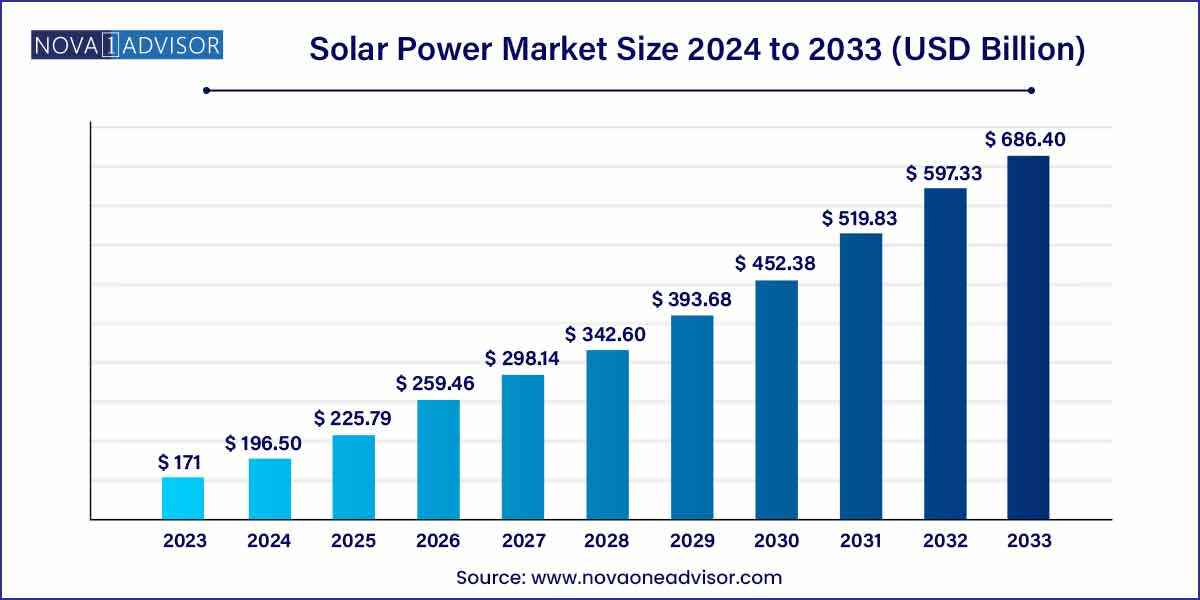

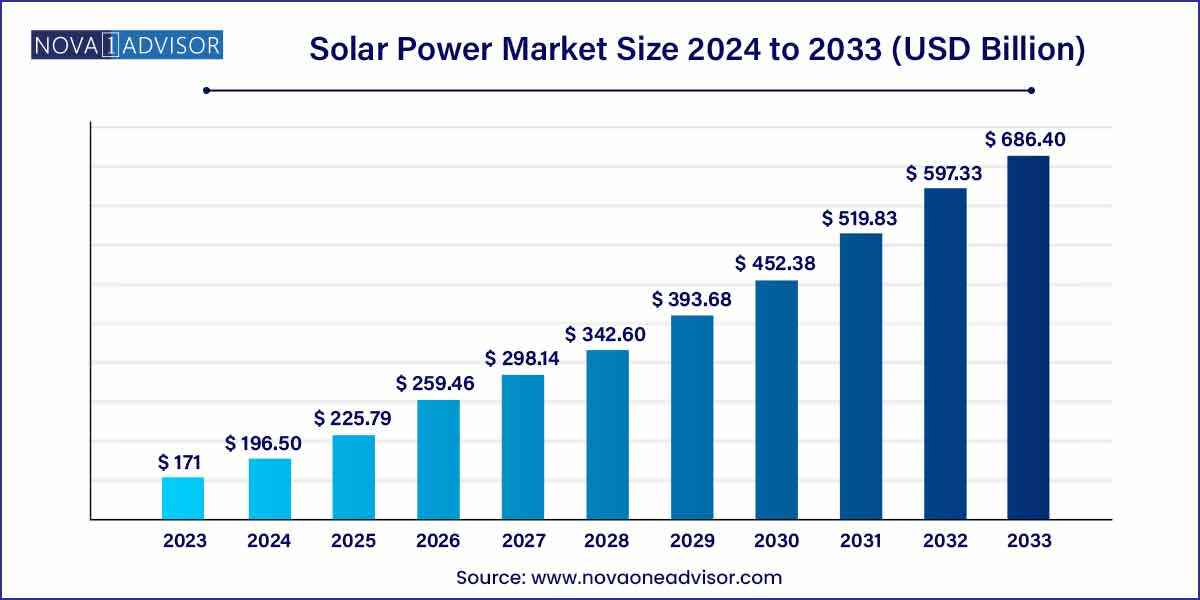

The global solar power market size was exhibited at USD 171.00 billion in 2023 and is projected to hit around USD 686.40 billion by 2033, growing at a CAGR of 14.91% during the forecast period of 2024 to 2033.

Key Takeaways:

