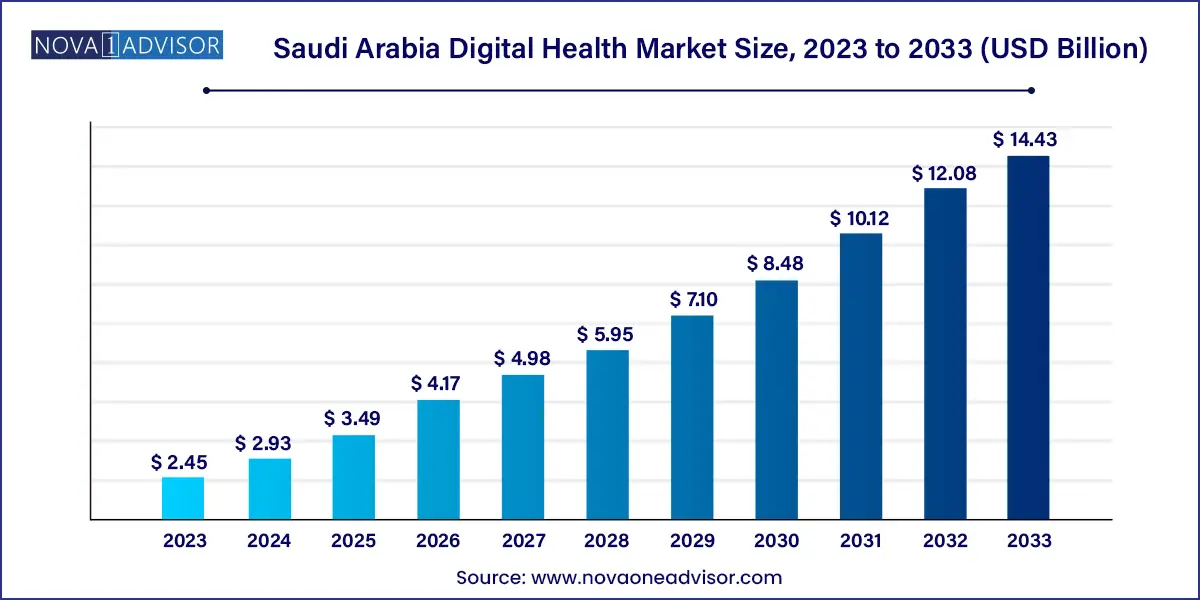

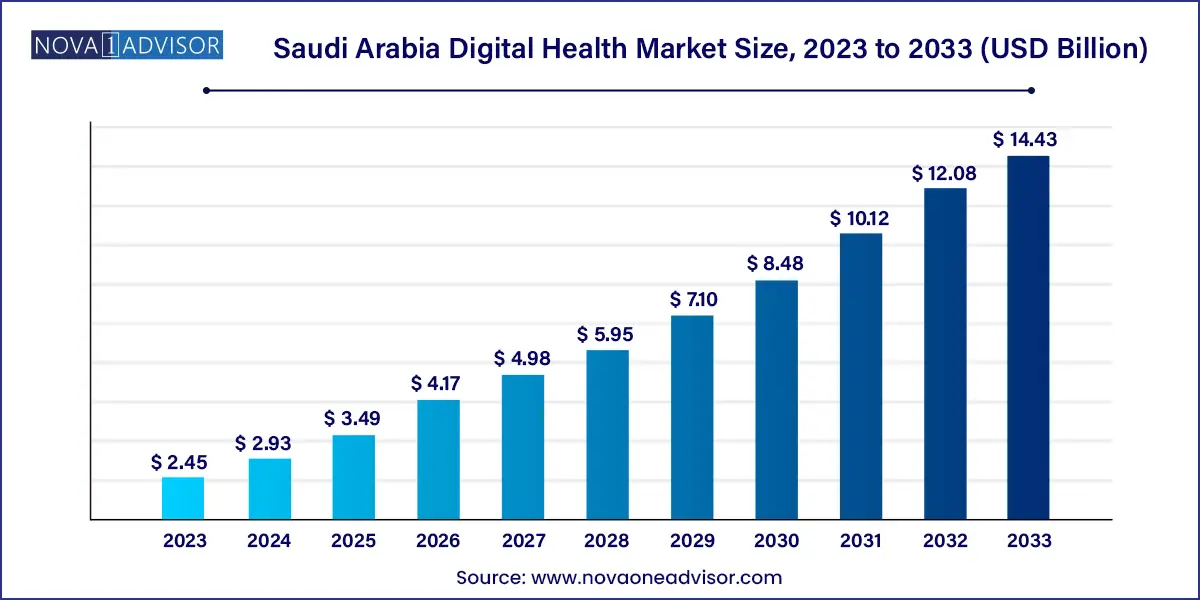

The Saudi Arabia digital health market size was estimated at USD 2.45 billion in 2023 and is expected to surpass around USD 14.43 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 19.4% during the forecast period 2024 to 2033.

Key Takeaways:

- The tele-healthcare segment dominated the market and accounted for a share of over 45.9% in 2023

- The services segment accounted for the largest revenue share in 2023

- The software segment is expected to register the fastest CAGR over the forecast period

- The diabetes segment held the largest share of around 30.12% in 2023 and is anticipated to register the fastest growth over the forecast period.

- The patient segment dominated the market with the largest share of over 30.18% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period.

Market Overview

The Saudi Arabia digital health market is undergoing a profound transformation, influenced by the convergence of healthcare modernization efforts, growing digital infrastructure, and ambitious national strategies such as Vision 2030. Digital health in Saudi Arabia spans a broad array of technologies including telehealth, mobile health (mHealth), healthcare analytics, and digital health systems like electronic health records (EHR) and e-prescribing platforms.

Historically reliant on traditional healthcare delivery, the Kingdom has shifted its focus to smarter, data-driven, and patient-centric care models. This transformation has accelerated since the COVID-19 pandemic, which highlighted the need for resilient digital alternatives to physical consultations. As a result, Saudi citizens and residents have increasingly turned to teleconsultation platforms, health monitoring apps, and AI-assisted diagnostics.

The Ministry of Health (MOH) has been instrumental in driving digital adoption. Initiatives such as Sehha, Mawid, and Tawakkalna apps have demonstrated the government’s commitment to building a robust digital health ecosystem. Not only do these platforms offer appointment scheduling and virtual consultations, but they also collect vital population health data for strategic planning.

