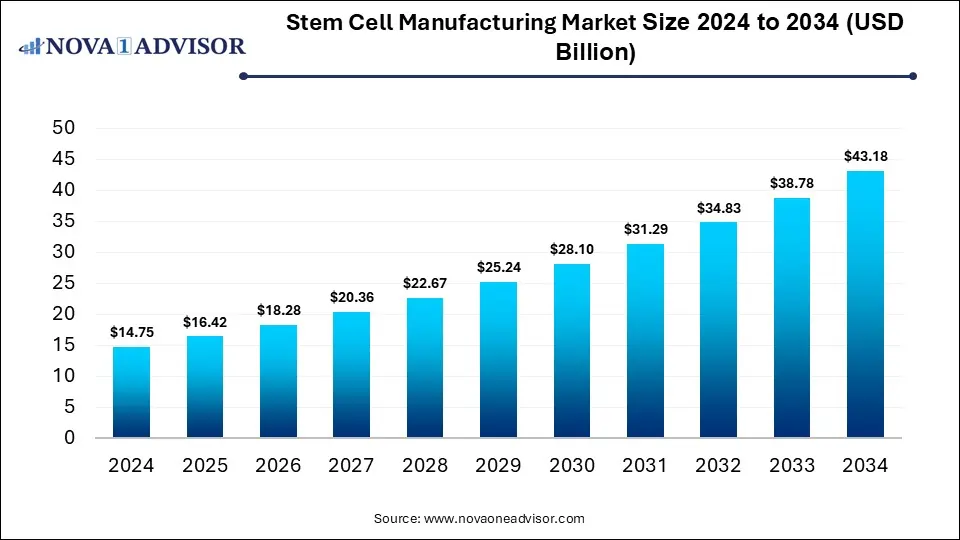

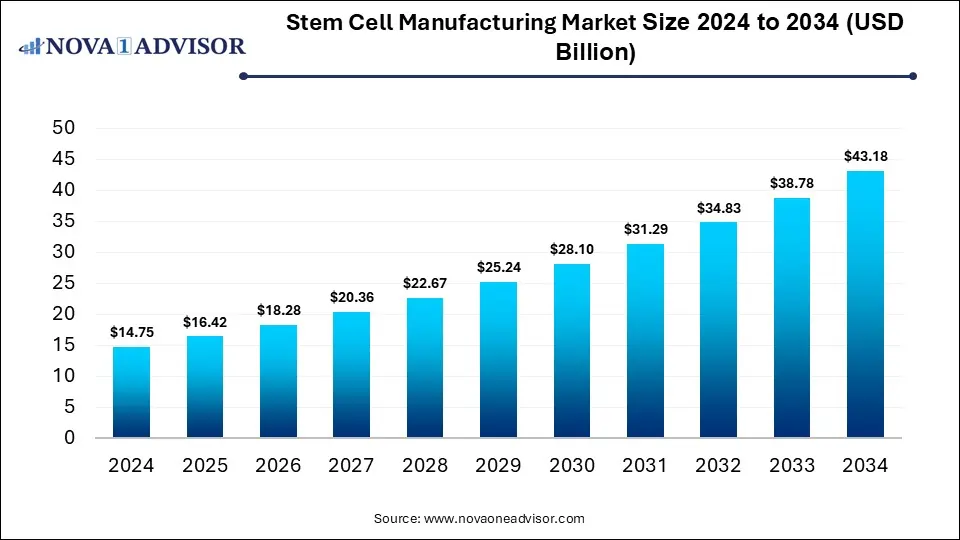

Stem Cell Manufacturing Market Size and Growth 2025 to 2034

The global stem cell manufacturing market was valued at USD 14.75 billion in 2024 and is projected to hit around USD 43.18 billion by 2034, growing at a CAGR of 11.34% during the forecast period 2025 to 2034. The growth of the market is attributed to the rising demand for cell-based therapies, advancements in manufacturing technologies, and favorable regulatory environment.

Stem Cell Manufacturing Market Key Takeaways

- By region, North America dominated the stem cell manufacturing market with the largest market share in 2024.

- Asia Pacific is poised for the fastest growth in the upcoming period.

- By product, the consumables segment dominated the market in 2024.

- By product, the instruments segment is expected to expand at the fastest CAGR over the projection period.

- By application, the clinical application segment led the market in 2024.

