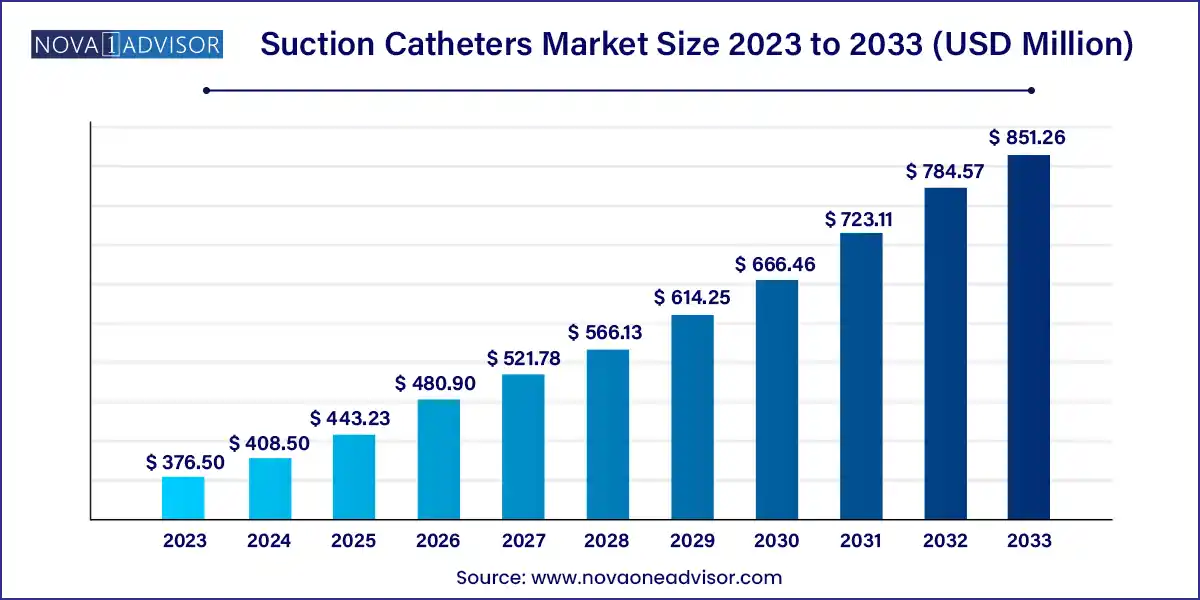

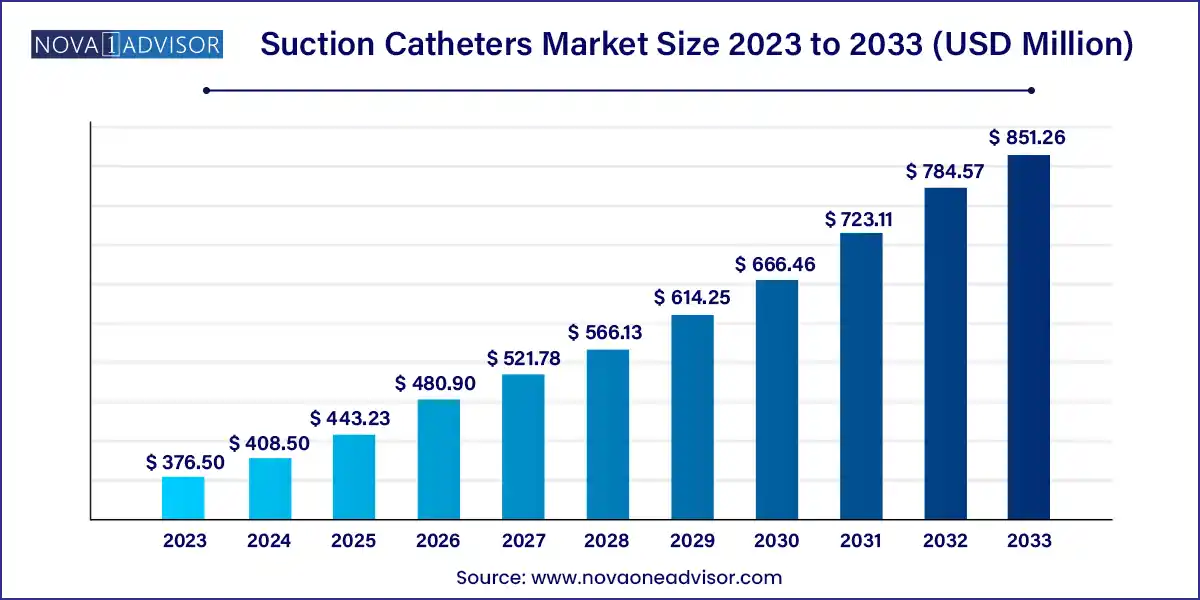

The global suction catheters market size was exhibited at USD 376.50 million in 2023 and is projected to hit around USD 851.26 million by 2033, growing at a CAGR of 8.5% during the forecast period 2024 to 2033.

Key Takeaways:

