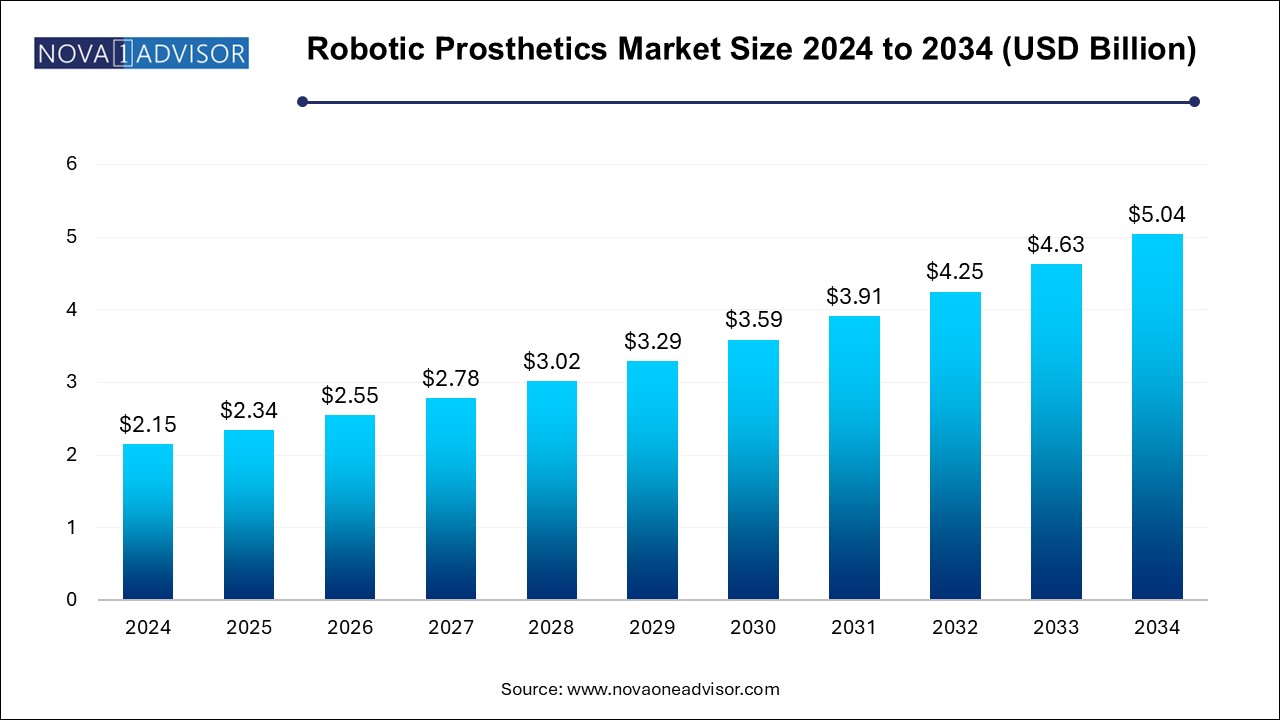

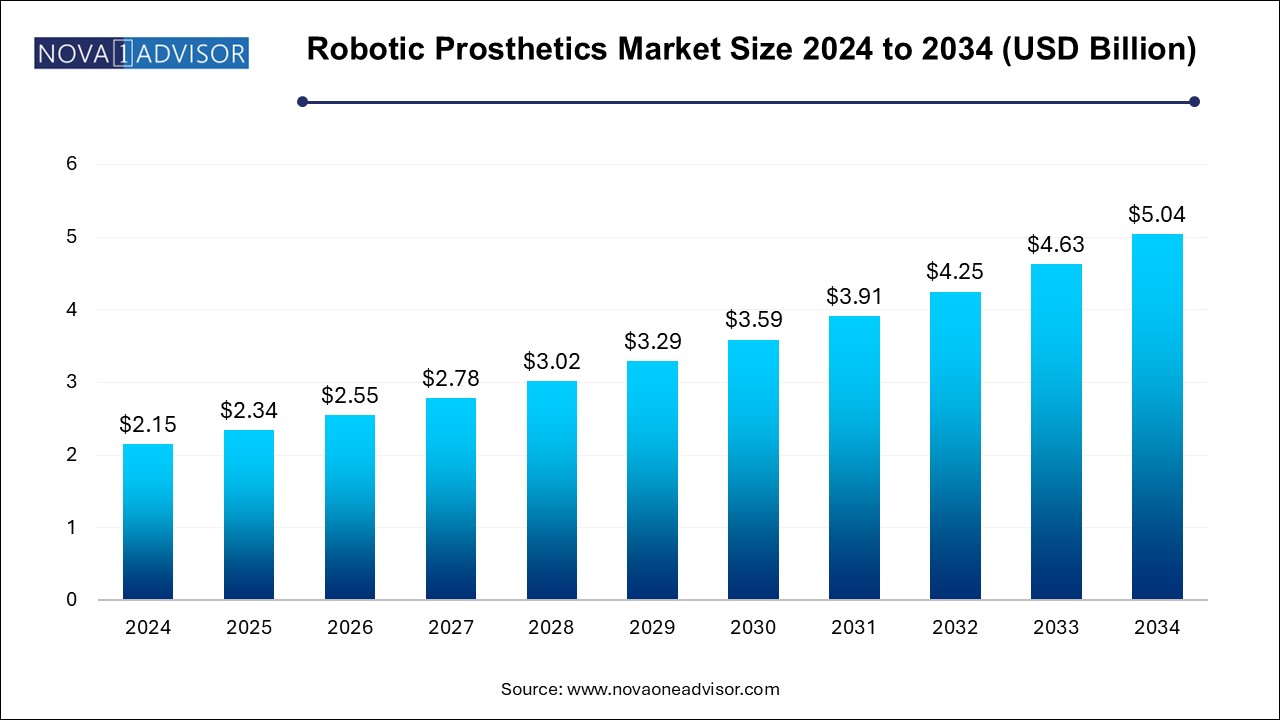

Robotic Prosthetics Market Size and Growth

The robotic prosthetics market size was exhibited at USD 2.15 billion in 2024 and is projected to hit around USD 5.04 billion by 2034, growing at a CAGR of 8.9% during the forecast period 2024 to 2034.

Robotic Prosthetics Market Key Takeaways:

- The microprocessor prosthetics segment held the largest market share of 58.15% in 2024.

- Myoelectric prosthetics are anticipated to register the fastest growth rate of 9.7% over the forecast period.

