Spine Biologics Market Size and Trends 2026 to 2035

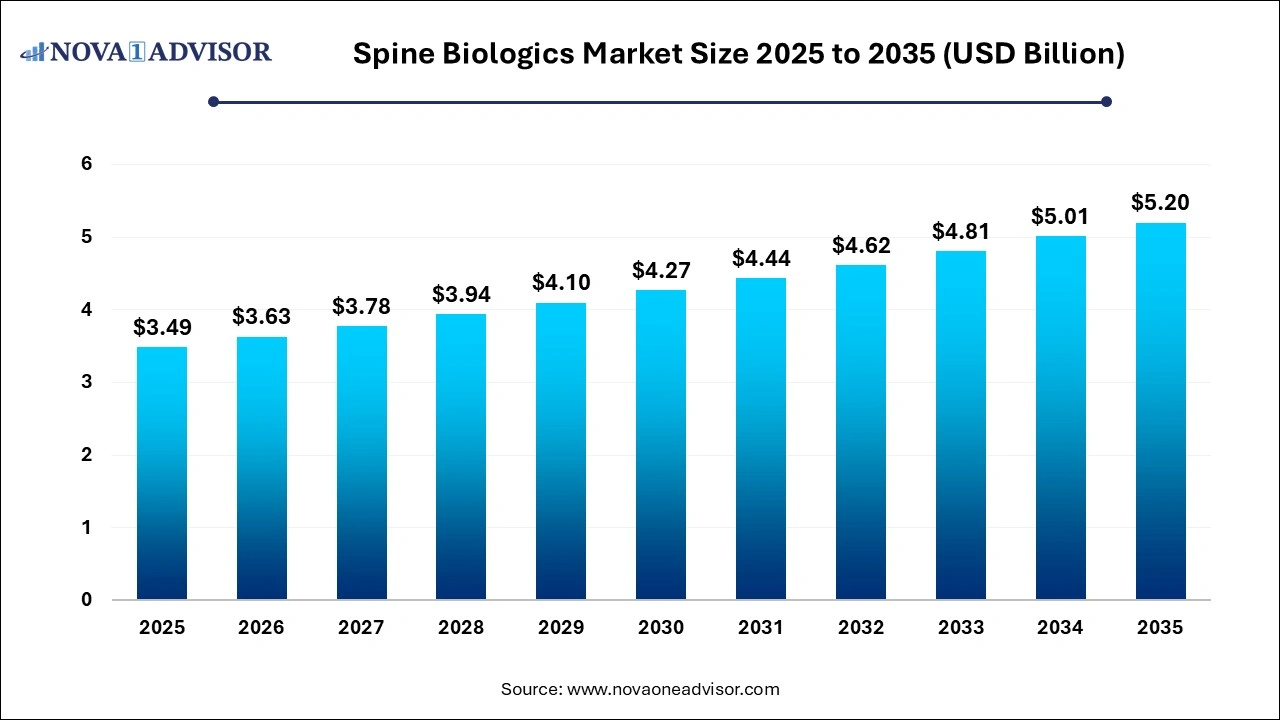

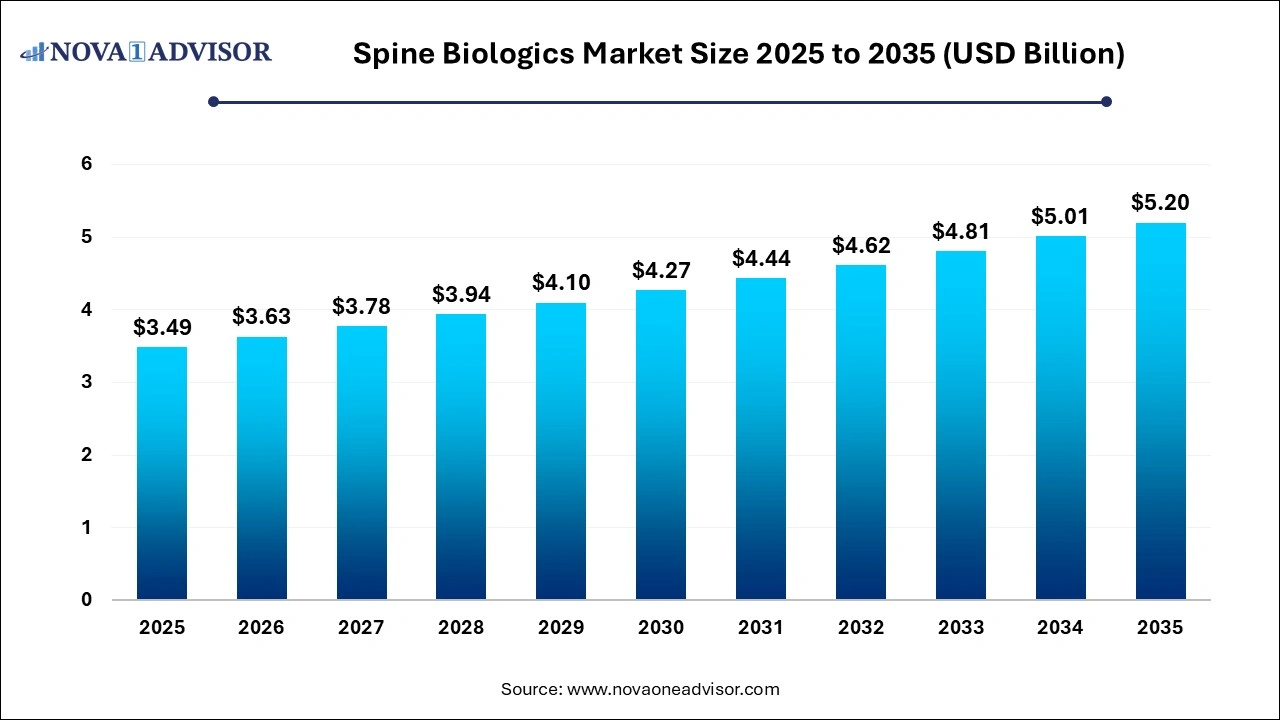

The spine biologics market size was exhibited at USD 3.49 billion in 2025 and is projected to hit around USD 5.20 billion by 2035, growing at a CAGR of 4.07% during the forecast period 2026 to 2035. The growth of the spine biologics market can be linked to the rising cases of spinal disorders across the globe, increased emphasis on regenerative medicine and improving healthcare infrastructure.

Spine Biologics Market Key Takeaways:

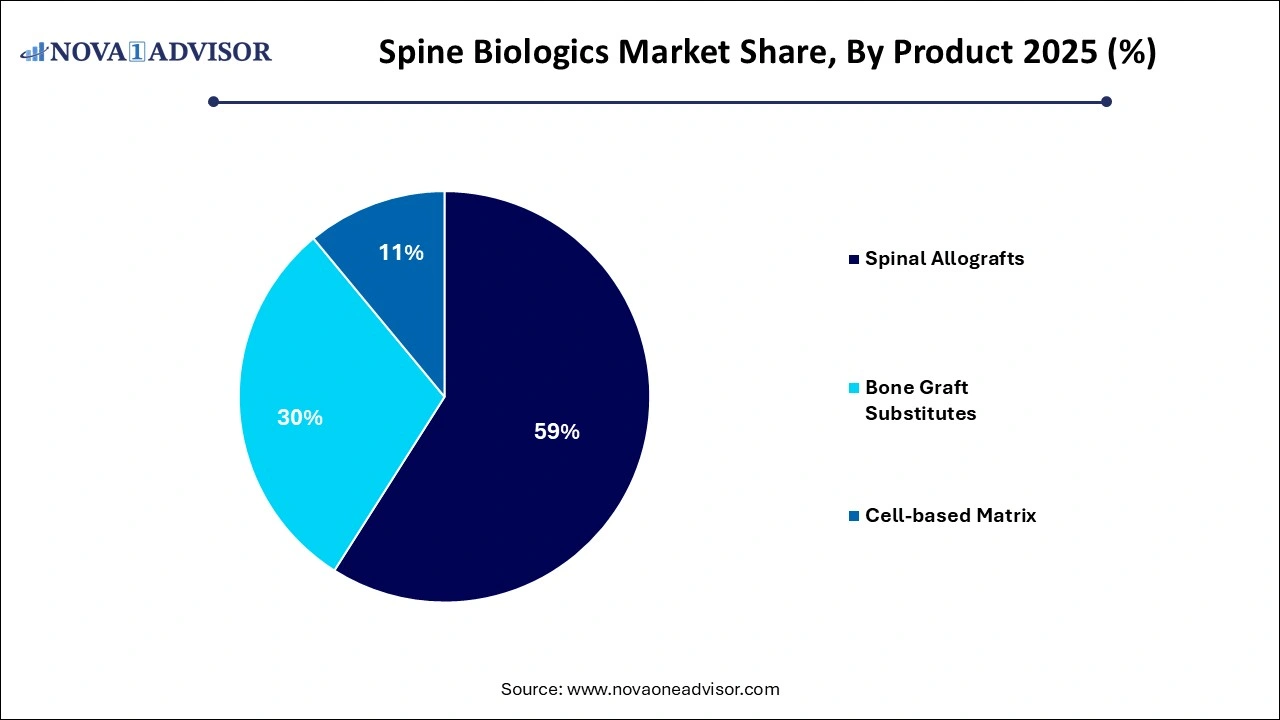

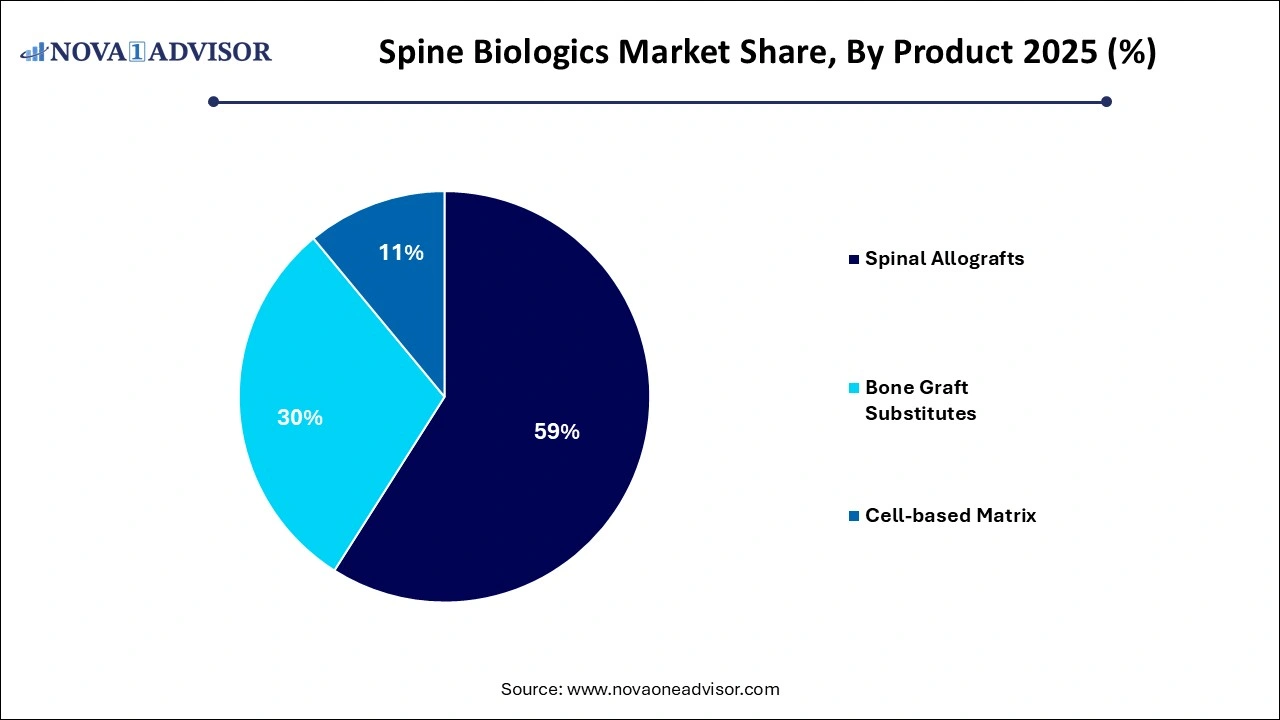

- The spinal allografts segment dominated the market, with a revenue share of 59% in 2025.

- The cell-based matrix is projected to witness the fastest CAGR of 7.0% over the forecast period

- The anterior cervical discectomy and fusion (ACDF) segment dominated the market with the largest revenue share of 25.9% in 2025.

- The transforaminal lumbar interbody fusion (TLIF) segment is projected to grow at a CAGR of 6.2% over the forecast period.