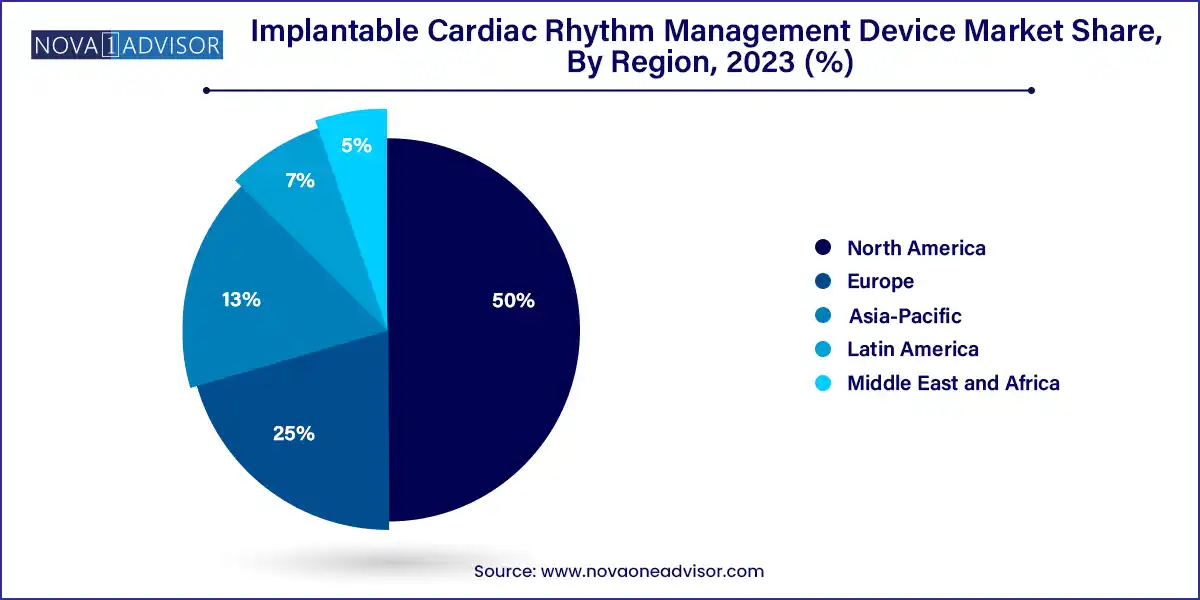

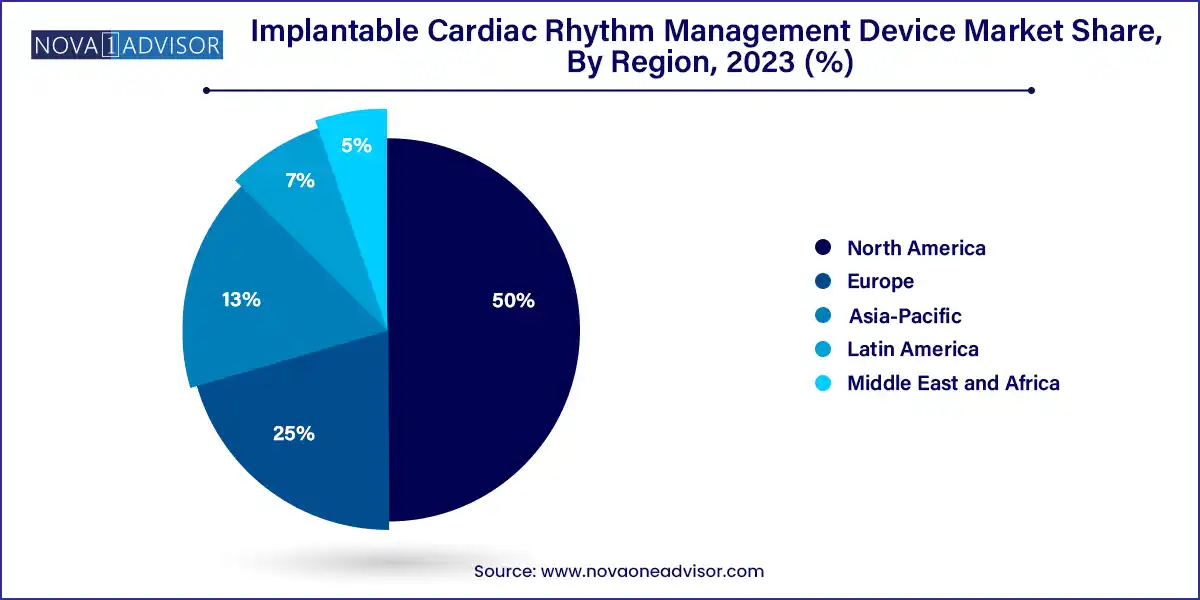

- North America dominated the suction catheters market and held a revenue share of 50.0% in 2023.

- The closed suction catheter segment dominated the market and accounted for a revenue share of 73.0% in 2023.

