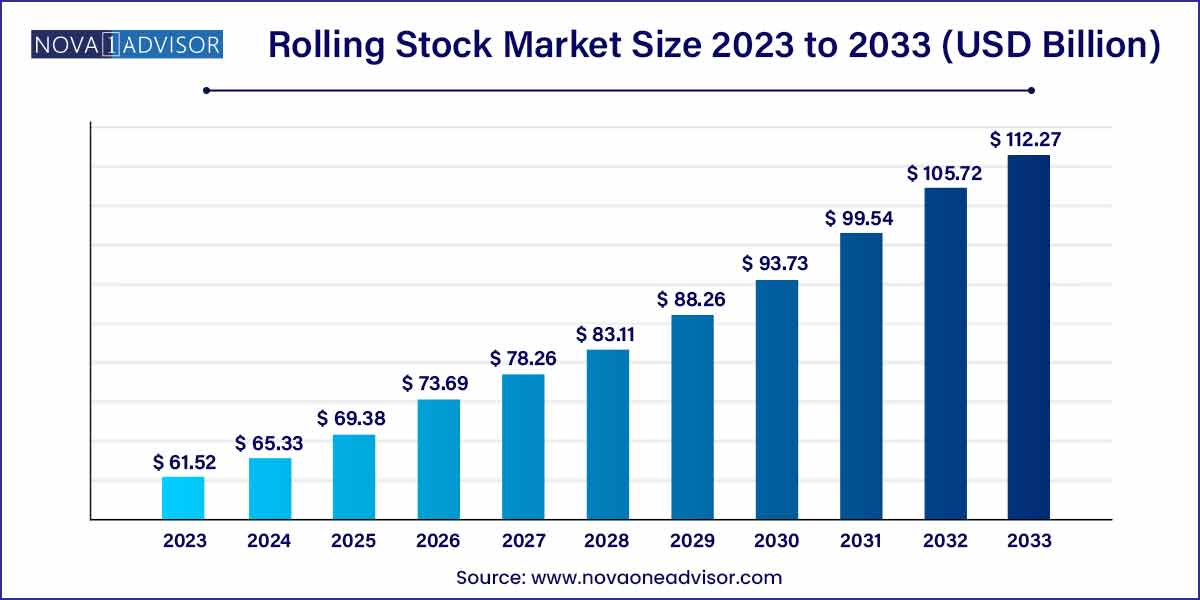

The global rolling stock market size was exhibited at USD 61.52 billion in 2023 and is projected to hit around USD 112.27 billion by 2033, growing at a CAGR of 6.2% during the forecast period of 2024 to 2033.

Key Takeaways:

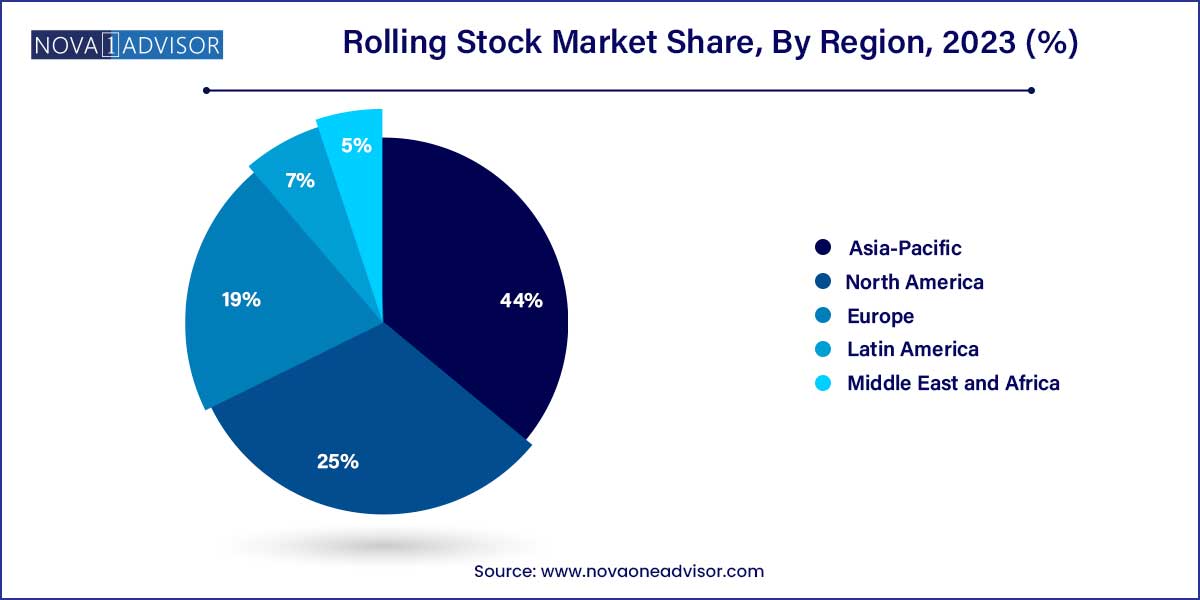

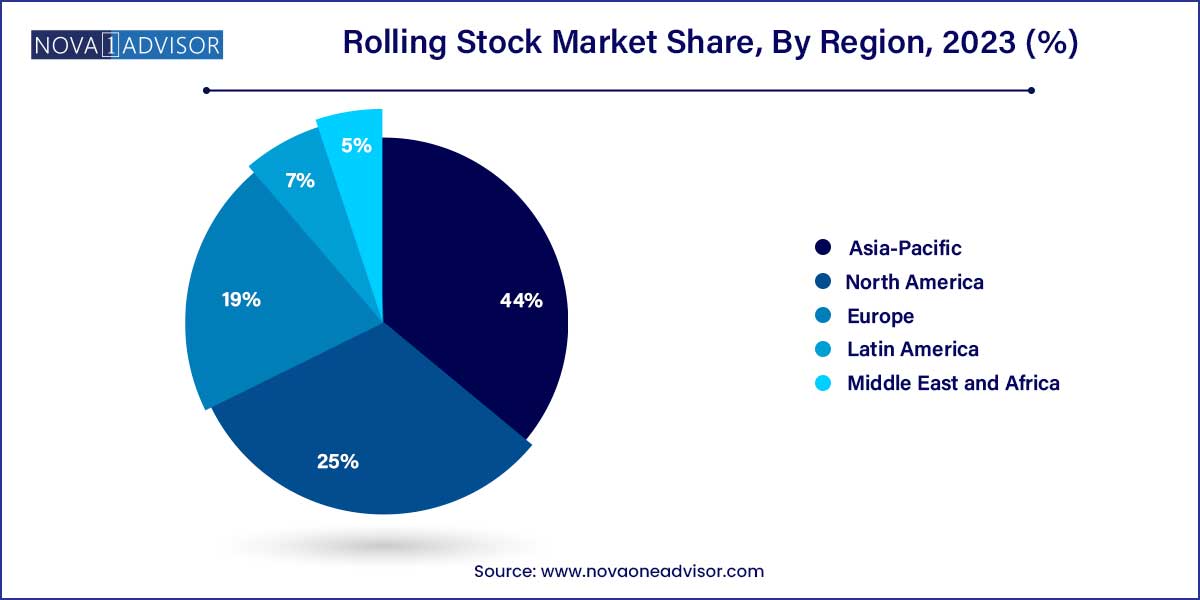

- Asia Pacific dominated the rolling stock market and held the largest revenue share of 44% in 2023.

- The wagons segment led the market and held 34.1% of the total revenue share in 2023.

- The diesel segment held the largest market revenue share in 2023.