- By application, the research application segment is expected to grow at a significant rate in the coming years.

- By end-user, the pharmaceutical & biotechnology companies segment dominated the market with the largest share in 2024.

- By end-user, the academic institutes, research laboratories & contract research organizations segment is likely to expand at a rapid pace between 2025 and 2034.

How is AI Revolutionizing Stem Cell Manufacturing?

AI is significantly transforming stem cell manufacturing by enhancing process efficiency, precision, and scalability. Through advanced data analytics and machine learning algorithms, AI enables real-time monitoring and optimization of stem cell culture conditions, ensuring consistent quality and yield. It also accelerates cell line development by predicting cell behavior and identifying optimal culture parameters. AI-powered automation reduces manual intervention, minimizing human error and contamination risks. Moreover, AI facilitates predictive maintenance for manufacturing equipment and streamlines regulatory compliance by ensuring data integrity and traceability. As a result, AI integration is driving faster, cost-effective, and more reliable cell manufacturing workflows.

In June 2025, Invetech partnered with AiCella to integrate AI into cell therapy manufacturing, aiming to enhance efficiency, scalability, and patient outcomes. The collaboration combines Invetech’s automation expertise with AiCella’s predictive AI models to identify critical process parameters, reduce variability, and support personalized therapies.

Market Overview

The stem cell manufacturing market involves the large-scale production and processing of stem cells for research, clinical, and commercial applications, including regenerative medicine, drug discovery, and cell therapy. It enables consistent, high-quality, and scalable generation of various stem cell types, such as mesenchymal, hematopoietic, and induced pluripotent stem cells, crucial for treating conditions like cancer, neurological disorders, and autoimmune diseases. The market is experiencing robust growth due to rising investment in regenerative medicine, increasing prevalence of chronic diseases, and expanding applications of stem cells in personalized medicine. Supportive government policies and a growing number of clinical trials are also contributing to the market's rapid evolution.