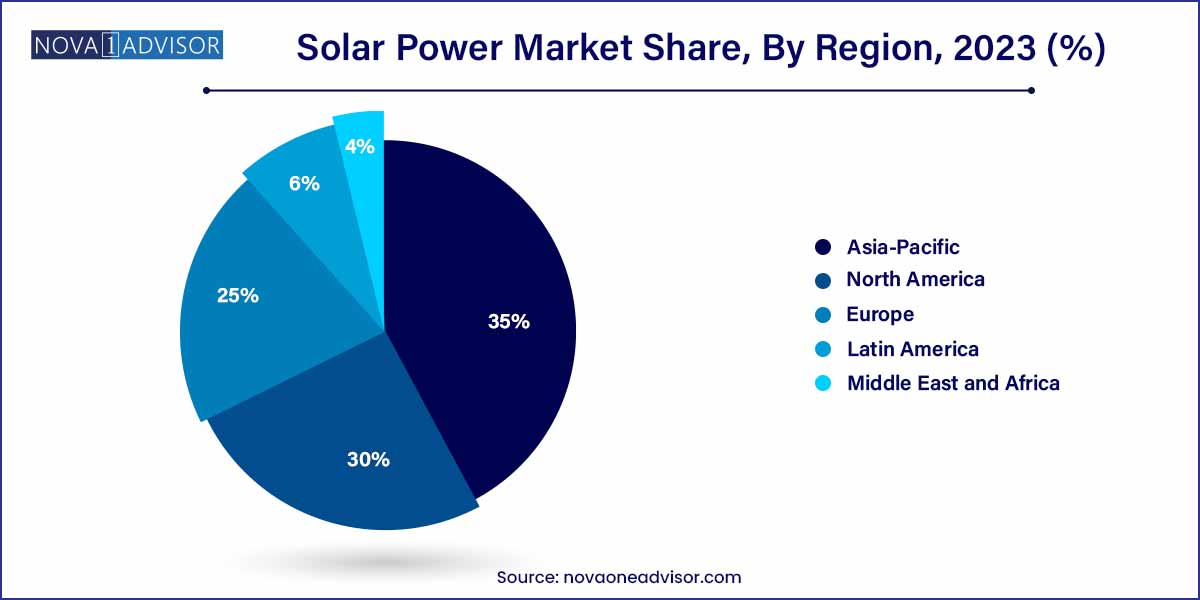

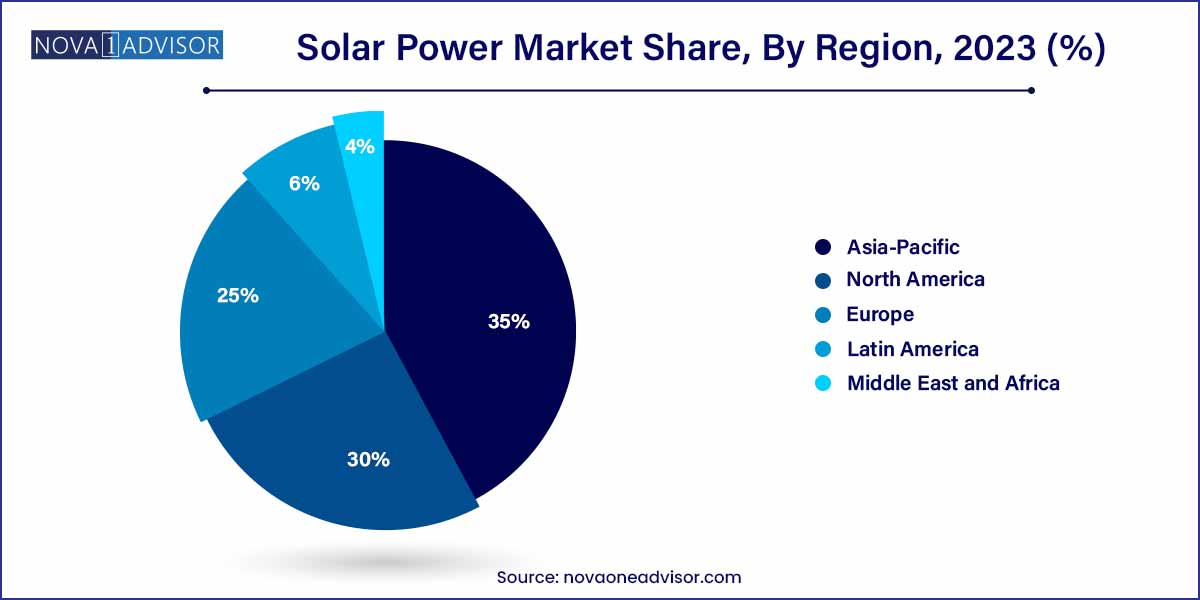

- Asia Pacific was the leading solar power market that garnered a market share of more than 35% in 2023.

- North America is estimated to grow at a considerable pace during the forecast period.

- Based on the technology, the Photovoltaic (PV) systems segment dominated the global solar power market, garnering a market share of around 71% in 2023.

- Based on application, industrial segment has generated a revenue share of more than 35% and dominated the global solar power market in 2023.

Solar Power Market: Overview

The solar power market is undergoing a transformative expansion, positioning itself at the forefront of the global renewable energy revolution. Solar energy, harvested from the sun’s radiation, is converted into electricity or thermal energy through various technologies, making it one of the cleanest, most abundant, and increasingly cost-competitive energy sources available today.

In 2024, the growing urgency to mitigate climate change, coupled with supportive government policies, technological advancements, and rapidly declining costs, has propelled the solar market to new heights. Solar power is now a critical pillar for achieving global net-zero emissions targets, with applications spanning residential, commercial, and industrial sectors. The integration of solar power with storage solutions, smart grids, and electric mobility is further accelerating its adoption across diverse energy landscapes.

Countries around the world are scaling up investments in utility-scale solar projects, rooftop installations, and off-grid solar solutions to address energy access challenges, reduce fossil fuel dependence, and foster sustainable economic growth. The surging demand for decentralized energy systems and the widespread electrification of transportation are opening new opportunities for solar technologies across multiple dimensions.

