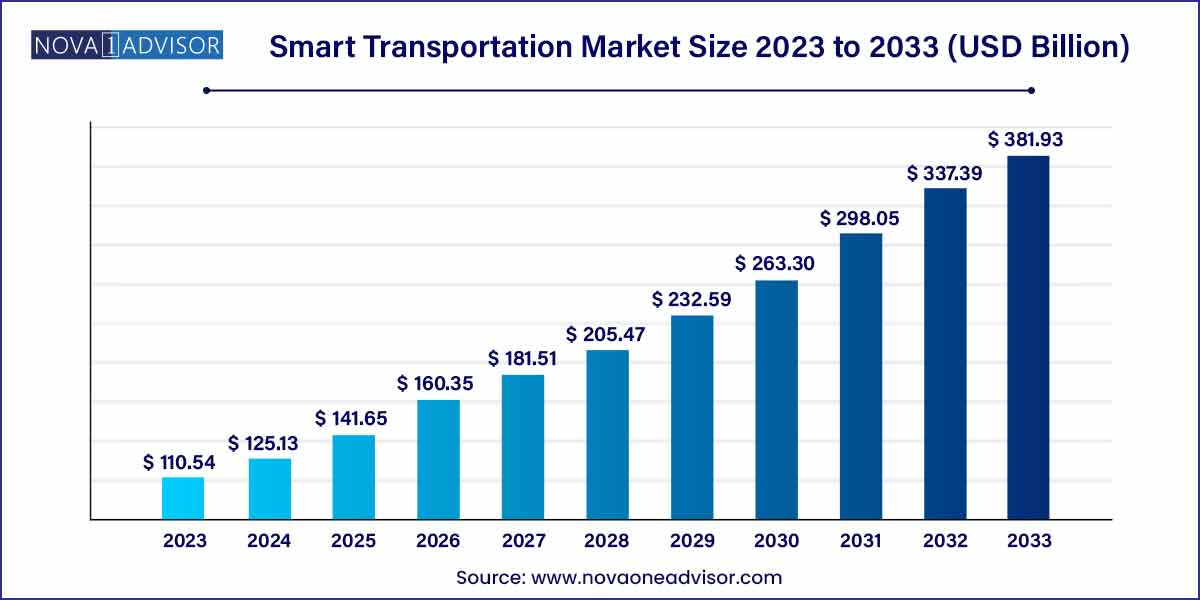

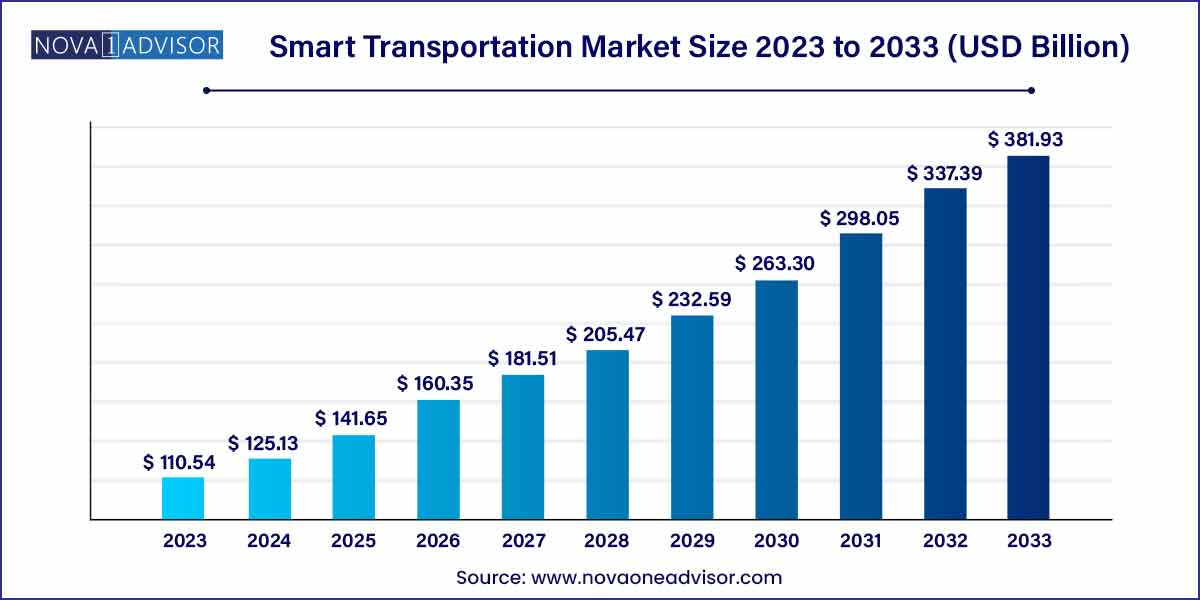

The global smart transportation market size was exhibited at USD 110.54 billion in 2023 and is projected to hit around USD 381.93 billion by 2033, growing at a CAGR of 13.2% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America accounted for over 34% of the global market share in 2023.

