RNA Analysis Market Size, Share, Growth, Report 2025 to 2034

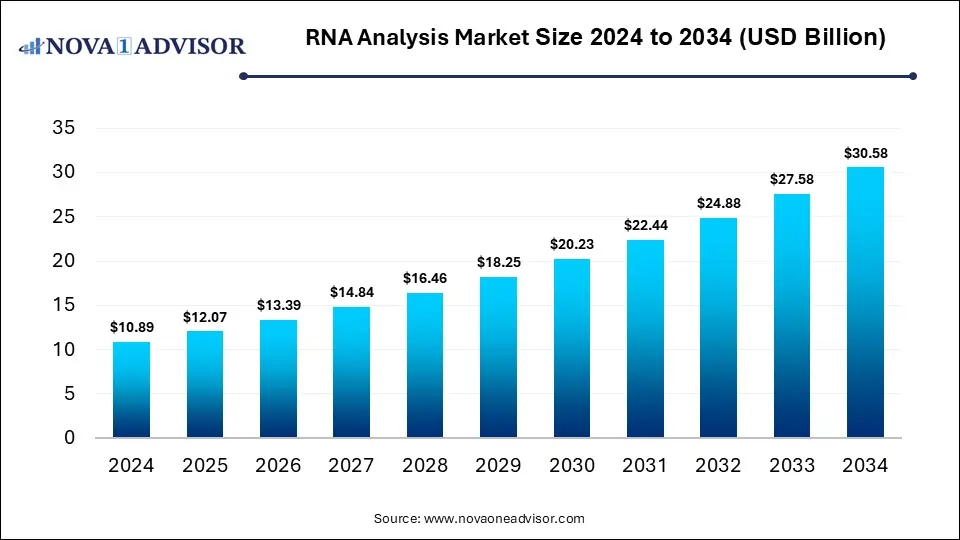

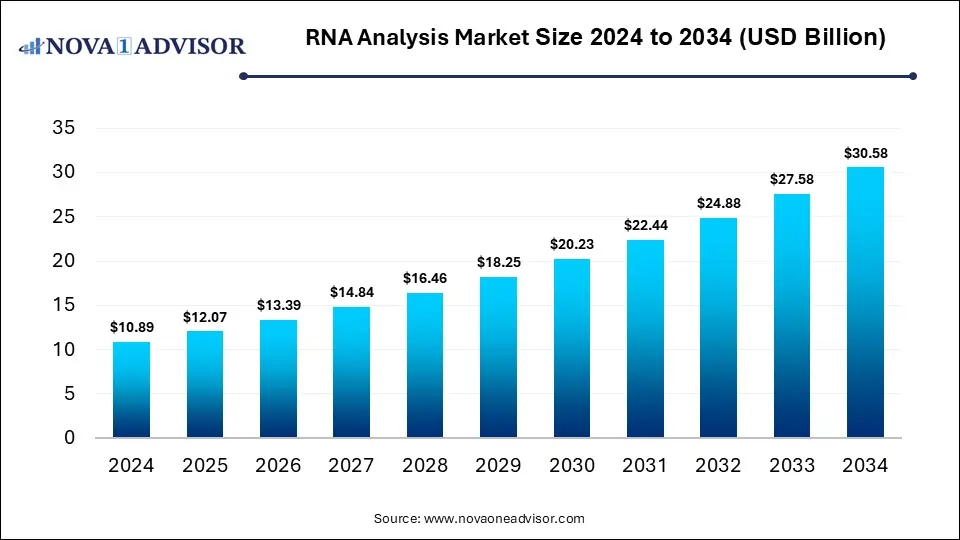

The global RNA analysis market was valued at USD 10.89 billion in 2024 and is projected to hit around USD 30.58 billion by 2034, growing at a CAGR of 10.88% during the forecast period 2025 to 2034. The growth of the market is attributed to advancements in biotechnology, rising prevalence of chronic diseases, and increasing demand for personalized medicine.

RNA Analysis Market Key Takeaways

- By region, North America held the largest share of the market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth in the market.

- By product, the kits & reagents segment dominated the market in 2024.

- By product, the services segment is expected to expand at the highest CAGR during the forecast period.

- By technology, the real-time PCR (qPCR) segment led the market in 2024.

- By technology, the sequencing segment is likely to grow at the fastest rate between 2025 and 2034.

