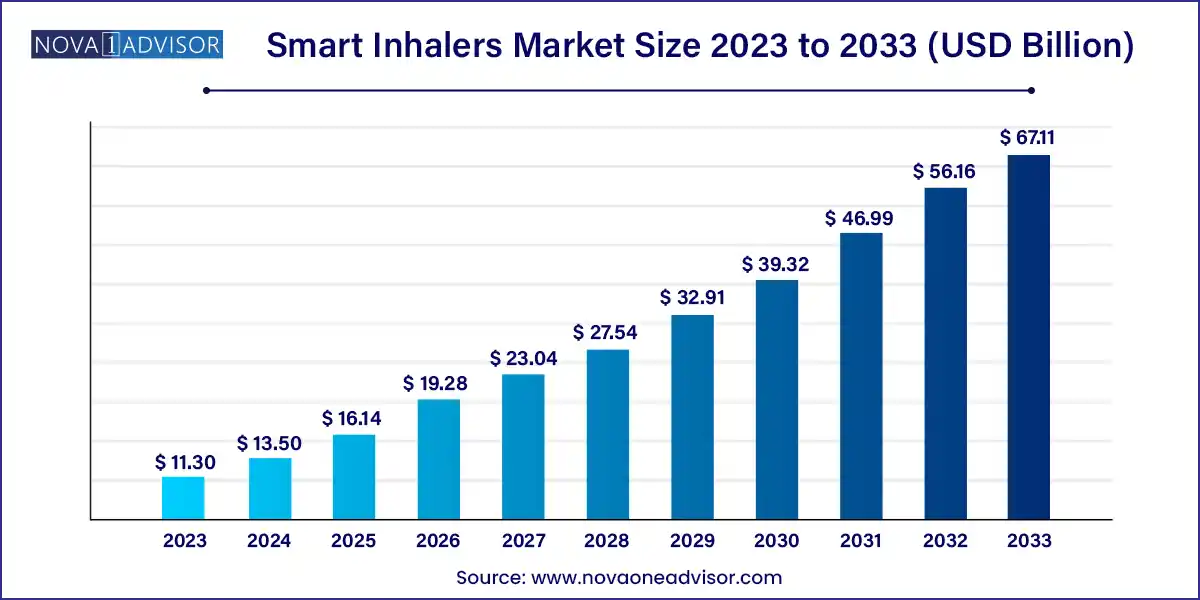

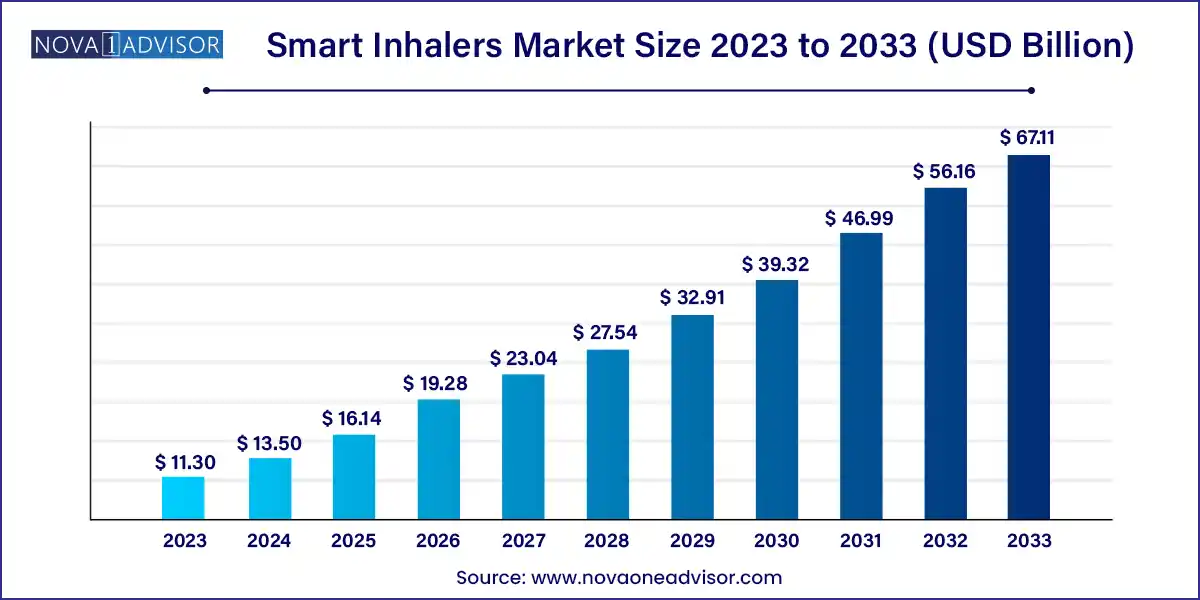

The global smart inhalers market size was exhibited at USD 11.30 billion in 2023 and is projected to hit around USD 67.11 billion by 2033, growing at a CAGR of 19.5% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, North America held the largest share of over 47.0%.

