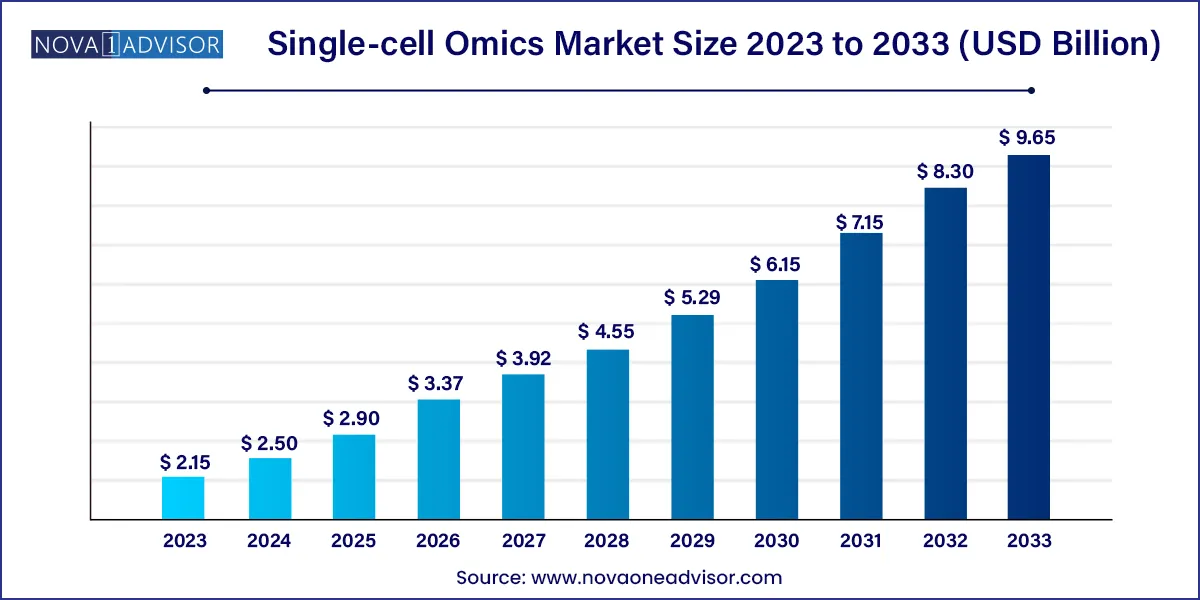

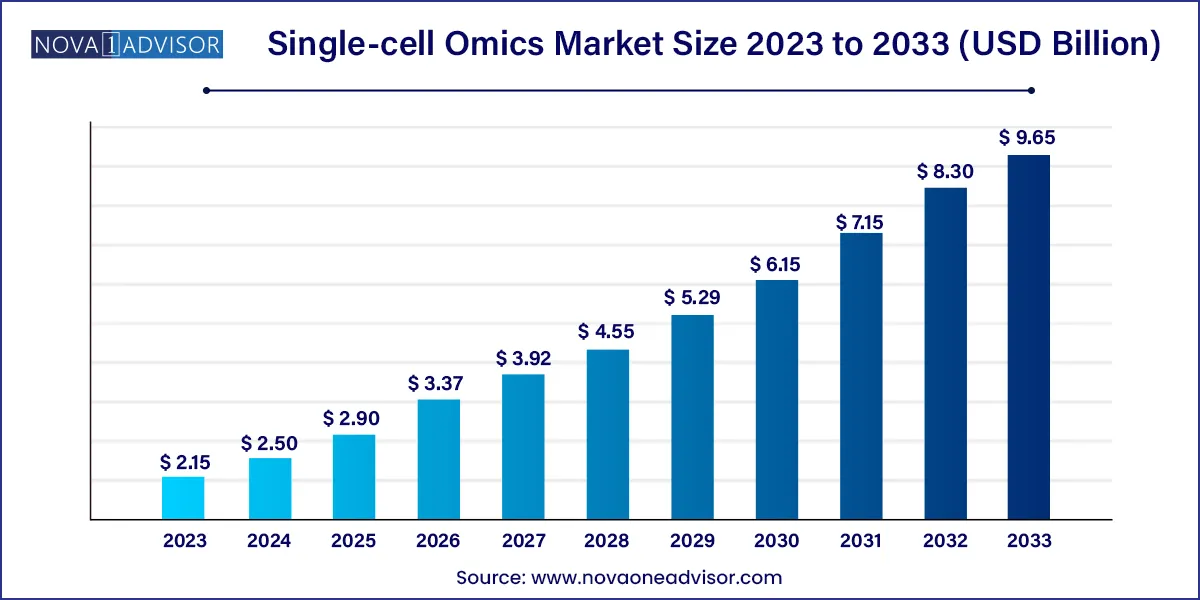

The global single-cell omics market size was estimated at USD 2.15 billion in 2023 and is projected to hit around USD 9.65 billion by 2033, growing at a CAGR of 16.2% during the forecast period from 2024 to 2033.

