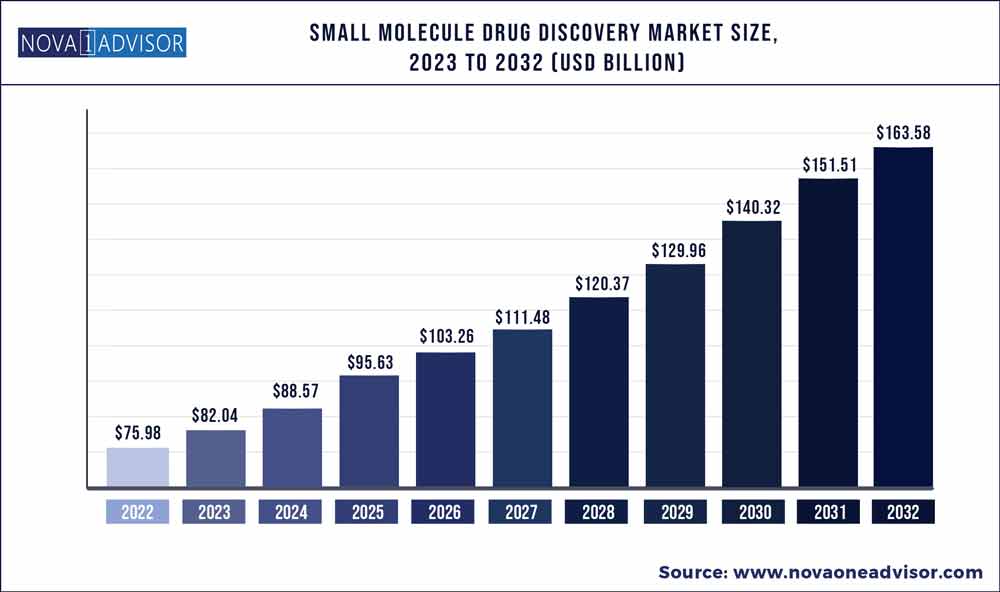

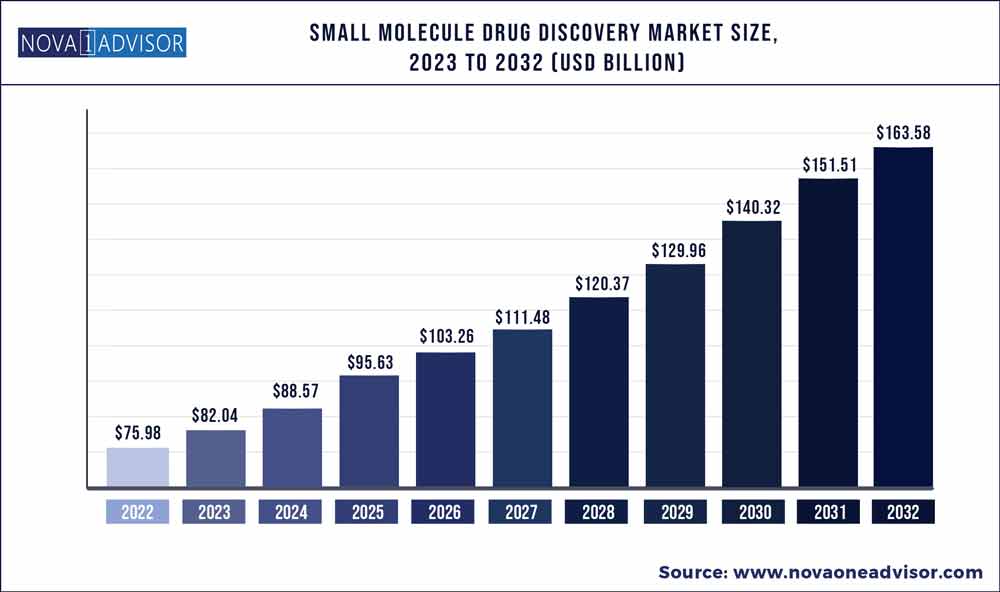

The global small molecule drug discovery market size was exhibited at USD 75.98 billion in 2022 and is projected to hit around USD 163.58 billion by 2032, growing at a CAGR of 7.97% during the forecast period 2023 to 2032.

Key Pointers:

- By drug type, the small molecule drug segment was the market leader in 2022.

- By geography, North America dominated the market in 2022.

- By geography, the Asia Pacific is anticipated to be the most opportunistic market in 2022.