- By application, the infectious diseases & pathogenesis segment dominated the market with a significant share in 2024.

- By application, the epigenetics segment is expected to expand at a significant growth rate over the projection period.

- By end-use, the government institutes & academic centers segment dominated the market in 2024.

- By end-use, the contract research organizations (CROs) segment is expected to experience rapid growth in the coming years.

How is AI Redefining RNA Analysis?

Artificial intelligence (AI) is revolutionizing RNA analysis by significantly enhancing the speed, accuracy, and scalability of data interpretation. AI algorithms can process massive RNA sequencing datasets to identify gene expression patterns, alternative splicing events, and potential biomarkers with greater precision than traditional methods. Machine learning models are being used to predict RNA structures, interactions, and functions, accelerating the discovery of novel RNA-based therapeutics. AI also streamlines diagnostics by automating workflows and enabling real-time insights into disease-related transcriptomic changes. Furthermore, integration of AI with high-throughput technologies is facilitating personalized medicine by tailoring treatments based on individual RNA profiles.

- In December 2024, QIAGEN launched IPA Interpret, a new AI-powered feature in Ingenuity Pathway Analysis that streamlines the interpretation of complex biological data. It helps researchers quickly identify key genes involved in diseases, biological processes, or responses to drugs and environmental factors.

Market Overview

The RNA analysis market involves technologies and tools used to study ribonucleic acid (RNA), playing a vital role in understanding gene expression, regulation, and cellular functions. It supports a wide range of applications including disease diagnostics, drug discovery, vaccine development, and the advancement of RNA-based therapeutics. RNA analysis offers advantages such as precise transcriptomic profiling, detection of alternative splicing, and insights into disease mechanisms at the molecular level. The market is experiencing strong growth due to rising demand for personalized medicine, increasing investments in genomic research, and advancements in next-generation sequencing (NGS) and bioinformatics. The growing focus on RNA therapeutics, such as mRNA vaccines and gene silencing drugs, further accelerates market growth. Moreover, increasing gene therapy development contributes to market growth.

Gene Therapy Pipeline 2024

| Global Status |

Q1 |

Q2 |

Q3 |

Q4 |

| Preclinical |

1,471 |

1,436 |

1,393 |

1,424 |

| Phase I |

301 |

314 |

318 |

341 |

| Phase II |

282 |

279 |

289 |

306 |

| Phase III |

35 |

34 |

35 |

35 |

| Preregistration |

4 |

5 |

6 |

11 |

Major Market Trends

- Widespread Adoption of RNA Sequencing (RNA-Seq): RNA-Seq is rapidly becoming the preferred method for transcriptome analysis due to its high sensitivity and ability to detect novel transcripts, isoforms, and gene fusions. Its application spans disease research, personalized medicine, and biomarker discovery, replacing older technologies like microarrays.

- Rapid Growth in RNA-Based Therapeutics: The success of mRNA vaccines and advancements in RNA interference (RNAi) and antisense oligonucleotides have fueled interest in RNA-based therapies. This is increasing demand for RNA analysis tools to support drug development, target validation, and therapeutic monitoring.

- Expanding Research Activities in Emerging Markets: Countries in Asia Pacific and Latin America are investing in genomics and biotechnology, opening new opportunities for RNA analysis solutions. Growing government support, academic collaborations, and healthcare infrastructure improvements are accelerating market penetration in these regions.

- Rising Prevalence of Chronic Diseases: The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions drives the demand for RNA analysis to understand gene expression patterns and identify disease-specific biomarkers. This enables early diagnosis, personalized treatment, and development of targeted RNA-based therapeutics.

Report Scope of RNA Analysis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 12.07 Billion |

| Market Size by 2034 |

USD 30.58 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.88% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc., Illumina, Inc., QIAGEN N.V., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, Novogene Co., Ltd., BGI Genomics, CD Genomics, Promega Corporation |

Market Dynamics

Drivers

Government Funding and Support

Rising government investments in genomics research are significantly driving the growth of the RNA analysis market by enhancing infrastructure, funding large-scale transcriptomic studies, and supporting innovation in molecular diagnostics. National initiatives across regions like the U.S., Europe, and Asia-Pacific are promoting precision medicine and genomic data integration, which heavily rely on RNA profiling technologies. These funds enable academic institutions and research centers to adopt advanced RNA sequencing platforms and bioinformatics tools.

