Sample Preparation Market Size, Share and Trends Analysis Report 2026 to 2035

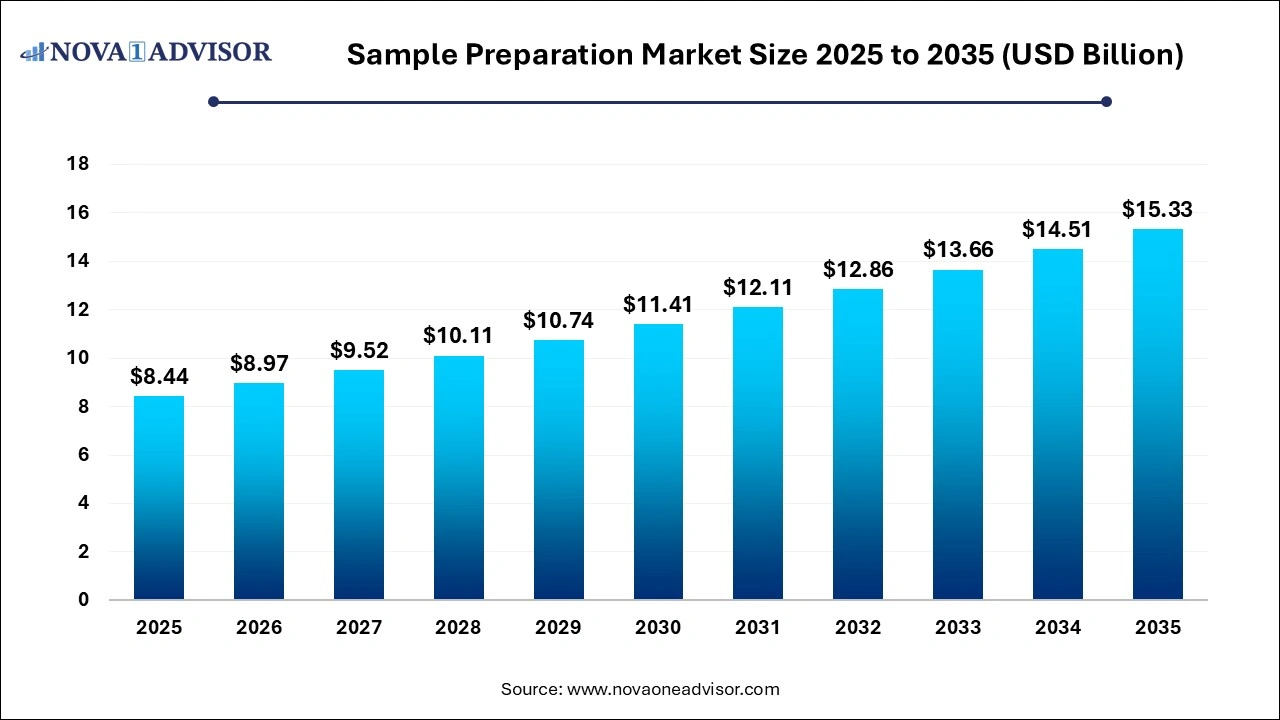

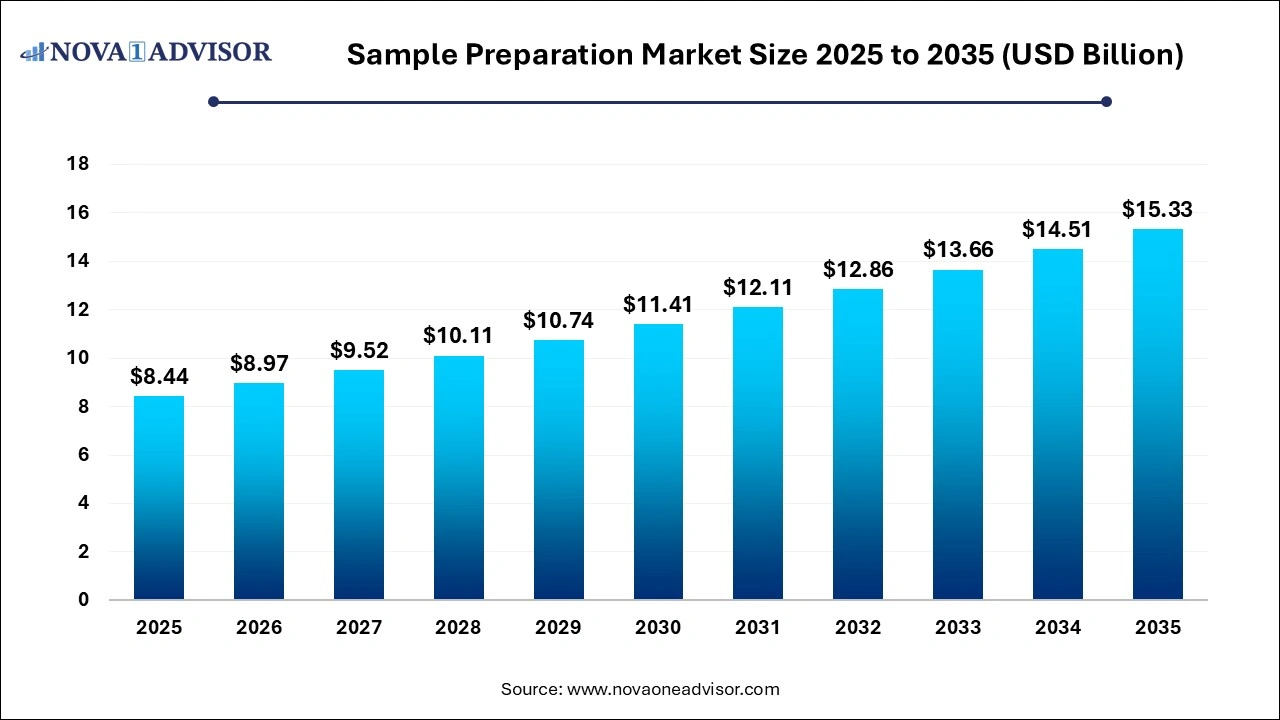

The sample preparation market size was exhibited at USD 8.44 billion in 2025 and is projected to hit around USD 15.33 billion by 2035, growing at a CAGR of 6.15% during the forecast period 2026 to 2035.

Sample Preparation Market Key Takeaways:

- The consumables segment dominated the market in 2025, with a share of 61.99%, and is expected to witness the fastest growth rate over the forecast period.

- The protein preparation segment dominated the market in 2025, with a share of 45.06%, and is expected to witness the fastest growth rate over the forecast period.

- The genomics segment dominated the market in 2025, with a share of 30.94%, and is expected to witness the fastest growth rate over the forecast period.