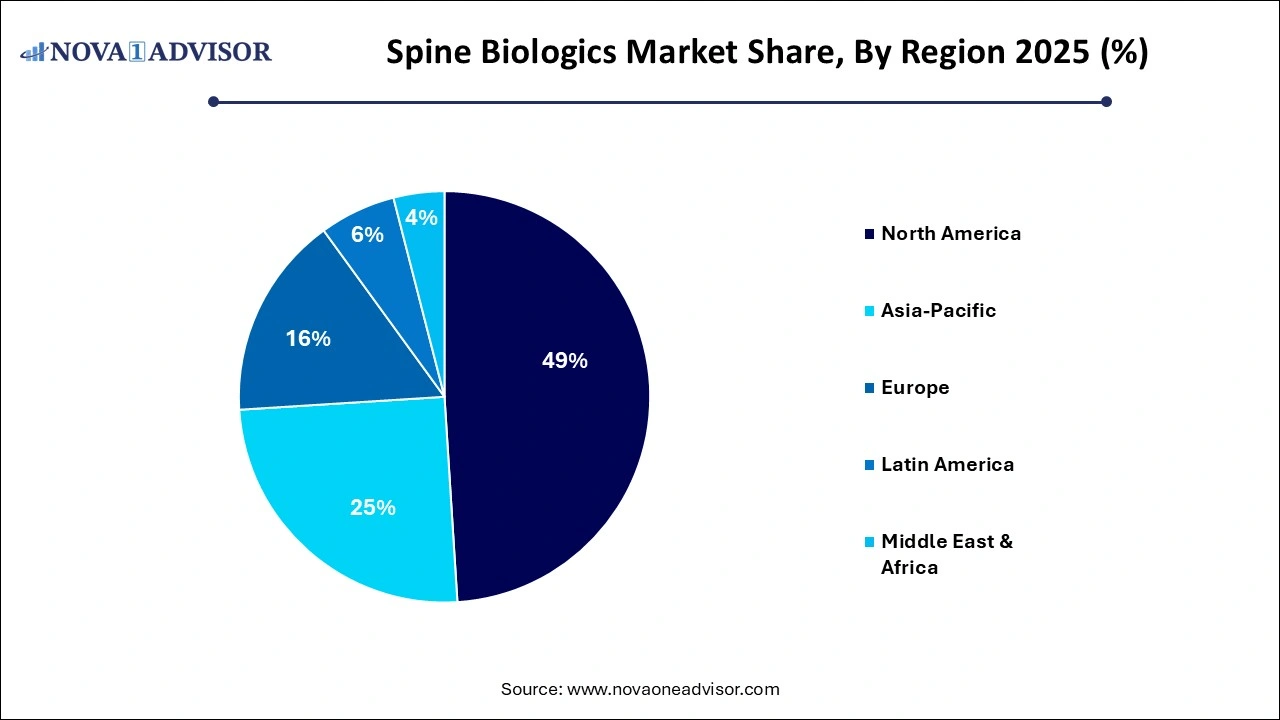

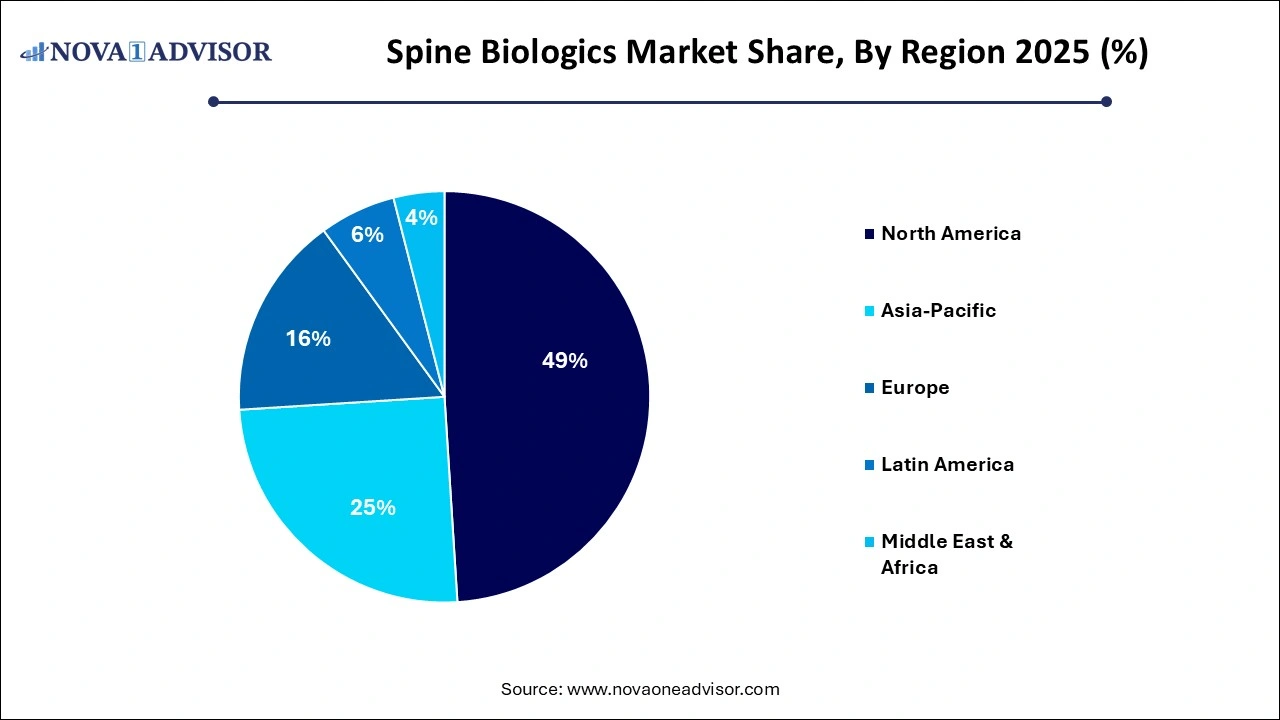

- North America spine biologics market dominated the global market with a revenue share of 49% in 2025.

Spine Biologics Market Overview

The spine biologics market is an integral part of the orthopedic and regenerative medicine industries, focusing on biological substances that facilitate spinal fusion and bone healing. These biologics ranging from demineralized bone matrices and synthetic grafts to bone morphogenetic proteins (BMPs) and cell-based matrices—play a pivotal role in spinal surgeries, especially those involving degenerative disc disease, deformities, trauma, and spinal tumors. The goal is to stimulate natural bone regeneration, enhance structural stability, and reduce recovery time.

Rising incidences of spinal disorders due to an aging population, sedentary lifestyles, and traumatic injuries are fueling the demand for spine biologics. Surgical interventions such as spinal fusion, which aim to relieve pain and restore mobility, are increasingly relying on advanced biologic products to improve surgical outcomes. Additionally, the growing preference for minimally invasive spinal procedures has amplified the use of biologics that are easy to deliver and integrate within the surgical field.

The development of spine biologics is driven by advancements in biotechnology, molecular biology, and material science. Innovative products are being engineered to mimic the osteoconductive, osteoinductive, and osteogenic properties of natural bone, thus improving spinal fusion rates. Clinical trials continue to explore new applications of stem cell-based therapies and genetically engineered proteins in orthopedic spine care.

