Stem Cell Therapy Market Size and Forecast 2025 to 2034

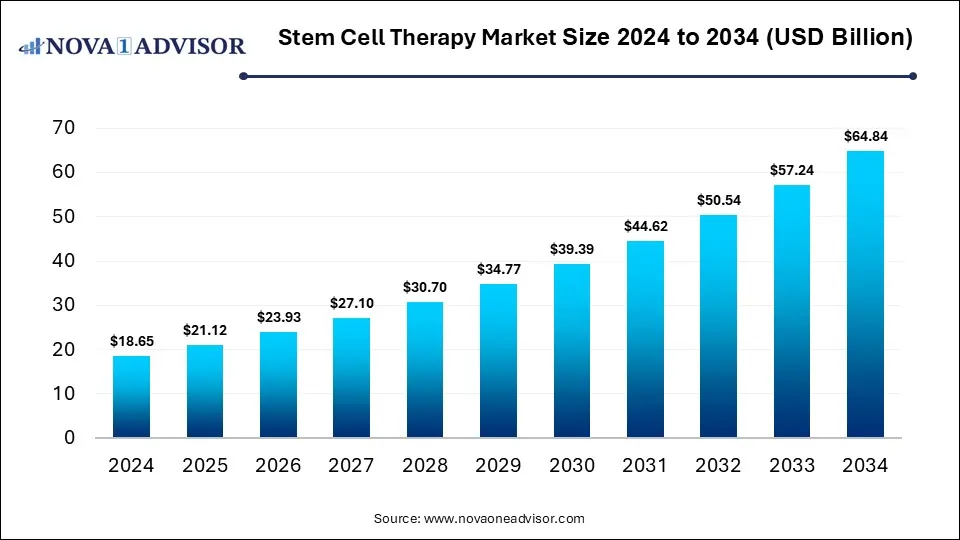

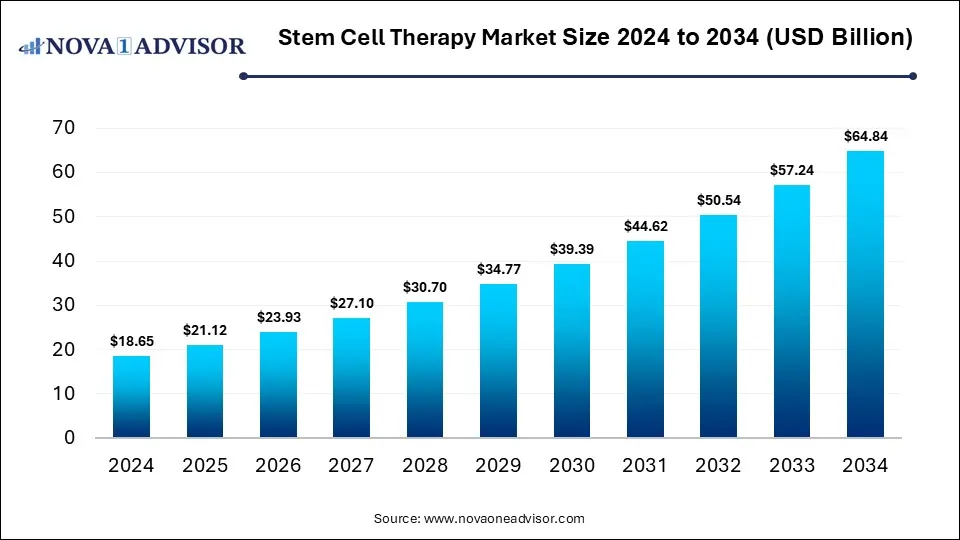

The global stem cell therapy market was valued at USD 18.65 billion in 2024 and is projected to hit around USD 64.84 billion by 2034, growing at a CAGR of 13.27% during the forecast period 2025 to 2034. The growth of the market is attributed to the rising development of new stem cell-based therapies, demand for personalized medicine, and R&D activities.

Stem Cell Therapy Market Key Takeaways

- By region, North America dominated the stem cell therapy market in 2024.

- By region, Asia Pacific is expected to experience the fastest growth between 2025 and 2034.

