Sepsis Diagnostics Market Size and Research

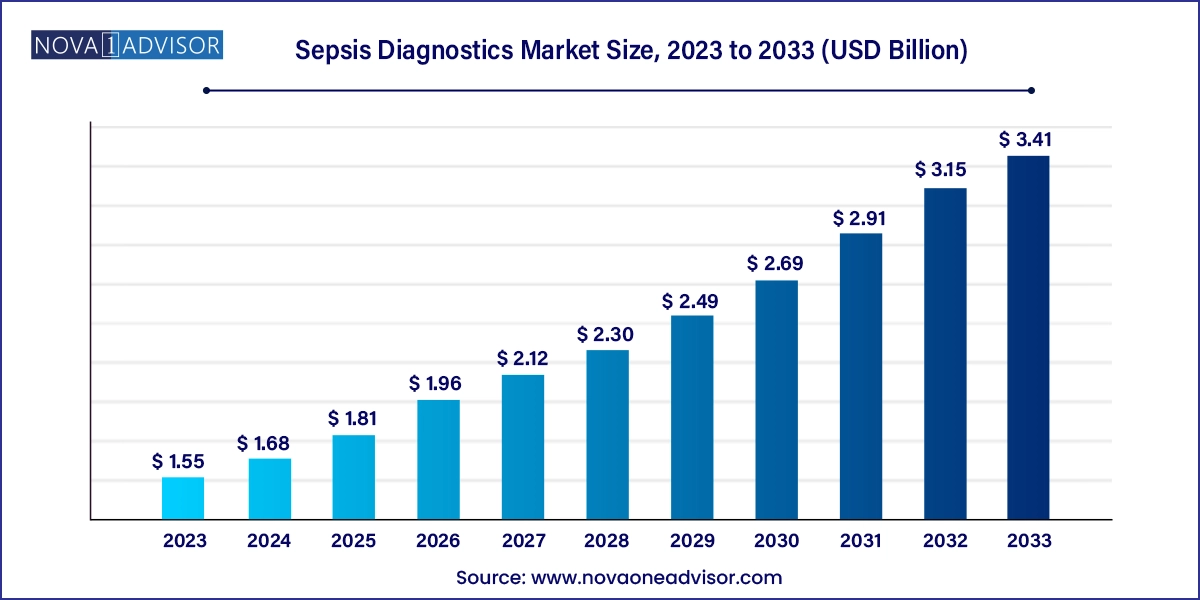

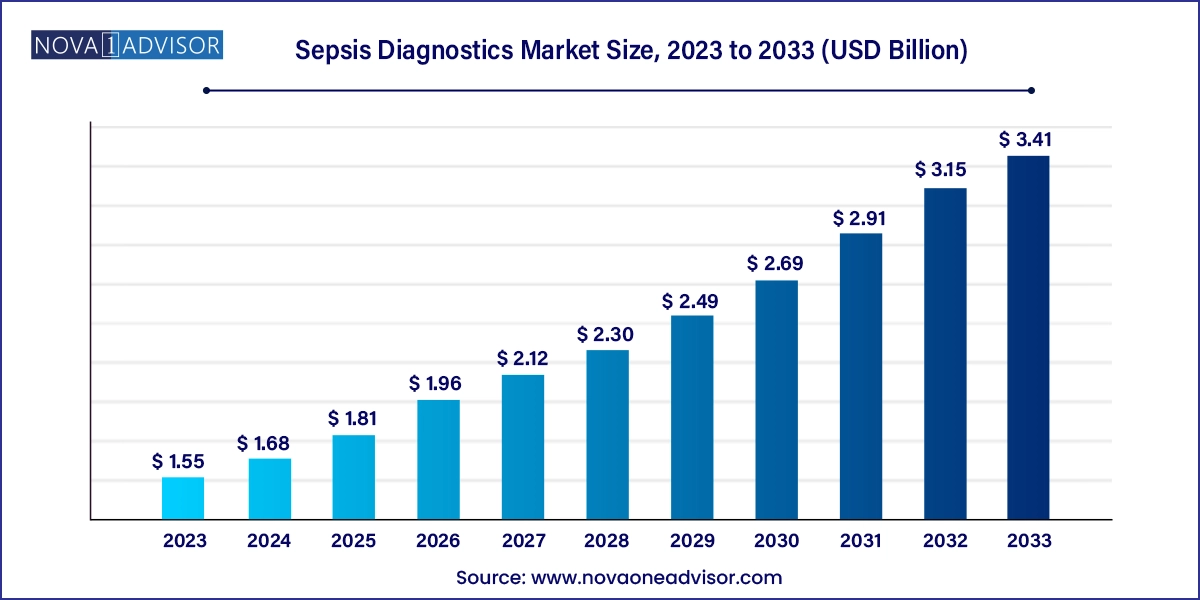

The global sepsis diagnostics market size was exhibited at USD 1.55 billion in 2023 and is projected to hit around USD 3.41 billion by 2033, growing at a CAGR of 8.2% during the forecast period 2024 to 2033.