Spine biologics are being widely adopted across hospitals, ambulatory surgery centers, and outpatient orthopedic clinics. Reimbursement policy improvements, technological innovation, and rising awareness among both surgeons and patients are enhancing market penetration. However, challenges such as high product costs, regulatory barriers, and variability in efficacy remain areas of concern.

Major Trends in the Spine Biologics Market

-

Shift Toward Minimally Invasive Spine Surgeries (MISS): Spine biologics compatible with MISS techniques are in high demand due to faster recovery and reduced complications.

-

Increased Use of Cell-based Therapies: Stem cells derived matrices and autologous biologics are gaining traction as regenerative solutions.

-

Surge in Demand for Synthetic Grafts: With concerns over disease transmission from allografts, synthetic bone grafts are witnessing increased adoption.

-

R&D in Bone Morphogenetic Proteins (BMPs): New-generation BMPs with controlled release and improved safety profiles are under development.

-

Customizable Biologics Through 3D Bioprinting: Emerging technologies are being explored to produce patient-specific graft materials with superior osteoconductivity.

-

Growing Interest in Nanotechnology: Nanomaterials are enhancing surface interactions to stimulate bone cell proliferation and integration.

-

Emphasis on Outpatient Spine Procedures: Healthcare providers are transitioning to cost-effective outpatient settings for spinal interventions, driving biologics demand.

-

Strategic M&A Activity: Consolidation among manufacturers and distributors is expanding product portfolios and global reach.