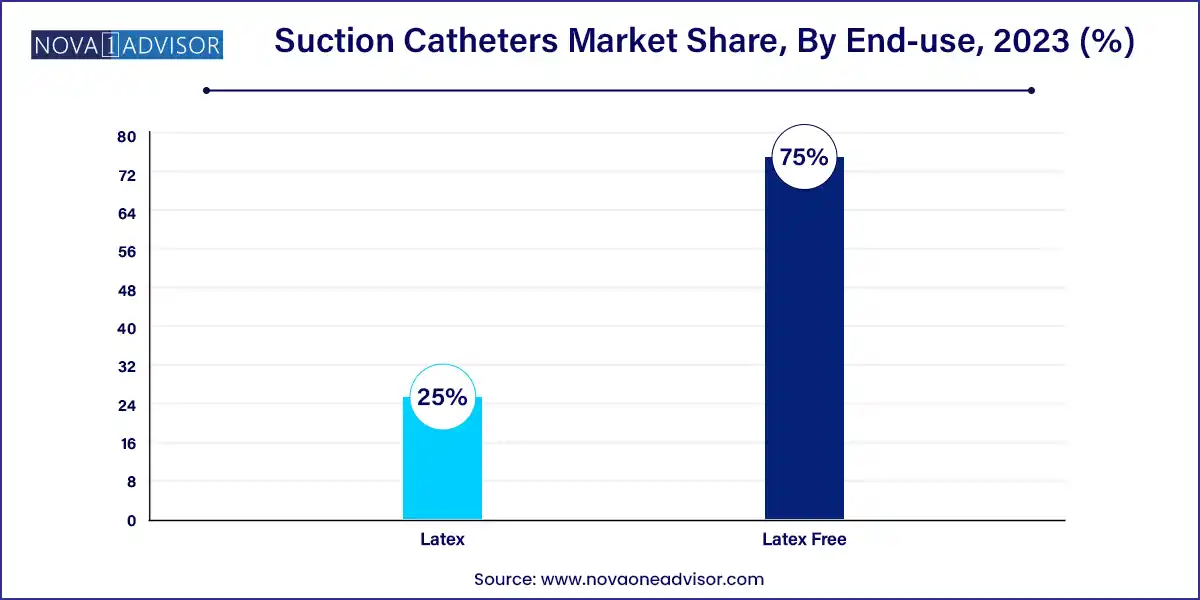

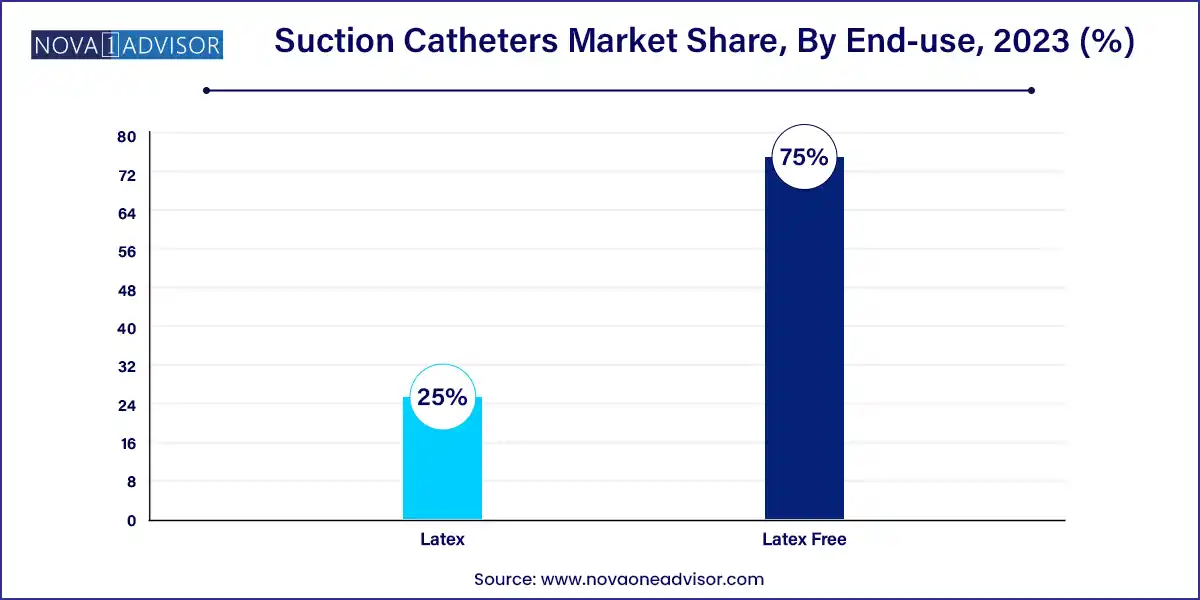

- The latex-free segment dominated the market and accounted for a revenue share of 75.0% in 2023.

- The hospital segment dominated the market and held the majority of the revenue share of 65.6% in 2023 and is likely to retain its dominance during the forecast period.

Market Overview

The suction catheters market is a crucial segment within the broader medical devices and respiratory care landscape, addressing critical needs in airway clearance and secretion management for patients across various healthcare settings. Suction catheters are sterile, flexible tubes used primarily to remove mucus, blood, or other fluids from the respiratory tract, ensuring the patency of the airway and improving ventilation. They are indispensable in emergency care, intensive care units (ICUs), post-operative recovery, and chronic respiratory care.

Suction catheters are especially vital for patients who are intubated, have tracheostomies, or are unable to cough effectively—such as those with chronic obstructive pulmonary disease (COPD), neuromuscular disorders, or traumatic brain injuries. The growing burden of respiratory diseases worldwide, driven by aging populations, rising smoking rates, and air pollution, is fueling market growth. According to the WHO, respiratory diseases are among the leading causes of death globally, with conditions like asthma, COPD, and pneumonia affecting hundreds of millions of people.

Furthermore, the rising number of surgical procedures, increasing adoption of home-based respiratory care, and expansion of intensive care services particularly in developing countries are accelerating demand for suction catheters. Technological advancements, such as closed suction systems and ergonomically designed Yankauer tips, have further expanded usage by reducing infection risks and improving clinician ease-of-use.

The suction catheter market is also influenced by broader healthcare trends, such as infection prevention, patient comfort, regulatory scrutiny, and the shift toward value-based care. With innovations in material science, manufacturing, and catheter tip design, the market is poised for sustained growth and diversification in the years ahead.

Major Trends in the Market

-

Increased Preference for Closed Suction Systems: Hospitals are shifting from open to closed suction catheters due to their superior infection control and reduced risk of ventilator-associated pneumonia (VAP).

-

Rise in Home-Based and Ambulatory Respiratory Care: The growth in chronic disease management at home is creating new demand for safe, user-friendly suction catheters.

-

Material Innovation with Latex-Free Alternatives: Latex allergies are leading to increased demand for latex-free catheters made from silicone and polyurethane.

-

Integration with Suction Devices and Smart Systems: Catheters are being bundled with suction machines and integrated into respiratory monitoring platforms.

