Smart Diagnostics And Monitoring Devices Market Size and Research

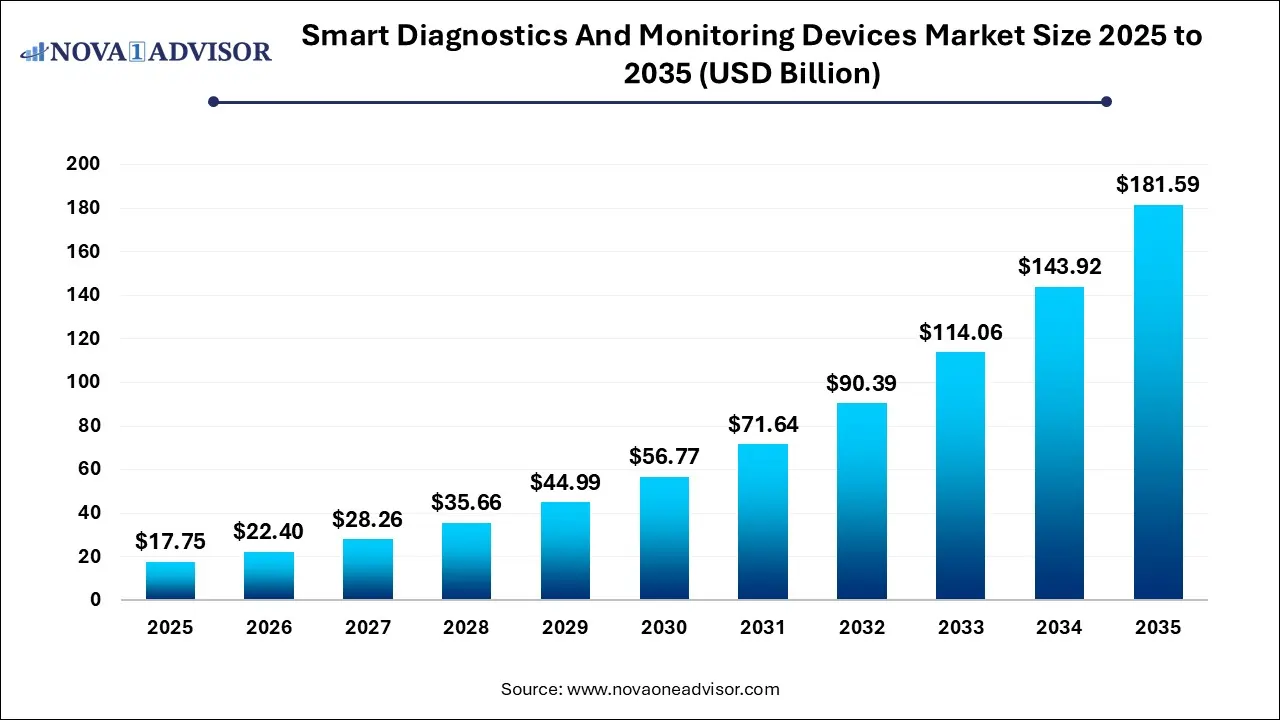

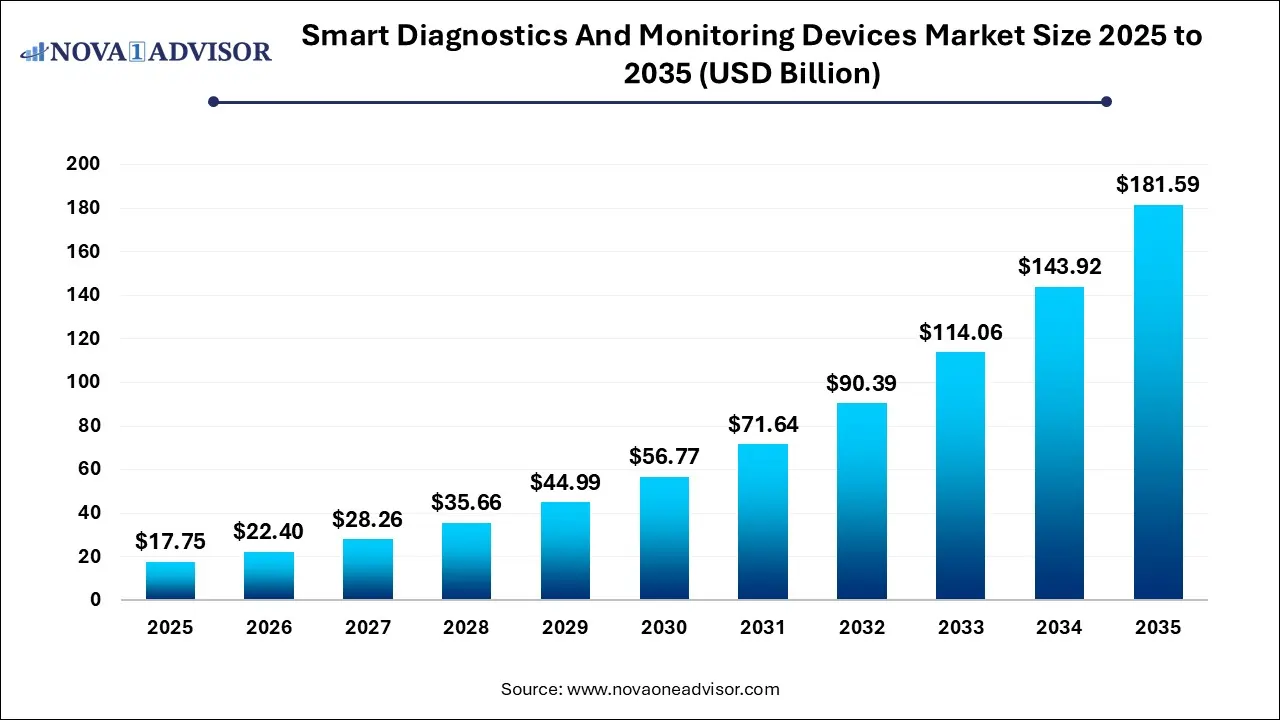

The Smart Diagnostics And Monitoring Devices Market size was exhibited at USD 17.75 billion in 2025 and is projected to hit around USD 181.59 billion by 2035, growing at a CAGR of 26.18% during the forecast period 2026 to 2035.

Key Takeaways:

- In 2025, the blood glucose monitors category led the market, accounting for the highest revenue share of 19%.

- Pharmacies emerged as the leading distribution channel in 2025, capturing the largest portion of market revenue.

- Hospitals represented the dominant end-user segment in the smart diagnostics and monitoring devices market in 2025.

- North America held the top position in the global smart diagnostics and monitoring devices market in 2025, contributing 36% of the total market share.

Market Overview

The Smart Diagnostics and Monitoring Devices Market is undergoing a significant transformation fueled by advancements in sensor technology, miniaturization of electronics, and the global shift toward personalized and preventive healthcare. These intelligent devices combine real-time data acquisition with cloud connectivity and AI-based analytics, enabling continuous monitoring, early diagnosis, and timely medical intervention. The convergence of healthcare and digital technology is revolutionizing patient engagement and clinical workflows, creating a dynamic ecosystem where smart health monitoring plays a central role.

