Small Molecule Drug Discovery Outsourcing Market Size and Research

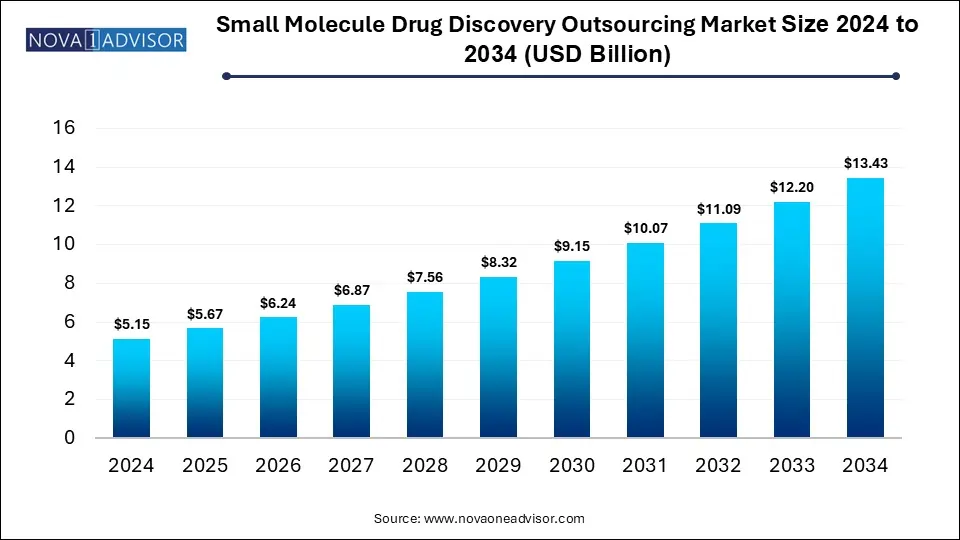

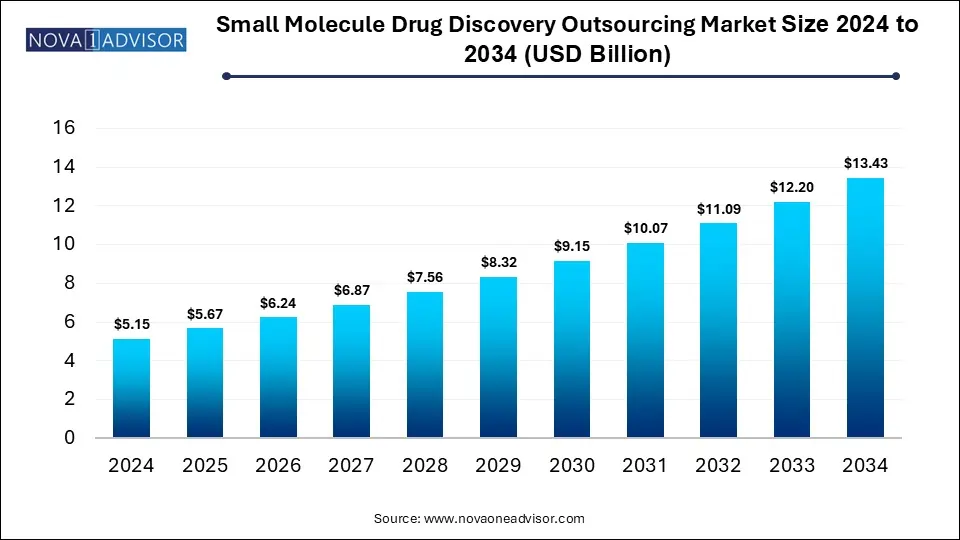

The global small molecule and drug discovery and outsourcing market size is calculated at USD 5.15 billion in 2024, grows to USD 5.67 billion in 2025, and is projected to reach around USD 13.43 billion by 2034, growing at a CAGR of 10.06% from 2025 to 2034. The small molecule drug discovery outsourcing market growth is driven by the rising complexity of drug targets, increased spending on R&D, expansion of existing facilities and emergence on new outsourcing hubs.