Sepsis Diagnostics Market Key Takeaways:

- The market is driven by technological advancements, such as molecular diagnostic technologies, multiplex assays, and biomarkers.

- Based on product type, blood culture media dominated the market in 2023 with a revenue share of more than 38.9%, as blood culture is considered the most cost-effective and convenient testing mode.

- The microbiology technology segment dominated the market in 2023 and held the largest share of more than 48.9% of the overall revenue.

- Bacterial segment held the largest revenue share of 86.0% of the market in 2023.

- The fungal segment is expected to grow at a significant CAGR over the forecast period.

- The conventional diagnostics segment held the largest revenue share of 57.6% of the market in 2023.

- The hospital and clinics segment held the largest revenue size of 79.5% of the market in 2023.

- The laboratory testing type segment dominated the market in 2023 with a share of 82.6%.

- PoC testing is estimated to grow at a significant CAGR over the forecast period.

- North America dominated the market in 2023 and held the largest revenue share of more than 44.4%.

Market Overview

The global sepsis diagnostics market is an integral segment of the healthcare diagnostics industry, focused on the timely identification of sepsis a severe, life-threatening organ dysfunction caused by a dysregulated host response to infection. Early and accurate diagnosis is critical, as delayed detection can significantly increase morbidity, mortality, and healthcare costs.

Sepsis is a leading cause of death worldwide, responsible for millions of fatalities annually. The condition's rapid progression necessitates swift intervention based on accurate diagnostic tools capable of detecting pathogens and immune responses. The market encompasses a wide range of products and technologies, including blood culture systems, molecular assays, immunoassays, and advanced software platforms that streamline sepsis detection and management.

The escalating incidence of hospital-acquired infections, an aging global population more vulnerable to sepsis, growing awareness among clinicians about early detection, and technological advances in pathogen identification have significantly fueled the market’s growth. Additionally, government initiatives aimed at reducing sepsis-related mortality rates, such as the Surviving Sepsis Campaign, have further emphasized the need for robust diagnostic solutions.

Looking ahead, with continued investments in molecular diagnostics, point-of-care (PoC) testing advancements, and artificial intelligence (AI) integration into sepsis management algorithms, the global sepsis diagnostics market is expected to witness substantial expansion.

Major Trends in the Market

-

Rising Shift Toward Rapid, Syndromic Panel-Based Testing: Shortening the time-to-diagnosis and enabling early intervention.

-

Increased Adoption of Molecular Diagnostics: PCR and microarrays enhancing sensitivity and specificity of pathogen detection.

-

Emergence of Point-of-Care (PoC) Testing Solutions: Enabling bedside testing for faster clinical decision-making.

-

Integration of AI and Machine Learning (ML): Improving sepsis prediction, diagnosis, and risk stratification models.

-

Expansion of Blood Culture Innovations: Development of faster, more automated blood culture systems.

-

Development of Biomarker-Based Diagnostics: Growing focus on biomarkers like procalcitonin (PCT) and C-reactive protein (CRP) for early sepsis detection.

-

Collaborations Between Hospitals and Diagnostic Companies: Accelerating product validation and commercialization.

-

Growth in Sepsis Awareness Campaigns Globally: Driving both diagnostic demand and regulatory focus.

Report Scope of Sepsis Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.68 Billion |

| Market Size by 2033 |

USD 3.41 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Technology, Pathogen, Testing Type, Method, End-user, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

bioMérieux SA; Becton, Dickinson & Company; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Danaher Corporation (Beckman Coulter, Inc.); Luminex Corp.; Bruker; Cepheid; Immunexpress, Inc.; Koninklijke Philips N.V. |

Sepsis Diagnostics Market By Product Insights

Blood culture media dominate the product segment, traditionally serving as the gold standard for diagnosing bloodstream infections that can lead to sepsis. Blood cultures provide crucial information on pathogen type and antibiotic susceptibility, guiding targeted therapy.

Assay kits and reagents are growing fastest, driven by the demand for rapid molecular assays, immunoassays, and syndromic panels that detect sepsis biomarkers and causative agents faster than traditional culture methods. Increasing investment in biomarker discovery and multiplexing technologies is further fueling this segment's expansion.

Sepsis Diagnostics Market By Technology Insights

Microbiology leads the technology segment, given the established use of blood cultures and pathogen isolation techniques in clinical sepsis diagnosis.

Molecular diagnostics are growing fastest, owing to their ability to detect bacterial, fungal, and viral DNA/RNA directly from patient samples within hours. Techniques like polymerase chain reaction (PCR) and syndromic panel testing offer enhanced sensitivity and quicker turnaround, revolutionizing sepsis management paradigms.

