Single-use Bioprocessing Market Size Trends Analysis and Forecast till 2035

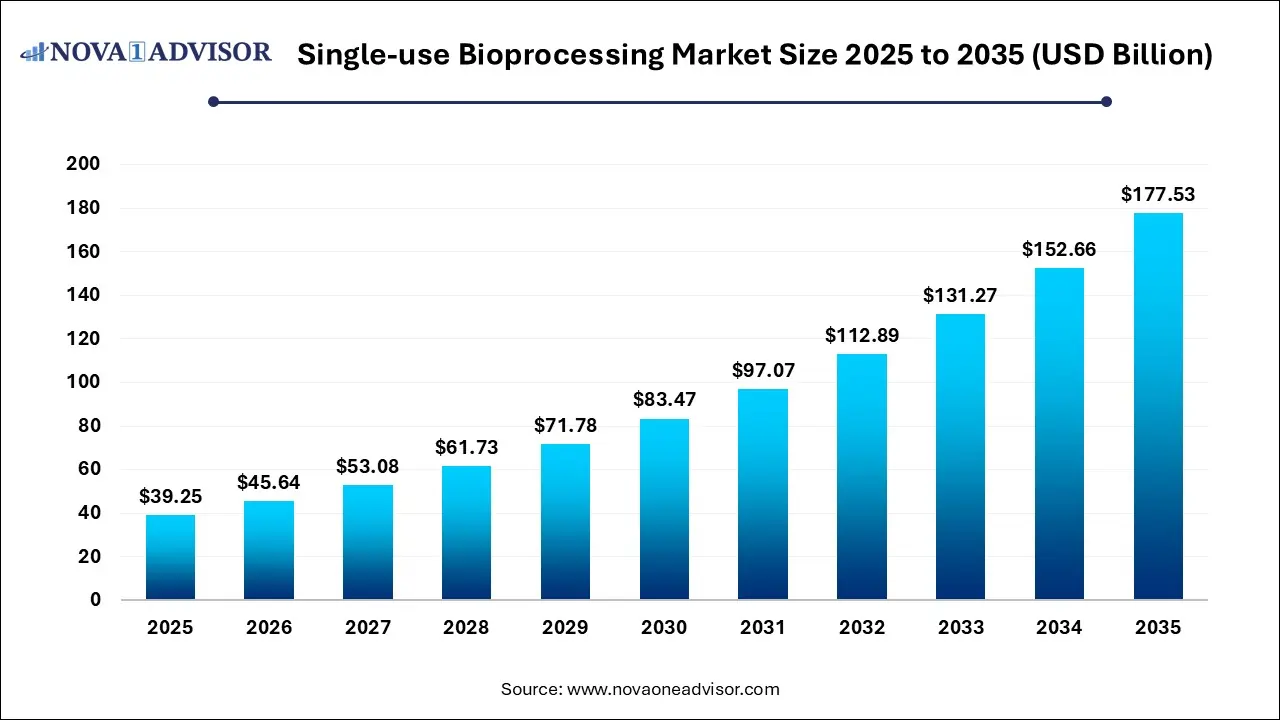

The global single-use bioprocessing market size is calculated at USD 39.25 billion in 2025, grows to USD 45.64 billion in 2026, and is projected to reach around USD 177.53 billion by 2035. grow at a CAGR of 16.29% from 2026 to 2035. The market is growing due to rising demand for cost-efficient, flexible, and contamination-free biomanufacturing solutions. Increasing adoption in biologics and vaccine production further fuels its expansion.