-

Increased Use in Pediatric and Neonatal Care: Pediatric ICUs and neonatal care units are adopting specialized suction catheter sizes for smaller airways.

-

Disposable and Single-Use Product Surge: Infection control policies and environmental contamination concerns are boosting adoption of single-use suction catheters.

-

Focus on Ergonomics and Patient Comfort: Manufacturers are refining catheter tip designs to reduce trauma, improve navigation, and enhance clinician control.

Suction Catheters Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 408.50 Million |

| Market Size by 2033 |

USD 851.26 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 8.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Material, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medline Industries L.P.; B Braun SE; BD; Aminso International Inc.; Cardinal Health; Dynarex Corporation; PFM Medical AG; Ivor Shaw T/A Pennine Healthcare; Smiths Group Plc. |

Market Driver: Rising Incidence of Respiratory Diseases and Surgical Procedures

One of the primary drivers of the suction catheter market is the increasing prevalence of respiratory illnesses and the rising number of surgical interventions worldwide. Respiratory diseases such as asthma, bronchitis, COPD, cystic fibrosis, and pneumonia require regular suctioning to maintain airway patency, especially in hospitalized patients or those under mechanical ventilation.

According to the Global Burden of Disease study, COPD alone affects over 250 million people globally and is projected to become the third leading cause of death by 2030. Furthermore, post-operative patients often experience secretion accumulation due to anesthesia, immobility, or impaired swallowing requiring timely suctioning to prevent complications.

Additionally, the rapid growth in ICU admissions and the expansion of intensive care infrastructure particularly post-COVID-19 has increased the frequency of catheter use in intubated patients. The demand for suction catheters is also rising in trauma care, neurology, and pediatric wards. Collectively, these factors are boosting market demand across hospital and outpatient settings.

Market Restraint: Infection Risks and Improper Usage

Despite their clinical importance, suction catheters carry inherent risks, particularly if used improperly or without adequate infection control measures. Open suction systems, if not used with proper sterile technique, can introduce pathogens into the lower respiratory tract, increasing the risk of ventilator-associated pneumonia (VAP) and cross-contamination.

A key concern is that reusable suction catheters or those improperly discarded can harbor biofilms and lead to healthcare-associated infections (HAIs). The Centers for Disease Control and Prevention (CDC) estimates that HAIs affect 1 in 31 hospital patients on any given day in the U.S., and inadequate suctioning practices contribute significantly to this burden.

Moreover, inappropriate suctioning pressure or technique can cause mucosal trauma, bleeding, hypoxemia, or arrhythmias, especially in pediatric and geriatric patients. These complications underscore the need for comprehensive training and robust product design factors that may limit usage in resource-constrained settings or undertrained facilities.

Market Opportunity: Technological Advancements in Suction Systems

A promising opportunity lies in the development of advanced suction systems that combine catheter innovation with integrated monitoring, smart feedback, and infection control technologies. Manufacturers are increasingly investing in closed suction systems that allow suctioning without disconnecting the patient from a ventilator, thereby maintaining oxygenation and reducing infection risk.

Next-generation suction catheters are being designed with features such as pre-lubricated tips, anti-kink tubing, pressure feedback indicators, and dual-lumen systems for lavage and suction. These features not only enhance user safety but also contribute to shorter ICU stays and lower healthcare costs, aligning with value-based care models.

Additionally, the integration of suction catheter kits with real-time respiratory monitoring devices or portable suction machines is enhancing their utility in emergency medical services, ambulatory surgery centers, and home care. As the healthcare industry moves toward automation and digitization, suction catheters with connectivity features may become a key component of smart respiratory management systems.

Segments Insights:

By Type Insights

Closed suction catheters dominate the type segment, as infection control remains a top priority in modern intensive care and mechanical ventilation management. These systems prevent exposure to external pathogens during suctioning and reduce the likelihood of VAP. Closed catheters are especially popular in ICUs and long-term care units where patients are on ventilators for extended periods. The ability to maintain positive end-expiratory pressure (PEEP) during suctioning also preserves oxygenation, making them a standard of care in critical care settings.

