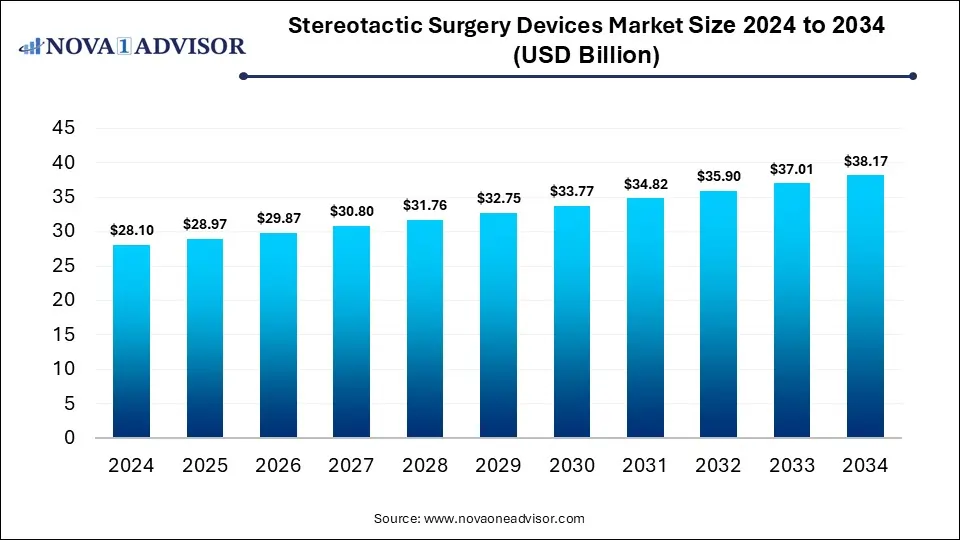

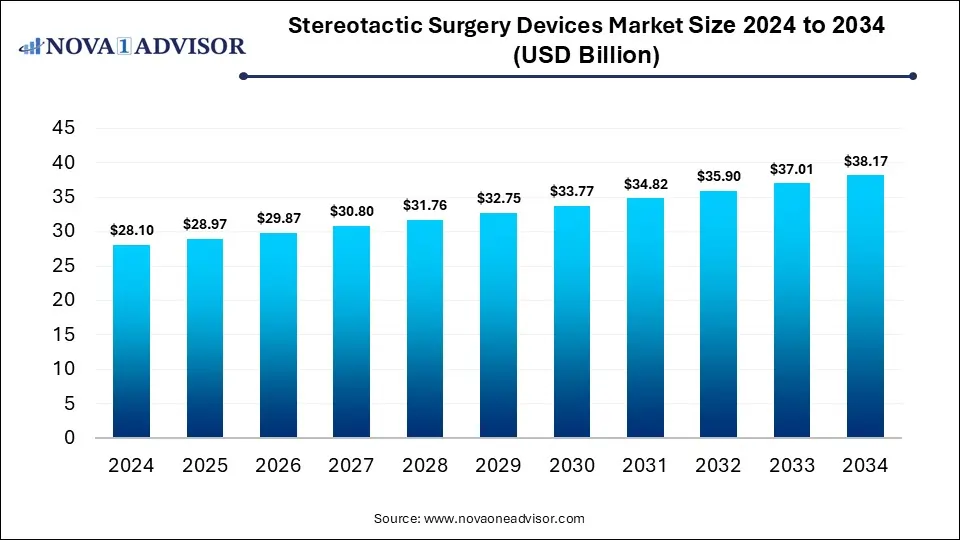

Stereotactic Surgery Devices Market Size and Growth 2025 to 2034

The global stereotactic surgery devices market size is calculated at USD 28.10 billion in 2024, grows to USD 28.97 billion in 2025, and is projected to reach around USD 38.17 billion by 2034, growing at a CAGR of 3.11% from 2025 to 2034. The market is growing due to the rising prevalence of neurological disorders and cancers requiring minimally invasive treatment. Advancements in imaging technologies and precision-driven surgical systems further accelerate adoption worldwide.

Stereotactic Surgery Devices Market Key Takeaways

- North America dominated the stereotactic surgery devices market with a revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the PBRT segment led the market with the largest revenue share in 2024.

- By product, the CyberKnife segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the breast segment held the largest market share in 2024.

- By application, the lung segment is expected to grow at the fastest CAGR in the market during the forecast period.

What is Stereotactic Surgery Devices Systems?