Moreover, public-private partnerships and government-backed programs are accelerating the development of RNA-based diagnostics and therapeutics. This support not only expands access to RNA analysis technologies but also fosters collaborations that drive scientific discoveries.

Increasing Focus on Drug Discovery and Development

The increasing focus on novel drug discovery and development is a key driver for the growth of the market, as pharmaceutical and biotech companies rely on transcriptomic insights to identify new therapeutic targets. RNA analysis allows researchers to understand gene expression patterns, alternative splicing events, and disease-related molecular mechanisms at a granular level. This data is crucial in screening drug candidates, evaluating efficacy, and minimizing off-target effects.

With the rise of precision medicine and RNA-based therapies, RNA analysis technologies are becoming central to the drug development pipeline. Additionally, RNA biomarkers are being used to stratify patient populations and predict treatment outcomes, improving clinical trial success rates. As the demand for innovative and personalized treatments grows, RNA analysis continues to play a vital role in accelerating drug discovery efforts.

- In October 2024, Waters Corporation launched a new suite of sample prep enzymes, reagents, and waters_connect software designed to streamline LC-MS analysis for large molecule RNA therapeutics. This integrated workflow enhances sequence and modification confirmation for RNA-based drugs like CRISPR sgRNA and mRNA vaccines, accelerating development of advanced therapies for diseases such as COVID-19, cancer, and genetic disorders like sickle cell anemia.

Restraint

High Costs and Complexity of RNA Analysis

The high cost associated with RNA sequencing and analysis tools create significant barriers, particularly for smaller research institutions and clinics with limited budgets. Advanced RNA sequencing technologies, reagents, and specialized equipment require substantial upfront investments and ongoing operational expenses. Additionally, the complexity of data interpretation demands skilled bioinformaticians and sophisticated computational tools, which are not always readily available. This creates challenges in scaling RNA analysis across less developed regions and smaller organizations. Furthermore, maintaining high data accuracy and reproducibility adds to the procedural intricacies, potentially delaying research timelines and hampering the growth of the market.

Opportunities

Expansion of Liquid Biopsies

The expansion of liquid biopsies is creating significant opportunities in the RNA analysis market by enabling non-invasive, real-time monitoring of diseases such as cancer. RNA-based liquid biopsies allow for the detection of circulating RNA molecules, including mRNA and miRNA, which serve as valuable biomarkers for early diagnosis, prognosis, and treatment response. This approach reduces the need for invasive tissue biopsies while offering high sensitivity and specificity. As the demand for personalized and minimally invasive diagnostics increases, RNA analysis technologies are becoming integral to the development and application of liquid biopsy solutions.

Development of Advanced RNA Analysis Tools

A major opportunity for future market growth lies in the development of advanced RNA analysis tools. Innovations such as single-cell RNA sequencing, long-read sequencing, and improved bioinformatics platforms are enabling deeper insights into gene expression and regulatory mechanisms. These tools support more precise disease characterization, biomarker discovery, and personalized therapeutic strategies. As research and clinical applications continue to evolve, the demand for next-generation RNA analysis technologies is expected to grow, creating new avenues for market expansion across both developed and emerging regions.

Segment Outlook

By Product Insights

Why Did the Kits & Reagents Segment Dominate the RNA Analysis Market in 2024?

The kits & reagents segment dominated the market while capturing the largest share in 2024. The dominance of kits & reagents stems from their critical role in ensuring the accuracy, efficiency, and reliability of RNA workflows across research and clinical applications. These products are essential for RNA extraction, purification, amplification, and quantification, making them indispensable in high-throughput and routine molecular biology labs. The increasing demand for RNA-based diagnostics, transcriptomic studies, and RNA therapeutics has driven the widespread adoption of these kits, especially in pharmaceutical, academic, and diagnostic settings.

Moreover, the availability of ready-to-use, standardized kits has simplified complex procedures, reduced turnaround times, and improved reproducibility. Advancements in reagent chemistry and the development of specialized kits for single-cell and low-input RNA analysis further contributed to this segment's growth.