- By product, the adult stem cells (ASCs) segment held the largest revenue share in 2024.

- By product, the induced pluripotent stem cells (iPSCs) segment is expected to grow at a significant CAGR between 2025 and 2034.

- By therapy type, the autologous segment led the market in 2024.

- By therapy type, the allogenic segment is likely to grow at the highest CAGR in the coming years.

- By application, the regenerative medicine segment held the largest market share in 2024.

- By application, the drug discovery & development segment is expected to grow at the highest CAGR in the upcoming period.

- By end user, the hospitals segment led the market in 2024.

- By end user, the research institutes segment is expected to grow at a significant rate between 2025 and 2034.

How is AI Impacting the Stem Cell Therapy Market

AI is playing a transformative role in the stem cell therapy market by streamlining research, development, and clinical applications. It accelerates drug discovery by identifying optimal conditions for stem cell differentiation and predicting therapeutic outcomes with greater accuracy. In manufacturing, AI ensures consistency and quality through real-time monitoring and predictive analytics. It also supports personalized medicine by analyzing complex patient data to tailor stem cell treatments to individual needs. Additionally, AI enhances imaging and diagnostics, allowing for better tracking of stem cell behavior and treatment efficacy. Overall, AI is driving innovation, improving efficiency, and reducing costs across the stem cell therapy value chain.

Market Overview

The stem cell therapy market refers to the segment of regenerative medicine focused on using stem cells to treat or prevent various diseases and conditions by repairing, replacing, or regenerating damaged tissues or organs. This market is growing rapidly due to rising incidences of chronic and degenerative diseases, increased investment in regenerative medicine, and advancements in stem cell research and manufacturing technologies. Supportive government policies, expanding clinical trials, and growing public awareness of the potential benefits of stem cell treatments are also fueling market expansion. With continued innovation and regulatory support, the market is expected to see substantial growth in the coming years.

- On July 29, 2024, the ISSCR submitted comments on the FDA’s draft guidance for safety testing of human allogeneic cells in cell-based products. While supporting the FDA’s initiative, ISSCR sought clarification on genomic testing requirements and recommended refining guidelines on sequencing depth and cytogenetic testing. It also advocated for using both methods to ensure thorough safety assessments.

Major Trends in the Stem Cell Therapy Market

- Growing Focus on Personalized Stem Cell Therapies: There is a rapid shift toward personalized treatments using a patient’s own stem cells (autologous therapy) to reduce immune rejection and enhance treatment efficacy. This trend is supported by advancements in genomics and AI, enabling tailored approaches for conditions like neurodegenerative disorders and autoimmune diseases.

- Advancements in Manufacturing and Automation: Stem cell production is becoming more efficient with the integration of automated bioreactors and AI-driven quality control systems. These technologies improve scalability, reduce contamination risks, and help meet stringent regulatory standards, making stem cell therapies more commercially viable.