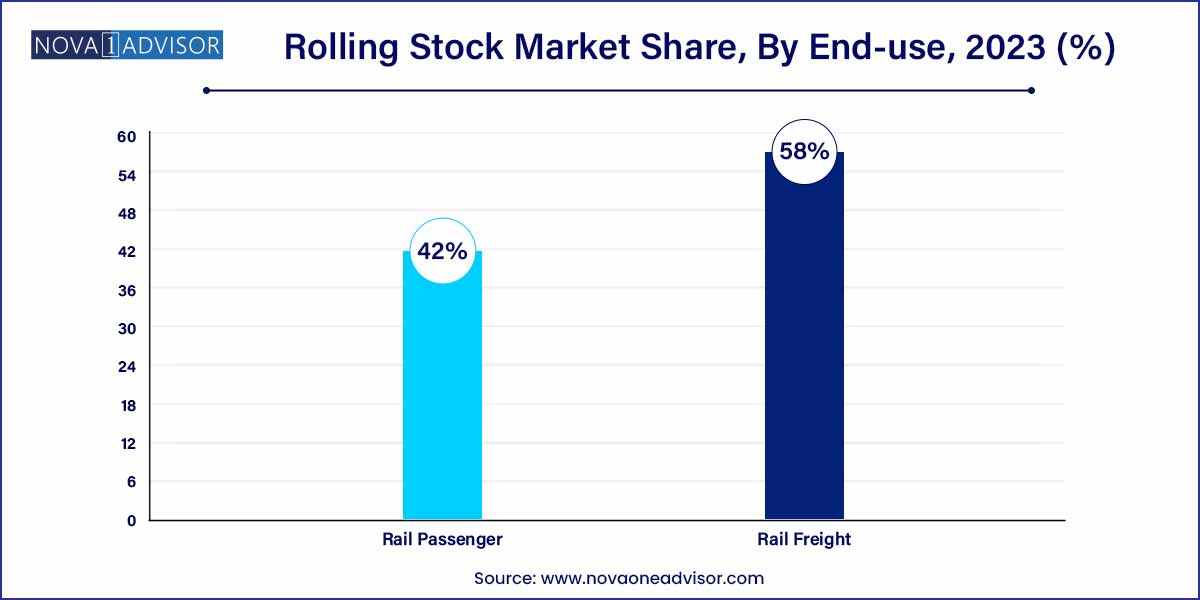

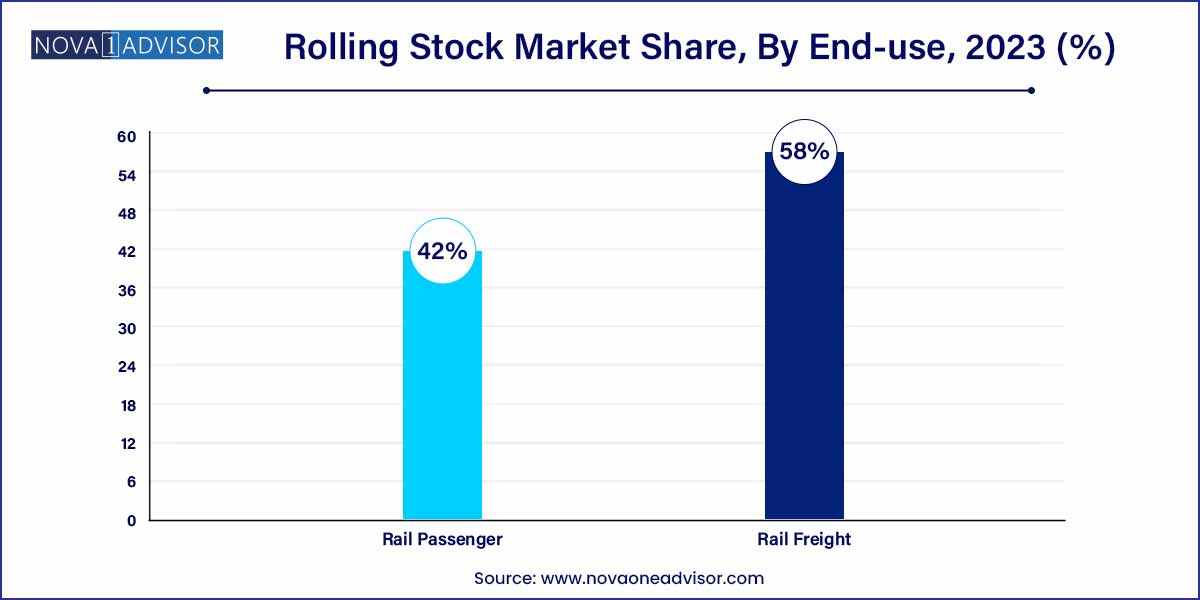

- The rail freight segment led the market share in 2023.