Single-use Bioprocessing Market Key Takeaways

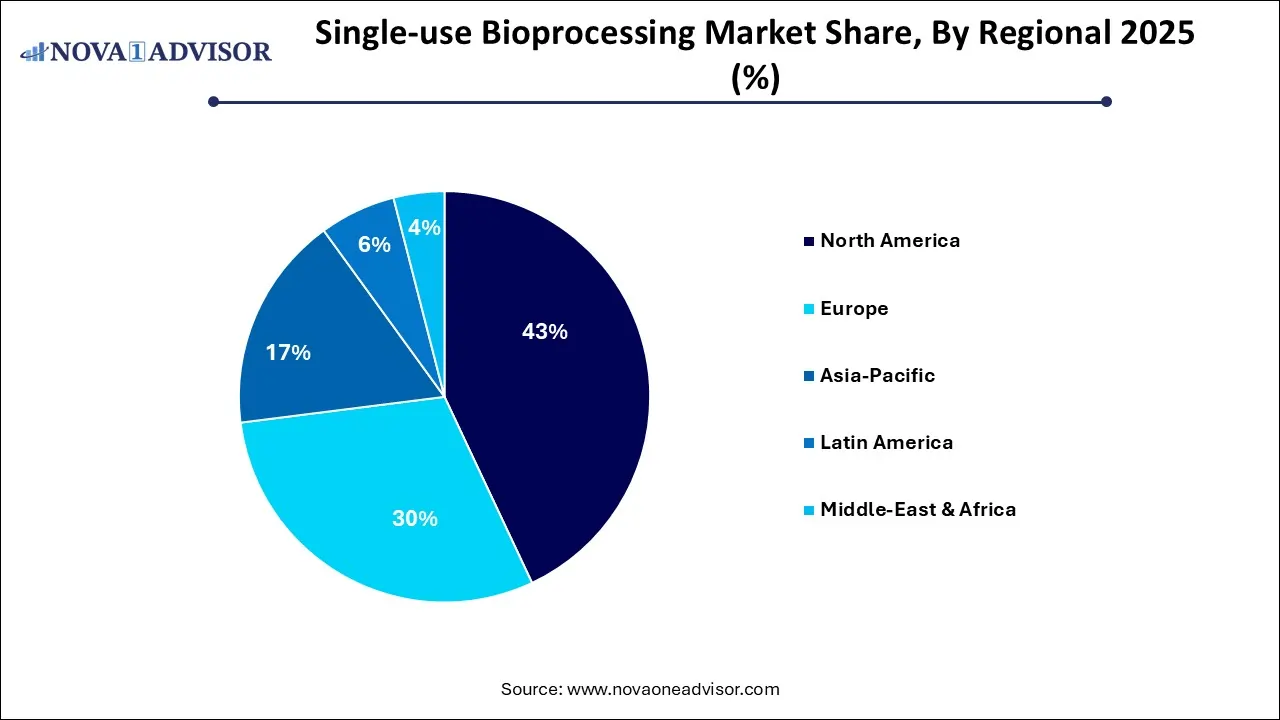

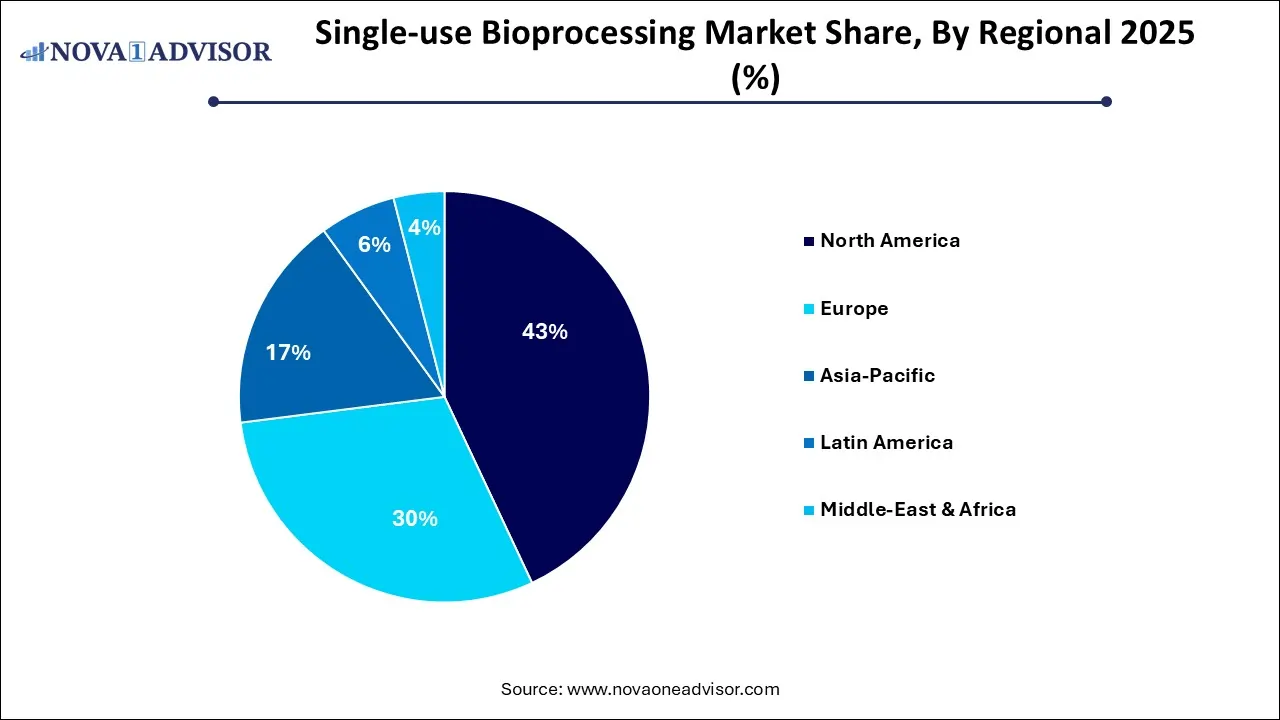

- North America dominated the single-use bioprocessing market with a revenue share of approximately 43% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the simple & peripheral elements segment held the largest market share in 2025.

- By product, the apparatus & plants segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By workflow, the upstream bioprocessing segment dominated the market with a major revenue share in 2025.

- By workflow, the fermentation segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end use, the biopharmaceutical manufacturers segment led the market in 2025.

- By end use, the academic & clinical research institutes segment is expected to grow at the fastest CAGR in the market during the forecast period.

How Single-Use Bioprocessing Market Evolving?

Single-use bioprocessing is a manufacturing approach in biopharma that uses disposable equipment, like bags and bioreactors, to produce biologics efficiently while reducing contamination risks and operational costs. The single-use bioprocessing market is evolving through greater integration of digital technologies, real-time monitoring, and data-driven process optimization. Companies are focusing on hybris systems that combine single-use and traditional equipment to balance flexibility and large-scale production equipment to balance flexibility and larger-scale production needs. Growing investments in advanced materials are improving the durability and performance of disposable systems. Moreover, expansion of biologics manufacturing in emerging markets and regulatory support for faster drug approvals are further shaping the market's progression towards broader global adoption.

What are the Key trends in the single-se bioprocessing Market in 2025?

- In April 2025, AmplifyBio shut down after being unable to raise additional funding, despite previously securing USD 200 million, highlighting the funding hurdles faced by early-stage CDMOs.