- In May 2025, Lexogen launched the miRVEL Discovery Small RNA-Seq Library Prep Kit, a cutting-edge solution for small RNA discovery in low-input biofluid samples like blood and plasma. The kit enhances transcriptomic insights by suppressing abundant RNA species (e.g., hY4 Y RNA), allowing better detection of disease-related sRNAs. It features UMIs for accurate quantification, 10 nt UDIs for precise multiplexing of up to 120 samples, and a gel-free, 7-hour protocol for faster prep. Designed for high reproducibility and sensitivity, miRVEL Discovery outperforms competitors in miRNA detection from biofluids.

The services segment is expected to expand at the highest CAGR in the coming years due to the increasing outsourcing of complex transcriptomic studies by pharmaceutical, biotech, and academic institutions. Many organizations lack in-house expertise or infrastructure for advanced RNA sequencing and data analysis, driving demand for specialized service providers. These services offer end-to-end solutions, including RNA extraction, library preparation, sequencing, and bioinformatics, enabling faster and more cost-effective research outcomes. Additionally, the growing use of RNA analysis in clinical trials and personalized medicine is further boosting the need for reliable service-based models. This trend is likely to continue as research becomes more data-intensive and resource-demanding.

- In July 2024, Biostate AI launched two new services: Total RNA Sequencing, powered by its patented BIRT technology for comprehensive RNA analysis, and OmicsWeb Copilot, an AI-driven tool that uses large-language models to assist biologists in analyzing RNA sequencing data. Copilot enables users to work with both their own data and over 1,000 curated RNA-seq datasets. It is available free for academic and nonprofit researchers.

By Technology Insights

What Made Real-Time PCR (qPCR) the Dominant Segment in the RNA Analysis Market?

The real-time PCR (qPCR) segment dominated the market in 2024. This is mainly due to its high sensitivity, specificity, and quantitative capabilities in measuring gene expression levels. It is widely adopted across clinical diagnostics, infectious disease testing, and gene expression research because it allows real-time monitoring of amplification and delivers rapid results. The technique is relatively cost-effective, easy to use, and well-established, making it accessible for both small labs and large institutions. Its critical role during the COVID-19 pandemic further accelerated adoption and familiarity across global healthcare and research sectors. Additionally, advancements in qPCR reagents, instruments, and multiplexing capabilities have enhanced its performance and broadened its applications.

The sequencing segment is expected to expand at the fastest CAGR during the forecast period, owing to its ability to provide comprehensive, high-throughput insights into the transcriptome. Unlike traditional methods, RNA sequencing (RNA-Seq) enables the detection of novel transcripts, alternative splicing events, and low-abundance RNAs with high accuracy. Its expanding use in cancer genomics, rare disease research, and personalized medicine is driving demand across both clinical and research settings. As sequencing costs continue to decline and data analysis tools become more accessible, adoption is expected to accelerate significantly in the coming years.

By Application Insights

Why Did the Infectious Diseases and Pathogenesis Segment Lead the Market?

The infectious diseases & pathogenesis segment led the market, capturing a significant share in 2024. This is primarily due to the heightened global focus on understanding and managing viral and bacterial infections. The COVID-19 pandemic significantly accelerated the use of RNA-based diagnostics and transcriptomic profiling to study viral genomes, host responses, and disease progression. RNA analysis enables rapid detection of pathogens and identification of gene expression changes during infection, making it a crucial tool for disease surveillance and therapeutic development.

Governments and research organizations heavily invested in infectious disease research, further boosting the demand for RNA technologies. Additionally, the growing burden of other infectious diseases such as HIV, tuberculosis, and influenza reinforced the importance of RNA-based tools in clinical diagnostics and vaccine development.

The epigenetics segment is expected to grow at a CAGR in the upcoming period due to increasing interest in understanding how gene expression is regulated beyond the DNA sequence itself. RNA analysis plays a vital role in studying non-coding RNAs, histone modifications, and RNA methylation, which are central to epigenetic mechanisms. This is particularly important in cancer, neurodegenerative diseases, and developmental biology, where epigenetic changes influence disease onset and progression. As advanced RNA sequencing and bioinformatics tools become more accessible, researchers are better equipped to explore these complex regulatory networks. This growing focus on epigenetics is expected to drive continued demand for RNA analysis technologies in the coming years.

By End-Use Insights

How Does Government Institutes & Academic Centers Sustained Dominance in the Market in 2024?

