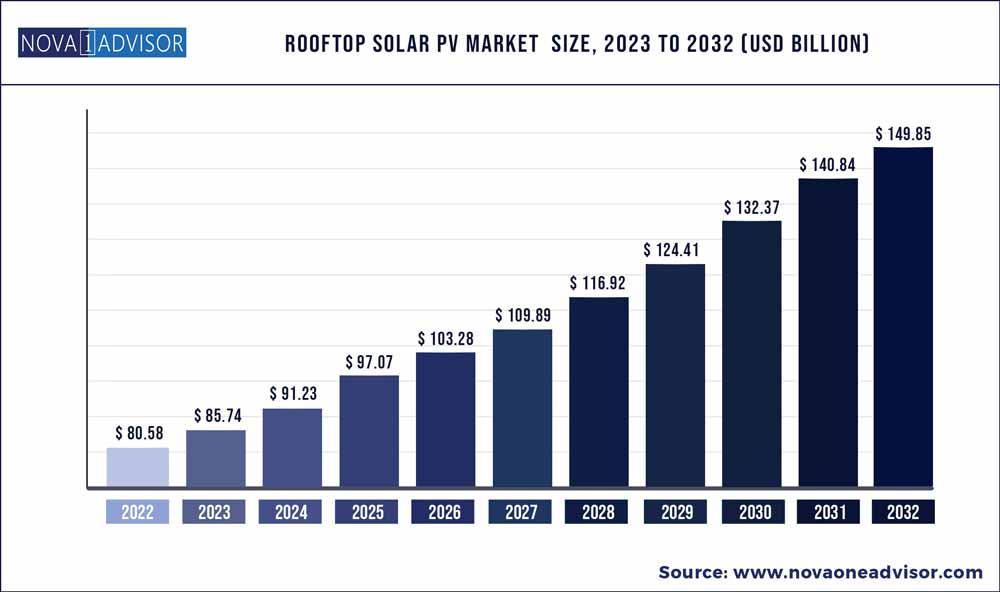

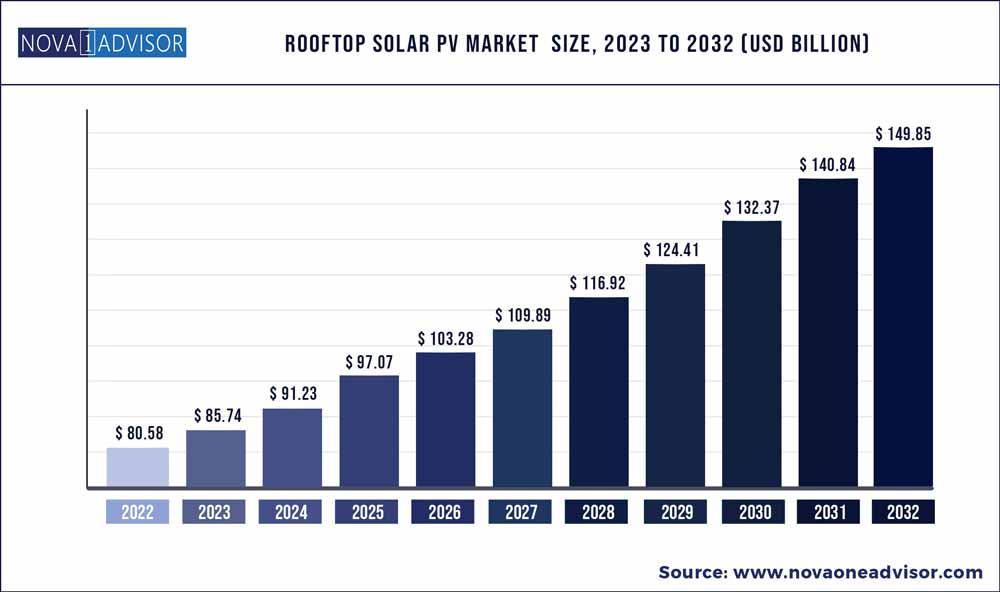

The global Rooftop Solar PV market size was exhibited at USD 80.58 billion in 2022 and is projected to hit around USD 149.85 billion by 2032, growing at a CAGR of 6.4% during the forecast period 2023 to 2032.

