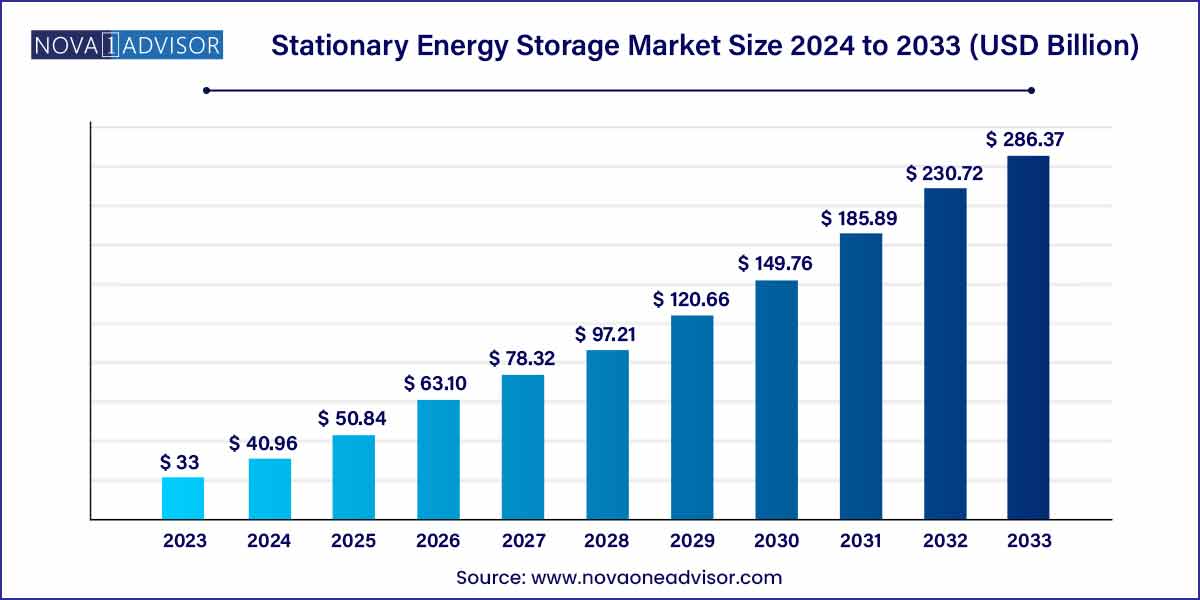

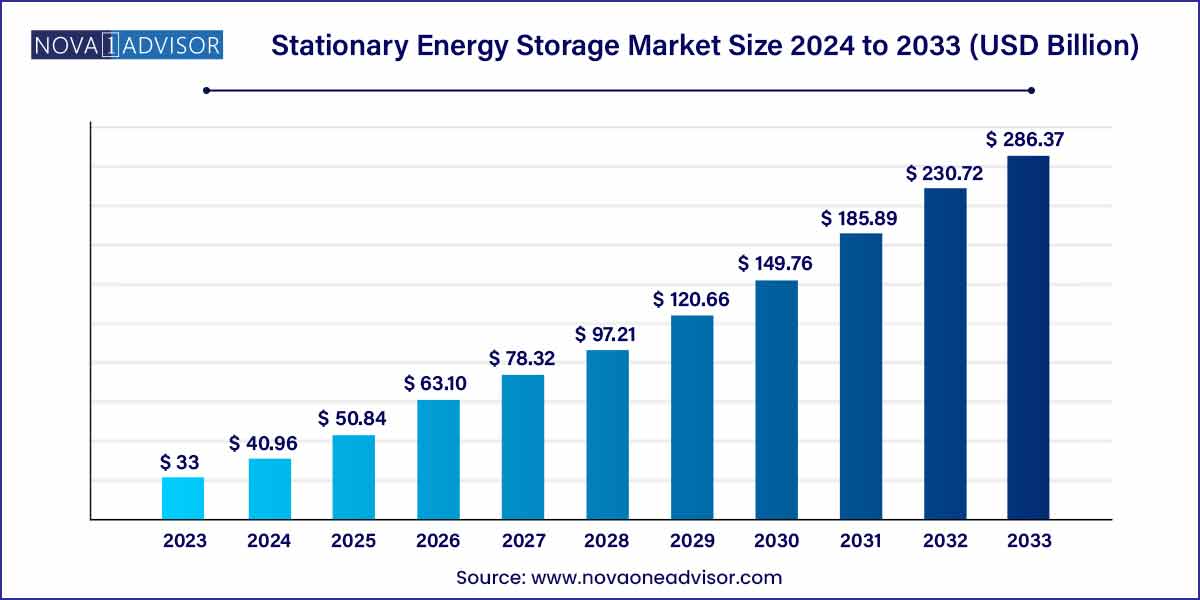

The global stationary energy storage market size was exhibited at USD 33.0 billion in 2023 and is projected to hit around USD 286.37 billion by 2033, growing at a CAGR of 24.12% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the stationary energy storage market in 2022.

- In 2022, the sodium sulfur segment dominated the stationary energy storage market.

- In 2022, the hydrogen and ammonia storage segment dominated the stationary energy storage market.