- In May 2024, Takara Bio introduced large-scale viral vector manufacturing using Thermo Fisher’s DynaDrive reactors, offering capacities of 50 L to 5,000 L.

How Can AI Affect the Single-Use Bioprocessing Market?

AI can significantly impact the market by enabling real-time process monitoring, predictive analytics, and automation, leading to improved efficiency and reduced errors. It supports better design and optimization of disposable systems, enhances quality control, and minimizes batch failures. AI-driven insights can also accelerate scale-up processes, lower production costs, and ensure consistent product yields. Additionally, integrating AI with single-use technologies can speed up drug development timelines and strengthen decision-making in biomanufacturing operations.

Single-use Bioprocessing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 39.01 Billion |

| Market Size by 2035 |

USD 151.48 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 16.27% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Workflow, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Sartorius AG; Danaher Corporation; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc; Eppendorf SE; Corning Incorporated; Lonza; PBS Biotech, Inc.; Meissner Filtration Products, Inc. |

Market Dynamics

Driver

Rising Demand for Biologics, Vaccines, and Cell & Gene Therapies

The growing need for biologics, vaccines, and cell & gene therapies is fueling the single-use bioprocessing market because traditional stainless-steel systems often lack the speed and flexibility required for these products. Single-use systems allow rapid changeovers between different therapies, supporting multi-product facilities and quicker clinical trial supplies. They also simplify compliance with stringent regulatory standards for sterility and quality, making them highly suitable for advanced therapeutic products that demand precision and adaptability in production.