- The traffic management segment accounted for the largest market share of over 32% in 2023 and is projected to remain dominant throughout the forecast period.

- The cloud services segment accounted for the largest market share of over 43.0% in 2023.

Smart Transportation Market: Overview

The Smart Transportation Market represents the convergence of advanced information technologies, communication systems, and transportation infrastructure to create more efficient, safer, and sustainable mobility solutions. Smart transportation encompasses traffic management systems, parking solutions, integrated supervision systems, and connected ticketing systems, among others. It aims to optimize urban mobility, reduce congestion, improve fuel efficiency, and enhance commuter experience.

The ongoing urbanization, increasing vehicular congestion, and rising awareness about sustainable transportation are major factors propelling the demand for smart transportation solutions. Governments worldwide are heavily investing in smart city projects, encouraging the deployment of intelligent transportation systems (ITS). Moreover, the integration of emerging technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and Big Data analytics is enabling real-time monitoring, predictive maintenance, and automated decision-making within transportation ecosystems.

Leading market players, including Siemens AG, IBM Corporation, and Thales Group, are playing pivotal roles by providing end-to-end smart transportation solutions. With the rising popularity of Mobility-as-a-Service (MaaS) models and the expansion of electric vehicle (EV) ecosystems, smart transportation is poised for exponential growth across both developed and emerging economies.

Smart Transportation Market Growth

The growth of the smart transportation market is propelled by a convergence of factors that collectively shape its trajectory. One pivotal driver is the escalating demand for sustainable mobility solutions in response to environmental concerns and regulatory mandates. The integration of cutting-edge technologies such as IoT, AI, and electrification empowers transportation systems with unprecedented efficiency, safety, and convenience, driving widespread adoption. Additionally, rapid urbanization and population growth necessitate scalable transportation solutions, spurring investments in smart infrastructure and innovative transit options. Moreover, the emergence of data-driven decision-making enables stakeholders to optimize resource allocation, traffic management, and user experience, further fueling market expansion. As stakeholders navigate challenges such as interoperability, cybersecurity risks, and socioeconomic equity, strategic investments and collaborative partnerships unlock opportunities for market growth and innovation.

Smart Transportation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 110.54 Billion |

| Market Size by 2033 |

USD 381.93 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Service, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Accenture PLC; Alstom, SA; Cisco System, Inc.; Cubic Corporation; General Electric Company (GE); Indra Sistema S.A.; International Business Machines Corporation; Kapsch; LG CNS Corporation; Xerox Holdings Corporation. |

Smart Transportation Market Dynamics

The smart transportation market exhibits diverse segmentation, encompassing various segments such as intelligent transportation systems (ITS), connected vehicles, ride-sharing platforms, electric mobility solutions, and smart infrastructure. Each segment presents unique challenges and opportunities, driving innovation and competition among market players. The proliferation of interconnected technologies and services within these segments fosters a dynamic ecosystem where collaboration and interoperability are paramount.

Regulatory frameworks play a pivotal role in shaping the smart transportation market, as governments worldwide introduce policies and standards to address environmental concerns, safety requirements, and urban planning priorities. Regulations encompass a wide range of areas, including emissions standards, data privacy regulations, vehicle safety standards, and infrastructure investments. Compliance with these regulations not only ensures legal adherence but also drives innovation and market differentiation. Furthermore, regulatory initiatives such as incentives for electric vehicles, mandates for intelligent transportation systems, and public-private partnerships facilitate market growth by incentivizing investment and adoption of smart transportation solutions.

Smart Transportation Market Restraint

- Infrastructure Interoperability:

One of the foremost challenges hindering the advancement of smart transportation is the interoperability of infrastructure. Legacy systems, diverse communication protocols, and proprietary technologies create barriers to seamless connectivity and data exchange between various components of the transportation ecosystem. This lack of interoperability impedes the realization of the full potential of smart transportation solutions, limiting their scalability and effectiveness.

The increasing connectivity and digitization of transportation systems expose them to a myriad of cybersecurity threats, including data breaches, ransomware attacks, and system vulnerabilities. As smart transportation relies heavily on interconnected networks, sensors, and data platforms, the potential for cyberattacks targeting critical infrastructure, autonomous vehicles, and passenger information poses significant risks to safety, privacy, and operational continuity. Mitigating cybersecurity risks necessitates robust security measures, including encryption protocols, intrusion detection systems, and cybersecurity training for personnel.

Smart Transportation Market Opportunity

- Technological Convergence:

The convergence of emerging technologies such as 5G, edge computing, artificial intelligence (AI), and blockchain presents significant opportunities for innovation and growth within the smart transportation market. These technologies enable enhanced connectivity, real-time data processing, predictive analytics, and secure transactions, thereby unlocking new capabilities and functionalities for transportation systems. For example, the integration of 5G networks facilitates ultra-low latency communication, enabling seamless connectivity for autonomous vehicles, traffic management systems, and smart infrastructure.