Report Scope of Spine Biologics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.63 Billion |

| Market Size by 2035 |

USD 5.20 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 4.07% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Product, By Surgery, By End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Stryker; NuVasive, Inc.; Orthofix; DePuy Synthes (Johnson & Johnson); Exactech, Inc.; Zimmer Biomet; Arthrex, Inc.; Medtronic; Organogenesis Inc.; Kuros Biosciences. |

Spine Biologics Market Dynamics

Driver

Rising Incidence of Degenerative Disc Diseases and Age-related Spine Conditions

The primary driver of the spine biologics market is the rising prevalence of degenerative disc diseases (DDD), spinal stenosis, and other age-associated spinal disorders. With life expectancy increasing globally, the incidence of spine-related issues such as herniated discs, spondylolisthesis, and osteoarthritis is growing significantly. These conditions often lead to chronic pain, disability, and reduced quality of life, necessitating surgical intervention.

Spinal fusion surgeries, in particular, have become a mainstay in treating such conditions. Spine biologics, when used as grafting materials, eliminate the need for autografts, reducing donor site morbidity and surgical time. This is particularly beneficial for older patients who may not tolerate complex surgeries. As the geriatric population continues to rise—especially in countries like the U.S., Germany, Japan, and China—the demand for effective, minimally invasive, and biologically active spinal solutions is surging.

Restraint

High Cost of Spine Biologics and Limited Reimbursement Policies

Despite their clinical advantages, spine biologics come with significant cost burdens. BMPs and cell-based matrices, in particular, are priced higher than traditional grafts, which can limit their usage in cost-sensitive settings. Furthermore, not all biologics are consistently covered by health insurance or national reimbursement programs, especially in emerging markets.

Hospitals and outpatient facilities often face budgetary constraints when choosing between advanced biologics and standard options. The lack of universal reimbursement coverage leads to disparities in access to high-quality care. Additionally, variability in outcomes and concerns over adverse events—such as ectopic bone formation with BMPs—can deter adoption by conservative surgeons and insurers.

Opportunity

Advancement in Regenerative and Cell-based Therapies

A major opportunity within the spine biologics market lies in the advancement of regenerative medicine and cell-based therapies. As researchers explore the full potential of mesenchymal stem cells (MSCs), induced pluripotent stem cells (iPSCs), and genetically engineered cellular constructs, the market is poised to benefit from novel biologics that offer true regenerative potential rather than mere bone replacement.

Next-generation biologics that combine scaffolding properties with active cellular components are under development, and many are in preclinical or early clinical phases. These innovations promise faster healing, reduced post-operative pain, and fewer complications. Companies that can demonstrate long-term efficacy and safety while ensuring scalable manufacturing will have significant growth potential. Regulatory agencies are also beginning to establish frameworks to accommodate these biologics, creating fertile ground for innovation.

Spine Biologics Market Segmental Insights

By Product Insights

The spinal allografts segment dominated the market, with a revenue share of 59% in 2025. primarily due to their established safety profile, osteoconductive properties, and ease of integration into surgical workflows. Within this category, demineralized bone matrices (DBMs) are the most commonly used owing to their versatility and wide availability. DBMs retain native growth factors that promote osteoinduction, making them suitable for a variety of spinal fusion procedures. Machined bone allografts also contribute significantly, especially in reconstructive surgeries requiring structural support.

Cell-based matrices are the fastest-growing product segment, propelled by increasing research in regenerative medicine. These biologics offer osteoinductive and osteogenic potential, differentiating them from passive graft materials. Cell-based matrices containing autologous or donor-derived stem cells are particularly effective in enhancing bone growth in patients with compromised healing abilities. As regulatory clarity improves and clinical data accumulates, this segment is expected to see exponential adoption.

By Surgery Insights

Anterior cervical discectomy and fusion (ACDF) is the most dominant surgical category where spine biologics are utilized. ACDF is a commonly performed procedure for treating cervical spine disorders such as herniated discs and degenerative spondylosis. The use of biologics in ACDF improves fusion rates, reduces the need for hardware revisions, and facilitates faster post-operative recovery. Biologics also reduce complications associated with autograft harvesting, which is critical in delicate cervical spine surgeries.

Lateral lumbar interbody fusion (LLIF) is the fastest-growing surgical category, driven by the adoption of minimally invasive techniques. LLIF offers benefits such as reduced blood loss, quicker recovery, and minimal muscle disruption. The use of biologics in LLIF enhances interbody fusion and stability without the need for anterior or posterior access. As training in LLIF techniques spreads among orthopedic and neurosurgeons, the demand for compatible biologic implants is rising swiftly.