These devices span a wide spectrum from wearable ECG monitors and smart clothing to glucose-sensing contact lenses and AI-powered tricorders. Their ability to collect, interpret, and transmit health parameters wirelessly has made them essential tools not only in clinical settings but also in homes, fitness centers, and remote environments. The COVID-19 pandemic served as a pivotal inflection point, highlighting the need for non-contact, connected diagnostic tools. Since then, demand has surged across demographics and regions, with chronic diseases like diabetes, cardiovascular conditions, and respiratory disorders driving adoption.

Technological integration with IoT platforms, machine learning algorithms, and smartphone interfaces has made these devices more user-friendly and accessible. Startups and established medtech giants alike are racing to bring innovations to market, while healthcare providers are increasingly embedding smart monitoring into remote patient management strategies. As regulatory pathways become more accommodating and data security solutions mature, the market is poised for sustained, exponential growth.

Major Trends in the Market

-

Growing Integration of Artificial Intelligence (AI): AI algorithms are enhancing diagnostic precision and predictive analytics in wearable devices, improving disease prevention.

-

Miniaturization and Flexible Electronics: Advancements in micro-sensor technology and flexible circuit boards are enabling more compact and comfortable wearable designs.

-

Rising Popularity of Smart Wearables in Fitness and Wellness: Fitness enthusiasts and athletes are fueling demand for multifunctional health monitors embedded in clothing and accessories.

-

Cloud-Based Remote Monitoring Platforms: The surge in telehealth services is encouraging the deployment of cloud-connected monitoring tools for real-time patient tracking.