- Global Urbanization and Mobility Trends:

The rapid urbanization and changing mobility preferences worldwide present lucrative opportunities for smart transportation solutions. As urban populations continue to grow, cities face mounting pressure to address transportation challenges such as congestion, pollution, and limited infrastructure capacity. Smart transportation technologies offer scalable and sustainable solutions to these challenges by optimizing traffic flow, promoting multimodal transit options, and reducing carbon emissions. Moreover, shifting consumer preferences towards shared mobility, electric vehicles, and on-demand transportation services create new market niches and revenue streams for innovative mobility providers.

Smart Transportation Market Challenges

- Infrastructure Interoperability:

A key challenge in the smart transportation market is the lack of interoperability among diverse infrastructure components and systems. Legacy infrastructure, disparate communication protocols, and proprietary technologies often hinder seamless connectivity and data exchange between different elements of the transportation ecosystem. This interoperability gap not only complicates integration efforts but also limits the scalability and effectiveness of smart transportation solutions.

The increasing connectivity and digitization of transportation systems expose them to a myriad of cybersecurity threats, including data breaches, ransomware attacks, and system vulnerabilities. Smart transportation systems rely heavily on interconnected networks, sensors, and data platforms, making them prime targets for cyberattacks aimed at disrupting operations, compromising passenger safety, and stealing sensitive information. Mitigating cybersecurity risks requires robust security measures, including encryption protocols, intrusion detection systems, and regular security audits.

Segments Insights:

Solution Insights

Traffic Management Systems dominated the smart transportation solution segment in 2024. Traffic management systems are crucial for optimizing traffic flow, reducing congestion, improving road safety, and enhancing commuter experience. Solutions like adaptive traffic signals, real-time traffic monitoring, and dynamic message signs have witnessed wide deployment across metropolitan cities globally. For instance, London’s real-time congestion management system significantly improved traffic movement during the 2023-2024 period, highlighting the effectiveness of smart traffic management initiatives.

Parking Management Systems are the fastest-growing segment. With urban centers facing an acute shortage of parking spaces, smart parking solutions that provide real-time availability information, automated guidance, and digital payment options are gaining rapid traction. In February 2024, San Francisco expanded its smart parking program using IoT sensors and dynamic pricing, reducing parking search times and improving revenue collection.

Service Insights

Cloud Services dominated the smart transportation service segment. Cloud services provide the scalability, flexibility, and centralized data management capabilities essential for real-time monitoring and analytics across smart transportation systems. Governments and private operators are increasingly relying on cloud platforms for data storage, predictive analytics, and remote operation of smart infrastructure. The ability to easily integrate multiple services and scale operations has positioned cloud solutions at the forefront of smart transportation services.

Professional Services are the fastest-growing service segment. The complexity of planning, deploying, and managing smart transportation ecosystems necessitates expert consultancy, system integration, training, and maintenance services. Professional services ensure the seamless integration of diverse technologies and help optimize operations. For example, in January 2024, IBM expanded its smart city consultancy services to support North American municipalities implementing smart mobility solutions, highlighting the surging demand for specialized professional services.

Regional Insights

Europe dominated the global smart transportation market in 2024. European countries have been pioneers in adopting intelligent transportation systems (ITS), driven by strong regulatory support, sustainability targets, and advanced technology adoption. Cities like Copenhagen, Amsterdam, and Helsinki are at the forefront of integrating smart mobility solutions, including smart traffic lights, congestion pricing, and integrated public transport systems. The European Union’s Green Deal and Urban Mobility Framework initiatives further strengthen Europe's leadership in smart transportation.

Asia-Pacific is the fastest-growing region. The rapid urbanization of cities in China, India, South Korea, and Southeast Asian countries is creating a strong demand for intelligent transportation solutions. Governments in the Asia-Pacific region are heavily investing in smart city projects. In April 2024, India’s Ministry of Urban Affairs announced an expansion of its Smart Cities Mission, including extensive investments in smart transportation infrastructure across 100+ cities. The region's large population base and expanding urban centers make it a fertile ground for market growth.

Some of the prominent players in the smart transportation market include:

- Accenture PLC

- Alstom, SA

- Cisco System, Inc.

- Cubic Corporation

- General Electric Company (GE)

- Indra Sistema S.A.

- International Business Machines Corporation

- Kapsch

- LG CNS Corporation

- Xerox Holdings Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global smart transportation market.

Smart Transportation Solution

- Ticketing Management System

- Parking Management System

- Integrated Supervision System

- Traffic Management System

Smart Transportation Service

- Cloud Services

- Business Services

- Professional Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)