The healthcare burden in Saudi Arabia is increasingly shaped by chronic conditions such as diabetes, obesity, and cardiovascular diseases a reflection of lifestyle changes over the past two decades. With a relatively young but tech-savvy population and one of the highest smartphone penetration rates in the Middle East, Saudi Arabia is uniquely positioned to scale its digital health offerings rapidly.

Major Trends in the Market

-

Expansion of Government-Sponsored Health Apps: National apps like Sehhaty, Tawakkalna, and Mawid are being constantly upgraded to provide a broader spectrum of health services.

-

Growth in AI-Powered Diagnostics: Hospitals and startups are experimenting with AI for radiology interpretation, patient triage, and risk stratification.

-

Increased Use of Wearables in Lifestyle Management: Fitness tracking and chronic condition monitoring are becoming popular among Saudi youth and middle-aged citizens alike.

-

Localization of Health Content: Arabic-language health apps and culturally tailored telemedicine services are being developed to improve user engagement.

-

Cloud-Based EHR Adoption: Healthcare providers are migrating to cloud infrastructure to store and manage digital patient records more efficiently.

-

Private-Public Collaboration: Partnerships between global digital health companies and Saudi public health institutions are fostering innovation and knowledge transfer.

Saudi Arabia Digital Health Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.93 Billion |

| Market Size by 2033 |

USD 14.43 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 19.4% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, component, application, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Philips; Siemens; Healthineers; GE Healthcare; Cerner; Epic Systems; Apple Inc.; Vodafone Group; Samsung Electronics Co., Ltd.; Veradigm.

|

Key Market Driver: Vision 2030 and Healthcare Digitization

A significant driver of the Saudi digital health market is the Vision 2030 strategy, a government-led blueprint for economic diversification and public service modernization. One of its primary pillars is health sector transformation, aimed at improving quality, efficiency, and accessibility.