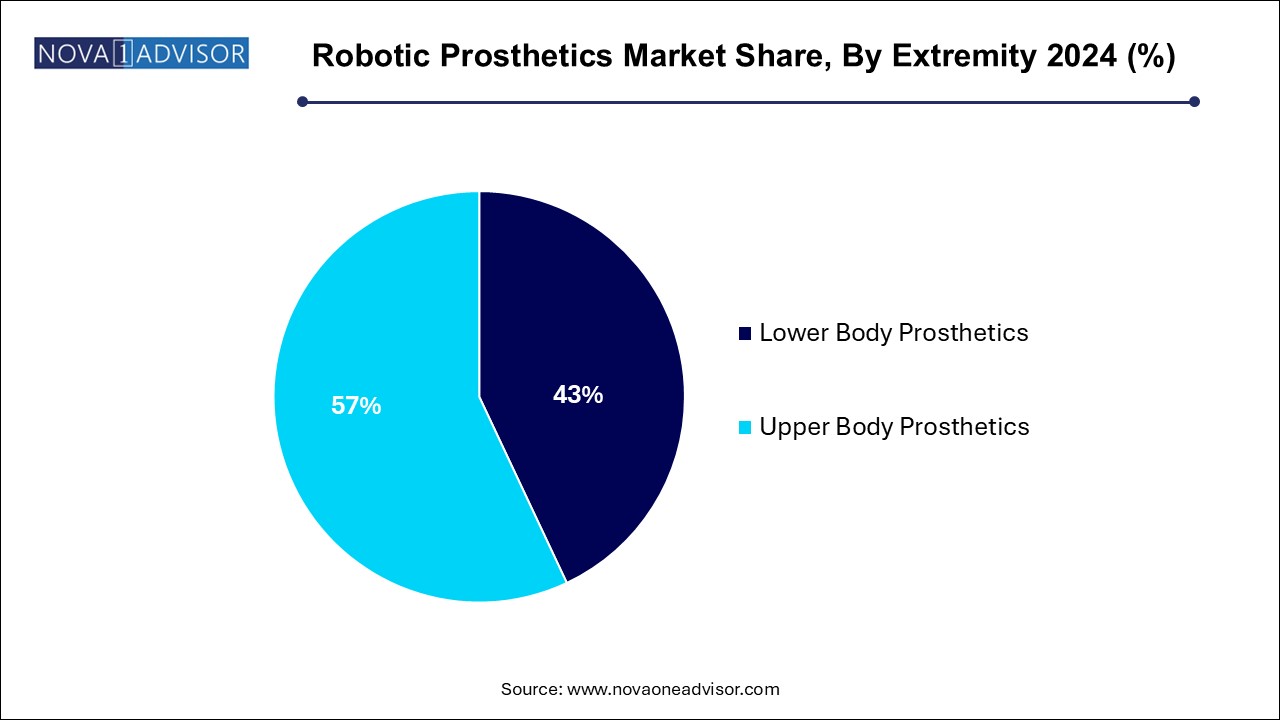

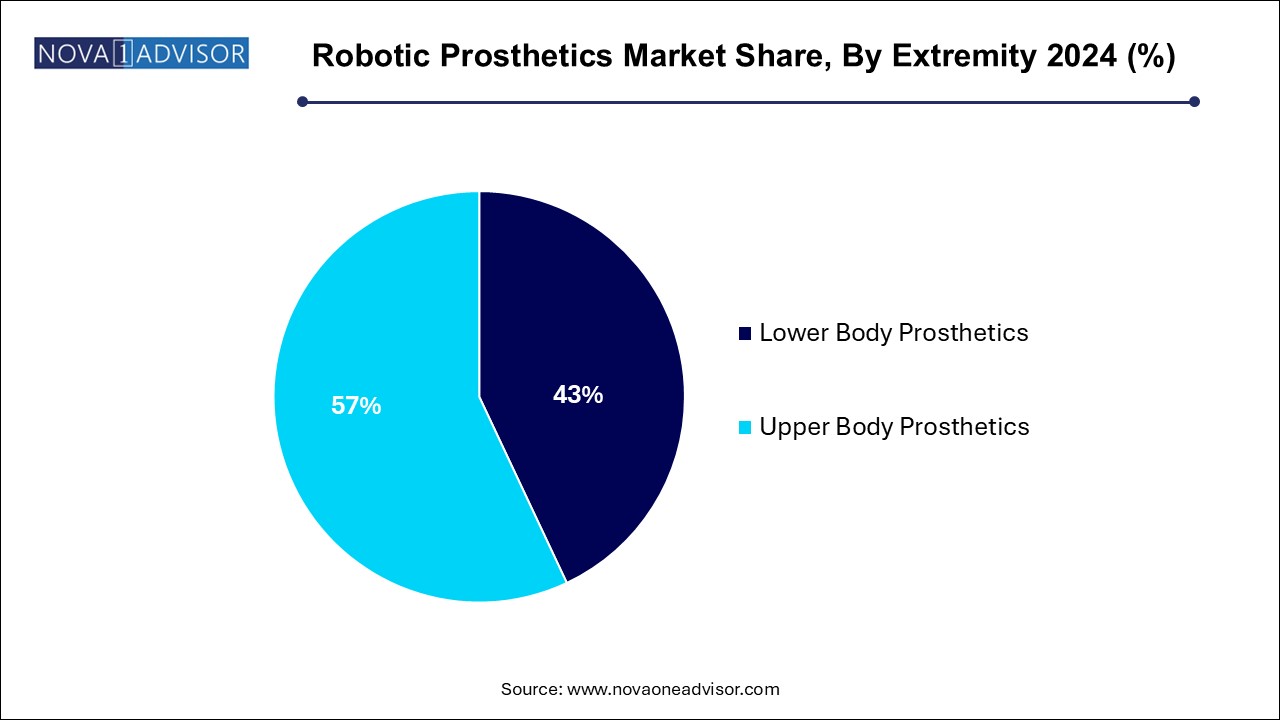

- As of 2024, the lower body extremity section held the largest market share of 57.0%.

- North America accounted for the largest market share of 43.12% of the global robotic prosthetic market as of 2024.

Market Overview

The robotic prosthetic market has evolved from mechanical aids to highly sophisticated, sensor-driven, and AI-powered limb replacements. The fusion of robotics and prosthetics has revolutionized mobility and independence for individuals with limb loss or limb deficiencies. As of 2025, the market is witnessing significant momentum driven by advancements in mechatronics, bioelectronics, AI, and neuroprosthetics. Robotic prosthetics, unlike traditional prostheses, are capable of mimicking the complex movement of human limbs, offering users more control, adaptability, and comfort.

With the increasing global incidence of diabetes, cancer, vascular diseases, and traumatic injuries leading to amputations, the demand for advanced prosthetic devices is accelerating. The World Health Organization (WHO) estimates over 30 million people worldwide need prosthetic or orthotic devices. This unmet need is a key motivator for innovation and investment in robotic prosthetic technologies.