On the other hand, Yankauer suction catheters are the fastest-growing segment, particularly in surgical and emergency care environments. The Yankauer tip, typically rigid and ergonomically shaped, is used to clear secretions from the oral cavity, especially during anesthesia or trauma resuscitation. Its growing popularity is attributed to its ease of use, cost-effectiveness, and adaptability in both pre-hospital and perioperative scenarios. As surgical volumes and trauma response protocols expand globally, the demand for Yankauer suction devices is expected to rise sharply.

By Material Insights

Latex-free suction catheters dominate the material segment, owing to increasing concerns over latex allergies and hypersensitivity reactions. Modern latex-free catheters are made from medical-grade silicone or polyurethane, offering biocompatibility, flexibility, and chemical resistance. Hospitals and healthcare providers are increasingly shifting toward latex-free products to reduce liability and comply with regulations, particularly in regions such as North America and Europe, where latex-free policies are becoming standard.

However, latex catheters continue to find use in cost-sensitive markets, where price competitiveness remains a priority. These catheters, though declining in demand, are still popular in some parts of Asia, Africa, and Latin America due to their lower manufacturing cost and wide availability. Nonetheless, safety concerns and the global trend toward hypoallergenic products are pushing manufacturers to phase out latex lines in favor of synthetic alternatives.

By End-use

Hospitals are the leading end-use segment, representing the highest volume of suction catheter usage due to their broad application in ICUs, operating rooms, emergency departments, and inpatient wards. Hospitals also house ventilated patients who require frequent airway clearance, making closed suction systems indispensable. In addition, hospitals often use suction catheter kits integrated with other respiratory devices during surgery and post-operative care.

Meanwhile, ambulatory care centers are the fastest-growing end-use segment, driven by the increasing shift of procedures and care delivery away from hospitals. These centers are adopting advanced suction devices for pre- and post-operative care, minor surgeries, and emergency airway management. Their compact format, lower cost, and shorter patient turnover cycles make them ideal settings for safe, efficient suction catheter use.

By Regional Insights

North America dominates the global suction catheter market, driven by high ICU admissions, robust hospital infrastructure, and stringent infection control standards. The U.S. accounts for the largest market share due to its extensive use of mechanical ventilation in both inpatient and outpatient settings, supported by established reimbursement systems. The widespread use of closed suction systems in North American hospitals reflects a mature market focused on reducing healthcare-associated infections. Moreover, strong regulatory oversight by agencies like the FDA and CDC ensures the availability of high-quality, compliant suction catheter products.

In contrast, Asia-Pacific is the fastest-growing region, led by rising healthcare investments, expanding hospital infrastructure, and increasing awareness of infection control practices. Countries such as China, India, and South Korea are witnessing a rapid rise in surgical procedures and ICU capacity, thereby increasing suction catheter usage. Local manufacturers are entering the market with cost-effective alternatives, while international players are investing in regional manufacturing hubs to meet demand. In addition, government initiatives to improve critical care standards such as India's National Health Mission and China's Healthy China 2030 are boosting adoption of advanced suction systems.

Some of the prominent players in the Suction catheters market include:

- Medline Industries L.P.,

- B Braun SE

- BD

- Aminso International Inc.,

- Cardinal Health

- Dynarex Corporation

- PFM Medical AG

- Ivor Shaw T/A Pennine Healthcare

- Smiths Group Plc

Recent Developments

-

March 2025 – Teleflex Medical announced the global launch of its new CleanSweep™ Closed Suction System, designed to reduce the risk of VAP while improving secretion clearance in mechanically ventilated patients.

-

January 2025 – Cardinal Health expanded its suction catheter portfolio with a new line of latex-free Yankauer devices, featuring ergonomically improved handles for better clinician grip during oral suctioning.

-

November 2024 – Vyaire Medical partnered with a leading European healthcare group to supply closed suction catheter kits across a chain of ICUs, as part of an infection reduction strategy.

-

September 2024 – Medtronic initiated trials for its smart suction catheter system embedded with pressure sensors to provide real-time feedback and minimize airway trauma in pediatric applications.

-

July 2024 – Intersurgical Ltd. released a biodegradable line of single-use suction catheters targeting hospitals in environmentally regulated markets across the EU and Australia.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global suction catheters market.

Type

- Closed Suction Catheters

- Yankauer Suction Catheters

Material

End-use

- Hospitals

- Ambulatory Care Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)