Skincare Devices Market Size, Share, Growth, Report 2025 to 2034

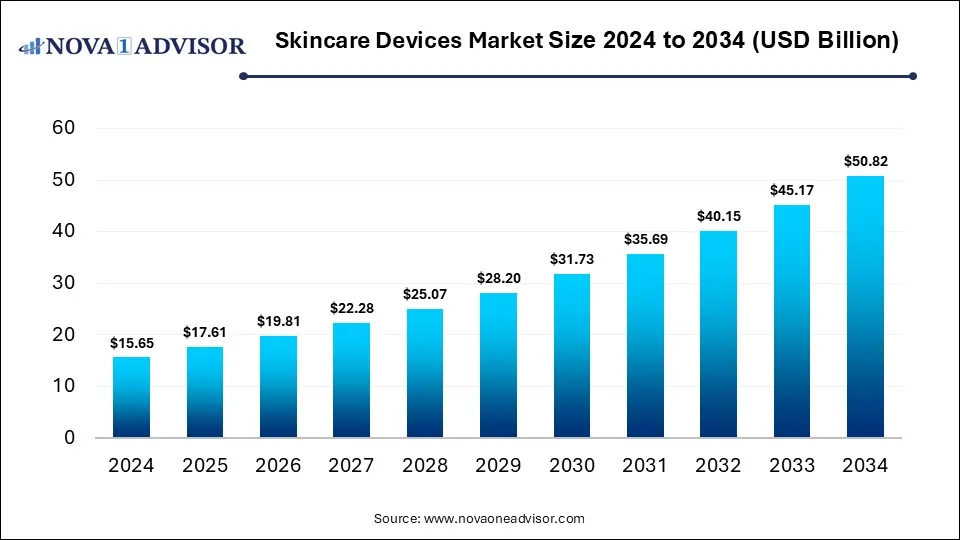

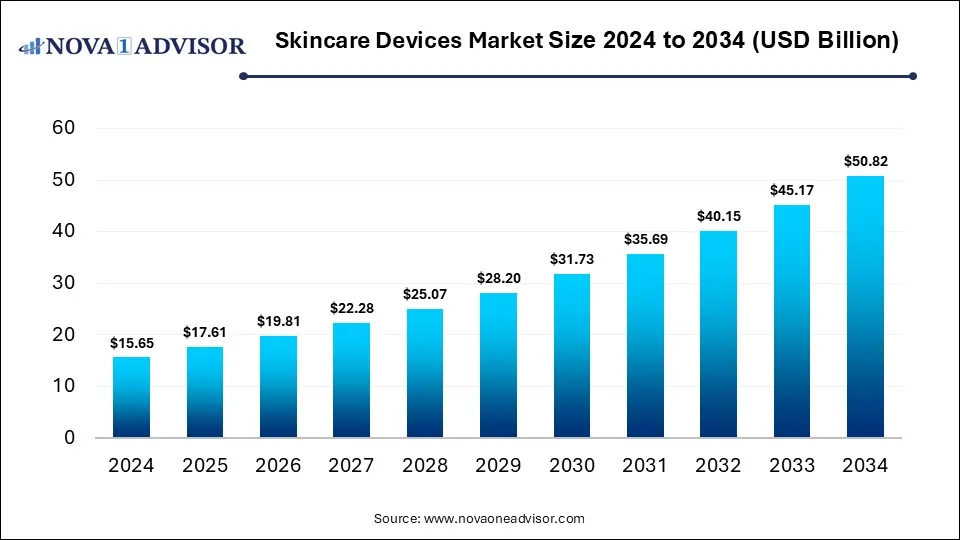

The global skincare devices market size was valued at USD 15.65 billion in 2024, and is predicted to be worth around USD 50.82 billion by 2034, registering a CAGR of 12.5% during the forecast period 2025 to 2034.

Growth Factors:

An increasing number of skin-related disorders such as cancer and assorted disorders are likely to increase the adoption rate of these devices.

Rising use of home-care products and growing medical spa treatments are some of the key trends stimulating market growth. Some of the key factors that are driving growth are technological advancements, growing appearance consciousness, and rising disposable income.

