandemic. For instance, 1.63 million Moderna vaccines were recalled in Japan by Takeda, a pharma company based out in Japan, due to contamination. Furthermore, adopting artificial intelligence in the reverse logistics process, helps providers automate the recall and return process, thereby generating savings in the whole supply chain process. Predictive analytics tools such as machine learning are adopted in multiple stages for managing the supply chain. Based on historical return data, these tools help assess the patterns for reverse logistics requirements, thereby managing the resources cost-effectively.

Return-Type Insights

Based on return type, the market is classified into recall returns, B2B returns and commercial returns, repairable returns, end-of-use returns, and end-of-life returns. The B2B and commercial returns segment dominated the market with the largest revenue share of 34.59% in 2023 and it is witnessing a CAGR of 10.2% for the forecast period from 2023 to 2033. B2B returns refer to the product the retailer sends to the manufacturer. Generally, the merchandise is returned in bulk if defective or damaged. Businesses can sell returned goods if they are not defective and repairable. These goods can be put back into the market in secondary marketplaces such as outlet stores, overstock shops and websites, dollar stores, and auctions.

B2B returns and commercial returns have experienced significant growth within the realm of reverse logistics. This growth can be attributed to various factors that have influenced the dynamics of the industry. One of the primary drivers behind the rise in B2B returns is the increasing emphasis on sustainability and environmental responsibility. As companies become more aware of their environmental impact, they actively seek ways to reduce waste and adopt sustainable practices. This has led to a greater focus on managing returned products efficiently and responsibly. B2B returns, which involve products being returned from one business to another, have become a critical aspect of reverse logistics as companies strive to minimize their carbon footprint.

The repairable returns segment is anticipated to observe significant growth at a CAGR of 9.7% throughout the forecast period. Repair and return refer to fixing defective merchandise and shipping it back to the buyer. Some clients only desire the repair and return of a damaged item rather than a replacement. If a client does not want the item returned after the repairs are performed, the item can be brought back into circulation, in such cases, the total price of returns is decreased.

Some businesses establish a field repair operations center where items can be promptly examined, fixed, and dispatched to the market. The item might be marketed as "like-new" or "reconditioned" if the problem was small. Products with defects can be fixed and priced accordingly. The rising awareness and emphasis on sustainability have played a significant role in driving the growth of repairable returns. As companies and consumers become more environmentally conscious, minimizing waste and extending the lifecycle of products is greatly desired. Repairable Returns offer a viable solution by allowing returned items to be fixed and put back into circulation, reducing the need for new product manufacturing.

Service Insights

In terms of service, the market is classified into warehousing, transportation, replacement management, reselling, refund management, and others. Among these, the transportation segment dominated in 2023, gaining a revenue share of 45.76%. It is anticipated to witness a CAGR of 9.8% during the forecast period. An efficient transportation system is critical to reducing lead time and freight costs for recycled and used goods. The transportation system is the most important component of any logistics supply chain. It constitutes a significant portion of the logistical expense and plays a major role throughout the entire process.

A reliable transportation network offers improved logistics performance, reduced overall operating costs, and fosters better customer service, which is crucial for dealing with product returns. In reverse logistics, transportation refers to transporting and distributing returned or replaced merchandise. The increase in e-commerce and online shopping has led to a surge in the volume of returned products. Therefore, businesses require reliable transportation services to facilitate the movement of these goods from the customer back to the seller or manufacturer. The transportation service segment is crucial in ensuring that returned products are efficiently collected, sorted, and transported to the appropriate locations for further processing.

The warehousing segment is anticipated to observe significant growth at a CAGR of 9.6% throughout the forecast period. Warehousing in reverse logistics refers to storing returns, replacements, end-of-use or end-of-life products, and unsold merchandise. Although warehouses are already essential to reverse logistics, their demand has been growing rapidly with the expansion of the circular economy. In addition to the relatively straightforward processing and return of the stocks of undesired online order items, warehouses must perform a wider range of value-added operations.