Sepsis Diagnostics Market By Pathogen Insights

Bacterial sepsis dominates the pathogen segment, with gram-negative and gram-positive bacteria accounting for the majority of sepsis cases. Pathogens like Staphylococcus aureus, Escherichia coli, and Klebsiella species are major culprits in hospital-acquired and community-acquired sepsis.

Viral sepsis is growing fastest, particularly in the wake of global viral pandemics such as COVID-19, which revealed the potential for viral infections to precipitate sepsis-like syndromes. Ongoing research into viral biomarkers and viral-host interaction mechanisms is driving demand for viral sepsis diagnostics.

Sepsis Diagnostics Market By Method Insights

Conventional diagnostics dominate the method segment, particularly in low- and middle-income countries where access to automated systems remains limited.

Automated diagnostics are growing fastest, offering standardized workflows, reduced human error, and faster results, crucial in time-sensitive conditions like sepsis. Fully integrated platforms combining sample processing, pathogen detection, and data interpretation are gaining widespread clinical adoption.

Sepsis Diagnostics Market By End-user Insights

Hospitals and clinics dominate the end-user segment, given the high volume of critical care patients requiring sepsis evaluation, particularly in intensive care units (ICUs) and emergency departments.

Pathology and reference laboratories are growing fastest, driven by outsourcing trends, where hospitals without specialized diagnostic capabilities rely on centralized labs equipped with cutting-edge molecular and syndromic testing platforms.

Sepsis Diagnostics Market By Testing Type Insights

Laboratory testing dominates the testing type segment, reflecting the traditional reliance on centralized labs equipped for blood culture, molecular assays, and immunoassays.

Point-of-care (PoC) testing is growing fastest, enabling rapid bedside or emergency department-based sepsis diagnostics. The growing need for faster clinical decision-making and the trend toward decentralized healthcare models are major accelerators for this segment.

Sepsis Diagnostics Market By Regional Insights

North America holds the largest market share, primarily driven by the United States, where high healthcare expenditure, advanced healthcare infrastructure, and widespread adoption of innovative diagnostics technologies support market dominance.

The region's strong regulatory frameworks, presence of major diagnostic companies, and aggressive awareness campaigns like the Sepsis Alliance initiatives contribute to maintaining leadership. Additionally, favorable reimbursement policies for rapid sepsis diagnostic tests further enhance market adoption.

Asia-Pacific is the fastest-growing region, fueled by rising healthcare investments, improving diagnostic infrastructure, and increasing sepsis awareness in emerging economies like China, India, and Southeast Asia.

The region's large patient pool, increasing organ transplantation activities, rising ICU admissions, and government support for strengthening critical care services contribute to the rapid market expansion. International collaborations and technology transfers are also accelerating the penetration of advanced diagnostics across Asia-Pacific.

Sepsis Diagnostics Market Recent Developments

-

March 2025: BioMérieux launched its new VIDAS® Sepsis Panel, a fully automated biomarker-based platform offering early sepsis detection from a single sample in under an hour.

-

February 2025: Roche Diagnostics received CE marking for its Elecsys® IL-6 immunoassay, providing rapid detection of the key inflammatory biomarker associated with early-stage sepsis.

-

January 2025: T2 Biosystems announced positive clinical trial results for T2Resistance™ Panel, a rapid molecular test that identifies sepsis-causing antibiotic-resistant pathogens within 3-5 hours.

-

December 2024: Becton, Dickinson and Company (BD) launched BD BACTEC™ FX40, a compact, next-generation blood culture instrument targeting mid-sized hospitals and emergency care centers.

-

November 2024: Thermo Fisher Scientific introduced the Sepsityper® Kit MDx, a molecular-based assay for rapid microbial identification directly from positive blood cultures.

Some of the prominent players in the global sepsis diagnostics market include:

- BD, Becton, Dickinson & Company

- bioMérieux SA

- Thermo Fisher Scientific, Inc.

- Danaher Corporation (Beckman Coulter, Inc.)

- F. Hoffmann-La Roche AG

- Cepheid

- Luminex Corp.

- Koninklijke Philips N.V.

- Bruker

- Immunexpress, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global sepsis diagnostics market

Product

- Instruments

- Blood Culture Media

- Assay Kits and Reagents

- Software

Technology

- Microbiology

- Molecular Diagnostics

-

- Polymerase Chain Reaction (PCR)

- DNA Microarrays

- Syndromic Panel testing

- Others

- Immunoassays

- Flow Cytometry

- Others

Pathogen

-

- Gram-positive Bacteria

- Gram-negative Bacteria

- Fungal Sepsis

- Viral Sepsis

- Others

Testing Type

- Laboratory Testing

- PoC Testing

Method

- Automated Diagnostics

- Conventional Diagnostics

End-user

- Hospitals & Clinics

- Pathology & Reference Laboratories

- Research Institutes and Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- MEA