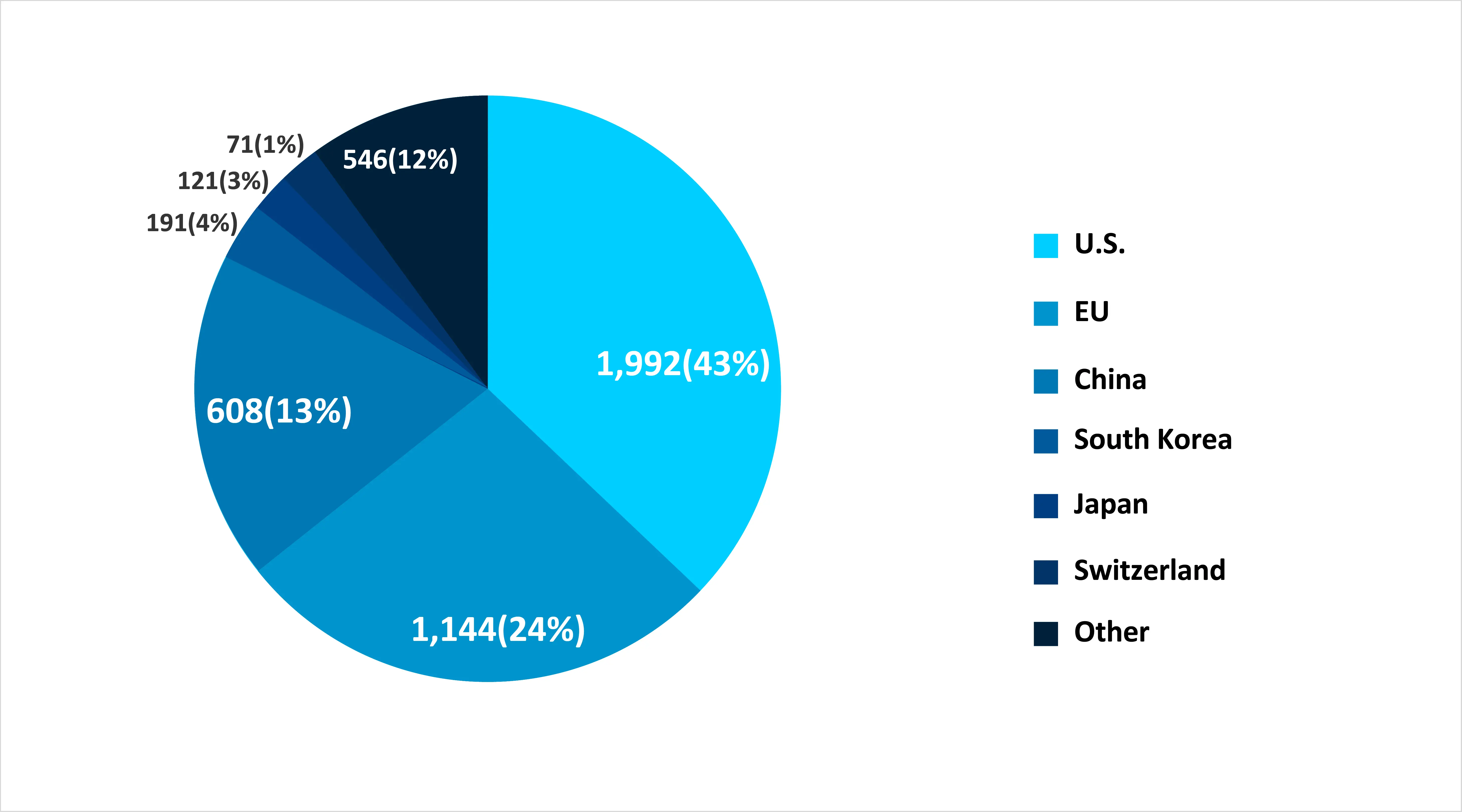

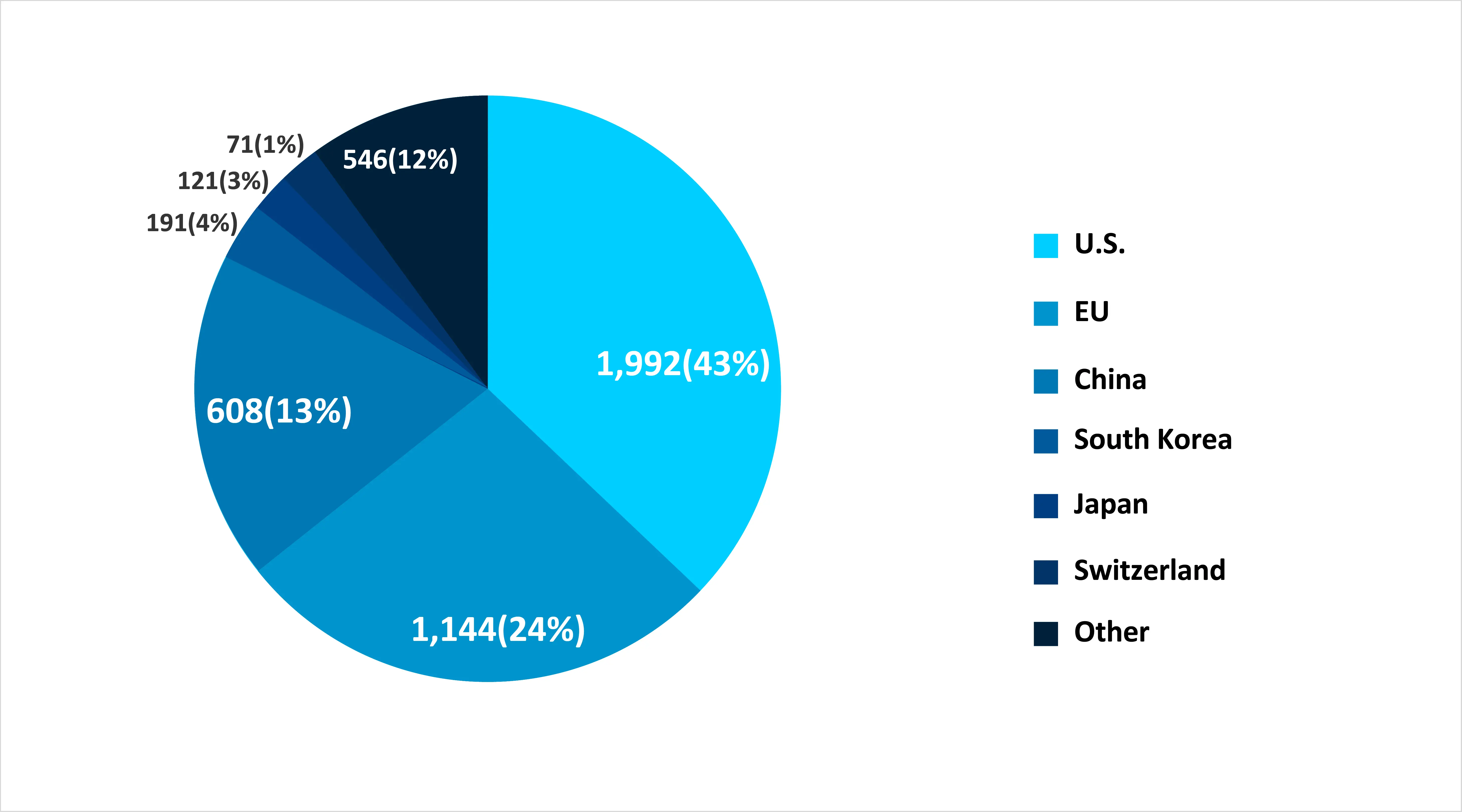

The Global Stem Cell Frontier: Which Countries Took the Lead in 2024?

As of June 20, 2024, a search using the terms "stem cell therapies OR stem cell treatments" yielded 3,329 results from ClinicalTrials.gov and 1,938 from ICTRP. After removing duplicates (matched by trial ID and study title), 4,673 unique clinical studies were identified. Country-wise distribution showed the U.S. leading with 1,992 studies (43%), followed by the EU with 1,144 (24%)—including Germany (324), France (296), Italy (270), and Spain (254). China reported 608 studies (13%), South Korea 191 (4%), Japan 121 (3%), and Switzerland 71 (1%).

What are the Major Trends in the Stem Cell Manufacturing Market?

- Growing Use of Allogeneic Stem Cell Therapies: Allogeneic (off-the-shelf) therapies are gaining momentum due to their scalability, cost-effectiveness, and easier logistics compared to autologous treatments.

- Expansion of Stem Cell Banking Services: Increasing awareness and demand for personalized medicine are fueling growth in public and private stem cell banking, particularly for cord blood and adipose-derived stem cells.

- Strategic Collaborations and Partnerships: Biotech firms, pharma companies, and research institutions are forming partnerships to co-develop stem cell products and manufacturing platforms, accelerating innovation and market reach.

- Regulatory Support and Evolving Guidelines: Governments and regulatory bodies are streamlining approval pathways and providing funding for stem cell research and manufacturing, encouraging innovation while ensuring safety and compliance.

Report Scope of Stem Cell Manufacturing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.42 Billion |

| Market Size by 2034 |

USD 43.18 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.34% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product Insights, By Application Insights, By End-User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

