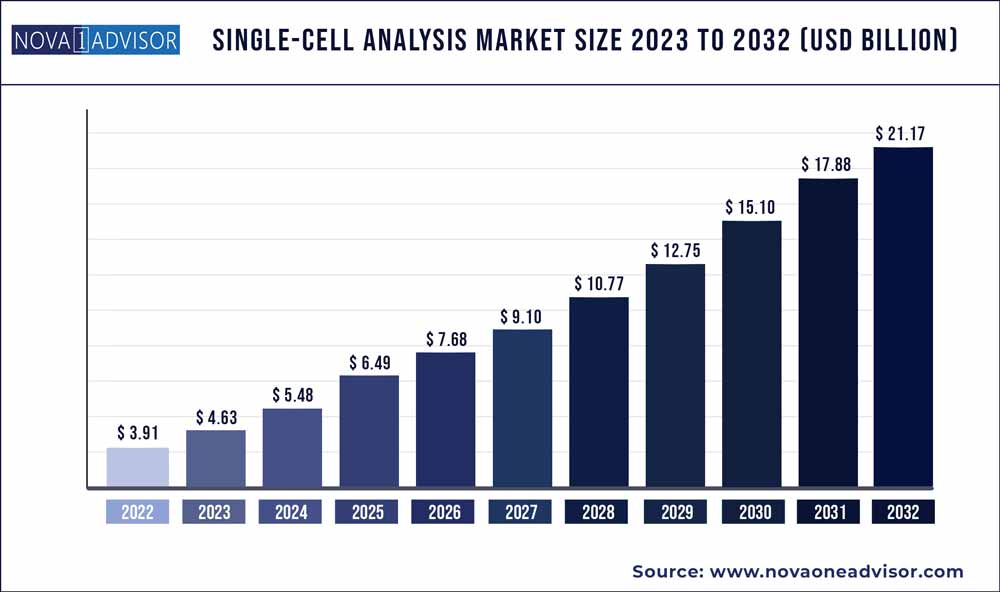

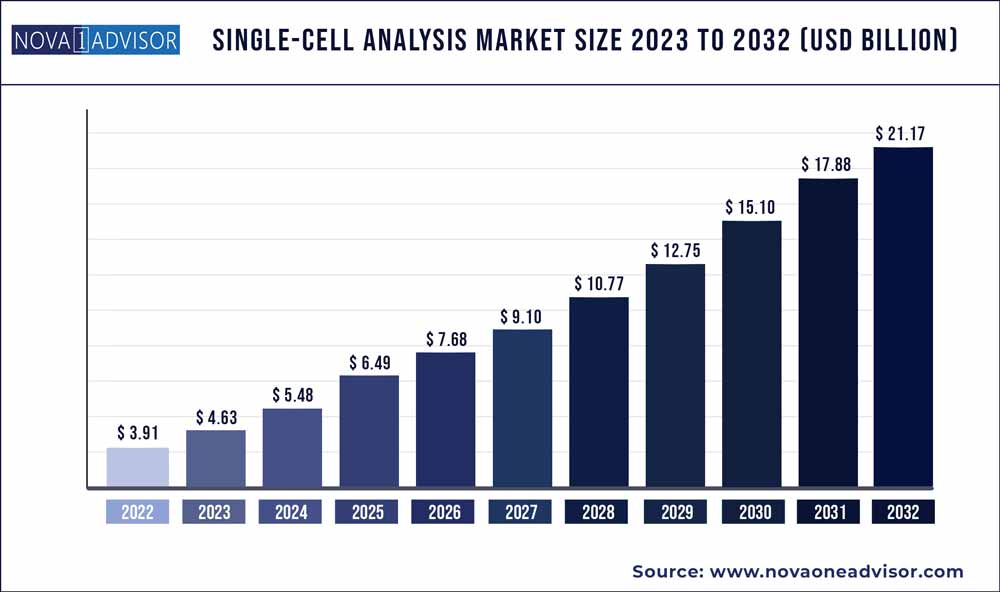

The global single-cell analysis market size was exhibited at USD 3.91 billion in 2022 and is projected to hit around USD 21.17 billion by 2032, growing at a CAGR of 18.4% during the forecast period 2023 to 2032. The rising prevalence of cancer worldwide and the rapid development of technologies have cascaded huge investments from life sciences companies and government funding initiatives for research activities. The research and development (R&D) in the field of medical and clinical diagnostics, the availability of advanced technologies such as sequencing, and the increasing adoption of single-cell analysis devices to understand the central dogma of molecular biology are some of the factors that are contributing to the growth of the market. The ongoing COVID-19 pandemic positively impacted the market for single-cell analysis (SCA).