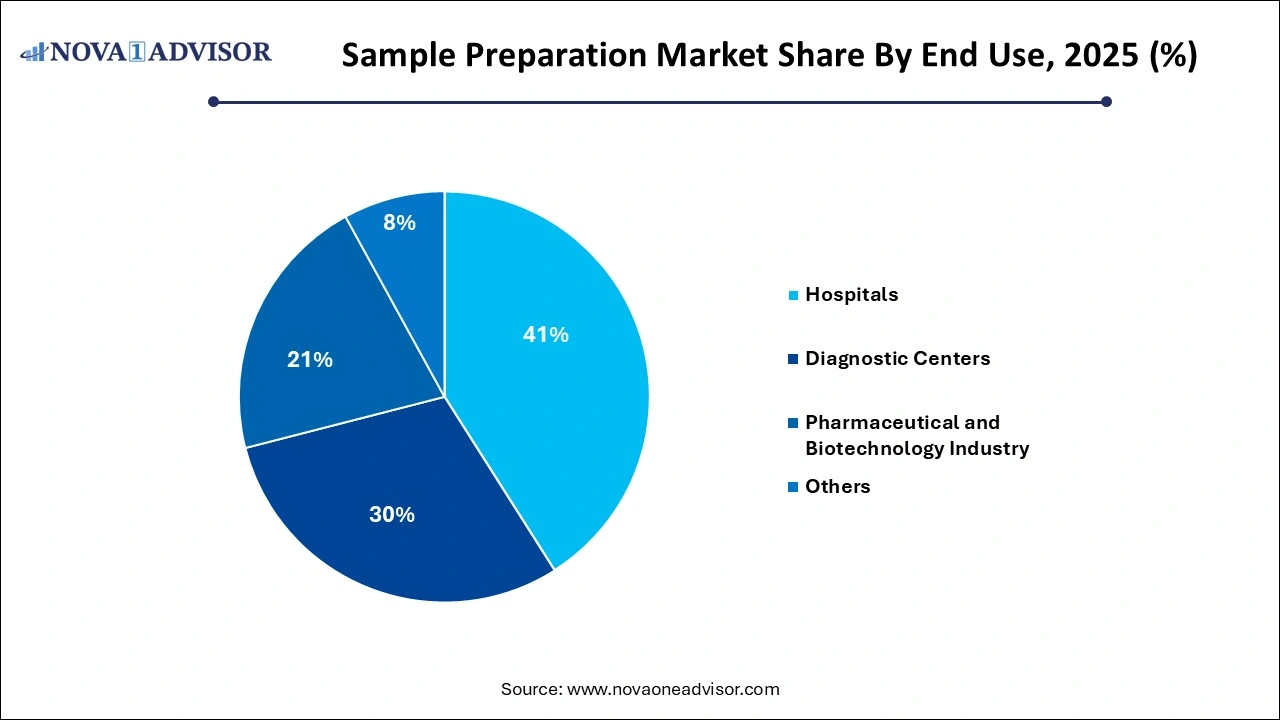

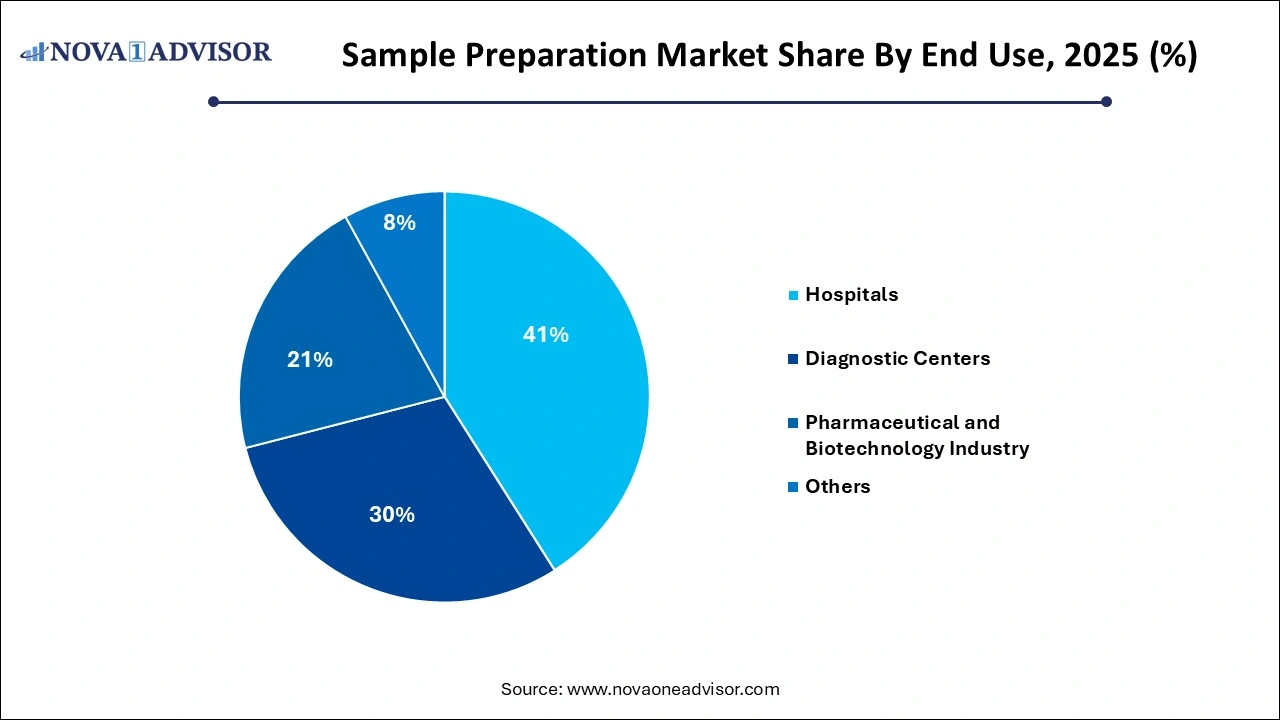

- The diagnostic center segment dominated the market in 2025, with a share of 30%, and is expected to witness the fastest growth rate over the forecast period.

- North America sample preparation market has established global dominance in 2025 with a 41.21% share.

Sample Preparation Market Overview

The sample preparation market has evolved as a fundamental pillar of modern laboratory workflows, underpinning critical applications in diagnostics, research, pharmaceutical, and biotechnology. Sample preparation refers to the various techniques and processes employed to transform biological, chemical, or material samples into a format suitable for subsequent analysis. Accurate, reproducible, and efficient sample preparation is vital for achieving reliable and meaningful experimental outcomes.

Growing demand for accurate disease diagnostics, the surge in genomic and proteomic research, the expansion of pharmaceutical pipelines, and the increasing focus on personalized medicine are collectively driving the expansion of the sample preparation market. In research laboratories and clinical settings alike, preparation steps such as extraction, purification, isolation, and concentration are essential for removing interfering substances and enhancing analytical sensitivity.