Small Molecule Drug Discovery Outsourcing Market Key Takeaways

- North America dominated the global small molecule drug discovery outsourcing market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- By workflow, the lead identification & candidate optimization segment dominated the market with the largest share in 2024.

- By workflow, the preclinical development segment is expected to grow significantly over the forecast period.

- By service, the chemistry services segment accounted for the highest market share in 2024.

- By service, the biology services segment is expected to show significant growth during the predicted timeframe.

- By therapeutic area, the respiratory system segment held the largest market share in 2024.

- By therapeutic area, the oncology segment is expected to show significant growth over the forecast period.

- By end-use, the pharmaceutical & biotechnology segment generated the highest market revenue in 2024.

- By end-use, the academic institutes segment is expected to register significant growth during the forecast period.

What Drives Growth of the Small Molecule Drug Discovery Outsourcing Market?

Small molecule drug discovery outsourcing refers to contracting out several stages of drug discovery and development process to specialized outsourcing organizations which can potentially reduce R&D costs and accelerate time to market for pharmaceutical companies. The small molecule drug discovery outsourcing market is experiencing significant growth due to factors such as rising investments in drug discovery, need for addressing unmet medical needs, demand for specialized expertise, increasing complexity of disease targets such as in cancer and neurological disorders, and globalization of clinical trials.

What Are the Key Trends in the Small Molecule Drug Discovery Outsourcing Market?

- In June 2025, Samsung Biologics, a leading CDMO, expanded its advanced drug screening services with the launch of Samsung Organoids for supporting clients in drug discovery and development.

- In March 2025, Shilpa Medicare introduced its new full service hybrid Contract Development and Manufacturing Organization (CDMO) which has capabilities spanning small and large molecules as well as peptides, with extensive expertise in oncology.

How AI Impacts the Small Molecule Drug Discovery Outsourcing Market?

Artificial intelligence (AI) integration in outsourcing services is making small molecule drug discovery processes more efficient and cost-effective. AI-powered virtual screening can assist in analysing vast chemical databases for identifying potential small molecule drug candidates, leading to reduced times and improving resource allocation. AI-based models and machine learning methodologies are accelerating drug discovery and development processes through predictive modeling, automating synthesis and optimization of drug candidates as well as by assisting in target identification and validation. Cloud-based platforms are enhancing transparency and enabling faster decision-making, facilitating real-time data sharing and communication among CROs and sponsors.

- For instance, in September 2024, XtalPi officially launched its two proprietary software products, XFEP and XMolGen which are specifically designed for accelerating and enhancing the efficiency of drug discovery. XMolGen is an AI-powered software that allows designing and screening of molecules by utilizing a generative chemistry module and also covers a wide range of applications such as de novo molecular generation, focused-library creation, and virtual screening.

Report Scope of Small Molecule Drug Discovery Outsourcing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 13.43 Billion |

| Market Size by 2034 |

USD 13.43 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 10.06% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Workflow, Service, Therapeutics Area, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Albany Molecular Research (Curia), Charles River Laboratories, Dalton Pharma Services, Domainex, Dr. Reddy Laboratories Ltd., Eurofins, Evotec, GenScript Biotech,Jubilant Biosys, Laboratory Corporation of America Holdings (Covance), Merck & Co., Inc., Oncodesign, Pharmaceutical Product Development, LLC, Pharmaron, QIAGEN, Syngene International, TCG Lifesciences Pvt Ltd., WuXi AppTec |

Market Dynamics

Drivers

Rising Focus on Reducing R&D Costs

Various pharmaceutical & biotechnology companies as well as research organizations involved in small molecule drug discovery are seeking outsourcing services from Contract Research Organizations (CROs) to reduce R&D costs and improve their efficiency. Outsourcing avoids the need and high costs associated with development and maintenance of in-house drug discovery infarscture for many companies. CROs enhancing the efficiency and accelerate timelines for drug discovery by providing access to cutting-edge technologies and specialized expertise. Companies can focus in core competencies such as drug formulation and marketing strategies by leveraging outsourcing services.