Rolling Stock Market by Overview

The global rolling stock market is a cornerstone of modern transportation infrastructure, providing the essential mobility backbone for freight and passenger transit systems. Rolling stock, encompassing locomotives, wagons, rapid transit vehicles, and railcars, plays an indispensable role in facilitating economic activities by supporting logistics chains, commuter mobility, and cross-border trade. As urbanization accelerates and governments focus increasingly on sustainable transportation, the demand for technologically advanced and energy-efficient rolling stock has surged.

The market is witnessing a significant shift towards electrification, automation, and digital integration, driven by the need to reduce carbon emissions, enhance operational efficiency, and meet the growing mobility needs of urban populations. Leading economies are investing heavily in expanding and modernizing their railway networks, while developing regions are seeking cost-effective rolling stock solutions to build foundational infrastructure. This environment presents a compelling opportunity for manufacturers, service providers, and technology innovators alike.

According to industry estimates, the rolling stock market size is poised for healthy growth through 2034, supported by strategic partnerships, public-private investments, and a steady rise in rail freight and passenger transport volumes.

Rolling Stock Market Growth

The rolling stock market is experiencing robust growth propelled by various factors. Urbanization and population expansion are driving the demand for efficient transportation systems, prompting investments in rail networks. Technological advancements, including high-speed trains and energy-efficient propulsion systems, are enhancing safety and operational efficiency. Additionally, growing concerns about environmental sustainability are fostering the adoption of electrification and alternative fuels. Government initiatives aimed at improving connectivity and reducing traffic congestion further stimulate market growth. Moreover, increasing investments in urban rail projects, such as metros and light rail systems, are addressing urban mobility challenges.

Rolling Stock Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 61.52 Billion |

| Market Size by 2033 |

USD 112.27 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Train Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

CRRC Corporation; Trinity Rail; Alstom Transport; GE Transportation; Siemens Mobility; Stadler Rail AG; Hitachi Rail System; The Greenbrier Co.; Hyundai Rotem; Kawasaki Heavy Industries, Ltd. |

Rolling Stock Market Dynamics

- Technological Advancements and Innovation:

The rolling stock market is continuously influenced by technological advancements and innovation. Manufacturers are investing heavily in research and development to enhance the safety, efficiency, and sustainability of rolling stock. Key technological trends include the development of high-speed trains, lightweight materials, energy-efficient propulsion systems, and digitalization. These innovations not only improve the performance and reliability of rolling stock but also contribute to reducing operational costs and environmental impact. Additionally, advancements in automation, artificial intelligence, and predictive maintenance are transforming maintenance practices, optimizing fleet management, and enhancing passenger experience.

- Shift Towards Sustainability and Electrification:

Environmental sustainability considerations are driving a significant shift towards electrification and alternative fuels in the rolling stock market. With increasing concerns about carbon emissions and climate change, governments and rail operators worldwide are prioritizing the adoption of electric and hybrid trains. Electrification initiatives involve the conversion of existing diesel-powered lines to electric traction or the development of new electrified rail networks. Additionally, advancements in battery technology and hydrogen fuel cells are paving the way for the deployment of zero-emission trains, further reducing the environmental footprint of rail transportation. The transition towards sustainable rolling stock not only aligns with global climate goals but also offers long-term cost savings through reduced energy consumption and operational efficiencies.

Rolling Stock Market Restraint

- High Initial Costs and Budget Constraints:

One of the primary restraints hindering the rolling stock market is the high initial costs associated with procurement, maintenance, and operation. The development and acquisition of modern rolling stock, equipped with advanced technologies and safety features, entail substantial investments for rail operators and governments. Additionally, ongoing maintenance and lifecycle costs further add to the financial burden. In many cases, budget constraints, particularly in emerging economies or regions with limited infrastructure funding, impede the timely implementation of rolling stock projects. The high upfront costs and financial constraints often result in delays or cancellations of planned investments, affecting market growth and modernization efforts.

