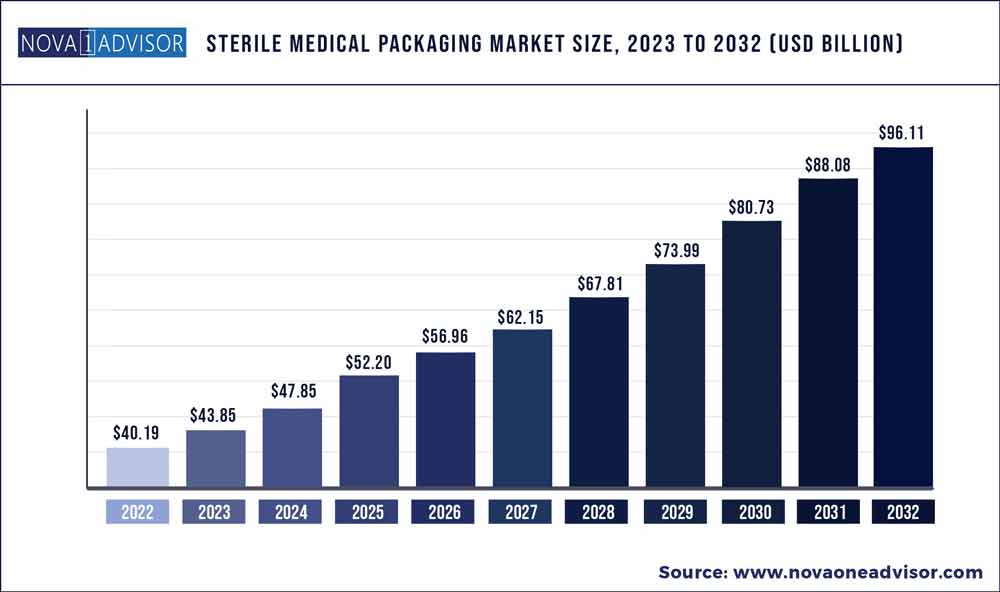

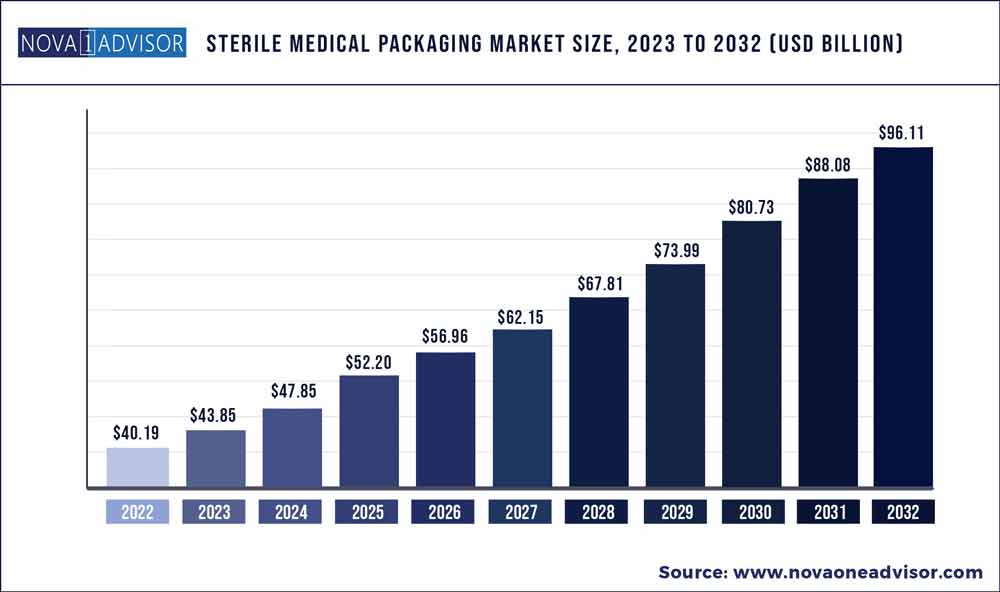

The global sterile medical packaging market size was exhibited at USD 40.19 billion in 2022 and is projected to hit around USD 96.11 billion by 2032, growing at a CAGR of 9.11% during the forecast period 2023 to 2032.

Key Pointers:

- North America accounted for the largest share and is expected to witness the highest growth during the forecast period.

- Based on application, the pharmaceutical biological application is projected to lead the sterile medical packaging market.

- Based on type, the thermoform trays segment is projected to record the highest CAGR.

- The plastic sterile medical packaging segment is expected to lead the sterile medical packaging market.