STEMCELL Technologies, Thermo Fisher Scientific, Lonza Group, Takara Bio, Pluristem Therapeutics Merck, KGaA (Sigma-Aldrich), Thermo Fisher Scientific, Bio-Techne, PromoCell , HiMedia Laboratories |

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases

The rising prevalence of chronic diseases such as cancer, cardiovascular disorders, diabetes, and neurodegenerative conditions is a major factor driving the growth of the stem cell manufacturing market. Stem cells offer unique regenerative capabilities that can repair or replace damaged tissues, making them highly valuable for treating conditions where conventional therapies often fall short. This growing disease burden is increasing demand for stem cell-based therapies, prompting the need for scalable and reliable manufacturing processes. As more clinical trials and approvals for stem cell treatments emerge, healthcare systems are investing in manufacturing infrastructure to meet future therapeutic demand.

Increasing Demand for Personalized Medicine

The increasing demand for personalized medicine is significantly driving the growth of the market, as stem cell therapies can be tailored to an individual’s unique genetic and clinical profile. Personalized treatments, particularly autologous stem cell therapies, require precise and patient-specific manufacturing processes, driving the need for flexible and scalable production technologies. This shift is encouraging investment in advanced bioprocessing systems and automation to ensure consistency, quality, and regulatory compliance in customized cell products. Moreover, the integration of genomic and biomarker data is enabling more targeted applications of stem cells, enhancing therapeutic outcomes. As personalized medicine continues to expand, so does the demand for efficient and adaptive stem cell manufacturing solutions.