The government institutes & academic centers segment dominated the market with a major share in 2024. This is mainly due to their critical role in conducting foundational research and driving large-scale transcriptomic studies. These institutions receive significant funding from national and international bodies to support genomic and biomedical research initiatives, including disease biology, drug discovery, and vaccine development. With access to cutting-edge technologies and skilled researchers, they are well-positioned to lead innovation in RNA analysis. Additionally, their collaborations with industry and healthcare organizations further strengthened their influence in advancing RNA-based applications.

The contract research organizations (CROs) segment is likely to grow at the fastest rate during the projection period, owing to the increasing outsourcing of research and development activities by pharmaceutical and biotech companies. CROs offer specialized expertise, cost-effective services, and faster turnaround times, making them valuable partners for complex RNA sequencing and transcriptomic studies. As drug discovery and personalized medicine demand deeper molecular insights, CROs are expanding their RNA analysis capabilities to support these evolving needs. Additionally, the rising number of clinical trials and preclinical studies involving RNA-based therapeutics is further boosting demand for CRO-led analytical services.

By Regional Insights

What Made North America the Dominant Region in the RNA Analysis Market in 2024?

North America dominated the RNA analysis market in 2024 by capturing the largest share. This is mainly due to its well-established biotechnology and pharmaceutical industries, along with strong government and private sector investments in genomics research. The region benefits from advanced research infrastructure, widespread adoption of RNA-based technologies, and a high concentration of leading market players. Supportive regulatory policies and funding initiatives, such as those from the NIH and other federal agencies, have further accelerated the adoption of RNA analysis tools in both academic and clinical settings. Additionally, North America's early involvement in RNA-based vaccine development and infectious disease research during the COVID-19 pandemic strengthened its leadership.

The U.S. is a major contributor to the North American RNA analysis market due to its robust biotechnology and pharmaceutical industries, along with significant federal funding for genomics and biomedical research. Institutions like the NIH and private organizations heavily invest in RNA-based studies for disease diagnosis, drug development, and personalized medicine. The country also houses many leading companies and academic centers that drive innovation in RNA sequencing and bioinformatics. This strong research ecosystem, combined with advanced infrastructure and high adoption of cutting-edge technologies, solidifies the U.S.'s leadership in the regional market.

- In September 2024, the NIH awarded US$ 5.4 million in first-year funding to launch the Genomics-enabled Learning Health System (gLHS) Network, aiming to integrate genomics into hospital-based learning health systems. These systems continuously analyze patient data to improve care, and gLHS will help translate genomic insights into real-time clinical practice, enhancing diagnostics and treatment.

What Factors Contribute to the Growth of the RNA Analysis Market in Asia Pacific?

Asia Pacific is expected to experience the fastest growth in the market, owing to increasing investments in life sciences research, expanding healthcare infrastructure, and rising awareness of benefits of genomic technologies. Governments across countries like China, India, and Japan are actively funding biotechnology and precision medicine initiatives, driving demand for advanced RNA analysis tools. Additionally, the growing prevalence of chronic and infectious diseases in the region is boosting the need for RNA-based diagnostics and therapeutics. Collaborations between academic institutions and global biotech firms are also fostering innovation and technology transfer. This supportive environment is positioning Asia Pacific as a key emerging hub for RNA research and application in the coming years.

China is a major player in the market in Asia Pacific, driven by substantial government investments in biotechnology, genomics, and precision medicine. The country has rapidly expanded its research infrastructure, established national genomics programs, and encouraged collaborations between academic institutions and biotech companies. China's large patient population and increasing demand for advanced diagnostics and targeted therapies further boost the adoption of RNA analysis technologies. Additionally, supportive policies and growing biotech innovation make China a key growth engine in the region.

RNA Analysis Market Value Chain Analysis

1. Research & Development (R&D)

This stage involves innovation in RNA sequencing, expression profiling, and analysis tools, including reagent development, assay design, and bioinformatics solutions.

2. Regulatory Approvals

This phase ensures that RNA-based diagnostic kits and platforms meet global standards such as FDA, CE-IVD, and ISO certifications for clinical and research use.

3. Packaging and Serialization

This stage involves the packaging of RNA analysis kits, reagents, and instruments with unique serialization codes for tracking, safety, and compliance — especially for clinical use.

4. Distribution to Hospitals, Pharmacies, Research Institutes

The final stage delivers RNA analysis tools, kits, and services to end-users such as hospitals, diagnostics labs, academic centers, and pharma/biotech companies.