Key Takeaways:

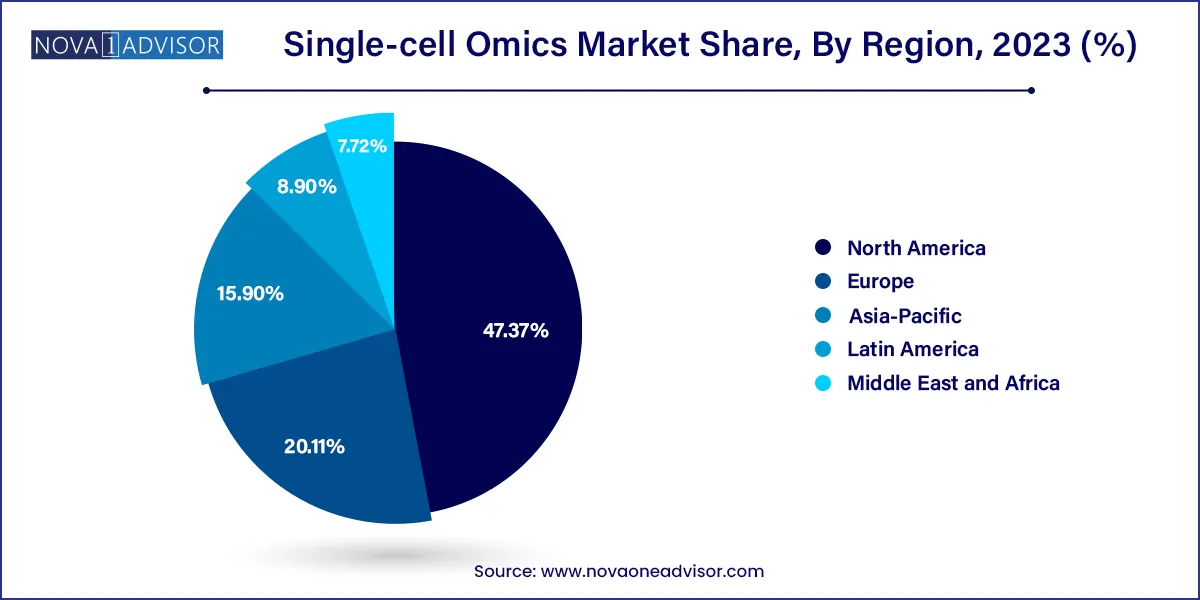

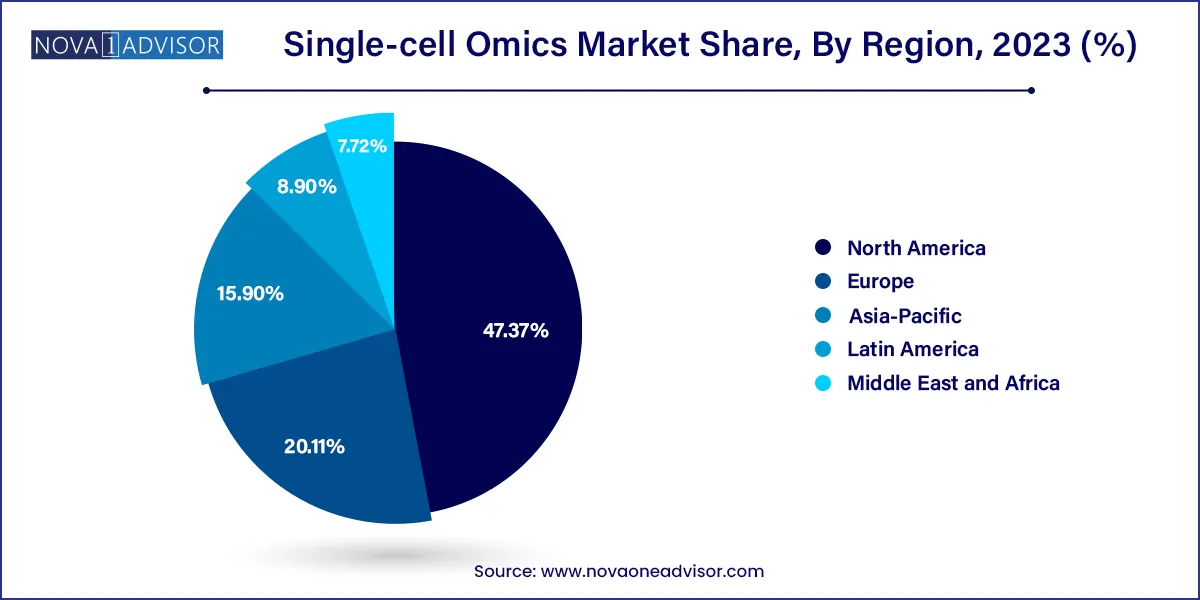

- North America accounted for the largest share of the global market and accounted for 47.37% of the market in 2022.

- Asia Pacific is estimated to grow at the fastest rate of 17.9% CAGR from 2023 to 2033.

- The single-cell genomics segment was the leading revenue contributor for the market in 2023 and held 46.78% of the market share.

- The oncology segment led the single-cell omics market in 2023 with a share of 56.85% and the segment is also projected to exhibit the highest growth rate during the 2024-2033 period.

- The immunology segment is projected to hold the second-fastest CAGR of 15.9% during the forecast period.