Growth Factors

Solar energy is the radiant energy emitted from the sun, which is exercised by using numerous technologies similar as photovoltaic cells, solar heating, and others. It's an effective form of unconventional energy and an accessible renewable solution toward growing greenhouse emigrations and global warming. The growth of the solar energy market is majorly driven by rise governmental provision of impulses & duty rebates to install solar panels and environmental pollution. In addition, drop in footprint of water is associated with solar energy systems has propelled their demand in power generation sectors. The solar cells demand has gained huge traction due to rise in rooftop installations, which is further followed by rise in operations in the sector of architecture. Likewise, the demand for solar power halls and parabolic troughs in the generation of electricity is anticipated to propel the concentrated solar power systems demand in the market. One of the prominent factors contributing towards the growth of the global solar power market is the growing prices of fossil fuels. The growing environmental concerns regarding greenhouse gases and carbon emissions. In addition, the growing government initiatives and favorable policies in order to curb the adverse effects of the toxic gases emissions is driving the growth of the global solar power market during the forecast period.

The solar energy market growth is driven by rise provision of government incentives and tax rebates in order to install solar panels and growing environmental pollution. Furthermore, decrease in footprint of water associated with systems of solar energy has driven their demand in the sectors of power generation. The solar cells demand has gained huge traction due to rise in rooftop installations, which is further followed by rise in architectural sector applications. In addition, the demand for solar power towers and parabolic troughs in the generation of electricity is expected to propel the demand for concentrated solar power systems.

Solar Power Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 171.00 Billion |

| Market Size by 2033 |

USD 686.40 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.91% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Application, End User, Solar Module, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abengoa Se, Acciona S.A., Canadian solar, Inc., Esolar, Inc., United renewable energy co. Ltd., Sunpower corporation, Kaneka corporation, Tata power solar systems ltd., Wuxi suntech power co., ltd., Brightsource energy, Inc. |

Driver: Rapid Decline in Solar Technology Costs

The dominant driver fueling the solar power market is the rapid decline in solar technology costs over the past decade. Innovations in manufacturing processes, economies of scale, and advancements in materials science have driven down the cost of photovoltaic (PV) modules, inverters, and balance-of-system components.

According to the International Renewable Energy Agency (IRENA), the global weighted-average cost of electricity from solar PV has fallen by nearly 85% between 2010 and 2023. This dramatic cost reduction has made solar competitive with, or even cheaper than, fossil fuels in many regions, even without subsidies. As a result, solar power has become the go-to technology for countries, corporations, and consumers seeking clean, affordable, and scalable energy solutions.

Restraint: Intermittency and Energy Storage Challenges

One major restraint for the solar power market is the intermittency of solar energy generation and the associated challenges of energy storage. Solar output is inherently variable, dependent on weather conditions and diurnal cycles, leading to fluctuations that can impact grid stability.

Without adequate energy storage or grid integration solutions, high solar penetration can cause curtailment and reliability issues. Although battery storage costs are declining, large-scale deployments remain capital-intensive. Furthermore, energy storage technologies are still evolving, and their integration with solar systems requires careful planning and investment. Addressing these challenges through robust storage infrastructure and flexible grid management will be critical for sustained solar market growth.

Opportunity: Growth of Solar-Powered Green Hydrogen Production

An exciting opportunity within the solar power sector is the growth of solar-powered green hydrogen production. Green hydrogen, produced through electrolysis powered by renewable energy, is emerging as a key enabler of deep decarbonization across hard-to-abate sectors like heavy industry and long-haul transportation.

Solar energy's falling costs make it an ideal candidate to power electrolysis processes. Projects like Saudi Arabia’s "NEOM" and Australia’s "Asian Renewable Energy Hub" are pioneering large-scale solar-to-hydrogen initiatives. As countries commit to hydrogen strategies, integrating solar power into hydrogen production offers vast potential for market expansion, cross-sectoral integration, and new business models.

Segments Insights

Technology Insights

Photovoltaic (PV) systems dominated the technology segment, owing to their widespread adoption, technological maturity, and continuous innovation. Among PV systems, monocrystalline silicon (Mono-Si) solar cells are particularly prevalent due to their high efficiency, longevity, and decreasing manufacturing costs. Mono-Si panels are now widely deployed in residential rooftops, commercial facilities, and utility-scale projects worldwide.