- In 2023, the MDIs segment captured a dominant share of over 60.0%.

- In 2023, the COPD segment held the largest revenue share of over 50.0%.

- The hospital pharmacies segment accounted for the largest share of over 40.0% in 2023.

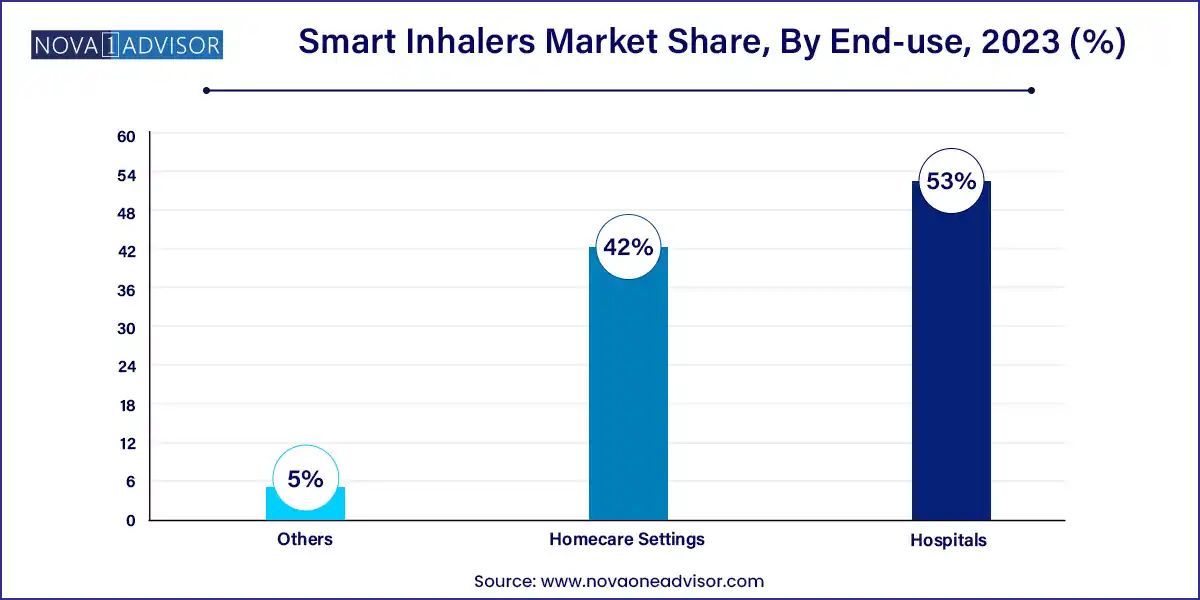

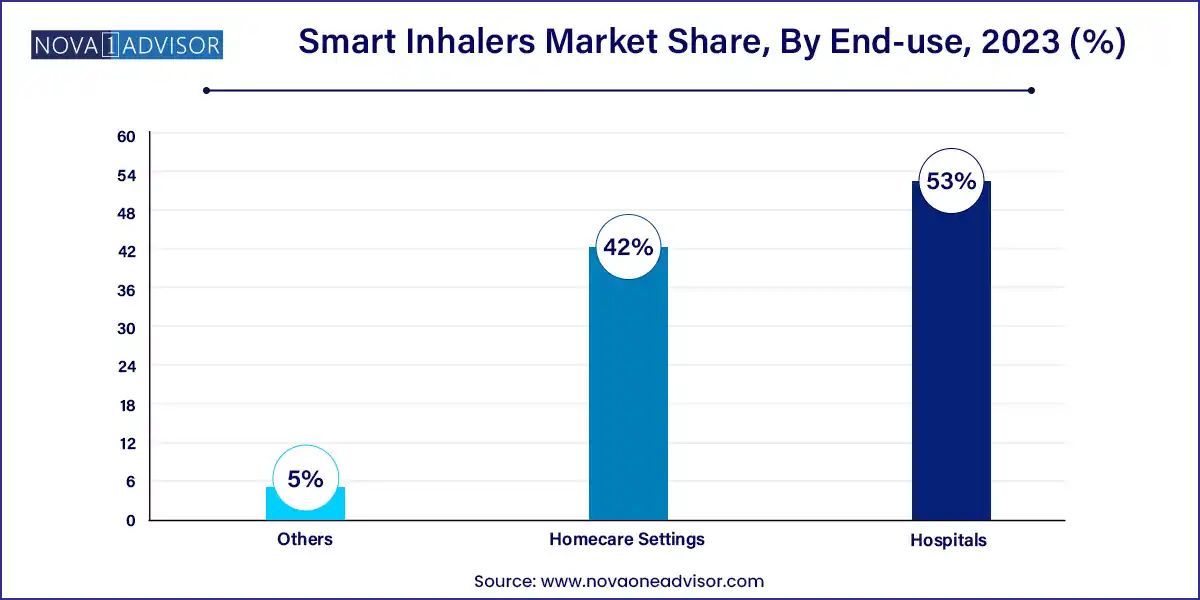

- In 2023, hospitals accounted for the largest share of over 53.0%.