Sterilization is an important processing step performed in the healthcare industry. Hence, the usage of sterile packaging products or sterile barrier systems has gained significant importance in this industry. Sterile medical packaging is a non-reusable packaging material that acts as a barrier against microbial transmission. Most of these packaging, such as wraps, pouches, and containers, are designed to prevent medical products from the external environment and unintended transmission of infections. Furthermore, these sterile barrier systems maintain product sterility from the point of packaging and sterilization until the time of use. They offer beneficial properties such as tear resistance, durability, breathability, and a superior microbial barrier to keep the pharmaceuticals and medical equipment sterile throughout their lifecycle. These properties would surge the demand for such packaging in various applications ranging from in-vitro diagnostic products to surgical & medical instruments.

Sterile Medical Packaging Market Report Scope

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 43.85 Billion

|

|

Market Size by 2032

|

USD 96.11 Billion

|

|

Growth Rate From 2023 to 2032

|

CAGR of 9.11%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Packaging Type, By Material, By Sterilization Method and By Application

|

|

Market Analysis (Terms Used)

|

Value (US$ Million/Billion) or (Volume/Units)

|

|

Regional Scope

|

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa

|

|

Key Companies Profiled

|

Amcor Plc, Placon, DuPont, Steripack Ltd., Wipak Group, Nelipak Healthcare, Tekni-Plex, Sonoco, BillerudKorsnäs AB, ProAmpac, West Pharmaceutical Services, Inc., Riverside Medical Packaging Company Ltd, Oliver Healthcare Packaging, GS Medical Packaging, Orchid, Technipaq Inc. and Others.

|

COVID-19 Impact on the Sterile Medical Packaging Market

The recent outbreak of COVID-19 and its rapid spread across the world has led to economic disruption. The increasing outbreak of various infectious and communicable diseases and viruses such as COVID-19, flu, tuberculosis, and SARS has led to improved hygiene in medical devices intending to prevent any contamination or spread of disease in patients. This leads to an increase in the demand for sterile medical packaging. The demand for medical supplies, masks, devices, syringes, etc. is rising, leading to an increased demand for their primary and secondary packaging.

Sterile Medical Packaging Market Dynamics

Driver: High consumption rate of sterile medical packaging in healthcare and pharmaceutical industries

The sterile medical packaging market is witnessing growing demand from the healthcare industry. The use of plastics and paper & paperboard offers advantages, such as low weight, recyclability, and longevity. Sterile medical packaging also helps protect from damage caused by environmental conditions, such as moisture during transit, leading to a rise in demand from the medical sector. Properties such as microbial barrier make sterile medical packaging the perfect choice in the healthcare industry where it is used for the packaging of medical devices and pharmaceutical products.

The sterile medical packaging market has a positive outlook due to increasing health awareness and growing concerns for infection control. It is convenient to handle sterile medical packaging products, which drive its demand. The rising consumer income level will move consumer preference toward increased spending on healthcare services, which in turn will support the growth of sterilized medical packaging products. These products require sterile packaging to withstand moisture and other environmental influences that may affect pharmaceutical products.

The aging population around the world is increasing, leading to health issues, which require assistance from the medical sector, driving the demand for sterile medical packaging. Diseases, such as diabetes and high blood pressure are common among the aging population. To offer better living, the healthcare industry advances technology, which requires sterile medical packaging to prevent further infection, which may lead to deterioration of consumer health.

Restraint: Stringent regulations

Stringent regulations regarding specifications and materials used by manufacturers in packaging are expected to restrain market growth. Compliance with regulations is necessary as the smallest defect in the packaging may contaminate the product and ultimately risk the life of a patient. It will also negatively impact the manufacturer’s profit. Healthcare packaging requires control over moisture, light barriers, and childproofing. The packaging used for health care products and devices helps in creating a sterile barrier for the device and protects its functionality. However, the technical process required for such packaging is tedious and time-consuming. The FDA has several standards for sterilization validation, such as for radiation validation, consensus standard ISO 11138. Complying with such standards requires specialized skills, time, resources, and money, which restrains the growth of sterile medical packaging. Gaps in quality and process failures can lead to the deterioration of a patient’s health and drug shortages, ultimately affecting public health.

Opportunities: Developing new sustainable packaging options

Industry changes, such as the introduction of new regulatory initiatives and the rising cost of healthcare, have encouraged manufacturers to develop new packaging options. Moreover, growing concerns regarding the use of plastic for the packaging of medical products and its impact on human health and the environment have also driven manufacturers to develop sustainable packaging options that are safe and secure. In order to reduce the cost pressure and at the same time maintain the integrity of product packages, manufacturers are considering sustainable packaging solutions that require less material and energy to manufacture a package, reduce transportation costs, and offer extended shelf life to the product.