Stereotactic surgery devices are minimally invasive medical technology that uses 3D imaging and precision coordinates to accurately target and treat specific areas in the brain or body. The stereotactic surgery devices market is expanding due to the rising geriatric population prone to brain prone tobrain disorders, along with growing healthcare expenditure worldwide. Increased government support for advanced neurosurgical procedures and the integration of robotics and AI into surgical systems are enhancing accuracy and efficiency. Furthermore, expanding clinical applications beyond neurology, such as oncology and ENT, are broadening usage. Strategic collaboration between medical device companies and hospitals is also boosting accessibility and adoption of stereotactic surgery systems.

What are the Key trends in the Stereotactic Surgery Devices Market in 2024?

- In December 2024, Accuray Incorporated reported study findings in the International Journal of Cancer showing that its CyberKnife® System is both safe and effective for treating brainstem metastases with SRS and FSRT, delivering strong local control and expanding treatment choices. (Source: https://investors.accuray.com/)

- In January 2024, the FDA cleared ClearPoint Neuro’s SmartFrame OR Stereotactic System, designed to assist in neurosurgeries like biopsies, catheter placement, and electrode delivery. Unlike MRI-dependent systems, it uses preoperative CT/MR imaging, improving accessibility. A limited launch began early 2024, with full rollout planned later in the year. (Source: https://www.accessdata.fda.gov/)

How Can AI Affect the Stereotactic Surgery Devices Market?

AI is influencing the market by streamlining workflow automation, reducing surgeon fatigue, and enabling faster decision-making through predictive analytics. It also supports remote surgical guidance and training, making advanced procedures more accessible in regions with limited specialists. Moreover, AI-based quality control improves device reliability and maintenance efficiency. These advancements not only lower healthcare costs but also expand the reach of stereotactic procedures, fostering broader adoption and long-term market growth.

Report Scope of Stereotactic Surgery Devices Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 28.97 Billion |

| Market Size by 2034 |

USD 38.17 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 3.11% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Koninklijke Philips N.V.; Hitachi Medical Systems; Huiheng Group; Siemens Ag; Elekta AB; Varian Medical Systems; IBA; Accuray Incorporated |

Market Dynamics

Driver

Rising Prevalence of Neurological Disorders and Cancer

The increasing of neurological disorders and cancers drives the stereotactic surgery devices market by creating a higher need for advanced treatment option that improves survival and quality of life. As traditional surgeries carry higher risks and longer recovery times, clinicians increasingly prefer sterostatic systems for their precision and reduced invasiveness. This trend, coupled with growth awareness of early diagnosis and intervention, is fueling demand for innovative devices that can effectively manage complex brain and tumor conditions.

- For Instance, In April 2024, a Phase II clinical trial initiated by the National Cancer Institute explored the combination of stereotactic radiosurgery (SRS) and the immunotherapy drug pembrolizumab for treating recurrent meningiomas. This trial underscores the growing interest in integrating stereotactic surgery with advanced therapies to enhance treatment outcomes for patients with complex neurological conditions. (Source: https://www.clinicaltrials.gov/)

Restraint

High Device and Procedure Costs

The high cost of stereotactic surgery devices limits market growth by restricting their availability to well-funded hospitals and specialized centres. Smaller clinics and healthcare facilities often cannot afford these sophisticated systems, reducing patient access. Furthermore, expensive maintenance, software updates, and staff training add to the overall financial burden. As a result, hospitals may delay or avoid adopting these devices, slowing the expansion of the market despite increasing demand for minimally invasive, precision-based surgical solutions.

Opportunity

Developing multi-functional and portable systems

Developing multi-functional and portable stereotactic systems offers future opportunities by increasing flexibility and reducing dependency on large, specialized operating rooms. These systems can be easily deployed across multiple hospitals or clinics, enabling more patients to access advanced surgical care. They also support faster procedure setup, lower operational costs, and improved scalability for healthcare providers. As demand grows for minimally invasive and precise surgeries in diverse clinical settings, such versatile devices are positioned to expand market penetration and drive long-term growth.

Segmental Insights

What made the PBRT Segment Dominant in the Stereotactic Surgery Devices Market in 2024?

The PBRT segment dominated the market in 2024 because it offers advanced, non-invasive treatment options that reduce side effects and improve patient outcomes. Hospitals and cancer centers prefer PBRT systems for their ability to treat hard-to-reach tumors with high accuracy. Rising investment in PBRT infrastructure, technological upgrades, and increasing patient preference for safer, precision-based therapies have further fueled adoption, making this segment the leading revenue contributor in the stereotactic surgery devices market.