Technological advancements, particularly automation and miniaturization, have revolutionized sample preparation by reducing human error, increasing throughput, and enabling high-sensitivity analysis. Furthermore, the emergence of point-of-care diagnostics and the proliferation of next-generation sequencing (NGS) platforms have fueled demand for highly efficient, user-friendly sample preparation solutions. With regulatory standards for sample handling becoming more stringent, particularly in clinical research and diagnostics, the market is experiencing robust growth.

Major Trends in the Sample Preparation Market

-

Automation and High-throughput Systems: Increasing adoption of automated liquid handling and extraction systems to enhance workflow efficiency.

-

Integration of Microfluidics: Lab-on-chip and microfluidic technologies are streamlining sample preparation processes.

-

Rising Demand for NGS and Omics Research: Accelerated use of genomics, proteomics, and metabolomics studies drives demand for efficient sample preparation.

-

Miniaturization of Sample Preparation Systems: Compact, portable devices are gaining traction for field and point-of-care applications.

-

Consumables-as-a-Service: Companies offering consumables with subscription models to ensure continuous supply and client retention.

-

Focus on Green Chemistry: Development of environmentally friendly reagents and processes for sustainable laboratory practices.

-

Expansion in Emerging Markets: Rising investment in healthcare infrastructure and research facilities in Asia-Pacific and Latin America.