Restraints

Increasing Complexity and High Costs of Drug Development

Discovering a new drug to commercialization is an extensive process including many risks and significant investments, with the possibility of several drugs failing during the clinical trials. Increasing complexity of modern drug discovery processes along with high costs for drug development as well as to maintain compliance with stringent regulatory standards can become a burden, especially for small biotechs and emerging pharmaceutical companies.

Opportunities

Expansion of Service Offerings

Outsourcing providers such as Contract Research Organizations (CROs) offer comprehensive, integrated and end-to-end solutions in the small molecule drug discovery pipeline from target identification and validation to preclinical development with ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) testing as well as in early-stage clinical trial development. These expanded service offerings provided by CROs attracts various companies seeking outsourcing services, further creating opportunities for market growth. Additionally, increased global footprint of large CROs offering diverse geographical options for outsourcing is contributing to the market expansion.

Small Molecule Drug Discovery Outsourcing Market By Segmental Insights

What Made Lead Identification & Candidate Optimization the Dominant Segment in 2024?

By workflow, the lead identification & candidate optimization segment accounted for the largest market share in 2024. Increasing complexity of innovative small molecule drugs as well as high R&D spending by pharmaceutical and biotechnology companies is creating the need for outsourcing services which offer specialized expertise and access to cutting-edge technologies in lead identification and candidate optimization which is a crucial step in drug discovery pipeline. Cost-effectiveness, optimized resource allocation and improved efficiency of processes offered by outsourcing providers such as Contract Research Organizations (CROs) through their established infrastructure, skilled personnel and state-of-the-art technologies is streamlining workflows.

By workflow, the preclinical development segment is expected to show significant growth during the forecast period. Various companies are seeking outsourcing services in preclinical development which allows them access to advanced infrastructure and specialized expertise, specifically in areas such as immunogenicity, in vivo pharmacokinetics and toxicology. This potentially reduces capital expenditure and accelerates the Investigational New Drug (IND)- enabling studies.

Small Molecule Drug Discovery Outsourcing Market Size By Workflow, 2024 to 2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Lead Identification & Candidate Optimization |

1.56 |

1.70 |

1.87 |

2.06 |

2.26 |

2.48 |

2.72 |

3.00 |

3.34 |

3.62 |

4.08 |

| Target Identification & Screening |

1.04 |

1.13 |

1.24 |

1.34 |

1.47 |

1.67 |

1.83 |

2.04 |

2.20 |

2.46 |

2.70 |

| Target Validation & Functional Informatics |

0.74 |

0.87 |

0.94 |

1.01 |

1.14 |

1.29 |

1.38 |

1.58 |

1.62 |

1.97 |

2.08 |

| Preclinical Development |

1.30 |

1.43 |

1.57 |

1.75 |

1.92 |

2.08 |

2.26 |

2.55 |

2.80 |

3.06 |

3.31 |

| Others |

0.52 |

0.54 |

0.62 |

0.70 |

0.76 |

0.80 |

0.97 |

0.91 |

1.13 |

1.10 |

1.27 |

How Chemistry Services Segment Dominated the Market in 2024?

By service, the chemistry services segment dominated the market with the largest share in 2024. Chemistry is essential part of every step of small molecule drug discovery from synthesizing initial candidates to optimizing lead compounds as well as development of scalable synthetic methods for preclinical and clinical development. Rising complexity of medicinal chemistry is modern drug discovery is creating the need for specialized expertise in designing scalable synthetic pathways for novel molecules, creating customized compounds, quantitative structure-activity relationship (QSAR) studies as well as for modifying compounds based on their biological activity and ADME (absorption, distribution, metabolism, excretion) properties. Outsourcing providers are integrating computational chemistry services such as molecular modelling and docking, housing teams of highly skilled chemists as well as investing heavily for development of advanced synthetic chemistry labs and adoption of analytical equipment like LC-MS a