Key Pointers:

- Thin film segment occupied a dominant market share of over 39% in 2022

- The crystalline silicon segment occupied a 37.6% share of market revenue in 2022.

- The industrial sector accounted for the largest revenue share of around 46% in 2022.

- The commercial segment occupied 35.37% of market revenue share in 2022.

- On-grid segment accounted for the largest revenue share of over 85% in 2022.

- The Asia Pacific region accounted for the largest revenue share of over 38.9% in 2022.

- The European regional market captured a revenue share of over 30.52% in 2022.

A rooftop solar photovoltaic installation is a type of electrical installation setup mounted on the roof that converts solar energy into electricity. Rooftop solar PV systems are a type of distributed power generating system that helps to cater to the energy demands of buildings within an existing distribution network. Rooftop solar PVs act as a secure investment for end-use customers against the volatility in prices of electricity. End-use segments can calculate their electricity generation cost for another 10 years, owing to ease of calculation of price of power generated from these photovoltaics. This trend is estimated to positively influence the industry landscape during the forecast period.

Rooftop Solar PV Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 85.74 Billion

|

|

Market Size by 2032

|

USD 149.85 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 6.4%

|

|

Base year

|

2022

|

|

Forecast period

|

2023 to 2032

|

|

Segments covered

|

Technology, grid type, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key companies profiled

|

JinkoSolar; JA Solar; Trina Solar; LONGi Solar; Canadian Solar; Hanwha Q-CELLS; Risen Energy; GCL-SI; First Solar; Talesun; SunPower Corporation; ReneSola; Shenzhen Yingli New Energy Resources Co., Ltd; E-Ton Solar; Indosolar

|

High Efficiency and Declining Energy Payback Time Supported by Government Subsidies and Tax Credits

Rooftop solar systems can be installed at various locations, such as household and commercial building rooftops and above parking spaces, using balance of system including inverters, transformers, wiring, and monitoring equipment, making them a convenient option. Rooftop solar capacities range from 1 Watt to several GW for on-grid as well as off-grid applications. This makes rooftop solar systems a highly preferred source of power over other green alternative sources. The demand for rooftop solar systems is primarily driven by various incentive mechanisms such as technology-specific renewable portfolio standards (RPS) and tenders, tax credits, traditional feed-in tariffs or Power Purchase Agreements (PPAs), as well as premiums for the feed-in of excess power generated in self-consumption systems.

Rise in Adoption of Distributed PV Technology Globally

Distributed PVs (DPVs) with a capacity of less than 100 kW are preferred for rooftop solar systems. However, as the difficulties with FIT persist for DPV, solar leasing has gained popularity and is expected to boost the rooftop solar market. The demand for DPV has been increasing at a steady pace, owing to high number of installations in developed countries such as Japan and the U.S. Electricity generated by DPV is available at competitive prices; hence, the local government in China has changed policies in order include systems under 20 MW as DPV.

Some of the key trends likely to shape the near-term utility PV market outlook include continued growth of utility PV outside of renewable portfolio standard (RPS) obligations and increased procurement by municipal and cooperative utilities. Utilities are voluntarily introducing large-scale solar into resource planning as hedge, due to competitive prices, in order to cope with price volatility of natural gas and other fossil fuels.

Technology Insights

Thin film segment occupied a dominant market share of over 39% in 2022 and is expected to expand at the highest CAGR over the forecast period. The growth can be attributed to thin film manufacturing from lightweight and flexible materials, strong durability, and narrow design. Thin film rooftop solar PV majorly finds application in the commercial sector as they have lower installation costs due to their light weight.

The crystalline silicon segment occupied a 37.6% share of market revenue in 2022. Low cost manufacturing of silicon semiconductors, extended lifecycle of panels, and low weight volume ratio are among the key factors driving the segment growth. Mono crystalline rooftop solar PV made from fine grade silicon possesses enhanced space efficiency when compared to thin film modules.