Growing awareness regarding the benefits of skin rejuvenation amongst patients, rising demand for aesthetics, and increasing incidence of skin disorders are among the primary growth stimulants. Syneron Medical, a U.S.-based company, is one of the biggest players in the skin rejuvenation market. Its product is known as VelaSmooth which has been approved by the U.S. FDA.

The increasing prevalence of skin cancer and other skin diseases is contributing largely to the high demand for skincare devices. Furthermore, growing awareness among people about the esthetic appeal and technological advancements in skincare devices are also increasing the adoption of these devices significantly. The rise in disposable income is also considered as one of the important factors driving the market.

Report Scope of Skincare Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 17.61 Billion |

| Market Size by 2034 |

USD 50.82 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 12.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Canfield Scientific, Inc.; 3Gen; Aesthetic Group; Ambicare Health; Image Derm, Inc. |

By Product Analysis

The treatment devices segment held the largest revenue share of about 79.0% in 2024 and is also expected to witness the highest CAGR over the forecast period. This is mainly due to the availability of wide applications of dermatology treatment. The low market share for diagnostic devices can be attributable to less awareness level pertaining to the various novel instruments. However, the rising prevalence of skin cancer is anticipated to drive this segment in the future.

Among the treatment devices, the laser segment held the largest revenue share in 2025 and is also expected to show the highest growth over the forecast period owing to its wide adoption. On the other hand, the dermatoscopes segment dominated the diagnostic devices segment in 2021 due to the availability of advanced technologies.

By Application Analysis

The hair removal application segment dominated the market for skincare devices and held the largest revenue share of about 16.0% in 2024. The treatment application segment is bifurcated into hair removal, skin rejuvenation, acne, psoriasis, and tattoo removal, wrinkle removal and skin resurfacing, body contouring and fat removal, cellulite reduction, vascular and pigmented lesion removal, and others.

A rise in demand for cosmetic laser treatments like tattoo removal, skin resurfacing and skin tightening has significantly increased the adoption of dermatology devices. According to the International Society of Aesthetic Plastic Surgery, treatments like non-invasive fat reduction witnessed a 21.1% increase, laser hair removal witnessed a 76.1% increase and Photo Rejuvenation saw a 32.3% increase in 2024 as compared to 2025.

By End-use Analysis

The hospital segment dominated the market and held the largest revenue share of about 48.0% in 2024 owing to the presence of advanced skincare equipment in hospital settings. In addition, the availability of wide treatment options in such facilities has also increased the number of visits for skin disease diagnosis and treatments in these facilities.

The clinics segment is anticipated to witness the highest CAGR over the forecast period owing to rising demand for various skincare-related services. Dermatology clinics are cosmetic and medical facilities that focus on the diagnosis and treatment of skin conditions.

By Regional Analysis

North America dominated the skincare devices market and accounted for the largest revenue share of 43.0% in 2024. The increasing prevalence of skin cancer and other skin diseases such as acne, eczema, and rosacea and the increasing adoption of cosmetic procedures are some of the major factors contributing to the growth of the market in this region.

In Asia Pacific, the market is expected to witness significant growth over the forecast period owing to the growth of medical tourism in the region. In addition, the availability of affordable treatment options is also expected to propel market growth.

Competitive Rivalry

Foremost players in the market are attentive on adopting corporation strategies to enhance their market share. Some of the prominent tactics undertaken by leading market participants in order to sustain the fierce market completion include collaborations, acquisitions, substantial spending in R&D and the improvement of new-fangled products or reforms among others.

Major manufacturers & their revenues, percentage splits, market shares, growth rates and breakdowns of the product markets are determined through secondary sources and verified through the primary sources.

- Company Overview

- Company Market Share/Positioning Analysis

- Product Offerings

- Financial Performance

- Recent Initiatives

- Key Strategies Adopted by Players

- Vendor Landscape

- List of Suppliers

- List of Buyers

Some of the prominent players in the Skincare Devices Market include:

Key Players

- Alma Lasers GmbH

- Cynosure, Inc.

- Solta Medical, Inc.

- Cutera, Inc.

- Syneron Medical Ltd.

- Canfield Scientific, Inc.

- 3Gen

- Aesthetic Group

- Ambicare Health

- Image Derm, Inc.