By service, the biology services segment is expected to grow significantly over the forecast period. In biology services, outsourcing providers like Contract Research Organizations (CROs) assist in various stages of research such as target identification and validation, hit-to-lead generation and lead optimization. Continuous expansion of drug pipelines with focus into new and demanding therapeutic areas like rare diseases, oncology and neuroscience is creating a need for wider range of biological models and assay systems, usually provided by CROs. Advancements in biology field such as high throughput screening (HTS), phenotypic screening, advanced cell-based assays like induced pluripotent stem cell (iPSC)-derived cells and 3D cell cultures (organoids, spheroids), as well as emergence of omics-based technologies like genomics, proteomic and metabolomics. CROs are well-equipped for offering these advanced services to pharmaceutical companies which drives the market growth.

Small Molecule Drug Discovery Outsourcing Market Size By Service, 2024 to 2034 (USD Billion)

| Year |

Biology Services |

Chemistry Services |

| 2024 |

2.84 |

2.31 |

| 2025 |

3.13 |

2.54 |

| 2026 |

3.43 |

2.81 |

| 2027 |

3.75 |

3.11 |

| 2028 |

4.14 |

3.41 |

| 2029 |

4.54 |

3.78 |

| 2030 |

5.01 |

4.14 |

| 2031 |

5.58 |

4.50 |

| 2032 |

6.00 |

5.09 |

| 2033 |

6.79 |

5.41 |

| 2034 |

7.37 |

6.06 |

What Drives the Dominance of the Respiratory System Segment in 2024?

By therapeutic area, the respiratory system segment captured the largest market share in 2024. The rising prevalence of chronic respiratory disorders such as asthma, Chronic Obstructive Pulmonary Disease (COPD), idiopathic pulmonary fibrosis (IPF) and cystic fibrosis in a large patient population is driving the demand for discovery of new drugs for addressing these unmet medical needs. Complex pathophysiology of several respiratory diseases requires specialized expertise in lung biology, immunology, inflammation and regenerative medicine, often provided by CROs. Small molecules can target intracellular pathways directly in the lungs, further reducing potential systemic side effects and improving efficacy.

By therapeutic area, the oncology segment is expected to show significant growth over the forecast period. Cancer is one of the leading cause of morbidity and mortality across the globe. Complexity of cancer biology coupled with stringent regulatory requirements for oncology drugs can be challenging for in-house drug discovery and development for many companies. This drives the shift towards outsourcing which provides access to advanced platforms, specialized expertise and sophisticated tools for cancer drug discovery. Emergence of novel therapeutic modalities such as immunotherapies, PROTACs (Proteolysis Targeting Chimeras) and High-Potency Active Pharmaceutical Ingredients (HPAPIs) are expanding the market potential.

Small Molecule Drug Discovery Outsourcing Market Size By Therapeutic Area, 2024 to 2034 (USD Billion)