Spine Biologics Market By Regional Insights

North America remains the largest and most mature spine biologics market, backed by a high volume of spine surgeries, robust reimbursement systems, and a strong presence of leading manufacturers. The U.S. leads global innovation in biologics, with numerous FDA-approved products and a favorable regulatory environment for clinical research. The widespread adoption of minimally invasive spinal techniques and the strong demand for regenerative therapies have made North America a key revenue contributor for global players.

What Drives the Spine Biologics Market in U.S.?

U.S. dominates the spine biologics market in North America. The market growth can be attributed to the increasing incidences of spinal disorders such as degenerative disc disease, spinal fractures and spinal stenosis due to sedentary lifestyles, obesity, traumatic injuries and aging population is creating a strong demand for effective treatments like spine biologics. Well-established healthcare infrastructure with advances surgical facilities and rise in number of ambulatory surgical centers (ASCs) is supporting the high volume of spinal surgeries in the state driving the utilization of spine biologics. Increased adoption and utilization of advanced technologies by manufacturers and researchers is enabling the development of novel spine biologics such as cell-based therapies, bone morphogenetic proteins (BMPs) and advanced bone graft substitutes which offer enhanced outcomes, quick recovery with minimum complications. Rising preference towards minimally invasive surgical procedures and favourable reimbursement policies are bolstering the market growth.

Asia Pacific is the fastest-growing region, owing to rising healthcare investments, a growing elderly population, and increasing incidence of spinal disorders. Countries such as China, India, and South Korea are rapidly adopting modern spine surgery practices, supported by government funding and private sector expansion. As awareness around biologics grows and surgical training improves, Asia Pacific is expected to witness significant growth in the adoption of advanced spinal fusion technologies.

Why is China Experiencing Growth in the Spine Biologics Market?

China is expected to register fastest CAGR in Asia Pacific region. Rising prevalence of spinal disorders, rapidly aging demographic, increased investments in expansion of healthcare infrastructure, surging awareness among healthcare professionals and patients as well as increasing strategic collaborations among biotechnology organizations and medical device manufacturers are the factors boosting the market growth. Continuous advancements in regenerative medicine and biotechnology field fuelled by China’s strong research infrastructure is driving development of innovative, safe and effective spine biologics.

Some of the prominent players in the spine biologics market include:

- Stryker

- NuVasive, Inc.

- Orthofix.

- DePuy Synthes (Johnson & Johnson)

- Exactech, Inc.

- Zimmer Biomet

- Arthrex, Inc.

- Medtronic

- Organogenesis Inc.

- Kuros Biosciences.

Spine Biologics Market Recent Developments

- In April 2025, Spine Wave successfully completed the limited market release of its Tempest DCF Demineralized Cortical Fibers. This launch marks the company’s entry into the cortical fiber segment of the spinal allograft market.

- In March 2025, the U.S. Food and Drug Administration accepted a Biologics License Application (BLA) for Scholar Rock’s apitegromab which is an investigational muscle-targeted treatment for improving motor function in people living with spinal muscular atrophy (SMA).

- In February 2025, Medtronic bought Nanovis’ nano surface technology for developing PEEK interbody spine fusion devices which enhance implant fixation.

- In January 2025, Fair Winds Medical, a leading company in healthcare commercialization and distribution entered into a strategic collaboration with Royal Biologics, a pioneering regenerative medicine company. The partnership aims at driving innovation into regenerative medicine and patient by leveraging Royal Biologics’ breakthrough FIBRINET Platelet Rich Fibrin Matrix, a next-generation innovation in bone grafting and spinal fusion.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the spine biologics market

By Product

-

- Machined Bones Allograft

- Demineralized Bone Matrix

-

- Bone Morphogenetic Proteins

- Synthetic Bone Grafts

By Surgery

- Anterior Cervical Discectomy and Fusion (ACDF)

- Transforaminal Lumbar Interbody Fusion (TLIF)

- Posterior Lumbar Interbody Fusion (PLIF)

- Anterior Lumbar Interbody Fusion (ALIF)

- Lateral Lumbar Interbody Fusion (LLIF)

By End Use

- Hospitals

- Outpatient Facilities

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)