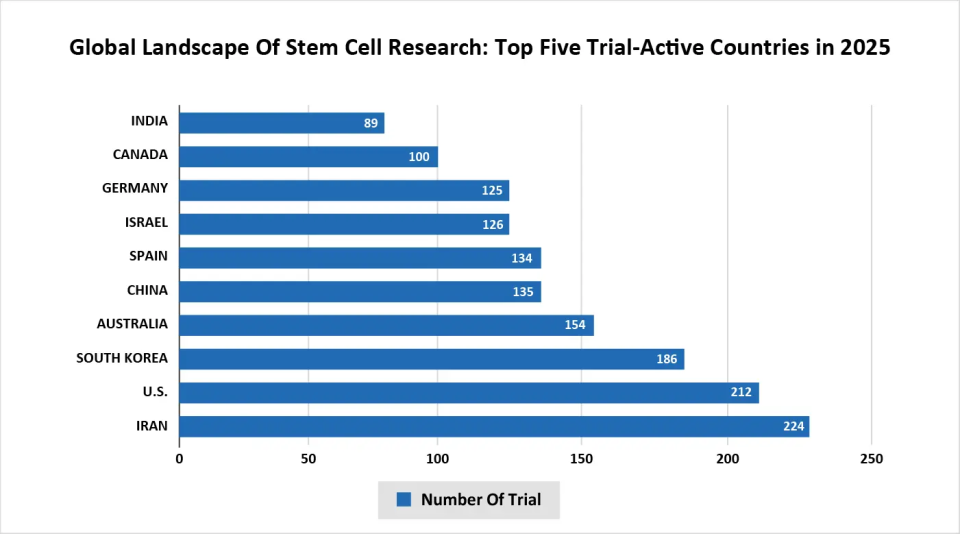

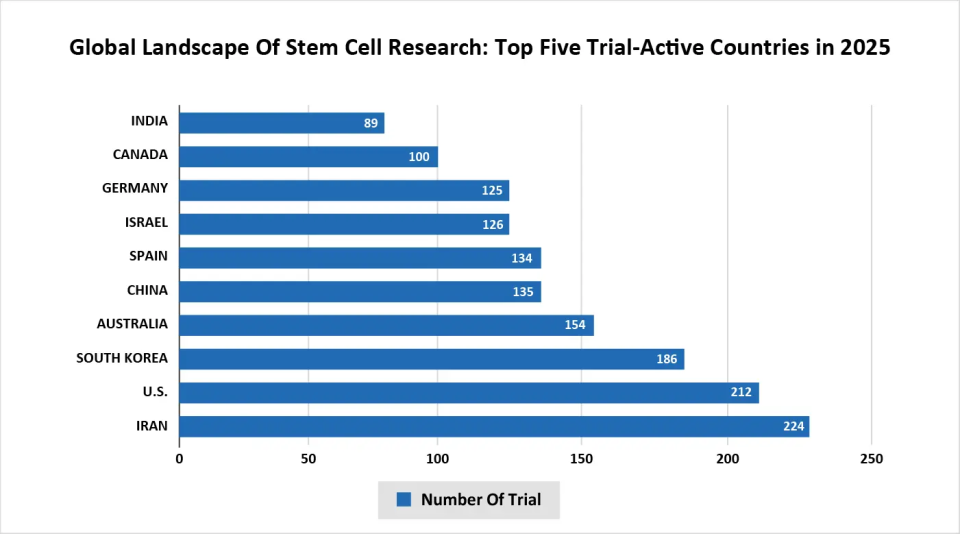

- Expansion of Clinical Trials and Indications: There is a significant increase in the number of clinical trials exploring stem cell therapies across various conditions such as cardiovascular diseases, diabetes, spinal cord injuries, and cancer. This diversification is expanding the potential application areas and accelerating market growth.

Report Scope of Stem Cell Therapy Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 21.12 Billion |

| Market Size by 2034 |

USD 64.84 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 13.27% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Therapy Type, By Application, By End User, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Mesoblast Ltd., Smith+Nephew plc, Cynata Therapeutics , Athersys, Inc. , Lineage Cell Therapeutics, Inc. , MEDIPOST Co., Ltd. , Pluristem Therapeutics Inc. , Fate Therapeutics, Inc. , TiGenix NV (acquired by Takeda) , BrainStorm Cell Therapeutics |

Market Dynamics

Drivers

Increasing Investments in Stem Cell Research

A major factor driving the growth of the market is the increasing investment in stem cell research. Increased funding from governments, private investors, and biopharmaceutical companies is accelerating the development of novel therapies and expanding the pipeline of clinical trials. These investments support advanced technologies, improve manufacturing processes, and enhance understanding of stem cell biology, all of which contribute to more effective and scalable treatments. Additionally, financial backing helps overcome regulatory and commercialization hurdles, bringing therapies to market faster. As a result, increasing stem cell research is fueling innovation and expanding the market's reach across a wide range of medical conditions.

Acceptance of Stem Cell Therapies

The rising acceptance of stem cell therapies is significantly driving the growth of the stem cell therapy market. As clinical evidence of their safety and efficacy grows, both healthcare providers and patients are increasingly embracing these treatments for conditions like orthopedic disorders, neurodegenerative diseases, and autoimmune conditions. This growing trust is leading to wider adoption in mainstream medicine and higher demand for approved therapies. Additionally, media coverage, patient advocacy, and supportive government policies are boosting public awareness and confidence in stem cell-based interventions. This shift in perception is expanding the market and encouraging further investment and innovation.