The CyberKnife segment is projected to grow rapidly due to its flexibility in treating a wide range of tumor types, including those in complex or sensitive locations. Its outpatient-friendly design, shorter recovery times, and reduced need for anesthesia make it attractive to both patients and healthcare providers. Additionally, expanding clinical evidence supporting its effectiveness, along with increasing installations in emerging markets, is boosting adoption, making CyberKnife one of the fastest-growing segments in the stereotactic surgery devices market.

Stereotactic Surgery Devices Market By Product, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Gamma Knife |

5.06 |

5.19 |

5.32 |

5.45 |

5.59 |

5.73 |

5.88 |

6.02 |

6.18 |

6.33 |

6.49 |

| LINAC |

15.46 |

15.83 |

16.22 |

16.62 |

17.02 |

17.44 |

17.86 |

18.30 |

18.74 |

19.19 |

19.66 |

| PBRT |

2.81 |

2.97 |

3.14 |

3.31 |

3.49 |

3.68 |

3.88 |

4.09 |

4.31 |

4.54 |

4.77 |

| CyberKnife |

4.78 |

4.98 |

5.20 |

5.42 |

5.65 |

5.90 |

6.15 |

6.41 |

6.68 |

6.96 |

7.25 |

How did Breast Dominate the Stereotactic Surgery Devices Market in 2024?

The Breast segment dominated in 2024 due to growing investments in advanced breast care centers and rising demand for minimally invasive diagnostic and treatment procedures. Technologies like stereotactic-guided biopsies and focused therapies enable quicker, more accurate interventions, reducing complications and recovery time. Increasing patient preference for less invasive procedures, coupled with expanding insurance coverage for breast-related surgeries, has further accelerated the adoption of stereotactic devices in this application, making the breast segment the largest contributor to market revenue.

The Lung segment is projected to grow rapidly due to the increasing use of stereotactic devices for treating small, hard-to-reach lung tumors with high precision. Rising demand for outpatient-friendly procedures, shorter recovery times, and reduced complications is boosting adoption. Additionally, advancements in navigation systems and image-guided technologies for lung interventions, along with expanding awareness of non-invasive treatment benefits, are fueling growth, making the lung application segment the fastest-growing in the stereotactic surgery devices market during the forecast period.

Stereotactic Surgery Devices Market By Application, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Liver |

4.50 |

4.67 |

4.84 |

5.02 |

5.21 |

5.40 |

5.61 |

5.82 |

6.03 |

6.26 |

6.49 |

| Breast |

4.22 |

4.34 |

4.47 |

4.60 |

4.74 |

4.88 |

5.03 |

5.17 |

5.33 |

5.49 |

5.65 |

| Prostate |

5.06 |

5.20 |

5.35 |

5.50 |

5.65 |

5.81 |

5.98 |

6.15 |

6.32 |

6.50 |

6.68 |

| Lung |

6.74 |

6.93 |

7.11 |

7.30 |

7.50 |

7.70 |

7.90 |

8.11 |

8.33 |

8.55 |

8.78 |

| Colon |

3.37 |

3.47 |

3.57 |

3.67 |

3.77 |

3.88 |

3.99 |

4.11 |

4.22 |

4.34 |

4.47 |

| Others |

4.22 |

4.38 |

4.54 |

4.71 |

4.89 |

5.08 |

5.27 |

5.47 |

5.67 |

5.89 |

6.11 |

Regional Insights

How is North America contributing to the Expansion of the Stereotactic Surgery Devices Market?

North America led the market in 2024 because of early adoption of innovative surgical technologies and a high concentration of specialized hospitals and cancer treatment centers. Government support for advanced healthcare solutions, coupled with ongoing clinical trials and collaborations between device manufacturers and medical institutions, has accelerated deployment. Moreover, growing patient preference for minimally invasive procedures and precision therapies, along with easy access to cutting-edge imaging and robotic systems, reinforced the region’s dominance in market revenue.

How is Asia-Pacific Accelerating the Stereotactic Surgery Devices Market?

Asia-Pacific is projected to witness the fastest growth due to increasing medical tourism, rising disposable incomes, and a growing middle-class population seeking advanced healthcare. The region is also seeing rapid adoption of modern imaging and robotic-assisted stereotactic systems in tier-1 and tier-2 cities. Expanding clinical research collaborations, local manufacturing of medical devices, and government initiatives to improve cancer and neurological care infrastructure further accelerate market expansion, positioning Asia-Pacific as the fastest-growing region in the stereotactic surgery devices market.