- Regulatory Compliance and Certification Challenges:

Stringent regulatory requirements and certification processes pose significant challenges for rolling stock manufacturers and operators. The industry is subject to a myriad of safety standards, technical specifications, and regulatory frameworks mandated by government agencies and international organizations. Ensuring compliance with diverse regulatory regimes across different markets adds complexity and cost to the development, testing, and deployment of rolling stock. Moreover, obtaining certifications and approvals for new technologies or innovative solutions often involves lengthy and rigorous procedures, leading to delays in market entry and product launches. The complexity of regulatory compliance also presents barriers to entry for new market players, limiting competition and innovation within the rolling stock industry.

Rolling Stock Market Opportunity

- Expansion of Urban Rail Networks:

The expansion of urban rail networks presents a significant opportunity for growth within the rolling stock market. With rapid urbanization and population growth in cities worldwide, there is a growing demand for efficient and sustainable mass transit solutions. Governments and local authorities are increasingly investing in the development and expansion of metro systems, light rail transit (LRT) networks, and tramways to address urban mobility challenges and reduce congestion. These urban rail projects offer opportunities for rolling stock manufacturers to supply a diverse range of vehicles tailored to specific urban transport needs, including metro trains, tramcars, and electric multiple units (EMUs). Moreover, the integration of modern amenities, such as real-time passenger information systems, accessibility features, and energy-efficient technologies, enhances the attractiveness and competitiveness of urban rail systems.

- Technological Innovation and Digitalization:

The ongoing technological innovation and digitalization within the rolling stock industry present lucrative opportunities for market players. Advances in digital technologies, such as predictive maintenance, condition monitoring, and onboard connectivity, are revolutionizing the way rolling stock is designed, operated, and maintained. Predictive analytics and data-driven insights enable proactive maintenance strategies, reducing downtime, optimizing asset utilization, and extending the lifespan of rolling stock. Furthermore, onboard Wi-Fi, passenger infotainment systems, and smart ticketing solutions enhance the passenger experience, making rail travel more convenient and attractive. Additionally, the integration of Internet of Things (IoT) devices and sensors enables real-time monitoring of train performance, track conditions, and passenger behavior, facilitating more efficient and responsive rail operations.

Rolling Stock Market Challenges

- Infrastructure Constraints and Interoperability Issues:

Infrastructure constraints and interoperability issues present significant challenges for the rolling stock market. Many rail networks, particularly in densely populated urban areas, face capacity constraints, outdated infrastructure, and limited expansion opportunities. The lack of adequate rail infrastructure hinders the deployment of modern rolling stock, limits service frequency, and compromises network reliability. Moreover, interoperability challenges arise when different rail systems, such as high-speed rail, commuter rail, and urban transit, operate on shared tracks or interchange stations. Incompatibilities in signaling systems, voltage standards, and platform heights create technical barriers that impede seamless integration and coordination between different rolling stock types. Addressing infrastructure constraints and interoperability issues requires substantial investments in rail infrastructure upgrades, standardization efforts, and collaborative planning between rail operators and infrastructure managers.

- Regulatory Compliance and Safety Standards:

Stringent regulatory compliance and safety standards pose significant challenges for rolling stock manufacturers and operators. The rolling stock industry is subject to a complex regulatory framework governing various aspects, including design, manufacturing, testing, and operation. Compliance with safety regulations, technical specifications, and certification requirements is essential to ensure the integrity, reliability, and safety of rolling stock systems. However, navigating the regulatory landscape can be time-consuming, costly, and resource-intensive, particularly for new market entrants or companies seeking to introduce innovative technologies. Additionally, evolving regulatory requirements and standards pose ongoing challenges for manufacturers to keep pace with changing industry norms and requirements. Ensuring compliance with regulatory standards while balancing cost considerations and market demands requires close collaboration between industry stakeholders, regulatory authorities, and standards organizations.

Segments Insights:

Product Type Insights

Rapid Transport dominated the product segment of the rolling stock market. Rapid transit vehicles, such as metros and suburban trains, have gained immense popularity in urban environments where the need for frequent, efficient, and environmentally friendly transportation solutions is critical. With rising urbanization rates, metro projects like the Crossrail in London and the Riyadh Metro in Saudi Arabia have significantly boosted this segment. Rapid transport is highly favored due to its ability to transport large numbers of passengers quickly across congested cities, thereby reducing traffic congestion and emissions.