Restraint

What are the Major Factors Hampering the Growth of the Market?

The growth of the stem cell therapy market is restrained by several key challenges, including high costs, regulatory complexities, and ethical concerns. Developing and manufacturing stem cell therapies require advanced infrastructure, skilled personnel, and strict quality control, making treatments expensive and less accessible to many patients. Regulatory approval processes are often lengthy and vary across countries, slowing the pace of product development and commercialization. Additionally, ethical issues, particularly surrounding embryonic stem cells, continue to spark debate, limiting research and acceptance in certain regions. These concerns also contribute to public skepticism and cautious policymaking, which can hinder funding and clinical adoption.

Opportunities

Expanding Scope of Application

The expanding use of stem cell therapies in cosmetic and aesthetic procedures is creating new growth opportunities in the stem cell therapy market. Stem cells are increasingly being used for skin rejuvenation, hair restoration, anti-aging treatments, and scar repair due to their regenerative properties. These applications are attracting a broader consumer base, including those seeking minimally invasive and natural alternatives to traditional cosmetic procedures. With rising demand for aesthetic enhancements and growing awareness of regenerative solutions, this segment is becoming a lucrative area for clinics and biotech companies. As technologies advance and safety data improves, the cosmetic application of stem cell therapies is expected to further boost market expansion.

Development of Standardized Protocols

The development of standardized protocols for stem cell therapies is creating significant opportunities in the market by improving consistency, safety, and regulatory compliance. Standardization helps streamline clinical processes, reduce variability in treatment outcomes, and build trust among healthcare providers and patients. It also facilitates smoother regulatory approvals and international collaborations by aligning practices across regions. As more uniform guidelines emerge, they lower entry barriers for new players and encourage investment in research and commercialization. Ultimately, standardized protocols support broader adoption of stem cell therapies, accelerating market growth.

- For instance, the International Society for Stem Cell Research (ISSCR) has released updated Guidelines for Stem Cell Research and Clinical Translation, reinforcing ethical, scientific, and regulatory standards for safe and effective therapies. The revised guidelines, developed by a multi-group task force, provide clear principles and recommendations to guide global research and prevent premature commercialization of stem cell treatments.

Segment Outlook

By Product

What Made Adult Stem Cells (ASCs) the Dominant Segment in the Market?

The adult stem cells (ASCs) segment dominated the stem cell therapy market with the largest revenue share in 2024. The dominance of ASCs stems from their strong safety profile, ethical acceptability, and clinical track record. Unlike embryonic stem cells, ASCs do not involve controversial ethical issues, making them widely accepted by regulators and the public. Their use in autologous therapies (from the same patient) significantly reduces the risk of immune rejection, and they have a lower tendency to form tumors compared to pluripotent stem cells. ASCs, especially mesenchymal and hematopoietic stem cells, have already demonstrated effectiveness in treating various conditions, such as blood disorders, orthopedic injuries, and autoimmune diseases. Additionally, they are easier and less invasive to harvest, making them more accessible and cost-effective for therapeutic applications. These combined advantages have driven higher research investment and commercial adoption, solidifying their importance in stem c

The induced pluripotent stem cells (iPSCs) segment is expected to expand at a significant CAGR over the projection period due to their unique ability to differentiate into almost any cell type, offering vast potential for regenerative medicine and personalized therapies. iPSCs are created by reprogramming adult cells, avoiding the ethical concerns associated with embryonic stem cells while retaining similar pluripotent capabilities. This makes them ideal for developing patient-specific treatments, disease models, and drug testing platforms. Advances in gene editing and reprogramming techniques have improved the safety and efficiency of iPSC generation, further driving interest. Additionally, growing investment in research and development, particularly in areas like neurological, cardiovascular, and rare genetic disorders, is accelerating their clinical translation. As a result, iPSCs are emerging as a promising tool for future therapeutic innovations.

By Therapy Type

How Does the Autologous Segment Dominate the Stem Cell Therapy Market in 2024?