Stereotactic Surgery Devices Market By Regional, 2024-2034 (USD Billion)

| Year |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

10.12 |

10.37 |

10.64 |

10.91 |

11.18 |

11.46 |

11.75 |

12.05 |

12.35 |

12.66 |

12.98 |

| Europe |

7.87 |

8.08 |

8.31 |

8.53 |

8.77 |

9.01 |

9.25 |

9.51 |

9.77 |

10.03 |

10.31 |

| Asia Pacific |

7.59 |

7.90 |

8.22 |

8.55 |

8.89 |

9.25 |

9.62 |

10.01 |

10.41 |

10.83 |

11.26 |

| Latin America |

1.41 |

1.46 |

1.51 |

1.57 |

1.63 |

1.69 |

1.75 |

1.81 |

1.88 |

1.95 |

2.02 |

| Middle East and Africa (MEA) |

1.12 |

1.17 |

1.21 |

1.25 |

1.30 |

1.34 |

1.39 |

1.44 |

1.49 |

1.55 |

1.60 |

Top Companies in the Stereotactic Surgery Devices Market

Recent Developments in the Stereotactic Surgery Devices Market

- In July 2024, Apollo Cancer Centres teamed up with Accuray to launch the Indian subcontinent’s first robotic stereotactic radiotherapy program, providing precise, non-invasive cancer treatment using advanced technology. (Source: https://www.prnewswire.com/)

- In May 2024, Elekta launched its Evo CT-Linac, featuring high-definition AI-enhanced imaging for both offline and online adaptive radiation therapy, as well as improved image-guided treatments. Introduced at ESTRO 2024 in Glasgow, the system allows clinicians to select the most suitable radiation technique for each patient. Elekta’s CEO highlighted that Evo represents a step forward in delivering precise, personalized, and effective cancer care, reinforcing the company’s commitment to innovation in radiation oncology. (Source: https://ir.elekta.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the stereotactic surgery devices market.

By Product

- Gamma Knife

- LINAC

- PBRT

- CyberKnife

By Application

- Liver

- Breast

- Prostate

- Lung

- Colon

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

List of Tables

1. Global and Regional Market Overview

- Global Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Regional Market Share, 2024 (%)

- Regional Market Forecast, 2024–2034 (USD Billion)

2. Country-Level Market Estimates

- North America Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- U.S. Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Canada Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Mexico Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Europe Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Germany Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- France Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- U.K. Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Italy Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Spain Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Asia Pacific Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- China Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Japan Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- South Korea Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- India Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Southeast Asia Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Latin America Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Brazil Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Middle East & Africa Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- GCC Countries Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Turkey Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

- Africa Stereotactic Surgery Devices Market Size, 2024–2034 (USD Billion)

3. Market Segmentation by Product

- Global Market by Product, 2024–2034 (USD Billion)

- Gamma Knife Market by Region and Country, 2024–2034 (USD Billion)

- LINAC Market by Region and Country, 2024–2034 (USD Billion)

- PBRT Market by Region and Country, 2024–2034 (USD Billion)

- CyberKnife Market by Region and Country, 2024–2034 (USD Billion)

4. Market Segmentation by Application

- Global Market by Application, 2024–2034 (USD Billion)

- Liver Application Market by Region and Country, 2024–2034 (USD Billion)

- Breast Application Market by Region and Country, 2024–2034 (USD Billion)

- Prostate Application Market by Region and Country, 2024–2034 (USD Billion)

- Lung Application Market by Region and Country, 2024–2034 (USD Billion)

- Colon Application Market by Region and Country, 2024–2034 (USD Billion)

- Other Applications Market by Region and Country, 2024–2034 (USD Billion)

5. Competitive Landscape

- Company Market Share Analysis, 2024 (%)

- Key Developments by Leading Players, 2022–2025

- Revenue Comparison of Top 10 Players, 2022–2024 (USD Billion)

- Global Stereotactic Surgery Devices Market Snapshot, 2024 vs. 2033

- Market Dynamics: Drivers, Restraints, Opportunities, and Trends

- Porter’s Five Forces Analysis of the Market

- Value Chain Analysis of Stereotactic Surgery Devices

- Global Market Share by Product, 2024 (%)

- Global Market Share by Application, 2024 (%)

- Regional Market Share, 2024 (%)

- U.S. Market Share by Product, 2024 (%)

- Europe Market Share by Product, 2024 (%)

- Asia Pacific Market Share by Product, 2024 (%)

- Product Comparison by Technology Type (Gamma Knife, LINAC, PBRT, CyberKnife)

- Country-Level Growth Comparison, 2024–2034 (%)

- Revenue Forecast by Application Segment, 2024–2034

- Competitive Landscape Map – Key Players by Product Offering

- Investment and Partnership Analysis in Stereotactic Surgery Devices Market