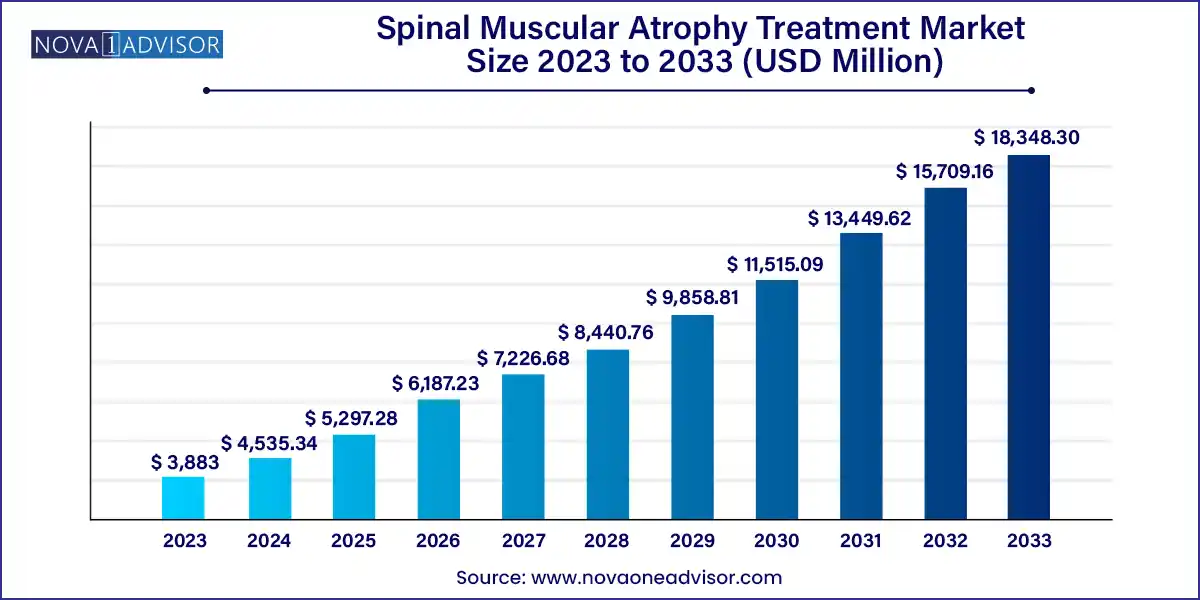

The global spinal muscular atrophy treatment market size was exhibited at USD 3,883.00 million in 2023 and is projected to hit around USD 18,348.30 million by 2033, growing at a CAGR of 16.8% during the forecast period of 2024 to 2033.

Key Takeaways:

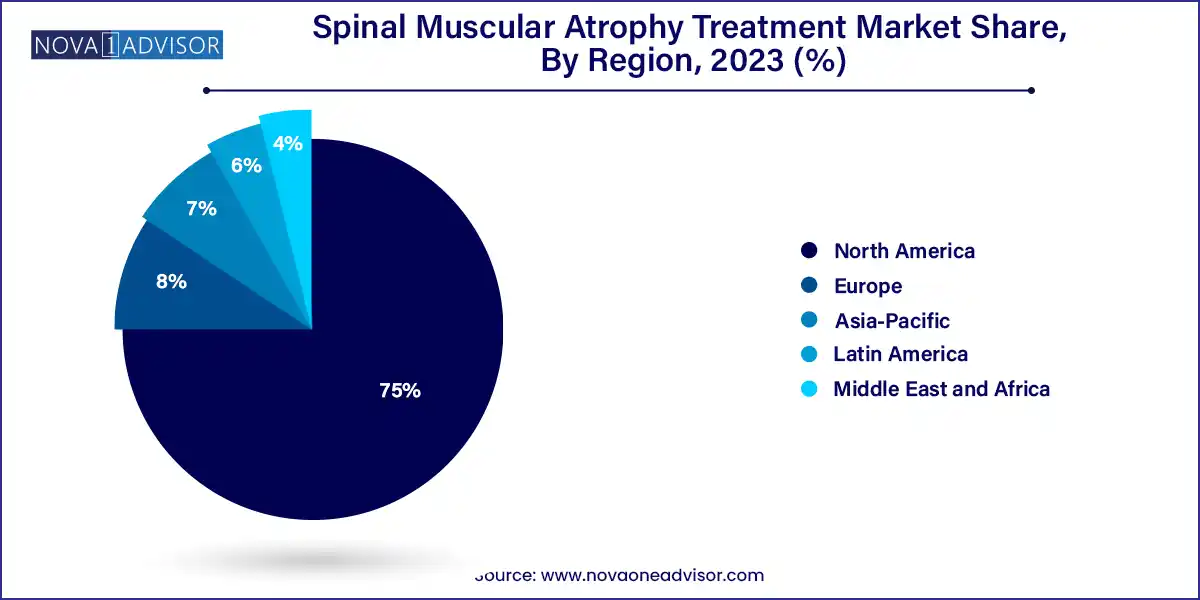

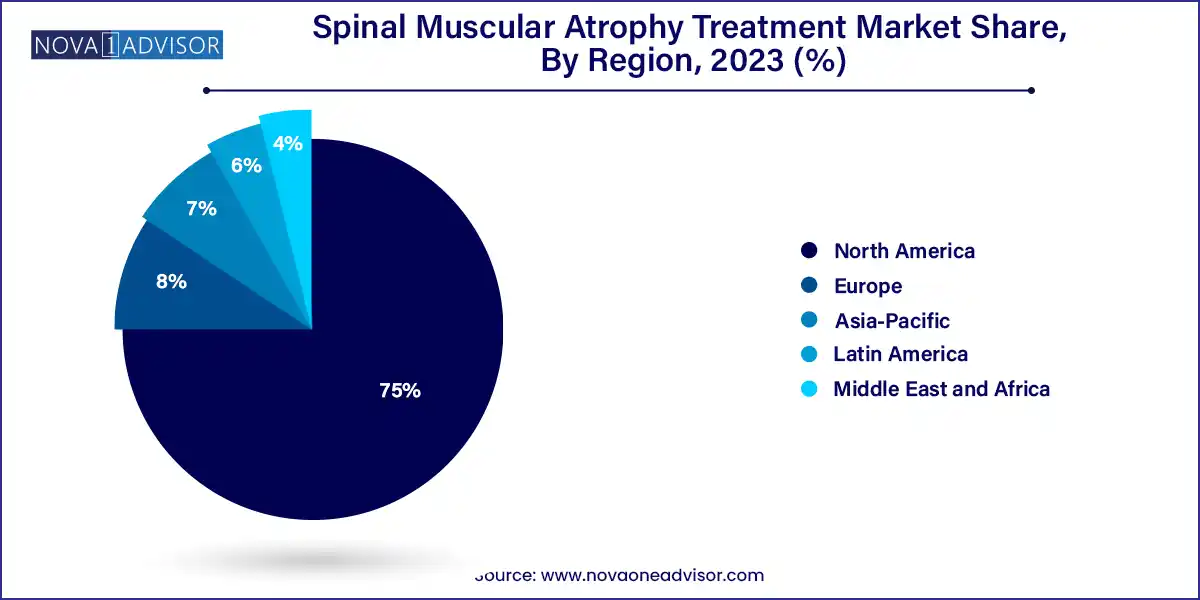

- North America dominated the market and accounted for revenue share of 75.0% in 2023.

- The type1 segment dominated the market and accounted for the largest revenue share of 63.1% in 2023 owing to the high prevalence rate.

- The drug segment dominated the market and accounted for the largest revenue share of 75.9% in 2023.

- The Spinraza segment dominated the market and accounted for the largest revenue share of 50.0% in 2023.