The autologous segment dominated the market, holding the largest share in 2024. This is mainly due to its strong advantages in safety, compatibility, and regulatory approval. In autologous therapies, stem cells are derived from the patient’s own body, significantly reducing the risk of immune rejection and eliminating the need for immunosuppressive drugs. This personalized approach also lowers the likelihood of disease transmission and adverse reactions, making it a preferred option in clinical settings. Technological advancements have made it easier to isolate and process autologous stem cells, particularly from sources like bone marrow and adipose tissue. Additionally, autologous treatments often face fewer ethical and regulatory hurdles, speeding up development and commercialization.

The allogenic segment is likely to grow at the highest CAGR in the coming years, owing to its scalability, cost-effectiveness, and potential for mass production. Unlike autologous therapies, allogeneic stem cells are sourced from healthy donors and can be prepared in advance, allowing for off-the-shelf treatments that are readily available when needed. This makes them especially suitable for emergency applications and large-scale clinical use. Advances in cell banking, HLA matching, and immunomodulation are helping to minimize the risks of immune rejection, making allogeneic therapies increasingly viable. Furthermore, their use in treating a wide range of conditions, such as cancers, genetic disorders, and degenerative diseases, is being supported by ongoing clinical trials and rising investment. As demand for standardized, efficient, and widely accessible stem cell therapies grows, the allogeneic segment is poised to play a central role in the future of regenerative medicine.

By Application

Why Did the Regenerative Medicine Segment Contributed Largest Revenue Share in 2024?

The regenerative medicine segment dominated the stem cell therapy market with the largest revenue share in 2024. This is mainly due to its broad and growing range of applications in treating chronic, degenerative, and injury-related conditions. Stem cell therapies have shown promising results in areas such as orthopedics, neurology, cardiology, and wound healing, driving high demand for regenerative treatments. The rising prevalence of conditions like osteoarthritis, spinal cord injuries, and cardiovascular diseases further boosted adoption. Additionally, advancements in stem cell processing, improved clinical outcomes, and increasing patient acceptance have supported widespread use in clinical settings.

The drug discovery & development segment is expected to grow at the fastest CAGR during the forecast period due to the increasing use of stem cells as reliable models for studying disease mechanisms and screening drug candidates. Stem cell-derived human cells offer greater physiological relevance compared to traditional animal models, improving the accuracy of toxicity testing and efficacy evaluation. This enhances the drug development process by reducing failure rates in clinical trials and accelerating timelines. Additionally, advancements in induced pluripotent stem cell (iPSC) technology are enabling personalized drug testing and precision medicine approaches. As pharmaceutical companies seek more predictive tools, stem cell platforms are becoming essential in early-stage research.

By End User

How Does the Hospitals Segment Dominate the Market in 2024?

The hospitals segment dominated the stem cell therapy market in 2024 due to its central role in delivering advanced medical treatments and its access to a large and diverse patient base. Hospitals are typically equipped with the necessary infrastructure, such as stem cell processing units, specialized surgical facilities, and intensive care units, which are essential for administering complex therapies like bone marrow transplants and regenerative procedures. They also house multidisciplinary teams of trained healthcare professionals who can manage stem cell therapy protocols and monitor patients effectively. Moreover, many hospitals are involved in clinical trials and partner with biotech firms, enabling early adoption of cutting-edge stem cell technologies.

The research institutes segment is expected to grow significantly in the upcoming period, driven by rising investments in regenerative medicine, personalized therapies, and advanced cellular technologies. Research institutions are at the forefront of innovation, focusing on the development of novel stem cell treatments, including gene-edited therapies, induced pluripotent stem cells (iPSCs), and disease-specific models. Increased funding from government bodies, private organizations, and global health initiatives is accelerating research activities and clinical translation. Moreover, growing collaborations between academia and biotech companies are helping to bridge the gap between laboratory research and commercial application. These institutes also play a key role in conducting early-phase clinical trials and validating the safety and efficacy of emerging therapies.

By Regional Insights

What Made North America the Dominant Region in the Stem Cell Therapy Market?