- For Instance, In April 2024, Thermo Fisher Scientific expanded its biologics facility in St. Louis by adding new single-use bioreactor lines tailored for vaccine and viral vector production. This strategic move enhances their capacity to rapidly produce both clinical and commercial vaccines, underscoring the industry’s shift toward flexible, fast-deployable, and contamination-minimizing single-use technologies.

Restraint

Limited Scalability and High Cost of Large-Volume Production

Limited scalability and high costs act as a restraint in the single-use bioprocessing market because large-scale production often demands consistent performance under prolonged use, which disposable performance under prolonged use, which disposable systems struggle to provide. Frequent replacement of components increases operational expenses, while downtime for system setup impacts efficiency. In addition, technical limitations, such as difficulties in maintaining uniform mixing, oxygen transfer, and process stability at very high volumes, make single-use systems less practical for large commercial manufacturing compared to stainless-steel solutions.

Opportunity

Growing Adoption of Personalized Medicine and Advanced Therapies

The rise of personalized medicine and advanced therapies creates future opportunities for the single-use bioprocessing market, as these treatments involve complex molecules and sensitive processes that need precise control. Single-use systems can easily integrate with digital monitoring tools, allowing real-time adjustments for specific requirements. Moreover, their modular design supports decentralized and on-demand manufacturing, which is essential for delivering therapies closer to patients, reducing logistics challenges, and meeting the unique demand for next-generation healthcare models.

- For Instance, In October 2024, Avantor partnered with NIBRT to introduce Masterflex pump systems and auxiliary single-use technologies critical for aseptic fluid handling in downstream bioprocessing. This collaboration supports the stringent sterility and flexibility requirements of advanced therapies like personalized biologics and cell treatments, demonstrating how single-use systems are being tailored to meet the unique demands of precision medicine.

Segmental Insights

How will the Simple & Peripheral Elements Segment dominate the single-use bioprocessing Market in 2025?

The simple & peripheral elements segment led the segment market in 2025 because these components enable seamless integration between different single-use systems, ensuring smooth process continuity. Their standardized design makes them compatible with a wide range of equipment, reducing complexity for manufacturers. Additionally, frequent upgrades in design and material innovation enhance performance and reliability. Since these elements are indispensable for scaling both small-and large batch operations, their broad applicability and interoperability solidified their dominant market position.

The apparatus & plants segment is expected to grow faster in the single-use bioprocessing market as manufacturers shift towards building modular and decentralized production facilities. These systems allow quicker facility setup and easy adaptation to changing product pipelines. Growing emphasis on continuous bioprocessing and integration of digital technologies with large-scale single-use equipment also supports this trend. Moreover, the need for sustainable, resource-efficient infrastructure is encouraging biopharma companies to adopt advanced apparatus and plant solutions at a higher pace.

Single-use Bioprocessing Market Size By Product, 2025 to 2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

|

Simple & Peripheral Elements

|

11.74 |

13.62

|

15.85 |

18.49 |

21.45 |

24.92 |

28.48 |

34.35 |

39.21 |

46.75 |

52.13 |

|

Apparatus & Plants

|

13.42

|

15.62 |

18.10 |

20.92 |

24.15 |

28.10 |

33.31 |

38.25 |

44.57 |

51.89 |

63.27 |

|

Work Equipment

|

8.39

|

9.77 |

11.41 |

13.32

|

15.71 |

18.27

|

21.11 |

23.77 |

28.28 |

31.64 |

36.09 |

Why Did the Upstream Bioprocessing Segment Dominate the Market in 2025?

The upstream bioprocessing segment captured the largest revenue share because most R&D and early-stage production activities rely heavily on single-use systems for flexibility and rapid experimentation. These solutions enable quick setup of pilot studies, faster turnaround for process optimization, and efficient handling of small to medium batches. As innovation in biologics and advanced therapies accelerates, the need for adaptable upstream tools like disposable culture systems and sensors has grown, positioning this workflow as the strongest revenue contributor.