Competitive Landscape

Thermo Fisher is a major contributor to the RNA analysis market through its comprehensive portfolio of RNA extraction kits, reagents, and qPCR solutions. The company’s advanced sequencing platforms and cloud-based data analysis tools support both research and clinical applications.

Illumina dominates the RNA sequencing segment with its high-throughput platforms (such as NovaSeq and NextSeq), enabling large-scale transcriptomic studies. It also provides integrated software solutions for RNA-Seq data analysis, making it a core enabler of precision medicine.

QIAGEN offers a wide range of RNA purification kits, sample prep technologies, and bioinformatics platforms (like CLC Genomics Workbench), supporting end-to-end RNA analysis workflows for both basic research and diagnostics.

Agilent contributes to the RNA analysis market through its microarray platforms, bioanalyzers, and RNA integrity assessment tools, which are widely used in gene expression profiling and quality control of RNA samples.

- Bio-Rad Laboratories, Inc.

Bio-Rad provides advanced real-time PCR and droplet digital PCR (ddPCR) systems that enable sensitive and precise RNA quantification. These tools are widely used in research, diagnostics, and therapeutic development.

- Oxford Nanopore Technologies

Oxford Nanopore is a pioneer in real-time, portable RNA sequencing, offering long-read sequencing technology that allows full-length transcript analysis — valuable for studying transcript isoforms and RNA modifications.

Novogene is a leading genomics service provider, offering RNA sequencing and bioinformatics services to academic, biotech, and pharmaceutical clients worldwide, helping accelerate discovery and development in RNA-based research.

BGI Genomics delivers large-scale RNA sequencing and transcriptomics services using its proprietary sequencing platforms, contributing significantly to population-scale RNA research and personalized medicine initiatives.

CD Genomics provides customized RNA analysis services, including RNA-Seq, small RNA sequencing, and gene expression profiling, supporting both standard and complex transcriptomic projects for global clients.

Promega supports RNA analysis through its RNA purification kits, reverse transcription reagents, and enzymatic tools, commonly used in upstream sample processing for RNA-based applications.

These companies are actively involved in developing advanced RNA analysis tools, reagents, instruments, and services to meet growing market demands.

- For instance, in June 2024, Bio-Rad Laboratories launched the ddSEQ™ Single-Cell 3' RNA-Seq Kit alongside Omnition v1.1 analysis software, enhancing single-cell transcriptome and gene expression research. Designed for use with Bio-Rad’s droplet-based ddSEQ Cell Isolator, the kit offers a fast, efficient, and cost-effective workflow for generating high-quality RNA-Seq libraries. The Omnition software streamlines data QC, analysis, and reporting, supporting research in oncology, immunology, neurology, and stem cell biology.

Recent Developments

- In April 2025, a team led by A*STAR Genome Institute of Singapore released SG-NEx, one of the world’s largest long-read RNA sequencing datasets, featuring over 750 million reads across 14 human cell lines. This open-access resource addresses limitations of short-read RNA sequencing by enabling full-length RNA analysis, improving detection of splicing patterns, fusion transcripts, and disease-linked RNA modifications. SG-NEx provides deeper insights for diagnostics and precision medicine, aiding researchers, biotech firms, and healthcare systems. Developed in collaboration with global institutes, it sets a new benchmark for RNA research and supports innovation in RNA-based therapeutics and diagnostics.

- In October 2024, Geneyx and Ocean Genomics launched SVDuo™, a software solution that integrates DNA and RNA analysis to improve genomic variant detection for research and clinical use. Now available on Geneyx Analysis and integrated into Ocean’s TxomeAI®, SVDuo™ enhances disease diagnosis and supports biomarker and drug target discovery.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the RNA analysis market.

By Product

- Instruments

- Kits & Reagents

-

- miRNA & siRNA

- Reverse Transcriptases & RT-PCR

- RNA Extraction & Purification

- RNA Interference

- Others

By Technology

- Real Time-PCR (qPCR)

- Microarray

- Sequencing

- Others

By Application

- Construction of RNA Expression Atlas

- Epigenetics

- Infectious Diseases & Pathogenesis

- Alternative RNA Splicing

- RNA Structure & Molecular Dynamics

- Development & Delivery of RNA Therapeutics

- Others

By End-use

- Government Institutes & Academic Centers

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Contract Research Organizations (CROs)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)