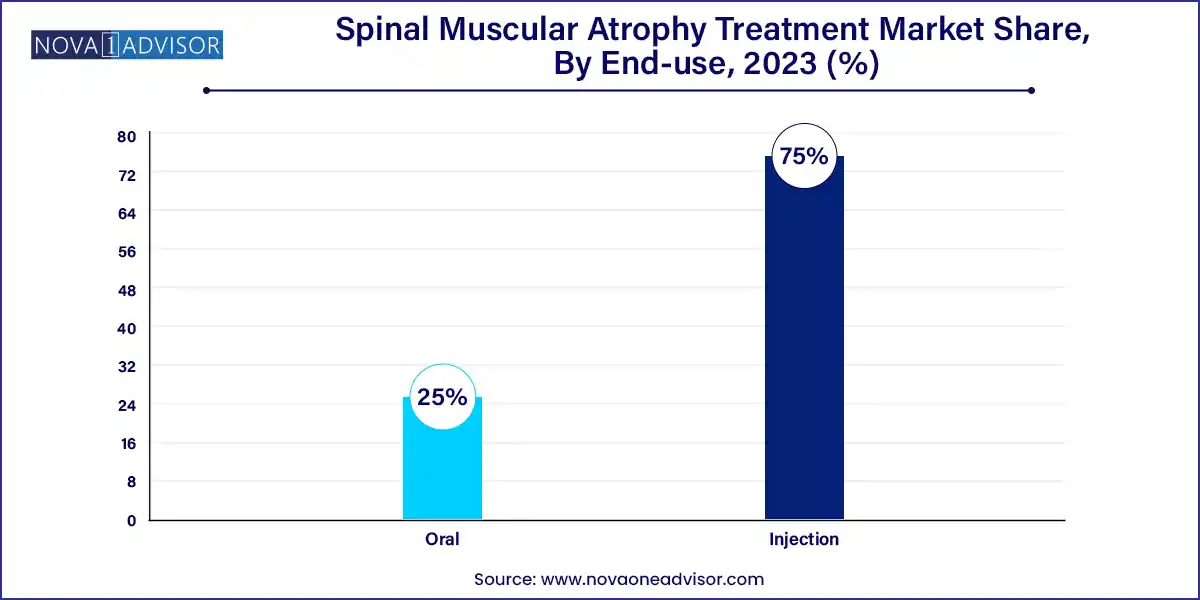

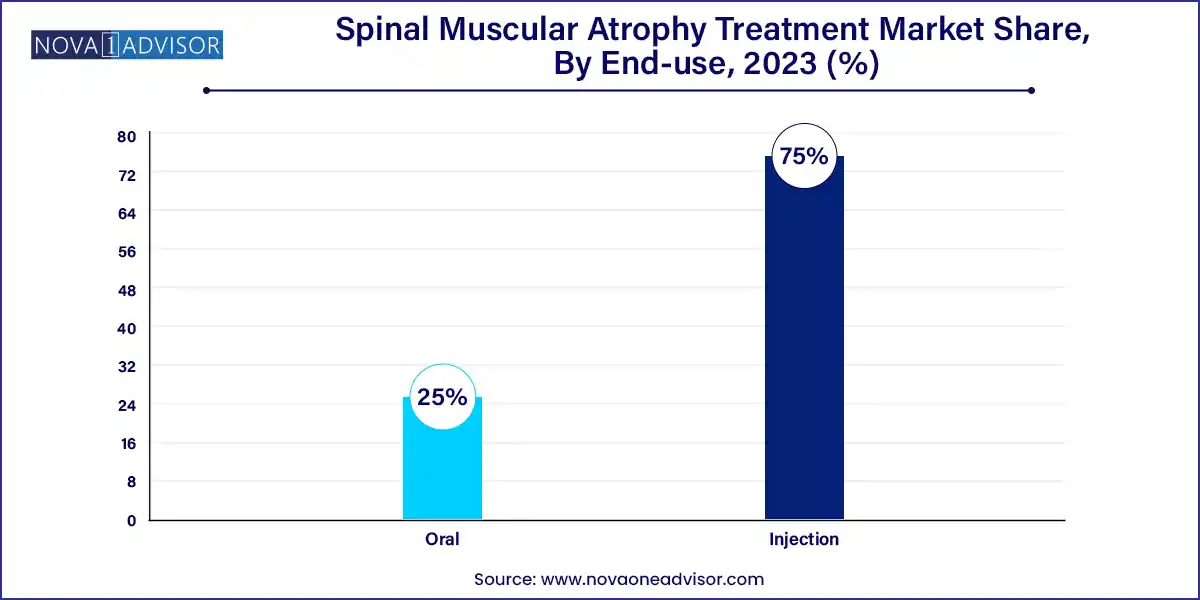

- The injectable segment dominated the market and accounted for the largest revenue share of 75.0% in 2023.