The fermentation segment is poised to expand at the fastest CAGR as biopharma companies increasingly explore novel microbial platforms for producing enzymes, probiotics, and next-generation therapeutics. Single-use systems support quick adaptations to these diverse applications, offering flexibility in synthetic biology and precision fermentation are also boosting demand for disposable equipment as they enable rapid prototyping and scalable production. This evolving landscape positions fermentation as a key growth driver in the forecast period.

Single-use Bioprocessing Market Size By Workflow, 2025 to 2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Upstream Bioprocessing |

15.10 |

17.62 |

20.34 |

23.66 |

27.47 |

31.76 |

36.62 |

44.17 |

50.66 |

59.56 |

69.00 |

| Fermentation |

6.71 |

7.76 |

9.11 |

10.60 |

11.93 |

13.93 |

17.01 |

18.64 |

21.46 |

27.51 |

28.82 |

| Downstream Bioprocessing |

11.74

|

13.62

|

15.90 |

18.47 |

21.92 |

25.61 |

29.25 |

33.57 |

39.93 |

43.22

|

53.67 |

How does the Biopharmaceutical Manufacturers Segment Dominated Single-Use Bioprocessing the Market?

The biopharmaceutical manufacturing segment dominated the market in 2024 as it heavily invested in modernizing facilities with single-use systems to support global expansion and regulatory compliance. These technologies offered easier validation processes and simplified supply chain management, which were crucial for accelerating product approvals. Additionally, the ability of single-use systems to integrate with advanced monitoring and automation tools allowed manufacturers to enhance process control and efficiency, strengthening their leadership in adopting such solutions ahead of other end-users.

The academic and chemical research institute segment is projected to grow at the fastest CAGR as these institutions are expanding their role in translation research and proof-of-concept studies. Single-use systems enable rapid testing of novel bioprocesses without heavy infrastructure investment, making them attractive for exploratory projects. Increased funding for advanced biologics and next-generation therapies is also boosting reliance on disposable equipment in research labs, allowing faster experiment cycles and supporting their rising influence in the bioprocessing ecosystems.

Single-use Bioprocessing Market Size By End-use, 2025 to 2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Biopharmaceutical Manufacturers |