To fulfill their commitments to reverse logistics, enterprises must properly plan, outfit, and staff their facilities. The increase in product returns, particularly in the e-commerce sector, has necessitated the growth of warehousing services in reverse logistics. With the rise of online shopping, customers can return products they are dissatisfied with or that are damaged or faulty. This surge in returns requires efficient warehousing solutions to accommodate the influx of returned goods. Warehouses play a critical role in providing temporary storage and managing the inventory of these products until they are processed, repaired, or disposed of.

End-user Industry Insights

In terms of the end-user industry, the market is classified into retail & e-commerce, automotive, consumer electronics, healthcare, and others. The retail & e-commerce segment dominated the overall market in 2023 attaining a revenue share of 50.0%. It is anticipated to witness a CAGR of 10.2% during the forecast period. The retail and e-commerce end-user industry segment has experienced significant growth within reverse logistics. This segment specifically focuses on managing product returns within the retail and e-commerce sectors.

Several factors have contributed to the expansion of this segment. E-commerce has transformed the retail landscape and significantly impacted reverse logistics. With the increasing popularity of online shopping, customers have the convenience of purchasing products remotely. However, this has also led to a higher volume of product returns. As a result, retailers and e-commerce companies require robust reverse logistics processes to handle the influx of returned items effectively. This has led to the growth of dedicated reverse logistics operations in retail and e-commerce.

The automotive segment is anticipated to observe significant growth at a CAGR of 9.9% throughout the forecast period. Many stakeholders are impacted by automotive recalls, including car owners, automakers, component manufacturers, franchised dealers, insurers, and government authorities. However, reverse logistics is essential in the automobile sector for several reasons, including legal policies surrounding ecological and environmental issues.

In addition, the vehicle manufacturer is responsible for maintaining the product after its useful life has expired due to the composition of ecologically sensitive components in automobiles. Some factors responsible for automotive recalls include emission recalls, electric vehicle battery defects, and electronic component defects. The significance of reverse logistics in the automotive sector increases due to all these factors and the growing awareness of consumers regarding the environment. The automotive segment is further segmented into spare parts, lubricants, and vehicle accessories.

Regional Insights

Asia Pacific led the overall market in 2023, with a revenue share of 53.0%. The region is anticipated to retain its dominance over the forecast period owing to the growing popularity of fashionable apparel among the young population. The growth is also driven by the high proliferation of the e-commerce industry and the rapid growth of e-commerce activities in countries such as India and China. The growing use of e-commerce results in increasing returns, which is expected to contribute to regional market growth. Moreover, the increasing growth of manufacturing industries in developing countries and the rising demand for reverse logistics for electric vehicles are expected to fuel market expansion.

The Middle East and Africa are anticipated to observe a significant CAGR of 9.9% throughout the forecast period. The reverse logistics industry in the Middle East & Africa is anticipated to grow at the second-fastest CAGR over the forecast period. Key players are adopting various strategic initiatives to gain a competitive advantage. For instance, in November 2023, Cartlow raised USD 18 billion to optimize its technology in reverse logistics and boost its operations in Saudi Arabia and UAE. Moreover, increasing investments are being made in the Middle East to establish the region as a hub for logistics. The abovementioned factors, coupled with a rise in disposable income, offer favorable opportunities for the growth of the reverse logistics industry in the region.

Some of the prominent players in the reverse logistics market include:

- DB SCHENKER (Deutsche Bahn AG)

- Deutsche Post AG

- FedEx Corporation

- Kintetsu World Express, Inc.

- United Parcel Service, Inc.

- Yusen Logistics Co., Ltd.

- RLG Systems AG

- Core Logistic Private Limited

- Safexpress Pvt. Ltd.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global reverse logistics market.

Return Type

- Recall Returns

- B2B Returns and Commercial Returns

- Repairable Returns

- End of Use Returns

- End of Life Returns

Service

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management

- Others

End-user Industry

-

- Clothing

- Electronic Devices

- Footwear

- Home Décor

- Others

-

- Spare Parts

- Lubricants

- Vehicle Accessories

-

- Refrigerator

- Television

- Air-Conditioner

- Grinder

- Others

-

- Medicine

- Personal Care Products

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)