Furthermore, the growing emphasis on personalized medicine and rehabilitation, along with government and private funding for assistive technologies, is fostering market expansion. Major companies are focusing on R&D to enhance limb dexterity and interface connectivity between the human nervous system and prosthetic limbs, signaling a future where robotic limbs are virtually indistinguishable from biological ones.

Major Trends in the Market

-

Neuro-controlled prosthetics: Development of brain-computer interface (BCI) systems to control limbs using neural signals is gaining momentum.

-

Use of AI and machine learning: These technologies are increasingly being incorporated to enhance gait prediction and motion adaptability.

-

Miniaturization of sensors and actuators: Enabling more compact, lightweight, and precise prosthetics.

-

3D printing in custom prosthetics: Additive manufacturing is revolutionizing the customization process for patient-specific solutions.

-

Integration with wearable devices: Robotic limbs are being designed to sync with wearables to monitor performance and provide real-time feedback.

-

Rise of modular robotic systems: Enabling scalable prosthetics that can be easily upgraded or repaired.

-

Military and veteran rehabilitation programs: Growing investments in robotic prosthetics for injured soldiers.

-

Smart prosthetics with IoT connectivity: Allowing remote diagnostics and performance analytics.

-

Growth of pediatric robotic prosthetics: Companies are expanding their product lines to address children’s unique anatomical and growth-related needs.

-

Expansion in emerging markets: Increasing access and affordability are fueling demand in countries like India, Brazil, and China.

Report Scope of Robotic Prosthetics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.34 Billion |

| Market Size by 2034 |

USD 5.04 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 8.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Technology, Extremity, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Touch Bionics Inc.; Touch Bionics Limited; HDT Global; SynTouch, Inc.; Artificial Limbs & Appliances; Ottobock; Ossur Americas; Blatchford Group |

Key Market Driver: Increasing Amputation Rates Due to Diabetes and Trauma

One of the strongest drivers propelling the robotic prosthetic market is the rise in limb amputations due to diabetes-related complications, road traffic accidents, and war-related injuries. Diabetes, in particular, is a leading cause of lower limb amputations, especially in developing nations where preventive care is lacking. According to the International Diabetes Federation, over 500 million adults were living with diabetes in 2021, and this number is projected to rise significantly.

Robotic prosthetics offer a transformative solution for amputees, allowing them to regain independence and functionality. They can significantly enhance the quality of life, especially when conventional prosthetics fail to meet user expectations for control and precision. The potential for sensory feedback and responsive movement in robotic limbs appeals to users who desire greater autonomy and closer-to-natural mobility.

Key Market Restraint: High Cost and Limited Reimbursement

Despite technological advancements, the high cost of robotic prosthetics remains a significant barrier to widespread adoption. Most robotic limbs, especially those integrating myoelectric sensors and AI features, can cost upwards of $50,000–$100,000 per unit. This cost is unaffordable for many individuals, particularly in low- and middle-income countries.

Moreover, insurance providers and national health systems often offer limited reimbursement for such advanced devices. Unlike basic prosthetics, robotic alternatives are often categorized under "luxury" or "non-essential" medical devices, limiting accessibility. This financial barrier not only affects end-users but also deters smaller clinics from investing in or prescribing robotic systems.

Key Opportunity: Advancements in Brain-Machine Interfaces (BMI)

The development of brain-machine interface (BMI) technology presents a game-changing opportunity for the robotic prosthetic market. BMI enables direct communication between the brain and an external device, allowing robotic limbs to interpret and execute neural commands in real-time. Companies and research institutes, like DARPA and the University of Pittsburgh, have made significant strides in this area.

For instance, in 2023, researchers successfully demonstrated a prosthetic arm that could be controlled using signals directly from the user’s brain, restoring not just motion but also a sense of touch. This opens doors for patients with spinal cord injuries and neurological disorders to control prosthetics without physical muscle signals. As BMI becomes more refined and commercially viable, it is poised to redefine the scope and scale of robotic prosthetics.

Robotic Prosthetics Market By Technology Insights

Myoelectric Prosthetics dominated the robotic prosthetic market in terms of revenue share in 2024. These devices detect electrical signals generated by residual limb muscles and translate them into limb movement. The technology allows for precise control, smoother movement, and intuitive functionality, making it the preferred choice among advanced prosthetic users. Myoelectric prosthetics are ideal for both upper and lower limb amputees and are increasingly integrated with AI-based predictive movement algorithms. Their ability to be customized for children and adults, as well as their adaptability across multiple use cases, fuels their dominance.