23.49 |

27.29 |

31.63 |

36.92 |

43.18 |

50.20 |

57.86 |

66.77 |

79.69 |

91.27 |

105.71 |

| Academic & Clinical Research Institutes |

10.07 |

11.72 |

13.73 |

15.82 |

18.13 |

21.09 |

25.03 |

29.60 |

32.37 |

39.02 |

45.77 |

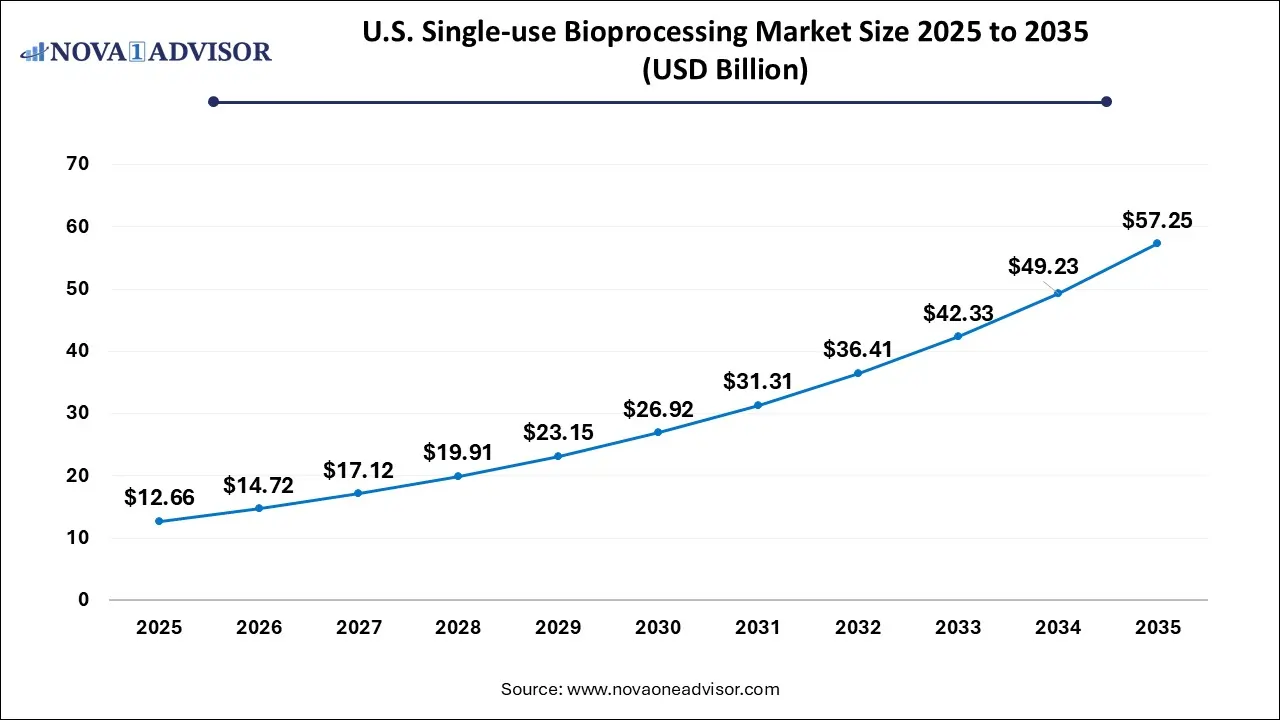

U.S. Single-use Bioprocessing Market Size and Growth 2026 to 2035

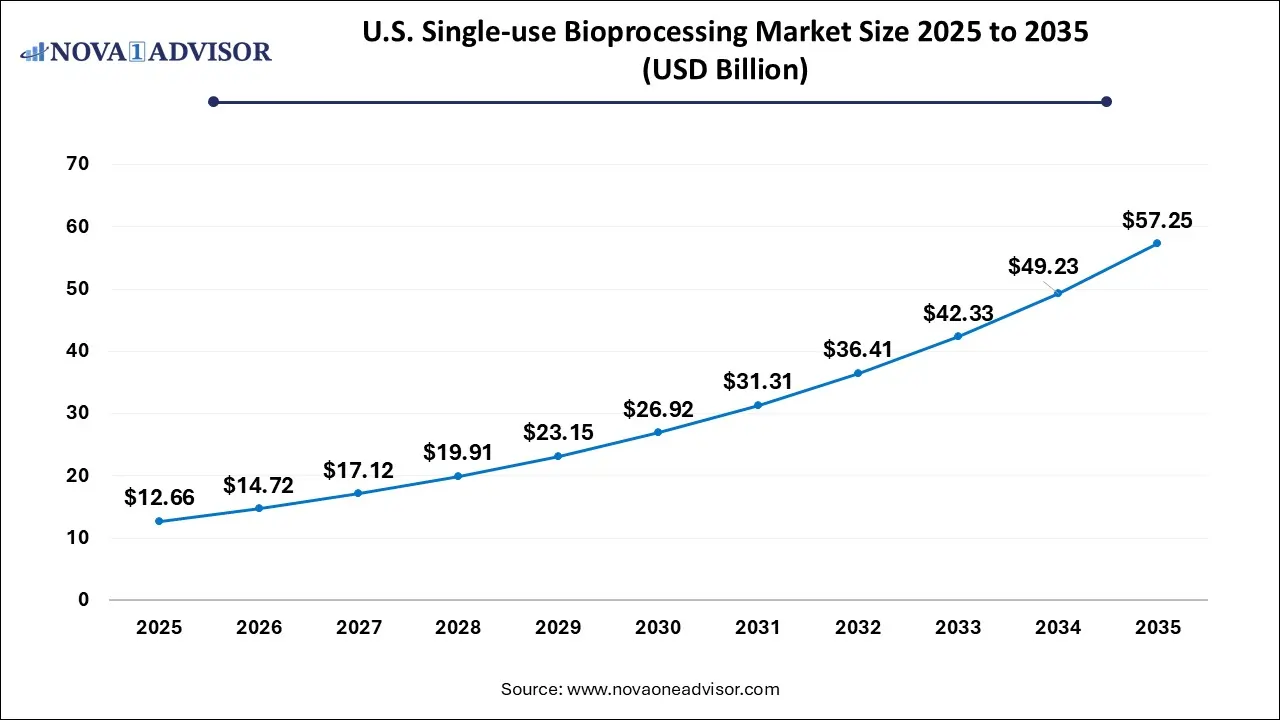

The U.S. single-use bioprocessing market size is calculated at USD 12.66 billion in 2025 and is expected to reach nearly USD 57.25 billion in 2035, accelerating at a strong CAGR of 14.7% between 2026 and 2035.

How is North America Contributing to the Expansion of the Single-Use Bioprocessing Market?

North America dominated the market in 2025 owing to the strong presence of leading biopharma companies, advanced research facilities, and rapid adoption of innovative manufacturing technologies. High investment in biologics, vaccines, and cell and gene therapy production fueled demand for flexible and scalable single-use systems. Additionally, well-established regulatory frameworks, strong funding for bioprocessing innovation, and growing collaborations between biotech firms and CDMOs further reinforced the region’s leadership in capturing the largest revenue share.

How is Asia-Pacific Accelerating the Market?

Asia-Pacific is projected to grow at the fastest CAGR as regional healthcare providers are increasingly adopting biometrics to overcome challenges of patient misidentification and fraud. The rising number of clinical trials and pharmaceutical research activities is also driving the need for secure identity management systems. Moreover, the region’s expanding startup ecosystem and strong focus on AI-powered biometric innovations are accelerating adoption. Favorable regulatory reforms and cross-border collaborations further support the region’s rapid growth in healthcare biometrics.

- For Instance, In June 2025, Sphere Bio strengthened its footprint in China by teaming up with Redbert Biotechnology to distribute its picodroplet microfluidics technology designed for single-cell analysis.