Market Overview

The Smart Inhalers Market is revolutionizing the management of chronic respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). These connected devices combine traditional inhalation therapies with digital technology, enabling real-time tracking of medication adherence, inhalation patterns, and environmental triggers. By integrating Bluetooth sensors, mobile apps, and cloud-based analytics, smart inhalers are transforming how patients and physicians monitor and manage respiratory health.

The market is being propelled by the growing burden of respiratory conditions globally, advancements in digital health infrastructure, and rising patient demand for personalized and data-driven care. Chronic respiratory diseases affect over 500 million people worldwide, and poor adherence to treatment regimens contributes significantly to disease exacerbation, hospitalizations, and healthcare costs. Smart inhalers address this issue by offering reminders, usage feedback, and remote monitoring capabilities.

Pharmaceutical and med-tech companies are increasingly collaborating to develop device-drug combinations that optimize therapy outcomes and enhance patient engagement. From basic dose counters to AI-powered predictive analytics, the spectrum of smart inhaler functionality continues to expand. As health systems move toward value-based care, smart inhalers offer a compelling solution to reduce costs while improving outcomes.

Major Trends in the Market

-

Integration of IoT and AI in Inhalers: Devices are now capable of predictive analytics for early detection of asthma or COPD exacerbations.

-

Rising Popularity of Connected Health Platforms: Seamless connectivity with smartphones and cloud-based EMRs is enhancing adherence tracking and physician oversight.

-

Increased Consumer Demand for Personalized Medicine: Patients are seeking real-time feedback and individualized insights to manage their conditions.

-

Regulatory Support for Digital Therapeutics: Agencies like the FDA and EMA are clearing smart inhalers as part of broader digital therapy regimens.

-

Home Monitoring and Remote Care Models: Especially post-COVID-19, there’s a surge in home-based chronic care using digital tools.

-

Expansion in Pediatric and Elderly Populations: Smart inhalers designed with usability features for children and older adults are gaining traction.

-

Pharma-Tech Collaborations for Device-Drug Ecosystems: Companies like GSK, Novartis, and Propeller Health are pioneering integrated offerings.

-

Data Monetization and Real-World Evidence: Insurers and pharma firms are leveraging inhaler data to model population-level outcomes.

Smart Inhalers Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 13.50 Billion |

| Market Size by 2033 |

USD 67.11 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 19.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Indication, Distribution Channel, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

H&T Presspart Manufacturing Ltd.; Personal Air Quality Systems Private Limited; COHERO Health Inc.; Cognita Labs; Adherium Limited; Amiko Digital Health Limited; Teva Pharmaceuticals Industries Ltd.; Propeller Health; Novartis AG; Pneuma Respiratory Inc.; 3M Health Care Limited; AireHealth, Inc.; FindAir Sp. z o.o |

Market Driver: Growing Prevalence of Asthma and COPD

A key driver of the smart inhalers market is the escalating prevalence of asthma and COPD worldwide, particularly in urban and aging populations. According to the Global Burden of Disease study, more than 260 million individuals suffer from asthma, while COPD is the third leading cause of death globally. These conditions require long-term management with consistent medication adherence, which remains a major challenge.

Traditional inhalers offer no insights into patient usage behavior, often resulting in missed doses or incorrect techniques. Smart inhalers address these challenges by tracking usage and providing feedback in real-time. This is especially critical in COPD patients, where medication nonadherence can result in acute exacerbations, hospitalizations, and increased mortality. The ability to transmit inhalation data to healthcare providers supports timely intervention and promotes proactive disease management.

Market Restraint: High Cost and Data Privacy Concerns

Despite their clinical benefits, smart inhalers face barriers to adoption related to cost and data privacy. These devices are more expensive than conventional inhalers, and in many regions, they are not covered by public or private insurance. This limits their accessibility, particularly in low-income or rural areas.

Additionally, smart inhalers collect sensitive health data, including patient location, environmental exposure, and medication usage. Concerns about data security, ownership, and potential misuse by insurers or third parties can deter both physicians and patients. Regulatory frameworks for digital health devices are still evolving, and compliance with data protection laws like HIPAA (U.S.) or GDPR (EU) adds complexity for manufacturers.

Market Opportunity: Integration with Digital Health Ecosystems and Telehealth

A significant opportunity lies in leveraging smart inhalers as part of broader digital health and remote monitoring ecosystems. As telehealth platforms and virtual care models gain momentum, particularly post-pandemic, smart inhalers can function as key tools for continuous respiratory monitoring.