Segments Covered in the Report

This research report offers market revenue, sales volume, production assessment and prognoses by classifying it on the basis of various aspects. Further, this research study investigates market size, production, consumption and its development trends at global, regional, and country level for the period of 2021 to 2034 and covers subsequent region in its scope:

Market Segmentation

By Product

- Diagnostic Devices

- Dermatoscopes

- Microscopes

- Other Imaging Devices

- Biopsy Devices

- Treatment Devices

- Light Therapy Devices

- Lasers

- Electrosurgical Equipment

- Liposuction Devices

- Microdermabrasion Devices

- Cryotherapy Devices

By Application

- Diagnostic Devices

- Skin Cancer Diagnosis

- Other

- Treatment Devices

- Hair Removal

- Skin Rejuvenation

- Acne, Psoriasis, and Tattoo Removal

- Wrinkle Removal and Skin Resurfacing

- Body Contouring and Fat Removal

- Cellulite Reduction

- Vascular and Pigmented Lesion Removal

- Others

By End-use

By Geography

North America

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

List of Figure

List of Tables

-

Global Skincare Devices Market Size (USD Billion), 2024–2034

-

Global Market Share by Product, 2024 & 2034

-

Global Market Share by Application, 2024 & 2034

-

Global Market Share by End-use, 2024 & 2034

-

North America Skincare Devices Market Size, by Country, 2024–2034

-

U.S. Market Size, by Product, 2024–2034

-

U.S. Market Size, by Application, 2024–2034

-

U.S. Market Size, by End-use, 2024–2034

-

Canada Market Size, by Product, 2024–2034

-

Mexico Market Size, by Product, 2024–2034

-

North America Market Size, by Application, 2024–2034

-

North America Market Size, by End-use, 2024–2034

-

Europe Skincare Devices Market Size, by Country, 2024–2034

-

Germany Market Size, by Product, 2024–2034

-

France Market Size, by Product, 2024–2034

-

U.K. Market Size, by Product, 2024–2034

-

Italy Market Size, by Product, 2024–2034

-

Rest of Europe Market Size, by Product, 2024–2034

-

Europe Market Size, by Application, 2024–2034

-

Europe Market Size, by End-use, 2024–2034

-

Asia Pacific Skincare Devices Market Size, by Country, 2024–2034

-

China Market Size, by Product, 2024–2034

-

Japan Market Size, by Product, 2024–2034

-

South Korea Market Size, by Product, 2024–2034

-

India Market Size, by Product, 2024–2034

-

Southeast Asia Market Size, by Product, 2024–2034

-

Rest of Asia Pacific Market Size, by Product, 2024–2034

-

Asia Pacific Market Size, by Application, 2024–2034

-

Asia Pacific Market Size, by End-use, 2024–2034

-

Latin America Skincare Devices Market Size, by Country, 2024–2034

-

Brazil Market Size, by Product, 2024–2034

-

Rest of Latin America Market Size, by Product, 2024–2034

-

Latin America Market Size, by Application, 2024–2034

-

Latin America Market Size, by End-use, 2024–2034

-

Middle East & Africa Skincare Devices Market Size, by Country, 2024–2034

-

Turkey Market Size, by Product, 2024–2034

-

GCC Countries Market Size, by Product, 2024–2034

-

Africa Market Size, by Product, 2024–2034

-

Rest of MEA Market Size, by Product, 2024–2034

-

Middle East & Africa Market Size, by Application, 2024–2034

-

Middle East & Africa Market Size, by End-use, 2024–2034

-

Global Skincare Devices Market Outlook, 2024–2034 (USD Billion)

-

Global Market Share, by Product, 2024

-

Global Market Share, by Application, 2024

-

Global Market Share, by End-use, 2024

-

Global Market Share, by Product, 2034

-

Global Market Share, by Application, 2034

-

Global Market Share, by End-use, 2034

-

North America Market Share, by Country, 2024

-

U.S. Market Share, by Product, 2024

-

Europe Market Share, by Country, 2024

-

Germany Market Share, by Product, 2024

-

Asia Pacific Market Share, by Country, 2024

-

China Market Share, by Product, 2024

-

Latin America Market Share, by Country, 2024

-

Brazil Market Share, by Product, 2024

-

Middle East & Africa Market Share, by Country, 2024

-

GCC Countries Market Share, by Product, 2024

-

Comparative Growth Rate of Skincare Devices Market across Regions, 2024–2034