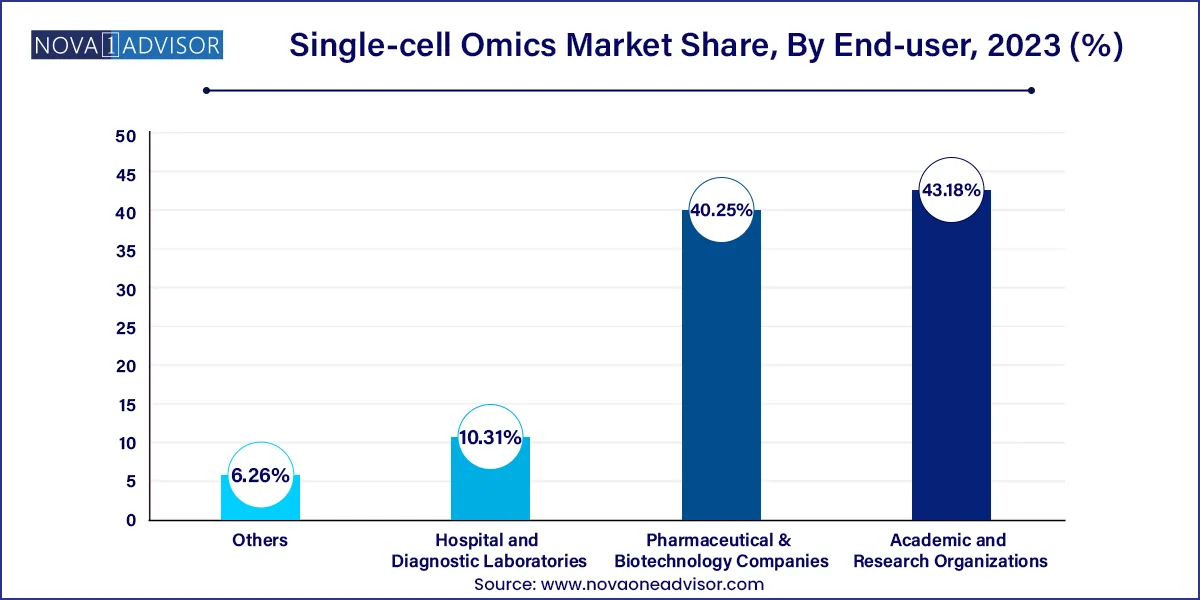

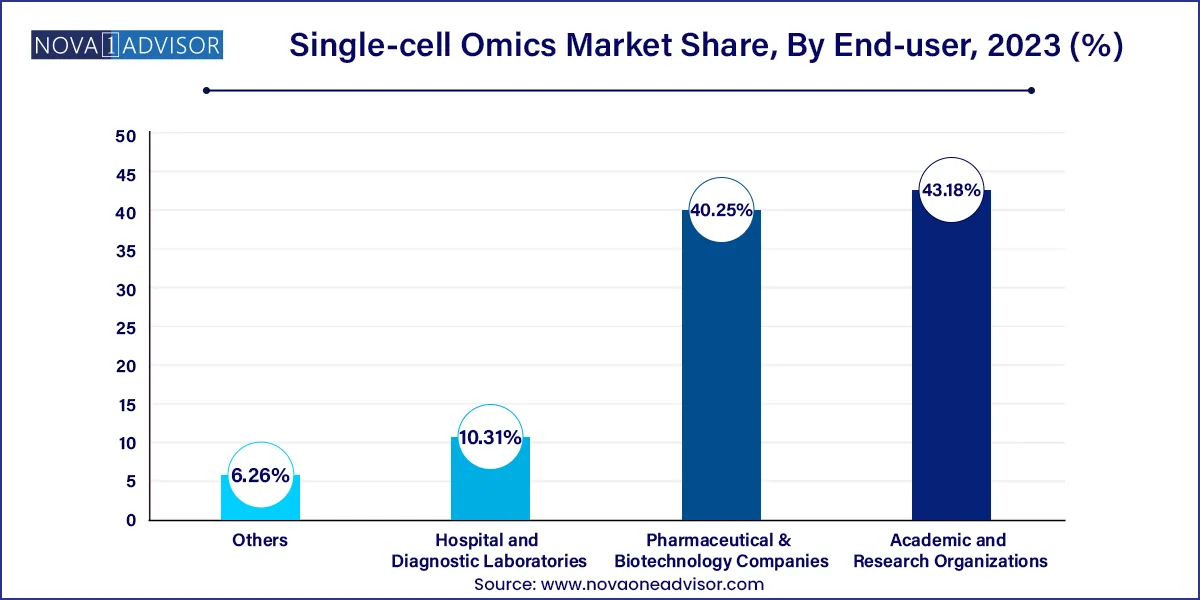

- The academic and research organizations segment dominated the end-user segment of the market with a 43.18% market share in 2023.

Market Overview

The Single-cell Omics Market has emerged as a transformative force in life sciences, enabling researchers to dissect biological complexity at an unprecedented resolution. Unlike traditional bulk analyses, which average signals across thousands or millions of cells, single-cell omics technologies allow scientists to examine the genomic, transcriptomic, proteomic, and metabolomic landscapes of individual cells. This capability is revolutionizing our understanding of developmental biology, disease heterogeneity, immune responses, tumor evolution, and therapeutic mechanisms.

Driven by breakthroughs in microfluidics, next-generation sequencing (NGS), mass spectrometry, and bioinformatics, single-cell omics platforms have matured from research prototypes into robust, scalable systems suitable for both discovery and clinical applications. These methods are especially valuable in fields such as oncology, immunology, neurology, and regenerative medicine, where cell-to-cell variability often underlies disease mechanisms or treatment outcomes.

The market is being propelled by the convergence of computational biology, precision medicine, and multi-omics integration. Research institutions, biopharmaceutical companies, and diagnostics labs are rapidly adopting single-cell technologies to gain more granular insights into cell types, states, and transitions. Key players such as 10x Genomics, BD Biosciences, Parse Biosciences, Mission Bio, and Bio-Rad Laboratories are continuously innovating, launching new solutions that expand throughput, reduce costs, and enhance multidimensional cellular analysis.