| Year |

Anti-infective |

Cardiovascular |

Central Nervous System |

Dermatology |

Endocrine |

Gastrointestinal |

Genitourinary System |

Hematology |

Immunomodulation |

Oncology |

Ophthalmology |

Pain and Anesthesia |

Respiratory system |

| 2024 |

0.25 |

0.38 |

0.52 |

0.21 |

0.27 |

0.37 |

0.30 |

0.28 |

0.39 |

1.06 |

0.26 |

0.43 |

0.42 |

| 2025 |

0.33 |

0.43 |

0.57 |

0.25 |

0.35 |

0.42 |

0.31 |

0.30 |

0.38 |

1.19 |

0.32 |

0.42 |

0.41 |

| 2026 |

0.32 |

0.46 |

0.67 |

0.30 |

0.34 |

0.43 |

0.29 |

0.38 |

0.52 |

1.27 |

0.28 |

0.46 |

0.51 |

| 2027 |

0.31 |

0.49 |

0.78 |

0.34 |

0.36 |

0.49 |

0.30 |

0.35 |

0.53 |

1.50 |

0.34 |

0.48 |

0.59 |

| 2028 |

0.40 |

0.52 |

0.77 |

0.27 |

0.47 |

0.66 |

0.40 |

0.33 |

0.58 |

1.61 |

0.40 |

0.56 |

0.60 |

| 2029 |

0.40 |

0.56 |

0.83 |

0.40 |

0.50 |

0.55 |

0.44 |

0.38 |

0.67 |

1.82 |

0.42 |

0.64 |

0.71 |

| 2030 |

0.48 |

0.72 |

0.97 |

0.38 |

0.55 |

0.64 |

0.50 |

0.51 |

0.59 |

1.89 |

0.44 |

0.73 |

0.76 |

| 2031 |

0.57 |

0.82 |

1.03 |

0.42 |

0.54 |

0.71 |

0.50 |

0.49 |

0.74 |

2.13 |

0.53 |

0.75 |

0.85 |

| 2032 |

0.53 |

0.87 |

1.27 |

0.41 |

0.61 |

0.80 |

0.58 |

0.63 |

0.77 |

2.31 |

0.57 |

0.82 |

0.92 |

| 2033 |

0.57 |

1.00 |

1.39 |

0.40 |

0.66 |

0.87 |

0.66 |

0.62 |

0.94 |

2.58 |

0.63 |

0.86 |

1.04 |

| 2034 |

0.73 |

0.95 |

1.43 |

0.42 |

0.68 |

0.98 |

0.62 |

0.77 |

1.06 |

2.83 |

0.75 |

1.05 |

1.15 |

Why Did the Pharmaceutical & Biotechnology Segment Dominated the Market in 2024?

By end-use, the pharmaceutical & biotechnology companies segment dominated the market with highest revenue share in 2024. These companies are actively seeking outsourcing services for drug discovery and development to ensure predictability and scalability of R&D costs as well as to mitigate financial risks, in case a project fails. Outsourcing complex and resource-intensive stages such as lead identification, optimization of candidates and preclinical development allows pharmaceutical and biotechnology companies to focus on core competencies. Furthermore, expanding drug pipelines from small and mid-sized biotech companies with lack of infrastructure and capital to carry out full-scale drug discovery and development of small molecules drives the demand for outsourcing services.

By end-use, the academic institutes segment is expected to show significant CAGR during the predicted timeframe. Academic institutions are actively involved in fundamental scientific discoveries with core focus on understanding disease pathways, novel biological mechanisms and addressing unmet therapeutic areas. Research organizations and universities house highly skilled and world-class scientists with specialized expertise across various fields crucial for drug discovery, including pharmacology, genomics, medicinal chemistry, structural biology and computational biology. Companies are outpouring and collaborating with these group of academic experts to leverage their specialized knowledge and cutting-edge technologies for expediting drug discovery processes.

Small Molecule Drug Discovery Outsourcing Market Size By End Use, 2024 to 2034 (USD Billion)

| Year |

Academic Institutes |

Pharmaceutical & Biotechnology companies |

| 2024 |

1.05 |

4.10 |

| 2025 |

1.15 |

4.52 |

| 2026 |

1.24 |

5.00 |

| 2027 |

1.38 |

5.49 |

| 2028 |

1.51 |

6.04 |

| 2029 |

1.62 |

6.70 |

| 2030 |

1.83 |

7.33 |

| 2031 |

2.05 |

8.03 |

| 2032 |

2.27 |

8.82 |

| 2033 |

2.40 |

9.80 |

| 2034 |

2.68 |

10.75 |

Regional Insights

How is North America Dominating the Small Molecule Drug Discovery Outsourcing Market?