MPC (Microprocessor-Controlled) Prosthetics are expected to grow at the fastest CAGR through 2034. MPC prosthetics, particularly for knees and ankles, offer real-time adaptation to terrain and walking speed, making them highly efficient for lower limb amputees. These devices use sensors and microprocessors to continuously analyze gait and movement patterns, improving stability and reducing falls. Innovations in battery life and embedded AI systems are making these prosthetics more accessible and user-friendly. As costs decline and awareness grows, adoption is expected to surge, especially in rehabilitation centers and orthopedic clinics across emerging economies.

Robotic Prosthetics Market By Extremity Insights

Lower Body Prosthetics, particularly Prosthetic Knees, accounted for the largest market share in 2024. The high demand is driven by the prevalence of vascular disease-related amputations, which predominantly affect the lower limbs. Prosthetic knees embedded with motion sensors and microprocessor systems offer better balance and energy efficiency, crucial for mobility in elderly patients. Companies like Ottobock and Össur have introduced intelligent knee joints that can be customized for sports, walking, and even climbing stairs. The functionality, safety, and user confidence associated with lower limb robotic prosthetics have made them the dominant extremity segment.

Upper Body Prosthetics, especially Prosthetic Arms, are projected to witness the highest growth rate over the forecast period. These devices are undergoing rapid innovation to mimic complex shoulder and elbow movements. Myoelectric arms with multi-grip functions are now being integrated with haptic feedback sensors to provide users with the sensation of touch. As upper limb prosthetics are particularly challenging due to the dexterity required, the market is investing heavily in R&D. The U.S. Department of Defense, for example, has been funding projects to develop advanced robotic arms for injured veterans, accelerating this segment’s growth.

Robotic Prosthetics Market By Regional Insights

North America dominated the global robotic prosthetic market in 2024.

This dominance is fueled by a strong healthcare infrastructure, high disposable income, and a robust reimbursement framework. The U.S. government, through organizations like the Veterans Health Administration and NIH, funds several assistive technology projects, including robotic limb research. Moreover, key market players such as Össur Americas, Mobius Bionics, and Integrum AB have significant operations across the region. Clinical trials and early adoption of new prosthetic technologies are most active here, with specialized rehabilitation centers offering robotic prosthetic fittings and training. North America's ecosystem for startups, research funding, and tech partnerships makes it the cornerstone of this market.

Asia Pacific is expected to be the fastest-growing region from 2025 to 2034.

Driven by a surge in diabetes and road accidents, Asia Pacific countries like India, China, and Japan are seeing an increased demand for prosthetic solutions. Rising healthcare awareness, government initiatives to support disability aids, and the penetration of telehealth services are contributing to market growth. Japan, with its leadership in robotics and aging population, is emerging as a hub for geriatric and high-functioning prosthetics. Meanwhile, Indian startups are introducing affordable robotic limbs using local manufacturing and 3D printing. The rapid pace of urbanization and economic growth is making robotic prosthetics more accessible across the region.

Some of the prominent players in the robotic prosthetics market include:

- Ottobock

- Touch Bionics, Inc.

- EndoliteSynTouch, Inc.

- HDT Global

- Össur Americas

- Shadow Robot Company

Recent Developments

-

January 2025 – Mobius Bionics, in collaboration with a U.S. university, announced successful human trials of their next-generation LUKE Arm, incorporating a tactile sensory feedback system that can simulate touch and temperature perception.

-

November 2024 – Össur launched the "Proprio Foot Gen3", a robotic ankle-foot prosthetic featuring terrain-adaptive capabilities and Bluetooth-enabled remote programming.

-

August 2024 – Open Bionics unveiled an upgraded version of its Hero Arm in the UK, designed for children aged 8 and above, using lightweight materials and enhanced grip strength.

-

June 2024 – Integrum AB received regulatory approval in the European Union for its OPRA Implant System, allowing direct skeletal attachment of robotic arms through osseointegration.

-

March 2024 – Ottobock expanded its global footprint by launching a prosthetics innovation center in India to address the growing demand for customized robotic limbs in South Asia.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the robotic prosthetics market

Technology

- MPC Prosthetics

- Myoelectric Prosthetics

Extremity

-

- Prosthetic Knee

- Prosthetic Ankle

- Others

-

- Prosthetic Arm

- Prosthetic Hand

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)