As investments in single-cell research increase and more applications reach translational stages, the global single-cell omics market is poised for robust expansion, reshaping both academic discovery and clinical diagnostics landscapes.

Major Trends in the Market

-

Rise of Multi-omics Platforms: Integrating genomics, transcriptomics, proteomics, and metabolomics at the single-cell level is gaining traction for holistic cellular profiling.

-

Increased Adoption in Cancer Immunotherapy Research: Single-cell tools are being used to map tumor-infiltrating lymphocytes, immune escape pathways, and clonal evolution.

-

Emergence of Spatial Omics: Technologies that preserve spatial context while profiling single cells are driving new discoveries in tissue architecture and tumor microenvironments.

-

Cloud-based Bioinformatics and AI Integration: Advanced analytics platforms are addressing the data complexity of single-cell outputs through scalable, real-time interpretation.

-

Miniaturization and Automation: High-throughput and benchtop instruments are becoming more user-friendly and accessible, encouraging broader adoption beyond elite research centers.

-

Commercialization of Single-cell Diagnostics: Startups and diagnostic labs are developing single-cell-based liquid biopsy panels and immunophenotyping assays for clinical use.

-

Expansion of CRISPR-based Functional Genomics: Single-cell readouts of gene perturbation experiments are becoming essential in target validation and drug screening.