Restraints

High Costs and Regulatory Hurdles

The high cost of stem cell manufacturing is a significant barrier to market growth, as complex processes, specialized equipment, and stringent quality control requirements drive up production expenses. These costs can make therapies less accessible and limit adoption, especially in low- and middle-income countries. Additionally, navigating the strict and evolving regulatory landscape poses challenges for manufacturers, with lengthy approval timelines and rigorous compliance demands. These hurdles can delay commercialization, increase operational burdens, and discourage smaller companies from entering the market.

Ethical Concerns and Scalability Issues

Ethical concerns, particularly regarding the use of embryonic stem cells, continue to pose a barrier to the stem cell manufacturing market by limiting funding, regulatory approvals, and public acceptance in certain regions. These concerns often result in stricter oversight and policy restrictions, which can slow research and commercialization. At the same time, scalability remains a major technical challenge, as expanding stem cell production to clinical or industrial levels without compromising quality, consistency, or functionality is complex and costly. Many stem cell types are sensitive to changes in culture conditions, making it difficult to standardize large-scale manufacturing processes.

Opportunities

Development of Automated and Scalable Manufacturing Technologies

The development of automated and scalable manufacturing technologies is creating significant opportunities in the stem cell manufacturing market by addressing key challenges such as process variability, labor intensity, and high production costs. Automation enhances consistency and reproducibility in cell culture, expansion, and differentiation, which is critical for meeting regulatory standards and ensuring therapeutic safety. Scalable systems like advanced bioreactors and closed-loop processing platforms enable the efficient production of large cell quantities needed for clinical and commercial applications. These innovations also accelerate time-to-market and support the growing demand for personalized and allogeneic stem cell therapies.

- In January 2025, Aspen Neuroscience, Inc. advanced its plans for automating and expanding production of its Parkinson’s cell therapy ANPD001 at its GMP facility based in San Diego. The therapy is currently in Phase 1/2a clinical trials under the ASPIRO program. As part of this expansion, Aspen has entered into a collaboration agreement with Mytos, a leader in automated cell manufacturing, to focus on advancing plans to automate production of dopaminergic neuronal precursor cells (DANPCs) for ANPD001.

Innovation in Allogenic Stem Cell Therapies and Rising Investments in R&D

Innovation in allogeneic stem cell therapies is creating new opportunities in the market by enabling the development of “off-the-shelf” treatments that can be mass-produced and readily available to patients. Unlike autologous therapies, allogeneic approaches offer greater scalability and cost-efficiency, making them attractive for widespread clinical use. In addition, increasing R&D investments from pharmaceutical companies, governments, and academic institutions are accelerating the discovery of new stem cell applications and manufacturing technologies. These investments are driving advancements in cell culture methods, bioprocessing systems, and quality control, which are essential for commercializing next-generation therapies.

Segment Outlook

By Product Insights

What Made Consumables the Dominant Product Type in the Stem Cell Manufacturing Market in 2024?

Consumables emerged as the dominant product type in the market in 2024 due to their critical and recurring role in every stage of stem cell production. Items such as culture media, growth factors, reagents, and other lab supplies are essential for maintaining cell viability, promoting growth, and ensuring reproducibility throughout the manufacturing process. Unlike instruments or equipment, consumables are used continuously and must be replenished frequently, leading to high demand and steady revenue generation.

The rise in clinical trials and stem cell research globally has further fueled the consumption of these products, especially in academic, biopharmaceutical, and clinical manufacturing settings. Additionally, ongoing innovations in specialized culture media and reagent formulations tailored for specific stem cell types have increased their adoption. This sustained and expanding need for high-quality, GMP-grade consumables has firmly positioned them as the leading segment in the market.

The instruments segment is expected to grow at the fastest rate during the forecast period due to increasing automation and the need for advanced equipment that ensures precision and scalability. Innovations in bioreactors, cell sorters, and incubators are enhancing the efficiency and reproducibility of stem cell production processes. As demand for large-scale manufacturing rises, these sophisticated instruments become essential for maintaining consistent quality and meeting regulatory standards. Additionally, growing investments in stem cell research and therapy development are driving the adoption of cutting-edge instruments across pharmaceutical companies and research institutions. This surge in demand for reliable, high-throughput equipment is propelling the growth of the instruments segment.

By Application Insights

Why Did the Clinical Application Segment Dominate the Stem Cell Manufacturing Market in 2024?