Market Overview

Spinal Muscular Atrophy (SMA) is a rare genetic disorder characterized by progressive muscle wasting and weakness due to the loss of motor neurons in the spinal cord. It is primarily caused by mutations in the SMN1 gene, which leads to a deficiency in survival motor neuron (SMN) protein. SMA has four primary types (Types 1 through 4), categorized by the age of onset and severity of symptoms, with Type 1 being the most severe and Type 4 the mildest.

Over the last decade, the SMA treatment landscape has experienced a seismic shift with the advent of gene therapies, antisense oligonucleotides, and small-molecule drugs. Once considered untreatable, SMA is now managed through disease-modifying therapies that either replace the missing gene, enhance SMN protein production, or compensate for its deficiency.

The market is fueled by increasing disease awareness, improved diagnostic techniques (including newborn screening), and massive pharmaceutical investment in rare disease R&D. However, the ultra-high cost of therapies and unequal access across regions pose challenges to sustainable market expansion.

Major Trends in the Market

-

Widespread Newborn Screening Programs: Early detection enables pre-symptomatic treatment, significantly improving outcomes.

-

Emergence of Oral Therapies: Convenience and long-term maintenance benefits are increasing adoption of drugs like Evrysdi.

-

High Pricing and Reimbursement Debates: Zolgensma, priced at over $2 million per dose, has reignited discussions on gene therapy affordability.

-

Patient-Centric Outcomes: Therapies are being evaluated for quality of life metrics alongside motor milestone improvements.

-

Rise of Combination Approaches: Research is exploring use of gene therapy followed by maintenance treatment with SMN-enhancing drugs.

-

Expansion into Adult SMA Types: Focus shifting beyond infants to long-term disease management for Type 2, 3, and 4 patients.

-

Geographic Access Gaps: Significant disparities in access between high-income and low-income countries.

-

Pipeline Expansion: Novel gene therapies (next-gen AAVs), RNA modulators, and muscle-targeting agents are under investigation.

Spinal Muscular Atrophy Treatment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4,535.34 Million |

| Market Size by 2033 |

USD 18,348.30 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 16.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Treatment, Drug, Route Of Administration, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Biogen; Novartis AG; Ionis Pharmaceuticals Inc.; Biohaven Pharmaceuticals; F. Hoffmann-La Roche Ltd; Cytokinetics; Scholar Rock, Inc.; PTC Therapeutics; NMD Pharma A/S |

A major driver for this market is the unprecedented efficacy of approved treatments such as Spinraza (Biogen), Zolgensma (Novartis), and Evrysdi (Roche). These therapies are not only life-extending but also life-enhancing, particularly when administered early. They target the underlying cause SMN protein deficiency rather than merely managing symptoms.

Spinraza, the first FDA-approved SMA drug, set a new benchmark in 2016, followed by the one-time gene therapy Zolgensma, which delivered functional SMN1 genes via viral vectors. Roche’s Evrysdi added a convenient oral option to the treatment mix in 2020, enabling chronic administration without hospital visits.

This therapeutic revolution has fundamentally shifted the clinical outlook for SMA, transforming it from a lethal disease into a manageable chronic condition in many cases.

Market Restraint: Ultra-High Therapy Costs and Reimbursement Challenges

A persistent restraint is the extraordinary cost of SMA therapies, which severely limits accessibility in many parts of the world. Zolgensma is among the most expensive drugs ever approved, priced at over $2.1 million per dose. Spinraza therapy can cost $750,000 in the first year and $375,000 annually thereafter.

Despite these costs being justified by single-dose administration or lifelong benefits, payers face challenges in managing upfront expenditure. In low-income and middle-income countries, even partial reimbursement is often unavailable, leading to reliance on patient advocacy groups, charitable funds, and compassionate access programs.

Until sustainable pricing models or public-private funding mechanisms are adopted globally, market penetration will remain constrained in many regions.

Market Opportunity: Expansion of Early Diagnosis and Pre-Symptomatic Intervention

The opportunity for early-stage intervention in newly diagnosed infants is a game-changer. Clinical evidence shows that administering treatment before symptom onset particularly for gene therapies can result in near-normal motor development.

To capitalize on this, governments and healthcare systems are integrating SMA into national newborn screening programs. Countries such as the U.S., Germany, and Australia have already mandated SMA screening at birth.