On the other hand, the fastest-growing product segment is the locomotive sector. The expansion of freight corridors and the rejuvenation of transcontinental trade routes, such as China's Belt and Road Initiative, have necessitated a growing demand for powerful and efficient locomotives. Additionally, the shift towards electric and hybrid locomotives is accelerating this growth, as nations prioritize low-carbon transportation infrastructure. Emerging markets in Asia and Africa are expected to contribute substantially to this growth trajectory.

Type Insights

Electric rolling stock held the largest share in the type segment. Growing environmental concerns, government mandates for zero-emission transportation, and advances in electric propulsion technology have made electric rolling stock the preferred choice globally. Projects like Japan's Shinkansen, France's TGV, and China's CRH trains are emblematic of this trend. These high-speed electric trains have revolutionized passenger rail travel by offering faster, cleaner, and more energy-efficient alternatives to conventional diesel-powered systems.

Diesel-powered rolling stock is the fastest-growing type in certain regions, particularly where full electrification of rail networks remains economically or geographically challenging. Regions with vast terrains and lower investment capabilities, like parts of Africa and Latin America, continue to rely on modern, fuel-efficient diesel trains to enhance connectivity while managing costs. Hybrid solutions, combining diesel and electric, are also gaining momentum in transitional economies.

Train Type Insights

Rail Passenger transport dominated the train type segment. The surge in daily commuters, urban dwellers, and international travelers has propelled demand for efficient passenger rail systems. High-profile projects such as India's Dedicated Suburban Rail corridors and Europe's interconnected rail networks are a testament to the dominant position of passenger rail transport. It not only eases road congestion but also provides a safer, more sustainable alternative to short-haul flights and personal vehicles.

Rail Freight is emerging as the fastest-growing segment, driven by the escalating demand for cost-effective, bulk transportation of goods. Initiatives like the Trans-Asian Railway Network and dedicated freight corridors in India demonstrate how rail freight is vital for economic development, offering a lower carbon footprint compared to trucking and shipping. Furthermore, technological upgrades such as GPS tracking and real-time monitoring are enhancing operational efficiencies in freight railways.

Regional Insights

Asia-Pacific dominated the global rolling stock market in terms of revenue share. The region's leadership is attributed to its extensive investments in high-speed rail projects, mass rapid transit systems, and the modernization of freight infrastructure. China remains the largest contributor, with over 35,000 kilometers of high-speed railway in operation as of 2024. Countries like India, Japan, and South Korea are also heavily investing in upgrading their rail networks, spurred by economic growth, urban expansion, and government initiatives supporting public transport.

The fastest-growing region is the Middle East & Africa (MEA). With mega-projects like the Riyadh Metro, Dubai's Route 2020, and the Nairobi Commuter Rail project, the MEA region is witnessing unprecedented rail infrastructure development. These investments aim to diversify economies away from oil dependency, enhance urban mobility, and attract international tourism. In Africa, regional connectivity efforts like the African Integrated High-Speed Railway Network (AIHSRN) plan to link major cities across the continent, creating fertile ground for rolling stock manufacturers.

Recent Developments

-

March 2025: Alstom announced the successful trial of its battery-electric train in Saxony, Germany, marking a milestone in zero-emission rolling stock solutions.

-

February 2025: Siemens Mobility secured a major contract worth €3 billion to deliver 150 high-speed trains for Spain's national railway operator, Renfe.

-

January 2025: CRRC Corporation Limited launched a new-generation autonomous high-speed train with a maximum speed of 350 km/h at the World Rail Congress in Beijing.

-

December 2024: Bombardier Transportation (now part of Alstom) inaugurated its new manufacturing facility for metro cars in Ontario, Canada, aiming to fulfill growing North American orders.

Some of the prominent players in the rolling stock market include:

- Alstom Transport

- CRRC Corporation Limited

- GE Transportation

- Hitachi Rail System

- Hyundai Rotem

- Kawasaki Heavy Industries, Ltd.

- Siemens Mobility

- Stadler Rail AG

- The Greenbrier Co.

- Trinity Rail

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global rolling stock market.

Product

- Locomotive

- Rapid Transport

- Wagon

Type

Train Type

- Rail Freight

- Rail Passenger

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)