Key Takeaways:

- The consumables segment demonstrated a dominant share of 54.19% of the market in 2022 and is also expected to have fastest growth rate of 19.61% during the forecast period.

- The cancer segment captured the highest market share of 33.02% in 2022. This segment is also expected to be the fastest growing segment of the market with a CAGR of 19.94% from 2023-2032.

- The single-cell isolation and library preparation accounted for significant revenue share of 37.41% In 2022.

- The academic and research laboratories accounted for a major revenue share of 73.61% in 2022.

- The biotechnology and pharmaceutical companies segment is expected to grow significantly with a CAGR of 18.17%.

- North America dominated the global single-cell analysis market with a revenue share of 35.61% in 2022.

- The Asia Pacific region is anticipated to be the fastest-growing region with CAGR of 19.85% during the forecast period.

Single-cell Analysis Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 3.91 Billion |

| Market Size by 2032 |

USD 21.17 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 18.4% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Product, Application, Workflow, End Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., QIAGEN NV, Bio-Rad Laboratories Inc., Illumina Inc., Merck KGaA, Becton, Dickinson & Company, Fluidigm Corporation, 10x Genomics, Inc., BGI, Novogene Corporation |

The pandemic has triggered the widespread adoption of SCA methods in virology research. To understand the immune response and the long-term effects of infections, researchers are utilizing the specimens from COVID-19 biobanks for performing analysis to comprehend the profiles of infected patients. For instance, in March 2021, the researchers from The NHLBI LungMap Consortium and The Human Cell Atlas Lung Biological Network performed a single-cell meta-analysis in 1,320,896 cells from 228 humans. This study was aimed at understanding the entry genes of SARS-CoV-2 across demographics.

The demand for SCA is growing in omics research activities, including genomics, proteomics, transcriptomics, and metabolomics. The study of single-cell omics helps in the analysis of huge data sets and understanding the genetic basis. It is the key to mastering the advancement in human health via disease diagnosis and drug discovery. The technological development has resulted in high throughput assays, efficient cell sorting and tagging, sequencing, microfluidics, single-cell amplification, and advanced software tools. The availability of these products and vast application areas are organically increasing the revenue of this market.

The growing demand for analytical tools for innovative research and subsequent funding has led to the introduction of high-throughput equipment within the market. Multiple innovations have led this equipment to involve features such as automation, high sensitivity, and accuracy, which ultimately help in analyzing scarce samples. For example, in March 2022, Deepcell Inc., a U.S.-based company, received funding of USD 73 million to accelerate its AI-powered single cell analysis platform and move towards commercialization. Thus, key players are significantly investing in developing solutions leading to a lucrative opportunity for revenue generation in the upcoming years. However, the market penetration will face hindrance due to the high cost of these instruments and consumables. The continuous maintenance costs and other expenses related to these products will create constraints for several clinical and research applications with budget limitations.

Product Insights

The consumables segment demonstrated a dominant share of 54.19% of the market in 2022 and is also expected to have fastest growth rate of 19.61% during the forecast period. The large share is attributive to the high usability of isolation products, large-scale adoption of cell sorting beads, frequent purchase of buffers and reagents, and, growing demand for assay kits. Increase in prevalence of target diseases and constant need for consumables required for the assays during scientific activities is propelling the segment growth.

Moreover, the extensive use of consumables such as reagents throughout SCA assays creates a continuous high demand for these products. These reagents are available in different forms including probes, cellular markers, multicolor cocktails, and even phenotyping agents. The robust activities of scientific entities have resulted in the massive adoption and purchase of reagents, thus leading to revenue generation in the global market.

The installation of new instruments, replacement of old instruments, and services related to instruments led to revenue generation for the instruments segment. Owing to the high-end features and the technically advanced analytical options, the automated instruments are anticipated to witness significant growth during the forecast period.

Application Insights

The cancer segment captured the highest market share of 33.02% in 2022. This segment is also expected to be the fastest growing segment of the market with a CAGR of 19.94% from 2023-2032. Single-cell analysis has proved to be effective for the diagnosis of cancer cells. Genetic variation via cell proliferation conditions, mutation rates, and cell types can be easily identified using these techniques. As per the American Cancer Society, cancer is the second most common cause of death in the U.S. after heart disease. According to cancer statistics, in 2022, 1.9 million new cancer cases are expected to occur in the U.S. Thus, the increasing prevalence of cancer and the never-ceasing studies and developments in this field are anticipated to positively impact the industry growth.

The existence of a significant number of research activities for evaluating single-cell genomics and proteomics has led to the increasing implementation of SCA methods in therapeutics and diagnostics applications. Moreover, increasing demand for stem cell therapies for regenerative and personalized medicines is bolstering this market space. Therapies like regeneration of hair, transplants of tissue, and organ and bone marrow are boosting the usage rates of single-cell analysis techniques.