Pharma companies are collaborating with diagnostic providers and regulatory bodies to promote universal SMA testing, opening doors for early adoption of therapies and broader market growth.

Segments Insights:

By Type Insights

Type 1 SMA dominates the treatment market, as it represents the most severe and early-onset form. Without treatment, children with Type 1 typically do not survive beyond two years. These patients are the primary target population for Zolgensma and Spinraza, both of which have shown dramatic improvements in survival and motor function.

Type 2 and Type 3 are the fastest-growing segments, particularly in the context of long-term disease management. These patients live longer but experience progressive muscle weakness, scoliosis, and respiratory issues. The focus here is shifting toward oral therapies like Evrysdi that are easier to administer over the long term and support stable maintenance or slow progression.

By Treatment Insights

Drug therapy leads the market, with Biogen’s Spinraza and Roche’s Evrysdi commanding significant market share due to their widespread availability, established reimbursement pathways, and long-term efficacy data.

Gene therapy, however, is the fastest-growing treatment modality, with Zolgensma at the forefront. Its single-dose delivery and curative potential have made it a preferred option for newly diagnosed infants. Ongoing trials are now assessing its utility in older age groups and in combination with other therapies.

By Drug Insights

Spinraza maintains dominance, thanks to its first-mover advantage, robust clinical evidence, and long-term safety profile. It is used across all SMA types and age groups, making it highly versatile.

Zolgensma is the fastest-growing product, fueled by its curative potential, high-profile regulatory approvals (including in Japan, Brazil, and Canada), and robust advocacy from patient groups. Its real-world performance continues to be monitored in long-term extension studies.

Evrysdi is expanding rapidly due to its ease of administration and suitability for both pediatric and adult populations. It also offers a more scalable and accessible treatment alternative in healthcare systems lacking infrastructure for injections or gene therapy infusion.

By Route Of Administration Insights

Injection remains the primary mode, particularly for gene therapy and intrathecal delivery of Spinraza. Hospitals with pediatric neurology units continue to dominate this segment, though administration logistics and costs are high.

Oral delivery is the most rapidly adopted format, especially in outpatient settings and in older children or adults. The success of Evrysdi is demonstrating that long-term disease management with oral small molecules is both practical and clinically effective.

By Regional Insights

North America dominates the global SMA treatment market, owing to early adoption of gene therapy, high reimbursement capabilities, and strong patient advocacy networks. The U.S. has also pioneered newborn screening for SMA and approved all three major drugs. Moreover, pharmaceutical headquarters, including those of Biogen and Novartis, are based in North America, providing direct access to innovation.

Asia-Pacific is the fastest-growing region, driven by increasing diagnostic rates, improved healthcare access, and regulatory support for orphan drug approval in countries like Japan, South Korea, and China. Despite pricing constraints, domestic biosimilar development and strategic licensing partnerships are helping these markets expand access to life-saving SMA treatments.

Some of the prominent players in the Spinal muscular atrophy treatment market include:

- Biogen

- Novartis AG

- Ionis Pharmaceuticals Inc.

- Biohaven Pharmaceuticals

- F. Hoffmann-La Roche Ltd

- Cytokinetics

- Scholar Rock, Inc.

- PTC Therapeutics

- NMD PHARMA A/S

Recent Developments (As of April 2025)

-

Biogen (March 2025): Published long-term extension data for Spinraza showing sustained motor function preservation in Type 2 and 3 patients over 5 years.

-

Novartis (February 2025): Received conditional approval in India for Zolgensma under the government’s rare disease framework for compassionate pricing.

-

Roche (January 2025): Launched an Evrysdi Starter Pack for pre-symptomatic infants diagnosed via newborn screening in Europe.

-

PTC Therapeutics (March 2025): Advanced their next-generation SMN2 splicing modulator into Phase II trials, aiming for once-weekly dosing in older patients.

-

Cure SMA & Biopharma Consortium (April 2025): Announced a global patient registry and data-sharing platform to track long-term outcomes of SMA treatment worldwide.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global spinal muscular atrophy treatment market.

Type

- Type 1

- Type 2

- Type 3

- Type 4

Treatment

Drug

- Spinraza

- Zolgensma (AVXS-101)

- Evrysdi

- Others

Route of Administration

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)