Concentrated Solar Power (CSP) systems are the fastest-growing segment, particularly in sunny, high-irradiance regions like the Middle East and North Africa (MENA). CSP technologies, such as parabolic troughs and solar power towers, offer the advantage of integrated thermal energy storage, enabling electricity generation even after sunset. Recent developments in molten salt storage and hybrid CSP-PV plants are enhancing the viability and competitiveness of CSP projects.

Application Insights

Residential applications dominated the solar power market, capturing the largest share in 2024. The proliferation of rooftop solar installations, driven by declining panel prices, net metering policies, and rising electricity costs, has fueled residential adoption. Homeowners are increasingly investing in solar-plus-storage solutions to enhance energy independence, reduce bills, and contribute to sustainability goals. Notably, residential solar markets are thriving in the United States, Australia, Germany, and Japan, where supportive incentive schemes, financing options, and digital platforms facilitate easy adoption.

Commercial applications are the fastest-growing application segment, propelled by businesses seeking to lower operational costs, achieve ESG (Environmental, Social, and Governance) targets, and hedge against energy price volatility. Warehouses, office complexes, shopping malls, and universities are investing in on-site solar systems, often coupled with storage and energy management platforms. The trend toward corporate power purchase agreements (PPAs) and green branding further amplifies commercial sector growth. Companies like Amazon, Apple, and Walmart are leading examples of large-scale commercial solar investments.

Region Insights

Asia-Pacific dominated the solar power market, holding the largest share in 2024. China leads global solar PV deployment, accounting for over one-third of the world’s installed capacity, driven by ambitious renewable energy targets, state incentives, and technological leadership. India’s "National Solar Mission," Australia’s rooftop solar boom, and Southeast Asia's emerging markets further reinforce Asia-Pacific's leadership. Manufacturing prowess, supportive policies, and expanding domestic markets make the region a powerhouse for solar growth.

Middle East and Africa (MEA) is the fastest-growing regional market, fueled by abundant solar resources, energy diversification efforts, and mega-projects. Saudi Arabia's "Vision 2030," UAE's "Energy Strategy 2050," and Egypt's Benban Solar Park exemplify the region's commitment to scaling up solar capacity. In Africa, decentralized solar systems are revolutionizing energy access, with mini-grids and pay-as-you-go models empowering off-grid communities. Growing investment, international collaborations, and innovation position MEA as a dynamic frontier for solar market expansion.

Key Market Developments

-

April 2025: First Solar, Inc. announced a $1.5 billion investment to build a new manufacturing facility in India, supporting domestic and export demand.

-

March 2025: LONGi Green Energy Technology Co., Ltd. unveiled its "Hi-MO 8" high-efficiency monocrystalline module series, targeting utility-scale projects.

-

February 2025: NextEra Energy Resources commissioned a 400 MW solar-plus-storage project in Texas, enhancing grid reliability with renewable energy.

-

January 2025: Trina Solar Limited launched its "Agri-PV" integrated solutions, promoting dual land use and sustainable agriculture practices.

-

December 2024: SunPower Corporation introduced its new residential storage system "SunVault 2.0," enhancing solar self-consumption and backup capabilities.

Some of the prominent players in the solar power market include:

- Abengoa Se

- Acciona S.A.

- Canadian solar, Inc.

- Esolar, Inc.

- United renewable energy co. Ltd.

- Sunpower corporation

- Kaneka corporation

- Tata power solar systems ltd.

- Wuxi suntech power co., ltd.

- Brightsource energy, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global solar power market.

By Application

- Residential

- Commercial

- Industrial

By Technology

-

- Moni-Si

- Thin Film

- Multi-Si

- Others

- Concentrated Solar Power Systems

-

- Parabolic trough

- Solar power tower

- Fresnel reflectors

- Dish Stirling

By End Use

- Electricity Generation

- Lighting

- Heating

- Charging

By Solar Module

- Monocrystalline

- Polycrystalline

- Cadmium Telluride

- Amorphous Silicon Cells

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)