-

Increased Focus on Non-invasive Diagnostics: There’s a major industry push toward non-invasive monitoring solutions such as breath analyzers and smart contact lenses.

-

Expansion into Emerging Markets: Rising healthcare spending and mobile penetration are opening up new markets in Asia Pacific and Latin America.

-

Consumerization of Healthcare: Direct-to-consumer (DTC) models are gaining traction, with online sales platforms witnessing high traffic and engagement.

-

Regulatory Push for Interoperability and Security Standards: As device interoperability becomes critical, regulators are tightening standards for data privacy and health system integration.

Report Scope of Smart Diagnostics And Monitoring Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 22.4 Billion |

| Market Size by 2035 |

USD 181.59 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 26.18% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Distribution Channel, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott Laboratories; Dexcom, Inc.; F. Hoffmann-La Roche Ltd.; Medtronic, plc.; Drägerwerk AG & Co. KGaA; LifeScan, Inc.; NeuroMetrix, Inc.; OMRON Corporation; Seer Medical; VitalConnect Inc.; STRIDE BP; NIPRO CORPORATION |

Market Driver: Rising Burden of Chronic Diseases

The growing prevalence of chronic conditions, particularly diabetes, cardiovascular diseases, and respiratory disorders, is a significant driver accelerating the smart diagnostics and monitoring devices market. According to the World Health Organization, chronic diseases account for nearly 71% of all global deaths annually, and many of these can be managed more effectively with early detection and continuous monitoring.

Smart diagnostic devices like wearable ECG monitors, blood glucose monitors, and smart thermometers allow for real-time tracking of health metrics and enable personalized care plans. For instance, diabetic patients benefit greatly from continuous glucose monitors (CGMs) integrated into smart lenses or patches, avoiding the inconvenience and pain of finger-prick tests. The convenience and precision of these devices improve adherence to care regimens and reduce emergency visits, creating value for both patients and healthcare systems. As aging populations grow and healthcare shifts toward value-based care models, the importance of these tools is expected to surge.

Market Restraint: Data Security and Interoperability Challenges

While smart devices offer unprecedented insights into health, data security and interoperability remain major concerns. These devices generate vast amounts of sensitive personal health data, which, if breached, can lead to privacy violations, identity theft, or misuse. Inadequate encryption, outdated software, and insecure transmission channels make some consumer-grade devices vulnerable to cyberattacks.

Moreover, many smart devices operate in silos, with limited ability to integrate into hospital electronic health record (EHR) systems. This lack of interoperability creates friction in care coordination, hampers real-time clinical decision-making, and diminishes the overall value of the data collected. The healthcare industry’s conservative regulatory environment and varied compliance mandates across geographies further compound the challenge. Unless manufacturers and regulators develop universal standards and protocols, scalability and trust in these technologies could be hindered.

Market Opportunity: Expansion into Remote and Rural Healthcare

A compelling opportunity lies in expanding smart diagnostics and monitoring devices to underserved, rural, and remote populations. Globally, billions of people lack access to quality healthcare services due to geographic or infrastructural barriers. Smart monitoring devices, particularly those integrated with telemedicine platforms, can bridge this gap by enabling remote consultations and real-time health status updates without requiring hospital visits.

For example, in India and sub-Saharan Africa, startups are leveraging solar-powered wearable devices with mobile connectivity to monitor blood pressure and heart rate among rural populations. In the U.S., veterans and elderly individuals in remote regions are being provided with smart kits that include pulse oximeters and ECG patches for continuous care. Governments and NGOs are showing growing interest in public-private partnerships to roll out such technology in large-scale community health programs. With scalable manufacturing, local language support, and mobile-first interfaces, the next frontier for this market is undoubtedly rural digital health.

Segmental Analysis

By Product

Blood glucose monitors held the dominant share in the product segment, fueled by the rising global burden of diabetes. These devices are widely used both clinically and at home, and their widespread adoption is reinforced by technological upgrades like smartphone integration and non-invasive sensors. Continuous glucose monitors (CGMs) are increasingly being adopted in advanced economies, helping patients better manage type 1 and type 2 diabetes. Devices from companies like Abbott and Dexcom have set benchmarks in this space, combining real-time readings with cloud-based dashboards for physicians and caregivers.