Small Molecule Drug Discovery Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 82.04 Billion

|

|

Market Size by 2032

|

USD 163.58 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 7.97%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Drug Type, By Technology, and By End-User

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Pfizer Inc., GlaxoSmithKline PLC, Merck & Co. Inc., Agilent Technologies Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, Bayer AG, Abbott Laboratories Inc., Thermo Fisher Scientific Inc., Shimadzu Corp, and others.

|

During the COVID-19 pandemic, many countries invested heavily in research and development to combat the virus. Research groups worldwide tried to identify small-molecule drugs for the treatment of COVID-19 by screening both novel and existing drugs for their ability to alleviate symptoms and stem viral replication. For instance, in the article published by the National Library of Medicine, in January 2021, by exploiting computational tools, researchers attempted to predict and design small-molecule and peptide-based antiviral agents against various targets of SARS-CoV-2 viral disease. It also reported that during the pandemic, research was done on repurposing small molecules to develop a therapy for treating COVID-19. According to an article published by the Journal of Biomedical Science in September 2022, a large-scale compound repurposing study (screening of a library of 12,000 small molecules) was started, and it found several compounds that were able to prevent the SARS-CoV-2 virus from replicating, with 21 medicines exhibiting dose-response associations. Other than in vitero cells, the chemicals were also tested for their effectiveness against SARS-CoV-2 replication-supporting human cell lines. There is no denying that vaccines were the most effective method for preventing SARS-CoV-2 infections; however, the most urgent need at that moment was the addition of small molecules to the anti-COVID19 arsenal, to increase the variety of therapeutic options, particularly for patients with compromised immune systems. Thus, the use of small molecule drug discovery for COVID-19 therapeutic options was expected to have significant impact on the market.

Factors such as the rise in demand for small-molecule drugs, an increasing number of contract organizations for research and development and increasing usage of small molecules in the treatment of chronic diseases are expected to drive the growth of the market. The increasing number of chronic diseases propels the market's growth. According to the British Heart Foundation's August 2022 statistics, there were around 7.6 million people in the United Kingdom living with some form of heart or cardiovascular disease in 2021. As per the GLOBOCAN 2020 statistics, globally, there were 19.3 million new cases of cancer in 2020 and this number is expected to reach 30.2 million by 2040. Such an increase in chronic diseases is expected to increase the demand for treatments, and ultimately the demand for small molecules.

Additionally, the launch of technologically advanced products and partnership by the market players is expected to propel the growth of the market. For instance, in July 2022, Dotmatics, one of the leaders in the research and development of scientific software connecting science, data, and decision-making, released a small-molecule drug discovery solution. It is an integrated scientific research and development platform with pre-configured workflows and expanded data management capabilities. In April 2022, Iktos and Teijin Pharma Limited signed a strategic collaboration agreement in artificial intelligence for new drug design. As per the agreement, Iktos generative modeling technology will be implemented and applied to several of Teijin Pharma’s small molecule drug discovery projects to expedite the identification of potential pre-clinical candidates. Such launches and partnerships are expected to contribute to the growth of the market.

Factors such as rise in demand for small-molecule drugs, and increasing usage of small molecules in the treatment of chronic diseases are driving the market growth of the small molecule drug discovery market. However, high drug development costs and strict regulations are the factors expected to restrain the market growth.

Target identification is made to identify a small molecule's direct molecular target, such as protein or nucleic acid. In the case of clinical pharmacology, target identification is aimed at finding out the efficacy of the target of the drug molecule. The main objective of target validation is to identify and access the chances of a molecular target in achieving the development of pharmaceuticals for therapeutic application. Three key distinct and complementary approaches are used for target identification and validation: genetic interaction, direct biochemical, and computational interference. In many cases, combinations of multiple approaches may be required to characterize the target entirely.

Technology is crucial in every small molecule drug discovery aspect, from target identification and validation to lead optimization. Hence, technological advancements have been acting as a driving factor for the market segment. For instance, in August 2021, Insilico Medicine, one of the industry leaders in end-to-end artificial intelligence for target discovery, small molecule chemistry, and clinical development, and Usynova signed a strategic cooperation to advance the development of small molecule innovative therapies.

The market segment growth is also propelled by the increasing burden of diseases such as cancer, Alzheimer, and others, as with the increasing burden of diseases, there is an increasing need for research and development for better and more effective therapeutics.

Some of the prominent players in the Small Molecule Drug Discovery Market include:

- Pfizer Inc.

- GlaxoSmithKline PLC

- Merck & Co. Inc.

- Agilent Technologies Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Bayer AG

- Abbott Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corp

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Small Molecule Drug Discovery market.

By Drug Type

- Small Molecule Drugs

- Biologic Drugs

By Technology

- High Throughput Screening

- Pharmacogenomics

- Combinatorial Chemistry

- Nanotechnology

- Others

By End-User

- Pharmaceutical Companies

- Contract Research Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)