Stationary Energy Storage Market: Overview

The stationary energy storage market is experiencing rapid growth, driven by the increasing adoption of renewable energy sources, advancements in battery technology, and the need for grid stabilization. This overview aims to provide insights into the current state of the market, key trends shaping its trajectory, and the opportunities it presents for stakeholders.

Stationary Energy Storage Market Growth

When and how much power is produced differs from when and how much electricity is utilized on a daily basis. Furthermore, renewable energy sources are inflexible, which means they cannot be dispatched as needed to satisfy the ever-changing needs of energy consumers. When traditional power plants and interconnections will continue to be important tools in addressing this problem, energy storage solutions are expected to emerge as a top contender in addressing their flexibility issue.The emergence of stationary energy storage systems is being fueled by advancements in battery technology and lower costs.

When needed, a stationary energy storage device can store energy and discharge it in the form of electricity. An array of batteries, an inverter, an electronic control system, and a thermal management system are often included in a stationary energy storage system. Unlike a fuel cell, which creates power without having to be charged, energy storage systems must be charged in order to deliver electricity when it is required. The operation of stationary energy storage systems is based on batteries and an electronic control system. Lithium is the most common element used to store chemical energy in batteries.

The electrons that make up lithium are kept on one end of the battery. Electrons are extracted from lithium and circulated in a circuit to power the loads. In the meantime, lithium ions travel from one side of the battery to the other, then positively charged after losing negatively charged electrons. The battery is discharged when all of the lithium ions have moved to the other end. An external source of power begins to supply electricity to the battery, causing the battery to receive an influx of electrons. These negatively charged electrons begin to combine with positively charged lithium ions, and the lithium elements, then neutrally charged begin to travel from one side of the battery to the other.

One of the primary factors of where stationary energy storage systems will be embraced more quickly is economic feasibility. Despite the fact that a high local electricity price, inadequate robustness of current power infrastructure, and the criticality of business operations all play a role, two groups of consumers are likely to choose energy storage solutions first. Another application for stationary energy storage systems is to provide a continuous supply of electricity in the event of a power loss while backup generators are being set up. This is where these solutions’ quick dispatch capacity comes into effect such as in responding to loads with considerable voltage and frequency fluctuation, which certain generating assets are not capable of responding without causing outages.

Battery storage systems are essential for ensuring a constant and reliable power source. It is also becoming one of the most essential options for properly integrating large amounts of solar and wind renewables into power grids around the world. They are used in a variety of industries to provide superior connection and energy storage. High-capacity batteries are used as a backup source to ensure the electrical grid’s stability and to provide electricity during power outages. The increasing global use of renewable energy sources, combined with severe government laws aimed at reducing carbon emissions will drive product adoption during the projected period.

Batteries are used in variety of industries to provide superior connection and energy storage. High-capacity batteries are used as a backup source to keep the electrical grid stable and provide electricity during power outages. The surge in use of renewable energy sources around the world, along with strict government rules aimed at reducing carbon emissions will drive the growth of the stationary energy storage market.

The rapid deployment of renewable energy coupled with favorable government measures to reduce carbon emissions is the primary market driver for stationary energy storage. In addition, the continued integration of clean energy systems such as wind and solar necessitates cost effective solutions for network synchronization, which is likely to drive the stationary energy storage market expansion. Furthermore, rising electricity demand and grid stability are boosting the growth of the stationary energy storage market during the forecast period. The stationary energy storage market’s growth is projected to be hampered by volatile investment prospects in several industrial sectors and a lack of standardization.

Stationary Energy Storage Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 33.0 Billion |

| Market Size by 2033 |

USD 286.37 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 24.12% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Battery,Type of Energy Storage, Applicaion, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Tesla, Durapower, Exide Technologies, Duracell, Toshiba Corporation, Panasonic Corporation, Samsung SDI, Johnson Controls, Philips, Hoppecke Batteries. |

Driver: Increasing Renewable Energy Integration

A primary driver for the stationary energy storage market is the increasing integration of renewable energy into power grids worldwide. Solar and wind energy sources are inherently variable, leading to supply-demand imbalances that can destabilize grids. Stationary energy storage mitigates these fluctuations by storing surplus energy and dispatching it when generation falls short.

For instance, California’s massive deployment of battery storage systems has significantly reduced curtailment of solar power, allowing for more renewable energy to be utilized effectively. Similarly, in Europe, countries like Germany and Spain are heavily investing in grid-scale battery and thermal storage projects to align with their ambitious renewable energy targets. As global renewable capacity continues to grow, the demand for robust and scalable storage solutions will intensify, positioning stationary energy storage as an indispensable market.

Restraint: High Capital Investment Requirements

Despite the clear benefits, high capital investment requirements remain a significant restraint for the stationary energy storage market. Building storage systems—particularly large-scale grid-connected projects—involves substantial upfront costs for batteries, inverters, control systems, installation, and integration.