Report Scope of Sample Preparation Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 8.97 Billion |

| Market Size by 2035 |

USD 15.33 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 6.15% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Technique, By Application, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck KGaA, Thermo Fisher Scientific Inc., Bio-RAD Laboratories Inc., Tecan Group Ltd., Agilent Technologies Inc., Hamilton Company, Promega Corporation, Illumina Inc., Roche Applied Science, Danaher Corporation, Qiagen N.V. |

Sample Preparation Market Dynamics

-

Driver: Surge in Genomic and Proteomic Research

One of the primary drivers of the sample preparation market is the explosive growth of genomic and proteomic research. Projects like the Human Genome Project and the increasing application of next-generation sequencing (NGS) have made DNA and RNA sample preparation a cornerstone of life science research. Similarly, proteomic studies aimed at understanding protein structure, function, and interactions demand meticulous sample preparation techniques to ensure purity and integrity. Companies such as Illumina, Thermo Fisher Scientific, and Agilent Technologies have introduced advanced kits and automation systems to cater to the rising demands of these research domains. As the scientific community delves deeper into personalized medicine and biomarker discovery, the need for reliable, standardized, and high-throughput sample preparation will continue to expand.

-

Restraint: High Cost of Advanced Sample Preparation Instruments

Despite the market's robust growth prospects, the high cost associated with advanced sample preparation instruments remains a significant restraint. Automated workstations, high-end liquid handling robots, and microfluidic extraction systems can require substantial capital investments, often limiting access to large and well-funded research institutions. Small and mid-sized laboratories, particularly in developing regions, may find these systems financially inaccessible. Moreover, the recurring costs of specialized consumables and maintenance further strain operational budgets. As a result, the full potential of modern sample preparation technologies remains untapped across a significant portion of the global market.

-

Opportunity: Rising Demand for Point-of-Care Diagnostics

The growing emphasis on point-of-care (POC) diagnostics presents a compelling opportunity for the sample preparation market. Efficient and rapid sample preparation is critical for achieving accurate and timely results at the point of care. In infectious disease diagnosis, oncology, and chronic disease management, portable sample preparation solutions integrated with diagnostic platforms are transforming healthcare delivery. Companies are developing compact, automated sample preparation devices tailored for POC settings, particularly in resource-limited environments. The COVID-19 pandemic underscored the importance of rapid and reliable sample processing, spurring innovations that are now extending to broader diagnostic applications.

Sample Preparation Market Segmental Insights

By Product Insights

Consumables dominated the product segment. Consumables, including reagents, kits, and columns, are critical for daily sample preparation workflows across research and diagnostic laboratories. They ensure consistency, reproducibility, and compliance with standardized protocols. High consumption rates, recurring purchasing cycles, and the proliferation of NGS and proteomics have made consumables the largest revenue generator in the market. Leading players offer a broad range of specialized consumables for nucleic acid extraction, protein purification, and metabolite analysis.

Instruments are the fastest-growing product segment. With increasing demand for high-throughput and automated workflows, instruments such as liquid handling systems, extraction workstations, and automated evaporation units are witnessing rapid adoption. Innovations like Thermo Fisher's KingFisher Flex and Hamilton's Microlab STAR platforms exemplify how automation reduces hands-on time and improves consistency. As laboratories face growing sample volumes and strive for operational efficiency, investment in advanced instruments is projected to surge.

By Technique Insights

Solid-phase extraction dominated the technique segment. Solid-phase extraction (SPE) remains the most widely used technique for sample cleanup and concentration across clinical, forensic, and pharmaceutical laboratories. Its advantages—such as reduced solvent consumption, high selectivity, and ease of automation have ensured its dominance. SPE cartridges and plates are crucial for isolating analytes from complex matrices, ensuring reliable downstream analysis.

Protein preparation is the fastest-growing technique segment. The surging interest in proteomics research, therapeutic protein development, and biomarker discovery has fueled the demand for specialized protein preparation techniques. Technologies like magnetic bead-based protein isolation, immunoprecipitation, and affinity purification are being increasingly adopted. As the pharmaceutical industry shifts towards biologics, the need for efficient protein sample preparation will continue to expand.

By Application Insights

Genomics dominated the application segment. With the advent of precision medicine, cancer genomics, and personalized therapies, genomic research has become a cornerstone of modern healthcare. Sample preparation steps such as DNA/RNA extraction, purification, and amplification are essential precursors for NGS and qPCR analyses. The growing use of genomics in disease diagnostics, agriculture, and forensic sciences further amplifies the demand for robust sample preparation protocols.