The clinical application segment dominated the market with a significant share in 2024. This is mainly due to the increased adoption of stem cell therapies for treating various chronic and degenerative diseases. Growing awareness and acceptance of regenerative medicine have driven demand for allogenic and autologous stem cell treatments in clinical settings. Additionally, advancements in manufacturing technologies and regulatory approvals have facilitated the commercialization of these therapies. The rising prevalence of conditions such as cancer, cardiovascular diseases, and autoimmune disorders further creates the need for effective stem cell therapies.

The research application segment is expected to expand at a significant CAGR in the upcoming period due to the surge in stem cell-based studies across drug discovery, disease modeling, and regenerative medicine. Increasing funding from governments and private sectors is fueling basic and translational research, particularly in academic institutes and biotech firms. Additionally, the development of innovative stem cell lines and genome editing tools like CRISPR is expanding the scope of research applications. Researchers are also increasingly leveraging stem cells to study disease mechanisms and test therapeutic responses, accelerating the demand for high-quality, research-grade stem cell products.

By End-User Insights

How Did Pharmaceutical & Biotechnology Companies Contribute the Largest Market Share in 2024?

Pharmaceutical & biotechnology companies sustained dominance in the stem cell manufacturing market by holding the largest share in 2024. This is primarily due to their significant investments in developing and commercializing stem cell-based therapies. These companies are at the forefront of clinical trials and product development, requiring large-scale, GMP-compliant stem cell production to meet regulatory standards. With the growing focus on regenerative medicine and personalized therapies, pharma and biotech firms are increasingly incorporating stem cell technologies into their R&D pipelines. Their robust infrastructure, financial capabilities, and strategic partnerships have enabled them to lead in scaling up production and bringing novel therapies to market.

The academic institutes, research laboratories & contract research organizations segment is expected to expand at the fastest CAGR during the projection period due to increasing stem cell-related research and preclinical studies. These institutions are actively exploring the therapeutic potential of stem cells for disease modeling, drug testing, and regenerative medicine, driving demand for high-quality stem cell lines and manufacturing technologies. Additionally, growing government and private funding is supporting academic and collaborative research initiatives globally. CROs, in particular, are becoming essential partners in outsourcing R&D and manufacturing services, especially for smaller biotech firms looking to reduce costs and accelerate development.

By Regional Insights

What Made North America the Dominant Region in the Stem Cell Manufacturing Market?

North America dominated the stem cell manufacturing market by capturing the largest share in 2024 due to its robust biotechnology infrastructure, advanced healthcare system, and substantial investments in stem cell research and development. The presence of leading pharmaceutical and biotech companies, along with well-established academic and research institutions, has driven innovation and large-scale manufacturing capabilities in the region. Supportive regulatory frameworks, such as those from the FDA, have also facilitated the development and approval of stem cell therapies. Additionally, high healthcare spending and a growing number of clinical trials in the U.S. and Canada have further fueled market growth.

The U.S. is a major contributor to the North America stem cell manufacturing market, driven by its advanced biotechnology ecosystem and strong focus on regenerative medicine. The country is home to some of the leading pharmaceutical and biotech companies, research institutions, and clinical centers actively engaged in stem cell research and therapy development. Substantial government funding from agencies like the NIH, along with supportive regulatory guidance from the FDA, has accelerated innovation and commercialization. The U.S. also leads in the number of ongoing clinical trials and patent filings related to stem cell technologies

- For instance, the International Society for Stem Cell Research (ISSCR) has released updated guidelines to strengthen ethical, scientific, and regulatory standards for stem cell research and clinical translation. Developed by a multi-group task force, the guidelines aim to ensure safe, effective therapies and curb premature commercialization.

Why is Asia Pacific Experiencing Rapid Growth in the Stem Cell Manufacturing Market?

Asia Pacific is expected to experience rapid growth in the market due to increasing investments in healthcare infrastructure, biotechnology research, and regenerative medicine. Countries like China, Japan, South Korea, and India are actively promoting stem cell research through government funding, favorable regulations, and public-private partnerships. The rising prevalence of chronic diseases, coupled with a growing aging population, is also driving demand for advanced therapies in the region. Additionally, lower operational costs and the emergence of skilled scientific talent are attracting global companies to establish manufacturing and R&D facilities in Asia Pacific.