North America dominated the stem cell therapy market while holding the largest share in 2024 due to its advanced healthcare infrastructure, strong research capabilities, and supportive regulatory environment. The region benefits from significant government and private sector investments in regenerative medicine, fueling innovation and the development of new therapies. The presence of leading biotechnology and pharmaceutical companies, along with world-class academic and clinical research institutions, further drives progress in stem cell research and commercialization. Additionally, favorable policies by regulatory bodies like the FDA have encouraged clinical trials and accelerated approvals for stem cell-based treatments.

The U.S. is leading the North America stem cell therapy market due to its robust research ecosystem, significant funding in regenerative medicine, and a highly developed healthcare infrastructure. It hosts numerous biotech firms, academic institutions, and clinical centers actively engaged in stem cell research and therapy development. The U.S. Food and Drug Administration (FDA) also plays a crucial role by providing clear regulatory pathways, which encourages innovation and clinical adoption. Additionally, strong investor interest and a high rate of patient acceptance for advanced treatments contribute to the country's leadership in this space.

What Makes Asia Pacific the Fastest-Growing Market for Stem Cell Therapy?

Asia Pacific is the fastest-growing market due to rising healthcare investments, expanding research infrastructure, and supportive government initiatives. Countries like China, Japan, South Korea, and India are heavily investing in regenerative medicine and stem cell research, accelerating clinical trials and therapy development. The region also benefits from a large patient population, increasing demand for advanced treatments, and growing awareness of stem cell therapies. Additionally, more flexible regulatory frameworks in some countries are allowing faster approval and commercialization of therapies. This dynamic environment is attracting global collaborations and making Asia Pacific a key hub for innovation and growth in stem cell therapy.

In March 2025, the Government of India has disbanded the National Apex Committee for Stem Cell Research and Therapy (NAC-SCRT), following expert and public consultations. This marks a major shift in the regulatory framework, with Institutional Ethics Committees now responsible for reviewing stem cell research, including two stem cell experts. While the move aims to streamline oversight and reduce compliance burdens, it raises questions about which agency will take over NAC-SCRT’s former roles in setting standards and guiding national research.

Stem Cell Therapy Market Value Chain Analysis

1. Stem Cell Sourcing & Cell Line Development

This is the foundation of all stem cell therapies. The type (e.g., embryonic, mesenchymal, hematopoietic, induced pluripotent) and quality of sourced stem cells directly affect safety, efficacy, and therapeutic applicability.

Key Functions:

- Procurement from tissues (e.g., bone marrow, placenta, umbilical cord)

- Generation of cell lines (e.g., iPSCs, ESCs)

- Banking and cryopreservation

2. Development of Reagents, Culture Media & Consumables

High-quality reagents and media are vital to ensure cell viability, proliferation, and differentiation. These inputs define the reproducibility and scalability of the therapy.

Key Functions:

- Growth media, sera, cytokines, buffers

- Single-use cultureware and cryoprotectants

- Sterile consumables for cleanroom use

3. Cryopreservation, Storage & Logistics

To maintain cell viability and therapeutic function, stem cells must be stored and transported under stringent temperature-controlled conditions. This stage is vital for product integrity and global distribution.

Key Functions:

- Cryogenic freezing and controlled-rate thawing

- Cold chain logistics

4. Quality Control

Stem cell therapies fall under stringent regulatory frameworks (e.g., FDA, EMA, PMDA). Meeting quality and documentation standards ensures therapy approval and patient safety.

Key Functions:

- Quality assurance and sterility testing

- Regulatory dossier preparation (IND, BLA, etc.)

- GMP inspections and compliance audits

5. Clinical Trials & Therapeutic Delivery

Clinical development validates the efficacy and safety of stem cell therapies. This stage is crucial for commercial approval and clinical adoption.

Key Functions:

- Clinical trial design and management

- Patient recruitment and dosing

- Post-treatment monitoring and reporting

6. End-User Integration & Commercialization

After regulatory approval, therapies must be integrated into hospitals, clinics, and specialized treatment centers. Commercial logistics, physician training, and post-market surveillance occur here.