Metabolomics is the fastest-growing application segment. Metabolomics, the study of small-molecule metabolites in biological systems, is gaining traction for its applications in disease biomarker discovery, drug development, and nutritional sciences. Sample preparation in metabolomics requires highly sensitive techniques to capture dynamic metabolite profiles without degradation. Increasing investments in metabolomic research platforms and the expanding application landscape drive the segment's rapid growth

By End Use Insights

Pharmaceutical and Biotechnology Industry dominated the end-use segment. Pharmaceutical companies and biotechnology firms rely heavily on sample preparation for drug discovery, development, and quality control. From biomarker discovery to clinical trials assays, precise and reproducible sample handling is critical. Increasing R&D spending, growing biologics pipelines, and the need for compliance with regulatory standards contribute to the segment's dominance.

Diagnostic Centers are the fastest-growing end-user segment. The rising demand for accurate, rapid diagnostics, particularly in infectious diseases and cancer, is fueling investments in advanced sample preparation at diagnostic centers. Automated sample preparation solutions are increasingly being deployed to meet the high throughput needs of modern diagnostic workflows. Initiatives promoting early disease detection and personalized healthcare further bolster this trend.

Sample Preparation Market By Regional Insights

North America dominated the sample preparation market. The region's supremacy is driven by a strong concentration of research institutions, pharmaceutical giants, and biotechnology firms. High healthcare spending, robust government funding for life sciences research (e.g., NIH grants), and rapid adoption of advanced technologies support market growth. Companies such as Thermo Fisher Scientific, Agilent Technologies, and PerkinElmer have extensive operational footprints in North America. Additionally, the growing demand for personalized medicine and molecular diagnostics further amplifies market expansion.

Asia-Pacific is the fastest-growing region. The region's rapid growth is fueled by increasing investments in healthcare infrastructure, expanding biotechnology sectors, and rising research activities across countries like China, India, and South Korea. Government initiatives such as China's "Made in China 2025" plan and India's "National Biopharma Mission" aim to promote domestic biopharma and research capabilities. Moreover, a growing focus on genomics and infectious disease research post-COVID-19 is creating robust demand for sample preparation solutions across Asia-Pacific.

Some of the prominent players in the sample preparation market include:

Sample Preparation Market Recent Developments

-

March 2025: Thermo Fisher Scientific launched the "KingFisher Apex," a next-generation automated purification system designed to streamline nucleic acid and protein extraction workflows.

-

February 2025: QIAGEN introduced "EZ1 Advanced XL," a fully automated sample preparation instrument tailored for mid- to high-throughput molecular diagnostic laboratories.

-

January 2025: Agilent Technologies announced a collaboration with a leading academic institution to develop novel microfluidic platforms for sample preparation, focusing on genomics and proteomics applications.

-

December 2024: Bio-Rad Laboratories unveiled its "SEQuoia Complete Library Prep Kit," designed to simplify RNA sample preparation for next-generation sequencing.

-

November 2024: Hamilton Company expanded its "Microlab Prep" platform to include new modules for metabolomics and lipidomics sample preparation workflows.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the sample preparation market

By Product

-

- Extraction System

- Workstation

- Automated Evaporation System

- Liquid Handling Instrument

-

-

- Liquid handling workstations

- Pipetting systems

- Reagents dispensers

- Microplate washer

- Other liquid handling systems

-

- Purification Kit

- Isolation Kit

- Extraction Kit

By Technique

- Protein Preparation

- Solid-phase extraction

- Liquid-liquid extraction

By Application

- Genomics

- Proteomics

- Epigenomics

- Transcriptomics

- Metabolomics

- Others

By End Use

- Hospitals

- Diagnostic Centers

- Pharmaceutical and Biotechnology Industry

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)