Application Insights

The industrial sector accounted for the largest revenue share of around 46% in 2022 and is anticipated to maintain its dominance over the forecast period. Rooftop solar provides energy for industrial heating and cooling, which otherwise would be sourced from fossil fuels generating harmful emissions. Growing industrialization across developing economies is expected to provide a major impetus to the market demand over the forecast period.

The residential segment is expected to expand at the highest CAGR over the forecast period. Off-grid rooftop solar PV equipped with an energy battery storage system provides reliable secondary power in residential households, thereby boosting product demand across the segment. Deployment of large scale storage systems to protect against peak demand power changes have resulted in the adoption of extra-large rooftop solar PV system to store desired power in batteries.

The commercial segment occupied 35.37% of market revenue share in 2022. Growing penetration rooftop solar PV across hospitals, hotels, and corporate offices along with rising power demand from data centers & communication base stations is expected to propel the product demand across the commercial sector. In addition, module level monitoring, improved energy yield, and enhanced panel efficiency are among the major factors propelling the segment growth.

Grid Type Insights

On-grid segment accounted for the largest revenue share of over 85% in 2022, as it offers the benefit of transferring the excess electricity generated to the grid and no battery storage needs to be installed near the system source. Non-complexity of grid connected rooftop PV systems along with low operating and maintenance costs is bound to generate positive demand for on-grid segment market growth.

Off-grid segment is projected to ascend at the highest CAGR over the forecast period owing to growing power demand from remote locations coupled with stringent regulatory schemes for decentralized power generation. Off-grid rooftop PV are self-sustaining systems, saving and storing solar power into a battery energy storage system for later use when the grid power goes down.

Regional Insights

The Asia Pacific region accounted for the largest revenue share of over 38.9% in 2022 and is expected to continue its dominance over the forecast period. China accounted for the largest contributor to the market revenue generation. Favorable government policies providing financial incentives and subsidies to solar PV projects along with the presence of large market players are among the significant factors contributing to the market growth in China.

The European regional market captured a revenue share of over 30.52% in 2022. U.K. registered for the largest revenue market share in Europe. Increasing trend of generating power through renewable energy is adding to the rising rooftop solar PV capacity. Moreover, stringent regulatory reforms regarding clean energy deployment are driving the regional market growth.

North America occupied a significant market share, with the U.S. being the major revenue contributor to regional growth. The growing requirement for clean fuel power generation along with the surging capacity of residential solar is anticipated to enhance product penetration across the country in the forthcoming years.

Key Developments in Global Rooftop Solar PV Market

- In April 2021, Amplus Solar Power Pvt. Ltd, a member of the Petronas Group of Malaysia, announced that it had acquired 17 solar rooftop assets of Sterling & Wilson, totaling 7.2 megawatts (MW). The company also revealed that the 17 projects of Sterling & Wilson supply to 13 leading industrial, commercial, and institutional customers. Such developments are expected to help the company consolidate its position in the rooftop solar PV market.

- In September 2021, Tata Motors entered into an agreement with Tata Power to install and operate a 3 MWp rooftop solar project at its passenger vehicle business unit (PVBU) plant in Pune, India

- In 2018 Tata Solar Power, an India-based company that manufactures and implements solar PV rooftop systems, reported that a rooftop PV system has been installed at the Wankhede Cricket Stadium in Mumbai, India

- In 2017, The European Investment Bank and the International Solar Alliance signed a partnership deal. The partnership is for 800 Mn Euro financial aid to support India's renewable energy project. The collaboration between the two organizations helpful to raise funds for the development of affordable solar energy in nations with plenty of sunlight.

Some of the prominent players in the Rooftop Solar PV Market include:

- JA Solar

- JinkoSolar

- SunPower Corporation

- Shenzhen Yingli New Energy Resources Co., Ltd,

- ReneSola

- First Solar

- Talesun

- Trina Solar

- LONGi Solar

- Canadian Solar

- Hanwha Q-CELLS

- Risen Energy

- GCL-SI

- Indosolar

- E-Ton Solar

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Rooftop Solar PV market.

By Technology

- Thin Film

- Crystalline Silicon

- Others

By Grid Type

By Application

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)