Key Functions:

- Distribution to treatment centers

- Physician training and support

- Market access and reimbursement

Competitive Landscape

1. Mesoblast Ltd.

A global leader in allogeneic (off-the-shelf) adult stem cell therapies, Mesoblast develops treatments for inflammatory diseases, cardiovascular conditions, and spine disorders. Their lead products are in late-stage clinical trials or approved in certain markets.

2. Vericel Corporation

Vericel commercializes autologous stem cell-based therapies such as MACI® for cartilage repair and Epicel® for burn treatment, making them a key provider of FDA-approved regenerative treatments in the U.S.

3. Pluristem Therapeutics

It specializes in placenta-derived allogeneic stem cell therapies using a 3D expansion platform, targeting indications like ischemia, inflammation, and musculoskeletal injuries.

4. Athersys Inc.

It is a developer of MultiStem®, an allogeneic stem cell product platform for treatment of neurological, cardiovascular, and inflammatory conditions. The company is active in global clinical trials, including for stroke and ARDS.

5. BrainStorm Cell Therapeutics

Focused on neurodegenerative diseases, BrainStorm is developing NurOwn®, an autologous MSC-NTF cell therapy targeting ALS, with promising clinical trial results.

6. Caladrius Biosciences (now part of Lisata Therapeutics)

The company develops personalized stem cell therapies for cardiovascular diseases and autoimmune disorders, including late-stage clinical programs in refractory angina and critical limb ischemia.

7. Cynata Therapeutics

It pioneers the use of induced pluripotent stem cells (iPSCs) to create mesenchymal stem cell (MSC) therapies, offering a scalable, off-the-shelf solution for various inflammatory and immune diseases.

8. BlueRock Therapeutics (subsidiary of Bayer AG)

It develops iPSC-based allogeneic cell therapies for degenerative diseases like Parkinson’s and heart failure, leveraging stem cell engineering and scalable manufacturing platforms.

9. MEDIPOST Co., Ltd.

It is one of Asia's leading stem cell therapy companies, known for Cartistem®, an approved stem cell treatment for knee cartilage defects and osteoarthritis.

10. Anterogen Co., Ltd.

The company focuses on adipose-derived stem cell therapies, with approved products in Asia for conditions like Crohn’s disease-associated fistulas and soft tissue defects.

11. Gamida Cell

It develops NAM-expanded stem cell therapies, such as Omisirge®, which has received FDA approval for patients undergoing stem cell transplantation.

12. CORESTEM

It specializes in stem cell therapies for neurodegenerative diseases, including the world’s first approved stem cell therapy for ALS, Neuronata-R®.

Stem Cell Therapy Market Companies

- Mesoblast Ltd.

- Smith+Nephew plc

- Cynata Therapeutics

- Athersys, Inc.

- Lineage Cell Therapeutics, Inc.

- MEDIPOST Co., Ltd.

- Pluristem Therapeutics Inc.

- Fate Therapeutics, Inc.

- TiGenix NV (acquired by Takeda)

- BrainStorm Cell Therapeutics

Recent Developments

- In July 2024, Bioserve India has launched advanced stem cell products from REPROCELL in the Indian market, aiming to boost innovation in research, drug development, and regenerative medicine. This launch supports the growing demand in India's rapidly expanding stem cell industry, which spans R&D, manufacturing, and therapy distribution.

- In December 2024, the FDA approved Ryoncil (remestemcel-L-rknd), the first allogeneic mesenchymal stromal cell (MSC) therapy for treating steroid-refractory acute graft-versus-host disease (SR-aGVHD) in pediatric patients aged 2 months and older. Ryoncil contains MSCs derived from healthy adult donor bone marrow, known for their ability to differentiate and support various bodily functions.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Stem Cell Therapy Market.

By Product

-

- Hematopoietic

- Mesenchymal

- Neural

- Epithelial/Skin

- Others

- Human Embryonic Stem Cells (HESCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Very Small Embryonic Like Stem Cells

By Therapy Type

By Application

-

- Neurology

- Orthopedics

- Oncology

- Hematology

- Cardiovascular and Myocardial Infraction

- Injuries

- Diabetes

- Liver Disorder

- Incontinence

- Others

- Drug Discovery & Development

By End User

- Hospitals

- Research Institutes

- surgical Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)