As part of this initiative, Saudi Arabia has launched national platforms such as Sehhaty for accessing medical records, Mawid for scheduling appointments, and Tetamman for COVID-related inquiries and remote care. These platforms have collectively reached millions of users, proving their efficacy. Moreover, the National Platform for Health Information Exchange (NPHIE) is being developed to centralize and secure medical data exchange between providers.

Government funding for health tech startups, coupled with streamlined regulatory pathways for digital health products, has stimulated rapid innovation and deployment. Vision 2030 has thus not only created a policy foundation for digital health but also enabled public-private synergies that benefit both urban and rural populations.

Key Market Restraint: Limited Digital Literacy and Cultural Barriers

Despite significant infrastructure advancements, digital literacy remains a restraint in the widespread adoption of digital health platforms. While younger Saudis are proficient with smartphones and apps, older citizens and those in remote regions may lack familiarity with digital tools. This creates an accessibility gap that digital health providers must address through training, user-friendly interfaces, and multilingual support.

Additionally, cultural sensitivities related to telehealth such as privacy concerns during video consultations or hesitance to adopt female physicians in virtual settings still affect utilization rates. Although the Kingdom has made strides in modernizing its healthcare system, overcoming deep-rooted traditions and comfort with face-to-face care remains a challenge that requires long-term behavioral shifts.

Key Market Opportunity: Remote Chronic Disease Management for Diabetes and Obesity

With obesity rates exceeding 35% and diabetes prevalence rising above 18%, chronic disease management presents a major opportunity for digital health expansion. Lifestyle-induced conditions dominate the healthcare burden, creating demand for long-term monitoring and proactive intervention.

Digital tools—such as glucose monitoring wearables, mHealth coaching apps, and AI-based dietary recommendation engines—can support patients in maintaining treatment adherence and preventing complications. For instance, a wearable glucose monitor integrated with the Sehhaty app could alert physicians in real-time if a patient’s sugar level spikes.

Riyadh-based hospitals have begun to deploy such solutions in pilot programs, and the government is exploring integration of these technologies into national insurance schemes. This opens up scalable opportunities for companies to partner with healthcare providers in developing modular, culturally adaptable chronic care pathways.

Segmental Analysis

By Technology

Tele-healthcare dominated the Saudi Arabia digital health market in 2024, fueled by strong adoption of video consultation platforms and government-backed telehealth initiatives. During the pandemic, apps like Sehha and Mawid allowed millions of users to consult with doctors remotely, setting a precedent for future telecare services. Remote medication management has also gained momentum, particularly among elderly patients who require regular follow-ups. In the telecare subset, activity monitoring tools are being used by rehabilitation centers to track recovery in post-operative patients and accident victims.

In contrast, mHealth is poised to be the fastest growing segment, driven by widespread smartphone usage and increasing awareness of personal health tracking. Wearables such as BP monitors, sleep apnea devices, and actigraphs are becoming popular among middle-aged consumers for early detection of health anomalies. Mobile operators and device vendors are collaborating to bundle health apps with smartwatches and fitness bands. Moreover, medical and fitness apps in Arabic are rapidly growing in popularity, especially among younger Saudis looking to balance lifestyle with proactive wellness.

By Component

Services held the dominant position in the Saudi Arabia digital health market, due to their integral role in enabling telehealth, diagnostics, and monitoring. Government healthcare centers and private hospitals alike are relying on external service providers for everything from remote patient management to AI-based imaging interpretation. Even insurance companies are now integrating digital consultation services into their offerings, showing the breadth of service-based models.

Software is the fastest growing component, especially due to increasing demand for flexible, interoperable platforms that can be customized for different providers. SaaS-based electronic medical records and clinical decision support tools are being rapidly adopted, particularly by mid-sized and private hospitals. These platforms allow for easy data entry, reporting, and analytics without the burden of heavy infrastructure investments.