Workflow Insights

In 2022, the single-cell isolation and library preparation accounted for significant revenue share of 37.41%. The vast range of applications for SCA has subsequently increased the demand for cell isolation and library preparation products such as kits and reagents. In addition, a substantial number of industry players are offering a range of products for single-cell isolation, to name a few, FACS and MACS for heterogeneous cell suspensions, microdissection of fixed tissue samples, flow cytometry, and microfluidics, in this segment, in turn, augmenting the revenue growth.

The downstream analysis segment is gaining traction owing to the technological advancements over the past few years. This segment is expected to be the fastest growing segment with a 21.22% during the forecast period. Technologies such as the emergence of next-generation sequencing for analyzing cellular expressions, mass spectrometry, and FISH (Fluorescence in situ hybridization) have proven to be important tools for SCA. Also, the market is witnessing the increasing automation of machines and artificial intelligence for data analysis. Several software and computational methods have been developed and are being employed due to their benefits such as scalability, flexibility, and high success rates. For example, as of 2021, there were over 1000 single-cell RNA analysis tools. Thus, this high growth of database tools reflects the interest and availability of SCA technologies, which, in turn, will spur industry growth in the near future.

End-use Insights

The academic and research laboratories accounted for a major revenue share of 73.61% in 2022. The large share is due to the wide use of single-cell analysis technology in research settings. he considerable number of ongoing scientific projects at various universities employing SCA techniques has driven its adoption in 2021. The introduction of spatial genomics accelerates the single-cell analysis in research activities, which is another key factor driving the segment. Furthermore, developing new tools to tackle the research limitation is driving the market, for example, researchers at Stony Brook University, New York developed a new biomedical research tool, single-cell cyclic multiplex in situ tagging (CycMIST) technology in June 2022. This technology enables scientists to assess functional proteins in a single cell and contribute to the diagnostic and discovery fields.

The biotechnology and pharmaceutical companies segment is expected to grow significantly with a CAGR of 18.17%. Technological progressions such as the use of microfluidics for the development of cell and gene therapies have increased the adoption of SCA by biotechnology and pharmaceutical companies. Moreover, increasing penetration of multi-omics in drug development research would further drive the market. A substantial number of firms have invested in genomics to have access to various genomics databases. For instance, Lifebit, a U.K.-based big data company, announced partnering with Boehringer Ingelheim in March 2022. The partnership will make use of the Cloud OS of Lifebit, the first federated platform for genomics to build a data analytics infrastructure for Boehringer. This infrastructure will capture disease insights from biobanks for the development of medicines. Boehringer was also associated with Lifebit’s REAL platform in 2021 to accelerate the detection and tracking of disease outbreaks.

Regional Insights

North America dominated the global single-cell analysis market with a revenue share of 35.61% in 2022. This can be attributed to factors such as multiple government funding programs, rising awareness regarding personal healthcare and related expenditure, faster adoption of novel analytical tools and techniques, and the availability of trained personnel. The U.S. is a major contributor to the industry growth in North America. For example, the U.S. NIH (National Institutes of Health) through its Common Fund Programs is supporting metabolomics research. Formerly, the NIH had also supported the single cell analysis program (SCAP) through the same funds. Extraordinary healthcare infrastructure, demand for personalized medicines, and the presence of key market players are some of the key factors fueling regional growth.

The Asia Pacific region is anticipated to be the fastest-growing region with CAGR of 19.85% during the forecast period. In the past years, the growing medical industry, rapidly developing healthcare systems, and increasing geriatric population have resulted in fueling the demand for cutting-edge diagnostic tools in the emerging economies of Asia Pacific. The focused efforts and outsourcing in this region have led to significant growth.

Some of the prominent players in the Single-cell analysis Market include:

- Thermo Fisher Scientific, Inc.

- QIAGEN NV

- Bio-Rad Laboratories Inc.

- Illumina Inc.

- Merck KGaA

- Becton, Dickinson & Company

- Fluidigm Corporation

- 10x Genomics, Inc.

- BGI

- Novogene Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Single-cell analysis market.

Product

-

- Microscope

- Hamocytometers

- Flow Cytometers

- NGS Systems

- PCR

- High Content Screening Systems

- Cell Microarrays

- Single Live Cell Imaging

- Automated Cell Counters

Application

- Cancer

- Immunology

- Neurology

- Stem Cell

- Non-Invasive Prenatal Diagnosis

- In-Vitro Fertilization

- Others

Workflow

- Single Cell Isolation & Library Preparation

- Downstream Analysis

- Data Analysis

End-use

- Academic & Research Laboratories

- Biotechnology & Pharmaceutical Companies

- Hospitals & Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)