China is a major player in the market in Asia Pacific, owing to its substantial investments in biotechnology and regenerative medicine. The Chinese government has launched several national initiatives to support stem cell research, including funding programs and the establishment of dedicated research centers. China's large patient population, rising incidence of chronic diseases, and growing demand for advanced therapies are further fueling the need for stem cell-based solutions. Additionally, the country offers lower manufacturing costs and a skilled scientific workforce, making it an attractive hub for both domestic and international stem cell companies.

- On September 8, 2024, China’s Ministry of Commerce, National Health Commission, and National Medical Products Administration announced a pilot program allowing foreign-invested enterprises to develop and manufacture human stem cell, gene diagnostic, and therapy products in the Beijing, Shanghai, Guangdong.

India is emerging as a significant player in the Asia Pacific stem cell manufacturing market due to its rapidly advancing biotechnology sector, cost-effective manufacturing capabilities, and growing government support for regenerative medicine. The country has seen a rise in stem cell research institutions and clinical trials, supported by favorable regulatory developments and increased public and private funding. India’s large patient population and high burden of chronic diseases further drive the demand for stem cell-based therapies. Additionally, the availability of skilled professionals and expanding infrastructure make it an attractive hub for both domestic and international companies.

- For instance, with strong government support, rising private investment, and a robust academic ecosystem, India’s stem cell sector is gaining momentum. According to Dr. Mrinalini Chaturvedi, Medical Director at Cryoviva Life Sciences, advancements in technology, expanding clinical trials, and increasing demand for regenerative and personalized therapies are driving this growth. Stem cell therapy is rapidly transforming modern medicine in the country.

Stem Cell Manufacturing Market Value Chain Analysis

Stem Cell Sourcing & Cell Line Development

This is the foundation of the entire manufacturing process. The choice and quality of stem cells (e.g., embryonic, mesenchymal, hematopoietic, iPSCs) directly influence the efficiency, safety, and therapeutic outcome of the final product.

Key Activities:

- Derivation and banking of stem cell lines

- Ensuring cell viability, genetic stability, and purity

- Ethical and regulatory sourcing (e.g., iPSC over ESC)

Key Players:

- STEMCELL Technologies

- Thermo Fisher Scientific

- Lonza Group

- Takara Bio

- Pluristem Therapeutics

2. Production of Growth Media

Culture media and reagents provide the necessary nutrients and signals for stem cells to grow and differentiate. They must be highly consistent, sterile, and tailored for specific stem cell types and stages.

Key Activities:

- Production of growth media, cytokines, sera, buffers

- Quality assurance and lot-to-lot consistency

- GMP-grade sourcing for clinical use

Key Players:

- Merck KGaA (Sigma-Aldrich)

- Thermo Fisher Scientific

- Bio-Techne

- PromoCell

- HiMedia Laboratories

3. Contract Manufacturing & GMP Production (CDMOs)

GMP compliance is crucial to ensure safety, consistency, and regulatory approval. Many companies outsource this to Contract Development and Manufacturing Organizations (CDMOs) due to the high cost and complexity of GMP infrastructure.

Key Activities:

- GMP-compliant stem cell expansion

- Lot release, quality control, documentation

- Scaling from preclinical to commercial batches

- Key Players:

- Lonza Group

- Catalent (MaSTherCell)

- Fujifilm Diosynth

- WuXi AppTec

- Organogenesis

4. Packaging, Cryopreservation & Storage

Stem cells are sensitive and must be stored and transported in tightly controlled environments to maintain viability. This stage ensures long-term usability and logistics efficiency.

Key Activities:

- Controlled-rate freezing and cryogenic storage

- Design of secure, sterile packaging

- Cold chain logistics and distribution to clinics

- Key Players:

- CryoLife

- American CryoStem

- VWR International

- HiMedia

- BioLife Solutions

5. Regulatory Compliance & Quality Assurance

Stem cell therapies are classified as advanced therapy medicinal products (ATMPs) in many regions. Adhering to regulatory standards ensures patient safety and accelerates market approval.

Key Activities:

- Adherence to FDA, EMA, and GMP guidelines

- Batch testing, sterility, and potency assays

- Documentation for regulatory submissions

- Key Players:

- Lonza

- Sartorius

- Charles River Laboratories

- Parexel (for regulatory consulting)

6. Distribution, Clinical Applications & End Users

The final products are used in a wide range of therapeutic areas like oncology, neurology, cardiology, and orthopedics. Efficient distribution and clinician training ensure successful adoption.