In contrast, smart contact lenses are projected to witness the fastest growth due to ongoing innovations in non-invasive intraocular sensors. These lenses are being developed to monitor both glucose and intraocular pressure, offering a pain-free solution for diabetics and glaucoma patients. Alphabet’s Verily Life Sciences, in collaboration with Alcon, has made significant strides in developing glucose-sensing lenses, although commercial rollout is still pending. The combination of vision correction and medical monitoring in one device presents a transformative solution for millions of patients.

By Distribution Channel

Pharmacies currently dominate the distribution channel landscape, as they remain the most accessible point of care for both prescription and over-the-counter smart devices. Pharmacists also play a crucial role in patient education, helping users understand device usage, maintenance, and calibration. Chain pharmacies in North America and Europe often stock a variety of smart diagnostic tools, reinforcing their position as the primary sales channel.

However, online channels are witnessing the fastest growth, thanks to the rising popularity of e-commerce, especially among tech-savvy consumers. Companies like Amazon, Flipkart, and Alibaba have dedicated health-tech sections with detailed product guides and consumer reviews. During the COVID-19 pandemic, sales through online platforms skyrocketed, and this behavior has largely continued. Subscription models, personalized shopping assistants, and bundled digital health plans are further enhancing the appeal of digital retail for medical devices.

By End Use

Home care is the leading end-use segment, as patients increasingly prefer managing chronic conditions in the comfort of their own homes. Devices like blood pressure monitors, pulse oximeters, and smart thermometers have become household staples, especially in aging populations. The rise of remote patient monitoring (RPM) programs supported by insurance providers and hospitals has further driven device placement in home settings.

Meanwhile, the "Others" category, which includes sports, fitness centers, and assisted living facilities, is growing at a brisk pace. Fitness centers are integrating smart diagnostics into wellness assessments and performance tracking, while assisted living homes are adopting smart ECG and respiratory monitors to support eldercare. Wearable technology is also being deployed by sports teams and military units for real-time biometric analysis during training and operations.

Regional Analysis

North America held the largest share of the smart diagnostics and monitoring devices market, driven by its advanced healthcare infrastructure, high chronic disease prevalence, and widespread consumer adoption of digital health tools. The U.S. alone has a significant installed base of wearable health devices and RPM systems, supported by favorable reimbursement frameworks from CMS and private insurers. The presence of major players like Apple, Fitbit, and Medtronic fuels continuous innovation and robust product pipelines. Strategic acquisitions and high funding activity in medtech startups further sustain North America’s dominance.

Asia Pacific is the fastest growing region, propelled by population size, rapid urbanization, and increasing healthcare expenditure. Countries like China and India are witnessing a surge in lifestyle-related diseases and a parallel boom in mobile health applications. Government initiatives to promote digital health infrastructure—such as India’s Ayushman Bharat and China’s Healthy China 2030—are encouraging both public and private investments. Moreover, local manufacturers are producing cost-effective devices tailored to the needs of price-sensitive consumers, further expanding market penetration.

Some of The Prominent Players in The Smart Diagnostics And Monitoring Devices Market Include:

Recent Developments

-

May 2025: Verily Life Sciences resumed development of its smart glucose-sensing contact lens, partnering with Japan’s Menicon for new clinical trials.

-

March 2025: Dexcom launched the G8 Continuous Glucose Monitoring System with AI-powered alerts for hypoglycemia prediction.

-

January 2025: Philips Healthcare announced the integration of its wearable biosensor technology into 30+ hospital networks across the U.S. for real-time patient monitoring.

-

December 2024: Withings unveiled a next-generation smart thermometer with multi-user support and real-time syncing to pediatricians for child health tracking.

-

November 2024: Apple Inc. filed a patent for non-invasive blood glucose measurement through the Apple Watch, signaling further expansion into medical diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Product

- Blood Glucose Monitors

- Pulse Oximeters

- Breath Analyzers

- Medical Tricorders

- Blood Pressure Monitors

- Smart Thermometers

- Heart Rate Monitors

- Smart Contact Lenses

-

- Glucose Monitoring

- Intraocular Pressure Monitoring

-

- Embedded Health Sensors

- Fitness Monitoring

By Distribution Channel

- Pharmacies

- Online Channel

- Direct-to-Consumer (DTC)

- Others (Hypermarkets, Specialty Retailers)

By End-use

- Hospitals

- Clinics

- Home Care

- Others (Sports, Fitness Centers, Assisted Living)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)