North America dominated the global market with the largest share in 2024. The region’s market dominance is driven by well-developed research infrastructure, increasing R&D expenditure, and a huge presence of CROs with focus on key areas such as early-stage biotech research and chemistry services. Stringent regulations imposed by government bodies such as the U.S. Food and Drug Administration (FDA) for drug discovery potentially drives the market growth. Furthermore, rising chronic disease burden, adoption of advanced technologies such as ultra-high throughput screening and computational drug design as well as increased collaborations among pharmaceutical companies, academic and research organizations are contributing to the market expansion.

What Fuels Expansion of the Asia Pacific Small Molecule Drug Discovery Outsourcing Market?

Asia Pacific is anticipated to show fastest growth in the market over the forecast period. The emergence of several biotech companies, increased pharmaceutical R&D support through various government initiatives, large and diverse patient population demanding innovative drugs and therapies as well as availability of skilled labor are boosting the market growth. Competitive pricing models for drug discovery and development services offered by outsourcing providers in the region makes it an attractive option for companies focused on reducing costs. Focus on regulatory harmonization with international standards such as ICH guidelines is streamlining conduction of clinical trials and expediting regulatory submissions for several companies in the Asia Pacific region. Shift towards targeted therapies and precision medicine are contributing to market expansion.

Small Molecule Drug Discovery Outsourcing Market Size By Regional, 2024 to 2034 (USD Billion)

| Year |

North America |

Asia Pacific |

Europe |

Latin America |

Middle East and Africa |

| 2024 |

1.80 |

1.29 |

1.04 |

0.56 |

0.47 |

| 2025 |

1.93 |

1.41 |

1.11 |

0.61 |

0.61 |

| 2026 |

2.21 |

1.52 |

1.22 |

0.65 |

0.63 |

| 2027 |

2.34 |

1.73 |

1.34 |

0.76 |

0.70 |

| 2028 |

2.62 |

1.91 |

1.51 |

0.72 |

0.80 |

| 2029 |

2.98 |

2.06 |

1.64 |

0.85 |

0.80 |

| 2030 |

3.19 |

2.27 |

1.90 |

0.96 |

0.83 |

| 2031 |

3.54 |

2.47 |

2.05 |

0.99 |

1.02 |

| 2032 |

3.96 |

2.69 |

2.13 |

1.20 |

1.11 |

| 2033 |

4.21 |

3.07 |

2.40 |

1.26 |

1.26 |

| 2034 |

4.83 |

3.27 |

2.74 |

1.27 |

1.32 |

Some of the Prominent Players in the Small Molecule Drug Discovery Outsourcing Market

- Albany Molecular Research (Curia)

- Charles River Laboratories

- Dalton Pharma Services

- Domainex

- Dr. Reddy Laboratories Ltd.

- Eurofins

- Evotec

- GenScript Biotech

- Jubilant Biosys

- Laboratory Corporation of America Holdings (Covance)

- Merck & Co., Inc.

- Oncodesign

- Pharmaceutical Product Development, LLC

- Pharmaron

- QIAGEN

- Syngene International

- TCG Lifesciences Pvt Ltd.

- WuXi AppTec

Small Molecule Drug Discovery Outsourcing Market By Recent Developments

- In October 2024, AION Labs, launched a new startup, ProPhet which leverages artificial intelligence for identifying active small molecules for drug discovery.

- In October 2024, at the CPHI Milan 2024, Thermo Fisher Scientific, Inc., launched its Accelerator Drug Development which is the company’s 360° contract development and manufacturing organization and contract research organization drug development solutions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the small molecule drug discovery outsourcing market.

By Workflow

- Lead Identification & Candidate Optimization

- Target Identification & Screening

- Target Validation & Functional Informatics

- Preclinical Development

- Others

By Service

- Biology Services

- Chemistry Services

By Therapeutic Area

- Anti-infective

- Cardiovascular

- Central Nervous System

- Dermatology

- Endocrine

- Gastrointestinal

- Genitourinary System

- Hematology

- Immunomodulation

- Oncology

- Ophthalmology

- Pain and Anesthesia

- Respiratory system

By End Use

- Academic Institutes

- Pharmaceutical & Biotechnology companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)