Although the levelized cost of storage (LCOS) has been decreasing, financing these projects can still be challenging, especially in markets without supportive policy frameworks or in emerging economies with limited investment capacity. Additionally, technologies like flow batteries and compressed air storage, while promising for long-duration storage, often require substantial space and specialized infrastructure, further escalating costs. Consequently, while long-term benefits such as grid reliability and energy cost savings are compelling, the initial financial hurdle can delay or restrict project deployment.

Opportunity: Growth in Hydrogen and Ammonia Energy Storage

A significant opportunity lies in the growth of hydrogen and ammonia-based energy storage systems. As the global economy moves toward deep decarbonization, hydrogen and its derivatives are emerging as key enablers of long-term energy storage and cross-sectoral integration.

Hydrogen produced via electrolysis during periods of surplus renewable generation can be stored and later used for electricity generation, industrial processes, or even mobility solutions. Projects like Australia’s "Asian Renewable Energy Hub" and Germany’s "National Hydrogen Strategy" illustrate how hydrogen storage is gaining momentum globally. Similarly, ammonia, with its high energy density and easier storage and transportation characteristics, is being explored for large-scale energy storage and shipping fuel applications. Investment in hydrogen infrastructure, electrolyzers, and storage solutions is poised to unlock substantial new market potential.

Segments Insights:

By Battery

Lithium-ion batteries dominated the battery segment, commanding the largest market share due to their technological maturity, superior energy density, and rapidly declining costs. Lithium-ion technology is widely deployed across utility-scale storage, commercial applications, and residential systems. Companies like Tesla, LG Energy Solution, and Panasonic continue to drive innovations, enhancing battery longevity and safety. The versatility of lithium-ion batteries, combined with robust supply chains and established manufacturing capacity, reinforces their dominance.

Flow batteries are emerging as the fastest-growing battery segment, particularly for long-duration applications. Flow batteries, such as vanadium redox and zinc-bromine, offer scalable energy storage with longer cycle life and minimal degradation over time. These characteristics make them ideal for applications like renewable integration and grid services requiring 6-12 hours of storage. Recent advancements in reducing vanadium costs and improving system efficiency are propelling flow battery adoption, as evidenced by projects in Australia and China.

By Type of Energy Storage

Thermal energy storage dominated the type of energy storage segment, especially in industrial and district energy applications. Thermal storage systems, such as molten salt or phase-change materials (PCMs), are highly efficient in storing and releasing energy, particularly for heating and cooling needs. Companies like EnergyNest and Azelio are pioneering modular thermal storage solutions, enabling industries to decarbonize process heat requirements and reduce operational costs.

Hydrogen and ammonia storage is the fastest-growing type, gaining remarkable traction as countries invest heavily in hydrogen economies. The versatility of hydrogen—as a fuel, a feedstock, and an energy carrier—makes it an attractive solution for long-duration and seasonal energy storage. Major projects in Europe, Australia, and the Middle East are demonstrating the potential of large-scale hydrogen storage facilities to support energy system flexibility and resilience.

By Application

Grid services dominated the application segment, comprising the largest portion of the stationary energy storage market. Energy storage systems provide critical grid services such as frequency regulation, voltage support, spinning reserve, and load shifting. Utilities and grid operators are increasingly deploying storage assets to enhance grid reliability, defer infrastructure investments, and enable higher renewable penetration. Notable examples include PG&E’s Moss Landing battery project in California and the Hornsdale Power Reserve in South Australia.

Behind-the-meter applications are growing the fastest, driven by businesses and households seeking energy autonomy, cost savings, and backup power capabilities. Commercial and industrial facilities, in particular, are installing on-site battery systems to manage peak demand charges, optimize self-consumption of renewable energy, and enhance operational resilience. Residential adoption is also surging, especially when coupled with rooftop solar installations and smart home energy management systems.

Regional Analysis

Asia-Pacific dominated the stationary energy storage market, led by countries such as China, Japan, South Korea, and Australia. China alone accounts for a significant share of global energy storage deployments, driven by aggressive renewable energy expansion, supportive government policies, and technological leadership. Japan's "Strategic Energy Plan" emphasizes energy storage for grid resilience, while Australia's booming solar market has catalyzed massive growth in residential and utility-scale storage installations.

North America is the fastest-growing regional market, fueled by robust policy incentives, private sector investments, and technological innovation. The United States, in particular, has seen a surge in battery storage installations following the passage of the Inflation Reduction Act (IRA) in 2022, which extended tax credits to standalone energy storage systems. States like California, Texas, and New York are leading storage capacity additions. Canada's focus on clean energy transition is also boosting storage deployments across provinces.

Some of the prominent players in the stationary energy storage market include:

- Tesla

- Durapower

- Exide Technologies

- Duracell

- Toshiba Corporation

- Panasonic Corporation

- Samsung SDI

- Johnson Controls

- Philips

- Hoppecke Batteries

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global stationary energy storage market.

By Battery

- Lithium Ion

- Sodium Sulphur

- Lead Acid

- Flow Battery

By Type of Energy Storage

- Hydrogen and Ammonia Storage

- Gravitational Energy Storage

- Compressed Air Energy Storage

- Liquid Air Storage

- Thermal Energy Storage

By Application

- Grid Services

- Behind the Meter

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)