By Application

Diabetes emerged as the most dominant application, reflecting the high prevalence and economic burden of the disease in Saudi Arabia. Digital tools are being deployed for blood sugar monitoring, medication adherence tracking, and lifestyle coaching. For example, several MOH clinics are now using integrated digital dashboards to monitor diabetic patients and adjust their care plans in real time.

On the other hand, obesity management is the fastest growing application, supported by growing public awareness campaigns and fitness tech penetration. Weight management apps that include meal tracking, workout regimes, and virtual health coaches have become increasingly popular, especially among urban residents in Riyadh and Jeddah. Integration with smartwatches and Arabic-language meal databases has helped these apps gain traction across genders and age groups.

By End-use

Patients constitute the largest end-use segment, largely because of their direct interaction with apps, wearable devices, and teleconsultation services. A growing number of patients now prefer managing their care remotely, particularly for non-urgent conditions like hypertension or seasonal flu. User-friendly interfaces and insurance-covered access to digital services have encouraged more people to become active participants in their care.

Providers are the fastest growing segment, as hospitals and clinics look to optimize workflows, improve diagnostics, and reduce operational costs. From AI-supported triage systems to EHR integration for better patient data handling, providers are at the forefront of digital transformation. Major hospital chains are now investing in digital innovation labs and staff training programs to accelerate adoption and integration across departments.

Country-Level Analysis

Saudi Arabia’s digital health ecosystem is characterized by a strong central regulatory push, high urban-rural disparity, and increasing consumer readiness. In major cities like Riyadh, Jeddah, and Dammam, hospitals have already embraced digital systems such as EHRs, and private clinics offer comprehensive telehealth packages. Urban dwellers, especially the youth, are quick to adopt fitness trackers and digital consultation services.

In contrast, rural areas are still catching up, although the MOH has prioritized the deployment of mobile health units and teleconsultation services to underserved regions. The National eHealth Strategy aims to unify health data across all regions, ensuring every citizen and resident benefits from digital innovation, irrespective of geography. Saudi Arabia’s large population of expatriates also influences the market; many private healthcare providers tailor digital services for diverse linguistic and cultural backgrounds.

Recent Developments

-

March 2025 – Tawuniya, a leading insurance provider, partnered with a digital health startup to launch an AI-powered chronic disease management platform focused on diabetes and hypertension.

-

January 2025 – King Faisal Specialist Hospital & Research Centre in Riyadh implemented a new AI-based imaging solution to assist radiologists in detecting early-stage tumors.

-

October 2024 – Sehhaty app introduced mental health consultation services, offering virtual therapy sessions in collaboration with licensed professionals.

-

August 2024 – STC Health, the digital health arm of Saudi Telecom Company, announced a partnership with Samsung to bundle smartwatches with preventive health apps customized for the Saudi market.

Key Saudi Arabia Digital Health Companies:

- Advanced Micro Devices

- Philips, Siemens

- Healthineers

- GE Healthcare

- Cerner

- Epic Systems

- Apple Inc.

- Vodafone Group

- Samsung Electronics Co., Ltd.

- Veradigm

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Saudi Arabia Digital Health market.

By Technology

- Tele-healthcare

- Tele-care

- Activity Monitoring

- Remote Medication Management

- Tele-health

- LTC Monitoring

- Video Consultation

- mHealth

- Wearables

- BP Monitors

- Glucose Meters

- Pulse Oximeters

- Sleep Apnea Monitors

- Neurological Monitors

- Activity Trackers/Actigraphs

- mHealth Apps

- Medical Apps

- Fitness Apps

- Services

- mHealth Service, By Type

- Monitoring Services

- Independent Aging Solutions

- Chronic Disease Management & Post-acute Care Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

- mHealth Services, By Participants

- Mobile Operators

- Device Vendors

- Content Players

- Healthcare Providers

- Healthcare Analytics

- Digital Health Systems

- EHR

- E-prescribing Systems

By Component

- Hardware

- Software

- Services

By Application

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

By End-use

- Patients

- Providers

- Players

- Other Buyers