Key Activities:

- Delivery to hospitals, research institutions, and biopharma

- End-use in cell therapy, regenerative medicine, and drug testing

- Feedback loop to improve upstream manufacturing

- Key Stakeholders:

- Hospitals & Clinics

- Pharmaceutical Companies (e.g., Vertex, Novartis)

- Research Institutions

- Biotech Startups

- CROs/Academic Labs

Competitive Landscape

1. Thermo Fisher Scientific

The company provides a broad range of stem cell culture reagents, consumables, and GMP-compliant manufacturing platforms, enabling scalable and standardized stem cell production for research and clinical use.

2. Lonza Group

It offers end-to-end contract manufacturing (CDMO) services, including cell expansion and GMP production, making it a critical partner for companies developing stem cell therapies.

3. Merck KGaA / MilliporeSigma

It supplies high-quality culture media, growth factors, and cell processing tools that support consistent and reproducible stem cell growth and differentiation.

4. STEMCELL Technologies

The company specializes in developing cell culture media and cell separation products for various stem cell types, supporting both academic and industrial researchers in upstream manufacturing.

5. Fujifilm Cellular Dynamics

It develops and manufactures iPSC-derived cell types at commercial scale, playing a vital role in providing ready-to-use stem cell models for therapeutic and drug discovery applications.

6. Sartorius AG

It supplies bioprocessing instruments like bioreactors, single-use systems, and analytics platforms that enable efficient and GMP-compliant scale-up of stem cell production.

7. Bio-Techne

It produces critical reagents such as cytokines and growth factors, essential for stem cell differentiation and expansion in both research and therapeutic manufacturing.

8. Catalent (via MaSTherCell acquisition)

The company acts as a CDMO for advanced therapies, offering process development and GMP manufacturing services for autologous and allogeneic stem cell products.

9. Takara Bio

It offers tools for stem cell reprogramming, iPSC generation, and expansion, facilitating the development of next-gen regenerative therapies.

10. Pluristem Therapeutics

The company develops placenta-derived stem cell therapies using a proprietary 3D expansion platform, contributing novel products and technologies to the market.

11. Cellares

It pioneers closed, automated stem cell manufacturing through its CellShuttle system, addressing scalability and cost-efficiency challenges in cell therapy production.

12. BioLife Solutions

It provides biopreservation media and cryogenic storage solutions critical for the viability and transportation of stem cell products.

13. Vericel Corporation

The company engages in commercializing FDA-approved autologous stem cell therapies for orthopedic and burn care, representing the therapeutic end of the stem cell manufacturing value chain.

14. WuXi AppTec

It delivers contract research and GMP manufacturing services to cell therapy companies globally, supporting R&D and commercialization of stem cell-based treatments.

15. American CryoStem

It offers adipose-derived stem cell processing and cryopreservation services, enabling personalized regenerative therapies and cell banking.

Stem Cell Manufacturing Market Recent Developments

- In April 2024, SCG Cell Therapy and A*STAR launched joint labs for cellular immunotherapies with nearly S$30 million in funding under Singapore’s RIE2025 Plan. The collaboration aims to advance the development of induced pluripotent stem cell (iPSC) technology to produce novel cell therapies that meet GMP standards and includes a talent development program to train future experts in line with regulatory requirements.

- In March 2023, the CellQualiaTM Intelligent Cell Processing System, an innovative stem cell-growing robot developed in Japan, is being trialled by the Medicines and Healthcare products Regulatory Agency (MHRA) to assess its potential for safer, cost-effective therapies. It is the only system of its kind outside Japan and is being tested over 12 months by the UK Stem Cell Bank.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the stem cell manufacturing market.

By Product

-

- Culture Media

- Other Consumables

-

- Bioreactors and Incubators

- Cell Sorters

- Other Instruments

-

- Hematopoietic Stem Cells (HSC)

- Mesenchymal Stem Cells (MSC)

- Induced Pluripotent Stem Cells (iPSC)

- Embryonic Stem Cells (ESC)

- Neural Stem Cells (NSC)

- Multipotent Adult Progenitor Stem Cells

By Application

-

- Life Science Research

- Drug Discovery and Development

-

- Allogenic Stem Cell Therapy

- Autologous Stem Cell Therapy

- Cell & Tissue Banking Applications

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic Institutes, Research Laboratories & Contract Research Organizations

- Hospitals & Surgical Centers

- Cell & Tissue Banks

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)