Single-use Bioprocessing Market Size By Region, 2025 to 2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| North America |

11.74 |

13.74 |

16.05 |

18.80 |

21.67 |

24.29 |

28.12 |

33.76 |

41.45 |

43.55 |

52.22 |

| Europe |

8.39 |

9.77 |

11.18 |

12.94 |

15.55 |

17.79 |

20.38 |

23.98 |

27.11 |

30.97 |

36.90 |

| Asia Pacific |

8.39 |

9.72 |

11.26 |

13.14 |

15.43 |

18.49 |

21.38 |

25.10 |

28.12 |

33.72 |

38.29 |

| Latin America |

2.68 |

3.09 |

3.74 |

4.20 |

4.61 |

5.40 |

6.75 |

6.86 |

8.82 |

11.38 |

13.96 |

| Middle East and Africa (MEA) |

2.35 |

2.69 |

3.12 |

3.65 |

4.06 |

5.32 |

6.26 |

6.68 |

6.57 |

10.66 |

10.12 |

Key Single-use Bioprocessing Companies:

The following are the leading companies in the single-use bioprocessing market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these single-use bioprocessing companies are analyzed to map the supply network.

Recent Developments in the Single-Use Bioprocessing Market

- In May 2025, WuXi Biologics carried out its first commercial PPQ campaign in Hangzhou using three 5,000 L single-use bioreactors, achieving a 70% reduction in protein production costs.

- In September 2024, TekniPlex Healthcare introduced eco-friendly blister packaging solutions, including the first fully transparent recyclable mid-barrier blister pack and PVDC-coated PVC structures for single-use bioprocessing. These innovations were unveiled at CPHI Milan to highlight the company’s expertise and proprietary technologies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the single-use bioprocessing market.

By Product

- Simple & Peripheral Elements

-

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes & Sensors

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Sensors

- Others

- Others

- Apparatus & Plants

- Bioreactors

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

- Work Equipment

- Cell Culture System

- Syringes

- Others

By Workflow

- Upstream Bioprocessing

- Fermentation

- Downstream Bioprocessing

By End-use

- Biopharmaceutical Manufacturers

- CMOs & CROs

- In-house Manufacturers

- Academic & Clinical Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America