Integration with electronic medical records (EMRs), mobile apps, and wearable devices enables a holistic view of a patient’s health status. For instance, a patient’s inhaler usage data can be cross-referenced with sleep patterns, physical activity, and exposure to allergens, allowing AI algorithms to deliver predictive alerts for potential flare-ups.

This opens up avenues for partnerships between inhaler manufacturers, digital health startups, hospitals, and payers to offer subscription-based or bundled care packages. It also supports chronic care programs under value-based reimbursement frameworks, where outcomes rather than procedures are incentivized.

Segments Insights:

By Type Insights

Metered Dose Inhalers (MDIs) dominate the smart inhalers market, primarily due to their historical prevalence, ease of use, and compatibility with add-on smart sensors. MDIs deliver medication via a pressurized canister and are widely prescribed for both asthma and COPD. Many existing MDIs are being retrofitted with Bluetooth-enabled sensors that can track usage patterns and transmit data to mobile applications.

However, Dry Powdered Inhalers (DPIs) are the fastest-growing segment, driven by their breath-actuated design which eliminates the need for coordination between actuation and inhalation. DPIs are increasingly being integrated with sensors that monitor inspiratory flow rates and dose delivery, providing richer clinical data. These devices are gaining favor among younger and tech-savvy populations due to their compact design and app-based customization features.

By Indication Insights

Asthma remains the leading indication segment, accounting for the majority of smart inhaler usage. The condition often begins in childhood and requires long-term management, making it ideal for monitoring and adherence tools. Pediatric applications, in particular, benefit from smart reminders and caregiver alerts that support consistent therapy.

COPD is emerging as the fastest-growing segment, driven by the aging population and increased diagnosis rates in smokers and occupational workers. COPD management relies heavily on maintenance inhalation therapy, and smart inhalers can reduce hospitalization by detecting early signs of exacerbation. In countries with well-established chronic care programs, smart inhalers are being integrated into remote pulmonary rehabilitation programs.

By End-use Insights

Hospitals remain the leading end-user segment, particularly in developed regions where integrated health systems can track outcomes and adjust treatment plans based on real-time inhaler data. Hospital-based pulmonary specialists are also more likely to adopt smart technologies for research and population health programs.

Homecare settings are growing rapidly as telehealth adoption expands, enabling patients with stable conditions to manage their therapy independently. Caregivers and family members often support elderly patients using smart inhalers, and features like remote alerts and usage history are highly valued in this context.

By Regional Insights

North America dominates the smart inhalers market, led by the United States. Factors contributing to this include high disease prevalence, favorable reimbursement for digital health tools, and strong presence of key players such as Propeller Health and Teva Pharmaceuticals. The U.S. FDA has approved several smart inhalers and digital therapeutics platforms, and insurers are increasingly offering digital asthma management packages.

Asia-Pacific is the fastest-growing region, fueled by rising respiratory disease burden, smartphone penetration, and supportive government initiatives in countries like China, India, and Australia. Public health campaigns focusing on asthma education, combined with the rise of health tech startups, are expanding market access. In Japan and South Korea, integration of inhalers into home health monitoring systems is becoming standard practice.

Some of the prominent players in the Smart inhalers market include:

- H&T Presspart Manufacturing Ltd.

- Personal Air Quality Systems Private Limited

- COHERO Health Inc.

- Cognita Labs

- Adherium Limited

- Amiko Digital Health Limited

- Teva Pharmaceuticals Industries Ltd.

- Propeller Health

- Novartis AG

- Pneuma Respiratory Inc.

- 3M Health Care Limited

- AireHealth, Inc.

- FindAir Sp. z o.o

Recent Developments

-

Teva Pharmaceuticals (April 2025): Announced the expansion of its Digihaler® line with AI-based medication adherence scoring, approved for both asthma and COPD management in North America and Europe.

-

Propeller Health (March 2025): Partnered with Philips Healthcare to integrate inhaler data into connected respiratory care platforms, supporting hospital-to-home transitions for COPD patients.

-

Adherium (February 2025): Received CE Mark for its next-generation Hailie® sensor with enhanced connectivity features and compatibility across leading DPI brands.

-

Cohero Health (January 2025): Launched its digital BreatheSmart® platform in Southeast Asia, focusing on pediatric asthma monitoring in collaboration with UNICEF.

-

Novartis (December 2024): Initiated a global pilot program combining Breezhaler® DPI with a digital companion app to reduce readmissions among high-risk COPD patients.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global smart inhalers market.

Type

- Dry Powdered Inhalers (DPIs)

- Metered Dose Inhalers (MDIs)

Indication

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD)

- Other

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

End-use

- Hospitals

- Homecare Settings

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)