-

Growing Accessibility of TCR/BCR Profiling: Immune repertoire profiling is expanding from basic research to clinical immunology and vaccine development.

Single-cell Omics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.50 Billion |

| Market Size by 2033 |

USD 9.65 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 16.2% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product type, application, end-user, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

CYTENA GmbH; 10x Genomics; BD; CELLENION; PerkinElmer Inc.; ANGLE plc; Illumina, Inc.; Bio-Rad Laboratories, Inc.; Mission Bio; Standard BioTools Inc. |

Market Driver: Rapid Growth in Precision Oncology and Immunotherapy

A significant driver of the single-cell omics market is the expanding role of precision oncology and immunotherapy, which demand high-resolution molecular insights. Tumors are inherently heterogeneous, and bulk analyses fail to capture the diversity of genetic mutations, gene expression profiles, and immune infiltration within the tumor microenvironment. Single-cell omics fills this gap by enabling researchers to trace tumor evolution, identify rare cell subpopulations, and profile immune cell dynamics with exquisite granularity.

For instance, in CAR-T cell therapy development, single-cell transcriptomics and proteomics are being used to monitor T-cell activation states, exhaustion markers, and cytokine profiles. Similarly, genomic tools are being deployed to assess clonal expansion and mutation burden in tumor cells. As personalized immunotherapies become mainstream, the need for robust, reproducible single-cell data to guide therapeutic decisions and monitor efficacy continues to surge—fostering demand across research and clinical sectors.

Market Restraint: High Cost and Technical Complexity

Despite its promise, the high cost and technical complexity of single-cell omics remain significant barriers to broader adoption. These technologies often require specialized instrumentation, extensive training, and complex workflows involving cell isolation, barcoding, amplification, and sequencing or imaging. Moreover, the consumables, reagents, and computational infrastructure add to the total cost of ownership.

Data analysis also presents challenges. A single experiment can generate terabytes of data, requiring high-performance computing and sophisticated bioinformatics pipelines. For institutions without in-house bioinformatics support, interpreting these data accurately and reproducibly can be daunting. These issues limit uptake among smaller research labs, hospitals, or diagnostics companies without dedicated infrastructure or funding. Although vendors are working to simplify workflows and reduce per-sample costs, financial and logistical hurdles still constrain market growth in resource-limited settings.

Market Opportunity: Expansion of Spatial and Multi-Omics Integration

A significant growth opportunity lies in the integration of spatial and multi-omics technologies at the single-cell level. Traditional single-cell assays lose information about the physical context of a cell within tissue. Spatial transcriptomics, which preserves tissue architecture while mapping gene expression, is bridging this gap. When combined with single-cell proteomics and genomics, spatial omics provides an unprecedented view of cellular interactions and microenvironmental cues.

Companies like 10x Genomics (with Visium), NanoString (CosMx), and others are investing heavily in this frontier. In February 2024, Parse Biosciences launched its Evercode TCR platform, allowing for T-cell receptor profiling with single-cell resolution—enabling high-dimensional immune mapping. These tools are being applied in areas like neuroscience, where brain architecture is critical, and oncology, where tumor-immune cell crosstalk influences prognosis. The ability to simultaneously profile genes, proteins, and spatial context will be a cornerstone of next-generation diagnostics, biomarker discovery, and drug development.

Segments Insights:

By Product Type Insights

Single-cell Transcriptomics dominated the product type segment, primarily because of its widespread adoption in research for gene expression profiling. Technologies like 10x Genomics’ Chromium platform and BD Rhapsody have set industry standards by allowing the study of thousands of genes across tens of thousands of individual cells in one run. Applications in immune profiling, stem cell differentiation, cancer heterogeneity, and developmental biology have made transcriptomics the most accessible and impactful entry point into single-cell analysis.

Single-cell Proteomics is the fastest-growing segment, fueled by advances in mass cytometry (CyTOF), imaging mass spectrometry, and barcoded antibody panels. Protein-level analysis adds crucial functional context, especially in immunology and oncology. Researchers use proteomics to track signaling pathways, surface markers, and immune activation status, all of which are not fully captured by transcriptomic data. As antibody libraries expand and multi-modal platforms emerge, proteomic insights are becoming essential for clinical translation and therapeutic decision-making.