For instance, in November 2019, Amcor invested over USD 11 million in the all-new multi-layer cast extrusion technology that produces a film of up to 11-layers to create safe, durable, and cost-efficient medical device packaging. This technology supports medical device customers to meet ever-increasing regulatory demands, make important material cost savings, and continue to ensure the sterility of their devices at the point of use.

Challenges: Maintaining medical packaging integrity

Testing of medical packaging is done to determine the sterility of products and their shelf life. A microbial barrier for medical products is essential during the entire value chain. Maintaining the integrity of the medical package during storage, handling, and distribution becomes a challenge for manufacturers. Maintaining device sterility is critical to protect the patient and prevent the transmission of disease. The efficacy of sterile medical packaging is also evaluated after its exposure to environmental conditions, posing a challenge for suppliers. Integrity of sterile packaging is generally caused due to damage or vibrations during transportation and storage.

Factors, such as humidity and aging may compromise the package integrity of the product. Hence, manufacturers are responsible for assigning an accurate shelf life to the product and ensure that the packaging material chosen is appropriate for the intended sterilization method, storage, transportation, and end-use. Maintaining the integrity of sterile medical packaging in such conditions and remaining affordable at the same time has become a challenge for manufacturers.

The pharmaceutical & biological segment is expected to lead the sterile medical packaging market during the forecast period.

Based on application, the pharmaceutical biological application is projected to lead the sterile medical packaging market. The growth of this segment can be attributed to the growing healthcare industry and the advent of new healthcare medicines. Technological advancements have optimized and integrated the sterile packaging process of pharmaceutical products and made it more capital-intensive. This process reduces the risk of contamination. The processing and packaging of pharmaceutical & biological products goes through various inspections, quality checks and ensures that they adhere to regulatory compliances about the drug contents and the material used in packaging.

The thermoform trays segment is expected to lead the sterile medical packaging market during the forecast period.

Based on type, the thermoform trays segment is projected to record the highest CAGR. These are versatile and easy to transport because of their low weight. Thermoformed trays are manufactured from plastics, come in a wide variety of shapes and sizes, and are equipped for internal use. Plastic trays have a highly versatile style of packaging design as the plastics used for trays can be molded to form different shapes by the thermoforming process. This versatility makes them advantageous for everything. Semi-rigid and flexible are two types of thermoform trays used in the healthcare industry.

The plastic segment is expected to account for the largest share of the sterile medical packaging market during the forecast period

The plastic sterile medical packaging segment is expected to lead the sterile medical packaging market. this growth can be attributed to its high consumption and increasing demand from end-users. Plastic polymers, such as HDPE, polyester, and polypropylene are used extensively in the manufacturing of bottles, vials & ampoules, and pre-filled syringes in the sterile medical packaging market.

North America is projected to be the largest consumer of the sterile medical packaging market

Based on the region, the sterile medical packaging market is segmented into Asia Pacific, the Middle East & Africa, North America, Europe, and South America. Among these, North America accounted for the largest share and is expected to witness the highest growth during the forecast period. This growth can be attributed to multiple regulations that are imposed by the FDA, which, in turn, is driving the demand for sustainable and high-quality products in this region. Moreover, owing to the presence of many major players and stringent FDA regulations, the market has become very competitive in the region.

Some of the prominent players in the Sterile Medical Packaging Market include:

- Amcor Plc

- Placon

- DuPont

- Steripack Ltd.

- Wipak Group

- Nelipak Healthcare

- Tekni-Plex

- Sonoco

- BillerudKorsnäs AB

- ProAmpac

- West Pharmaceutical Services, Inc.

- Riverside Medical Packaging Company Ltd

- Oliver Healthcare Packaging

- GS Medical Packaging

- Orchid

- Technipaq Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Sterile Medical Packaging market.

By Packaging Type

- Electrical & Electronics

- Transportation

- Medical

- Chemical

- Others

By Material

- Plastics

- Glass

- Metal

- Paper & Paperboard

- Others

By Sterilization Method

- Chemical Sterilization

- Ethylene Oxide (ETO)

- Hydrogen Peroxide

- Others

- Radiation Sterilization

- Gamma Radiation

- E-beam

- Others

- High Temperature/Pressure Sterilization

- Steam Autoclave

- Dry Heat

By Application

- Pharmaceutical & Biological

- Surgical & Medical Instruments

- In Vitro Diagnostic Products

- Medical Implants

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)