By Application Insights

Oncology held the largest share of the application segment, with single-cell technologies enabling deep tumor profiling, immune cell characterization, and resistance mechanism discovery. Oncologists and cancer biologists rely on single-cell omics to understand intratumoral heterogeneity, which is a key factor in treatment resistance and relapse. Platforms like Mission Bio’s Tapestri are designed specifically for single-cell DNA and protein analysis in oncology, supporting precision diagnostics and MRD (minimal residual disease) monitoring.

Immunology is the fastest-growing application, particularly post-COVID-19, where immune profiling and vaccine response studies have accelerated. Single-cell TCR/BCR sequencing and cytokine profiling are unlocking insights into immune memory, exhaustion, and cell-mediated immunity. With autoimmune diseases, allergy research, and infectious disease immunology gaining traction, this segment is poised for exponential growth, particularly as new diagnostic and therapeutic tools are developed.

By End-User Insights.

Pharmaceutical and Biotechnology Companies dominate the end-user landscape, leveraging single-cell omics in drug discovery, target validation, and biomarker development. These companies require high-throughput, reproducible platforms that provide actionable insights into cell behavior, especially in complex disease models. The ability to identify rare drug-resistant clones or validate targets in heterogeneous tissues provides a competitive edge in pipeline development.

Academic and Research Organizations are the fastest-growing end-users, backed by increasing government and grant funding. NIH-funded projects like the Human Cell Atlas and Brain Initiative have led to widespread adoption of single-cell tools in academia. Universities are not only leading basic research but also collaborating with industry to translate findings into diagnostics and therapies. The increasing availability of core facilities and training is further democratizing access.

By Regional Insights

North America, especially the United States, dominates the global single-cell omics market due to its mature biotech ecosystem, academic excellence, and funding support. Leading companies like 10x Genomics, Bio-Rad, and BD Biosciences are headquartered in the U.S., and academic institutions such as MIT, Stanford, and Harvard are driving innovation through major cell atlas projects. The NIH, through initiatives like the BRAIN Initiative and Human Tumor Atlas Network (HTAN), continues to fund single-cell research at scale.

The region also benefits from favorable reimbursement frameworks for molecular diagnostics and strong regulatory infrastructure, allowing faster commercialization of single-cell applications. Additionally, collaborations between pharma giants and omics startups are fueling innovation in oncology, immunotherapy, and cell therapy.

Asia-Pacific is the fastest-growing region, spurred by increasing investments in genomics and biomedical research by countries like China, Japan, South Korea, and Singapore. China’s Precision Medicine Initiative and Japan’s Moonshot R&D Program have included single-cell research as a strategic focus. Moreover, academic and commercial collaborations between Asia-Pacific and Western countries are accelerating knowledge transfer and infrastructure development.

Emerging biotech companies across India, Singapore, and China are developing localized single-cell platforms and reagent kits to reduce dependence on imports. Additionally, as clinical trials expand across Asia, the need for companion diagnostics and patient stratification is expected to further boost single-cell omics adoption in the region.

Recent Developments

-

March 2024: Mission Bio launched an upgraded version of its Tapestri platform, offering dual DNA and protein profiling for high-resolution mutation mapping in hematologic malignancies.

-

February 2024: Parse Biosciences released Evercode TCR, a new single-cell immune profiling platform that enables deep characterization of T-cell receptor sequences and transcriptomic signatures in a scalable format.

-

January 2024: 10x Genomics unveiled a next-gen single-cell multi-omics platform integrating transcriptomic, epigenomic, and protein analysis in a single workflow, aimed at high-throughput applications in immuno-oncology.

-

December 2023: BD Biosciences announced enhancements to its BD Rhapsody system, enabling increased multiplexing capabilities and reduced sample preparation time, catering to translational research labs.

-

November 2023: Bio-Rad Laboratories partnered with an AI bioinformatics company to develop an end-to-end single-cell analysis pipeline for precision oncology applications.

Some of the prominent players in the Single-cell Omics Market include:

- Danaher Corporation

- CYTENA GmbH

- 10x Genomics

- BD

- CELLENION

- PerkinElmer Inc.

- ANGLE plc

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

- Mission Bio

- Standard BioTools Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Single-cell Omics market.

By Product Type Scope

- Single-Cell Genomics

- Single-Cell Transcriptomics

- Single-Cell Proteomics

- Single-Cell Metabolomics

By Application Scope

- Oncology

- Cell Biology

- Neurology

- Immunology

By End-User Scope

- Pharmaceutical & Biotechnology Companies

- Academic and Research Organizations

- Hospital and Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)